Académique Documents

Professionnel Documents

Culture Documents

Sembcorp Marine LTD: Expecting Tardy Recovery

Transféré par

John TanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sembcorp Marine LTD: Expecting Tardy Recovery

Transféré par

John TanDroits d'auteur :

Formats disponibles

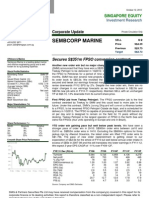

Sembcorp Marine Ltd

Expecting tardy recovery

2 May 2017

SINGAPORE | OIL & GAS | RESULTS

Revenue was in line with our expectation.

Neutral (Upgrade)

Gross profit substantially missed our expectation, mainly due to costs incurred for a CLOSING PRICE SGD 1.630

floater project which is pending finalisation with the customer. No details were given FORECAST DIV SGD 0.030

by the management on this project. TARGET PRICE SGD 1.580

The divestment of Cosco Shipyard Group Co., Ltd (Cosco) was completed in 1Q17. TOTAL RETURN -1.2%

We upgrade our call to Neutral with an unchanged TP of S$1.58, based on a PER of COMPANY DATA

23.9x, since the last done price of S$1.63 is near our TP. This implies a downside of O/S SHA RES (M N) : 2,088

3.1% from the last close price. M A RKET CA P (USD mn / SGD mn) : 2439 / 3404

52 - WK HI/LO (SGD) : 2.09 / 1.22

3M A verage Daily T/O (mn) : 7.395218

Results at a glance

(SGD mn) 1Q17 1Q16 y-y (%) Comments MAJOR SHAREHOLDERS (%)

Revenue 760.1 918.4 (17.2) Low revenue recognition from rig building segment, resulting SEM B CORP INDUSTRIES LTD 61.0%

FRA NKLIN RESOURCES 5.0%

from delivery deferment and lower repair business

Gross profit 19.9 80.6 (75.3) Lower contribution from rig building projects and costs incurred PRICE PERFORMANCE (%)

for a floater project that is pending finalisation with the customer 1M T H 3 M TH 1Y R

Operating proft 13.6 71.7 (81.1) Lower gross profit and mild decrease in overhead costs COM P A NY (14.4) 10.0 (0.7)

STI RETURN 0.4 5.0 15.9

Net profit 39.6 55.6 (28.8) Divestment of 30% equity interest in Cosco, which generated

S$46.8mn gain PRICE VS. STI

Source: Company , Phillip Securities Research (Singapore) 2.40

1.90

Draining order books protract the recovery

In 1Q17, Sembcorp Marine (SMM) secured S$75mn new orders that were from non-drilling 1.40

segments (Offshore platforms and Floaters). Comparatively, new contracts worth of

0.90

S$320mn signed in FY16 were from these segment, and $60mn out of which were logged Apr-16

up in 1Q16. Net order book YTD excluding repairs and upgrades totalled S$7.1bn with 26% SMM SP Equity FSSTI Index

Y-o-Y drop and 8.8% Q-o-Q drop. As of Mar-17, the drillship contracts from Sete Brasil So urce: B lo o mberg, P SR

valued at S$3.1bn out of S$7.1bn remained frozen.

The recovery of in oil price since 3Q16 effectively revitalised upstream drilling and KEY FINANCIALS

Y / E D ec, SG D mn F Y 15 F Y 16 F Y 17e F Y 18 e

production activities, driving reactivation of idled rigs. However, new flows of capital Revenue 4,968 3,545 3,056 2,999

expenditure on exploration and production will still take time to be injected into the Gro ss pro fit 131 293 244 255

market. Therefore, it remains challenging to solicit large orders from drilling segment. The Net P ro fit (290) 79 137 115

momentum in the non-drilling segment is a path for new businesses, but the size of P /E (x) 10.0 36.6 24.0 28.6

P /B (x) 1.2 1.2 1.3 1.3

contracts may not be substantial to improve profitability in the near term. In a nutshell,

EV/EB ITDA 7.7 16.0 14.4 12.9

the shrinking order books will drag the recovery, and SMM could have to endure longer Dividend (SG Cents) 6.0 2.5 3.0 3.0

than expected. Dividend Yield, % 4.2 1.8 1.9 1.9

So urce: Co mpany Data, P SR est.

