Académique Documents

Professionnel Documents

Culture Documents

Usha Martin-Q2fy10 Update

Transféré par

A_KinshukTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Usha Martin-Q2fy10 Update

Transféré par

A_KinshukDroits d'auteur :

Formats disponibles

02 NOVEMBER, 2009 Q2 FY10 AND H1FY10

RESULT UPDATE

USHA MARTIN

CMP : 63.05

RESEARCH

RECOMMENDATION REDUCE

COMPANY DETAILS

Usha Martin Ltd. has come out with Q2and H1 FY10 result. The company continues BSE Code 517146

to report dismal performance on YoY basis, however on QoQ basis the company NSE Symbol USHAMART

Bloomberg USM IN

witnessed some growth. The company reported a standalone net sales of Rs. Market Cap. (Rs. Crs) 1577.51

482.26 crore compared to Rs.593.85 crore in the corresponding quarter last year, Free Float 53.84

signifying a drop of 18.8% on YoY basis. Consolidated net sales came at Rs.669.68 52 Week High 80

crore which is 17% lower compared to the Rs.807 crore reported in the same 52 Week Low 18

Dividend Yield -% 1.59

quarter last year. Profit after tax is down YoY by 65% and 38% on standalone and P/E Ratio 20.74

consolidated basis respectively. P/BV 1.55

Beta 0.97

Result Highlight Share Holding Pattern (%)

Promoter Group 46.16

Consolidated (Rs. in Cr.) FII 19.03

Other Institutions 19.01

Particulars 2009-10 Growth 2009-10 Growth 2008-09 Others 13.58

Qtr II % H1 (%) Annual Total 100

Turnover 697.61 -20.2 1333.33 -18.1 3146.79

669.68 -17.0 1278.22 -15.1 2949.85 Financial Details (Rs. Crs)

Net Sales

Share Capital 25.09

PBT 56.13 -28.8 106.37 -40.8 280.59

Net Sales (Cons) 2949.85

PAT 32.53 -37.9 64.56 -45.0 185.34 Net Sales (Standalone) 2127.23

EPS (FV Rs 1/-) PAT (Cons) 185.34

(in Rs.) 1.30 2.58 7.41 PAT (Standalone) 142.29

EPS (Cons) (in Rs.) 7.41

EPS (Standalone) (in Rs.) 5.95

Standalone (Rs. in Cr.) Ratios

PBIDTM (%) 16.42

Particulars 2009-10 Growth 2009-10 Growth 2008-09 APATM (%) 3.04

Qtr II % H1 (%) Annual ROCE (%) 10.1

Turnover 508.83 -22.4 939.21 -21.5 2307.21 RONW (%) 11.4

Net Sales 482.25 -18.8 887.38 -18.2 2127.23

PBT 32.22 -45.4 57.97 -59.8 207.34 Stock Price Movement (Rs.)

PAT 14.65 -65.0 28.05 -71.5 142.29

EPS (FV Rs 1/-)

(in Rs.) 0.59 1.12 5.95

EUREKA RESEARCH www.eurekasecurities.com

USHA MARTIN

02 NOVEMBER, 2009

Performance Review

During the quarter the realization for wire rods and bars have firmed up marginally by 3% compared to the previous quarter. The

realization for the quarter has been in the vicinity of Rs. 37,000 per ton compared to Rs. about 47,000 per ton a year ago and about 36,000

per ton last quarter. Wire rope contributes 35% of the company's revenue, which is a 5% drop from the year ago level. In the wire rope

front the company has witnessed a QoQ drop in realization to approx. Rs. 84,000 per ton compared to Rs. 95,000/ton in Q1FY10 and

about 91,000 in Q2FY09.

Source: Company, Eureka Research

On the other hand the realization of the wire strands and bright bars have remained more or less stable with wire strand realization

dropping on QoQ basis by 1% and bright bar realization remaining the same.

