Académique Documents

Professionnel Documents

Culture Documents

Uber's Potential in Global Mobility Services Market

Transféré par

Sergio OlarteDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Uber's Potential in Global Mobility Services Market

Transféré par

Sergio OlarteDroits d'auteur :

Formats disponibles

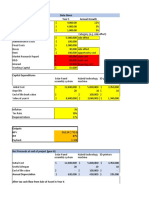

Company's current status

What was the total grossed by your company in the most recent twelve months?

What revenues did your company generate in the most recent twelve months?

What operating profits (losses) did your company report in that twelve-month period?

Overall Market

What is the potential market for Uber?

Based on your potential market choice above, this is the potential market

What effect will Uber have on the size (growth) of the potential market?

Expected annual growth rate (next 10 years) based on your growth rate choice

Company's share of that market

How strong will Uber's network effect be in the potential market?

Expected market share (based upon your network choice)

When do you expect the company to get to this market share?

How strong and sustainable are Uber's competitive advantages

What will the gross receipts will accrue to the company as revenues?

How much incremental revenue do you expect for every dollar of incremental investment?

If direct input of incremental investment, enter the number here

Profitability

What is the expected operating margin (in steady state)?

What is the effective tax rate on your income?

Risk

What cost of capital would you assign to this company, ignoring surivival risk?

If direct input, what is the cost of capital you would like to use initially (first 5 years)?

What cost of capital would you assign to established players in this business?

If direct input, what is the cost of capital you would like to use in steady state (after year 10)

What is the probability that the company will fail sometime in the next 10 years?

What return on capital do you see the company generating in steady state?

General inputs

What is the risk free rate?

What is the statutory tax rate for the country in which the company in incorporated?

Do you want me to use this as the effective tax rate in steady state?

Your narrative for Uber

Uber's potential market is

Uber's effects on growth in the potential market will be

Within this market, Uber will have

Uber's competitive advantages in that market will be

Uber' reinvestment for growth will be

Uber's operating risk will result in a cost of capital that puts it in

Uber's chance of failure (not making it) is

And your resulting valuation of Uber is

Value of the operating assets =

Imputed multiple of current revenues =

$3,500.00

$700.00

$10.00

A2. All car service

$150,000.00

B3. Increase market by 50%

7.26%

C4. Weak global network effects

25.00%

10

D3. Semi-strong

15.00%

Minimal capital needs, small acquisitions (5.00)

5.00

40.00%

30.00%

Ninth decile of US companies (12%)

Median of US companies (8%)

10%

90th percentile (ROIC=25%)

2.25%

40.00%

Yes

A2. All car service

B3. Increase market by 50%

C4. Weak global network effects

D3. Semi-strong

Minimal capital needs, small acquisitions (5.00)

Ninth decile of US companies (12%)

10%

$17,404.33

24.86

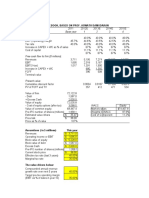

Potential Market Market size (in millions)

A1. Urban car service $100,000

A2. All car service $150,000

A3. Logistics $205,000

A4. Mobility Services $285,000

Growth Effect Annual growth rate (next 10 years)

B1. None 3.00%

B2. Increase market by 25% 5.32%

B3. Increase market by 50% 7.26%

B4. Double market size 10.39%

Network Effects Market share of potential market

C1. No network effects 5%

C2. Weak local network effects 10%

C3. Strong local network effects 15%

C4. Weak global network effects 25%

C5. Strong global network effects 40%

Competitive Advantages Slice of Gross Receipts

D1. None 5%

D2. Weak 10%

D3. Semi-strong 15%

D4. Strong & Sustainable 20%

Description

Taxi cabs, limos & car services (urban)

+ Rental Cars+ Non-urban car service

+ Moving + Local Delivery

+ Mass Transit + Car Sharing

ext 10 years)

