Académique Documents

Professionnel Documents

Culture Documents

Notes To Consolidated Financial Statements: Note 36: Segment Information For The Year Ended 31 March, 2016

Transféré par

Gaurang GroverTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Notes To Consolidated Financial Statements: Note 36: Segment Information For The Year Ended 31 March, 2016

Transféré par

Gaurang GroverDroits d'auteur :

Formats disponibles

Business Statutory Financial

Overview Reports Statements

Consolidated

Financial Statements

notes to Consolidated FinanCial statements

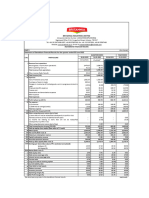

NOTE 36 : SEGMENT INFORMATION FOR THE YEAR ENDED 31ST MARCH, 2016

(i) Primary segment information - Business segment:

(` in Crores)

2015-16 2014-15

Paints Home Total Paints Home Total

Improvement* Improvement*

REVENUE

External Sales (Net) 15,292.20 241.94 15,534.14 13,981.18 201.63 14,182.81

Inter-Segment Sales - - - - -

Other Income 49.13 1.00 50.13 38.84 0.05 38.89

Total Revenue 15,341.33 242.94 15,584.27 14,020.02 201.68 14,221.70

RESULT

Segment result 2,891.40 (51.94) 2,839.46 2,237.57 (30.07) 2,207.50

Unallocated expenses (268.68) (226.69)

Operating Profit 2,570.78 1,980.81

Finance costs (40.51) (34.76)

Interest Income 22.62 11.51

Dividends 69.78 70.61

Profit on sale of short term 5.37 4.26

investments

Profit on sale of long term 24.71 27.56

investments

Profit on sale of fixed assets 10.94 2.69

Other non-operating income 17.17 14.19

Exceptional Item (52.45) -

Income taxes (849.14) (649.54)

Profit after tax 1,779.27 1,427.33

OTHER INFORMATION

Segment assets 7,187.32 214.38 7,401.70 6,602.19 239.94 6,842.13

Unallocated assets 2,741.63 2,072.57

Total assets 10,143.33 8,914.70

Segment liabilities 3,447.08 61.79 3,508.87 3,229.96 53.67 3,283.63

Unallocated liabilities 1,029.21 888.71

Total liabilities 4,538.08 4,172.34

Capital expenditure 950.35 6.09 956.44 268.66 53.16 321.82

Unallocated capital expenditure 43.47 29.14

TOTAL 999.91 350.96

Depreciation, Amortisation and 230.99 16.40 247.39 219.15 14.87 234.02

Impairment

Unallocated depreciation/Impairment 40.58 34.31

TOTAL 287.97 268.33

* Home Improvement business is identified as a separate business segment which includes Sleek International Private Limited acquired

by the parent company on 8th August, 2013 and bath fittings business acquired by the parent company effective 1st June, 2014 [Refer

Note 27 C (c)].

214 Annual Report 2015-16

notes to Consolidated FinanCial statements

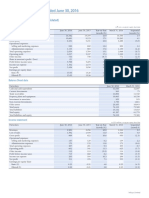

NOTE 36 : SEGMENT INFORMATION FOR THE YEAR ENDED 31ST MARCH, 2016 (Continued)

(ii) Secondary segment information - Geographical Segment:

(` in crores)

2015-16 2014-15

Domestic International Total Domestic International Total

Operations Operations Operations Operations

Segment revenue 13,498.69 2,085.58 15,584.27 12,436.17 1,785.53 14,221.70

Carrying cost of segment assets 8,483.04 1,660.29 10,143.33 7,569.63 1,345.07 8,914.70

Additions to fixed and intangible assets* 906.08 179.03 1,085.11 202.10 85.33 287.43

* FY 2014-15 includes additions pursuant to acquisition of stake in Kadisco Paint and Adhesive Industry Share Company [Refer note

27 C (a)].

NOTE 37: DISCLOSURE OF ADDITIONAL INFORMATION PERTAINING TO THE PARENT COMPANY, SUBSIDIARIES

AND JOINT VENTURE COMPANIES:

(` in Crores)

Name of the Company Net Assets (Total Assets minus Total Liabilities) Share in Profit or Loss

2015-16 2014-15 2015-16 2014-15

As % of Net Assets As % of Net Assets As % of Profit/ As % of Profit/(Loss)

Consolidated Consolidated Consolidated (Loss) Consolidated

net assets net assets profit or loss profit or loss

Parent Company

Asian Paints Limited 83.3 4,907.44 83.9 4,200.54 90.4 1,606.84 91.9 1,311.08

Indian Subsidiaries

Direct Subsidiaries

Asian Paints Industrial Coatings Limited 0.2 10.36 0.2 9.52 0.0 0.84 0.0 0.38

Multifacet Infrastructure (India) Limited * 0.0 - 0.0 (0.04) 0.0 - 0.0 (0.01)

