Académique Documents

Professionnel Documents

Culture Documents

SP Uni CA 2016

Transféré par

mahendrabpatel0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues2 pagesQuestion Paper

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentQuestion Paper

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues2 pagesSP Uni CA 2016

Transféré par

mahendrabpatelQuestion Paper

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

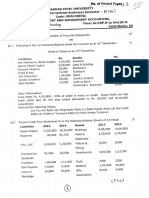

Seat No. SARDAR PATEL UNIVERSITY No. of printed page: 02

{09} BBA (ISM) (III Semester) Examination - 2016

UMO3CBBS08 - Cost Account

Tuesday, 6" December, 2016 2.00 pm - 4.00 pm Total Marks: 60

Note: Figures to the right indicate full marks of the question.

a4

{a) What do you mean by Cost Accounting ? Discuss Advantages & (10)

Limitations of Cost Accounting ?

(b) Write notes on : Elements of Cost. (08)

OR

Q.1_ A firm manufactured and sold 1000 computers in the year 2015 and supplies (15)

following information:

Rs.

Cost of materials 160000

Direct wages 240000

Manufacturing charges 100000

Salary 120000

Rent 20000

General expenses 40000

Selling expenses 60000

Sales 800000

For the year 2016, it is estimated that:

1) The output and sales will be of 1200 computers,

2) Price of material will rise by 20%.

3) Wage rates will rise by 5%

4) Manufacturing charges will increase in proportion to the combined cost

of materials and wages.

5) Salling expenses per unit will remain unchanged.

6) Other expenses will remain unaffected by rise in output.

Prepare @ statement showing the price at which computers would be

sold so as to show a profit of 10% on the selling price,

Q.2 Write notes on (15)

(i) Types of Materials

(ii), Economic Order Quantity

(i) ABC Analysis

OR

Q.2. A.Company has 3 production departments A, B, C and two service (18)

departments X & Y. The following information are extracted from the

records of the company for a particular given period:

Rs,

Rent and Rates 25000

Indirect wages 7500

General lighting 3000

Power 7500

Depreciation on machinery 50000

Sundries 50000

Additional data department wise:

Total [A B cy x Y

Direct wages 0000 | #6000) 10000 | 15000 | 7500 | ~2500

HP of machines used 150 60 30 50 40 -

Cost of machinery (Rs.)_ | 1250000 } 300000 | 400000 | s00000 | 25000 | 25000

Production hours worked - 6226 | 4028 | 4086 | - -

Floor space used 1000 | 2000 | 2500 | 3000 | 2000 | 500

Lighting points (Nos,) 60 40 15 20 10 5

Service Departments expenses allocation:

A | ef[cy|x | y¥

X [20% | 30% | ao%e |= | 10% |

Y¥ [40% [20% "30% | 40% |_-

You are required to Compute the overhead rate of production

departments using Repeated distribution method.

Q.3_ Why itis necessary to reconcile the profits as shown by the cost and (15)

financial accounts ? Discuss various causes for such differences.

OR

Q.3. The following figures have been extracted from the financial accounts of (15)

@ manufacturing firm

Rs.

Direct Material Consumption 500000

Direct wages 300000

Factory overheads 160000

Administrative overheads 70000

Selling 8 Distribution overheads 96000

Bad Debts 8000

Preliminary expenses written off 4000

Legal charges 1000

Dividend received 410000

Interest received on deposits 2000

Sales (12,000 units) 41200000

Glosina stocks

Finished Goods (400 units) 32000

Work-in-progress 24000

The cost accounts for the same period reveal that the direct

material consumption was Rs. 560000. Factory overhead is recovered at

20% on prime cost. Administration overhead is recovered at Rs. 6 per

unit of production. Selling and distribution overheads are recovered at

Rs. 8 per unit sold.

Prepare Profit and Loss Accounts. Statement of Cost sheet and

reconcile the profit as per two records.

a4

{a) Define Cost Audit. Discuss various objectives and types of Cost Audit. (10)

() Differentiate Financial Audit and Cost Audit. (05)

OR

Q.4 Write notes on: (15)

(i) Appointment & Qualification of Cost Auditor

(ii) Duties and Responsibilities of Cost Auditor

GO890

2

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Historia Del Mondonguito A La ItalianaDocument7 pagesHistoria Del Mondonguito A La ItalianaJuan OrocoPas encore d'évaluation

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelPas encore d'évaluation

- Get Started Right AwayDocument2 pagesGet Started Right AwaymahendrabpatelPas encore d'évaluation

- Material Variance: Unit 2 Standard Costing (MA-06101355)Document12 pagesMaterial Variance: Unit 2 Standard Costing (MA-06101355)mahendrabpatelPas encore d'évaluation

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelPas encore d'évaluation

- Assignenment 1 DT Unit 1Document9 pagesAssignenment 1 DT Unit 1mahendrabpatelPas encore d'évaluation

- Question BankDocument31 pagesQuestion BankmahendrabpatelPas encore d'évaluation

- Financial Accounting: Prof. Mahendra PatelDocument15 pagesFinancial Accounting: Prof. Mahendra PatelmahendrabpatelPas encore d'évaluation

- Unit V Cost of CapitalDocument24 pagesUnit V Cost of CapitalmahendrabpatelPas encore d'évaluation

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelPas encore d'évaluation

- MotivationDocument6 pagesMotivationmahendrabpatelPas encore d'évaluation

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelPas encore d'évaluation

- 1 CostsheetDocument8 pages1 CostsheetNash ShahPas encore d'évaluation

- Ch1 6Document109 pagesCh1 6Tia MejiaPas encore d'évaluation

- Capital BudgetingDocument24 pagesCapital BudgetingmahendrabpatelPas encore d'évaluation

- SP Uni CA 2016 MayDocument4 pagesSP Uni CA 2016 MaymahendrabpatelPas encore d'évaluation

- Amit ResumeDocument3 pagesAmit ResumemahendrabpatelPas encore d'évaluation

- SP Uni CA 1Document4 pagesSP Uni CA 1mahendrabpatelPas encore d'évaluation

- No. of Printed Pages: 03: Particulars Rs. Particulars RsDocument3 pagesNo. of Printed Pages: 03: Particulars Rs. Particulars RsmahendrabpatelPas encore d'évaluation

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelPas encore d'évaluation

- TestDocument2 pagesTestmahendrabpatelPas encore d'évaluation

- TestDocument2 pagesTestmahendrabpatelPas encore d'évaluation

- API Format 2017Document4 pagesAPI Format 2017mahendrabpatelPas encore d'évaluation

- SP Uni CA 2015Document3 pagesSP Uni CA 2015mahendrabpatelPas encore d'évaluation

- What Is Cost Reconciliation Statement?Document2 pagesWhat Is Cost Reconciliation Statement?mahendrabpatelPas encore d'évaluation

- Capital StructureDocument37 pagesCapital StructuremahendrabpatelPas encore d'évaluation

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelPas encore d'évaluation

- Instructor Effectiveness Form (IEF) Cronbach ReliabilitiesDocument3 pagesInstructor Effectiveness Form (IEF) Cronbach ReliabilitiesmahendrabpatelPas encore d'évaluation

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)