No change in market size

Increase market size by 25% over 10 years

Increase market size by 50% over 10 years

Double market size over 10 years

tial market

Open competition in every market

Dominance in a few local markets

Dominance in multiple local markets

Weak spillover benefits in new markets

Strong spillover benefits in new markets

Unrestricted entry + No pricing power

Unrestricted entry+ Some Pricing Power

Unrestricted entry + Pricing Power

Restricted entry + Pricing Power

Base 1 2

Overall market $150,000.00 $160,890.00 $172,570.61

Share of market (gross) 2.33% 4.600% 6.867%

Revenues as percent of gross 20.00% 19.50% 19.00%

Annual Revenue $700.00 $1,443.18 $2,251.47

Operating margin 1.43% 5.29% 9.14%

Operating Income $10.00 $76.28 $205.85

Effective tax rate 30.00% 31.00% 32.00%

- Taxes $3.00 $23.65 $65.87

After-tax operating income $7.00 $52.63 $139.98

Sales/Capital Ratio 5.00 5.00

- Reinvestment $148.64 $161.66

Free Cash Flow to the Firm -$96.00 -$21.68

Terminal value

Present value of FCFF -$85.72 -$17.28

Present value of terminal value

Cost of capital 12.00% 12.00% 12.00%

Cumulated cost of capital = 1.1200 1.2544

Imputed Return on capital

PV of cash flows during next 10 years $3,535.81

PV of terminal value = $15,802.34

Value of operating assets $19,338.14

Probability of failure 10%

Adjusted value of operating assets $17,404.33

3 4 5 6 7

$185,099.24 $198,537.45 $212,951.26 $228,411.53 $244,994.20

9.133% 11.400% 13.667% 15.933% 18.200%

18.50% 18.00% 17.50% 17.00% 16.50%

$3,127.56 $4,073.99 $5,093.08 $6,186.91 $7,357.18

13.00% 16.86% 20.71% 24.57% 28.43%

$406.58 $686.76 $1,055.00 $1,520.21 $2,091.54

33.00% 34.00% 35.00% 36.00% 37.00%

$134.17 $233.50 $369.25 $547.28 $773.87

$272.41 $453.26 $685.75 $972.94 $1,317.67

5.00 5.00 5.00 5.00 5.00

$175.22 $189.29 $203.82 $218.76 $234.05

$97.19 $263.97 $481.93 $754.17 $1,083.62

$69.18 $167.76 $273.46 $384.84 $500.85

12.00% 12.00% 12.00% 11.20% 10.40%

1.4049 1.5735 1.7623 1.9597 2.1635

8 9 10 Terminal year

$262,780.78 $281,858.67 $302,321.61 $309,123.84

20.467% 22.733% 25.000% 25.00%

16.00% 15.50% 15.00% 15.00%

$8,605.19 $9,931.76 $11,337.06 $11,592.14

32.29% 36.14% 40.00% 40.00%

$2,778.25 $3,589.62 $4,534.82 $4,636.86

38.00% 39.00% 40.00% 40.00%

$1,055.73 $1,399.95 $1,813.93 $1,854.74

$1,722.51 $2,189.67 $2,720.89 $2,782.11

5.00 5.00 5.00

$249.60 $265.31 $281.06 $250.39

$1,472.91 $1,924.36 $2,439.83 $2,531.72

$44,029.99

$621.16 $745.90 $875.66

$15,802.34

9.60% 8.80% 8.00%

2.3712 2.5799 2.7863

25.00%

Taxi & Limo Market

New York $2,500

United States $11,000

United Kingdom $9,000

Tokyo $22,000

Global urban car service $100,000

Rental Car Market

US rental car market $36,000

Global rental car market $50,000

Logisitics Market

Moving Services $20,000

Local Delivery $35,000

Moving + Local Delivery $55,000

Mobility Services

Mass Transit (US) $60,000

Car Sharing (Global) $20,000

Mobility $80,000

Potential Market Market Size

Roughly $100 billion (based upon

Taxi & Limo Market city-specific estimates)

Approximately $36 billion just for

Rental Car Market the US and $50 billion globally

Approximately $20 billion in the

Moving Services US (and no data is available for

global)

Approximately $35 billion (more

guesstimate than estimate).

Local Delivery business

Approximately $60 billion for the

Mass Transit US.

Approximately $20 billion, bigger

Car Sharing in Europe than in the US, but

growing fast.

Industry structure

Highly splintered (top 50 companies Entry and operations are

account for 35% market share), highly regulated in most

localized and private. cities.

Three companies (Enterprise, Hertz and

Avis) account for 60% of the overall Control airport access and

market. rental fleets.

A few large companies but none with

dominant market share, with lots of Truck fleets and local

localized, small movers. knowledge.

Historically, its been a localized,

splintered business but Amazon and

Google have entered business recently.

Barring a few privately owned bus

companies, mostly government owned

and subsidized.

A mix of young businesses, some tech

based, trying to match needs to

resources.