Near shore gas infrastructure solutions help but take time VALUATION METHOD

According to the management, inquires for near-shore infrastructure solutions have been P /E M ultiple (P ER:23.9x)

increasing. Moreover, ongoing reallocation and retaining of manpower are commensurate

Chen Guangzhi (+65 6212 1859)

with the shift towards non-drilling projects. In addition, the development and

chengz@phillip.com.sg

commercialization of Gravifloat LNG solutions are on track. All of these signal the near-

shore gas projects (floating LNG) could vivify the current tardy business. However, it may

not see a surge in terms of revenue contribution from the new segment in a short term,

but it will relieve to pressure from other segments order books drying out.

Page | 1 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

MCI (P) 118/10/2015

Ref. No.: SG2017_0088

SEMBCORP MARINE LTD RESULTS

Investment Action

Since SMM booked in the gain in divestment of Cosco, we slightly revise upward our

forecast of net income to S$137mn and EPS of 6.6 cents in FY17e, compared with our

previous forecast of net income of S$130mn and EPS of 6.2 cents. Currently, SMM is

trading at a 12-month blended forward PE of 23.9x.

We upgrade our call to Neutral with an unchanged TP of S$1.58, based on a PER of 23.9x,

since the last close price of S$1.63 is near our TP This implies a downside of 3.1% from the

last close price.

Page | 2 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

SEMBCORP MARINE LTD RESULTS

Financials

Income Statement Balance Sheet

Y/E Dec, SGD mn FY14 FY15 FY16 FY17e FY18e Y/E Dec, SGD mn FY14 FY15 FY16 FY17e FY18e

Revenue 5,833 4,968 3,545 3,056 2,999 ASSETS

Gross profit 844 131 293 244 255 PP&E 3,009 3,541 3,987 4,249 4,569

EBITDA 822 (18) 363 391 423 Trade receivables 41 54 53 53 53

Depreciation & Amortisation 115 132 138 179 190 Intangible assets 53 47 202 182 162

EBIT 707 (150) 225 211 233 Associates & JVs 470 312 75 75 75

Net Finance (Expense)/Inc (11) (36) (81) (85) (86) Others 98 131 80 76 74

Associates & JVs 10 (173) (35) (14) (13) Total non-current assets 3,671 4,084 4,397 4,635 4,932

Profit Before Tax 707 (378) 91 160 134 Cash 1,079 629 1,217 2,100 2,442

Taxation (106) 78 (15) (19) (16) Trade receivables 469 590 492 441 475

Profit After Tax 601 (300) 75 140 118 Inventories & WIP 3,005 3,833 3,067 2,212 1,850

Non-controlling interest 41 (10) (4) 3 3 Others 14 65 242 54 54

Net Income, reported 560 (290) 79 137 115 Total current assets 4,567 5,117 5,018 4,807 4,820

Net Income, adj. 560 384 79 137 115 Total Assets 8,238 9,201 9,415 9,442 9,753

LIABILITIES

Trade payables 84 78 91 109 120

Per share data Borrowings 1,308 2,465 2,791 2,971 3,031

Y/E Dec (SG Cents) FY14 FY15 FY16 FY17e FY18e Others 266 97 177 177 177

EPS, basic 26.8 (13.9) 3.8 6.6 5.5 Total non-current liabilities 1,658 2,640 3,059 3,257 3,328

EPS, diluted 26.8 (13.9) 3.8 6.6 5.5 Trade payables 1,853 2,519 2,120 1,793 1,872

DPS, basic 13.0 6.0 2.5 3.0 3.0 Borrowings 434 915 1,364 1,464 1,564

DPS, diluted 13.0 6.0 2.5 3.0 3.0 Progress billings in excess of WIP 1,005 288 193 188 206

