Académique Documents

Professionnel Documents

Culture Documents

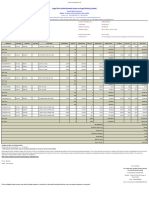

Cash Transactions Wef 01042017

Transféré par

sudy0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues1 pagecash transaction details

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentcash transaction details

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

22 vues1 pageCash Transactions Wef 01042017

Transféré par

sudycash transaction details

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

FAQ on Cash Receipt of Rs.2 Lakh or More w.e.f 01.04.

2017

(Section 269ST)

Sr. Questions Answers

no.

1) From which date this section is This section applies from 01/04/2017 (F.Y.2017-

applicable? 18 onwards)

2) What are the provisions of Finance Bill 2017 proposed to insert section 269ST in

Section 269ST? the Income Tax Act to provide that

no person shall receive an amount of Two lakh

rupees or more,

(a) in aggregate from a person in a day;

(b) in respect of a single transaction; or

(c) in respect of transactions relating to

one event or occasion from a person,

other-wise than by an account payee cheque or

account payee bank draft or use of electronic

clearing system through a bank account.

3) EXAMPLES OF TRANSACTIONS COVERED IN (a), (b) & (c ) above

(a) in aggregate from a person in E.g. if a person receives Rs.2.25 lakhs in cash for 2

a day different bills of Rs.1 lakh and 1.25 lakh, then also

penalty is levied

(b) in respect of single E.g. if there is single bill of Rs.3.10 Lakh and cash is

transaction received on different days of Rs.1.6 lakh and

Rs.1.5 lakh, then also penalty is levied.

(c) in respect E.g. if marriage is one occasion and a person

of transactions relating to receives amount of Rs.3,00,000/-. Thus penalty is

one event or occasion from a levied of 100% of amount received.

person

(d) withdrawal of amount from E.g. if a person withdraws in a day amount of Rs.2

own bank account lakhs or above, then penalty is levied.

4) To whom does Section 269 ST To any person receiving cash above Rs.2 lakh.

applies?

5) For which transactions is Section Restriction on cash receipt of Rs.2 Lakh or more w.e.f

269ST not applicable? 01.04.2017 shall not apply to

Government, any banking company, post

office savings bank or co-operative bank.

Transactions of the nature referred to in

section 269SS;

Such other persons or class of persons or

receipts, as may be specified by the

Central Government by notification in the

Official Gazette.

6) Whether penalty is applicable for Any type of amount of Rs.2 Lakh or above received

regular receipts only? in cash whether capital or revenue in nature.

7) Whether exempt income is Both taxable and exempt incomes are covered in

covered under Section 269ST? Section 269ST.

8) If the amount is received for Irrespective of purpose of accepting amount i.e.,

personal purpose, whether whether business purpose or personal purpose

269ST is applicable? or as a trustee, custodian etc. section 269ST is

applicable.

9) What is the Penalty for 100% penalty on receiver of amount.

Contravention of Section 269ST?

Ambalal Patel & Co.

Chartered Accountants

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- 7 Habits Weekly Planner Clean TemplateDocument1 page7 Habits Weekly Planner Clean Templatesudy100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Amatuer Radio 2Document51 pagesAmatuer Radio 2sudyPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- UFOs, Aliens, and Ex-Intelligence Agents - Who's Fooling Whom - PDFDocument86 pagesUFOs, Aliens, and Ex-Intelligence Agents - Who's Fooling Whom - PDFCarlos Eneas100% (2)

- Vicente Vs EccDocument1 pageVicente Vs EccMaria Theresa AlarconPas encore d'évaluation

- 7steps 523 PDFDocument100 pages7steps 523 PDFsudyPas encore d'évaluation

- Eirdecember 2018Document3 392 pagesEirdecember 2018sudyPas encore d'évaluation

- Eirdecember 2018Document3 392 pagesEirdecember 2018sudyPas encore d'évaluation

- BNL Reviewer - Set ADocument8 pagesBNL Reviewer - Set ARowena JeanPas encore d'évaluation

- Ampatuan Case DigestDocument2 pagesAmpatuan Case DigestDeanne ClairePas encore d'évaluation

- Hilario V Salvador - GR No. 160384 - Case DigestDocument2 pagesHilario V Salvador - GR No. 160384 - Case DigestAbigail Tolabing100% (1)

- CALALAS V CA Case DigestDocument2 pagesCALALAS V CA Case DigestHazel Canita100% (2)

- Quick Starter - TroyDocument37 pagesQuick Starter - TroyBrlien AlPas encore d'évaluation

- Guide Q CrimDocument3 pagesGuide Q CrimEzra Denise Lubong Ramel100% (1)

- Eirnovember 2018Document2 294 pagesEirnovember 2018sudyPas encore d'évaluation

- Eirnovember 2018Document2 294 pagesEirnovember 2018sudyPas encore d'évaluation

- Sample Secretary's CertificateDocument1 pageSample Secretary's CertificateaprilPas encore d'évaluation

