Académique Documents

Professionnel Documents

Culture Documents

Suresh Rathi Securities PVT LTD.: Ronak Jajoo

Transféré par

Ronak JajooTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Suresh Rathi Securities PVT LTD.: Ronak Jajoo

Transféré par

Ronak JajooDroits d'auteur :

Formats disponibles

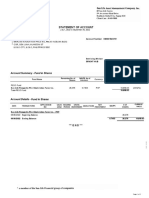

Suresh Rathi Securities Pvt Ltd.

Member : BSE / NSE / CDSL / Derivatives / NCDEX / MCX

Mahesh Hostel Complex Opp. Bombay Motors, Chopasni Road Jodhpur (Raj) 342003

Ph : 0291-5155555,9982254000 8239854000 Fax : 0291-2430913

Email : sales@sureshrathi.in

PORTFOLIO RETURNS - Unrealized Holding

As on :01/05/2017

RONAK JAJOO

Bhajan Chowki Near

Kabutano Ka Chowk

Jodhpur 342001

Mobile No : 9702490064

Email : jajoo_2002@rediff.com

Allocation by Company Allocation by Scheme

Company Purchase Market Abs Ret Ann Alloc. Scheme Purchase Market Abs Ann Ret Alloc

Cost Value (%) Ret (%) (%) Cost Value Ret(%) (%) (%)

Axis Mutual Fund 22,000 24,850 12.96 20.82 5.42 Axis - Long Term Equity (G) 22,000 24,850 12.96 20.82 5.42

Birla Sunlife Mutual Fund 27,000 29,750 10.19 22.07 6.48 Birla SL - MNC Fund Reg (G) 12,000 12,893 7.44 14.70 2.81

Birla SL - Tax Relief 96 Fund ELSS Reg (G) 15,000 16,858 12.38 29.06 3.67

DSP BlackRock Mutual 53,500 72,320 35.18 17.18 15.76

Fund DSP BlackRock - Micro Cap Fund Reg (G) 18,000 21,453 19.19 37.91 4.68

HDFC Mutual Fund 35,500 57,425 61.76 21.84 12.52 DSP BlackRock - Top 100 Equity Reg Fund 35,500 50,867 43.29 15.30 11.09

(G)

ICICI Prudential Mutual 14,500 16,578 14.33 22.71 3.61

Fund HDFC - Tax Saver (G) 35,500 57,425 61.76 21.84 12.52

Mirae Asset Mutual Fund 12,000 14,596 21.63 42.73 3.18 ICICI Pru - Exports and Other Services Fund 12,000 13,314 10.95 21.63 2.90

Reg (G)

SBI Mutual Fund 112,000 196,430 75.38 20.54 42.81 ICICI Pru - Long Term Equity Fund Reg (G) 1,000 1,200 20.02 15.22 0.26

Sundaram Mutual Fund 20,257 46,844 131.25 24.95 10.21 ICICI Pru - Value Discovery Reg (G) 1,500 2,065 37.63 32.09 0.45

296,757 458,793 54.60 21.07 100.00 Mirae - Asset Emerging Bluechip Fund Reg 12,000 14,596 21.63 42.73 3.18

(G)

SBI - Blue Chip Fund Reg (G) 15,000 16,454 9.70 24.13 3.59

SBI - Emerging Business Fund Reg (G) 35,500 56,904 60.29 21.08 12.40

SBI - M MidCap Fund Reg (G) 10,000 11,161 11.61 27.97 2.43

SBI - M Tax Gain Reg (G) 51,500 111,910 117.30 20.19 24.39

Sundaram - Tax Saver OE (G) 20,257 46,844 131.25 24.95 10.21

296,757 458,793 54.60 21.07 100.00

Allocation by Category Allocation by Applicant

Category Purchase Market Abs Ret Ann Ret Alloc Applicant Purchase Market Abs Ret Ann Ret Alloc

Cost Value (%) (%) (%) Cost Value (%) (%) (%)

Equity: Large Cap 50,500 67,321 33.31 15.80 14.67 DEEPTI JAJOO 193,000 246,855 27.90 20.17 53.81

Equity: Mid Cap 47,500 71,500 50.53 22.30 15.58 RONAK JAJOO 103,757 211,938 104.26 21.55 46.19

Equity: Multi Cap 1,500 2,065 37.63 32.09 0.45 296,757 458,793 54.60 21.07 100.00

Equity: Sectoral 24,000 26,206 9.19 18.16 5.71

Equity: Small Cap 28,000 32,614 16.48 34.80 7.11

Equity: Tax Planning 145,257 259,087 78.36 21.57 56.47

296,757 458,793 54.60 21.07100.00

Your SIP Details

Applicant Scheme Folio Amount Start Date End Date Frequency

DEEPTI JAJOO Axis - Long Term Equity (G) 91023888043 1,500.00 06/05/2016 10/12/2099 MONTHLY

DEEPTI JAJOO Birla SL - Tax Relief 96 Fund ELSS Reg (G) 1017735155 1,500.00 25/06/2016 10/12/2099 MONTHLY

DEEPTI JAJOO DSP BlackRock - Micro Cap Fund Reg (G) 3372341/77 1,500.00 06/05/2016 10/12/2099 MONTHLY

DEEPTI JAJOO 8289499/72

ICICI Pru - Exports and Other Services Fund Reg (G) 1,000.00 06/05/2016 10/12/2099 MONTHLY

DEEPTI JAJOO Mirae - Asset Emerging Bluechip Fund Reg (G) 7973853925 1,000.00 06/05/2016 10/12/2099 MONTHLY

DEEPTI JAJOO SBI - Blue Chip Fund Reg (G) 15451764 1,500.00 19/07/2016 25/06/2025 MONTHLY

DEEPTI JAJOO SBI - M MidCap Fund Reg (G) 15451763 1,000.00 19/07/2016 20/06/2025 MONTHLY

RONAK JAJOO Birla SL - Frontline Equity Fund Reg (G) 1017418038 1,500.00 04/01/2016 10/12/2020 MONTHLY

RONAK JAJOO Franklin - India Prima Plus (G) 0379909306396 1,500.00 04/01/2016 07/12/2020 MONTHLY

RONAK JAJOO HDFC - Mid Cap Opportunities Fund (G) 10404372/29 1,500.00 04/01/2016 20/12/2020 MONTHLY

RONAK JAJOO ICICI Pru - Value Discovery Reg (G) 8022251/14 1,500.00 04/01/2016 25/12/2020 MONTHLY

Total : 15,000.00

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 2 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

DEEPTI JAJOO PAN : AMPPJ7994P

Equity: Large Cap

DSP BlackRock - Top 100 Equity Reg Fund (G) [Folio:2821390/50] - [Balance Units/Nos : 276.6360]

Avg Cost : 128.3275, Current Price: 183.8760 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 4.504 111.0180 500.00 06/12/2012 828.18 0 328.18 65.64 1604 14.94 12.94

Systematic - Instalment 2/37 Y 4.418 113.1850 500.00 14/01/2013 812.36 0 312.36 62.47 1565 14.57 12.70

Systematic - Instalment 1/36 Y 4.430 112.8720 500.00 28/01/2013 814.57 0 314.57 62.91 1551 14.80 12.51

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 3 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 3/37 Y 4.657 107.3550 500.00 14/02/2013 856.31 0 356.31 71.26 1534 16.96 13.75

Systematic - Instalment 2/36 Y 4.818 103.7700 500.00 28/02/2013 885.91 0 385.91 77.18 1520 18.53 15.23

Systematic - Instalment 4/37 Y 4.607 108.5380 500.00 14/03/2013 847.12 0 347.12 69.42 1506 16.82 13.93

Systematic - Instalment 3/36 Y 4.898 102.0860 500.00 28/03/2013 900.62 0 400.62 80.12 1492 19.60 15.59

Systematic - Instalment 5/37 Y 4.896 102.1230 500.00 15/04/2013 900.26 0 400.26 80.05 1474 19.82 16.61

Systematic - Instalment 4/36 Y 4.691 106.5930 500.00 29/04/2013 862.56 0 362.56 72.51 1460 18.13 14.40

Systematic - Instalment 6/37 Y 4.622 108.1830 500.00 14/05/2013 849.87 0 349.87 69.97 1445 17.67 13.94

Systematic - Instalment 5/36 Y 4.577 109.2330 500.00 28/05/2013 841.60 0 341.60 68.32 1431 17.43 13.33

Systematic - Instalment 7/37 Y 4.819 103.7600 500.00 14/06/2013 886.10 0 386.10 77.22 1414 19.93 15.54

Systematic - Instalment 6/36 Y 4.820 103.7380 500.00 28/06/2013 886.28 0 386.28 77.26 1400 20.14 15.45

Systematic - Instalment 8/37 Y 4.646 107.6090 500.00 15/07/2013 854.29 0 354.29 70.86 1383 18.70 14.32

Systematic - Instalment 7/36 Y 4.782 104.5500 500.00 29/07/2013 879.30 0 379.30 75.86 1369 20.23 15.88

Systematic - Instalment 9/37 Y 4.816 103.8260 500.00 14/08/2013 885.55 0 385.55 77.11 1353 20.80 16.73

Systematic - Instalment 8/36 Y 5.225 95.6900 500.00 28/08/2013 960.75 0 460.75 92.15 1339 25.12 20.73

Systematic - Instalment 10/37 Y 4.857 102.9540 500.00 16/09/2013 893.09 0 393.09 78.62 1320 21.74 16.40

Systematic - Instalment 9/36 Y 4.917 101.6910 500.00 30/09/2013 904.12 0 404.12 80.82 1306 22.59 17.39

Systematic - Instalment 11/37 Y 4.664 107.2000 500.00 14/10/2013 857.60 0 357.60 71.52 1292 20.20 14.75

Systematic - Instalment 10/36 Y 4.631 107.9650 500.00 28/10/2013 851.53 0 351.53 70.31 1278 20.08 14.99

Systematic - Instalment 12/37 Y 4.624 108.1310 500.00 14/11/2013 850.24 0 350.24 70.05 1261 20.28 15.52

Systematic - Instalment 11/36 Y 4.638 107.8120 500.00 28/11/2013 852.82 0 352.82 70.56 1247 20.65 15.43

Systematic - Instalment 13/37 Y 4.514 110.7730 500.00 16/12/2013 830.02 0 330.02 66.00 1229 19.60 15.20

Systematic - Instalment 12/36 Y 4.424 113.0260 500.00 30/12/2013 813.47 0 313.47 62.69 1215 18.83 14.39

Systematic - Instalment 14/37 Y 4.505 110.9840 500.00 14/01/2014 828.36 0 328.36 65.67 1200 19.97 14.92

Systematic - Instalment 13/36 Y 4.627 108.0510 500.00 28/01/2014 850.79 0 350.79 70.16 1186 21.59 15.96

Systematic - Instalment 15/37 Y 4.660 107.2990 500.00 14/02/2014 856.86 0 356.86 71.37 1169 22.28 16.81

Systematic - Instalment 14/36 Y 4.468 111.9120 500.00 28/02/2014 821.56 0 321.56 64.31 1155 20.32 15.24

Systematic - Instalment 16/37 Y 4.330 115.4810 500.00 14/03/2014 796.18 0 296.18 59.24 1141 18.95 13.77

Systematic - Instalment 15/36 Y 4.230 118.1930 500.00 28/03/2014 777.80 0 277.80 55.56 1127 17.99 12.62

Systematic - Instalment 17/37 Y 4.219 118.5030 500.00 15/04/2014 775.77 0 275.77 55.15 1109 18.15 12.57

Systematic - Instalment 16/36 Y 4.164 120.0730 500.00 28/04/2014 765.66 0 265.66 53.13 1096 17.69 12.52

Systematic - Instalment 19/37 Y 3.601 138.8580 500.00 16/06/2014 662.14 0 162.14 32.43 1047 11.31 8.19

Systematic - Instalment 18/36 Y 3.514 142.2920 500.00 30/06/2014 646.14 0 146.14 29.23 1033 10.33 7.86