Industry name Number of firms

Advertising 65

Aerospace/Defense 95

Air Transport 25

Apparel 70

Auto & Truck 26

Auto Parts 75

Bank 7

Banks (Regional) 721

Beverage 47

Beverage (Alcoholic) 19

Biotechnology 349

Broadcasting 30

Brokerage & Investment Banking 49

Building Materials 37

Business & Consumer Services 179

Cable TV 16

Chemical (Basic) 47

Chemical (Diversified) 10

Chemical (Specialty) 100

Coal & Related Energy 45

Computer Services 129

Computer Software 273

Computers/Peripherals 66

Construction 18

Diversified 20

Educational Services 40

Electrical Equipment 135

Electronics 191

Electronics (Consumer & Office) 26

Engineering 56

Entertainment 85

Environmental & Waste Services 108

Farming/Agriculture 29

Financial Svcs. 76

Financial Svcs. (Non-bank & Insurance) 17

Food Processing 97

Food Wholesalers 18

Furn/Home Furnishings 36

Healthcare Equipment 193

Healthcare Facilities 47

Healthcare Products 58

Healthcare Services 126

Heathcare Information and Technology 125

Heavy Construction 46

Homebuilding 32

Hotel/Gaming 89

Household Products 139

Information Services 71

Insurance (General) 26

Insurance (Life) 27

Insurance (Prop/Cas.) 53

Internet software and services 330

Investment Co. 65

Machinery 141

Metals & Mining 134

Office Equipment & Services 30

Oil/Gas (Integrated) 8

Oil/Gas (Production and Exploration) 411

Oil/Gas Distribution 80

Oilfield Svcs/Equip. 163

Packaging & Container 24

Paper/Forest Products 21

Pharma & Drugs 138

Power 106

Precious Metals 166

Publshing & Newspapers 52

R.E.I.T. 46

Railroad 10

Real Estate (Development) 22

Real Estate (General/Diversified) 11

Real Estate (Operations & Services) 47

Recreation 70

Reinsurance 3

Restaurant 84

Retail (Automotive) 30

Retail (Building Supply) 7

Retail (Distributors) 87

Retail (General) 21

Retail (Grocery and Food) 21

Retail (Internet) 47

Retail (Special Lines) 137

Rubber& Tires 4

Semiconductor 104

Semiconductor Equip 51

Shipbuilding & Marine 14

Shoe 14

Steel 37

Telecom (Wireless) 28

Telecom. Equipment 131

Telecom. Services 82

Thrift 223

Tobacco 12

Transportation 22

Trucking 28

Utility (General) 20

Utility (Water) 20

Total Market 7766

Annual Average Revenue growth - Last 5 years Pre-tax Operating Margin

6.29% 11.54%

2.60% 11.13%

7.74% 6.60%

3.27% 12.95%

9.97% 3.34%

3.06% 7.45%

6.99% 0.00%

7.50% 0.00%

6.92% 17.75%

2.69% 20.23%

14.17% 16.91%

3.13% 24.41%

7.96% 0.59%

1.77% 6.35%

3.45% 9.51%

6.86% 18.61%

1.50% 10.01%

4.24% 9.38%

8.76% 15.25%

4.17% 2.70%

3.87% 9.78%

8.59% 26.73%

-1.20% 18.60%

0.49% 6.19%

22.98% 13.77%

7.73% 8.23%

4.58% 12.66%

1.07% 8.25%

16.78% 6.46%

3.94% 4.48%

-1.37% 19.81%

12.46% 11.62%

12.62% 2.40%

10.81% 9.85%

3.22% 0.14%

4.90% 10.75%

0.63% 4.00%

-0.39% 7.33%

11.30% 20.30%

5.16% 10.76%

22.82% 10.65%

7.41% 4.99%

6.62% 13.02%

1.01% 9.71%

-3.54% 8.80%

6.47% 15.76%

7.01% 16.43%

4.45% 24.23%

2.95% 13.04%

7.09% 8.54%

8.42% 14.35%

12.49% 18.91%

8.42% 6.83%

5.43% 12.07%

0.00% 14.28%

-3.24% 8.27%

-2.82% 12.61%

9.37% 22.49%

10.85% 7.95%

9.78% 5.69%

10.38% 9.29%

5.47% 7.20%

19.49% 24.76%

2.90% 17.06%

60.95% 11.65%

0.72% 9.24%

23.69% 0.29%

5.16% 30.74%

5.89% 8.18%

-10.83% 8.37%

-2.04% 9.14%

8.46% 14.11%

22.40% 8.25%

5.32% 15.05%

8.11% 5.47%

6.03% 9.86%

11.30% 9.32%

3.31% 5.28%

0.97% 3.00%

2.54% 4.37%

4.20% 7.02%

2.95% 7.01%

3.85% 15.65%

-3.01% 6.65%

-0.82% 7.68%

7.22% 12.67%

-2.45% 4.38%

4.25% 3.65%

3.73% 18.71%

7.19% 12.27%

8.47% -0.23%

3.55% 40.07%

7.86% 5.91%

0.08% 9.05%

-2.40% 17.48%

11.93% 29.10%

6.88% 10.57%

Sales/Capital Average effective tax rate Cost of capital EV/Sales

3.76 6.04% 6.80% 1.91

5.97 15.03% 6.95% 1.53

2.14 13.79% 5.88% 1.06

1.78 10.29% 7.73% 2.22

2.32 4.71% 6.76% 0.90

3.54 9.43% 8.61% 0.86

0.29 22.17% 4.45% 5.18

0.26 18.00% 4.50% 5.06

1.59 3.95% 8.73% 3.02

0.70 10.72% 7.28% 4.69

0.79 1.13% 7.80% 10.72

1.13 13.21% 8.43% 4.14

0.19 13.44% 4.42% 5.66

2.47 16.33% 7.71% 1.37

2.68 13.41% 6.35% 1.68

1.26 15.00% 6.13% 2.73