BVPS (SGD) 1.4 1.2 1.2 1.3 1.3 Others 184 175 70 74 78

Total current liabilities 3,476 3,897 3,748 3,518 3,721

Total Liabilities 5,133 6,537 6,807 6,775 7,049

Cash Flow Shareholder Equity 2,965 2,511 2,562 2,621 2,656

Y/E Dec, SGD mn FY14 FY15 FY16 FY17e FY18e Non-controlling interest 167 153 46 46 48

CFO

Operating profit 707 (150) 225 211 233 Valuation Ratios

Adjustments 144 686 159 180 190 Y/E Dec FY14 FY15 FY16 FY17e FY18e

WC changes (1,267) (1,364) 284 572 427 P/E (x) 15 10 37 24 29

Cash generated from ops (417) (828) 669 963 850 P/B (x) 3 2 1 1 1

Others (91) (161) (100) (104) (102) EV/EBITDA (x) 10 8 16 14 13

Cashflow from ops (508) (989) 569 859 748 Dividend Yield (%) 3 4 2 2 2

Growth & Margins (%)

CFI Growth

CAPEX, net (738) (932) (421) (421) (490) Revenue 6% -15% -29% -14% -2%

Others (32) 0 (69) 220 - EBITDA 10% n.m. n.m. 8% 8%

Cashflow from investments (770) (932) (490) (201) (490) EBIT 10% n.m. n.m. 8% 8%

Net Income, adj. 1% -31% -79% 74% -16%

CFF Margins

Loans, net of repayments 964 1,744 768 280 160 EBITDA margin 14% 0% 10% 13% 14%

Dividends to shareholders (272) (251) (73) (42) (63) EBIT margin 12% -3% 6% 7% 8%

Dividends to non-controlling interest (13) (15) (1) (13) (14) NP margin, adj. 10% 8% 2% 4% 4%

Others (10.8) (11.4) (160.0) - - Key Ratios

Cashflow from financing 668 1,467 534 225 83 ROE (%), adj. 19% 15% 3% 5% 4%

Net change in cash (611) (454) 612 883 342 ROA (%), adj. 7% 4% 1% 1% 1%

Effects of exchange rates (7) 5 (22.7) - - Net Debt or (Net Cash) 663 2,751 2,938 2,335 2,153

Ending cash 1,077 627 1,217 2,100 2,442 Net Gearing (x) 0.2 1.0 1.1 0.9 0.8

Source: Company, Phillip Securities Research (Singapore) Estimates n.m.: not meaningful

*Forward multiples & yields based on current market price; historical multiples & yields based on

historical market price.

Page | 3 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

SEMBCORP MARINE LTD RESULTS

Ratings History

Source: Bl oomberg, PSR

Market Price

2.00 Targ et Price

1.00

0.00

Jul-16

Oct-16

Jan-17

Apr-17

Jul-17

1

2

3

4

5

PSR Rating System

Total Returns Recommendation Rating

> +20% Buy 1

+5% to +20% Accumul a te 2

-5% to +5% Neutra l 3

-5% to -20% Reduce 4

< -20% Sel l 5

Remarks

We do not ba s e our recommenda ti ons enti rel y on the a bove qua nti ta ti ve

return ba nds . We cons i der qua l i ta ti ve fa ctors l i ke (but not l i mi ted to) a s tock's

ri s k rewa rd profi l e, ma rket s enti ment, recent ra te of s ha re pri ce a ppreci a ti on,

pres ence or a bs ence of s tock pri ce ca ta l ys ts , a nd s pecul a ti ve undertones

s urroundi ng the s tock, before ma ki ng our fi na l recommenda ti on

Page | 4 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

SEMBCORP MARINE LTD RESULTS

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial advisers license under

the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may

constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in

part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the Research) contained in this report has been obtained from