Systematic - Instalment 20/37 Y 3.633 137.6430 500.00 14/07/2014 668.02 0 168.02 33.60 1019 12.04 8.89

Systematic - Instalment 19/36 Y 3.510 142.4620 500.00 28/07/2014 645.40 0 145.40 29.08 1005 10.56 7.29

Systematic - Instalment 21/37 Y 3.542 141.1710 500.00 14/08/2014 651.29 0 151.29 30.26 988 11.18 7.17

Systematic - Instalment 20/36 Y 3.411 146.5680 500.00 28/08/2014 627.20 0 127.20 25.44 974 9.53 6.36

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 4 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 22/37 Y 3.306 151.2360 500.00 15/09/2014 607.89 0 107.89 21.58 956 8.24 5.99

Systematic - Instalment 21/36 Y 3.406 146.8200 500.00 29/09/2014 626.28 0 126.28 25.26 942 9.79 6.55

Systematic - Instalment 23/37 Y 3.451 144.8920 500.00 14/10/2014 634.56 0 134.56 26.91 927 10.60 7.21

Systematic - Instalment 22/36 Y 3.361 148.7570 500.00 28/10/2014 618.01 0 118.01 23.60 913 9.43 6.36

Systematic - Instalment 24/37 Y 3.227 154.9450 500.00 14/11/2014 593.37 0 93.37 18.67 896 7.61 4.44

Systematic - Instalment 23/36 Y 3.147 158.8860 500.00 28/11/2014 578.66 0 78.66 15.73 882 6.51 3.45

Systematic - Instalment 25/37 Y 3.257 153.5250 500.00 15/12/2014 598.88 0 98.88 19.78 865 8.35 5.57

Systematic - Instalment 24/36 Y 3.221 155.2350 500.00 29/12/2014 592.26 0 92.26 18.45 851 7.91 5.50

Systematic - Instalment 26/37 Y 3.192 156.6460 500.00 14/01/2015 586.93 0 86.93 17.39 835 7.60 5.42

Systematic - Instalment 25/36 Y 2.956 169.1680 500.00 28/01/2015 543.54 0 43.54 8.71 821 3.87 1.94

Systematic - Instalment 27/37 Y 3.013 165.9730 500.00 16/02/2015 554.02 0 54.02 10.80 802 4.92 2.56

Systematic - Instalment 26/36 Y 2.912 171.6910 500.00 02/03/2015 535.45 0 35.45 7.09 788 3.28 1.80

Systematic - Instalment 28/37 Y 3.044 164.2330 500.00 16/03/2015 559.72 0 59.72 11.94 774 5.63 3.66

Systematic - Instalment 27/36 Y 3.103 161.1600 500.00 30/03/2015 570.57 0 70.57 14.11 760 6.78 4.59

Systematic - Instalment 29/37 Y 3.026 165.2180 500.00 15/04/2015 556.41 0 56.41 11.28 744 5.53 3.11

Systematic - Instalment 28/36 Y 3.230 154.7830 500.00 28/04/2015 593.92 0 93.92 18.78 731 9.38 6.14

Systematic - Instalment 30/37 Y 3.255 153.5900 500.00 14/05/2015 598.52 0 98.52 19.70 715 10.06 6.70

Systematic - Instalment 29/36 Y 3.221 155.2410 500.00 28/05/2015 592.26 0 92.26 18.45 701 9.61 6.17

Systematic - Instalment 31/37 Y 3.321 150.5480 500.00 15/06/2015 610.65 0 110.65 22.13 683 11.83 8.60

Systematic - Instalment 30/36 Y 3.214 155.5550 500.00 29/06/2015 590.98 0 90.98 18.20 669 9.93 6.46

Systematic - Instalment 32/37 Y 3.089 161.8760 500.00 14/07/2015 567.99 0 67.99 13.60 654 7.59 5.61

Systematic - Instalment 31/36 Y 3.102 161.1890 500.00 28/07/2015 570.38 0 70.38 14.08 640 8.03 6.62

Systematic - Instalment 33/37 Y 3.040 164.4620 500.00 14/08/2015 558.98 0 58.98 11.80 623 6.91 5.40

Systematic - Instalment 32/36 Y 3.259 153.4290 500.00 28/08/2015 599.25 0 99.25 19.85 609 11.90 9.75

Systematic - Instalment 34/37 Y 3.276 152.6320 500.00 14/09/2015 602.38 0 102.38 20.48 592 12.63 11.21

Systematic - Instalment 33/36 Y 3.350 149.2460 500.00 28/09/2015 615.98 0 115.98 23.20 578 14.65 12.22

Systematic - Instalment 35/37 Y 3.290 151.9620 500.00 14/10/2015 604.95 0 104.95 20.99 562 13.63 9.58

Systematic - Instalment 34/36 Y 3.232 154.7060 500.00 28/10/2015 594.29 0 94.29 18.86 548 12.56 9.23

Systematic - Instalment 36/37 Y 3.308 151.1590 500.00 16/11/2015 608.26 0 108.26 21.65 529 14.94 13.24

Systematic - Instalment 35/36 Y 3.258 153.4520 500.00 30/11/2015 599.07 0 99.07 19.81 515 14.04 12.23

Systematic - Instalment 37/37 Y 3.378 148.0240 500.00 14/12/2015 621.13 0 121.13 24.23 501 17.65 15.75

Systematic - Instalment 36/36 Y 3.282 152.3600 500.00 28/12/2015 603.48 0 103.48 20.70 487 15.51 13.04

DSP BlackRock - Top 100 Equity Reg Fund (G) 276.636 35,500.00 50,866.71 0 15,366.71 43.29 1033 15.30 10.52

[Folio:2821390/50] Total :

SBI - Blue Chip Fund Reg (G) [Folio:15451764] - [Balance Units/Nos : 477.6210]

Avg Cost : 31.4057, Current Price: 34.4509 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 5 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

(IND)

Systematic Y 52.643 28.4938 1,500.00 06/05/2016 1,813.60 0 313.60 20.91 357 21.38 20.76

Systematic - Instalment 1/107 Y 47.424 31.6296 1,500.00 25/08/2016 1,633.80 0 133.80 8.92 246 13.23 12.29

Systematic - Instalment 2/107 Y 46.272 32.4172 1,500.00 26/09/2016 1,594.11 0 94.11 6.27 214 10.69 11.36

Systematic - Instalment 3/107 Y 46.176 32.4846 1,500.00 25/10/2016 1,590.80 0 90.80 6.05 185 11.94 13.91

Systematic - Instalment 4/107 Y 49.998 30.0011 1,500.00 25/11/2016 1,722.48 0 222.48 14.83 154 35.15 34.75

Systematic - Instalment 5/107 Y 52.089 28.7969 1,500.00 26/12/2016 1,794.51 0 294.51 19.63 123 58.25 52.38

Systematic - Instalment 6/107 Y 47.672 31.4648 1,500.00 25/01/2017 1,642.34 0 142.34 9.49 93 37.25 38.35

Systematic - Instalment 7/107 Y 46.325 32.3796 1,500.00 27/02/2017 1,595.94 0 95.94 6.40 60 38.93 27.85

Systematic - Instalment 8/107 Y 45.429 33.0187 1,500.00 27/03/2017 1,565.07 0 65.07 4.34 32 49.50 32.64

Systematic - Instalment 9/107 43.593 34.4093 1,500.00 25/04/2017 1,501.82 0 1.82 0.12 3 14.60 -3.33

SBI - Blue Chip Fund Reg (G) [Folio:15451764] Total : 477.621 15,000.00 16,454.47 0 1,454.47 9.70 147 24.13 21.98

Equity: Large Cap Total : 50,500.00 67,321.18 0 16,821.18 33.31 770 15.80 12.69

Equity: Mid Cap

Mirae - Asset Emerging Bluechip Fund Reg (G) [Folio:7973853925] - [Balance Units/Nos : 327.4200]

Avg Cost : 36.6502, Current Price: 44.5780 as on 28/04/2017

Name as on Fund's Record : DEEPTI JAJOO

(IND)

Systematic Investment 32.494 30.7750 1,000.00 06/05/2016 1,448.52 0 448.52 44.85 357 45.86 20.76

Systematic Investment 30.544 32.7400 1,000.00 10/06/2016 1,361.59 0 361.59 36.16 322 40.99 15.73

Systematic Investment 29.313 34.1140 1,000.00 11/07/2016 1,306.71 0 306.71 30.67 291 38.47 12.39

Systematic Investment 28.189 35.4750 1,000.00 10/08/2016 1,256.61 0 256.61 25.66 261 35.88 11.88

Systematic Investment 27.221 36.7360 1,000.00 12/09/2016 1,213.46 0 213.46 21.35 228 34.18 10.81

Systematic Investment 25.639 39.0030 1,000.00 10/10/2016 1,142.94 0 142.94 14.29 200 26.08 12.47

Systematic Investment 25.959 38.5220 1,000.00 10/11/2016 1,157.20 0 157.20 15.72 169 33.95 19.72

Systematic Investment 27.662 36.1510 1,000.00 12/12/2016 1,233.12 0 233.12 23.31 137 62.10 36.95

Systematic Investment 27.287 36.6480 1,000.00 10/01/2017 1,216.40 0 216.40 21.64 108 73.14 41.40

Systematic Investment 24.961 40.0630 1,000.00 10/02/2017 1,112.71 0 112.71 11.27 77 53.42 27.52

Systematic Investment 24.870 40.2090 1,000.00 10/03/2017 1,108.65 0 108.65 10.87 49 80.97 30.81

Systematic Investment 23.281 42.9540 1,000.00 10/04/2017 1,037.82 0 37.82 3.78 18 76.65 27.08

Mirae - Asset Emerging Bluechip Fund Reg (G) 327.420 12,000.00 14,595.73 0 2,595.73 21.63 185 42.73 18.13

[Folio:7973853925] Total :

SBI - Emerging Business Fund Reg (G) [Folio:13599299] - [Balance Units/Nos : 522.3680]

Avg Cost : 67.9598, Current Price: 108.9347 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 8.456 59.1300 500.00 06/12/2012 921.15 0 421.15 84.23 1604 19.17 12.94

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 6 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 2/37 Y 8.018 62.3600 500.00 07/01/2013 873.44 0 373.44 74.69 1572 17.34 12.86

Systematic - Instalment 1/36 Y 8.121 61.5700 500.00 15/01/2013 884.66 0 384.66 76.93 1564 17.95 12.51

Systematic - Instalment 3/37 Y 8.409 59.4600 500.00 05/02/2013 916.03 0 416.03 83.21 1543 19.68 13.29

Systematic - Instalment 2/36 Y 8.606 58.0975 500.00 15/02/2013 937.49 0 437.49 87.50 1533 20.83 13.82

Systematic - Instalment 4/37 Y 9.005 55.5227 500.00 05/03/2013 980.96 0 480.96 96.19 1515 23.17 14.66

Systematic - Instalment 3/36 Y 8.950 55.8633 500.00 15/03/2013 974.97 0 474.97 94.99 1505 23.04 14.17

Systematic - Instalment 5/37 Y 9.263 53.9793 500.00 05/04/2013 1,009.06 0 509.06 101.81 1484 25.04 16.61

Systematic - Instalment 4/36 Y 9.294 53.7984 500.00 15/04/2013 1,012.44 0 512.44 102.49 1474 25.38 16.61

Systematic - Instalment 6/37 Y 8.799 56.8278 500.00 06/05/2013 958.52 0 458.52 91.70 1453 23.04 14.02

Systematic - Instalment 5/36 Y 8.594 58.1825 500.00 15/05/2013 936.18 0 436.18 87.24 1444 22.05 12.98

Systematic - Instalment 7/37 Y 8.742 57.1938 500.00 05/06/2013 952.31 0 452.31 90.46 1423 23.20 14.64

Systematic - Instalment 6/36 Y 9.165 54.5537 500.00 17/06/2013 998.39 0 498.39 99.68 1411 25.79 15.27

Systematic - Instalment 8/37 Y 9.347 53.4912 500.00 05/07/2013 1,018.21 0 518.21 103.64 1393 27.16 15.34

