Académique Documents

Professionnel Documents

Culture Documents

GST Presentation Text

Transféré par

sgk1611Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

GST Presentation Text

Transféré par

sgk1611Droits d'auteur :

Formats disponibles

Opening :

Good Morning to you all and welcome to this presentation. My presentation today is

on Goods & Services Tax.

slide no. 1 :

Normally Question & Answer sessions are at the end. But for a change, we will

start with a few questions and their answers. Incidentally these questions do not

require any prior knowledge about Taxation.

1st question : If fine is a penalty for doing something wrong, then what is

Tax ?

The answer to this is : Tax is a penalty for doing something Right

I think most of us will readily agree on this definition of Tax.

Next Question : Why India is a Land of equal opportunity ?

The Answer : Because every one here has an equal opportunity to pay tax. Off

course, some Businessmen do not believe in this equal opportunity thing. They do

not pay any taxes at all.

Next question, How Dharmaraj of Mahabharata managed not telling a lie all his

life ?

The answer is, he never had to file a Tax Return.

Whereas in todays age, many people are forced to be economical with truth.

And the last question , Why Tax deducted at source, such as TDS on your FD, is

a fraction of the actual tax ?

This is because the Govt does not want you to become mad all at once.

And in any case the remaining tax will be payable at the end of the year.

Jokes apart, over and above income tax , which is a direct tax, each one of us also

pays a variety of indirect taxes like excise, VAT, octroi etc. Together with income

tax of about 30%, we end up paying something like 60 to 70 % of our income on

Taxes.

Slide no. 2

Coming to the main presentation on Goods and Services Tax , it will be covered in 4

parts.

The background,

the present international scenario,

proposed GST system in India

and lastly the benefits and challenges.

Slide no. 3

Goods and services Tax or GST will be a single tax to replace all indirect taxes on

goods and services. It will be a value added tax, like present state VAT. As most of

us know, in a VAT system , taxes are paid on the value addition at each stage in

the supply chain. This avoids cascading effect of multi point taxation.

In India, both Centre and states have power to legislate taxes. The present

main central indirect taxes are Excise and Service Tax . At state level , we have

VAT . At local municipal level, we have taxes like octroi and cess.

Slide no. 4

What are the taxes which will be replaced by single GST ? Actually the proposal at

this stage is quite radical . This is the present list of taxes which will be replaced by

GST.

It includes excise, service tax, state level Vat and range of other taxes. You may

notice that there is component in customs duty appropriately named as SAD by

some smart bureaucrat . It stands for special additional duty.

Slide no. 5

We will now have a look at the present international scenario.

More than 140 countries have already implemented GST . Most of them have

a single rate of tax. This single rate ranges between 17.5% to 21% in European

Union

In Australia it is lowest at 10% , New Zealand has 12.5% tax and China 17%

In India, the rate proposed at present is 16 %.

But there is catch. Like India believes in equal opportunity to all individuals, it is

also concerned about the loss of employment opportunities. If the things become so

simple, then a lot of people handling tax matters will loose their jobs. So unlike a

single GST in other countries, the Indian GST will have 2 components, Central

GST of 8 % and state GST of 8% . This is like present system of charging excise and

VAT on the same product. Still this will greatly simplify the matters as all

businesses have to file a common return. And also they will not have to deal with

present multiple no. of taxes.

Slide no. 6

There will be several benefits of a GST system.

It will be a greatly simplify the tax structure with combined tariffs for goods and

services

Uniform rates will apply the entire supply chain and nobody needs to spend time

trying to figure out taxes applicable in different states.

Transaction cost will reduce due to simplified and reduced tax return procedures.

The tax collections are expected to improve with wider tax base and better

compliance.

And all this will improve the global cost competitiveness of Indian Goods and

services.

Slide no. 7

Such a radical proposal will also involve some issues and challenges.

It is touted as the single most important tax reform since independence.

Getting the states the states to agree to abolish multiple taxes is Herculean

task, if we go by the experience of implementing state VAT.

The system is proposed to be implemented by April 2010. But ideally, the entire

scheme should be firmed up atleast 12 months before implementation.

Since that has not happened, the dead line of April 2010 looks difficult.

Slide no. 8

I will conclude my presentation by quoting George Harrison, the guitarist and song

writer of the 60s pop group Beatles.

He wrote the song Taxman when he realized that most of the groups earning

were actually being taken away in taxes.

In this song , the taxman says

If you drive a car, I will tax the street,

If you try to sit, I will tax your seat !

If you get too cold, I will tax the heat,

If you take a walk, I will tax your feet !

With the introduction of GST in India, more and more services will be included in the

tax net. We all hope that it will not lead to the scenarios in the song in which

intangibles like heat can also get taxed.

