Académique Documents

Professionnel Documents

Culture Documents

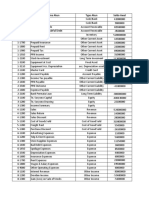

Account Name Account Classify Account Code

Transféré par

gazanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Account Name Account Classify Account Code

Transféré par

gazanDroits d'auteur :

Formats disponibles

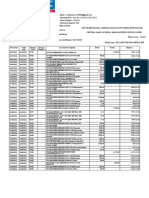

Mohammed Gazanfar Assessment 1

Unit FNSACC613A

Student ID 01429

Account Name Account Classify Account Code

Furniture & Fixtures Asset 1-3110

Debtors Asset 1-3120

Plant & Equipment Asset 1-3130

Input tax credits Liability 2-4140

Motor vehicles Asset 1-3310

Petty cash Asset 1-1140

Computer equipment Asset 1-3150

Cash Drawer Asset 1-3160

Credit card-Visa Liability 2-2320

Creditors Liability 2-2330

GST payable Liability 2-1330

PAYG withholding payable Liability 2-1420

Superannuation payable Liability 2-1440

Union fees payable Liability 2-1460

Loan from Equity 3-2312

Commonwealth Bank

Capital Equity 3-2412

Drawings Equity 3-1200

Sales Income 4-1100

Accounting fees Expense 5-0040

Advertising Expense 5-1000

Bank charges Expense 5-1020

Freight paid Expense 5-2000

Sales returns Income 4-1200

Delivery fee income Income 4-1300

Discounts received Income 4-1400

Interest Income Income 4-1420

Subscriptions and Expense 5-1500

magazines

Motor vehicle expenses Expense 5-1600

Cleaning Assets 1-1200

Electricity Expense 5-2420

Insurance Expense 5-1400

Discounts given Expense 5-3000

Photocopying Expense 5-4000

Postage Expense 5-2000

Purchases Expense 5-1100

Purchases returns Income 5-1400

Telephone Expense 5-2200

Travel Expense 5-2300

Wages and salaries Expense 5-1930

Stationery Expense 5-2000

Superannuation Liability 5-1920

General cheque account Assets 1-1500

Office supplies Expense 5-2400

Inventory Assets 1-1400

Vous aimerez peut-être aussi

- Training Manual Bookkeeping Financial & ManagementDocument81 pagesTraining Manual Bookkeeping Financial & ManagementJhodie Anne Isorena100% (1)

- Forest GumpDocument12 pagesForest Gumpɹɐʞ Thye100% (2)

- Part 1 - Strategic Planning - Top Level Planning & Analysis - Sol 21 Aug 2021Document67 pagesPart 1 - Strategic Planning - Top Level Planning & Analysis - Sol 21 Aug 2021Le BlancPas encore d'évaluation

- Chart of Accounts - BuilderDocument3 pagesChart of Accounts - BuilderPeter West40% (5)

- Economy Shipping Co Case SolutionDocument7 pagesEconomy Shipping Co Case SolutionPaco Colín100% (2)

- CFAS With KeyDocument5 pagesCFAS With KeyChesca Marie Arenal PeñarandaPas encore d'évaluation

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekPas encore d'évaluation

- Daftar Akun PT Kurnia - p3Document2 pagesDaftar Akun PT Kurnia - p3sodikin 01100% (1)

- Accounting EnglishDocument3 pagesAccounting EnglishfitriPas encore d'évaluation

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa InggrisIrma Triyani Yahya100% (4)

- Cocolife Cancellation LetterDocument1 pageCocolife Cancellation LetterIanRoseAcelajadoAderes50% (2)

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa InggrisAlinda Putri Palgunadi81% (21)

- Accounting Report SampleDocument14 pagesAccounting Report SampleGunawan MuhammadPas encore d'évaluation

- Daftar Akun-P1Document2 pagesDaftar Akun-P1santy kusumaningrumPas encore d'évaluation

- Accounts List (Summary) : CC Puno Jr. Construction, IncDocument4 pagesAccounts List (Summary) : CC Puno Jr. Construction, IncAndrew CatamaPas encore d'évaluation

- Revisi COA (Chart of Account)Document3 pagesRevisi COA (Chart of Account)Simarfian jaya abadiPas encore d'évaluation

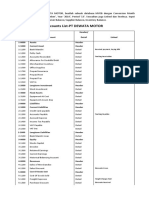

- Accounts List-PT DEWATA MOTOR: Received Payment, Paying BillsDocument4 pagesAccounts List-PT DEWATA MOTOR: Received Payment, Paying BillsAri KaruniaPas encore d'évaluation

- Mengenal Nama Akun Perusahaan Dagang: Current AssetsDocument2 pagesMengenal Nama Akun Perusahaan Dagang: Current AssetsDevi ArintaPas encore d'évaluation

