Académique Documents

Professionnel Documents

Culture Documents

Cost Audit Report

Transféré par

Hashim Ayaz Khan0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues12 pagesattock cement cost audit report 2015

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentattock cement cost audit report 2015

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues12 pagesCost Audit Report

Transféré par

Hashim Ayaz Khanattock cement cost audit report 2015

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 12

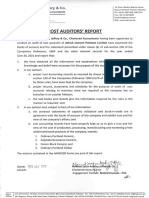

Naveed Zafar Ashfaq Jaffery & Co. ‘1st Floor, Modern Motors House,

‘Beaumont Road, Karachi, Pakistan

Chartered Accountants Ph +92:21-35671909, 35673754

Fax: 492:21-25210626

Amember firm of Emailkhi@nza|.compk

@ PrimeGlobal | ‘wee erent

COST AUDITORS’ REPORT

We, Naveed Zafar Ashfaq Jaffery & Co., Chartered Accountants having been appointed to

conduct an audit of cost accounts of Attock Cement Pakistan Limited have examined the

books of account and the statement prescribed under clause (e) of sub-section 230 of the

Companies Ordinance, 1984 and the other relevant records for the year ended

June 30, 2016 and report that:

1. We have obtained all the information and explanations which to the best of our

knowledge and belief were necessary for the purpose of this audit.

2. in our opinion:

a. proper cost accounting records as required by clause (e) of sub-section (1) of

section 230 of the Companies Ordinance 1984 (XLVI of 1984), and as required

by these rules, have been kept by the company;

b. proper returns, statements and schedules for the purpose of audit of cost

accounts relating to branches were not required as the company has no

branches in or outside Pakistan;

. the said books and records give the information required by the rules in the

manner so required ; and

in our opinion and, subject to best of our information:

a. the annexed statements of capacity utilization and stock-in-trade are in

agreement with the books of account of the company and exhibit true and fair

view of the company’s affairs; and

b. cost accounting records have been properly kept so as to give a true and fair

view of the cost of production, processing, manufacturing and marketing of the

undermentioned products of the company, namely:

1. Ordinary Portland Cement,

2. Sulphate Resistance Cement,

3. Falcon Block Cement, and

4, Ordinary Portland Clinker

The matters contained in the ANNEXED Forms are part of this report.

Chartered Account ae

: Shahid Hussain - ra

ee

‘Other | 35, ATS Contre, S0-Woet, Fazal ULHaq Road, Blue Area, Islamabad, Pakistan - Ph: 792 61-2870SU0.52 Fax: +02 61 2206209 Email: el@nzal compk

offices | 201-Regency Plaza, M.M. Alam Road, Gulbergell, Lahore, Pakistan - Ph: +92 42-37321969, 37249053 Fax: +02 42-37324103 Emall; l@nzaj.com.pk

Attock Cement Pakistan Limited Cost Audit Report, 2016

4. CAPACITY (Tone)

Licensed installed Uillized % of installed

Clinker Capacity Capacity Capacity

Kilns (2,600 TID x 300 days) 750,000 807,067 108

Kilell (2,800 T/D x 300 days) 290,000 4,059,930 407,

1,740,000 4,866,907 407

The company’s main business activity is manufacturing and sale of cement

2, COST ACCOUNTING SYSTEM

= Manufacturing of cement is @ continuous process, therefore, the company uses process cost accounting system as prescribed

by SECP as per Cement Industry (Cost Accounting Records) Order, 1994

+ The company is operating a fully online integrated costing system, which generates cost statements relating to six stages /

departments and allocates cost thereon.

3, PRODUCTION Qy. in Tone

Production

Increase/(Decrease)

@ YEARS

= Clinker 2016 2015, Tonne %

Line-t

Ordinary Portland Clinker 641,017 620,031 20986| 3.4%

‘Sulphate Resistance Clinker 166,050 178,869 (12.819)| 7.2%

807,087 "798,00 ate7] 1.0%

Line.