Maxbhumi Developers Limited 0.0 (1.29) 0.0 (1.25) 0.0 (0.24) (0.1) (0.96)

Sleek International Private Limited (0.1) (5.45) (0.1) (6.43) (0.6) (10.27) (0.6) (8.53)

Indirect Subsidiaries

Kitchen Grace (India) Private Limited # - - 0.0 1.38 - - 0.1 1.01

Foreign Subsidiaries

Direct Subsidiaries

Asian Paints (Nepal) Private Limited 0.8 46.68 0.8 38.39 0.7 11.64 0.6 9.02

Asian Paints (International) Limited 2.2 128.90 2.3 118.21 (0.3) (3.26) (0.3) (4.23)

Indirect Subsidiaries

Samoa Paints Limited 0.0 1.66 0.0 0.83 0.1 1.15 0.0 0.60

Asian Paints (South Pacific) Limited 0.5 29.20 0.3 15.57 0.4 6.70 0.5 6.74

Asian Paints (Tonga) Limited 0.0 0.19 0.0 0.49 0.0 0.87 0.1 1.25

Asian Paints (S I) Limited 0.1 3.90 0.1 3.23 0.2 3.51 0.3 3.74

Asian Paints (Vanuatu) Limited 0.0 0.32 0.0 0.24 0.1 0.95 0.0 0.35

Asian Paints (Middle East) LLC 0.4 26.49 0.5 24.58 0.2 2.78 0.2 2.60

Asian Paints (Bangladesh) Limited 1.0 60.10 0.9 44.93 0.6 11.40 0.5 6.49

SCIB Chemicals S.A.E. 1.9 112.42 1.7 86.39 1.5 27.10 1.2 17.78

Asian Paints (Lanka) Limited 0.0 0.93 0.1 3.78 0.0 (0.72) (0.1) (2.03)

Berger International Private Limited (0.1) (4.06) (1.8) (89.34) (0.7) (11.94) (0.2) (2.20)

Berger Paints Singapore Pte Limited (1.1) (65.45) (1.1) (57.31) (0.2) (3.92) (0.1) (1.13)

Berger Paints Bahrain W.L.L. 0.8 48.60 0.8 39.84 0.8 14.49 0.8 11.89

Berger Paints Emirates Limited 0.8 47.24 0.6 31.51 0.7 12.40 0.3 4.47

Nirvana Investments Limited 0.0 2.20 0.0 2.08 0.0 0.00 0.0 0.00

Enterprise Paints Limited (0.4) (20.84) (0.4) (19.94) 0.0 0.00 0.0 0.00

Universal Paints Limited 0.1 4.88 1.5 74.13 0.1 1.48 0.0 0.00

Asian Paints Limited 215

Vous aimerez peut-être aussi

- Income Taxation 1 PDFDocument11 pagesIncome Taxation 1 PDFShayne PenalosaPas encore d'évaluation

- InfoEdge Annual Report 2023 1Document1 pageInfoEdge Annual Report 2023 1Aditya RoyPas encore d'évaluation

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalPas encore d'évaluation

- Profit and LossDocument1 pageProfit and LossYagika JagnaniPas encore d'évaluation

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputPas encore d'évaluation

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzPas encore d'évaluation

- 14 - Net Profit Example 1Document2 pages14 - Net Profit Example 1balajiPas encore d'évaluation

- Indigo Income STMT 1Document1 pageIndigo Income STMT 1deepzPas encore d'évaluation

- Tata MotorsDocument41 pagesTata MotorsShubham SharmaPas encore d'évaluation

- Statement of Profit and Loss: For The Year Ended 31st March, 2021Document2 pagesStatement of Profit and Loss: For The Year Ended 31st March, 2021Only For StudyPas encore d'évaluation

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kPas encore d'évaluation

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006Pas encore d'évaluation

- Annual Report 2021Document3 pagesAnnual Report 2021hxPas encore d'évaluation

- Sumarised P&LDocument1 pageSumarised P&Lgargrohan989gargPas encore d'évaluation

- Audited Consolidated-Statements - PAL 2022Document10 pagesAudited Consolidated-Statements - PAL 2022P patelPas encore d'évaluation

- Integrated Report and Annual Accounts 2016-17-175 175Document1 pageIntegrated Report and Annual Accounts 2016-17-175 175Sanju VisuPas encore d'évaluation

- VISHAL KUMAR - Project IIDocument20 pagesVISHAL KUMAR - Project IIVISHAL KUMARPas encore d'évaluation

- Investor Presentation May 20 2022Document19 pagesInvestor Presentation May 20 2022Shwetta BajpaiPas encore d'évaluation