Source: Company, Eureka Research

EUREKA RESEARCH 2 www.eurekasecurities.com

USHA MARTIN

02 NOVEMBER, 2009

The production and sales volume of the company for both its intermediary and finished products have been as per the following table:

INDIA OPERATION

Particulars Q2 FY 09 Q2 FY 10 % Change H1 FY 09 H1 FY 10 % Change

Production (Qty in MT)

Sponge Iron 25,884 35,045 35% 50,390 63,260 26%

Hot Metal 38,537 36,247 -6% 85,845 78,160 -9%

Billets 80,825 77,071 -5% 174,633 164,806 -6%

Wire Rod & Bars 82,071 82,893 1% 165,292 149,689 -9%

Wire Ropes (including 18,778 17,831 -5% 36,117 32,740 -9%

conveyor belt)

Wire & Strand 22,609 24,244 7% 45,198 48,811 8%

Bright Bar 3,650 3,284 -10% 7,052 6,439 -9%

Sales (Qty in MT)

Wire Rod & Bars 35,212 35,876 2% 68,666 65,401 -5%

Wire Ropes 18,762 17,365 -7% 34,011 31,577 -7%

Wire & Strand 20,867 21,806 4% 38,658 42,755 11%

Bright Bar 3,703 3,523 -5% 6,957 6,596 -5%

FOREIGN SUBSIDIARIES

USSIL - Thailand

Particulars Q2 FY 09 Q2 FY 10 % Change H1 FY 09 H1 FY 10 % Change

Production Qty

- Wire Ropes 4474 4207 -6% 9704 7808 -20%

- Wire & Strand 4896 4557 -7% 8657 8114 -6%

Sales Qty

- Wire Ropes 4448 4492 1% 10269 7800 -24%

- Wire & Strand 4968 4383 -12% 8800 7837 -11%

BSUK

Particulars Q2 FY 09 Q2 FY 10 % Change H1 FY 09 H1 FY 10 % Change

Production Qty

- Wire Ropes 2015 1466 -27% 3814 2533 -34%

Sales Qty

- Wire Ropes 1973 1705 -14% 3834 3173 -17%

BWWR - Dubai

Particulars Q2 FY 09 Q2 FY 10 % Change H1 FY 09 H1 FY 10 % Change

Production Qty

- Wire Ropes 2415 2149 -11% 4804 3965 -17%

Sales Qty

- Wire Ropes 2564 2194 -14% 5208 3963 -24%

EUREKA RESEARCH 3 www.eurekasecurities.com

USHA MARTIN

02 NOVEMBER, 2009

Slow down in the global economy continues to take toll on the business of the company. Moreover, the company has been testing its

newly commissioned MBF for which its existing MBF were shut down mainly due to power management. The debugging process is still on

and hence has been adversely affecting the production of the company.

The company, however, have been able to commission its 2nd DRI Kiln, 30 MW thermal power and Wire rod mill successfully. This would

enable the company to augment its sponge iron and wire rod production in the days ahead. The management expects its turnover to

touch Rs 900 to Rs 950 crore in the fourth quarter of the current fiscal at the existing steel prices. For the 2nd half of the current fiscal, the

management has set a volume target as follows:

Volume Target Qty (in MT)

Steel 390000

Rolled products 340000

Rope (consolidated) 105000

As per the management guidance the sales volume for the company in the 3rd quarter is going to remain subdued mainly on the back of

demand concerns and more so because of the fact that the production from the new facilities are not going to get stabilized during the

coming quarter.

Traditionally, it has been observed that 3rd quarter happens to be the worst quarter for the company attributable to the fact that the

company exports more than 50% of its finished products in the international market, especially, in the Western European and North

American countries. During this time the demand slows down in these regions mainly because of two reasons, viz., sever cold wave,

which makes construction work nearly impossible and the festive season. The coming quarter is not going to be an exception in this

regard

The company has also commissioned SMS III and Blooming Mill on trial basis, however, the production from these facilities have not yet

been stabilized mainly on account of the fact that the de-bugging process is on. The management is confident about the fact that by the

end of the 4th quarter, these facilities would stabilize and start to make positive contribution to the company's overall production.