Systematic - Instalment 7/36 Y 9.193 54.3884 500.00 15/07/2013 1,001.44 0 501.44 100.29 1383 26.47 14.32

Systematic - Instalment 9/37 Y 10.058 49.7141 500.00 05/08/2013 1,095.67 0 595.67 119.13 1362 31.93 17.06

Systematic - Instalment 8/36 Y 10.172 49.1555 500.00 16/08/2013 1,108.08 0 608.08 121.62 1351 32.86 18.62

Systematic - Instalment 10/37 Y 10.370 48.2139 500.00 05/09/2013 1,129.65 0 629.65 125.93 1331 34.53 18.20

Systematic - Instalment 9/36 Y 10.299 48.5482 500.00 16/09/2013 1,121.92 0 621.92 124.38 1320 34.39 16.40

Systematic - Instalment 11/37 Y 9.953 50.2360 500.00 07/10/2013 1,084.23 0 584.23 116.85 1299 32.83 16.17

Systematic - Instalment 10/36 Y 9.869 50.6658 500.00 15/10/2013 1,075.08 0 575.08 115.02 1291 32.52 14.93

Systematic - Instalment 12/37 Y 9.484 52.7226 500.00 05/11/2013 1,033.14 0 533.14 106.63 1270 30.65 14.02

Systematic - Instalment 11/36 Y 9.503 52.6127 500.00 18/11/2013 1,035.21 0 535.21 107.04 1257 31.08 14.62

Systematic - Instalment 13/37 Y 9.112 54.8721 500.00 05/12/2013 992.61 0 492.61 98.52 1240 29.00 14.45

Systematic - Instalment 12/36 Y 9.157 54.6010 500.00 16/12/2013 997.52 0 497.52 99.50 1229 29.55 15.20

Systematic - Instalment 14/37 Y 8.916 56.0794 500.00 06/01/2014 971.26 0 471.26 94.25 1208 28.48 15.19

Systematic - Instalment 13/36 Y 8.826 56.6514 500.00 15/01/2014 961.46 0 461.46 92.29 1199 28.09 14.37

Systematic - Instalment 15/37 Y 9.244 54.0898 500.00 05/02/2014 1,006.99 0 506.99 101.40 1178 31.42 16.88

Systematic - Instalment 14/36 Y 9.349 53.4843 500.00 17/02/2014 1,018.43 0 518.43 103.69 1166 32.46 16.65

Systematic - Instalment 16/37 Y 9.028 55.3813 500.00 05/03/2014 983.46 0 483.46 96.69 1150 30.69 14.92

Systematic - Instalment 15/36 Y 8.748 57.1559 500.00 18/03/2014 952.96 0 452.96 90.59 1137 29.08 13.73

Systematic - Instalment 17/37 Y 8.424 59.3566 500.00 07/04/2014 917.67 0 417.67 83.53 1117 27.29 12.73

Systematic - Instalment 16/36 Y 8.353 59.8610 500.00 15/04/2014 909.93 0 409.93 81.99 1109 26.98 12.57

Systematic - Instalment 18/37 Y 8.323 60.0771 500.00 05/05/2014 906.66 0 406.66 81.33 1089 27.26 13.03

Systematic - Instalment 18/36 Y 7.125 70.1802 500.00 16/06/2014 776.16 0 276.16 55.23 1047 19.25 8.19

Systematic - Instalment 20/37 Y 6.558 76.2413 500.00 07/07/2014 714.39 0 214.39 42.88 1026 15.25 6.93

Systematic - Instalment 19/36 Y 6.746 74.1208 500.00 15/07/2014 734.87 0 234.87 46.97 1018 16.84 8.47

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 7 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 21/37 Y 6.522 76.6605 500.00 05/08/2014 710.47 0 210.47 42.09 997 15.41 7.36

Systematic - Instalment 20/36 Y 6.547 76.3704 500.00 18/08/2014 713.20 0 213.20 42.64 984 15.82 6.74

Systematic - Instalment 22/37 Y 6.190 80.7737 500.00 05/09/2014 674.31 0 174.31 34.86 966 13.17 5.69

Systematic - Instalment 21/36 Y 5.923 84.4125 500.00 15/09/2014 645.22 0 145.22 29.04 956 11.09 5.99

Systematic - Instalment 23/37 Y 6.169 81.0457 500.00 07/10/2014 672.02 0 172.02 34.40 934 13.44 7.22

Systematic - Instalment 22/36 Y 6.288 79.5121 500.00 16/10/2014 684.98 0 184.98 37.00 925 14.60 7.92

Systematic - Instalment 24/37 Y 6.017 83.0982 500.00 05/11/2014 655.46 0 155.46 31.09 905 12.54 4.67

Systematic - Instalment 23/36 Y 5.852 85.4357 500.00 17/11/2014 637.49 0 137.49 27.50 893 11.24 4.23

Systematic - Instalment 25/37 Y 5.638 88.6855 500.00 05/12/2014 614.17 0 114.17 22.83 875 9.52 3.74

Systematic - Instalment 24/36 Y 5.770 86.6594 500.00 15/12/2014 628.55 0 128.55 25.71 865 10.85 5.57

Systematic - Instalment 26/37 Y 5.533 90.3654 500.00 05/01/2015 602.74 0 102.74 20.55 844 8.89 4.78

Systematic - Instalment 25/36 Y 5.458 91.6031 500.00 15/01/2015 594.57 0 94.57 18.91 834 8.28 4.17

Systematic - Instalment 27/37 Y 5.493 91.0176 500.00 05/02/2015 598.38 0 98.38 19.68 813 8.84 3.05

Systematic - Instalment 26/36 Y 5.412 92.3953 500.00 16/02/2015 589.55 0 89.55 17.91 802 8.15 2.56

Systematic - Instalment 28/37 Y 5.311 94.1429 500.00 05/03/2015 578.55 0 78.55 15.71 785 7.30 1.91

Systematic - Instalment 27/36 Y 5.425 92.1586 500.00 16/03/2015 590.97 0 90.97 18.19 774 8.58 3.66

Systematic - Instalment 29/37 Y 5.373 93.0512 500.00 06/04/2015 585.31 0 85.31 17.06 753 8.27 3.61

Systematic - Instalment 28/36 Y 5.308 94.1891 500.00 15/04/2015 578.23 0 78.23 15.65 744 7.68 3.11

Systematic - Instalment 30/37 Y 5.532 90.3886 500.00 05/05/2015 602.63 0 102.63 20.53 724 10.35 5.93

Systematic - Instalment 29/36 Y 5.609 89.1489 500.00 15/05/2015 611.01 0 111.01 22.20 714 11.35 6.45

Systematic - Instalment 31/37 Y 5.753 86.9110 500.00 05/06/2015 626.70 0 126.70 25.34 693 13.35 7.72

Systematic - Instalment 30/36 Y 5.833 85.7221 500.00 15/06/2015 635.42 0 135.42 27.08 683 14.47 8.60

Systematic - Instalment 32/37 Y 5.481 91.2290 500.00 06/07/2015 597.07 0 97.07 19.41 662 10.70 5.06

Systematic - Instalment 31/36 Y 5.480 91.2382 500.00 15/07/2015 596.96 0 96.96 19.39 653 10.84 5.12

Systematic - Instalment 33/37 Y 5.300 94.3343 500.00 05/08/2015 577.35 0 77.35 15.47 632 8.93 4.96

Systematic - Instalment 32/36 Y 5.297 94.3962 500.00 17/08/2015 577.03 0 77.03 15.41 620 9.07 5.74

Systematic - Instalment 34/37 Y 5.749 86.9664 500.00 07/09/2015 626.27 0 126.27 25.25 599 15.39 14.07

Systematic - Instalment 33/36 Y 5.624 88.9004 500.00 15/09/2015 612.65 0 112.65 22.53 591 13.91 11.64

Systematic - Instalment 35/37 Y 5.494 91.0102 500.00 05/10/2015 598.49 0 98.49 19.70 571 12.59 9.33

Systematic - Instalment 34/36 Y 5.400 92.5847 500.00 15/10/2015 588.25 0 88.25 17.65 561 11.48 8.95

Systematic - Instalment 36/37 Y 5.440 91.9088 500.00 05/11/2015 592.60 0 92.60 18.52 540 12.52 11.46

Systematic - Instalment 35/36 Y 5.514 90.6857 500.00 16/11/2015 600.67 0 100.67 20.13 529 13.89 13.24

Systematic - Instalment 37/37 Y 5.519 90.5965 500.00 07/12/2015 601.21 0 101.21 20.24 508 14.54 14.24

Systematic - Instalment 36/36 Y 5.535 90.3261 500.00 15/12/2015 602.95 0 102.95 20.59 500 15.03 15.20

SBI - Emerging Business Fund Reg (G) 522.368 35,500.00 56,904.03 0 21,404.03 60.29 1044 21.08 10.48

[Folio:13599299] Total :

Equity: Mid Cap Total : 47,500.00 71,499.76 0 23,999.76 50.53 827 22.30 11.69

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 8 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Equity: Sectoral

Birla SL - MNC Fund Reg (G) [Folio:1017644742] - [Balance Units/Nos : 20.0970]

Avg Cost : 597.1040, Current Price: 641.5200 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 1.756 569.5300 1,000.00 06/05/2016 1,126.51 0 126.51 12.65 357 12.93 20.76

Systematic - Instalment 1/1003 Y 1.712 584.1900 1,000.00 10/06/2016 1,098.28 0 98.28 9.83 322 11.14 15.73

Systematic - Instalment 2/1003 Y 1.647 607.0500 1,000.00 11/07/2016 1,056.58 0 56.58 5.66 291 7.10 12.39

Systematic - Instalment 3/1003 Y 1.624 615.6400 1,000.00 10/08/2016 1,041.83 0 41.83 4.18 261 5.85 11.88

Systematic - Instalment 4/1003 Y 1.625 615.2200 1,000.00 12/09/2016 1,042.47 0 42.47 4.25 228 6.80 10.81

Systematic - Instalment 5/1003 Y 1.603 623.8300 1,000.00 10/10/2016 1,028.36 0 28.36 2.84 200 5.18 12.47

Systematic - Instalment 6/1003 Y 1.700 588.3800 1,000.00 10/11/2016 1,090.58 0 90.58 9.06 169 19.57 19.72

Systematic - Instalment 7/1003 Y 1.759 568.4000 1,000.00 12/12/2016 1,128.43 0 128.43 12.84 137 34.21 36.95

Systematic - Instalment 8/1003 Y 1.738 575.2400 1,000.00 10/01/2017 1,114.96 0 114.96 11.50 108 38.87 41.40

Systematic - Instalment 9/1003 Y 1.677 596.4700 1,000.00 10/02/2017 1,075.83 0 75.83 7.58 77 35.93 27.52

Systematic - Instalment 10/1003 Y 1.681 594.7200 1,000.00 10/03/2017 1,078.40 0 78.40 7.84 49 58.40 30.81

Systematic - Instalment 11/1003 Y 1.575 634.9500 1,000.00 10/04/2017 1,010.39 0 10.39 1.04 18 21.09 27.08

Birla SL - MNC Fund Reg (G) [Folio:1017644742] 20.097 12,000.00 12,892.62 0 892.62 7.44 185 14.70 18.13

Total :

ICICI Pru - Exports and Other Services Fund Reg (G) [Folio:8289499/72] - [Balance Units/Nos : 253.0130]

Avg Cost : 47.4284, Current Price: 52.6200 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Appln : 38855467 - ARN-20569/ Y 23.073 43.3400 1,000.00 06/05/2016 1,214.10 0 214.10 21.41 357 21.89 20.76

Systematic - Instalment 2/1004 - ARN-205 Y 22.356 44.7300 1,000.00 10/06/2016 1,176.37 0 176.37 17.64 322 20.00 15.73

Systematic - Instalment 3/1004 - ARN-205 Y 21.340 46.8600 1,000.00 11/07/2016 1,122.91 0 122.91 12.29 291 15.42 12.39