1.54 6.27% 6.91% 1.65

1.90 25.03% 7.99% 1.51

2.11 12.74% 7.05% 2.17

0.73 2.44% 6.93% 1.64

6.24 9.94% 6.62% 1.13

1.83 6.16% 7.61% 4.55

2.39 5.66% 7.98% 2.00

0.95 9.82% 6.57% 3.17

0.39 12.60% 4.64% 4.07

1.89 11.84% 8.07% 1.26

2.87 7.49% 7.81% 2.12

1.55 7.52% 7.28% 1.60

2.39 8.97% 8.14% 1.02

4.89 14.86% 7.83% 0.60

1.57 4.85% 7.76% 3.00

1.71 5.02% 7.16% 2.18

3.09 9.01% 5.63% 0.41

0.21 18.37% 5.29% 6.91

0.12 9.77% 4.23% 8.65

2.63 14.00% 6.08% 1.64

6.93 10.69% 7.80% 0.54

2.73 10.03% 7.94% 1.18

1.51 5.80% 6.46% 2.88

1.54 13.49% 5.95% 1.44

1.44 8.76% 7.07% 3.26

8.83 13.77% 6.10% 0.57

1.68 6.09% 7.13% 3.62

1.62 19.40% 8.26% 1.42

1.22 6.68% 8.73% 1.68

0.74 10.48% 7.23% 3.44

2.48 9.51% 7.08% 2.50

2.26 17.05% 6.40% 4.40

0.56 19.19% 5.80% 1.59

0.85 17.82% 6.28% 1.33

1.01 19.42% 5.53% 1.36

1.21 4.59% 7.63% 6.99

0.33 6.62% 4.85% 5.29

2.56 13.02% 7.09% 1.87

1.06 1.90% 7.45% 2.09

3.09 12.81% 6.66% 1.17

1.84 20.55% 7.22% 1.22

0.21 6.29% 7.69% 6.10

1.40 4.18% 5.32% 1.91

3.53 10.73% 8.35% 0.70

2.35 21.28% 5.96% 1.26

1.92 8.20% 7.18% 1.18

1.18 4.30% 7.61% 3.97

0.55 16.03% 4.54% 2.74

0.41 0.82% 7.93% 2.40

3.16 13.92% 6.85% 1.57

0.03 2.48% 3.34% 32.89

0.65 20.51% 7.10% 3.88

0.25 3.00% 6.79% 7.07

0.17 8.72% 5.66% 12.03

0.98 8.56% 7.81% 2.57

1.59 8.81% 8.14% 2.28

0.94 13.34% 4.55% 1.05

1.38 15.17% 6.31% 2.88

3.14 19.23% 6.88% 0.85

2.29 21.97% 7.31% 1.50

1.90 16.18% 6.37% 1.54

3.48 25.03% 6.53% 0.72

4.06 22.83% 5.77% 0.51

8.95 9.80% 7.55% 3.31

2.42 18.90% 7.05% 1.11

3.69 15.21% 6.77% 0.54

1.24 7.30% 7.97% 2.80

1.16 5.13% 8.18% 2.42

0.66 4.99% 7.99% 2.37

2.43 19.82% 6.53% 2.44

2.02 14.13% 6.94% 0.84

0.70 11.54% 5.04% 2.79

1.32 6.90% 7.90% 2.84

1.26 8.40% 5.92% 1.98

0.02 18.93% 3.19% 66.04

3.17 14.23% 6.45% 4.57

2.87 21.21% 7.08% 1.48

1.38 27.93% 6.32% 1.56

0.56 29.93% 4.15% 2.63

0.34 14.52% 5.12% 4.78

0.75 10.32% 6.06% 2.52

Industry name Number of firms

Advertising 243

Aerospace/Defense 207

Air Transport 157

Apparel 1170

Auto & Truck 129

Auto Parts 609

Bank 580

Banks (Regional) 947

Beverage 107

Beverage (Alcoholic) 209

Biotechnology 707

Broadcasting 134

Brokerage & Investment Banking 521

Building Materials 414

Business & Consumer Services 714

Cable TV 63

Chemical (Basic) 735

Chemical (Diversified) 84

Chemical (Specialty) 681

Coal & Related Energy 322

Computer Services 939

Computer Software 1059

Computers/Peripherals 316

Construction 477

Diversified 341

Educational Services 161

Electrical Equipment 863

Electronics 1167

Electronics (Consumer & Office) 185

Engineering 1167

Entertainment 352

Environmental & Waste Services 312

Farming/Agriculture 341

Financial Svcs. 548

Financial Svcs. (Non-bank & Insurance) 133

Food Processing 1201

Food Wholesalers 115

Furn/Home Furnishings 319

Healthcare Equipment 448

Healthcare Facilities 170

Healthcare Products 159

Healthcare Services 322

Heathcare Information and Technology 278

Heavy Construction 335

Homebuilding 164

Hotel/Gaming 648

Household Products 458

Information Services 177

Insurance (General) 235

Insurance (Life) 121

Insurance (Prop/Cas.) 219

Internet software and services 706

Investment Co. 433

Machinery 1270

Metals & Mining 1691

Office Equipment & Services 161

Oil/Gas (Integrated) 53

Oil/Gas (Production and Exploration) 1172

Oil/Gas Distribution 199

Oilfield Svcs/Equip. 593

Packaging & Container 398

Paper/Forest Products 303

Pharma & Drugs 820

Power 743

Precious Metals 1181

Publshing & Newspapers 390

R.E.I.T. 49

Railroad 54

Real Estate (General/Diversified) 422

Real Estate (Development) 647

Real Estate (Operations & Services) 481

Recreation 286

Reinsurance 37

Restaurant 304

Retail (Automotive) 148

Retail (Building Supply) 50

Retail (Distributors) 848

Retail (General) 229

Retail (Grocery and Food) 174

Retail (Internet) 118

Retail (Special Lines) 543

Rubber& Tires 93

Semiconductor 559

Semiconductor Equip 263

Shipbuilding & Marine 356

Shoe 92

Steel 714

Telecom (Wireless) 116

Telecom. Equipment 525

