Académique Documents

Professionnel Documents

Culture Documents

Chapter 33

Transféré par

Mike SerafinoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 33

Transféré par

Mike SerafinoDroits d'auteur :

Formats disponibles

CHAPTER 33

Statement of Changes in Equity

Questions

Q33-1 Historically, par value was equal to the market value of the shares at issuance.

Par value was also sometimes viewed by the courts as the minimum

contribution by investors. These days, par values for common stocks are

usually set at very low values (less than $1), so the importance of par value

has decreased substantially.

Q33-2 Preferred stock is stock that carries certain preferences over common stock,

such as prior claims to dividends and liquidation preferences. Often, preferred

stock has no voting rights or only limited voting rights, and dividends are

usually limited to a stated percentage or amount. The special rights of a

particular issue of preferred stock are set forth in the articles of incorporation

and in the preferred stock certificates issued by the corporation.

Q33-3 The difference between the purchase price and the selling price of treasury

stock is properly excluded from the income statement because treasury stock

transactions cannot be considered to give rise to a gain or a loss. Gain or loss

arises from the utilization of assets or resources by the corporation in

operating and investing activities. Because the recognition of treasury stock as

an asset is discouraged, transactions in treasury stock are considered capital

transactions between the company and its stockholders and thus do not give

rise to a gain or a loss.

Q33-4 Mandatorily redeemable preferred shares should be reported in the statement of

financial position as a liability.

Q33-5 When a corporation writes a put option on its own shares, the corporation

typically receives cash. In return, the corporation agrees to repurchase shares

of its own stock at a set price at some future date if those shares are offered

for sale by the option holder.

Q33-6 If an error is discovered in the current year, it is corrected with a correcting

entry. If a material error is discovered in a year subsequent to the error, the

error is corrected by a prior-period adjustment whereby the beginning balance

in Retained Earnings is adjusted. Some errors are counterbalancing (e.g.,

inventory errors) and may need no correction.

33-2 Solutions Manual to Accompany Financial Accounting and Reporting (Volume III)

Q33-7 State incorporation laws are written to prevent corporations from wrongfully

borrowing money and then funneling that money to shareholders. One device

to prevent this is to restrict the payment of cash dividends to the amount of

retained earnings. Retained earnings can also be restricted by private debt

agreements in which lenders constrain the ability of a borrowing company to

pay cash dividends.

Q33-8 The three types of unrealized gains and losses shown as direct equity

adjustments are:

Peso currency translation adjustment. This adjustment arises from

the change in the equity of foreign subsidiaries (as measured in terms

of U.S. dollars) that occurs as a result of changes in foreign currency

exchange rates.

Unrealized gains and losses on available-for-sale securities. Available-

for-sale securities are those that were not purchased with the

immediate intention to resell but will be held for an indefinite time.

Unrealized gains and losses arise because these securities must be

reported on the statement of financial position at their fair market

value.

Unrealized gains and losses on derivatives. Unrealized gains and

losses from market value fluctuations of derivative instruments that

are intended to manage risks associated with future sales or

purchases are deferred to allow for proper matching.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- p2 - Guerrero Ch7Document35 pagesp2 - Guerrero Ch7JerichoPedragosa66% (38)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- 5.AUDITING ProblemDocument111 pages5.AUDITING ProblemAngelu Amper68% (22)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- General Journal Date Account Titles / ExplanationDocument22 pagesGeneral Journal Date Account Titles / ExplanationPauline Bianca70% (10)

- CPAR - Auditing ProblemDocument12 pagesCPAR - Auditing ProblemAlbert Macapagal83% (6)

- GlowCorp CaseDocument25 pagesGlowCorp CaseJAMES WILLIAM BALAOPas encore d'évaluation

- Audit of Equity A PDFDocument8 pagesAudit of Equity A PDFMike SerafinoPas encore d'évaluation

- Applied Auditing 2017 Updates and Errata As of August 1 2017Document3 pagesApplied Auditing 2017 Updates and Errata As of August 1 2017Aira ButligPas encore d'évaluation

- Ap AbDocument8 pagesAp AbMike SerafinoPas encore d'évaluation

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesMike SerafinoPas encore d'évaluation

- Untitled 4Document28 pagesUntitled 4Mike SerafinoPas encore d'évaluation

- Annotations PepperDocument2 pagesAnnotations PepperMike SerafinoPas encore d'évaluation

- Palattao - RizalDocument3 pagesPalattao - RizalMike SerafinoPas encore d'évaluation

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- NOTESDocument2 pagesNOTESMike SerafinoPas encore d'évaluation

- Bibingkinitan XDocument83 pagesBibingkinitan XMike Serafino100% (3)

- 2009-11-01 020853 Laura 3Document2 pages2009-11-01 020853 Laura 3Mike SerafinoPas encore d'évaluation

- Notes For Quiz 1Document11 pagesNotes For Quiz 1Mike SerafinoPas encore d'évaluation

- Chapter 7Document17 pagesChapter 7Mike SerafinoPas encore d'évaluation

- Int AudDocument19 pagesInt AudMike SerafinoPas encore d'évaluation

- Test Bank - Chapter 4 Process CostingDocument51 pagesTest Bank - Chapter 4 Process Costingmaisie lanePas encore d'évaluation

- Cost Acct Concepts PDFDocument36 pagesCost Acct Concepts PDFMike SerafinoPas encore d'évaluation

- IPPTChap 006Document32 pagesIPPTChap 006Mike SerafinoPas encore d'évaluation

- Prelim Reviewer ADocument4 pagesPrelim Reviewer AMike SerafinoPas encore d'évaluation

