Académique Documents

Professionnel Documents

Culture Documents

BIR Ruling No. 464-08 (Business Taxes) 4.31.52 PM

Transféré par

Torrecampo YvetteCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BIR Ruling No. 464-08 (Business Taxes) 4.31.52 PM

Transféré par

Torrecampo YvetteDroits d'auteur :

Formats disponibles

November 26, 2008

BIR RULING [DA-(VAT-046) 464-08]

Secs. 30 & 106; 248-88; DA-040-02;

S30-027-2003

Servants of Jesus of Charity

2652 Maytubig St., Malate

Manila

Attention: Ma. Lourdes Dela Hoz

Mother Provincial General

Mesdames :

This refers to your letter dated October 7, 2008 requesting, in effect, exemption

from the payment of value-added tax (VAT) on the shipment of 1 x 20' and 1 x 40'

container, set to contain two (2) units of elevator, by The Local Superior of the

Religiosas Siervas De Jesus De La Caridad, Inc. or popularly known as the "Servants

of Jesus of Charity", a non-stock, non-profit religious organization exempt from the

payment of income tax pursuant to Section 30 (E) of the Tax Code of 1997, as

amended. IcCDAS

In reply thereto, please be informed that the exemption provided for under

Section 30 (E) of the Tax Code of 1997, as amended, pertains only to income tax.

Thus, business taxes, such as the value-added tax, are not covered by the said

exemption. If the Servants of Jesus of Charity will engage in the regular conduct or

pursuit of a commercial or economic activity, including transactions incidental to its

purposes, it will be subject to VAT. The above exemption from income tax does not

extend to activities conducted by religious organizations involving sale of goods and

services which are subject to the 12% VAT imposed under Section 106 of the same

Code. (BIR Ruling No. 248-88 dated June 6, 1988; BIR Ruling No. DA-040-02 dated

March 7, 2002; and BIR Ruling No. S30-027-2003 dated November 21, 2003).

On the other hand, the purchases of the organization, i.e., materials or

equipment for its building, are subject to the 12% VAT imposed under Section 106 of

Copyright 1994-2015 CD Technologies Asia, Inc. Taxation 2014 1

the Tax Code of 1997, as amended. Such tax payment may legitimately be passed on

to customers like non-stock, non-profit organizations or foundations. (BIR Ruling No.

248-88 dated June 6, 1988)

This ruling is being issued on the basis of the foregoing facts as represented.

However, if upon investigation, it will be disclosed that the facts are different, then

this ruling shall be considered null and void.

Very truly yours,

(SGD.) JAMES H. ROLDAN

Assistant Commissioner

Legal Service

Copyright 1994-2015 CD Technologies Asia, Inc. Taxation 2014 2

Vous aimerez peut-être aussi

- Angelo Niño Santos, Cresente Bernados, Irvin Bautista, Ivy Minette Mendoza and Sarah Jane CasauayDocument64 pagesAngelo Niño Santos, Cresente Bernados, Irvin Bautista, Ivy Minette Mendoza and Sarah Jane CasauayTorrecampo YvettePas encore d'évaluation

- Roman Catholic Bishop of TuguegaraoDocument3 pagesRoman Catholic Bishop of TuguegaraoTorrecampo YvettePas encore d'évaluation

- Office of Court Administrator Vs AmpongDocument1 pageOffice of Court Administrator Vs AmpongTorrecampo YvettePas encore d'évaluation

- Barangay San Roque vs. Heirs of Francisco PastorDocument1 pageBarangay San Roque vs. Heirs of Francisco PastorTorrecampo YvettePas encore d'évaluation

- Roxas Vs CaDocument1 pageRoxas Vs CaTorrecampo YvettePas encore d'évaluation

- Republic Vs BallocanagDocument1 pageRepublic Vs BallocanagTorrecampo YvettePas encore d'évaluation

- Moneyplus Protection Plan Variants: Monthly Premiums Monthly PremiumsDocument2 pagesMoneyplus Protection Plan Variants: Monthly Premiums Monthly PremiumsTorrecampo YvettePas encore d'évaluation

- Rep V CantorDocument2 pagesRep V CantorTorrecampo YvettePas encore d'évaluation

- ReversionDocument4 pagesReversionTorrecampo YvettePas encore d'évaluation

- Posadas Vs SandiganbayanDocument18 pagesPosadas Vs SandiganbayanTorrecampo YvettePas encore d'évaluation

- Group 1 Hospital Dentistry 1Document5 pagesGroup 1 Hospital Dentistry 1Torrecampo YvettePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Maria The CoptDocument2 pagesMaria The CoptmascomwebPas encore d'évaluation