- Cfin Sep2022Document14 pagesCfin Sep2022jdPas encore d'évaluation

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kPas encore d'évaluation

- 4.varroc Consolidated Result Sheet June 2021 SignedDocument3 pages4.varroc Consolidated Result Sheet June 2021 SignedA kumarPas encore d'évaluation

- Dufry HY 2022 ReportDocument27 pagesDufry HY 2022 ReportHaden BraPas encore d'évaluation

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsPas encore d'évaluation

- Eastern Coalfields LimitedDocument9 pagesEastern Coalfields LimitedSyed Shamiul HaquePas encore d'évaluation

- Siemens Report4You FY2022Document64 pagesSiemens Report4You FY2022Vibhore KanoongoPas encore d'évaluation

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95Pas encore d'évaluation

- Group Project - ACCDocument17 pagesGroup Project - ACCLovie GuptaPas encore d'évaluation

- Eum Edgenta Sofp& Sopl 2021Document4 pagesEum Edgenta Sofp& Sopl 2021ariash mohdPas encore d'évaluation

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GamePas encore d'évaluation

- 748foodfile FinancialResultsDocument4 pages748foodfile FinancialResultsPrashant VaishnavPas encore d'évaluation

- Audited Consolidated Financial Results 31 03 2023 5e87d66fb7Document9 pagesAudited Consolidated Financial Results 31 03 2023 5e87d66fb7LaraPas encore d'évaluation

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677Pas encore d'évaluation

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARPas encore d'évaluation

- Directors ReportDocument20 pagesDirectors ReportParasjkohli6659Pas encore d'évaluation

- Consolidated Statement of Profit and LossDocument1 pageConsolidated Statement of Profit and LossSukhmanPas encore d'évaluation

- R D Offlc Mbic Oad, Va o A 3 003: of MaDocument10 pagesR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalPas encore d'évaluation

- Ramco Cements Standalone-P&L2020Document1 pageRamco Cements Standalone-P&L2020MAANAS SINHAPas encore d'évaluation

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaPas encore d'évaluation

- KPIs Bharti Airtel 04022020Document13 pagesKPIs Bharti Airtel 04022020laksikaPas encore d'évaluation

- 4 Years of Financial Data - v4Document25 pages4 Years of Financial Data - v4khusus downloadPas encore d'évaluation

- Report For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)Document7 pagesReport For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)ashokdb2kPas encore d'évaluation

- 17 - Net Cash Accrual ExampleDocument3 pages17 - Net Cash Accrual ExamplebalajiPas encore d'évaluation

- C Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23Document325 pagesC Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23yash rajPas encore d'évaluation

- ITC-Profit-Loss 2017 PDFDocument1 pageITC-Profit-Loss 2017 PDFShristi GutgutiaPas encore d'évaluation

- FRA Group 10Document25 pagesFRA Group 10sovinahalli 1234Pas encore d'évaluation

- Q2 20 & 6 Months DhunseriDocument7 pagesQ2 20 & 6 Months Dhunserica.anup.kPas encore d'évaluation

- Account Cca (AutoRecovered) 1Document13 pagesAccount Cca (AutoRecovered) 1Saloni BaisPas encore d'évaluation

- Statement of OperationsDocument1 pageStatement of Operations227230Pas encore d'évaluation

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Document25 pagesHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiPas encore d'évaluation

- Standalone Results - Mar'23 - 0Document5 pagesStandalone Results - Mar'23 - 0Honey SinghalPas encore d'évaluation

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaPas encore d'évaluation

- Amazon Vs WallmartDocument13 pagesAmazon Vs WallmartHammad AhmedPas encore d'évaluation

- PNC Annual RPT 2020 LowresDocument229 pagesPNC Annual RPT 2020 LowresShehani ThilakshikaPas encore d'évaluation

- Lake House Printers QuarterlyDocument9 pagesLake House Printers QuarterlyGanu88Pas encore d'évaluation

- In Millions of Euros, Except For Per Share DataDocument24 pagesIn Millions of Euros, Except For Per Share DataGrace StylesPas encore d'évaluation

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrincePas encore d'évaluation

- Assets Non-Current Assets: (' in Crores)Document6 pagesAssets Non-Current Assets: (' in Crores)Amit JhaPas encore d'évaluation

- Book 2Document18 pagesBook 2Aishwarya DaymaPas encore d'évaluation

- LVMH 2020 Consolidated Financial StatementDocument99 pagesLVMH 2020 Consolidated Financial StatementGEETIKA PATRAPas encore d'évaluation

- Ramco Cements Standalone-P&L2022Document1 pageRamco Cements Standalone-P&L2022MAANAS SINHAPas encore d'évaluation

- Power Point: Kya Yar Matlab Andar Change Karna Padega Ab! Change!Document1 pagePower Point: Kya Yar Matlab Andar Change Karna Padega Ab! Change!Gaurang GroverPas encore d'évaluation

