Académique Documents

Professionnel Documents

Culture Documents

Financial Results, Limited Review Report For December 31, 2015 (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results, Limited Review Report For December 31, 2015 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

10.02.

2016

Bombay Stock Exchange Ltd

Phiroze Jeejeebhoy Towers,

Dalal Street, FOlt,

Mumbai -400 001

Dear Sirs,

Scrip Code No. 523489

Sub: Outcome of Board Meeting.

***

This is to inform you that the Board of Directors of the Company at their meeting held today

viz. io" February, 2016, inter-alia, considered and approved the Unaudited Financial Results of

the Company for the Quarter and nine months period ended on 31 st December, 2015.

Please find enclosed herewith the Unaudited Financial Results of the Company and the Limited

Review Report thereon for the Quarter and nine months period ended on 3151 December, 2015

along with a copy of the press release being issued in this regard.

Kindly take the above intimation on record.

Thanking you,

Yours faithfully,

for Chennai Meenakshi Multispeciality Hospital Ltd.

~

(T. lEY APRAGASAM)

COMPANY SECRETARY

Encl: As above

ISO 9001 : 2008/ ISO 14001 : 2004 CERTIFIED HOSPITAL

Old No.148, New No.72, Luz Church Road, Mylapore, Chennai - 600 004.

Ph: +91 4442938938 I Fax: +91 4424993282 I E-mail: cmmhospitais@gmail.com I Website: www.cmmh.in

CHENNAI MEENAKSHI MULTISPECIALITY HOSPITAL LIMITED

(Formerly known as Devaki Hospital Limited)

CIN:L85110TN1990PLC019545

Regd. Office: New No. 72 (Old no.149), Luz Church Road, Mylapore, Chennai - 600 004

Phone:+91 44 42938938, Fax:+91 44 24993282, E-mail: cmmhospitals@gmail.com, Website: www.cmmh.in

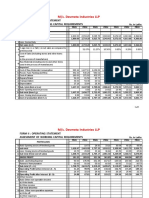

Statement of Unaudited Financial Results for the Quarter and Nine Months ended 31st December

2015

PART I IRucees

in lakhsl

SI. Particulars Previous Year

Quarter ended Nine month ended ended

No

31-12-2015 30-09-201 31-12-2014 31-12-2015 31-12-2014 31-03-2015

Unaudited Unaudited Unaudited Unaudited Unaudited Audited

1 Income from operations

a) Net Income from Operations 513.23 534.50 481.67 1564.93 1477.92 1872.36

b) Other Operating Income 3.94 3.84 3.15 11.51 10.49 14.83

Total income from operations (net) (1) 517.17 538.34 484.82 1576.44 1488.41 1887.19

2 Expenses

a) Cost of materials consumed - - - - - -

b) Purchase of Stock-in-trade 135.64 137.38 118.44 418.67 372.03 487.89

c) (Increase) / Decrease in Stock-in-trade (7.11) (3.06) 10.90 (17.07) 6.58 1.52

d) Employee benefits expenses 166.48 143.52 149.44 456.23 408.69 572.15

e) Depreciation & amortisation expenses 30.34 29.33 28.06 89.50 87.58 118.71

f) Other expenses 159.7 165.36 169.00 477.64 514.09 611.55

Total expenses (2) , 485.05 472.53 475.84 1424.97 1388.97 1791.82

3 Profit / (Loss) from operations before other Income. finance

costs & exceptional items (1-2) 32.12 65.81 8.98 151.47 99.44 95.37

4 Other Incomes 7.52 2.55 1.33 11.19 6.83 11.69

5 Profit / (Loss) from ordinary activities before finance costs &

exceptional items (3+4) 39.64 68.36 10.31 162.66 106.27 107.06

6 Finance costs 33.30 33.64 34.23 100.05 102.86 138.38

7 Profit / (Loss) from ordinary activities after finance costs but

before exceptional Items (5-6) 6.34 34.72 (23.92) 62.61 3.41 (31.32)