- Chapter 1Document5 pagesChapter 1Mike SerafinoPas encore d'évaluation

- Chapter 1Document5 pagesChapter 1Mike SerafinoPas encore d'évaluation

- Passport ADocument7 pagesPassport AMike SerafinoPas encore d'évaluation

- Chapter 1 NotesDocument3 pagesChapter 1 NotesMike SerafinoPas encore d'évaluation

- Chap 1 Test BankDocument22 pagesChap 1 Test BankMike SerafinoPas encore d'évaluation

- PassportApplicationForm Main English V1.0Document2 pagesPassportApplicationForm Main English V1.0Triloki KumarPas encore d'évaluation

- Chapter 1 NotesDocument3 pagesChapter 1 NotesMike SerafinoPas encore d'évaluation

- Chapter 35Document30 pagesChapter 35Mike SerafinoPas encore d'évaluation

- ACEFIAR Quiz No. 1Document3 pagesACEFIAR Quiz No. 1Marriel Fate CullanoPas encore d'évaluation

- SRM Sem1 Exam Fee ReceiptDocument2 pagesSRM Sem1 Exam Fee Receiptdeeksha6548gkPas encore d'évaluation

- Company Name: Starting Date Cash Balance Alert MinimumDocument3 pagesCompany Name: Starting Date Cash Balance Alert MinimumdantevariasPas encore d'évaluation

- Genet Tadesse - A Small Business Borrower in EthiopiaDocument2 pagesGenet Tadesse - A Small Business Borrower in EthiopiaWedpPepePas encore d'évaluation

- SECTION 4.1 Payment or PerformanceDocument6 pagesSECTION 4.1 Payment or PerformanceMars TubalinalPas encore d'évaluation

- Idec 8301381772Document1 pageIdec 8301381772denny palimbungaPas encore d'évaluation

- Malaysian Government Budgeting MalaysianDocument31 pagesMalaysian Government Budgeting MalaysianHanisah AbdulRahmanPas encore d'évaluation

- Merchandising Reviewer 2Document5 pagesMerchandising Reviewer 2Sandro Marie N. ObraPas encore d'évaluation

- Banco Filipino Vs NavarroDocument2 pagesBanco Filipino Vs NavarroAnonymous GMUQYq8100% (1)

- Taskforce On Nature Related Financial Disclosures (TNFD) - Summary - NCDocument5 pagesTaskforce On Nature Related Financial Disclosures (TNFD) - Summary - NCNiraj ChourasiaPas encore d'évaluation

- AFM Assignment 3Document6 pagesAFM Assignment 3Zuhair NasirPas encore d'évaluation

- Schedule of New Fees - RetooledDocument2 pagesSchedule of New Fees - RetooledRaymund Fernandez CamachoPas encore d'évaluation

- 3.2 Accounting For Corporation Reviewer With Sample ProblemDocument82 pages3.2 Accounting For Corporation Reviewer With Sample Problemlavender hazePas encore d'évaluation

- Signature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Document36 pagesSignature Not Verified: Speed Post BNPL Code-TN/SP/BNPL/54/CO/18 BPC, Anna Road, Chennai-02Ganesh PrasadPas encore d'évaluation

- Assign 2 Cash Flow Basic Sem 1 13 14Document2 pagesAssign 2 Cash Flow Basic Sem 1 13 14Sumaiya AbedinPas encore d'évaluation

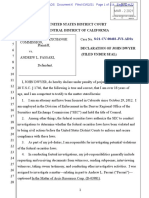

- United States District Court Central District of California: 8:21-Cv-00403-Jvs-AdsxDocument114 pagesUnited States District Court Central District of California: 8:21-Cv-00403-Jvs-Adsxtriguy_2010Pas encore d'évaluation

- Introduction To PPPDocument25 pagesIntroduction To PPPswatiPas encore d'évaluation

- Audit Programme For Accounts ReceivableDocument5 pagesAudit Programme For Accounts ReceivableDaniela BulardaPas encore d'évaluation

- Hhtfa8e ch01 SMDocument83 pagesHhtfa8e ch01 SMkbrooks323Pas encore d'évaluation

- Personal Financial Planning and Manage EntDocument19 pagesPersonal Financial Planning and Manage EntJosePas encore d'évaluation

- Contribution Reciept (1) CyungoDocument1 pageContribution Reciept (1) CyungoBizimenyera Zenza TheonestePas encore d'évaluation

- Economics PrimerDocument16 pagesEconomics PrimerAbinesh MaranPas encore d'évaluation

- Partnership & ClubsDocument8 pagesPartnership & ClubsGary ChingPas encore d'évaluation

- ADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsDocument6 pagesADMS 1010, ADMS 3530, ADMS 2511, All York BAS Course MaterialsFahad33% (3)

- Negotiating A Venture Capital Term SheetDocument2 pagesNegotiating A Venture Capital Term SheetmikeslackenernyPas encore d'évaluation

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Document8 pagesPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoPas encore d'évaluation

- Reinstatement of Provision of Earnest Money Deposit (Er (D) in BidsDocument10 pagesReinstatement of Provision of Earnest Money Deposit (Er (D) in BidsDevesh Kumar PandeyPas encore d'évaluation

- Case Study On Panipat-Jalandhar Toll Road ProjectDocument26 pagesCase Study On Panipat-Jalandhar Toll Road ProjectNeeraj Kumar Ojha50% (2)