- ChapterDocument12 pagesChapterRegine Navarro RicafrentePas encore d'évaluation

- Soriano Vs PeopleDocument5 pagesSoriano Vs PeopleSamantha BaricauaPas encore d'évaluation

- Twitter TemplateDocument1 pageTwitter TemplatesudyPas encore d'évaluation

- Fake Tweet Template PDFDocument1 pageFake Tweet Template PDFsudyPas encore d'évaluation

- Before The Child Friendly Court, Bengaluru Urban DistrictDocument30 pagesBefore The Child Friendly Court, Bengaluru Urban DistrictsudyPas encore d'évaluation

- articlepublishedinIHJ PDFDocument9 pagesarticlepublishedinIHJ PDFsudyPas encore d'évaluation

- Twitter Template 9703Document1 pageTwitter Template 9703sudyPas encore d'évaluation

- How To Produce Your Book With Scribus.: Make The Front MatterDocument3 pagesHow To Produce Your Book With Scribus.: Make The Front MattersudyPas encore d'évaluation

- The PC Configuration #435062: No. Component Selected Product Price (INR) Buy It OnlineDocument1 pageThe PC Configuration #435062: No. Component Selected Product Price (INR) Buy It OnlinesudyPas encore d'évaluation

- Value Value Value Value Value Value Value Value Value Value Volume (In Thousand) Value (In Rs. Thousand)Document2 pagesValue Value Value Value Value Value Value Value Value Value Volume (In Thousand) Value (In Rs. Thousand)sudyPas encore d'évaluation

- Diagnostic Services Pvt. LTDDocument2 pagesDiagnostic Services Pvt. LTDsudyPas encore d'évaluation

- Channel Cost Free To Air: Sheet1Document1 pageChannel Cost Free To Air: Sheet1sudyPas encore d'évaluation

- Gotra Pravara Colour FinalDocument5 pagesGotra Pravara Colour FinalsudyPas encore d'évaluation

- Ebook4Expert Ebook CollectionDocument177 pagesEbook4Expert Ebook CollectionsudyPas encore d'évaluation

- Subiecte 8Document4 pagesSubiecte 8Mario TescanPas encore d'évaluation

- Document 292Document3 pagesDocument 292cinaripatPas encore d'évaluation

- Assigment of literacture-WPS OfficeDocument4 pagesAssigment of literacture-WPS OfficeAakib Arijit ShaikhPas encore d'évaluation

- A Day in The Life of Abed Salama Anatomy of A Jerusalem Tragedy Nathan Thrall Full ChapterDocument67 pagesA Day in The Life of Abed Salama Anatomy of A Jerusalem Tragedy Nathan Thrall Full Chapterfannie.ball342100% (7)

- Process PaperDocument2 pagesProcess Paperapi-242470461Pas encore d'évaluation

- CPC Civil Procedure Code - LawSpiceDocument112 pagesCPC Civil Procedure Code - LawSpiceLegal MeeSaSubramaniamPas encore d'évaluation

- Angel One Limited (Formerly Known As Angel Broking Limited) : (Capital Market Segment)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited) : (Capital Market Segment)Kirti Kant SrivastavaPas encore d'évaluation

- California Medical Marijuana GuidelinesDocument11 pagesCalifornia Medical Marijuana GuidelinesHeather HempPas encore d'évaluation

- People v. Dela CruzDocument7 pagesPeople v. Dela CruzJose Antonio BarrosoPas encore d'évaluation

- Canon CodalDocument1 pageCanon CodalZyreen Kate BCPas encore d'évaluation

- Nehru Report & Jinnah 14 PointsDocument14 pagesNehru Report & Jinnah 14 Pointskanwal hafeezPas encore d'évaluation

- Social Issues in The PhilippinesDocument19 pagesSocial Issues in The PhilippinessihmdeanPas encore d'évaluation

- LESSON 4 - COM Credo PPT-GCAS 06Document9 pagesLESSON 4 - COM Credo PPT-GCAS 06Joanne Ronquillo1-BSED-ENGPas encore d'évaluation

- Riches v. Countrywide Home Loans Inc. Et Al - Document No. 3Document1 pageRiches v. Countrywide Home Loans Inc. Et Al - Document No. 3Justia.comPas encore d'évaluation

- Indici Patient Portal Terms and Conditions v0 2 - 2Document3 pagesIndici Patient Portal Terms and Conditions v0 2 - 2hine1009Pas encore d'évaluation

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 581Document6 pagesDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 581Justia.comPas encore d'évaluation

- TPF Gorab BannerjiDocument9 pagesTPF Gorab Bannerjishivamjain391Pas encore d'évaluation

- Admin Tribumal and Frank CommitteeDocument8 pagesAdmin Tribumal and Frank Committeemanoj v amirtharajPas encore d'évaluation

- E Court On Appeal. - Upon Appeal From A Judgment of The Regional TrialDocument3 pagesE Court On Appeal. - Upon Appeal From A Judgment of The Regional TrialPcl Nueva VizcayaPas encore d'évaluation