public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express

or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in

this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or

to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time

without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as

authoritative, without further being subject to the recipients own independent verification and exercise of judgment. The fact that this report has been made

available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or

appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be

suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an

independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product

should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this

report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or

persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but

not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading

activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors,

employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this

report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected

to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided

advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or

persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or

options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the

foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between

US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return

of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its

officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise

hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly,

information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its

officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons

associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this

report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or

persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of

this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where

such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any

registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any

particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a

professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the

specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities

Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSES

Where the report contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact Phillip Securities Research (and not the relevant foreign research house) in Singapore at 250 North

Bridge Road, #06-00 Raffles City Tower, Singapore 179101, telephone number +65 6533 6001, in respect of any matters arising from, or in connection

with, the analyses or reports; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore who is not an accredited investor,

expert investor or institutional investor, Phillip Securities Research accepts legal responsibility for the contents of the analyses or reports.

Page | 5 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

SEMBCORP MARINE LTD RESULTS

Contact Information (Singapore Research Team)

Head of Research Research Operations Officer

Paul Chew paulchewkl@phillip.com.sg Mohamed Amiruddin - amiruddin@phillip.com.sg

Consumer | Healthcare Property | Infrastructure Macro

Soh Lin Sin - sohls@phillip.com.sg Peter Ng - peterngmc@phillip.com.sg Pei Sai Teng - peist@phillip.com.sg

Transport | REITs (Industrial) REITs (Commercial, Retail, Healthcare) | Property Technical Analysis

Richard Leow, CFTe, FRM - Dehong Tan - tandh@phillip.com.sg Jeremy Ng - jeremyngch@phillip.com.sg

richardleowwt@phillip.com.sg

Banking and Finance US Equity Oil & Gas | Energy

Jeremy Teong - jeremyteongfh@phillip.com.sg Ho Kang Wei - hokw@phillip.com.sg Chen Guangzhi - chengz@phillip.com.sg

Contact Information (Regional Member Companies)

SINGAPORE MALAYSIA HONG KONG

Phillip Securities Pte Ltd Phillip Capital Management Sdn Bhd Phillip Securities (HK) Ltd

Raffles City Tower B-3-6 Block B Level 3 Megan Avenue II, 11/F United Centre 95 Queensway

250, North Bridge Road #06-00 No. 12, Jalan Yap Kwan Seng, 50450 Hong Kong

Singapore 179101 Kuala Lumpur Tel +852 2277 6600

Tel +65 6533 6001 Tel +603 2162 8841 Fax +852 2868 5307

Fax +65 6535 6631 Fax +603 2166 5099 Websites: www.phillip.com.hk

Website: www.poems.com.sg Website: www.poems.com.my

JAPAN INDONESIA CHINA

Phillip Securities Japan, Ltd. PT Phillip Securities Indonesia Phillip Financial Advisory (Shanghai) Co Ltd

4-2 Nihonbashi Kabuto-cho Chuo-ku, ANZ Tower Level 23B, No 550 Yan An East Road,

Tokyo 103-0026 Jl Jend Sudirman Kav 33A Ocean Tower Unit 2318,

Tel +81-3 3666 2101 Jakarta 10220 Indonesia Postal code 200001

Fax +81-3 3666 6090 Tel +62-21 5790 0800 Tel +86-21 5169 9200

Website: www.phillip.co.jp Fax +62-21 5790 0809 Fax +86-21 6351 2940

Website: www.phillip.co.id Website: www.phillip.com.cn

THAILAND FRANCE UNITED KINGDOM

Phillip Securities (Thailand) Public Co. Ltd King & Shaxson Capital Limited King & Shaxson Capital Limited

15th Floor, Vorawat Building, 3rd Floor, 35 Rue de la Bienfaisance 75008 6th Floor, Candlewick House,

