Académique Documents

Professionnel Documents

Culture Documents

Management of Accounts Receivable Sample Problems

Transféré par

Julienne AristozaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

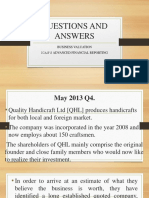

Management of Accounts Receivable Sample Problems

Transféré par

Julienne AristozaDroits d'auteur :

Formats disponibles

Illustration 1: A company has prepared the following projections for a year

Sales 21000 units

Selling Price per unit Rs.40

Variable Costs per unit Rs.25

Total Costs per unit Rs.35

Credit period allowed One month

The company proposes to increase the credit period allowed to its customers from one month

to two months .It is envisaged that the change in policy as above will increase the sales by 8%.

The company desires a return of 25% on its investment. You are required to examine and advise

whether the proposed credit policy should be implemented or not?

Solution:

Particulars Present Proposed Incremental

Sales (units) 21000 22680 1680

Contribution per unit Rs.15 Rs.15 Rs.15

Total Contribution Rs.3,15,000 Rs.3,40,000 Rs.25,200

Variable cost @ Rs.25 5,25,000 5,67,000 42,000

Fixed Cost 2,10,000 2,10,000 ------

42,000

Total Cost 7,35,000 7,77,000 -----

Credit period 1 month 2 month

Average debtors at cost Rs.61250 Rs.1,29,500 Rs.68,250

Incremental Return = Increased Contribution/Extra Funds

Blockage *100

= Rs.25,200/Rs.68,250*100

=36.92%

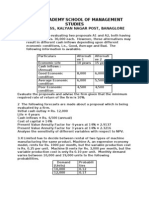

Illustration 2: ABC & Company is making sales of Rs.16,00,000 and it extends a

credit of 90 days to its customers. However, in order to overcome the financial

difficulties, it is considering to change the credit policy. The proposed terms of credit

and expected sales are given hereunder:

Policy Terms Sales

I 75 days Rs.15,00,000

II 60 days Rs. 14,50,000

III 45 days Rs 14,25,000

IV 30 days Rs 13,50,000

V 15 days

Rs.13,00,000

The firm has variable cost of 80% and fixed cost of Rs.1,00,000. The cost of capital is 15%.

Evaluate different policies and which policy should be adopted?

Solution:

figures in Rs.

Particular

Present I II III IV V

s

Sales 1,600,000 1,500,000 1,450,000 1,425,000 1,350,000 1,300,000

Variable cost 1,280,000 1,200,000 1,160,000 1,140,000 1,080,000 1,040,000

Fixed Cost 100,000 100,000 100,000 100,000 100,000 100,000

Profit (A) 220,000 200,000 190,000 185,000 170,000 160,000

Total Cost 1,380,000 1,300,000 1,260,000 1,240,000 1,180,000 1,140,000

Average 345,000 270,833 210,000 155,000 98,333 47,500

Receivable

(Cost360x

credit period

Cost of 51,750 40,625 31,500 23,250 14,750 7,125

debtors @

15% (B)

Net profit (A 168,250 159,350 158,500 161,750 155,250 152,875

B)

Illustration3: A trader whose current sales are Rs.1,500,000 per annum and average collection period is 30 days

wants to pursue a more liberal credit policy to improve sales. A study made by consultant firm reveals the following

information.

Credit Policy increase in collection period Increase in sales

A 15 days Rs.60,000

B 30 days 90,000

C 45 days 150,000

D 60 days 180,000

E 90 days 200,000

The selling price per unit is Rs.5. Average Cost per unit is Rs.4 and variable cost per unit I Rs.2.75 paise per unit. The

required rate of return on additional investments is 20 percent (cost of capital). Assume 360 days a year and also

assume that there are no bad debts. Which of the above policies would you recommend for adoption.