8 Exceptional Items - - - - - (65.89)

9 Profit / (Loss) from Ordinary Activities before Tax (7+8) 6.34 34.72 (23.92) 62.61 3.41 (97.21)

10 Tax Expenses - - - - -

11 Net Profit / (Loss) from Ordinary Activities after Tax (9-10) 6.34 34.72 (23.92) 62.61 3.41 (97.21)

12 Extraordinary Item (Net of tax Rs.Nil) - - - - - -

13 Net Profit / (Loss) for the Period (11-12) 6.34 34.72 (23.92) 62.61 3.41 (97.21)

14 Share of Profit / (Loss) of associates' NA NA NA NA NA NA

15 Minority Interest" NA NA NA NA NA NA

16 Net Profit / (Loss) after taxes. minority interest and share of

Profit / (Loss) of associates (13+14+15) 6.34 34.72 (23.92) 62.61 3.41 (97.21)

17 Paid up Equity Share Capital (Face Value Rs.10/- per share) 746.89 746.89 746.89 746.89 746.89 746.89

18 Reserves excluding revaluation reserves as per Balance Sheet

of the Previous Accounting Year (1294.27)

19 (i) Eaming Per Share (before extraordinary items)

(7468920 Equity Shares of Rs.l 0/- each) (not annualised)

(a) Basic (in Rs.) 0.08 0.46 (0.32) 0.84 0.05 (1.30)

(b) Diluted (in Rs.) 0.08 0.46 (0.32) 0.84 0.05 (1.30)

(ii) Earning Per Share (after extraordinary items)

(7468920 Equity Shares of Rs.10/- each) (not annualised)

(a) Basic (in Rs.) 0.08 0.46 (0.32) 0.84 0.05 (1.30)

(b) Diluted (in Rs.) 0.08 0.46 (0.32) 0.84 0.05 (1.30)

See accompanying note to the Financial Results

PART II

A PARTICULARS OF SHAREHOLDING

1 Public Share Holding

- No. of shares 3313212 3313212 3517362 3313212 3517362 3393798

- Percentage of share holding 44.36 44.36 47.10 44.36 47.10 45.43

2 Promoters and Promoters Group Share Holding

a) Pledged / Encumbered Nil Nil Nil Nil Nil Nil

- No. of shares - - - - -

- Percentage of Shares (AS a percentage of the total share

holding of promoter and promoter group)

- Percentage of Shares (As a percentage of the total share

-

- - - - -

capital of the company) - - - - - -

b) Non Encumbered

- No. of shares 4155708 4155708 3951558 4155708 3951558 4075122

- Percentage of Shares (AS a percentage of the total share

holding of promoter and promoter group) 100 100 100 100 100 100

- Percentage of Shares (As a percentage of the total share

capital of the company) 55.64 55.64 52.90 55.64 52.90 54.57

NOTES:

1 The entire operations of the Company relate to only one segment viz: Hospital.

2 The above results have been reviewed and recommended for adoption by the Audit Committee and approved by the Board of Directors

at their meeting held on 10.02.2016.

3 The Statutory Auditors have carried out a limited review of the financial results

4 Previous period / year figures have been regrouped / rearranged wherever necessary.

5 Not Applicable

For and on behalf of Board of Directors of

CHENNAI/~EENA~~I MULTIr~~~ 'tSPITAL LIMITED

~hv (L~-'/ i..L-

Place: Chennai A N RADHAKRISHNAN

Dated: 10th Februarv.2016 CHAIRMAN & MANAGING DIRECTOR

CHENNAI MEENAKSHI MULTlSPECIALlTY HOSPITAL LIMITED

(Formerly known as Devaki Hospital Limited)

CIN:L85110TN1990PLC019545

Regd. Office: New No. 72 (Old no.149), Luz Church Road, Mylapore, Chennai - 600004

Phone:+91 44 42938938, Fax:+91 44 24993282, E-mail: cmmhospitals@gmail.com, Website: www.cmmh.in

Extract of Unaudited Financial Results

for the Quarter and Nine Months ended 31st December,2015

(Rupees in lakhs)

Quarter ended Nine months ended Quarter ended

Particulars

31-Dec-15 31-Dec-15 31-Dec-14

Total Income from operations (net) 517.17 1576.44 484.82

Net Profit / (Loss) from ordinary activities after tax 6.34 62.61 (23.92)

Net Profit / (loss) for the period after tax (after

, 6.34 62.61 (23.92)