Ordinary Portland Clinker 1,059,930 1,036,354 23576| 23%

Sulphate Resistance Clinker - : : :

4,059,930) 1,036,354 23576| 2.3%

1,866,997 4,835,254 31,743] 1.7%

+ Cement

Ordinary Portland Cement 1,723,888, 1,688,248 35620] 2.1%

Sulphate Resistance Cement 152,194 152,454 (260) 0.2%

Block Cement 91,329 36,448 54g8t| 1.0%,

1,967,391 4,877,150 90241] 4.8%

(b) The plant design faclities production of the various types of cement as per production requirements within the installed

capacity limits

(c) There is no addition to producton capacity during the year under review.

©

zeoeee = = eowese = = sie b8 =

sto a ou - - - Beis punoip 6e1g

98's sos'ver —aze'sz zs" gos'es: cee esr 68928 060'08 unsdho,

ele wee'en v92'96 oze z16'SL sus'z6 ous J6b'19 s0e'z8 \asois uaa

ue pues eoilis 20 UOs}

‘ ys ‘ fons ‘i Sasa pues,

ost ver'sie = 66L'ISZ'L aL eio'sze —st'60u' ee zee FEL'SHL'L —Gexy uopunquang / 24s

zoe vosoor —L0'866 uz oee'soe ——Oz6'v10' sue eucove 940'080'L euoisouiry

auueL | ,000,usy | (euuel) | —uuo] —] 00, 0 Sa Teuuoay ‘ouuoT “000, usa | feuuoi)

sedisop_| omen | Arnuenp | sadisop | amen Anuend 4od3s09 aniea Anueno swat

rd sh02 9407

pewnsuod sjevarew men sofew (2)

TwraLyn mvs >

‘Boz wodeuUPHY IoD POUT WEST WSWED HOONY

Attock Cement Pakistan Limited

Cost Audit Report, 2016

(b) Major Raw Materials consumption per unit of production compared with standard requirements,

i. Ordinary Portland Cement

‘Ordinary Poriand Cement ‘increase / (Decrease)

Description Standard | 2046 2015 2016 as compared to Standard

Tonne Tonne, Tonne Tonne 2016 201s | 2016

Limestone Clinker 0240 oes 0.520 0507 137 wan

[Shale / Overburden/ Mag Sand Clinker 1328 097s 1.006 1.028 en nS)

ron Ore / Baux. ron CCinker 0.032 oat 0.088 0.088 a 38 “1

[Salica Sand Clinker : 3 -

stag Clinker : : : 100

TOTAL Clinker 41.600 41.559 1.568 1581 -2.50% 201% 4.19%

Gypsum ‘Cement 0.050 0.081 0.057 0.081 9) 13 (8)

‘Sulphate Resistance Comont

‘Sulphate Resistance Cement ‘% increase / (Decrease)

Description ‘Standard | 2016 2015 2016 as compared to Standard

tonne | tonne | tonne | tonne [2046 2018; 2014

Limestone clinker 0240 ©0829 0.861 oan 287 2028s

[Shale /Overburden /Mag Sand Clinker 1264 0.829 0595 0,599 (68) sa

lion Ore Baux. ron Clinker 0.098 = 0.110 0110 0.110 14 4 4

\Salica Sand Clinker - = a 2 . -

stag Clinker < . 7 3 : ss .

TOTAL Clinker 1.500 1.567 1.565 1580 -205% 2am 4.25%

Gypsum Cement 0.050 0.028 0.042 0.042 «3) “5 a8)

lil, Falcon Block Cement

Falcon Block Cement ‘increase (Decrease)

Description Standard [— 2016 2015 2018 as compared to Standard

tonne | tonne | tonne | tonne [2016 2015 2016

Limestone Clinker 0240 0.598 710 0707 149 198195

[Shale / Overburden / Mag Sand Clinker 1298 0.12 0776 0792 0) a)

Iron Ore / Baux. ron Clinker 0.064 0.050 0.081 0.081 21) 25 28

\Salica Sand linker - - - - - =

stag Clinker “ : 5 - . .

TOTAL, Clinkor 1.500 +1560 1.566 1500 -2.48% 210% 4.25%

Gypsum Cement 0.050 0.042 0.083 0.040 45) 6 6

{(c) Explanation of Variances

~The variances from standard requirements are atibuted to chemical contents of raw materials,

{@) Method of Accounting

+ The company is maintaining raw material records using perpetual inventory system. The per unit cost for issue of material is

determined using weighted average basis.