Telecom. Services 317

Thrift 281

Tobacco 53

Transportation 228

Trucking 191

Utility (General) 55

Utility (Water) 97

Total Market 40906

Annual Average Revenue growth - Last 5 years Pre-tax Operating Margin

5.04% 8.30%

4.86% 9.38%

7.67% 5.10%

6.38% 12.24%

6.71% 5.71%

6.04% 6.61%

8.98% 0.24%

6.44% 0.00%

6.04% 14.34%

6.88% 19.97%

11.03% 15.58%

4.12% 16.46%

4.59% 0.43%

5.37% 6.63%

7.52% 7.81%

10.40% 18.29%

6.09% 8.81%

2.78% 7.39%

8.57% 11.30%

15.68% 5.92%

6.29% 7.55%

7.96% 22.73%

-0.84% 10.55%

6.24% 11.08%

7.97% 8.63%

8.79% 9.01%

4.67% 6.85%

2.29% 5.40%

2.59% 3.29%

6.18% 4.03%

2.02% 17.23%

8.64% 8.97%

8.82% 3.95%

9.27% 7.36%

19.67% 3.97%

7.16% 8.09%

2.07% 3.07%

3.04% 6.64%

7.64% 18.37%

12.96% 10.56%

16.82% 12.59%

12.41% 4.86%

8.13% 11.93%

3.60% 6.31%

3.48% 6.57%

9.11% 11.94%

8.81% 14.73%

6.21% 23.19%

9.69% 8.75%

12.08% 8.67%

7.94% 10.97%

9.58% 19.33%

-2.32% 13.93%

2.08% 8.67%

9.15% 13.48%

0.82% 7.00%

6.66% 10.32%

12.46% 22.69%

11.09% 7.99%

9.00% 4.17%

6.04% 7.53%

2.19% 5.63%

12.16% 21.09%

12.80% 11.80%

29.33% 9.60%

0.47% 7.76%

20.47% 1.21%

4.64% 19.33%

3.78% 16.33%

13.65% 22.49%

11.14% 29.41%

2.77% 11.46%

13.21% 11.07%

5.91% 10.88%

9.04% 4.71%

4.20% 8.02%

5.91% 3.55%

8.91% 4.88%

6.59% 4.04%

9.44% 4.93%

4.59% 6.76%

6.75% 9.77%

2.98% 13.80%

-0.13% 4.54%

3.58% 6.06%

8.24% 9.46%

1.63% 3.39%

8.86% 15.91%

4.09% 9.25%

7.03% 13.81%

9.30% 1.04%

9.63% 28.64%

11.70% 7.83%

1.87% 6.33%

4.05% 10.53%

9.67% 28.16%

6.86% 8.63%

Sales/Capital Average effective tax rate Cost of capital EV/Sales

3.87 17.09% 8.24% 1.60

4.64 13.25% 8.10% 1.40

1.30 15.59% 6.76% 1.11

1.57 14.75% 7.74% 1.78

1.55 13.90% 7.60% 0.92

2.63 18.98% 8.90% 0.78

0.10 18.14% 5.02% 9.84

0.24 19.85% 5.21% 4.12

1.69 10.40% 8.00% 2.42

0.93 18.10% 6.97% 3.55

0.86 2.91% 8.96% 9.58

1.17 17.82% 9.35% 2.78

0.18 11.69% 5.38% 5.98

1.74 18.24% 7.39% 1.15

3.01 17.75% 7.35% 1.39

1.20 15.62% 7.18% 3.17

1.45 15.40% 8.22% 2.68

1.70 22.63% 8.60% 1.16

1.57 17.61% 7.79% 1.62

1.56 6.27% 8.49% 0.99

4.21 17.30% 7.80% 1.03

1.89 11.78% 8.73% 4.05

3.14 11.98% 9.04% 1.20

0.99 14.84% 6.80% 1.72

1.00 14.26% 6.23% 1.57

1.61 14.13% 7.65% 1.60

2.09 13.53% 8.32% 1.29

2.00 13.29% 8.55% 0.97

2.48 13.96% 8.49% 0.59

2.44 16.25% 7.50% 0.62

1.47 9.04% 8.28% 2.81

1.86 11.45% 8.23% 1.74

1.82 13.19% 6.49% 0.78

0.06 17.33% 4.57% 13.99

0.14 12.60% 5.21% 7.55

2.09 16.40% 6.67% 1.39

5.84 17.20% 6.41% 0.37

2.88 16.03% 7.51% 0.91

1.50 8.83% 7.58% 2.86

1.30 16.65% 6.04% 1.77

1.45 12.66% 7.56% 3.02

7.31 17.26% 6.94% 0.58

1.57 7.88% 9.02% 3.25

1.55 17.11% 8.16% 1.16

1.19 16.65% 8.89% 1.22

0.99 12.36% 7.20% 2.60

2.13 14.13% 7.28% 2.47

2.33 17.57% 7.40% 4.18

1.71 13.95% 6.16% 0.81

1.71 18.80% 7.91% 0.95

1.38 15.06% 6.24% 1.00

1.34 8.65% 9.31% 6.76

0.34 6.96% 6.49% 4.97

1.80 17.45% 8.43% 1.50

0.91 3.58% 9.34% 1.88

2.16 17.66% 6.43% 1.06

1.65 24.53% 8.80% 0.80

0.31 6.93% 9.46% 4.50

1.17 9.63% 7.41% 1.96

3.55 13.98% 8.31% 0.58

1.76 17.72% 6.59% 1.15

1.03 12.53% 6.55% 1.18

1.17 13.54% 7.66% 3.59

0.67 14.72% 5.94% 1.86

0.54 2.16% 9.84% 2.21

1.70 15.19% 7.30% 1.57

0.03 2.32% 4.06% 32.55

0.54 25.54% 6.02% 2.76

0.31 13.99% 7.00% 3.59

0.50 17.32% 5.09% 6.77

0.21 12.90% 6.26% 6.19

1.26 17.48% 7.68% 1.84

1.32 10.81% 7.37% 0.83

1.63 21.05% 6.79% 2.05

2.97 18.79% 6.79% 0.75

2.02 26.05% 7.31% 1.25

1.99 19.04% 6.12% 0.67

2.76 23.63% 7.22% 0.75

3.42 26.17% 5.97% 0.61

6.75 13.55% 10.14% 3.19

2.43 20.75% 7.96% 1.17

1.81 20.06% 8.15% 0.94

1.43 9.04% 10.41% 1.81

1.03 9.61% 9.72% 2.41

0.72 12.58% 6.91% 1.65

2.39 20.41% 8.01% 1.71

1.38 12.97% 7.53% 0.80

0.97 15.35% 7.31% 2.29

1.94 9.56% 9.19% 1.75

1.06 12.92% 6.30% 1.84

0.02 18.73% 3.85% 60.82

2.44 20.52% 6.27% 3.52

1.72 20.49% 6.95% 1.36

1.51 23.30% 6.21% 1.08

1.07 25.18% 5.09% 1.27

0.37 15.09% 6.42% 4.43

0.78 13.80% 6.85% 1.98

Yes or No Cost of capital

Yes Lowest decile of US companies (7%)

No 25th percentile of US companies (7.5%)

Median of US companies (8%)