Systematic - Instalment 4/1004 - ARN-205 Y 20.912 47.8200 1,000.00 10/08/2016 1,100.39 0 100.39 10.04 261 14.04 11.88

Systematic - Instalment 5/1004 - ARN-205 Y 20.777 48.1300 1,000.00 12/09/2016 1,093.29 0 93.29 9.33 228 14.94 10.81

Systematic - Instalment 6/1004 - ARN-205 Y 20.521 48.7300 1,000.00 10/10/2016 1,079.82 0 79.82 7.98 200 14.56 12.47

Systematic - Instalment 7/1004 - ARN-205 Y 20.859 47.9400 1,000.00 10/11/2016 1,097.60 0 97.60 9.76 169 21.08 19.72

Systematic - Instalment 8/1004 - ARN-205 Y 21.720 46.0400 1,000.00 12/12/2016 1,142.91 0 142.91 14.29 137 38.07 36.95

Systematic - Instalment 9/1004 - ARN-205 Y 21.404 46.7200 1,000.00 10/01/2017 1,126.28 0 126.28 12.63 108 42.68 41.40

Systematic - Instalment 10/1004 - ARN-20 Y 20.585 48.5800 1,000.00 10/02/2017 1,083.18 0 83.18 8.32 77 39.44 27.52

Systematic - Instalment 11/1004 - ARN-20 Y 20.375 49.0800 1,000.00 10/03/2017 1,072.13 0 72.13 7.21 49 53.71 30.81

Systematic - Instalment 12/1004 - ARN-20 Y 19.091 52.3800 1,000.00 10/04/2017 1,004.57 0 4.57 0.46 18 9.33 27.08

ICICI Pru - Exports and Other Services Fund Reg (G) 253.013 12,000.00 13,313.55 0 1,313.55 10.95 185 21.63 18.13

[Folio:8289499/72] Total :

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 9 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Equity: Sectoral Total : 24,000.00 26,206.17 0 2,206.17 9.19 185 18.16 18.13

Equity: Small Cap

DSP BlackRock - Micro Cap Fund Reg (G) [Folio:3372341/77] - [Balance Units/Nos : 355.2520]

Avg Cost : 50.6683, Current Price: 60.3890 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 34.634 43.3100 1,500.00 06/05/2016 2,091.51 0 591.51 39.43 357 40.31 20.76

Systematic - Instalment 2/1004 Y 33.011 45.4390 1,500.00 10/06/2016 1,993.50 0 493.50 32.90 322 37.29 15.73

Systematic - Instalment 3/1004 Y 31.020 48.3560 1,500.00 11/07/2016 1,873.27 0 373.27 24.88 291 31.21 12.39

Systematic - Instalment 4/1004 Y 30.390 49.3590 1,500.00 10/08/2016 1,835.22 0 335.22 22.35 261 31.26 11.88

Systematic - Instalment 5/1004 - ARN-205 Y 29.870 50.2170 1,500.00 12/09/2016 1,803.82 0 303.82 20.25 228 32.42 10.81

Systematic - Instalment 6/1004 - ARN-205 Y 28.282 53.0370 1,500.00 10/10/2016 1,707.92 0 207.92 13.86 200 25.29 12.47

Systematic - Instalment 7/1004 - ARN-205 Y 28.464 52.6990 1,500.00 10/11/2016 1,718.91 0 218.91 14.59 169 31.51 19.72

Systematic - Instalment 8/1004 - ARN-205 Y 29.972 50.0460 1,500.00 12/12/2016 1,809.98 0 309.98 20.67 137 55.07 36.95

Systematic - Instalment 9/1004 - ARN-205 Y 29.236 51.3070 1,500.00 10/01/2017 1,765.53 0 265.53 17.70 108 59.82 41.40

Systematic - Instalment 10/1004 - ARN-20 Y 27.162 55.2250 1,500.00 10/02/2017 1,640.29 0 140.29 9.35 77 44.32 27.52

Systematic - Instalment 11/1004 - ARN-20 Y 27.550 54.4470 1,500.00 10/03/2017 1,663.72 0 163.72 10.91 49 81.27 30.81

Systematic - Instalment 12/1004 - ARN-20 Y 25.661 58.4550 1,500.00 10/04/2017 1,549.64 0 49.64 3.31 18 67.12 27.08

DSP BlackRock - Micro Cap Fund Reg (G) 355.252 18,000.00 21,453.31 0 3,453.31 19.19 185 37.91 18.13

[Folio:3372341/77] Total :

SBI - M MidCap Fund Reg (G) [Folio:15451763] - [Balance Units/Nos : 145.9860]

Avg Cost : 68.4997, Current Price: 76.4528 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 16.280 61.4250 1,000.00 06/05/2016 1,244.65 0 244.65 24.47 357 25.02 20.76

Systematic - Instalment 1/107 Y 14.521 68.8661 1,000.00 22/08/2016 1,110.17 0 110.17 11.02 249 16.15 11.46

Systematic - Instalment 2/107 Y 14.243 70.2076 1,000.00 20/09/2016 1,088.92 0 88.92 8.89 220 14.75 9.98

Systematic - Instalment 3/107 Y 13.943 71.7223 1,000.00 20/10/2016 1,065.98 0 65.98 6.60 190 12.68 13.35

Systematic - Instalment 4/107 Y 15.526 64.4085 1,000.00 21/11/2016 1,187.01 0 187.01 18.70 158 43.20 40.06

Systematic - Instalment 5/107 Y 15.531 64.3862 1,000.00 20/12/2016 1,187.39 0 187.39 18.74 129 53.02 42.77

Systematic - Instalment 6/107 Y 14.855 67.3154 1,000.00 20/01/2017 1,135.71 0 135.71 13.57 98 50.54 42.59

Systematic - Instalment 7/107 Y 14.032 71.2672 1,000.00 20/02/2017 1,072.79 0 72.79 7.28 67 39.66 26.07

Systematic - Instalment 8/107 Y 13.815 72.3862 1,000.00 20/03/2017 1,056.20 0 56.20 5.62 39 52.60 18.17

Systematic - Instalment 9/107 13.240 75.5274 1,000.00 20/04/2017 1,012.24 0 12.24 1.22 8 55.66 83.72

SBI - M MidCap Fund Reg (G) [Folio:15451763] Total 145.986 10,000.00 11,161.06 0 1,161.06 11.61 152 27.97 21.74

:

Equity: Small Cap Total : 28,000.00 32,614.37 0 4,614.37 16.48 173 34.80 19.22

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 10 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Equity: Tax Planning

Axis - Long Term Equity (G) [Folio:91021356915] - [Balance Units/Nos : 138.5820]

Avg Cost : 28.8638, Current Price: 35.5565 as on 28/04/2017

Name as on Fund's Record : DEEPTI JAJOO

(IND)

Systematic Investment 32.942 30.3562 1,000.00 04/01/2016 1,171.30 0 171.30 17.13 480 13.03 14.76

Systematic Investment 37.025 27.0091 1,000.00 25/02/2016 1,316.48 0 316.48 31.65 428 26.99 28.55

Systematic Investment 34.766 28.7638 1,000.00 28/03/2016 1,236.16 0 236.16 23.62 396 21.77 20.44

Systematic Investment 33.849 29.5427 1,000.00 25/04/2016 1,203.55 0 203.55 20.36 368 20.19 18.30

Axis - Long Term Equity (G) [Folio:91021356915] 138.582 4,000.00 4,927.49 0 927.49 23.19 418 20.25 20.17

Total :

Axis - Long Term Equity (G) [Folio:91023888043] - [Balance Units/Nos : 560.3190]

Avg Cost : 32.1246, Current Price: 35.5565 as on 28/04/2017

Name as on Fund's Record : DEEPTI JAJOO

(IND)

Systematic Investment 50.767 29.5470 1,500.00 06/05/2016 1,805.10 0 305.10 20.34 357 20.80 20.76

Systematic Investment 48.475 30.9440 1,500.00 10/06/2016 1,723.60 0 223.60 14.91 322 16.90 15.73

Systematic Investment 47.128 31.8283 1,500.00 11/07/2016 1,675.71 0 175.71 11.71 291 14.69 12.39

Systematic Investment 45.654 32.8561 1,500.00 10/08/2016 1,623.30 0 123.30 8.22 261 11.50 11.88

Systematic Investment 45.319 33.0984 1,500.00 12/09/2016 1,611.39 0 111.39 7.43 228 11.89 10.81

Systematic Investment 44.580 33.6474 1,500.00 10/10/2016 1,585.11 0 85.11 5.67 200 10.35 12.47

Systematic Investment 46.303 32.3950 1,500.00 10/11/2016 1,646.37 0 146.37 9.76 169 21.08 19.72

Systematic Investment 48.736 30.7779 1,500.00 12/12/2016 1,732.88 0 232.88 15.53 137 41.38 36.95

Systematic Investment 48.944 30.6471 1,500.00 10/01/2017 1,740.28 0 240.28 16.02 108 54.14 41.40

Systematic Investment 45.953 32.6424 1,500.00 10/02/2017 1,633.93 0 133.93 8.93 77 42.33 27.52

Systematic Investment 45.451 33.0023 1,500.00 10/03/2017 1,616.08 0 116.08 7.74 49 57.66 30.81

Systematic Investment 43.009 34.8764 1,500.00 10/04/2017 1,529.25 0 29.25 1.95 18 39.54 27.08

Axis - Long Term Equity (G) [Folio:91023888043] 560.319 18,000.00 19,923.00 0 1,923.00 10.68 185 21.10 18.13

Total :

Birla SL - Tax Relief 96 Fund ELSS Reg (G) [Folio:1017735155] - [Balance Units/Nos : 633.0330]

Avg Cost : 23.6954, Current Price: 26.6300 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 68.556 21.8800 1,500.00 24/06/2016 1,825.65 0 325.65 21.71 308 25.73 17.81

Systematic - Instalment 2/1002 Y 63.776 23.5200 1,500.00 10/08/2016 1,698.35 0 198.35 13.22 261 18.49 11.88

Systematic - Instalment 3/1002 Y 63.211 23.7300 1,500.00 12/09/2016 1,683.31 0 183.31 12.22 228 19.56 10.81

Systematic - Instalment 4/1002 Y 61.175 24.5200 1,500.00 10/10/2016 1,629.09 0 129.09 8.61 200 15.71 12.47

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 11 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 5/1002 Y 63.318 23.6900 1,500.00 10/11/2016 1,686.16 0 186.16 12.41 169 26.80 19.72

Systematic - Instalment 6/1002 Y 66.637 22.5100 1,500.00 12/12/2016 1,774.54 0 274.54 18.30 137 48.76 36.95

Systematic - Instalment 7/1002 Y 65.445 22.9200 1,500.00 10/01/2017 1,742.80 0 242.80 16.19 108 54.72 41.40

Systematic - Instalment 8/1002 Y 61.754 24.2900 1,500.00 10/02/2017 1,644.51 0 144.51 9.63 77 45.65 27.52

Systematic - Instalment 9/1002 Y 61.602 24.3500 1,500.00 10/03/2017 1,640.46 0 140.46 9.36 49 69.72 30.81

Systematic - Instalment 10/1002 Y 57.559 26.0600 1,500.00 10/04/2017 1,532.80 0 32.80 2.19 18 44.41 27.08

Birla SL - Tax Relief 96 Fund ELSS Reg (G) 633.033 15,000.00 16,857.67 0 1,857.67 12.38 156 29.06 19.27

[Folio:1017735155] Total :

HDFC - Tax Saver (G) [Folio:10403973/62] - [Balance Units/Nos : 2.6960]

Avg Cost : 370.9199, Current Price: 483.5750 as on 28/04/2017

Name as on Fund's Record : DEEPTI JAJOO

(IND)

Systematic Y 2.696 370.8570 1,000.00 04/01/2016 1,303.72 0 303.72 30.37 480 23.09 14.76

HDFC - Tax Saver (G) [Folio:10403973/62] Total : 2.696 1,000.00 1,303.72 0 303.72 30.37 480 23.09 14.76

ICICI Pru - Long Term Equity Fund Reg (G) [Folio:8022681/82] - [Balance Units/Nos : 3.6870]

