Académique Documents

Professionnel Documents

Culture Documents

Bonzai Answers

Transféré par

api-3580958530 évaluation0% ont trouvé ce document utile (0 vote)

1K vues5 pagesTitre original

bonzai answers

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues5 pagesBonzai Answers

Transféré par

api-358095853Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 5

Bonzai answers

Q1: Why is good credit important when renting an apartment?

A: Good credit is important when renting an apartment because the interest will be

lower because you seem like a responsible person.

Q2: Approximately, how much does it cost to rent an apartment in your area?

A: Around $3000 to rent an apartment

Q3: What happens if you cant pay your rent?

A: You can get evicted if you are not able to pay

Q4: How long does an eviction stay on your credit history?

A: It will last 7 years on your credit report

Q5: Why would you want to have renters insurance?

A: So if something breaks or gets damaged you are covered

Q6: What is the difference between gross and net income?

A: Gross is before tax and net is after tax

Q7: Why do we pay Social Security taxes?

A: So we can social security benefits

Q8: What are Medicare taxes for?

A: Pays for hospital and medicine bills

Q9: How much can a high school graduate expect to earn in your area?

A: $28,000 a year

Q10: What are the benefits of using direct deposit?

A: Saves time, helps save money, and no delay in getting money

Q11: What factors influence your cars fuel economy?

A: Quick acceleration and heavy braking cam influence the fuel economy

Q12: What is the difference between paying with cash, debit, or credit cards?

Discuss the pros and cons of each form of payment.

A: Cash: good way to avoid overspending. Con: can get stolen, burns a hole in

wallets

Debit card: Pro: Some banks allow you to lock your debit card if it gets lost or stolen.

Con: If you try to spend more than you have, your purchase may be declined or the

bank may charge you an overdraft fee.

Credit Card: Pro: For certain purchases, credit cards may be convenient or even

necessary. For some purchases, you may be required to use a cardthings like

booking a hotel room or rental car in advance. In addition, many credit cards offer

rewards programs that allow you to earn points that are redeemable for things like

travel and merchandise; other rewards programs offer you cash back. Con: Carrying

a balance on your credit card will result in interest charges and can harm your credit

score if the balance gets too big.

Q13: Why does the total on the receipt differ from the total amount paid?

What is an appropriate tip at a restaurant?

For what other services is tipping appropriate?

A: The total does not add the taxes on receipt. 15-20% is a good tip. Delivery,

bartenders are jobs where tipping services are appropriate.

Q14: What are effective strategies for saving money on groceries (there are 8

strategies)?

A: Eat before you shop. Read the sales flyer. Read the sales flyer. Look up and down

for savings. Check for store brands. Grab from the back. Ask for a rain check. Join

your stores loyalty program.

Q15: These concert tickets were expensive. What are cheaper sources of

entertainment in your area?

A: Free museums, movies, read

Q16: What was the impact of going to the emergency room without insurance?

What are the benefits of having medical insurance?

The balance in the Reserves jar is now negative. What does this mean?

A: More money to pay. With insurance less money to pay. You dont have any more

money in the reserves jar.

Q17: Why are you unable to pay the entire credit card bill?

What are the consequences of not making a payment by the due date?

A: Doesnt let you put money in credit card. Making more payments every time.

Q18: What is a grace period?

A: The grace period is the gap between when your credit cards billing cycle closes

and when the bill comes due.

Q19: What if you ONLY made minimum payments on the entire $585 balance?

24.99% interest with a minimum payment of $20 .00

A: The number of months would increase and it will be a low cost.

Q20: You write a check for $25.00, but theres only $2.21 in your bank account.

What does this mean?

A: You will be charged with overdraft fees

Q21: Why are you charged an overdraft fee?

The bank could have bounced the check instead. What would have happened then?

If you pay through a credit or debit card and dont have enough money you will be

charged with an overdraft fee.

plans so that your checks do not bounce and your ATM and debit card transactions

go through

Q22: What is a W-4?

What happens if you ask your employer to withhold too much?

A: It is a form so that your employer can withhold the correct federal income tax for

your pay. You will owe the government money.

Q23: What is an ATM?

How do you avoid fees?

A: ATM is an Automatic Teller Machine and dispenses money from your bank

account.

By not over drafting

Q24: Is gasoline tax the same, higher, or lower than sales tax?

A: Gas taxes are higher

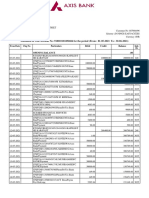

Q25: According to the Banzai scenario Why doesnt the bank statement show all

of your checking account

transactions?

Which transactions are missing from this statement?

How can you verify the current balance of your account?

A: Maybe because some are minor transactions.

Minor transactions are missing

Every time you make a debit entry, subtract that amount from your prior balance,

and record the difference in the Balance column.

Q26: What might you do with a tax refund?

What are the benefits of an emergency fund?

How large should your emergency fund be?

A: Spend the money

More money to have 6,000 t0 18,000 dollars

Q27: Higher-quality food costs more. What are some ways to eat healthily on a

budget?

Junk food is the cheapest, but is it the best choice?

A: Stick to grocery list buy more greens choose fresh or frozen over canned. Junk

food is not the best choice

Q28: Use Banzai Life Scenario: How was the monthly interest payment on the auto

loan calculated?

How was the monthly principal payment calculated?

How long will it take for you to pay off this car, and how much will you be paying in

interest over the life of this loan?

What happens if you fail to make your auto loan payments?

What happens when you have a poor credit score?

A: Total, term of loan

Total term of loan and interest rate

A year and $50

Modify auto loan, refinance your vehicle loan, trade in your car

Activities that negatively impact your credit score include:

Late or missed payments.