= Limestone, shale, overburden and magzine sand are extracted from leased mines.

+ Salica Sand, Iron ore, Bauxite, Gypsum and Siag are purchased from open market. The quantilies and values are recorded

in the store ledger and general ledger from stores receiving report.

&

5, WAGES AND SALARIES

(@) Total wages and salaries paid for all categories of employees

2016 2015 2014 | ‘hinerease / (Decrease)

Rs. in’000"| fs. in 000" | Rs. in 000" | Base 2015 | Base 2016

Direct labour cost on production 405,942 340,596 «(298.228 6 6

Indirect labour east on production euas70 738.920 977.821 14 25

129712 10087.515 976,045 18 2

Employees’ cost on administration 205515 242,888 201,288 2 a

Employees’ cost on selling and distribution e471 75361 65,084, 13 20

Total employees cost 7530,088 405,754 1,242,307 76 3

(b) Salaries and perquisites of Chief Executive, Directors and Executives

= The aggregate amounts charged in the financial accounts for remuneration to the Chief Executive, Directors and Executives

‘of the company are as follows:

2018 2016

ein 000" in 000"

het] Executive ‘hiot | Executive

Execute | Directors | PMN | csocuve | Directors | Freewlves

Managerial remuneration zen 14aas 167220883 CST SC AB

Housing Allowance 7309 $201 7haa7 was 4.752 70288

Utility Allowance 2708 4st t5.264 1 945 14900

Bonus 1740s 2005 tezeso = 1.220 see (t07.288

Retirement benefits ser 2a eas 4002.27 41708

Others sors 3733 sao 3.7748 3.201 34541

5743030424 640,162 49,094 __33.01____450,08

Number of person(s) 1 z 152 i z 15

= The Chief Executive, Executive Directors and certain executives are provided with free use of company maintained cars and

are also provided with medical facilities in accordance with their entitements

= Inaddion to the above, fee paid to 3 (2015: 3) non-executive directors for attending Board of Directors meetings during the

year amounted to Rs. 1.93 milion (2016: Rs. 1.73 milion)

(€) Total man-days of direct labour Worked ‘Available se Worked

300 days x 312 workers = 93,600 93,600) 93,600 00.00

300 days x312 workers = 93,600 —

(0) Average number of production workers employed 2016 2015 | % increase / (Decrease)

32, 378, 2%

(0) Direct tabour cost per tonne ao 8 pots [Zt lnerease /(Deerease)

Base 2014 | Base 2013

Direct labour cost (Rs. in 000) 4052 | 348.506| 208224 16 36

Production in tonne sioe701 | 1g77,150[ 912,921 5 3

Cost per tonne (Rs. tonne) 206 186. 156, 2 2

(9 Comments on incentives Scheme

= _ The company awards bonus based on the profitability of the company and performance of the employees.

We

STORES AND SPARE PARTS

(0) Expenditure per unit of output 2016 2016 | ‘of increase / (Decrease)

‘Stores & spares consumed (Rs.in'000) asqa7t | 455,657 oy

Production in tonne “1967,301 | 1.877.150 5

Cost per tonne (Rs.stonne) 229 243 ©

= Per tonne cost of stores and spares decreased during the year due to increase in production,

(b) System of stores

+ These are valued at monthly weighted average cost less provision for slow moving and obsolete stores, spares and loose

tools. tems in transit are stated at cost

+ Allitems of stores are properly coded and entered by designated staff members ofthe finance department through network

(6) Proportion of closing inventory of stores representing items which have not

‘moved for over twenty four months.

= Provision against slow moving items amounting to Rs. 36.502 millon which represents 2,70% of closing inventory (2016:

24,061 milion: 4.11% of closing inventory)

7. DEPRECIATION

(a) Method of depreciation

+ These are stated at cost less accumulated depreciation and impairment losses (if any) except freehold land, capital work in

‘progress and stores held for capital expenditures which are stated at cost, Depreciation is calculated using the straight line

‘method on all assets in use to charge off their cost excluding residual value, if not insignificant, over their estimated useful

lives,

+ Depreciation on acquisition is charged from the month of addition whereas no depreciation is charged in the month of

disposal

+ Company accounts for impairment, where indications exist, by reducing lis canying value to the estimated recoverable value.