Solution:

Particulars Present A B C D E

Credit period 30 days 45 days 60 days 75 days 90 days 120 days

No. of units @ Rs.5 300,000 312,000 318,000 330,000 336,000 340,000

Sales 1,500,000 1,560,000 1,590,000 1,650,000 1,680,000 1,700,000

Variable 8,25,000 8,58,000 874,500 907,500 924,000 935,000

cost@ 2.75

Fixed Cost 375,000 375,000 375,000 375,000 375,000 375,000

Total Cost 1,200,000 1,233,000 1,249,500 1,282,500 1,299,000 1,310,000

Profit (A) 300,000 327,000 340,500 367,500 381,000 390,000

Average

debtors 100,000 154,125 208,250 267,188 324,750 436,667

cost(at cost)

[(TC )(x/360)]

Cost of

investment@ 20,000 30,825 41,650 53,437 64,950 87,333

20% (B)

Net Profit (A- 280,000 296,175 298,850 314,063 316,050 302,667

B)

Lets Sum Up

The receivables emerge when goods are sold on credit and the payments are deferred by the customers. So, every firm

should have a well-defined credit policy.

The receivables management refers to managing the receivables in the light of costs and benefit associated with a

particular credit policy.

Receivables management involves the careful consideration of the following aspects: Forming of credit policy, Executing the

credit policy, Formulating and executing collection policy.

The credit policy deals with the setting of credit standards and credit terms relating to discount and credit period.

The credit evaluation includes the steps required for collection and analysis of information regarding the credit worthiness

of the customer.

Vous aimerez peut-être aussi

- Winning From Within - SummaryDocument4 pagesWinning From Within - SummaryShraddha Surendra100% (3)

- Eva ProblemsDocument10 pagesEva Problemsazam4989% (9)

- Business Valuation Questions and Answers-1Document80 pagesBusiness Valuation Questions and Answers-1Ralkan Kanton67% (3)

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisJade Gomez100% (2)

- Working Capital Management Problems and SolutionsDocument15 pagesWorking Capital Management Problems and SolutionsAlma Lopez75% (4)

- 2 Ratio Analysis Problems and SolutionsDocument30 pages2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- Stock Valuation Practice ProblemsDocument2 pagesStock Valuation Practice ProblemsHay Jirenyaa100% (1)

- Question Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalDocument12 pagesQuestion Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalBhavya Shrivastava100% (3)

- Short Term FinancingDocument5 pagesShort Term FinancingLumingPas encore d'évaluation

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajPas encore d'évaluation

- Capital Budgeting QuizDocument3 pagesCapital Budgeting QuizJen Zabala100% (1)

- Financial Numericals RatiosDocument27 pagesFinancial Numericals Ratiosanks0909100% (2)

- Chapter 06 - ManAcc CabreraDocument17 pagesChapter 06 - ManAcc CabreraNoruie MagabilinPas encore d'évaluation

- Inventory Valuation-ProblemsDocument3 pagesInventory Valuation-ProblemsKaran100% (1)

- FM Management NotesDocument96 pagesFM Management NotesGovindh200178% (9)

- Strategic Business AnalysisDocument3 pagesStrategic Business AnalysisRoseyy Galit100% (1)

- Answers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905Document7 pagesAnswers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905HasanAbdullahPas encore d'évaluation

- Problems in EBITDocument4 pagesProblems in EBITtj0000780% (5)

- 2..working Capital Management ProblemsDocument9 pages2..working Capital Management ProblemsAnshu SoumyaPas encore d'évaluation

- Answers For Problems On Financial Leverage - 1-4Document4 pagesAnswers For Problems On Financial Leverage - 1-4jeganrajraj67% (3)

- CH2 Practice QuestionsDocument11 pagesCH2 Practice QuestionsenkeltvrelsePas encore d'évaluation

- Consti 1 Gatmaytan Finals Reviewer PDFDocument130 pagesConsti 1 Gatmaytan Finals Reviewer PDFJulienne AristozaPas encore d'évaluation