In the quarter gone by, the share of value added products in overall steel production has been 58%

During the quarter under review the tax expenses were higher at 51.6% due to provisioning of deferred tax liability of 34.4% because of

higher tax depreciation compared to book depreciation arising because of the timing difference.

Gross debt in the book of the company for the quarter has been Rs. 1800 crore on consolidated basis and Rs. 1650 crore on standalone

basis, and the cost of this debt is around 7.2%. Out of this, the company has plans to pay back Rs. 250 crore within 1 year. The company has

cash (and cash equivalent) balance of Rs. 200 crore as of date.

The production of coal from its coal block has not yet started. This, as per the management, can be attributed to the fact that the block it

has been allotted is an open cast mine and there has been a significant amount of water logging that has taken place during the monsoon.

However, the company plans to start commercial production from its coal mine during the 3rd quarter from November and during the

quarter, i.e. during November and December the company plans to produce about 25,000 tons which would eventually be augmented to

50,000 tons. After the coal mine is fully commissioned, the company plans to produce about 2,00,000 tons of coal on annual basis. During

the quarter under review the company consumed 2,70,000 tons of coal which has been purchased from the open market at an average

cost of Rs. 1900 per ton. Though the company has been enjoying coal linkages previously, the government has discontinued that facility,

post the mine allocation. This has resulted in high cost of production for the company causing its EBITDA margin to come down to about

16% from 19% in the same quarter last year.

EUREKA RESEARCH 4 www.eurekasecurities.com

USHA MARTIN

02 NOVEMBER, 2009

During the quarter under review the company produced about 3,60,000 tons of iron ore out of which 1,50,000 tonnes of iron ore has

been sold in the open market which generated a turnover of Rs. 15 crore signifying a realization of Rs. 1000 per ton.

The company would be completing most of its Rs. 2100 crore expansion plan during the current fiscal, however the capex target for FY10-

11 has been earmarked at Rs. 100 crore. The company has capital work in progress of Rs. 1200 crore and plans to capitalize Rs. 800 crore

during the H2 of the current fiscal.

FINANCIALS

STANDALONE

2nd Qtr 2nd Qtr VAR 1st Qtr QoQ

2009-09 2008-09 [%] 2009-06 %

Gross Sales 508.83 655.95 -22.4 430.38 18.2

Excise Duty 26.57 62.1 -57.2 25.25 5.2

Net Sales 482.26 593.85 -18.8 405.13 19.0

Other Operating Income 3.49 2.94 18.7 6.57 -46.9

Other Income 0.77 1.9 -59.5 2.66 -71.1

Total Income 486.52 598.69 -18.7 414.36 17.4

Total Expenditure 407.35 485.62 -16.1 338.79 20.2

PBIDT 79.17 113.07 -30 75.57 4.8

PBITD margin (in %) 16.42 19.04 18.65

Interest 22.47 32.9 -31.7 25.9 -13.2

PBDT 56.7 80.17 -29.3 49.67 14.2

PBDT margin (in %) 11.76 13.50 12.26

Depreciation 24.48 21.15 15.7 23.92 2.3

PBT 32.22 59.02 -45.41 25.75 25.1

PBT margin (in %) 6.68 9.94 6.36

Tax 7.05 32.77 -78.5 2.91 142.3

Fringe Benefit Tax -0.3 0.3 -200 0.3 -200.0

Deferred Tax 10.82 -15.9 168.1 9.14 18.4

Reported Profit After Tax 14.65 41.85 -65 13.4 9.3

Extra-ordinary Items 0 0 0 0

Adjusted Profit After 14.65 41.85 -65 13.4 9.3

Extra-ordinary item

APAT margin (in %) 3.04 7.05 3.31

RATIOS

Particulars Standalone Consolidated

Sep-09 Mar-09 Sep-09 Mar-09

ROCE (Incl.CWIP) 7.50% 12.80% 10.10% 14.20%

ROCE (Excl.CWIP) 13.00% 23.70% 16.30% 23.90%

RONW 5.50% 6.30% 11.40% 19.20%

Debt Equity 1.64 1.40 1.57 1.47

Gross Profit/Debt 18.40% 28.80% 23.80% 31.80%

EPS Basic 1.12 5.86 2.58 7.41

Interest cover 3.20 3.40 4.00 3.70

EUREKA RESEARCH 5 www.eurekasecurities.com

USHA MARTIN

02 NOVEMBER, 2009

Recommendation

The 2nd quarter has been quite dismal for the company similar to the performance of other steel companies as the realization has been