Bankruptcy, foreclosure, or defaulting on other loans.

Little or no history of credit.

Having no assets that serve as collateral (e.g. a home or car).

Too much existing debt.

Q29: Rolands Bookstore pays its employees weekly. On what

other pay schedules do employers operate?

A: Once a month or every 2 weeks

Q30: Buying clothing is fun, but also expensive. What are ways to get quality

clothing for less?

A: Consignment stores, yard sales, thrift shops, host a clothing swap

Q31: It can be difficult to eat healthily while traveling. What are ways to avoid

eating a junk food during trips?

A: watch the added sugar amount, portions

Q32: Many people are surprised when they see the utility bill for a new home or

apartment. How can you reduce the amount you pay each month?

A: Lower usage of electricity

Q33: Transportation costs (fuel, maintenance, etc.) are among the top expenses for

young people. How can you keep from going broke when you need a car?

A: change oil, vehicle fluid flushes, replace timing belt

Q34: Going over your minutes is expensive. How can you avoid that mistake?

A:

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PERSONS and FAMILY RELATIONS DIGEST (Art 19-21)Document25 pagesPERSONS and FAMILY RELATIONS DIGEST (Art 19-21)Khristine Gubaton100% (1)

- EOI On Excess Bank ChargesDocument22 pagesEOI On Excess Bank ChargesOlufemi Moyegun100% (4)

- Fulton Iron Works V CHina BankDocument5 pagesFulton Iron Works V CHina BankAlfonso Miguel LopezPas encore d'évaluation

- T04 - Profits TaxDocument18 pagesT04 - Profits Taxting ting shihPas encore d'évaluation

- Chase Quickpay® With Zelle Service Agreement and Privacy NoticeDocument18 pagesChase Quickpay® With Zelle Service Agreement and Privacy NoticeRELOJERIAPas encore d'évaluation

- Practice of Banking I Law and PracticeDocument171 pagesPractice of Banking I Law and Practicecarltawia100% (1)

- What Is Commercial Bank? Discuss The Different Product and Services Provided by Commercial Banks?Document8 pagesWhat Is Commercial Bank? Discuss The Different Product and Services Provided by Commercial Banks?KING ZIPas encore d'évaluation

- Estmt - 2019 07 25Document8 pagesEstmt - 2019 07 25Sandra RíosPas encore d'évaluation

- Examiners' Report 2014: LA3002 Law of Trusts - Zone ADocument9 pagesExaminers' Report 2014: LA3002 Law of Trusts - Zone AJUNAID FAIZANPas encore d'évaluation

- Gregory Feb 2020 Wells StatementDocument4 pagesGregory Feb 2020 Wells StatementYoooPas encore d'évaluation

- Sonali BajajDocument90 pagesSonali Bajajranaindia2011100% (1)

- Chase Bank Account Rules and Regulations 12-31-08Document34 pagesChase Bank Account Rules and Regulations 12-31-08wps013100% (1)

- FIN 2024 AnswersDocument6 pagesFIN 2024 AnswersBee LPas encore d'évaluation

- Wells Fargo Everyday CheckingDocument3 pagesWells Fargo Everyday Checkingbaga ibakPas encore d'évaluation

- Account Relationships: Federal Reserve Banks Operating Circular 1Document18 pagesAccount Relationships: Federal Reserve Banks Operating Circular 1Wesley Davis100% (3)

- Agreements BBG enDocument26 pagesAgreements BBG enRajasheker ReddyPas encore d'évaluation

- Carol Coye Benson - Scott J Loftesness - Payments Systems in The U.S. - A Guide For The Payments Professional-Glenbrook Partners (2013)Document149 pagesCarol Coye Benson - Scott J Loftesness - Payments Systems in The U.S. - A Guide For The Payments Professional-Glenbrook Partners (2013)Chico TonhosoPas encore d'évaluation

- Module 1 - Cash and Cash EquivalentsDocument10 pagesModule 1 - Cash and Cash EquivalentsGRACE ANN BERGONIOPas encore d'évaluation

- Wells Fargo Preferred CheckingDocument4 pagesWells Fargo Preferred Checkingjames50% (2)

- FreeBlue DAAD MO 1291Document16 pagesFreeBlue DAAD MO 1291zolalaw4Pas encore d'évaluation

- WellsFargoDocument5 pagesWellsFargogarrettloehrPas encore d'évaluation

- BSBSMB406 - Acube Assessment BookletDocument31 pagesBSBSMB406 - Acube Assessment BookletDHRUV KHULLARPas encore d'évaluation

- Account STMTDocument3 pagesAccount STMTDhanush KumarPas encore d'évaluation

- FINALREPORTBANKNEW Converted 95201213Document58 pagesFINALREPORTBANKNEW Converted 95201213dinjoPas encore d'évaluation

- Chapter 09 - Short-Term DebtDocument15 pagesChapter 09 - Short-Term DebtKhang Tran DuyPas encore d'évaluation

- ZFG Bahrain SS-PDF 592Document16 pagesZFG Bahrain SS-PDF 592ahmet aslanPas encore d'évaluation

- What You Need To Know About Overdrafts and Overdraft FeesDocument1 pageWhat You Need To Know About Overdrafts and Overdraft Feesmetreus30Pas encore d'évaluation

- Wells Fargo Everyday CheckingDocument3 pagesWells Fargo Everyday CheckingTest000001Pas encore d'évaluation

- Wells Fargo Combined Statement of AccountsDocument5 pagesWells Fargo Combined Statement of AccountsJaram Johnson100% (1)

- Preview PDFDocument3 pagesPreview PDFMarius daniel SandorPas encore d'évaluation