- California Department of Housing and Community Development vs. City of Huntington BeachDocument11 pagesCalifornia Department of Housing and Community Development vs. City of Huntington BeachThe Press-Enterprise / pressenterprise.comPas encore d'évaluation

- Richard K. Neumann JR., J. Lyn Entrikin - Legal Drafting by Design - A Unified Approach (2018) - Libgen - LiDocument626 pagesRichard K. Neumann JR., J. Lyn Entrikin - Legal Drafting by Design - A Unified Approach (2018) - Libgen - LiEwertonDeMarchi100% (3)

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeePas encore d'évaluation

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoPas encore d'évaluation

- 1 Working CapitalDocument63 pages1 Working CapitalDeepika Mittal50% (2)

- Capital Structure Problems AssignmentDocument3 pagesCapital Structure Problems AssignmentRamya Gowda100% (2)

- Working Capital Management - NumericalsDocument9 pagesWorking Capital Management - NumericalsAnjali JainPas encore d'évaluation

- Leverages ProblemsDocument4 pagesLeverages Problemsk,hbibk,n0% (1)

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Leverages Question BankDocument3 pagesLeverages Question BankQuestionscastle Friend60% (5)

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- Problems LeverageDocument20 pagesProblems LeverageMadhav RajbanshiPas encore d'évaluation

- Problems On Cash Budget MBADocument3 pagesProblems On Cash Budget MBAsafwanhossain100% (1)

- Sums On PortfolioDocument8 pagesSums On PortfolioPrantikPas encore d'évaluation

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- 5.1 Receivable ManagementDocument18 pages5.1 Receivable ManagementJoshua Cabinas100% (1)

- Credit Management: by Prof Sameer LakhaniDocument50 pagesCredit Management: by Prof Sameer LakhaniDarshana Thakkar100% (3)

- Cash & Receivables ManagementDocument5 pagesCash & Receivables ManagementAlexandra Nicole IsaacPas encore d'évaluation

- Chapter 14Document18 pagesChapter 14RenPas encore d'évaluation

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SPas encore d'évaluation

- (PPT) Comparitive Statements and Common-Size StatementsDocument15 pages(PPT) Comparitive Statements and Common-Size StatementsMehek Bengani100% (2)

- Q1Document31 pagesQ1Bhaskkar SinhaPas encore d'évaluation

- Financial ManagementDocument11 pagesFinancial ManagementRuel VillanuevaPas encore d'évaluation

- Lecture Notes On Receivable ManagementDocument9 pagesLecture Notes On Receivable Managementritika rustagiPas encore d'évaluation

- Risk and Rates of Return Problem SolvingDocument7 pagesRisk and Rates of Return Problem SolvingBlueBladePas encore d'évaluation

- Crossword Puzzle - Intro To Cost ManagementDocument2 pagesCrossword Puzzle - Intro To Cost ManagementBSA3Tagum MariletPas encore d'évaluation

- Problems On Working CapDocument25 pagesProblems On Working Capamazing19inPas encore d'évaluation

- Financial ManagementDocument8 pagesFinancial ManagementshrutiPas encore d'évaluation

- Working Capital and Cash ManagementDocument65 pagesWorking Capital and Cash Managementrey mark hamacPas encore d'évaluation

- Risk Return Basics/Portfolio Management: Learning Objective of The ChapterDocument34 pagesRisk Return Basics/Portfolio Management: Learning Objective of The ChapterSushant MaskeyPas encore d'évaluation

- FIN5FMA Tutorial 9 SolutionsDocument4 pagesFIN5FMA Tutorial 9 Solutionsmitul tamakuwalaPas encore d'évaluation

- Point of IndifferenceDocument3 pagesPoint of IndifferenceSandhyaPas encore d'évaluation

- Answer Key For Strategic Cost Management MC QuestionsDocument18 pagesAnswer Key For Strategic Cost Management MC QuestionsDalia DelrosarioPas encore d'évaluation