849 Silom Road, Silom, Bangrak, Paris France 120 Cannon Street,

Bangkok 10500 Thailand Tel +33-1 45633100 London, EC4N 6AS

Tel +66-2 6351700 / 22680999 Fax +33-1 45636017 Tel +44-20 7426 5950

Fax +66-2 22680921 Website: www.kingandshaxson.com Fax +44-20 7626 1757

Website www.phillip.co.th Website: www.kingandshaxson.com

UNITED STATES AUSTRALIA SRI LANKA

Phillip Capital Inc Phillip Capital Limited Asha Phillip Securities Limited

141 W Jackson Blvd Ste 3050 Level 10, 330 Collins Street 2nd Floor, Lakshmans Building,

The Chicago Board of Trade Building Melbourne, Victoria 3000, Australia No. 321, Galle Road,

Chicago, IL 60604 USA Tel +61-03 9629 8288 Colombo 03, Sri Lanka

Tel +1-312 356 9000 Fax +61-03 9629 8882 Tel: (94) 11 2429 100

Fax +1-312 356 9005 Website: www.phillipcapital.com.au Fax: (94) 11 2429 199

Website: www.phillipusa.com Website: www.ashaphillip.net

INDIA TURKEY DUBAI

PhillipCapital (India) Private Limited PhillipCapital Menkul Degerler Phillip Futures DMCC

No.1, 18th Floor, Urmi Estate Dr. Cemil Beng Cad. Hak Is Merkezi Member of the Dubai Gold and

95, Ganpatrao Kadam Marg No. 2 Kat. 6A Caglayan Commodities Exchange (DGCX)

Lower Parel West, Mumbai 400-013 34403 Istanbul, Turkey Unit No 601, Plot No 58, White Crown Bldg,

Maharashtra, India Tel: 0212 296 84 84 Sheikh Zayed Road, P.O.Box 212291

Tel: +91-22-2300 2999 / Fax: +91-22-2300 2969 Fax: 0212 233 69 29 Dubai-UAE

Website: www.phillipcapital.in Website: www.phillipcapital.com.tr Tel: +971-4-3325052 / Fax: + 971-4-3328895

CAMBODIA

Phillip Bank Plc

Ground Floor of B-Office Centre,#61-64,

Norodom Blvd Corner Street 306,Sangkat

Boeung Keng Kang 1, Khan Chamkamorn,

Phnom Penh, Cambodia

Tel: 855 (0) 7796 6151/855 (0) 1620 0769

Website: www.phillipbank.com.kh

Page | 6 | PHILLIP SECURITIES RESEARCH (SINGAPORE)

Vous aimerez peut-être aussi

- 12oct10 SembcorpMarineDocument2 pages12oct10 SembcorpMarineseantbtPas encore d'évaluation

- Yongnam Holdings LTD: Good Results As ExpectedDocument5 pagesYongnam Holdings LTD: Good Results As Expectedsagger09Pas encore d'évaluation

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDocument2 pagesNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzPas encore d'évaluation

- Cochin PDFDocument8 pagesCochin PDFdarshanmadePas encore d'évaluation

- Sanghvi Movers 3QFY17 Results Miss Estimates on Lower Revenue; Maintain BuyDocument9 pagesSanghvi Movers 3QFY17 Results Miss Estimates on Lower Revenue; Maintain Buyarun_algoPas encore d'évaluation

- InterGlobe Aviation 2QFY20 Result Reveiw 24-10-19Document7 pagesInterGlobe Aviation 2QFY20 Result Reveiw 24-10-19Khush GosraniPas encore d'évaluation

- Suzlon Energy: Momentum Building UpDocument9 pagesSuzlon Energy: Momentum Building Uparun_algoPas encore d'évaluation

- 03 Jun 10Document2 pages03 Jun 10Muhammad Sarfraz AbbasiPas encore d'évaluation

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyPas encore d'évaluation

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitPas encore d'évaluation

- IJM Corporation Berhad - A Challenging Year For FY21 - 200629Document3 pagesIJM Corporation Berhad - A Challenging Year For FY21 - 200629YI HEN ONGPas encore d'évaluation