+ Maintenance and normal repairs are charged to profit and loss account as and when incurred. Major renewals and

improvements are capitalized and the assets so replaced, if any, are retired.

+ Gains and losses on disposal / retirement of fixed assets are included in proft and loss account.

(b) Basis of allocation of depreciation on common assets to the different departments,

2016 2018;

Depreciation on common assets is allocated as under: (Rs. 000) % | (Rs.000) %

() Cost of Sales 414.608, 9683 404.591 6.82

() Administrative Expenses 13,504 317 13,298 318

(i) Distribution Cost - -

5202 00 ai7,624 00,

(©) Basis of charging depreciation to cost of products

~The depreciation i allocated to cost of production on the value of assets employed.

we

Attock Cement Pakistan Limited

Cost Audit Report, 2016

8. OVERHEADS:

{a} Total amounts of the overheads

( Factory

(iy Administration

(i) Seling & distribution

() Financial

() Factory Overheads

Repairs and maintenance

Vehicle running & maintenance

Traveling and entertainment

Depreciation

Insurance

Others

2016 2015 2014.

Rs. in:000" | Rs. in '000"| "Rn 000"

727 717.688 008,785

401792 940,946, 307,163,

954,745 980,573, 206,050

21,309 25.899, 29,704

% increase (Decrease)

28 2s Boa | Basodon | Based on

Rsinooo | Rs.inooo | Rs.in 000" | 2016 2016

119445 «118870 70,118, ° ot

e148 88.307 93078 © 2)

7782 5374 7.387 45 5

414609404331 984,458 3 8

soese 62505 60,701 6 @

94322 100,122 74,955 e 3

T7271 777,689 696,785 © 2

= Overall factory overheads almost remain same but there significant increase in travelling and entertainment.

(ii) Administration Overheads

Salaries, wages and benefits

Utities

Repairs and maintenance

Depreciation

Traveling and entertainment

Communication and printing

‘Auditors’ remuneration

Legal and professional charges

Rent, rates and taxes

Donations

Insurance

Other expenses

“4 increase (Decrease)

2 2s 2a Based on

Rein0oo | Rs.in000" | Re.in'000"| 2018 2016

285518 242.888 201,288 2 a7

4356 sar7 Bats 53 a)

9240 © 10.495 11,768 ro en

13504 13.203 13,101 2 3

8.065 see ear 5 48

1380 15560 16,542 ay (18)

3607 3.489 4730 3 cy

17832 © 162181475. 10 2

14441 16288 12.813, © 6

vert 8401 5.465 2 4

2578 2532 3.40 2 3)

9451 9.042 8.364 5 13

401792 346,948 307,163, 6 3

+ The increase is mainly due to increase in salaries, wages and benefits utlites, donations ete

= Salaries, Wages and benefits include Rs.11.02 millon and Rs. 6.31 milion (2015: Rs. 12.01 milion and Rs. 5.74 milion) in

respect of charge for defined beneft plans and contributory provident fund respectively.

&

Attock Cement Pakist

@

©

@

(il) Seling and Distribution Overheads Ye Increase | (Decrease)

26 2s 72014 | Based on | Gased on

Reino" | Rs.in'000" 2015, 2014

Salaries, wages and benefits e497 75351 65,084 8 30

PSI marking fee 14283 1388812818 7 "

Carriage outward on export sales 2ei257 33007229447 (28) a)

Carriage outward on local sales 11390085788 2.728 73 107

‘Advertisement and sales promotion 1185 377 1736 ) 63)

“Traveling and entertainment sat 1.984 4,398 16 25

Henaling and other export related expenses 443,008 451,564 319,880, @ 30

Commission on export sales egos 37845 63,091, 2 24)

Other expenses 1918 4926 1,304 45 7

‘354,746 666,573 806,050. a 16

Selling & istrbution expenses decreased mainly due to decrease in carriage outwar

sales promotion etc.