Extraordinary items)

Equity Share Capital (Face value of RS.10/- per share) 746.89 746.89 746.89

Reserves (excluding Revaluation Reserve as shown in the

Balance sheet of previous year) *

Earnings Per Share before extraordinary items

(7468920 equity share of RS,10/- each) (not annualised)

Basic (in Rs.) 0.08 0.84 (0.32)

Diluted (in Rs.) 0.08 0.84 (0.32)

Earnings Per Share after extraordinary items

(7468920 equity share of RS,10/- each) (not annualised)

Basic (in Rs.) 0.08 0.84 (0.32)

Diluted (in Rs.) 0.08 0.84 (0.32)

* Reserves (excluding revaluation reserve) as on 31st March, 2015 (-) RS.1294.27Iakhs

Notes:

1 The above results have been reviewed and recommended for adoption by the Audit Committee and approved by

the Board of Directors at their meeting. held on 10.02.2016.

2 The Statutory Auditors have carried out a limited review of the financial results.

3 The above is an extract of the detailed format of Financial Results for the Quarter / Nine Months ended on

31.12.2015 filed with the Stock Exchange under Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015. The full format of the Quarter / Nine Months Financial Results are available on

the Stock Exchange Website (www.bseindia.com) and on the Company's website (www.cmmh.in)

For and on behalf of Board of Directors of

CHENNAI MEENAKSHI MULTISPECItL..:1PITAL LIMITED

-:

r:

V L~I

I

. (';

./

I\.. \,~

Place: Chennai A N RADHAKRISHNAN

Dated: 10th February,2016 CHAIRMAN & MANAGING DIRECTOR

"Sreela Terrace"

1 OS, First Main Road,

Gandhi Nagar, Adyar,

Chennai-600 020.

Phone: 044-24452239,24423496

E-mail: chennai@varmaandvarma.com

LIMITED REVIEW REPORT

To:

The Board of Directors of Chennai Meenakshi Multispecialty Hospital Limited on the Limited Review of un-

audited financial results for the quarter ended 31 st December, 2015.

,

1. We have reviewed the accompanying statement of un-audited financial results of

MIs. CHENNAI MEENAKSHI MULTISPECIALITY HOSPITAL LIMITED (formerly known as

DEVAKI HOSPITAL LIMITED) for the period ended 31st December, 2015 except for the disclosures

regarding 'Public Shareholding' and 'Promoter and promoter group Shareholding' which have been

traced from disclosures made by the management and have not been audited by us. This statement is

the responsibility of the Company's Management and has been approved by the Board of Directors 1

Committee of Board of Directors. Our responsibility is to issue a report on this financial statement

based on our review.

2. We conducted our review in accordance with the Standard on Review Engagements (SRE) 2410,

Engagements to Review Interim Financial Statements issued by the Institute of Chartered Accountants

of India. This standard requires that we plan and perform the review to obtain moderate assurance as to

whether the financial statements are free of material misstatement.

3. A review of interim financial information consists principally of applying analytical procedure for

financial data and making enquiries of persons responsible for financial and accounting matters. It is

substantially less in scope than an audit conducted in accordance with generally accepted auditing

standards, the objective of which is the expression of opinion regarding the financial statements taken

as a whole. We have not performed an audit and accordingly, we do not express an audit opinion.

4. Based on our review conducted as above, nothing has come to our notice that causes us to believe that

the accompanying statement of un-audited financial results prepared in accordance with accounting

standards and other recognized accounting practices and policies has not disclosed the information

required to be disclosed in terms of clause 41 of the Listing Agreements including the manner in which

it is to be disclosed, or that it contains any material misstatement.