- Weaker volumes weigh on Sanghi Industries' quarterly earningsDocument9 pagesWeaker volumes weigh on Sanghi Industries' quarterly earningsAnonymous y3hYf50mTPas encore d'évaluation

- Siemens India: Thematically It Makes Sense But Valuations Don'tDocument9 pagesSiemens India: Thematically It Makes Sense But Valuations Don'tRaghvendra N DhootPas encore d'évaluation

- Techno Electric & Engineering: Expensive ValuationsDocument9 pagesTechno Electric & Engineering: Expensive Valuationsarun_algoPas encore d'évaluation

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanPas encore d'évaluation

- Ciptadana Result Update 1H23 ADRO 24 Aug 2023 Maintain Buy LowerDocument7 pagesCiptadana Result Update 1H23 ADRO 24 Aug 2023 Maintain Buy Lowerrajaliga.inggerisPas encore d'évaluation

- Restated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncDocument4 pagesRestated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncJPas encore d'évaluation

- Proof of Pudding: Highlights of The QuarterDocument9 pagesProof of Pudding: Highlights of The QuarterAnonymous y3hYf50mTPas encore d'évaluation

- Sterlite Industries: Worst Seems To Be Priced inDocument3 pagesSterlite Industries: Worst Seems To Be Priced inramanathanseshaPas encore d'évaluation

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalPas encore d'évaluation

- Acc (Acc In) - Q2cy21 Result Update - PL IndiaDocument6 pagesAcc (Acc In) - Q2cy21 Result Update - PL IndiadarshanmaldePas encore d'évaluation

- SMM rhb170427Document9 pagesSMM rhb170427John TanPas encore d'évaluation

- LUCK Q3FY20 profit in line with expectationsDocument2 pagesLUCK Q3FY20 profit in line with expectationsUmer AftabPas encore d'évaluation

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoPas encore d'évaluation

- Birla Corp - 2QFY18 - HDFC Sec-201711131327011015336Document12 pagesBirla Corp - 2QFY18 - HDFC Sec-201711131327011015336Anonymous y3hYf50mTPas encore d'évaluation

- Australian Securities Exchange Notice: Half Year Results To 30 June 2020Document4 pagesAustralian Securities Exchange Notice: Half Year Results To 30 June 2020TimBarrowsPas encore d'évaluation

- DBS 1Q20 Earnings Miss Estimates Due to Higher AllowancesDocument7 pagesDBS 1Q20 Earnings Miss Estimates Due to Higher AllowancesCalebPas encore d'évaluation

- Ambuja Cement: Weak Despite The BeatDocument8 pagesAmbuja Cement: Weak Despite The BeatDinesh ChoudharyPas encore d'évaluation

- Mermaid Maritime Earnings to Disappoint on Weaker Drilling, Subsea UtilizationDocument9 pagesMermaid Maritime Earnings to Disappoint on Weaker Drilling, Subsea UtilizationfivemoreminsPas encore d'évaluation

- ACC Q3CY10 Result UpdateDocument6 pagesACC Q3CY10 Result UpdateAnshul RawatPas encore d'évaluation

- KNRC 3QFY17 Results Review Shows Strong Performance But Slowing Order GrowthDocument8 pagesKNRC 3QFY17 Results Review Shows Strong Performance But Slowing Order Growtharun_algoPas encore d'évaluation

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathPas encore d'évaluation

- Consolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadDocument6 pagesConsolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadVivek AgarwalPas encore d'évaluation

- Apar IndustriesDocument6 pagesApar IndustriesMONIL BARBHAYAPas encore d'évaluation

- 9M16 Earnings Beat Estimates As Coal Mining Outperforms: Share DataDocument4 pages9M16 Earnings Beat Estimates As Coal Mining Outperforms: Share DataJajahinaPas encore d'évaluation