- Akun-Akun Perusahaan DagangDocument2 pagesAkun-Akun Perusahaan Dagangyulistiana silviPas encore d'évaluation

- Daftar Akun PT KurniaDocument2 pagesDaftar Akun PT KurniaAnonymous wUY8CBZPas encore d'évaluation

- Daftar Akun Kel 9 - Ud AbadiDocument2 pagesDaftar Akun Kel 9 - Ud AbadiAyni Zakiah ramadhaniPas encore d'évaluation

- Daftar Akun Inggris.2024Document2 pagesDaftar Akun Inggris.2024aditia malunPas encore d'évaluation

- Akun ManunggalDocument1 pageAkun Manunggalyukidestara pardedePas encore d'évaluation

- Siklus Akuntansi Laporan KeuanganDocument67 pagesSiklus Akuntansi Laporan KeuanganAlya AdeliaPas encore d'évaluation

- Daftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiDocument4 pagesDaftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiFhina LarioPas encore d'évaluation

- LK Sesi Pertama - CV Maju HWDocument25 pagesLK Sesi Pertama - CV Maju HWAura Nur ApriliaPas encore d'évaluation

- Daftar Akun PT SentosaDocument2 pagesDaftar Akun PT SentosaDandy Edhya SaputraPas encore d'évaluation

- COADocument3 pagesCOARiri GayatriPas encore d'évaluation

- Daftar Nama Akun PT CAHAYADocument2 pagesDaftar Nama Akun PT CAHAYAHerlinaPas encore d'évaluation

- Daftar Akun PT. ManunggalDocument2 pagesDaftar Akun PT. ManunggalPutri FarsyaPas encore d'évaluation

- Bagan Akun PT CahayaDocument2 pagesBagan Akun PT CahayaLucky JrPas encore d'évaluation

- Daftar Akun PT AlamandaDocument4 pagesDaftar Akun PT AlamandaWigit Marseto AdjiPas encore d'évaluation

- Daftar AkunDocument2 pagesDaftar Akunike sinagaPas encore d'évaluation

- TemplateDocument2 pagesTemplateCastorPas encore d'évaluation

- Cerita Dongeng Bahasa Inggris ShakespeareDocument3 pagesCerita Dongeng Bahasa Inggris ShakespeareYolanda Herlina WijayaPas encore d'évaluation

- Akun Impor PT Surya SejahteraDocument4 pagesAkun Impor PT Surya SejahteraDiana FransiscaPas encore d'évaluation

- Nomor Akun Myob Ud BuanaDocument1 pageNomor Akun Myob Ud Buanadelive caPas encore d'évaluation

- Pengelompokan Kode AkunDocument3 pagesPengelompokan Kode AkunAYU PUJI SYABANIA100% (2)

- Lembar Kerja PT. ANDALAS Nur HidayantiDocument47 pagesLembar Kerja PT. ANDALAS Nur Hidayantinrhdynt240207Pas encore d'évaluation

- Akun Strawberry Salon & SpaDocument2 pagesAkun Strawberry Salon & SpaAn Nisa Sakinatul AhliyahPas encore d'évaluation

- Anlisis Soal Kasus PT BerkahDocument7 pagesAnlisis Soal Kasus PT Berkahputri nobellaPas encore d'évaluation

- TemplateDocument2 pagesTemplateCastorPas encore d'évaluation

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa InggrisLank BpPas encore d'évaluation

- Data Akun - PebriyantiDocument4 pagesData Akun - PebriyantiHabibah AzzahraPas encore d'évaluation

- DAFTAR AkunDocument2 pagesDAFTAR Akunindra kusmanaPas encore d'évaluation

- Daftar Akun Cv. Maju HomewareDocument2 pagesDaftar Akun Cv. Maju HomewareKamilatu Sa'diyahPas encore d'évaluation

- Daftar Akun PD. Mitra1Document2 pagesDaftar Akun PD. Mitra1Firda Nurnifsi FilaeliPas encore d'évaluation

- List Account: Nomor Nama Akun Fungsi Untuk Mencatat Mutasi Nilai Current AssetsDocument80 pagesList Account: Nomor Nama Akun Fungsi Untuk Mencatat Mutasi Nilai Current AssetsAnggi Anugrah Bintara100% (1)

- Daftar Akun - P1 - PD MitraDocument1 pageDaftar Akun - P1 - PD MitraWaryanAlifianBagusWicaksonoPas encore d'évaluation

- Data MyobDocument1 pageData Myobaline051107Pas encore d'évaluation

- Nomor Akun Nama Akun 1-1000 Current Assets: Type Akun Header Asset HeaderDocument20 pagesNomor Akun Nama Akun 1-1000 Current Assets: Type Akun Header Asset HeaderKrisdayanti BrchimbolonPas encore d'évaluation

- Charts of Accounts of Eagle Wheels Auto Solutions For QBDocument16 pagesCharts of Accounts of Eagle Wheels Auto Solutions For QBMuhammad UsmanPas encore d'évaluation