Place: Chennai For VARMA & VARMA

Date: 10102/2016 Chartered Accountants

\FRN : 04532S

/

, K M Sukumaran

Partner

M. No. 15707

Vous aimerez peut-être aussi

- Schaum's Outline of Principles of Accounting I, Fifth EditionD'EverandSchaum's Outline of Principles of Accounting I, Fifth EditionÉvaluation : 5 sur 5 étoiles5/5 (3)

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Document21 pagesAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahPas encore d'évaluation

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyPas encore d'évaluation

- Unaudited Financial Results For The Quarter Ended 30th September-2017Document2 pagesUnaudited Financial Results For The Quarter Ended 30th September-2017RajPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Q3FY22Document7 pagesQ3FY22Pratik PatilPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchPas encore d'évaluation

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Document13 pagesIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89Pas encore d'évaluation

- Q2 Results Bal 2021 22Document11 pagesQ2 Results Bal 2021 22Suraj PatilPas encore d'évaluation

- Devyani International Q3 ResultsDocument9 pagesDevyani International Q3 ResultsSaurabh AggarwalPas encore d'évaluation

- Third Quarter Financial Results Ended 31st December 2016 PDFDocument2 pagesThird Quarter Financial Results Ended 31st December 2016 PDFPreeti KhatwaPas encore d'évaluation

- Latest Financials - DR Agarwals May 2022Document11 pagesLatest Financials - DR Agarwals May 2022Mr SmartPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalPas encore d'évaluation

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirPas encore d'évaluation

- Wim Plast LTD.: CelloDocument5 pagesWim Plast LTD.: CelloAbhishek RanjanPas encore d'évaluation

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerPas encore d'évaluation

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARPas encore d'évaluation

- Icici 2009Document4 pagesIcici 2009Anudeep ReddyPas encore d'évaluation

- Standalone Consol Financial Results QE 9 Months 31 Dec 18Document7 pagesStandalone Consol Financial Results QE 9 Months 31 Dec 18Purav PatelPas encore d'évaluation

- 63 Moon Q3 ResultsDocument16 pages63 Moon Q3 Resultsdownloads.xaPas encore d'évaluation

- Sebi ReleaseDocument10 pagesSebi Releaseabhinashgiri2023Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Q1-Results Bal 2019-20Document5 pagesQ1-Results Bal 2019-20Krish PatelPas encore d'évaluation

- Arfin India LimitedDocument4 pagesArfin India Limitedkumar52Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Foaeecin: AHCL/ SE/ 41 /2020-21Document6 pagesFoaeecin: AHCL/ SE/ 41 /2020-21VijeshPas encore d'évaluation

- With The: One SunDocument14 pagesWith The: One SunPoojaDasguptaPas encore d'évaluation

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_naturePas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraPas encore d'évaluation

- Q2 18 19Document4 pagesQ2 18 19Surya SudheerPas encore d'évaluation

- Q1FY22Document8 pagesQ1FY22Anjalidevi TPas encore d'évaluation

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraPas encore d'évaluation

- Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)Document1 pageResubmission of Standalone Financial Results For December 31, 2014 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Final2010 PressAddwith CFSDocument1 pageFinal2010 PressAddwith CFStihadaPas encore d'évaluation

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediPas encore d'évaluation

- GHCL Limited (CIN: L24100GJ1983PLC006513)Document10 pagesGHCL Limited (CIN: L24100GJ1983PLC006513)soumyasibaniPas encore d'évaluation

- (Lacs) Particulars Consolidated Statement of Standalone/ Consolidated Audited Results For The Quarter and Year Ended March 31, 2015 StandaloneDocument5 pages(Lacs) Particulars Consolidated Statement of Standalone/ Consolidated Audited Results For The Quarter and Year Ended March 31, 2015 StandaloneRavi AgarwalPas encore d'évaluation

- The Limited: Ramcq CementsDocument12 pagesThe Limited: Ramcq Cementsdineshkumarhems15Pas encore d'évaluation

- Devmeta Project Report CmaDocument9 pagesDevmeta Project Report CmaharshPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Avantel LimitedDocument17 pagesAvantel LimitedContra Value BetsPas encore d'évaluation

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- ITC Financial Result Q4 FY2021 CfsDocument8 pagesITC Financial Result Q4 FY2021 CfsKaushik ViswanathanPas encore d'évaluation

- Reg30LODR QFR LRReport 31dec2020 WebsiteDocument15 pagesReg30LODR QFR LRReport 31dec2020 WebsiteAnveshPas encore d'évaluation

- CaplinPoint Q3FY22Document45 pagesCaplinPoint Q3FY22Ranjan PrakashPas encore d'évaluation

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Dolat: Algoieg-IlimitedDocument14 pagesDolat: Algoieg-IlimitedPãräs PhútélàPas encore d'évaluation