75th percentile of US companies (10%)

Ninth decile of US companies (12%)

Direct input

Return on capital (in stable growth)

Match the best (ROIC=40%)

90th percentile (ROIC=25%)

75th percentile (ROIC=20%)

50th percentile (ROIC=12.5%)

25th percentile (ROIC = Cost of capital)

10th percentile (ROIC =5.00%)

Reinvestment

Minimal capital needs, no acquisitions (10.00)

Minimal capital needs, small acquisitions (5.00)

Service company median (3.00)

Technology company median (2.50)

US company median (2.00)

Capital intensive company median (1.50)

Direct input

Total Market Growth Effect

A4. Mobility Services B4. Double market size

A3. Logistics B4. Double market size

A4. Mobility Services B3. Increase market by 50%

A2. All car service B4. Double market size

A1. Urban car service B4. Double market size

A3. Logistics B3. Increase market by 50%

A1. Urban car service B3. Increase market by 50%

A2. All car service B3. Increase market by 50%

A4. Mobility Services B1. None

A3. Logistics B1. None

A2. All car service B1. None

A1. Urban car service B1. None

Network Effect Competitive Advantages Value of Uber

C5. Strong global network effects D4. Strong & Sustainable $90,457

C5. Strong global network effects D4. Strong & Sustainable $65,158

C3. Strong local network effects D3. Semi-strong $52,346

C5. Strong global network effects D4. Strong & Sustainable $47,764

C5. Strong global network effects D4. Strong & Sustainable $31,952

C3. Strong local network effects D3. Semi-strong $14,321

C3. Strong local network effects D3. Semi-strong $7,127

C3. Strong local network effects D3. Semi-strong $4,764

C1. No network effects D1. None $1,888

C1. No network effects D1. None $1,417

C1. No network effects D1. None $1,094

C1. No network effects D1. None $799

Vous aimerez peut-être aussi

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaPas encore d'évaluation

- The Best of Charlie Munger 1994 2011Document349 pagesThe Best of Charlie Munger 1994 2011VALUEWALK LLC100% (6)

- Roc Roic Roe PDFDocument69 pagesRoc Roic Roe PDFCharlie NealPas encore d'évaluation

- DCF Analysis Discount Rate Cash Flow Growth Insurance CompanyDocument9 pagesDCF Analysis Discount Rate Cash Flow Growth Insurance Companymumbaideepika100% (1)

- Zorbas ExcelDocument23 pagesZorbas ExcelRoderick Jackson Jr100% (5)

- Making Your Real Estate Fortune - Robert AllenDocument491 pagesMaking Your Real Estate Fortune - Robert Allenknfzed100% (1)

- Assumptions - : Amazon Cashflow & Profit ForecastDocument22 pagesAssumptions - : Amazon Cashflow & Profit Forecastlengyianchua206Pas encore d'évaluation

- Wipro Mock Test 1Document9 pagesWipro Mock Test 1Sumit Gupta100% (1)

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- DCF Excel FormatDocument5 pagesDCF Excel FormatRaja EssakyPas encore d'évaluation

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgPas encore d'évaluation

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaPas encore d'évaluation

- CML Vs SMLDocument9 pagesCML Vs SMLJoanna JacksonPas encore d'évaluation

- Baldwin CompanyDocument4 pagesBaldwin CompanyShubham TetuPas encore d'évaluation

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaPas encore d'évaluation

- UberIPO2019 DuplicateDocument45 pagesUberIPO2019 DuplicatemanashipntPas encore d'évaluation

- Company's Current StatusDocument35 pagesCompany's Current StatusWeirdo BlackPas encore d'évaluation

- Money Moniker An AlyszDocument5 pagesMoney Moniker An AlyszelectronicmitraPas encore d'évaluation

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoPas encore d'évaluation

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654Pas encore d'évaluation

- Valuation of AppleDocument25 pagesValuation of AppleQuofi SeliPas encore d'évaluation

- Valuation+ +excel+ +students+Document4 pagesValuation+ +excel+ +students+snigdha.sanaboinaPas encore d'évaluation

- Mayes 8e CH11 SolutionsDocument22 pagesMayes 8e CH11 SolutionsRamez AhmedPas encore d'évaluation

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- Lady M ValuationDocument3 pagesLady M Valuationsairaj bhatkarPas encore d'évaluation

- Title Names University'S IdsDocument10 pagesTitle Names University'S IdsUzma SiddiquiPas encore d'évaluation

- TUGAS 4 MATA KULIAH MANAJEMEN KEUANGANDocument4 pagesTUGAS 4 MATA KULIAH MANAJEMEN KEUANGANdaraPas encore d'évaluation

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789Pas encore d'évaluation

- Presentación User Valuation DamodaranDocument42 pagesPresentación User Valuation Damodaranfrank bautistaPas encore d'évaluation

- Growing Market ModelDocument12 pagesGrowing Market ModeljanuarPas encore d'évaluation

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138Pas encore d'évaluation

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaPas encore d'évaluation

- Financial Analysis and ProjectionsDocument5 pagesFinancial Analysis and ProjectionsMa HiPas encore d'évaluation

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayPas encore d'évaluation

- Year 1 Year 2 Panel A - Projected Free Cash FlowDocument7 pagesYear 1 Year 2 Panel A - Projected Free Cash FlowLede Ann Calipus YapPas encore d'évaluation

- Final Req VCMDocument8 pagesFinal Req VCMMaxine Lois PagaraganPas encore d'évaluation

- All Dollar Values in Millions: Operating InformationDocument14 pagesAll Dollar Values in Millions: Operating InformationShubham SharmaPas encore d'évaluation