on the lower side on a yoy basis. The company receives more than 50% of its revenue from the international market, and considering the

fact that the demand situation in the western Europe and America has been quite bleak despite the fact that these countries have been

receiving huge amount of government stimulus, it did not get reflected in revenues of steel producers. So far the steel prices in the

international market have been driven by restocking and destocking phenomenon coupled with US dollar weakness. The real upsurge in

demand has not been very visible. Even in China, steel prices have been under pressure. Bao Steel has recently slashed prices of finished

steel by 500 yuan, after the record production of steel during the month of August. Given this fluid condition in the international markets,

we are a bit skeptical about the ambitious production and sales target set forth by the company for the next year. Though the company is

trading at a PEx of 12 and 8.5 based on FY10 and FY11 estimated EPS of Rs. 5.19 and Rs. 7.39 respectively, we believe that on account of

huge exposure in the international market the company faces a huge downside risk as such we recommend “Reduce” on the company.

Registered Office : 7 Lyons Range, 2nd Floor, Room No. 1, Kolkata - 700001

Corporate Office : B3/4, Gillander House, 8 N S Road, 3rd Floor, Kolkata - 700001

AKP - 9830005273

Phone : 91-33-2210 7500 / 01 / 02, Fax: 91-33-2210 5184

e: helpdesk@eurekasecurities.com

Mumbai Office : 909 Raheja Chamber, 213 Nariman Point, Mumbai-400021

Phone : 91-22-2202 5941 / 5942

e: mumbai@eurekasecurities.com

EUREKA RESEARCH 6 www.eurekasecurities.com

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Manjushree Tech No Pack LTD Initiating CoverageDocument12 pagesManjushree Tech No Pack LTD Initiating CoverageA_KinshukPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Research Speak - 16-04-2010Document12 pagesResearch Speak - 16-04-2010A_KinshukPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Research Speak - 23-04-2010Document13 pagesResearch Speak - 23-04-2010A_KinshukPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Research Speak - 14-05-2010Document12 pagesResearch Speak - 14-05-2010A_KinshukPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Research Speak-21 May 2010Document10 pagesResearch Speak-21 May 2010A_KinshukPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Research Speak 25-6-2010Document12 pagesResearch Speak 25-6-2010A_KinshukPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Research Speak 19-6-2010Document8 pagesResearch Speak 19-6-2010A_KinshukPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Research Speak - 10-7-2010Document7 pagesResearch Speak - 10-7-2010A_KinshukPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Microsoft Word - Research Speak - 03.07Document10 pagesMicrosoft Word - Research Speak - 03.07A_KinshukPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Urgent Communication: 25% Public Holding Made Mandatory For Listed FirmsDocument9 pagesUrgent Communication: 25% Public Holding Made Mandatory For Listed FirmsA_KinshukPas encore d'évaluation

- Camson Bio Technologies Ltd-Initiating CoverageDocument10 pagesCamson Bio Technologies Ltd-Initiating CoverageA_KinshukPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Research Speak - 17-7-2010Document9 pagesResearch Speak - 17-7-2010A_KinshukPas encore d'évaluation

- Elecon EngineeringDocument8 pagesElecon EngineeringA_KinshukPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Framework For Durable ConcreteDocument8 pagesFramework For Durable ConcreteDai ThanhPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- HOVAL Dati Tecnici Caldaie IngleseDocument57 pagesHOVAL Dati Tecnici Caldaie Ingleseosama alabsiPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Bit2203 Advanced Object-Oriented Programming Lectures Sep 2021Document250 pagesBit2203 Advanced Object-Oriented Programming Lectures Sep 2021Agnes MathekaPas encore d'évaluation