Thank you ! and time now for real Question and Answers session

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Binder1 PDFDocument5 pagesBinder1 PDFSaad Raza KhanPas encore d'évaluation

- U.S. Individual Income Tax Return: Standard DeductionDocument12 pagesU.S. Individual Income Tax Return: Standard DeductionBajan Beauty100% (1)

- Property TaxDocument1 pageProperty Taxfructoce4Pas encore d'évaluation

- Webinar On SST Changes On Taxable Service, Tax Rate & Transional PeriodDocument2 pagesWebinar On SST Changes On Taxable Service, Tax Rate & Transional PeriodFiza. MNorPas encore d'évaluation

- Details of Unstructured Learning Activities Undergone: Type of Ulas Particulars Details Topic Date Requested Cpe HoursDocument3 pagesDetails of Unstructured Learning Activities Undergone: Type of Ulas Particulars Details Topic Date Requested Cpe HoursmanishPas encore d'évaluation

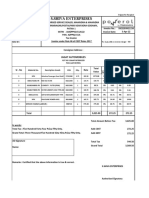

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESPas encore d'évaluation

- Revenue DetailsDocument1 pageRevenue Detailsviratkant143Pas encore d'évaluation

- New Microsoft PowerPoint Presentation TAXDocument10 pagesNew Microsoft PowerPoint Presentation TAXramesh BPas encore d'évaluation

- Tds Challan 281 Nov'2021Document6 pagesTds Challan 281 Nov'2021tojendra laltenPas encore d'évaluation

- DTL Group AssignmentDocument27 pagesDTL Group AssignmentPratik ChorariaPas encore d'évaluation

- What is Finance? Understanding the Key ConceptsDocument19 pagesWhat is Finance? Understanding the Key ConceptsArmilyn Jean CastonesPas encore d'évaluation

- FYCE BM1804 - Income Taxation HandoutDocument17 pagesFYCE BM1804 - Income Taxation HandoutLisanna DragneelPas encore d'évaluation

- OD329652827768379100Document1 pageOD329652827768379100nextl0395Pas encore d'évaluation

- HPCL Visakhapatnam price listDocument1 pageHPCL Visakhapatnam price listmc3lawrinPas encore d'évaluation

- Bidasar, ChuruDocument2 pagesBidasar, ChuruNarendra kumar indoriaPas encore d'évaluation

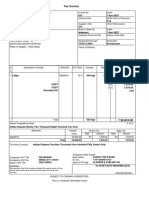

- Tax Invoice For Top Premium Ad 1: Account ID: 3319956331597968Document2 pagesTax Invoice For Top Premium Ad 1: Account ID: 3319956331597968CALL GIRLS DELHIPas encore d'évaluation

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1Hina SanPas encore d'évaluation

- Apartment Type Type A Type B Type C (4BHK+S.R) (3BHK+S.R) (3BHK) 3200 SQ FT 2350 SQ FT 1850 SQ FTDocument1 pageApartment Type Type A Type B Type C (4BHK+S.R) (3BHK+S.R) (3BHK) 3200 SQ FT 2350 SQ FT 1850 SQ FTRohit ChhabraPas encore d'évaluation

- Summarized Updates From CREATE LawDocument3 pagesSummarized Updates From CREATE LawJansel ParagasPas encore d'évaluation

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448Pas encore d'évaluation

- Group 1 - Sec. 23 24 NIRC Matrix PDFDocument4 pagesGroup 1 - Sec. 23 24 NIRC Matrix PDFDenise DuriasPas encore d'évaluation

- Solved Drake Inc A U S Corporation Operates A Branch Sales OfficeDocument1 pageSolved Drake Inc A U S Corporation Operates A Branch Sales OfficeAnbu jaromiaPas encore d'évaluation

- Tax Exempt de Minimis Benefits Under TRAIN RA 10963 Philippines - Tax and Accounting Center, Inc.Document7 pagesTax Exempt de Minimis Benefits Under TRAIN RA 10963 Philippines - Tax and Accounting Center, Inc.Nicale JeenPas encore d'évaluation

- ACC - Chapter 11Document29 pagesACC - Chapter 11Le Pham Khanh Ha (K17 HCM)Pas encore d'évaluation

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Document6 pagesTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaquePas encore d'évaluation

- Day AlanDocument1 pageDay AlanTechnetPas encore d'évaluation

- Pay-Slip March 2016 Field EngineerDocument1 pagePay-Slip March 2016 Field EngineerHari KumarPas encore d'évaluation

- Solved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFDocument1 pageSolved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFAnbu jaromiaPas encore d'évaluation

- E 02 P 3 Car LoanDocument1 pageE 02 P 3 Car LoanMattPas encore d'évaluation

- JHi 5 SJ 8 Oa FQTSMJ W8 L RFM 2 JJ 9 P MK VK7 I LNMM Ko Hy 7 G NCDocument1 pageJHi 5 SJ 8 Oa FQTSMJ W8 L RFM 2 JJ 9 P MK VK7 I LNMM Ko Hy 7 G NCShubham ThorbolePas encore d'évaluation