- NumbersDocument1 pageNumbersGaurang GroverPas encore d'évaluation

- Hello Progressions: Buy If You Want To Learn!Document1 pageHello Progressions: Buy If You Want To Learn!Gaurang GroverPas encore d'évaluation

- Jmet Sample PaperDocument13 pagesJmet Sample PaperGaurang GroverPas encore d'évaluation

- Snap 2003Document18 pagesSnap 2003Gaurang GroverPas encore d'évaluation

- B. A. Programme 1st Year 2010-11 English ADocument3 pagesB. A. Programme 1st Year 2010-11 English AGaurang GroverPas encore d'évaluation

- Technical Report Metal Energy Feb 07nirmalbangDocument5 pagesTechnical Report Metal Energy Feb 07nirmalbangGaurang GroverPas encore d'évaluation

- NTPC Challan FormDocument1 pageNTPC Challan FormGaurang Grover100% (1)

- Fort Bonifacio Development Vs CIR GR No 158885Document3 pagesFort Bonifacio Development Vs CIR GR No 158885Alfonso Dimla100% (1)

- Financial Statement 2020-21Document7 pagesFinancial Statement 2020-21celiaPas encore d'évaluation

- Income Taxation Module (Mid-Term)Document32 pagesIncome Taxation Module (Mid-Term)Joseph Anthony RomeroPas encore d'évaluation

- Tax Allocations and ApportionmentDocument18 pagesTax Allocations and Apportionmentrobertkolasa100% (1)

- Bitumen EmulsionsDocument27 pagesBitumen EmulsionsamitjustamitPas encore d'évaluation

- CIR V Tokyo ShippingDocument2 pagesCIR V Tokyo ShippingJerico GodoyPas encore d'évaluation

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalPas encore d'évaluation

- Corporate Tax Planning and Corporate Tax Disclosure (SKIRPSI)Document38 pagesCorporate Tax Planning and Corporate Tax Disclosure (SKIRPSI)onePas encore d'évaluation

- Year-to-Date Report: Payroll Journal Summary by EmployeeDocument2 pagesYear-to-Date Report: Payroll Journal Summary by EmployeeDavid PrietoPas encore d'évaluation

- InvoiceDocument2 pagesInvoicehaha heeePas encore d'évaluation

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerPas encore d'évaluation

- HW2 - Preparing Statement of Cash FlowsDocument2 pagesHW2 - Preparing Statement of Cash FlowsDeepak KapoorPas encore d'évaluation

- Form No. 10acDocument2 pagesForm No. 10acAditya NayakPas encore d'évaluation

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaPas encore d'évaluation

- Z13 Re - NPD Po: Page 1 / 1Document1 pageZ13 Re - NPD Po: Page 1 / 1sprabhaPas encore d'évaluation

- Explanatory Notes On The Application of Withholding Tax 9801 2Document4 pagesExplanatory Notes On The Application of Withholding Tax 9801 2Japh Dee100% (1)

- Notification No. 01-2021-Central ExciseDocument4 pagesNotification No. 01-2021-Central ExciseRetvik PrakashPas encore d'évaluation

- Conveyancing Project WorkDocument3 pagesConveyancing Project WorkBenjamin Brian NgongaPas encore d'évaluation

- Poverty Affidavit 2021Document5 pagesPoverty Affidavit 2021Almir OmerovicPas encore d'évaluation

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146Pas encore d'évaluation

- Laws of Taxation in TanzaniaDocument508 pagesLaws of Taxation in TanzaniaRuhuro tetere100% (3)

- 170822-R10149424-Mustaqim Siga-02258Document1 page170822-R10149424-Mustaqim Siga-02258akimPas encore d'évaluation

- Form - Capital Gains Tax (CGT) Schedule 2021Document4 pagesForm - Capital Gains Tax (CGT) Schedule 2021uly01 cubillaPas encore d'évaluation

- PKF Kenya Quick Tax Guide 2016Document10 pagesPKF Kenya Quick Tax Guide 2016KalGeorgePas encore d'évaluation

- BankDocument1 pageBankKixeaglePas encore d'évaluation

- Fringe Benefit - QuizDocument3 pagesFringe Benefit - QuizArlea AsenciPas encore d'évaluation

- Vighnesh Project Report On Impact of GST On Hotel and Tourisum IndustryDocument81 pagesVighnesh Project Report On Impact of GST On Hotel and Tourisum IndustryMohammad Ramiz ShaikhPas encore d'évaluation

- Excise Invoice 213Document4 pagesExcise Invoice 213Anonymous rNqW9p3Pas encore d'évaluation

- Employee Compensation + Payroll DeductionsDocument14 pagesEmployee Compensation + Payroll Deductionsrommel legaspi25% (4)