Salaries, Wages and benefits include Rs. 3.40 milion and Rs. 1.76 million (2015: Rs. 3.29 milion and Rs. 1.77 milion) in

respect of charge for defined beneft plans and contributory provident fund respectively

‘on export sales, advertisement and

(iv) Financial Charges “increase / (Decrease)

2016 2015, 2014 | Based on | Based on

Reinooo | Rs.ino00" | rs.in'o00'| 2015 2014

Finance charges on finance lease 220 1305 1291 4) 25)

Bank charges and commission 18,120 22.228 «18,288, (18) ©

Interest on workers’ profits participation fund 2,26 2378 2.248 6 1

Exchange loss 6,969 100

The decrease in finance cost is mainly due to decrease in finance charges on finance lease.

Reasons for any significant variances in the overheads

Reasons have already been given against items where ever necessary.

Basis of allocation of overheads

The allocation was made on activity based on ‘kage basis.

Cost of Packing

‘Quantity Sold (M. Tonno)

OPC + SRC +FBC 2016, 2015,

Packed cement 1.934.955 7164597

Bulk cement 35,634 17.244

Total 1.970,588 71381,981

2016 2018 Increase / (Decrease)

e.in'000"| RupessiTon | R.1n°000" | RupeosrTon | Rupessiton| Yh

Packing material 950.052 «401.61—=«905,174 33.60 (42) @

Power 38417 1950 43,988 2337 ® 7)

Solaries & wages 22188 1128 18.808 1001 1 2

‘Stores / spares, repair & maint e814 rz 72718 3864 Oy (10)

Insurance 4.193 ost 1,252 os? o (10)

Depreciation 8.202 421 8.087 430 o @

ther overheads 125,718 6430 110.266 6284 1 2

1.216.043 625.98 1,258,328 673.52 a) m

&

Limited Cost Audit Report, 2016

9, ROYALTY/ TECHNICAL AID PAYMENTS

2016 2018

Production | Amount | Rupees’ | Production | Amount | Rupees’

intone | Rs.in'000| tonne | inTonne | Re.tn'v00 | tonne

Limestone, Shale/Overburden &

Magsand 27e7g21 165815 so27 291.284 _164650___58.55

= Royalty, excise duty and lease rent is paid to the provincial government on the quantiy of Imestone, shale / overburden

extracted and transported to mil from quarries at statutory rates,

10. ABNORMAL NON-RECURRING FEATURES

(2) Features affecting production

NONE

(b) Special expenses

NONE

11. COST OF PRODUCTION

(As per Schedule-1 attached)

2016 201s ‘crease

@y.in | Rein Rs. ay.in | Rein Rs. | (Decrease)

Tonne, ooo | Perton | tonne 000__| perton | %Rs.Piton

Coment

orc. azsees| 7210726 aes] 688200] 77aatee] 4587 ea

SRC 152.14 [ 657.502 4s20| 152484] 762700] 6,003 (2.88)

FBC si,sz0| 967.530 4oz8[ 36.008| 155,608 4.956 4)

Ground Siag - : : -

‘Sub-total 8,266,396 8,665,572,

Clinker 74364] 42405 2.558 = 7

TOTAL 08, 5572

Roasons for variances

= Cost per tonne decreased mainly due to decrease in per ton cost of fuel and power.

12. SALES

(As per Schedule-2 attached)

FERS 201s Tnerease7

Gyn] Asia Be Gyn] Rain Rs. | (Decrease)

Tonne. 00 | Perton | tonne 000 | Perron | % Prton

LocaL,

ope 1.18725] 4.944.000 zssi] _oo.4e0| 7.722608] 7.727 25)

sre +s1,038 | 1.155.592 resi] 36767] erv3es| 25.062 94

Fec 99,932| 639,000 rox] 108.208| a7ser2| 2.506 47070

‘Ground Slag : - - - - :

Sub-total 10,738,592 8.875.961

EXPORT

ope 530,176 | 3,108,059, s77s|__693033| s.e2a16] 5746 0.50

SRC 2e20| 17,380 e103] 4367] zar7ea] 412 25.45

FBC “ : 2 P ‘i

Ground Slag : e « . z z

Clinker s4sse| 4310 3.784 . 2

3,179,748 4210,180,

TOTAL 13,918,340

= Export sales were made to regional markets of Srilanka, Yemen, India, other East African and Indian Ocean markets.