- 3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsDocument3 pages3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsQudsiya KalhoroPas encore d'évaluation

- Target Corporation - Simple Operating Model: General AssumptionsDocument6 pagesTarget Corporation - Simple Operating Model: General AssumptionsoussemPas encore d'évaluation

- BSFIN - Your Final OutputsDocument6 pagesBSFIN - Your Final OutputsPaul Jures DulfoPas encore d'évaluation

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotPas encore d'évaluation

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04Pas encore d'évaluation

- Market Analysis Worksheet: (Company Name) (Date)Document5 pagesMarket Analysis Worksheet: (Company Name) (Date)Rommel EsperidaPas encore d'évaluation

- PFE Financials As On 08-09-2023Document38 pagesPFE Financials As On 08-09-2023Asim MalikPas encore d'évaluation

- Amazon 4 Year Profit Cashflow Model - LLC VersionDocument23 pagesAmazon 4 Year Profit Cashflow Model - LLC Versionyou forPas encore d'évaluation

- Financial AnalysisDocument8 pagesFinancial AnalysisMaxine Lois PagaraganPas encore d'évaluation

- Caso Nextel DataDocument42 pagesCaso Nextel Dataelena ubillasPas encore d'évaluation

- Ms. Excel International Brews: Income StatementDocument9 pagesMs. Excel International Brews: Income StatementAphol Joyce MortelPas encore d'évaluation

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1Pas encore d'évaluation

- PE Exit AnalysisDocument5 pagesPE Exit AnalysisgPas encore d'évaluation

- Ross, Westerfield, Jaffe, and Jordan's Spreadsheet Master - Chapter 6 Section 2Document28 pagesRoss, Westerfield, Jaffe, and Jordan's Spreadsheet Master - Chapter 6 Section 2Faisal Siddiqui0% (1)

- W10 Case Study Capital BudgetingDocument2 pagesW10 Case Study Capital BudgetingJuanPas encore d'évaluation

- PC2020 Mid Year ReportDocument9 pagesPC2020 Mid Year ReportKW SoldsPas encore d'évaluation

- Market Analysis Worksheet: (Company Name) (Date)Document6 pagesMarket Analysis Worksheet: (Company Name) (Date)iPakistanPas encore d'évaluation

- Capital Budgeting - Baldwin Inc (Solved)Document27 pagesCapital Budgeting - Baldwin Inc (Solved)Contact InfoPas encore d'évaluation

- Excel To Business Analys ExamDocument15 pagesExcel To Business Analys Examrhea23aPas encore d'évaluation

- Market Analysis Worksheet: (Company Name) (Date)Document5 pagesMarket Analysis Worksheet: (Company Name) (Date)Neha Vrajesh PithwaPas encore d'évaluation

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliPas encore d'évaluation

- Net Synergies and Valuation of SBC Acquisition of AT&TDocument16 pagesNet Synergies and Valuation of SBC Acquisition of AT&TAnonymous 5z7ZOpPas encore d'évaluation

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikPas encore d'évaluation

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderPas encore d'évaluation

- Valuation - Wokmore PDFDocument2 pagesValuation - Wokmore PDFDaemon7Pas encore d'évaluation

- All Dollar Values in Millions: Operating InformationDocument32 pagesAll Dollar Values in Millions: Operating InformationanuPas encore d'évaluation

- NPV of A Borders - APDocument1 pageNPV of A Borders - APpillai21Pas encore d'évaluation

- Aid for Trade in Asia and the Pacific: Promoting Economic Diversification and EmpowermentD'EverandAid for Trade in Asia and the Pacific: Promoting Economic Diversification and EmpowermentPas encore d'évaluation

- Bernanke S ParadoxDocument26 pagesBernanke S ParadoxSergio OlartePas encore d'évaluation

- Democratizing MoneyDocument26 pagesDemocratizing MoneySergio OlartePas encore d'évaluation

- Bernanke S ParadoxDocument26 pagesBernanke S ParadoxSergio OlartePas encore d'évaluation

- An Antidote To Deficit PhobiaDocument4 pagesAn Antidote To Deficit PhobiaSergio OlartePas encore d'évaluation

- Course Notes: Reading Financial StatementsDocument63 pagesCourse Notes: Reading Financial StatementsSergio OlartePas encore d'évaluation

- Myth 5Document28 pagesMyth 5Sergio OlartePas encore d'évaluation

- Financial Analysis GlossaryDocument6 pagesFinancial Analysis GlossarySergio OlartePas encore d'évaluation

- Accounting Fact SheetDocument1 pageAccounting Fact SheetSergio OlartePas encore d'évaluation

- Wacc Usa CompaniesDocument15 pagesWacc Usa CompaniesSergio OlartePas encore d'évaluation

- Are We All MMTers NowDocument1 pageAre We All MMTers NowSergio OlartePas encore d'évaluation

- 10 Excel Pro Tips WorkbookDocument21 pages10 Excel Pro Tips WorkbookSergio OlartePas encore d'évaluation

- Functional CV TemplateDocument2 pagesFunctional CV TemplateSergio OlartePas encore d'évaluation

- Wa CC GlobalDocument6 pagesWa CC GlobalSergio OlartePas encore d'évaluation

- The Promise of BlockchainDocument2 pagesThe Promise of BlockchainSergio OlartePas encore d'évaluation

- A Brief History of BlockchainDocument3 pagesA Brief History of BlockchainSergio OlartePas encore d'évaluation

- Erp 2016Document136 pagesErp 2016Sergio OlartePas encore d'évaluation

- Dare To Be Great IIDocument10 pagesDare To Be Great IIWarren DickPas encore d'évaluation