Avg Cost : 271.2232, Current Price: 325.5200 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Appln : 3319010 - ARN-20569/E Y 3.687 271.2500 1,000.00 04/01/2016 1,200.19 0 200.19 20.02 480 15.22 14.76

ICICI Pru - Long Term Equity Fund Reg (G) 3.687 1,000.00 1,200.19 0 200.19 20.02 480 15.22 14.76

[Folio:8022681/82] Total :

SBI - M Tax Gain Reg (G) [Folio:15056276] - [Balance Units/Nos : 38.7420]

Avg Cost : 103.2471, Current Price: 129.0922 as on 28/04/2017

Name as on Fund's Record : Deepti Jajoo

(IND)

Systematic Y 9.177 108.9649 1,000.00 04/01/2016 1,184.68 0 184.68 18.47 480 14.04 14.76

Systematic - Instalment 2/60 Y 10.178 98.2524 1,000.00 10/02/2016 1,313.90 0 313.90 31.39 443 25.86 23.85

Systematic - Instalment 3/60 Y 9.910 100.9070 1,000.00 10/03/2016 1,279.30 0 279.30 27.93 414 24.62 21.41

Systematic - Instalment 4/60 Y 9.477 105.5175 1,000.00 11/04/2016 1,223.41 0 223.41 22.34 382 21.35 20.34

SBI - M Tax Gain Reg (G) [Folio:15056276] Total : 38.742 4,000.00 5,001.29 0 1,001.29 25.03 430 21.26 19.86

Equity: Tax Planning Total : 43,000.00 49,213.36 0 6,213.36 14.45 233 22.66 19.88

DEEPTI JAJOO PAN : AMPPJ7994P Total : 193,000.00 246,854.84 0 53,854.84 27.90 505 20.17 15.15

RONAK JAJOO PAN : AGYPJ1402F

Equity: Multi Cap

ICICI Pru - Value Discovery Reg (G) [Folio:8022251/14] - [Balance Units/Nos : 15.3850]

Avg Cost : 97.4976, Current Price: 134.1900 as on 28/04/2017

Name as on Fund's Record : RONAK JAJOO

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 12 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

(IND)

Systematic - Instalment 2/60 - ARN-20569 Y 15.385 97.5000 1,500.00 25/02/2016 2,064.51 0 564.51 37.63 428 32.09 28.55

ICICI Pru - Value Discovery Reg (G) 15.385 1,500.00 2,064.51 0 564.51 37.63 428 32.09 28.55

[Folio:8022251/14] Total :

Equity: Multi Cap Total : 1,500.00 2,064.51 0 564.51 37.63 428 32.09 28.55

Equity: Tax Planning

HDFC - Tax Saver (G) [Folio:8748586/17] - [Balance Units/Nos : 116.0540]

Avg Cost : 297.2754, Current Price: 483.5750 as on 28/04/2017

Name as on Fund's Record : Ronak Jajoo

(IND)

Systematic Y 2.077 240.7720 500.00 06/12/2012 1,004.39 0 504.39 100.88 1604 22.96 12.94

Systematic - Instalment 2/37 Y 2.015 248.1920 500.00 10/01/2013 974.40 0 474.40 94.88 1569 22.07 13.00

Systematic - Instalment 1/36 Y 1.983 252.1980 500.00 21/01/2013 958.93 0 458.93 91.79 1558 21.50 12.41

Systematic - Instalment 3/37 Y 2.094 238.7690 500.00 11/02/2013 1,012.61 0 512.61 102.52 1537 24.35 13.71

Systematic - Instalment 2/36 Y 2.105 237.4870 500.00 20/02/2013 1,017.93 0 517.93 103.59 1528 24.74 13.51

Systematic - Instalment 4/37 Y 2.104 237.6860 500.00 11/03/2013 1,017.44 0 517.44 103.49 1509 25.03 13.68

Systematic - Instalment 3/36 Y 2.214 225.7930 500.00 20/03/2013 1,070.64 0 570.64 114.13 1500 27.77 15.42

Systematic - Instalment 5/37 Y 2.243 222.9360 500.00 10/04/2013 1,084.66 0 584.66 116.93 1479 28.86 16.63

Systematic - Instalment 4/36 Y 2.174 229.9810 500.00 22/04/2013 1,051.29 0 551.29 110.26 1467 27.43 14.80

Systematic - Instalment 6/37 Y 2.133 234.4640 500.00 10/05/2013 1,031.47 0 531.47 106.29 1449 26.77 13.26

Systematic - Instalment 5/36 Y 2.100 238.0450 500.00 20/05/2013 1,015.51 0 515.51 103.10 1439 26.15 12.97

Systematic - Instalment 7/37 Y 2.189 228.4310 500.00 10/06/2013 1,058.55 0 558.55 111.71 1418 28.75 15.00

Systematic - Instalment 6/36 Y 2.272 220.0970 500.00 20/06/2013 1,098.68 0 598.68 119.74 1408 31.04 16.72

Systematic - Instalment 8/37 Y 2.291 218.2720 500.00 10/07/2013 1,107.87 0 607.87 121.57 1388 31.97 15.77

Systematic - Instalment 7/36 Y 2.236 223.5960 500.00 22/07/2013 1,081.27 0 581.27 116.25 1376 30.84 14.39

Systematic - Instalment 9/37 Y 2.352 212.5470 500.00 12/08/2013 1,137.37 0 637.37 127.47 1355 34.34 17.72

Systematic - Instalment 8/36 Y 2.419 206.6610 500.00 20/08/2013 1,169.77 0 669.77 133.95 1347 36.30 19.58

Systematic - Instalment 10/37 Y 2.274 219.8590 500.00 10/09/2013 1,099.65 0 599.65 119.93 1326 33.01 15.91

Systematic - Instalment 9/36 Y 2.219 225.3720 500.00 20/09/2013 1,073.05 0 573.05 114.61 1316 31.79 15.19

Systematic - Instalment 11/37 Y 2.178 229.5680 500.00 10/10/2013 1,053.23 0 553.23 110.65 1296 31.16 15.36

Systematic - Instalment 10/36 Y 2.107 237.3540 500.00 21/10/2013 1,018.89 0 518.89 103.78 1285 29.48 14.19

Systematic - Instalment 12/37 Y 2.073 241.2350 500.00 11/11/2013 1,002.45 0 502.45 100.49 1264 29.02 15.32

Systematic - Instalment 11/36 Y 2.051 243.7610 500.00 20/11/2013 991.81 0 491.81 98.36 1255 28.61 15.11

Systematic - Instalment 13/37 Y 1.960 255.1460 500.00 10/12/2013 947.81 0 447.81 89.56 1235 26.47 13.87

Systematic - Instalment 14/37 Y 2.004 249.5160 500.00 10/01/2014 969.08 0 469.08 93.82 1204 28.44 15.39

Systematic - Instalment 13/36 Y 1.977 252.8850 500.00 20/01/2014 956.03 0 456.03 91.21 1194 27.88 14.55

Systematic - Instalment 15/37 Y 2.040 245.1300 500.00 10/02/2014 986.49 0 486.49 97.30 1173 30.28 16.71

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 13 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 14/36 Y 2.023 247.2060 500.00 20/02/2014 978.27 0 478.27 95.65 1163 30.02 16.55

Systematic - Instalment 16/37 Y 1.895 263.9010 500.00 10/03/2014 916.37 0 416.37 83.27 1145 26.54 13.49

Systematic - Instalment 15/36 Y 1.914 261.2690 500.00 20/03/2014 925.56 0 425.56 85.11 1135 27.37 13.99

Systematic - Instalment 17/37 Y 1.748 285.9930 500.00 10/04/2014 845.29 0 345.29 69.06 1114 22.63 12.09

Systematic - Instalment 16/36 Y 1.725 289.7810 500.00 21/04/2014 834.17 0 334.17 66.83 1103 22.12 12.07

Systematic - Instalment 18/37 Y 1.675 298.4640 500.00 12/05/2014 809.99 0 309.99 62.00 1082 20.91 11.01

Systematic - Instalment 17/36 Y 1.530 326.6960 500.00 20/05/2014 739.87 0 239.87 47.97 1074 16.30 9.48

Systematic - Instalment 19/37 Y 1.407 355.3440 500.00 10/06/2014 680.39 0 180.39 36.08 1053 12.51 7.46

Systematic - Instalment 18/36 Y 1.444 346.3590 500.00 20/06/2014 698.28 0 198.28 39.66 1043 13.88 8.35

Systematic - Instalment 20/37 Y 1.423 351.3560 500.00 10/07/2014 688.13 0 188.13 37.63 1023 13.43 8.19

Systematic - Instalment 19/36 Y 1.402 356.6730 500.00 21/07/2014 677.97 0 177.97 35.59 1012 12.84 7.60

Systematic - Instalment 21/37 Y 1.435 348.3510 500.00 11/08/2014 693.93 0 193.93 38.79 991 14.29 8.10

Systematic - Instalment 20/36 Y 1.370 365.0520 500.00 20/08/2014 662.50 0 162.50 32.50 982 12.08 6.74

Systematic - Instalment 22/37 Y 1.312 381.1320 500.00 10/09/2014 634.45 0 134.45 26.89 961 10.21 5.68

Systematic - Instalment 23/37 Y 1.364 366.5430 500.00 10/10/2014 659.60 0 159.60 31.92 931 12.51 7.20

Systematic - Instalment 22/36 Y 1.356 368.8290 500.00 20/10/2014 655.73 0 155.73 31.15 921 12.35 7.17

Systematic - Instalment 24/37 Y 1.272 392.9570 500.00 10/11/2014 615.11 0 115.11 23.02 900 9.34 4.66

Systematic - Instalment 23/36 Y 1.255 398.2530 500.00 20/11/2014 606.89 0 106.89 21.38 890 8.77 4.40

Systematic - Instalment 25/37 Y 1.246 401.4440 500.00 10/12/2014 602.53 0 102.53 20.51 870 8.60 4.76

Systematic - Instalment 24/36 Y 1.257 397.7800 500.00 22/12/2014 607.85 0 107.85 21.57 858 9.18 5.01

Systematic - Instalment 26/37 Y 1.240 403.0860 500.00 12/01/2015 599.63 0 99.63 19.93 837 8.69 5.14

Systematic - Instalment 25/36 Y 1.212 412.4300 500.00 20/01/2015 586.09 0 86.09 17.22 829 7.58 3.08

Systematic - Instalment 27/37 Y 1.256 398.0270 500.00 10/02/2015 607.37 0 107.37 21.47 808 9.70 3.89

Systematic - Instalment 26/36 Y 1.212 412.7030 500.00 20/02/2015 586.09 0 86.09 17.22 798 7.88 2.44

Systematic - Instalment 28/37 Y 1.225 408.3080 500.00 10/03/2015 592.38 0 92.38 18.48 780 8.65 3.18

Systematic - Instalment 29/37 Y 1.207 414.2730 500.00 10/04/2015 583.68 0 83.68 16.74 749 8.16 2.91

Systematic - Instalment 28/36 Y 1.247 400.8790 500.00 20/04/2015 603.02 0 103.02 20.60 739 10.17 5.00

Systematic - Instalment 30/37 Y 1.279 391.0030 500.00 11/05/2015 618.49 0 118.49 23.70 718 12.05 5.98

Systematic - Instalment 29/36 Y 1.261 396.5070 500.00 20/05/2015 609.79 0 109.79 21.96 709 11.31 5.38

Systematic - Instalment 31/37 Y 1.311 381.5300 500.00 10/06/2015 633.97 0 133.97 26.79 688 14.21 7.70

Systematic - Instalment 30/36 Y 1.281 390.3490 500.00 22/06/2015 619.46 0 119.46 23.89 676 12.90 6.15

Systematic - Instalment 32/37 Y 1.275 392.2880 500.00 10/07/2015 616.56 0 116.56 23.31 658 12.93 6.26

Systematic - Instalment 33/37 Y 1.220 409.8630 500.00 10/08/2015 589.96 0 89.96 17.99 627 10.47 5.32