\

13, PROFITABILITY

(As per Schedule-3 attached)

Local

‘ope

sR

FBC

Ground Slag

Sub-total

EXPORT

ope.

SRC

Ground Slag

Clinker (OPC)

TOTAL

2016, 208 Tnerease7

ay.in | Asin Rs yin] Rs.in Rs. _] (Decrease)

Tone, 00 | perton | tonne 000 | Porton | % Piton

1.187.625 | 3,600,304 0x7] os0.400| 2esaor2] 2.056 3

ssi036 | 424471 zero] 106286] s25604| 3.066 @)

soso] 240,184 ees] s6767| soso10| 2,965 al

4275030 3,388,925

sagas] (27768) a] 603.033] 102,650) (148) (55)

2.820 sa wo] ase] sry) ais) 99)

s4sss| 1513) 02 - -

(99:333] (168,273)

4235,706 220,554

‘The increase in net profi is mainly cue to increase in local sales and decrease in cost of sales.

10

wo

Attock Cement Pakistan Limited Cost Audit Report, 2016

14 Cost Auditors’ Observations and Conclusions

(a) Matters which appear to him to be clearly wrong in principle or apparently unjustifiable

No such matters have so far come to our notice during the year under review.

(b) Cases where the company funds have been used in a negligent or inefficient manner.

NONE

(€) Factors which could have been controlled but have not been done resulting In increase in the cost of

production.

NONE

(d) (i) The Adequacy or otherwise of Budgetary Control System, if any, in vogue in the company.

‘The company prepares its budget on annual basis. A monthly report comparing actual results with budget is

generated along with the reasons for major variances. On the basis of such variances corrective measures

are initiated, implemented and followed up.

The scope and performance of Internal Audit, if any.

‘The Board has outsourced the internal audit function to M/s. Ernst & Young Ford Rhodes Sidat Hyder & Co.,

Chartered Accountants who are involved in the internal audit function on a full ime basis,

(e) Suggestion for improvements in performance.

(i) rectification of general imbalance in production facilities

Apparently, there is no general imbalance in production facilities.

(li) fuller utilization of installed capacity

‘The plant has already utilized maximum capacity shown by Kiln # |, It has achieved 108% capacity utilization

where as Kiln # II achieved 107% of capacity utilization which has yielded good production results.

(iil) Comments on ares offering scope for:

(@) Cost reduction

In order to improve the plant efficiencies and cost reduction, the company is continously making capital

‘expenditures in terms of balancing, modemaization and rehabilitation of plant.

(®) Increased productivity

‘The Company is installing a new production line of 4,000 Tons per Day at its existing Plant site.

(©) Key limiting factors causing production bottle necks.

NONE

wh

1"

Attock Cement Pakistan Limited Cost Audit Report, 2016

(A) Improved inventory policies

Present inventory policies are satisfactory.

() Energy conservancy

‘The company has already switched over to ‘COAL’ as one of the cheapest source of energy.

(iv) State of technology

‘The company uses 'Dry Process’ which is the latest technology in cement production.

(v) Plant

‘The plant was new when installed.

18 RECONCILIATIONS WITH FINANCIAL STATEMENTS,

The cost accounts are reconciled with audited financial accounts for the year ended June 30, 2016 as per

reconciliation statement annexed herewith

16 COST STATEMENTS

Copies of all cost statements on the formats prescribed by Securities and Exchange Commission of Pakistan under

clause (e) of sub-section (1) of section 230 of the Companies Ordinance, 1984, duly authenticated by the Chief

Executive and Chief Financial Officer of the company, and verified by us are appended to the report.

17 MISCELLANEOUS

Figures have been rounded off to nearest thousand and rupee one. Previous year's figures have been re-arranged

and regrouped where necessary to facilitate comparison,

Karachi Nessbae (shfag .