- Daftar AkunDocument1 pageDaftar AkunPutrii RJAPas encore d'évaluation

- Ud BuanaDocument1 pageUd Buanafinta febriyantiPas encore d'évaluation

- Excel Adi JayaDocument1 pageExcel Adi JayaMarcellino GeralPas encore d'évaluation

- Akun Impor Ud Prima EnergyDocument4 pagesAkun Impor Ud Prima EnergyAprillia NurjanahPas encore d'évaluation

- Book 1Document1 pageBook 1mareaaePas encore d'évaluation

- Kode Akun PT - Adi JayaDocument2 pagesKode Akun PT - Adi JayaDianatul QPas encore d'évaluation

- Kode Unit Kompetensi Judul Kompetensi Kode Soal: Instruksi KerjaDocument34 pagesKode Unit Kompetensi Judul Kompetensi Kode Soal: Instruksi Kerjanabilah syPas encore d'évaluation

- Daftar AkunDocument4 pagesDaftar AkunAkhrulisiPas encore d'évaluation

- Account List PD MITRA-1Document4 pagesAccount List PD MITRA-1fahtutikPas encore d'évaluation

- Latihan Ukk Brilian Anastasya PutriDocument36 pagesLatihan Ukk Brilian Anastasya PutriApoloos Ryan100% (1)

- Data CV Mandiri JayaDocument2 pagesData CV Mandiri Jayaaska askiaPas encore d'évaluation

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryD'EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Audit 2 l2 Test of ControlsDocument45 pagesAudit 2 l2 Test of ControlsGen AbulkhairPas encore d'évaluation

- EurobondsDocument217 pagesEurobondslovergal1992Pas encore d'évaluation

- Crescent Standard Modaraba: Managed by B.R.R. Investment (Private) LimitedDocument10 pagesCrescent Standard Modaraba: Managed by B.R.R. Investment (Private) Limiteds_kha100% (2)

- Group 1 - Data Automation & Artificial IntelligenceDocument25 pagesGroup 1 - Data Automation & Artificial IntelligenceFATIN 'AISYAH MASLAN ABDUL HAFIZPas encore d'évaluation

- Chapter 9 Cooperative BLAWDocument16 pagesChapter 9 Cooperative BLAWnovi bag-ayPas encore d'évaluation

- Cambridge International General Certificate of Secondary EducationDocument9 pagesCambridge International General Certificate of Secondary Educationcheah_chinPas encore d'évaluation

- PM Mudra Loan - How To Take Loan PDFDocument9 pagesPM Mudra Loan - How To Take Loan PDFbhramaniPas encore d'évaluation

- Monetary Policy Practice QuizDocument4 pagesMonetary Policy Practice QuizYu ChenPas encore d'évaluation

- RH Perennial - Nov 21Document46 pagesRH Perennial - Nov 21sambitPas encore d'évaluation

- 3174 Bike InsuranceDocument4 pages3174 Bike Insuranceanwar salafiPas encore d'évaluation

- Daftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkDocument3 pagesDaftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkMuhammad WildanPas encore d'évaluation

- Jiblr 2005 20 10 535-540Document6 pagesJiblr 2005 20 10 535-540Santanu RoyPas encore d'évaluation

- HUM-4717 Ch-5 Evaluating A Single Project 2020Document47 pagesHUM-4717 Ch-5 Evaluating A Single Project 2020SadatPas encore d'évaluation

- Project Chapter 1Document62 pagesProject Chapter 1HUMAIR123456Pas encore d'évaluation

- ShivamDocument6 pagesShivamAJOONEE AUTO PARTSPas encore d'évaluation

- Corporate Finance Asia Global 1st Edition Ross Test BankDocument25 pagesCorporate Finance Asia Global 1st Edition Ross Test BankDonnaNguyengpij100% (60)

- Invoicediscounting Factsheet NW BusDocument2 pagesInvoicediscounting Factsheet NW BusSinoj ASPas encore d'évaluation

- 1 Basic Concepts Quiz-MergedDocument50 pages1 Basic Concepts Quiz-MergedsukeshPas encore d'évaluation

- Apply For A U.SDocument1 pageApply For A U.Scm punkPas encore d'évaluation

- CBDCs and AMMDocument19 pagesCBDCs and AMMGopal DubeyPas encore d'évaluation

- Life Insurance - Wikipedia PDFDocument77 pagesLife Insurance - Wikipedia PDFTonu SPPas encore d'évaluation

- Months 6 Year 5 - 0 18 - 0 5000 450 Pi I NDocument4 pagesMonths 6 Year 5 - 0 18 - 0 5000 450 Pi I NDayLe Ferrer AbapoPas encore d'évaluation

- Accounting For Debt Srvice FundDocument10 pagesAccounting For Debt Srvice FundsenafteshomePas encore d'évaluation