- Civil Procedure Questions and AnswersDocument115 pagesCivil Procedure Questions and AnswersHalfani MoshiPas encore d'évaluation

- History Essay French RevolutionDocument3 pagesHistory Essay French RevolutionWeichen Christopher XuPas encore d'évaluation

- Embedded Plates Calculation - Part 2Document8 pagesEmbedded Plates Calculation - Part 2Mai CPas encore d'évaluation

- Romans Bible Study 32: Christian Liberty 2 - Romans 14:14-23Document4 pagesRomans Bible Study 32: Christian Liberty 2 - Romans 14:14-23Kevin MatthewsPas encore d'évaluation

- Macedonians in AmericaDocument350 pagesMacedonians in AmericaIgor IlievskiPas encore d'évaluation

- The Post-Standard's Argument To Make OCC Settlement PublicDocument23 pagesThe Post-Standard's Argument To Make OCC Settlement PublicDouglass DowtyPas encore d'évaluation

- Vham-Bai 3-The Gift of The MagiDocument20 pagesVham-Bai 3-The Gift of The MagiLý Thị Thanh ThủyPas encore d'évaluation

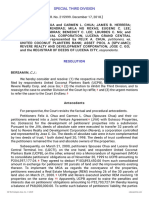

- Petitioners vs. vs. Respondents: Special Third DivisionDocument43 pagesPetitioners vs. vs. Respondents: Special Third DivisionBianca DawisPas encore d'évaluation

- Handbook For Coordinating GBV in Emergencies Fin.01Document324 pagesHandbook For Coordinating GBV in Emergencies Fin.01Hayder T. RasheedPas encore d'évaluation

- Haig's Enemy Crown Prince Rupprecht and Germany's War On The Western FrontDocument400 pagesHaig's Enemy Crown Prince Rupprecht and Germany's War On The Western FrontZoltán VassPas encore d'évaluation

- Home Alone 2Document2 pagesHome Alone 2elle maxPas encore d'évaluation

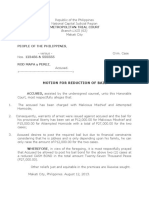

- Motion To Reduce BailDocument2 pagesMotion To Reduce BailMarycris OrdestaPas encore d'évaluation

- Esther Bible StudyDocument43 pagesEsther Bible StudyEsther Renda ItaarPas encore d'évaluation

- Constitution: Article 3, Section 2Document4 pagesConstitution: Article 3, Section 2Marcos BallesterosPas encore d'évaluation

- Tatenda Taibu ProfileDocument1 pageTatenda Taibu ProfilecreatePas encore d'évaluation

- Twilight (TwilDocument3 pagesTwilight (TwilAnn RamosPas encore d'évaluation

- ARIADocument3 pagesARIAangeli camillePas encore d'évaluation

- Revised Location Routing Numbers ListDocument8 pagesRevised Location Routing Numbers ListParveen Jindal100% (1)

- Canon CodalDocument1 pageCanon CodalZyreen Kate BCPas encore d'évaluation

- Verb With MeaningDocument2 pagesVerb With MeaningJatinPas encore d'évaluation

- Updesh Kumar, Manas K. Mandal Understanding Suicide Terrorism Psychosocial DynamicsDocument305 pagesUpdesh Kumar, Manas K. Mandal Understanding Suicide Terrorism Psychosocial DynamicsfaisalnamahPas encore d'évaluation

- Samsun, Turkey LTFH/SZF: Detos 1T Terme 1T Rwy 13 Rnav ArrivalsDocument30 pagesSamsun, Turkey LTFH/SZF: Detos 1T Terme 1T Rwy 13 Rnav ArrivalsTweed3APas encore d'évaluation

- The Old African: A Reading and Discussion GuideDocument3 pagesThe Old African: A Reading and Discussion GuidekgyasiPas encore d'évaluation

- S. M. G. M.: Strategic Mind Game ManualDocument34 pagesS. M. G. M.: Strategic Mind Game ManualJohn KonstantaropoulosPas encore d'évaluation

- ConservativeLibertarianBib PDFDocument136 pagesConservativeLibertarianBib PDFDiogo AugustoPas encore d'évaluation

- Remedial Law Reviewer BOCDocument561 pagesRemedial Law Reviewer BOCjullian Umali100% (1)

- Foundations of EducationDocument2 pagesFoundations of EducationFatima LunaPas encore d'évaluation

- ModestyDocument3 pagesModestywunderkindlucyPas encore d'évaluation

- Leasehold EstatesDocument1 pageLeasehold EstatesflorinaPas encore d'évaluation