Datec tered Agicot ts

2

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Compiled Document With References Added-SSCMDocument30 pagesCompiled Document With References Added-SSCMHashim Ayaz KhanPas encore d'évaluation

- RF CML SML CapmDocument30 pagesRF CML SML CapmHashim Ayaz KhanPas encore d'évaluation

- Presentation1 Brand LevisDocument11 pagesPresentation1 Brand LevisHashim Ayaz KhanPas encore d'évaluation

- Branding AssgnmentDocument24 pagesBranding AssgnmentHashim Ayaz KhanPas encore d'évaluation

- 6 & 7 VARp Total Risk of ProtfolioDocument12 pages6 & 7 VARp Total Risk of ProtfolioHashim Ayaz KhanPas encore d'évaluation

- Consumer Protection in PakistanDocument13 pagesConsumer Protection in PakistanHashim Ayaz KhanPas encore d'évaluation

- Active Portfolio Week 3Document2 pagesActive Portfolio Week 3Hashim Ayaz KhanPas encore d'évaluation

- 13 Simple Ranking Method of Tracing Eff FrontierDocument13 pages13 Simple Ranking Method of Tracing Eff FrontierHashim Ayaz KhanPas encore d'évaluation

- Investment Week 3 Assignment FinalDocument6 pagesInvestment Week 3 Assignment FinalHashim Ayaz KhanPas encore d'évaluation

- Portfolio Performance Evaluation MethodsDocument14 pagesPortfolio Performance Evaluation MethodsHashim Ayaz KhanPas encore d'évaluation

- Drugs (Specifications) Rules, 1978Document2 pagesDrugs (Specifications) Rules, 1978Hashim Ayaz KhanPas encore d'évaluation

- Lahore School of Economics: MBA-1 (2015-2017) Section-A (Winter Term)Document4 pagesLahore School of Economics: MBA-1 (2015-2017) Section-A (Winter Term)Hashim Ayaz KhanPas encore d'évaluation

- Drugs (Specifications) Rules, 1978Document2 pagesDrugs (Specifications) Rules, 1978Hashim Ayaz KhanPas encore d'évaluation

- Transforming Your Organization: White PaperDocument18 pagesTransforming Your Organization: White Paperalgerie algeriePas encore d'évaluation

- CASE-5 Daali Earth FoodsDocument9 pagesCASE-5 Daali Earth FoodsHashim Ayaz KhanPas encore d'évaluation

- 13 Simple Ranking Method of Tracing Eff FrontierDocument13 pages13 Simple Ranking Method of Tracing Eff FrontierHashim Ayaz KhanPas encore d'évaluation

- Classic Airline Case Study MMDocument2 pagesClassic Airline Case Study MMHashim Ayaz KhanPas encore d'évaluation

- Lahore School of Economics: MBA-1 (2015-2017) Section-A (Winter Term)Document4 pagesLahore School of Economics: MBA-1 (2015-2017) Section-A (Winter Term)Hashim Ayaz KhanPas encore d'évaluation

- CASE-5 Daali Earth FoodsDocument9 pagesCASE-5 Daali Earth FoodsHashim Ayaz KhanPas encore d'évaluation

- Chap08 AccountingDocument104 pagesChap08 AccountingHashim Ayaz KhanPas encore d'évaluation

- Chapter 07Document59 pagesChapter 07Hashim Ayaz KhanPas encore d'évaluation

- 1-Supply Chain and IotDocument10 pages1-Supply Chain and IotHashim Ayaz Khan100% (1)

- ABCDocument78 pagesABCMaria ZakirPas encore d'évaluation

- Chap SixDocument116 pagesChap SixHashim Ayaz KhanPas encore d'évaluation

- Cost AUdit Report 2016 PDFDocument12 pagesCost AUdit Report 2016 PDFHashim Ayaz KhanPas encore d'évaluation

- Packages (Corrected Years) TocDocument32 pagesPackages (Corrected Years) TocHashim Ayaz KhanPas encore d'évaluation

- P and G Strategic AnalysisDocument15 pagesP and G Strategic AnalysisHashim Ayaz KhanPas encore d'évaluation

- PressedDocument12 pagesPressedSikander JawaidPas encore d'évaluation

- Procter Gamble Fall 2015Document77 pagesProcter Gamble Fall 2015Hashim Ayaz Khan100% (1)