- Are Stocks Riskier Than BondsDocument7 pagesAre Stocks Riskier Than BondsSergio OlartePas encore d'évaluation

- What's Your Game Plan (090503)Document8 pagesWhat's Your Game Plan (090503)Sergio OlartePas encore d'évaluation

- COST DRIVERS & COST BEHAVIOUR: UNDERSTANDING THE LINKSDocument37 pagesCOST DRIVERS & COST BEHAVIOUR: UNDERSTANDING THE LINKSSergio Olarte100% (1)

- How To Catch Those Fleeting Investment OpportunitiesDocument5 pagesHow To Catch Those Fleeting Investment OpportunitiesSergio OlartePas encore d'évaluation

- SSRN Id1874892Document37 pagesSSRN Id1874892Sergio OlartePas encore d'évaluation

- The Capitalism Spirit 0470407379Document321 pagesThe Capitalism Spirit 0470407379Ildemaro ToranzoPas encore d'évaluation

- A New Way To Do Nuclear - The New YorkerDocument4 pagesA New Way To Do Nuclear - The New YorkerFeynman2014Pas encore d'évaluation

- Cash Flow Is A Fact Net Income An OpinionDocument17 pagesCash Flow Is A Fact Net Income An OpinionFeynman2014Pas encore d'évaluation

- Shpenzimet Kapitale - Cost of CapitalDocument61 pagesShpenzimet Kapitale - Cost of CapitalBujar MorinaPas encore d'évaluation

- Ajit Isaac LectureDocument16 pagesAjit Isaac LectureSergio OlartePas encore d'évaluation

- Has Advertising Lost Its Personality - Martin WeigelDocument21 pagesHas Advertising Lost Its Personality - Martin WeigelRajatPas encore d'évaluation

- Insurance OutlineDocument6 pagesInsurance Outlinefdafdaf8180Pas encore d'évaluation

- QAFD Project SolverDocument5 pagesQAFD Project SolverUJJWALPas encore d'évaluation

- International Investment Law ArticleDocument37 pagesInternational Investment Law ArticleChloe SteelePas encore d'évaluation

- KPMG International Survey Corporate Responsibility Survey Reporting 2008Document118 pagesKPMG International Survey Corporate Responsibility Survey Reporting 2008Rofidha TefaniaPas encore d'évaluation

- Non-Deposit Taking NBFIs Business RulesDocument24 pagesNon-Deposit Taking NBFIs Business RulesPrince McGershonPas encore d'évaluation

- Annual Report Highlights for 2010Document177 pagesAnnual Report Highlights for 2010Vasundhara KediaPas encore d'évaluation

- Comparative Financial Analysis of Tata Steel and SAILDocument53 pagesComparative Financial Analysis of Tata Steel and SAILManu GCPas encore d'évaluation

- BIR Ruling No. 206-90Document1 pageBIR Ruling No. 206-90Peggy SalazarPas encore d'évaluation

- Far430 Group Project Sept 2015 QsDocument9 pagesFar430 Group Project Sept 2015 QsNina ZamzulyanaPas encore d'évaluation

- Banking Industry OverviewDocument27 pagesBanking Industry OverviewNicole JoanPas encore d'évaluation

- Chapter 3 - Financial Statement AnalysisDocument22 pagesChapter 3 - Financial Statement AnalysisReyes JonahPas encore d'évaluation

- Understanding Customer Investment Preferences in PuneDocument36 pagesUnderstanding Customer Investment Preferences in PuneRubina MansooriPas encore d'évaluation

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevPas encore d'évaluation

- 2005 10 XBRL Progress ReportDocument18 pages2005 10 XBRL Progress ReportkjheiinPas encore d'évaluation

- Basic Problems of An EconomyDocument2 pagesBasic Problems of An EconomyMaria Andrea SajoniaPas encore d'évaluation

- Chapter 2Document43 pagesChapter 2Truely MalePas encore d'évaluation

- Ganje M FINC600 Week 5 Due Feb 9Document6 pagesGanje M FINC600 Week 5 Due Feb 9Nafis HasanPas encore d'évaluation

- Proposed FY 2018-19 BudgetDocument399 pagesProposed FY 2018-19 BudgetWatertown Daily TimesPas encore d'évaluation

- Jeda ConsDocument2 pagesJeda ConsNathan ChinhondoPas encore d'évaluation

- Security AnalysisDocument305 pagesSecurity AnalysisAoc HyderporaPas encore d'évaluation

- 001 Grant Thornton Corporate Governance Review 2011Document60 pages001 Grant Thornton Corporate Governance Review 2011Ali LoughreyPas encore d'évaluation

- CCL Products India Standalone Balance SheetDocument2 pagesCCL Products India Standalone Balance SheetSaurabh RajPas encore d'évaluation

- Sources of Finance: Name: Mahfooz Alam Shaikh Class: TYBBA Roll No: F39 Subject: Financial ManagementDocument6 pagesSources of Finance: Name: Mahfooz Alam Shaikh Class: TYBBA Roll No: F39 Subject: Financial ManagementMahfooz Alam ShaikhPas encore d'évaluation

- Individual Assignem (Minyichel)Document16 pagesIndividual Assignem (Minyichel)samuel debebePas encore d'évaluation

- Ecnomic Assiment of The NPPDocument144 pagesEcnomic Assiment of The NPPHamza AbdullahPas encore d'évaluation

- Insurance Law - Tibay v CA Syllabus Provides GuidanceDocument6 pagesInsurance Law - Tibay v CA Syllabus Provides GuidanceAlexandria ThiamPas encore d'évaluation