Systematic - Instalment 32/36 Y 1.253 399.1500 500.00 20/08/2015 605.92 0 105.92 21.18 617 12.53 6.58

Systematic - Instalment 34/37 Y 1.355 369.0830 500.00 10/09/2015 655.24 0 155.24 31.05 596 19.02 11.92

Systematic - Instalment 33/36 Y 1.321 378.6380 500.00 21/09/2015 638.80 0 138.80 27.76 585 17.32 10.38

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 14 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 35/37 Y 1.307 382.4990 500.00 12/10/2015 632.03 0 132.03 26.41 564 17.09 9.22

Systematic - Instalment 34/36 Y 1.282 390.1080 500.00 20/10/2015 619.94 0 119.94 23.99 556 15.75 8.28

Systematic - Instalment 36/37 Y 1.349 370.6710 500.00 10/11/2015 652.34 0 152.34 30.47 535 20.79 13.33

Systematic - Instalment 35/36 Y 1.326 377.1590 500.00 20/11/2015 641.22 0 141.22 28.24 525 19.63 12.81

Systematic - Instalment 37/37 Y 1.358 368.2540 500.00 10/12/2015 656.69 0 156.69 31.34 505 22.65 15.25

Systematic - Instalment 36/36 Y 1.340 373.1860 500.00 21/12/2015 647.99 0 147.99 29.60 494 21.87 13.86

HDFC - Tax Saver (G) [Folio:8748586/17] Total : 116.054 34,500.00 56,120.81 0 21,620.81 62.67 1048 21.82 10.52

SBI - M Tax Gain Reg (G) [Folio:11996727] - [Balance Units/Nos : 828.1580]

Avg Cost : 57.3562, Current Price: 129.0922 as on 28/04/2017

Name as on Fund's Record : RONAK JAJOO

(IND)

Systematic Y 9.321 53.6400 500.00 07/10/2009 1,203.27 0 703.27 140.65 2760 18.60 11.45

Systematic - Instalment 1/59 Y 8.943 55.9100 500.00 25/11/2009 1,154.47 0 654.47 130.89 2711 17.62 11.06

Systematic - Instalment 2/60 Y 8.884 56.2800 500.00 07/12/2009 1,146.86 0 646.86 129.37 2699 17.50 11.31

Systematic - Instalment 2/59 Y 8.679 57.6100 500.00 29/12/2009 1,120.39 0 620.39 124.08 2677 16.92 10.82

Systematic - Instalment 3/60 Y 8.488 58.9100 500.00 05/01/2010 1,095.73 0 595.73 119.15 2670 16.29 10.43

Systematic - Instalment 3/59 Y 8.917 56.0700 500.00 25/01/2010 1,151.12 0 651.12 130.22 2650 17.94 11.82

Systematic - Instalment 4/60 Y 9.330 53.5900 500.00 05/02/2010 1,204.43 0 704.43 140.89 2639 19.49 13.44

Additional Purchase Y 184.945 54.0700 10,000.00 15/02/2010 23,874.96 0 13,874.96 138.75 2629 19.26 13.02

Systematic - Instalment 4/59 Y 9.206 54.3100 500.00 25/02/2010 1,188.42 0 688.42 137.68 2619 19.19 12.75

Systematic - Instalment 5/60 Y 8.786 56.9100 500.00 05/03/2010 1,134.20 0 634.20 126.84 2611 17.73 11.58

Systematic - Instalment 5/59 Y 8.690 57.5400 500.00 25/03/2010 1,121.81 0 621.81 124.36 2591 17.52 10.83

Systematic - Instalment 6/60 Y 8.493 58.8700 500.00 05/04/2010 1,096.38 0 596.38 119.28 2580 16.87 10.37

Systematic - Instalment 6/59 Y 8.530 58.6200 500.00 26/04/2010 1,101.16 0 601.16 120.23 2559 17.15 10.67

Systematic - Instalment 7/60 Y 8.763 57.0600 500.00 05/05/2010 1,131.23 0 631.23 126.25 2550 18.07 11.67

Systematic - Instalment 7/59 Y 9.285 53.8500 500.00 25/05/2010 1,198.62 0 698.62 139.72 2530 20.16 13.50

Systematic - Instalment 8/60 Y 8.892 56.2300 500.00 07/06/2010 1,147.89 0 647.89 129.58 2517 18.79 12.30

Systematic - Instalment 8/59 Y 8.483 58.9400 500.00 25/06/2010 1,095.09 0 595.09 119.02 2499 17.38 11.19

Systematic - Instalment 9/60 Y 8.498 58.8400 500.00 05/07/2010 1,097.03 0 597.03 119.41 2489 17.51 11.39

Systematic - Instalment 9/59 Y 8.290 60.3100 500.00 26/07/2010 1,070.17 0 570.17 114.03 2468 16.86 10.60

Systematic - Instalment 10/60 Y 8.256 60.5600 500.00 05/08/2010 1,065.79 0 565.79 113.16 2458 16.80 10.51

Systematic - Instalment 10/59 Y 8.237 60.7000 500.00 25/08/2010 1,063.33 0 563.33 112.67 2438 16.87 10.53

Systematic - Instalment 11/60 Y 8.019 62.3500 500.00 06/09/2010 1,035.19 0 535.19 107.04 2426 16.10 10.05

Systematic - Instalment 11/59 Y 7.627 65.5600 500.00 27/09/2010 984.59 0 484.59 96.92 2405 14.71 8.22

Systematic - Instalment 12/60 Y 7.503 66.6400 500.00 05/10/2010 968.58 0 468.58 93.72 2397 14.27 7.83

Systematic - Instalment 12/59 Y 7.523 66.4600 500.00 25/10/2010 971.16 0 471.16 94.23 2377 14.47 8.04

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 15 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 13/60 Y 7.361 67.9300 500.00 08/11/2010 950.25 0 450.25 90.05 2363 13.91 7.46

Systematic - Instalment 13/59 Y 7.884 63.4200 500.00 25/11/2010 1,017.76 0 517.76 103.55 2346 16.11 9.40

Systematic - Instalment 14/60 Y 7.718 64.7800 500.00 06/12/2010 996.33 0 496.33 99.27 2335 15.52 8.64

Systematic - Instalment 14/59 Y 7.842 63.7600 500.00 27/12/2010 1,012.34 0 512.34 102.47 2314 16.16 8.69

Systematic - Instalment 15/60 Y 7.738 64.6200 500.00 05/01/2011 998.92 0 498.92 99.78 2305 15.80 8.40

Systematic - Instalment 15/59 Y 8.277 60.4100 500.00 25/01/2011 1,068.50 0 568.50 113.70 2285 18.16 10.16

Systematic - Instalment 16/60 Y 8.743 57.1900 500.00 07/02/2011 1,128.65 0 628.65 125.73 2272 20.20 11.64

Systematic - Instalment 16/59 Y 9.025 55.4000 500.00 25/02/2011 1,165.06 0 665.06 133.01 2254 21.54 12.21

Systematic - Instalment 17/60 Y 8.803 56.8000 500.00 07/03/2011 1,136.40 0 636.40 127.28 2244 20.70 11.44

Systematic - Instalment 17/59 Y 8.537 58.5700 500.00 25/03/2011 1,102.06 0 602.06 120.41 2226 19.74 10.58

Systematic - Instalment 18/60 Y 8.157 61.3000 500.00 05/04/2011 1,053.01 0 553.01 110.60 2215 18.23 9.46

Systematic - Instalment 18/59 Y 8.125 61.5400 500.00 25/04/2011 1,048.87 0 548.87 109.77 2195 18.25 9.71

Systematic - Instalment 19/60 Y 8.591 58.2000 500.00 05/05/2011 1,109.03 0 609.03 121.81 2185 20.35 11.76

Systematic - Instalment 19/59 Y 8.777 56.9700 500.00 25/05/2011 1,133.04 0 633.04 126.61 2165 21.35 12.47

Systematic - Instalment 20/60 Y 8.553 58.4600 500.00 06/06/2011 1,104.13 0 604.13 120.83 2153 20.48 11.56

Systematic - Instalment 20/59 Y 8.576 58.3000 500.00 27/06/2011 1,107.09 0 607.09 121.42 2132 20.79 11.70

Systematic - Instalment 21/60 Y 8.357 59.8300 500.00 05/07/2011 1,078.82 0 578.82 115.76 2124 19.89 11.20

Systematic - Instalment 21/59 Y 8.264 60.5000 500.00 25/07/2011 1,066.82 0 566.82 113.36 2104 19.67 11.07

Systematic - Instalment 22/60 Y 8.839 56.5700 500.00 05/08/2011 1,141.05 0 641.05 128.21 2093 22.36 13.70

Systematic - Instalment 22/59 Y 9.367 53.3800 500.00 25/08/2011 1,209.21 0 709.21 141.84 2073 24.97 16.24

Systematic - Instalment 23/60 Y 9.139 54.7100 500.00 05/09/2011 1,179.77 0 679.77 135.95 2062 24.06 15.12

Systematic - Instalment 23/59 Y 9.313 53.6900 500.00 26/09/2011 1,202.24 0 702.24 140.45 2041 25.12 16.53

Systematic - Instalment 24/60 Y 9.522 52.5100 500.00 05/10/2011 1,229.22 0 729.22 145.84 2032 26.20 17.21

Systematic - Instalment 24/59 Y 9.029 55.3800 500.00 25/10/2011 1,165.57 0 665.57 133.11 2012 24.15 14.37

Systematic - Instalment 25/60 Y 8.857 56.4500 500.00 08/11/2011 1,143.37 0 643.37 128.67 1998 23.51 13.87

Systematic - Instalment 25/59 Y 9.671 51.7000 500.00 25/11/2011 1,248.45 0 748.45 149.69 1981 27.58 17.97

Systematic - Instalment 26/60 Y 9.254 54.0300 500.00 05/12/2011 1,194.62 0 694.62 138.92 1971 25.73 15.67

Systematic - Instalment 26/59 Y 9.837 50.8300 500.00 26/12/2011 1,269.88 0 769.88 153.98 1950 28.82 17.72

Systematic - Instalment 27/60 Y 9.841 50.8100 500.00 05/01/2012 1,270.40 0 770.40 154.08 1940 28.99 18.04

Systematic - Instalment 27/59 Y 9.111 54.8800 500.00 25/01/2012 1,176.16 0 676.16 135.23 1920 25.71 15.28

Systematic - Instalment 28/60 Y 8.741 57.2000 500.00 06/02/2012 1,128.39 0 628.39 125.68 1908 24.04 14.07

Systematic - Instalment 28/59 Y 8.794 56.8600 500.00 27/02/2012 1,135.24 0 635.24 127.05 1887 24.58 14.73

Systematic - Instalment 29/60 Y 8.734 57.2500 500.00 05/03/2012 1,127.49 0 627.49 125.50 1880 24.37 14.79

Systematic - Instalment 29/59 Y 8.792 56.8700 500.00 26/03/2012 1,134.98 0 634.98 127.00 1859 24.94 15.60

Systematic - Instalment 30/60 Y 8.609 58.0800 500.00 09/04/2012 1,111.35 0 611.35 122.27 1845 24.19 15.38

Systematic - Instalment 30/59 Y 8.645 57.8400 500.00 25/04/2012 1,116.00 0 616.00 123.20 1829 24.59 15.74

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 16 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic - Instalment 31/60 Y 8.746 57.1700 500.00 07/05/2012 1,129.04 0 629.04 125.81 1817 25.27 16.46

Systematic - Instalment 31/59 Y 8.988 55.6300 500.00 25/05/2012 1,160.28 0 660.28 132.06 1799 26.79 18.08

Systematic - Instalment 32/60 Y 9.117 54.8400 500.00 05/06/2012 1,176.93 0 676.93 135.39 1788 27.64 18.64

Systematic - Instalment 32/59 Y 8.789 56.8900 500.00 25/06/2012 1,134.59 0 634.59 126.92 1768 26.20 16.91