- Working Capital Management p1 and 2Document23 pagesWorking Capital Management p1 and 2Emman Lubis50% (2)

- Premium & Warranty LiabilitiesDocument16 pagesPremium & Warranty LiabilitiesKring Zel0% (1)

- 1 - Objectives, Role and Scope of Management AccountingDocument11 pages1 - Objectives, Role and Scope of Management Accountingmymy100% (2)

- Chapter 7Document19 pagesChapter 7Arun Kumar SatapathyPas encore d'évaluation

- Accounting For Managerial DecisionsDocument6 pagesAccounting For Managerial DecisionsKrutika ManePas encore d'évaluation

- Advance Financial Management AssignmentDocument4 pagesAdvance Financial Management AssignmentRishabh JainPas encore d'évaluation

- Financial ManagementDocument7 pagesFinancial Managementsakshisharma17164Pas encore d'évaluation

- Receivable Management (Divya Jadi Booti)Document24 pagesReceivable Management (Divya Jadi Booti)Michael AdhikariPas encore d'évaluation

- SM C-2 Naturelle Beauty ClinicDocument5 pagesSM C-2 Naturelle Beauty Clinicsunil sakriPas encore d'évaluation

- Mock Recitation-Characteristic of Criminal LawDocument8 pagesMock Recitation-Characteristic of Criminal LawJulienne AristozaPas encore d'évaluation

- John Hay PAC vs. Lim Case DigestDocument2 pagesJohn Hay PAC vs. Lim Case DigestJulienne Aristoza100% (1)

- 19th Century PhilippinesDocument18 pages19th Century PhilippinesJulienne Aristoza73% (26)

- Receivables ManagementDocument6 pagesReceivables ManagementJulienne AristozaPas encore d'évaluation

- The 1987 Constitution of The Republic of The Philippines: PreambleDocument49 pagesThe 1987 Constitution of The Republic of The Philippines: PreambleJulienne AristozaPas encore d'évaluation

- PI 100 First SessionDocument26 pagesPI 100 First SessionJulienne AristozaPas encore d'évaluation

- Case Study HBPDocument20 pagesCase Study HBPJulienne AristozaPas encore d'évaluation

- 9 Introduction To Variance Analysis and Standard CostsDocument4 pages9 Introduction To Variance Analysis and Standard CostsJulienne AristozaPas encore d'évaluation

- Batch Vs Real Time ProcessingDocument27 pagesBatch Vs Real Time ProcessingJulienne AristozaPas encore d'évaluation

- Iloilo As An Investment OpportunityDocument3 pagesIloilo As An Investment OpportunityJulienne AristozaPas encore d'évaluation

- Strategic Management (Vision Mission, BOD, Corporate Governance)Document48 pagesStrategic Management (Vision Mission, BOD, Corporate Governance)Julienne AristozaPas encore d'évaluation

- Case Analysis - PaperDocument9 pagesCase Analysis - PaperJulienne AristozaPas encore d'évaluation

- A Literary Piece On MancriminationDocument2 pagesA Literary Piece On MancriminationJulienne AristozaPas encore d'évaluation

- INSURANCE - NotesDocument18 pagesINSURANCE - NotesJulienne Aristoza100% (1)

- Beano's Café Marketing AnswerDocument2 pagesBeano's Café Marketing AnswerJulienne Aristoza100% (4)

- Business Analysis On BMW's Flexibility StrategyDocument21 pagesBusiness Analysis On BMW's Flexibility StrategyJulienne AristozaPas encore d'évaluation

- Role of BOD in Corporate GovernanceDocument9 pagesRole of BOD in Corporate GovernanceJulienne AristozaPas encore d'évaluation

- Audit Problems Cash QuizzerDocument3 pagesAudit Problems Cash QuizzerJulienne AristozaPas encore d'évaluation

- Discussion: Functions, Advantages and Disadvantages of BIOPOT Cassava Peel and Husk CharcoalDocument4 pagesDiscussion: Functions, Advantages and Disadvantages of BIOPOT Cassava Peel and Husk CharcoalAhmad BurhanudinPas encore d'évaluation