- TrustworthinessDocument24 pagesTrustworthinessJamsheed Raza100% (1)

- A Job InterviewDocument8 pagesA Job Interviewa.rodriguezmarcoPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Employee Involvement TQMDocument33 pagesEmployee Involvement TQMAli RazaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Bromate Prove Ulr en 2016-01-06 HintDocument3 pagesBromate Prove Ulr en 2016-01-06 Hinttata_77Pas encore d'évaluation

- Response LTR 13 330 VielmettiDocument2 pagesResponse LTR 13 330 VielmettiAnn Arbor Government DocumentsPas encore d'évaluation

- Raport de Incercare TL 82 Engleza 2015 MasticDocument3 pagesRaport de Incercare TL 82 Engleza 2015 MasticRoxana IoanaPas encore d'évaluation

- Report - Summary - Group 3 - MKT201Document4 pagesReport - Summary - Group 3 - MKT201Long Nguyễn HảiPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- INTERFACING LCD WITH 8051 MIROCONTROLLER With CodeDocument14 pagesINTERFACING LCD WITH 8051 MIROCONTROLLER With CodeRajagiri CollegePas encore d'évaluation

- SOPDocument2 pagesSOPDesiree MatienzoPas encore d'évaluation

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Document21 pagesAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Donnie HavierPas encore d'évaluation

- Position PaperDocument9 pagesPosition PaperRoel PalmairaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Thermal Hybrids R5Document9 pagesThermal Hybrids R5amir.kalantariPas encore d'évaluation

- (Developer Shed Network) Server Side - PHP - Database Abstraction With PHPDocument29 pages(Developer Shed Network) Server Side - PHP - Database Abstraction With PHPSeher KurtayPas encore d'évaluation

- BACS2042 Research Methods: Chapter 1 Introduction andDocument36 pagesBACS2042 Research Methods: Chapter 1 Introduction andblood unityPas encore d'évaluation

- Link Belt Rec Parts LastDocument15 pagesLink Belt Rec Parts LastBishoo ShenoudaPas encore d'évaluation

- UntitledDocument1 pageUntitledsai gamingPas encore d'évaluation

- IllustratorDocument27 pagesIllustratorVinti MalikPas encore d'évaluation

- Taxonomy of Parallel Computing ParadigmsDocument9 pagesTaxonomy of Parallel Computing ParadigmssushmaPas encore d'évaluation

- Move It 3. Test U3Document2 pagesMove It 3. Test U3Fabian AmayaPas encore d'évaluation

- A 150.xx Service Black/ITU Cartridge Motor Error On A Lexmark C54x and X54x Series PrinterDocument4 pagesA 150.xx Service Black/ITU Cartridge Motor Error On A Lexmark C54x and X54x Series Printerahmed salemPas encore d'évaluation

- CPCDocument6 pagesCPCpranjalPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- EquisetopsidaDocument4 pagesEquisetopsidax456456456xPas encore d'évaluation

- Ex-Capt. Harish Uppal Vs Union of India & Anr On 17 December, 2002Document20 pagesEx-Capt. Harish Uppal Vs Union of India & Anr On 17 December, 2002vivek6593Pas encore d'évaluation

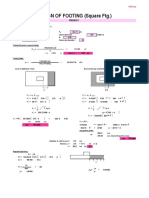

- Design of Footing (Square FTG.) : M Say, L 3.75Document2 pagesDesign of Footing (Square FTG.) : M Say, L 3.75victoriaPas encore d'évaluation

- Hey Can I Try ThatDocument20 pagesHey Can I Try Thatapi-273078602Pas encore d'évaluation

- Challenges Faced by DMRCDocument2 pagesChallenges Faced by DMRCSourabh Kr67% (3)

- AMM Company ProfileDocument12 pagesAMM Company ProfileValery PrihartonoPas encore d'évaluation