Systematic - Instalment 33/60 Y 8.418 59.4000 500.00 05/07/2012 1,086.70 0 586.70 117.34 1758 24.36 15.50

Systematic - Instalment 33/59 Y 8.588 58.2200 500.00 25/07/2012 1,108.64 0 608.64 121.73 1738 25.56 17.24

Systematic - Instalment 34/60 Y 8.378 59.6800 500.00 06/08/2012 1,081.53 0 581.53 116.31 1726 24.60 16.10

Systematic - Instalment 34/59 Y 8.258 60.5500 500.00 27/08/2012 1,066.04 0 566.04 113.21 1705 24.24 15.82

Systematic - Instalment 35/60 Y 8.409 59.4600 500.00 05/09/2012 1,085.54 0 585.54 117.11 1696 25.20 16.80

Systematic - Instalment 35/59 Y 7.884 63.4200 500.00 25/09/2012 1,017.76 0 517.76 103.55 1676 22.55 13.93

Systematic - Instalment 36/60 Y 7.747 64.5400 500.00 05/10/2012 1,000.08 0 500.08 100.02 1666 21.91 13.56

Systematic - Instalment 36/59 Y 7.726 64.7200 500.00 25/10/2012 997.37 0 497.37 99.47 1646 22.06 13.99

Systematic - Instalment 37/60 Y 7.782 64.2500 500.00 05/11/2012 1,004.60 0 504.60 100.92 1635 22.53 14.09

Systematic - Instalment 37/59 Y 7.830 63.8600 500.00 26/11/2012 1,010.79 0 510.79 102.16 1614 23.10 14.72

Systematic - Instalment 38/60 Y 7.487 66.7800 500.00 05/12/2012 966.51 0 466.51 93.30 1605 21.22 13.12

SBI - M Tax Gain Reg (G) [Folio:11996727] Total : 828.158 47,500.00 106,908.74 0 59,408.74 125.07 2264 20.17 11.95

Sundaram - Tax Saver OE (G) [Folio:SBBNAD297083] - [Balance Units/Nos : 491.3029]

Avg Cost : 41.2315, Current Price: 95.3473 as on 28/04/2017

Name as on Fund's Record : RONAK JAJOO

(IND)

Systematic Y 6.338 40.5886 257.25 21/03/2011 604.30 0 347.05 134.91 2230 22.08 12.02

Systematic Y 11.338 44.1002 500.01 07/04/2011 1,081.05 0 581.04 116.21 2213 19.17 9.58

Systematic Y 11.311 44.2041 499.99 20/04/2011 1,078.47 0 578.48 115.70 2200 19.20 9.79

Systematic Y 11.844 42.2147 499.99 09/05/2011 1,129.29 0 629.30 125.86 2181 21.06 11.31

Systematic Y 11.980 41.7376 500.02 20/05/2011 1,142.26 0 642.24 128.44 2170 21.60 11.70

Systematic Y 11.791 42.4044 499.99 07/06/2011 1,124.24 0 624.25 124.85 2152 21.18 11.44

Systematic Y 12.404 40.3100 500.01 20/06/2011 1,182.69 0 682.68 136.53 2139 23.30 13.13

Systematic Y 11.561 43.2476 499.99 07/07/2011 1,102.31 0 602.32 120.47 2122 20.72 10.73

Systematic Y 11.673 42.8342 500.00 20/07/2011 1,112.99 0 612.99 122.60 2109 21.22 11.62

Systematic Y 12.350 40.4861 500.00 08/08/2011 1,177.54 0 677.54 135.51 2090 23.67 14.28

Systematic Y 12.842 38.9350 500.00 22/08/2011 1,224.45 0 724.45 144.89 2076 25.47 15.81

Systematic Y 12.569 39.7795 499.99 07/09/2011 1,198.42 0 698.43 139.69 2060 24.75 14.45

Systematic 12.533 39.8954 500.01 20/09/2011 1,194.99 0 694.98 138.99 2047 24.78 14.44

Systematic 13.154 38.0124 500.02 07/10/2011 1,254.20 0 754.18 150.83 2030 27.12 16.24

Systematic 12.703 39.3604 500.00 20/10/2011 1,211.20 0 711.20 142.24 2017 25.74 14.97

Systematic 12.197 40.9921 499.98 08/11/2011 1,162.95 0 662.97 132.60 1998 24.22 13.87

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

RONAK JAJOO PORTFOLIO RETURNS - Unrealized Gains only Page 17 of 17

Amount in INR

Transaction DR Balance Purchase Purchase Purchase Market Dividend Gain Absolute Holding Annualized Benchmark

Type Units/Nos Price Value Date Value (Rs.) /FD Interest (Rs) Return Days Return % (%)

(%)

Systematic 13.354 37.4416 500.00 21/11/2011 1,273.27 0 773.27 154.65 1985 28.44 17.42

Systematic 12.754 39.2044 500.01 07/12/2011 1,216.06 0 716.05 143.21 1969 26.55 15.53

Systematic 13.985 35.7517 499.99 20/12/2011 1,333.43 0 833.44 166.69 1956 31.11 19.55

Systematic 13.617 36.7198 500.01 09/01/2012 1,298.34 0 798.33 159.66 1936 30.10 18.13

Systematic 12.891 38.7875 500.01 20/01/2012 1,229.12 0 729.11 145.82 1925 27.65 15.98

Systematic 12.112 41.2800 499.98 07/02/2012 1,154.85 0 654.87 130.98 1907 25.07 14.24

Systematic 11.534 43.3502 500.00 21/02/2012 1,099.74 0 599.74 119.95 1893 23.13 12.71

Systematic 12.186 41.0319 500.01 07/03/2012 1,161.90 0 661.89 132.38 1878 25.73 15.20

Systematic 12.000 41.6654 499.98 20/03/2012 1,144.17 0 644.19 128.84 1865 25.22 14.95

Systematic 11.882 42.0822 500.02 09/04/2012 1,132.92 0 632.90 126.57 1845 25.04 15.38

Systematic 11.958 41.8128 500.00 20/04/2012 1,140.16 0 640.16 128.03 1834 25.48 15.10

Systematic 12.447 40.1708 500.01 07/05/2012 1,186.79 0 686.78 137.35 1817 27.59 16.46

Systematic 12.884 38.8077 500.00 21/05/2012 1,228.45 0 728.45 145.69 1803 29.49 18.15

Systematic 12.633 39.5788 500.00 07/06/2012 1,204.52 0 704.52 140.90 1786 28.80 17.22

Systematic 12.451 40.1567 499.99 20/06/2012 1,187.17 0 687.18 137.44 1773 28.29 16.82

Systematic 11.959 41.8078 499.98 09/07/2012 1,140.26 0 640.28 128.06 1754 26.65 15.89

Systematic 11.927 41.9216 500.00 20/07/2012 1,137.21 0 637.21 127.44 1743 26.69 16.49

Systematic 11.756 42.5298 499.98 07/08/2012 1,120.90 0 620.92 124.19 1725 26.28 15.73

Systematic 11.530 43.3655 500.00 21/08/2012 1,099.35 0 599.35 119.87 1711 25.57 15.28

Systematic 11.721 42.6595 500.01 07/09/2012 1,117.57 0 617.56 123.51 1694 26.61 15.98

Systematic 11.378 43.9457 500.01 20/09/2012 1,084.86 0 584.85 116.97 1681 25.40 14.66

Systematic 10.968 45.5856 499.98 08/10/2012 1,045.77 0 545.79 109.16 1663 23.96 14.03

Systematic 10.940 45.7023 499.98 22/10/2012 1,043.10 0 543.12 108.63 1649 24.04 13.89

Systematic 10.736 46.5704 499.98 07/11/2012 1,023.65 0 523.67 104.74 1633 23.41 13.75

Systematic 11.112 44.9960 500.00 20/11/2012 1,059.50 0 559.50 111.90 1620 25.21 15.09

Sundaram - Tax Saver OE (G) 491.303 20,257.18 46,844.41 0 26,587.23 131.25 1920 24.95 14.41

[Folio:SBBNAD297083] Total :

Equity: Tax Planning Total : 102,257.18 209,873.96 0 107,616.78 105.24 1785 21.51 11.25

RONAK JAJOO PAN : AGYPJ1402F Total : 103,757.18 211,938.47 0 108,181.29 104.26 1766 21.55 11.35

Grand Total : 5,206.352 296,757.18 458,793.31 0 162,036.13 54.60 946 21.07 13.02

Please refer to Absolute return for Equity Investments held for less than and upto 1 year, and Annualized Return / CAGR for investments held for greater than 1 year.

Benchmark : Equity: NSE Nifty 50, Debt: 1 Year T-Bill, Gilt: 10 Year G.Sec Index

S&P BSE SENSEX as on 28/04/2017 : 29918.40 and NSE - CNX NIFTY as on 28/04/2017 : 9304.05

Disclaimer :

This statement is based on the information available with us, and is only for your reference. The statement from the resp. fund reflects the exact information for the respective folio. Any discrepancy may please be reported to us.

Current value of investments shown may be reduced by Exit Load/Unammortized expenses/Securities Transaction Tax (STT), as applicable on the date of redemption.

All investments in Mutual Funds carry risk of loss of principal. No returns are guaranteed, all projections are indicative and subject to market fluctuations.

Tax is payable on all your debt and equity transactions. Please contact your Accountant for the exact calculations. You can contact us for any assistance.

Maturity Date, where displayed is based on available information. Please confirm from respective AMC also.

Suresh Rathi Securities Pvt Ltd. [Ref:05546]

Vous aimerez peut-être aussi

- Corporate Actions: A Guide to Securities Event ManagementD'EverandCorporate Actions: A Guide to Securities Event ManagementPas encore d'évaluation

- Staywealthy Investment Services Portfolio Valuation SummaryDocument2 pagesStaywealthy Investment Services Portfolio Valuation SummaryGauri TripathiPas encore d'évaluation

- KBC Knowledge Series - Top Ten SchemesDocument2 pagesKBC Knowledge Series - Top Ten SchemesktiindiaPas encore d'évaluation

- Discounted Cash Flow: A Theory of the Valuation of FirmsD'EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsPas encore d'évaluation

- 01 Adm 05695 RumaDas 20220328 Portfolio DetailedDocument26 pages01 Adm 05695 RumaDas 20220328 Portfolio DetailedAnirPas encore d'évaluation

- Analysing ability of organizations to pay dividends based on financial metrics of HDFC Bank and SBIDocument6 pagesAnalysing ability of organizations to pay dividends based on financial metrics of HDFC Bank and SBIsumit rajPas encore d'évaluation

- Healthy SIP Returns Over 15, 10 and 5 YearsDocument4 pagesHealthy SIP Returns Over 15, 10 and 5 YearsAkash BPas encore d'évaluation

- MF CurrDocument2 pagesMF Curraparna tiwariPas encore d'évaluation

- Vederinus Stefanus 86220 0Document9 pagesVederinus Stefanus 86220 0PdoneeverPas encore d'évaluation

- 3rd Quarter Report 2021 2022Document12 pages3rd Quarter Report 2021 2022শ্রাবনী দেবনাথPas encore d'évaluation

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyPas encore d'évaluation

- HDFC BankDocument4 pagesHDFC BankKshitiz BhandulaPas encore d'évaluation

- Invesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512Document5 pagesInvesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512KUNAL GUPTAPas encore d'évaluation

- Krishan account pptDocument6 pagesKrishan account pptkrishan jindalPas encore d'évaluation

- Provisional Financial - Mar 2021Document8 pagesProvisional Financial - Mar 2021Anamika NandiPas encore d'évaluation

- Allocation Analysis-13-11-2023-08-08-56Document49 pagesAllocation Analysis-13-11-2023-08-08-56fortune144370Pas encore d'évaluation

- Accounts AssignmentDocument17 pagesAccounts AssignmentApoorvPas encore d'évaluation

- SCC 9M21 net income exceed estimatesDocument10 pagesSCC 9M21 net income exceed estimatesJajahinaPas encore d'évaluation

- MF Ready Reckoner Schemes Oct 2016Document4 pagesMF Ready Reckoner Schemes Oct 2016Murali Krishna DPas encore d'évaluation