- Public Investment Bank: Dayang Enterprise HoldingsDocument4 pagesPublic Investment Bank: Dayang Enterprise Holdingsumyatika92Pas encore d'évaluation

- MISC Berhad Outperform : Weaker Core Earnings in 1QFY21Document5 pagesMISC Berhad Outperform : Weaker Core Earnings in 1QFY21Iqbal YusufPas encore d'évaluation

- ACC-Limited 44 QuarterUpdateDocument6 pagesACC-Limited 44 QuarterUpdateRohan RustagiPas encore d'évaluation

- GMDC - 2QFY18 - HDFC Sec-201711141533578171264Document11 pagesGMDC - 2QFY18 - HDFC Sec-201711141533578171264Anonymous y3hYf50mTPas encore d'évaluation

- Annual Report 2009 Highlights EMP's Financials, OperationsDocument116 pagesAnnual Report 2009 Highlights EMP's Financials, Operationspuput utomoPas encore d'évaluation

- Sadbhav Engineering (SADE IN) : Q4FY20 Result UpdateDocument8 pagesSadbhav Engineering (SADE IN) : Q4FY20 Result UpdatewhitenagarPas encore d'évaluation

- Sagar Cement 0121 NirmalBangDocument10 pagesSagar Cement 0121 NirmalBangSunilPas encore d'évaluation

- Voltas Mixed Quarter Results Lead To UpgradeDocument9 pagesVoltas Mixed Quarter Results Lead To Upgradearun_algoPas encore d'évaluation

- Company Focus: Technics Oil & GasDocument6 pagesCompany Focus: Technics Oil & Gasandrei12320003181Pas encore d'évaluation

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Document18 pagesReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasPas encore d'évaluation

- Greaves +angel+ +04+01+10Document6 pagesGreaves +angel+ +04+01+10samaussiePas encore d'évaluation

- Jaiprakash Associates: Growth Across VerticalsDocument16 pagesJaiprakash Associates: Growth Across VerticalssachitanandaPas encore d'évaluation

- Deleum 2Q10Results UpdateDocument3 pagesDeleum 2Q10Results Updatelimml63Pas encore d'évaluation

- Cougar EnergyDocument6 pagesCougar EnergysamaussiePas encore d'évaluation

- United U-Li Corporation : OutperformDocument2 pagesUnited U-Li Corporation : OutperformZhi_Ming_Cheah_8136Pas encore d'évaluation

- Oil & Gas Firm Earnings Rise Despite CovidDocument5 pagesOil & Gas Firm Earnings Rise Despite CovidBrian StanleyPas encore d'évaluation

- Symphony: Back On The Fast LaneDocument18 pagesSymphony: Back On The Fast LaneanjugaduPas encore d'évaluation

- MMC Corp maintains BUY call amid 8% stake disposal in Saudi portDocument4 pagesMMC Corp maintains BUY call amid 8% stake disposal in Saudi portBrian StanleyPas encore d'évaluation

- Sing Daily 041110Document4 pagesSing Daily 041110iko_puteraPas encore d'évaluation

- PC - Ambuja Q4CY22 Update - Feb 2023 20230217183747Document8 pagesPC - Ambuja Q4CY22 Update - Feb 2023 20230217183747Gaurav PoplaiPas encore d'évaluation

- Weak Balance Sheet Drags Profitability: Q3FY18 Result HighlightsDocument8 pagesWeak Balance Sheet Drags Profitability: Q3FY18 Result Highlightsrishab agarwalPas encore d'évaluation

- BUMI - Initiation ReportDocument15 pagesBUMI - Initiation ReportBrainPas encore d'évaluation

- Top Glove Corporation Berhad - 3QFY21 Hit by Lower Volumes - 210610Document3 pagesTop Glove Corporation Berhad - 3QFY21 Hit by Lower Volumes - 210610Chin Yee LooPas encore d'évaluation

- 1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationDocument8 pages1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationJPas encore d'évaluation