- COVID19 Management PlanDocument8 pagesCOVID19 Management PlanwallyPas encore d'évaluation

- ConsignmentDocument2 pagesConsignmentKanniha SuryavanshiPas encore d'évaluation

- July 22, 2016 Strathmore TimesDocument24 pagesJuly 22, 2016 Strathmore TimesStrathmore TimesPas encore d'évaluation

- Action Plan Templete - Goal 6-2Document2 pagesAction Plan Templete - Goal 6-2api-254968708Pas encore d'évaluation

- 2 ND Green Investment Brochure New 27-09-2022Document4 pages2 ND Green Investment Brochure New 27-09-2022assmexellencePas encore d'évaluation

- SAP FICO Course Content - Core Global ITDocument12 pagesSAP FICO Course Content - Core Global ITVenkatrao VaraganiPas encore d'évaluation

- Top Notch 1 Unit 9 AssessmentDocument6 pagesTop Notch 1 Unit 9 AssessmentMa Camila Ramírez50% (6)

- Table 2: Fast Tenses ChartDocument5 pagesTable 2: Fast Tenses ChartAngel Julian HernandezPas encore d'évaluation

- Journey Toward OnenessDocument2 pagesJourney Toward Onenesswiziqsairam100% (2)

- Us and China Trade WarDocument2 pagesUs and China Trade WarMifta Dian Pratiwi100% (1)

- PotwierdzenieDocument4 pagesPotwierdzenieAmina BerghoutPas encore d'évaluation

- Project Initiation & Pre-StudyDocument36 pagesProject Initiation & Pre-StudyTuấn Nam NguyễnPas encore d'évaluation

- SEBI Management Summary SheetsDocument398 pagesSEBI Management Summary SheetsPriyanka ChandakPas encore d'évaluation

- The Holy Rosary 2Document14 pagesThe Holy Rosary 2Carmilita Mi AmorePas encore d'évaluation

- Wine Express Motion To DismissDocument19 pagesWine Express Motion To DismissRuss LatinoPas encore d'évaluation

- Macquarie Equity Lever Adviser PresentationDocument18 pagesMacquarie Equity Lever Adviser PresentationOmkar BibikarPas encore d'évaluation

- Channarapayttana LandDocument8 pagesChannarapayttana Landnagaraja.raj.1189Pas encore d'évaluation

- Dr. Nimal SandaratneDocument12 pagesDr. Nimal SandaratneDamith ChandimalPas encore d'évaluation

- Design and Pricing of Deposit ServicesDocument37 pagesDesign and Pricing of Deposit ServicesThe Cultural CommitteePas encore d'évaluation

- 00 NamesDocument107 pages00 Names朱奥晗Pas encore d'évaluation

- Breterg RSGR: Prohibition Against CarnalityDocument5 pagesBreterg RSGR: Prohibition Against CarnalityemasokPas encore d'évaluation

- 10 Grammar, Vocabulary, and Pronunciation ADocument7 pages10 Grammar, Vocabulary, and Pronunciation ANico FalzonePas encore d'évaluation

- Sri Lskhmi BharatgasDocument2 pagesSri Lskhmi BharatgasMytreyi AtluriPas encore d'évaluation

- Daftar Ebook-Ebook Manajemen Bisnis MantapDocument3 pagesDaftar Ebook-Ebook Manajemen Bisnis MantapMohamad Zaenudin Zanno AkilPas encore d'évaluation

- Surviving Hetzers G13Document42 pagesSurviving Hetzers G13Mercedes Gomez Martinez100% (2)

- Union Africana - 2020 - 31829-Doc-Au - Handbook - 2020 - English - WebDocument262 pagesUnion Africana - 2020 - 31829-Doc-Au - Handbook - 2020 - English - WebCain Contreras ValdesPas encore d'évaluation