- AJC - Funds Flow-Feb-18Document1 pageAJC - Funds Flow-Feb-18samar varshneyPas encore d'évaluation

- Project ReportDocument8 pagesProject ReportManish Kumar Chandaliya & Co.Pas encore d'évaluation

- BSheet 2022-23Document2 pagesBSheet 2022-23ranjanamalhari384Pas encore d'évaluation

- Flujo Del Efectivo Proyectado Expresado en TTDDocument3 pagesFlujo Del Efectivo Proyectado Expresado en TTDcarlos guillenPas encore d'évaluation

- Annual Report 2021Document3 pagesAnnual Report 2021hxPas encore d'évaluation

- Ibcp - Open House: 8 April 2023Document8 pagesIbcp - Open House: 8 April 2023ca_charanjitPas encore d'évaluation

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaPas encore d'évaluation

- Balance Sheet Before Day EndDocument4 pagesBalance Sheet Before Day EndDCCB KONDAPAKPas encore d'évaluation

- Bag 2023-24Document1 pageBag 2023-24Farhan NazirPas encore d'évaluation

- SIP Performance of Select Equity Schemes Leaflet - November 2023Document4 pagesSIP Performance of Select Equity Schemes Leaflet - November 2023Tanuj BhattPas encore d'évaluation

- Axis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjPas encore d'évaluation

- Assessment of Working Capital Requirements Form Ii-Operating StatementDocument9 pagesAssessment of Working Capital Requirements Form Ii-Operating Statementdeshrajji75% (4)

- SESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012Document38 pagesSESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012roalan1Pas encore d'évaluation

- August 11, 2023: 153/LG/SE/AUG/2023/GBSLDocument8 pagesAugust 11, 2023: 153/LG/SE/AUG/2023/GBSLmd zafarPas encore d'évaluation

- Project Report PDFDocument13 pagesProject Report PDFMan KumaPas encore d'évaluation

- Pal BS 2019-20 31122019 PDFDocument1 pagePal BS 2019-20 31122019 PDFpushpdeepPas encore d'évaluation

- Sbi 2022-23qs (Autosaved) Robin and HiteshDocument21 pagesSbi 2022-23qs (Autosaved) Robin and HiteshHitesh GuptaPas encore d'évaluation

- Jaiz Bank Q1 2019 financial statementsDocument44 pagesJaiz Bank Q1 2019 financial statementsMusodiq AbolarinPas encore d'évaluation

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenPas encore d'évaluation

- CF 01Document2 pagesCF 01John Alex SelorioPas encore d'évaluation

- Summary 2013Document2 pagesSummary 2013noel sincoPas encore d'évaluation

- Salon De Elegance Income & Financial Statements 2023-2027Document35 pagesSalon De Elegance Income & Financial Statements 2023-2027Ron Benlheo OpolintoPas encore d'évaluation

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesKIranPas encore d'évaluation

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjPas encore d'évaluation

- Asian Paints (Autosaved) 2Document32 767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240Pas encore d'évaluation

- Part 4 - Topic Part: CSR of IbblDocument38 pagesPart 4 - Topic Part: CSR of IbblfahadPas encore d'évaluation

- संचार िवभाग, क��ीय कायार्लय, एस.बी.एस.मागर्, मुंबई 400001 फोन/Phone 022-22660502 वेबसाइट ई-मेल emailDocument1 pageसंचार िवभाग, क��ीय कायार्लय, एस.बी.एस.मागर्, मुंबई 400001 फोन/Phone 022-22660502 वेबसाइट ई-मेल emailVasu Ram JayanthPas encore d'évaluation

- PRDocument10 pagesPRPradeep SenPas encore d'évaluation

- Reclassification of Financial AssetsDocument30 pagesReclassification of Financial AssetsSheila Grace BajaPas encore d'évaluation

- Fund Flow Statement Company (Standalone) : Sources of FundsDocument1 pageFund Flow Statement Company (Standalone) : Sources of FundsGayatri BeheraPas encore d'évaluation

- Navy Federal Bank Statement TemplateDocument1 pageNavy Federal Bank Statement TemplateLoubango MikePas encore d'évaluation

- Cash FlowDocument1 pageCash Flowpawan_019Pas encore d'évaluation

- Monthly report highlights top performing fundsDocument2 pagesMonthly report highlights top performing fundsPraful ThakrePas encore d'évaluation

- ASA Philippines BARMM Report Highlights Key MetricsDocument3 pagesASA Philippines BARMM Report Highlights Key MetricsAbdulmanan HaridPas encore d'évaluation

- Golden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012Document8 pagesGolden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012khurshid topuPas encore d'évaluation

- Asian Corporation (2)Document10 pagesAsian Corporation (2)priyankaPas encore d'évaluation

- 3rd Quarterly Accounts - Prime Finance 1st MF 13Document1 page3rd Quarterly Accounts - Prime Finance 1st MF 13Abrar FaisalPas encore d'évaluation

- Single Premium Endowment Plan Licindiagov - inDocument5 pagesSingle Premium Endowment Plan Licindiagov - inSampiPas encore d'évaluation

- Mahindra and MahindraDocument18 pagesMahindra and Mahindravenkataswamynath channa100% (1)

- Deshmukh Gruh UdyogDocument10 pagesDeshmukh Gruh UdyogJITPas encore d'évaluation

- India Strategy (Housing Boom Ahead) 20170428Document156 pagesIndia Strategy (Housing Boom Ahead) 20170428Ronak JajooPas encore d'évaluation

- Engg & Cap Goods Emkay PDFDocument57 pagesEngg & Cap Goods Emkay PDFRonak JajooPas encore d'évaluation

- WWAR Vol.127 PDFDocument61 pagesWWAR Vol.127 PDFRonak JajooPas encore d'évaluation

- Skipper - IC - HDFC Sec PDFDocument18 pagesSkipper - IC - HDFC Sec PDFRonak JajooPas encore d'évaluation

- AR - Transformers and Pumps Look Promising PDFDocument85 pagesAR - Transformers and Pumps Look Promising PDFRonak JajooPas encore d'évaluation

- Edel Consumer Goods-Sector Update-Apr-17 PDFDocument14 pagesEdel Consumer Goods-Sector Update-Apr-17 PDFRonak JajooPas encore d'évaluation

- Power T&D Reliance PDFDocument63 pagesPower T&D Reliance PDFRonak JajooPas encore d'évaluation

- MOSt - Big Leap - Errclub - (Thematic) Huge Opportunity, But Challenges TooDocument22 pagesMOSt - Big Leap - Errclub - (Thematic) Huge Opportunity, But Challenges TooRonak JajooPas encore d'évaluation

- Ambit AUSmallFinanceBank PreIPO MovingtothePremierLeague 28apr2017 PDFDocument27 pagesAmbit AUSmallFinanceBank PreIPO MovingtothePremierLeague 28apr2017 PDFRonak JajooPas encore d'évaluation

- SPASec BodalChemicals 270417 PDFDocument4 pagesSPASec BodalChemicals 270417 PDFRonak JajooPas encore d'évaluation

- Emkay - Shriram City Union Finance - Errclub - Refer To Important Disclosures at The End of This Report Weak Asset Quality Weighs On EarningsDocument6 pagesEmkay - Shriram City Union Finance - Errclub - Refer To Important Disclosures at The End of This Report Weak Asset Quality Weighs On EarningsRonak JajooPas encore d'évaluation

- HDFC Sec - Navin Fluorine International - Q4FY17 - 02052017 PDFDocument10 pagesHDFC Sec - Navin Fluorine International - Q4FY17 - 02052017 PDFRonak JajooPas encore d'évaluation

- HDFC Sec - Navin Fluorine International - Q4FY17 - 02052017 PDFDocument10 pagesHDFC Sec - Navin Fluorine International - Q4FY17 - 02052017 PDFRonak JajooPas encore d'évaluation

- Stock StatementDocument1 pageStock StatementRonak JajooPas encore d'évaluation

- BF Utilities 13th Annual Report 2012-13Document72 pagesBF Utilities 13th Annual Report 2012-13Ronak JajooPas encore d'évaluation

- Kotak - TelecomDocument5 pagesKotak - TelecomRonak JajooPas encore d'évaluation

- Chapter 31Document25 pagesChapter 31Wedaje AlemayehuPas encore d'évaluation

- 6 LeveragesDocument7 pages6 LeveragesMumtazAhmadPas encore d'évaluation

- MSCI Peru Index (USD) : Cumulative Index Performance - Net Returns (Usd) (MAY 2006 - MAY 2021) Annual Performance (%)Document3 pagesMSCI Peru Index (USD) : Cumulative Index Performance - Net Returns (Usd) (MAY 2006 - MAY 2021) Annual Performance (%)Henry W. Villegas SantosPas encore d'évaluation

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument20 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyPas encore d'évaluation

- HLA Venture Income Fund Apr 22Document3 pagesHLA Venture Income Fund Apr 22ivyPas encore d'évaluation

- Chapter 8.1 - OPTIONS MARKETDocument45 pagesChapter 8.1 - OPTIONS MARKETfarah zulkefliPas encore d'évaluation

- Bonds Duration NoteDocument3 pagesBonds Duration NoteRhea ZenuPas encore d'évaluation

- Angel One Limited (Formerly Known As Angel Broking Limited)Document1 pageAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELPas encore d'évaluation

- Wasim Uddin Orakzai KUST IM Sciences Multinational Business Finance All Formula List 10th Edition by David K Etiman Stone Hi Ill Micheal H Moffitt ISBN 0 321 17894 7Document14 pagesWasim Uddin Orakzai KUST IM Sciences Multinational Business Finance All Formula List 10th Edition by David K Etiman Stone Hi Ill Micheal H Moffitt ISBN 0 321 17894 7WasimOrakzaiPas encore d'évaluation

- Appendix 6 Grand Metropolitan ShareholdersDocument2 pagesAppendix 6 Grand Metropolitan ShareholdersNhan PhanPas encore d'évaluation

- Fabozzi Ch07Document31 pagesFabozzi Ch07cmb463100% (1)

- Financing Resources - Valuation of Stocks L4AEDocument57 pagesFinancing Resources - Valuation of Stocks L4AETacitus KilgorePas encore d'évaluation

- IBF301 Chapter 1 Tutorial QuestionsDocument3 pagesIBF301 Chapter 1 Tutorial QuestionsThắng Nguyễn HuyPas encore d'évaluation

- What I Learned Losing A Million Dollars PDFDocument12 pagesWhat I Learned Losing A Million Dollars PDFDimitrie Chiorean100% (1)

- Course of International Financial Management PDFDocument1 pageCourse of International Financial Management PDFTarun SrivastavaPas encore d'évaluation

- FRM Sample Questions 2011Document9 pagesFRM Sample Questions 2011Shuvo Hasan100% (1)

- Assessment and EvaluationDocument9 pagesAssessment and EvaluationDhruv MalhotraPas encore d'évaluation

- Fedai Rules LatestDocument25 pagesFedai Rules LatestVIJAYASEKARANPas encore d'évaluation

- BEC - CryptocurrencyDocument2 pagesBEC - CryptocurrencyCalPas encore d'évaluation

- AnswerDocument2 pagesAnswerMuskkan BhargavaPas encore d'évaluation

- Role of FIDocument39 pagesRole of FIVaibhav MahamunkarPas encore d'évaluation

- BDL Management Trainee FinanceDocument31 pagesBDL Management Trainee FinanceravinderPas encore d'évaluation

- Fin Zg520 SapmDocument13 pagesFin Zg520 SapmSivasankar APas encore d'évaluation

- Insider Trading: Rajdip Bhadra Chaudhuri Assistant Professor of Law School of Law, KIIT UniversityDocument13 pagesInsider Trading: Rajdip Bhadra Chaudhuri Assistant Professor of Law School of Law, KIIT UniversityRicha NandyPas encore d'évaluation

- Investment Analysis and Portfolio Management Chapter 7Document15 pagesInvestment Analysis and Portfolio Management Chapter 7Oumer Shaffi100% (1)