- Top correlated pairs from correlation matrixDocument22 pagesTop correlated pairs from correlation matrixSharadPas encore d'évaluation

- p1 ADocument8 pagesp1 Aincubus_yeahPas encore d'évaluation

- Functions of Central BankDocument7 pagesFunctions of Central BankJohn RobertsonPas encore d'évaluation

- MPA Trading Financial Statements and Adjusting EntriesDocument6 pagesMPA Trading Financial Statements and Adjusting EntriesJunjun SillezaPas encore d'évaluation

- Black BookDocument6 pagesBlack BookyomiPas encore d'évaluation

- Industrialisation by InvitationDocument10 pagesIndustrialisation by InvitationLashaniaPas encore d'évaluation

- Lesson 6: Typical Account UsedDocument23 pagesLesson 6: Typical Account UsedAices Jasmin Melgar BongaoPas encore d'évaluation

- Option GreeksDocument2 pagesOption GreeksajjupPas encore d'évaluation

- Brand Management As A Tool For Product Growth and DevelopmentDocument107 pagesBrand Management As A Tool For Product Growth and DevelopmentAshish SenPas encore d'évaluation

- Build a Stock StrategyDocument36 pagesBuild a Stock Strategylife_enjoy50% (2)

- (Stephen Spinelli JR., Robert Rosenberg, Sue Birle (BookFi) PDFDocument256 pages(Stephen Spinelli JR., Robert Rosenberg, Sue Birle (BookFi) PDFSulthonul Aulia100% (1)

- Bolt Seedrs PitchdeckDocument21 pagesBolt Seedrs PitchdeckIsfahan Doekhie100% (3)

- 141 14 513Document53 pages141 14 513Pik PokPas encore d'évaluation

- ch01 ACCOUNTING IN ACTIONDocument54 pagesch01 ACCOUNTING IN ACTIONpleastin cafePas encore d'évaluation

- Partnership Dissolution and Admission ExplainedDocument14 pagesPartnership Dissolution and Admission ExplainedMila aguasanPas encore d'évaluation

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokPas encore d'évaluation

- Project Report On Comparison of Mutual Funds With Other Investment OptionsDocument57 pagesProject Report On Comparison of Mutual Funds With Other Investment Optionsdharmendra dadhichPas encore d'évaluation

- Narendra Sir MergedDocument112 pagesNarendra Sir MergedShaurya GosainPas encore d'évaluation

- MBA - SyllabusDocument56 pagesMBA - SyllabusPreethi GopalanPas encore d'évaluation

- Coconut Based Food Processing Plant-KSIDCDocument7 pagesCoconut Based Food Processing Plant-KSIDCRabia JahaddinPas encore d'évaluation

- Pure CompetitionDocument19 pagesPure CompetitionKirth PagkanlunganPas encore d'évaluation

- Mahindra FinanceDocument39 pagesMahindra FinanceRanjeet Rajput50% (2)

- Merk AmericaDocument95 pagesMerk AmericafleckaleckaPas encore d'évaluation

- Entrepreneurial Finance ResourcesDocument6 pagesEntrepreneurial Finance Resourcesfernando trinidadPas encore d'évaluation

- Money Markets: ProblemsDocument3 pagesMoney Markets: ProblemsTonie NascentPas encore d'évaluation

- Trade War Between China and USDocument5 pagesTrade War Between China and USShayan HiraniPas encore d'évaluation

- Oasis Outsourcing DocumentDocument30 pagesOasis Outsourcing DocumentSasha NewmanPas encore d'évaluation

- Economic Growth in Nehru EraDocument15 pagesEconomic Growth in Nehru Erakoushikonomics4002100% (9)

- General Banking Act RA 8791Document48 pagesGeneral Banking Act RA 8791NHASSER PASANDALANPas encore d'évaluation

- Sept 2018 Top Links Work Round DocumentDocument65 pagesSept 2018 Top Links Work Round DocumentAndrew Richard ThompsonPas encore d'évaluation