- Audited Financial Results For The Year Ended 31st March 2019Document9 pagesAudited Financial Results For The Year Ended 31st March 2019Sujesh GPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Digital Marketing Agency Business Plan ExampleDocument37 pagesDigital Marketing Agency Business Plan ExampleMohsin SyedPas encore d'évaluation

- Window DressingDocument18 pagesWindow DressingdebasisPas encore d'évaluation

- Manac Quiz 2 With AnswersDocument4 pagesManac Quiz 2 With AnswersReymilyn Sanchez78% (9)

- 4) TaxationDocument21 pages4) TaxationKrushna MatePas encore d'évaluation

- Uncontrollable Variables That Affect The Hospitality IndustryDocument2 pagesUncontrollable Variables That Affect The Hospitality IndustryKumar SatyamPas encore d'évaluation

- FDNACCT - Quiz #1 - Solutions To PS - Set ADocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set AleshamunsayPas encore d'évaluation

- Pas 34 Interim Financial Reporting Group 15Document56 pagesPas 34 Interim Financial Reporting Group 15Faker MejiaPas encore d'évaluation

- Monthly Timesheet Template ExcelDocument28 pagesMonthly Timesheet Template ExceltajudinPas encore d'évaluation

- 1st Practice Set On Fabm2 1Document6 pages1st Practice Set On Fabm2 1Kezie GirayPas encore d'évaluation

- EPM 288190285-Enterprise-Performance-Management-MCQDocument29 pagesEPM 288190285-Enterprise-Performance-Management-MCQbhupesh joshiPas encore d'évaluation

- Bcom PrinceDocument251 pagesBcom PrinceJacob EdwardsPas encore d'évaluation

- Financial Statement Analysis - Chp03 - Summary NotesDocument6 pagesFinancial Statement Analysis - Chp03 - Summary NotesBrainPas encore d'évaluation

- Fin621 Final Term Solved MCQS: JournalizingDocument23 pagesFin621 Final Term Solved MCQS: JournalizingIshtiaq JatoiPas encore d'évaluation

- CEL 1 PRAC 1 Answer KeyDocument12 pagesCEL 1 PRAC 1 Answer KeyRichel ArmayanPas encore d'évaluation

- Fabm 1 - Q1 - WK 4 - Module 3 - 5 Major Accounts and The Chart of AccountDocument20 pagesFabm 1 - Q1 - WK 4 - Module 3 - 5 Major Accounts and The Chart of AccountJosephine C QuibidoPas encore d'évaluation

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroPas encore d'évaluation

- Management Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oDocument21 pagesManagement Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oHemantha RajPas encore d'évaluation

- Coffee Ville CompleteDocument29 pagesCoffee Ville CompleteBilal Zafar100% (6)

- AirThread ConnectionsDocument10 pagesAirThread ConnectionsGuru Charan ChitikenaPas encore d'évaluation

- Corrected Problem 3-5A Pitman CompanyDocument5 pagesCorrected Problem 3-5A Pitman CompanyCamron PetilloPas encore d'évaluation

- Basic InformationDocument44 pagesBasic Informationabera gebeyehu100% (1)

- ULOb SIM - 0Document16 pagesULOb SIM - 0Arabela HasanPas encore d'évaluation

- Role of Gram SabhaDocument12 pagesRole of Gram SabhaAyan NazirPas encore d'évaluation

- Meressa Paper 2021Document24 pagesMeressa Paper 2021Mk FisihaPas encore d'évaluation

- PROBLEMS On Contract CostingDocument3 pagesPROBLEMS On Contract CostingAnu RanePas encore d'évaluation

- E1Document5 pagesE1Muostapha FikryPas encore d'évaluation

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaquePas encore d'évaluation

- SBI Book 2024 (19.4.2024) PDFDocument120 pagesSBI Book 2024 (19.4.2024) PDFPhani GadivemulaPas encore d'évaluation

- Unit 3 Assignment 2 Task 2Document4 pagesUnit 3 Assignment 2 Task 2Noor KilaniPas encore d'évaluation

- Accounting For Managers - All in OneDocument445 pagesAccounting For Managers - All in OneYaredPas encore d'évaluation