Académique Documents

Professionnel Documents

Culture Documents

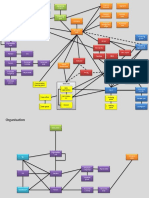

U000 Schema

Transféré par

claoker0 évaluation0% ont trouvé ce document utile (0 vote)

170 vues4 pagesu00000

Titre original

u000 schema

Copyright

© © All Rights Reserved

Formats disponibles

TXT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentu00000

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme TXT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

170 vues4 pagesU000 Schema

Transféré par

claokeru00000

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme TXT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

UINO: Initialization of Payroll

This schema manages status of PY control record.

Comment out the function CHECK if u want to bypass the control record check

during PY run.

Function CHECK (ABR Parameter) checks the payroll control record status. Dur

ing the testing stage, if this line

is commented, PY runs regardless of PY control record status.

In Production this should never be done.

UBDO: Basic Data Processing:

After initial check of control record are carried out, this schema checks for ex

istence of Basic Infotypes from EE master data

Function WPBP manages any splits in IT0001, IT0007, IT0008, and IT0027

Function P0002, P0006, P0207 & P0014 reads respective infotypes. If Residenc

e tax information (IT0207) is

missing in EE master data, then schema will cause an error when executin

g this sub-schema.

Various EE Master and transaction data are processed in this schema.

PCR UW14 is used to process data in IT0014 with function P0014

Several tables are relevant for subschemas UBD0:

WPBP is created by function WPBP and is visible in payroll results.

IT (input table) contains wage types with their amounts, numbers, and rat

e information.

NAME is created from Infotype 0002.

ADR is created from Infotype 0006.

TAXR contains the residence tax authority and is created from Infotype 02

07.

UT00: Gross Compensation & Time

UT00 is one of most important sub-schemas as it deals with Time Mgt, Gross c

ompensation & Rate calculations

This sub-schema is also main part in integration between Time and PY, as it

also reads Time Evaluation results (B2 time Clusters), alternatively if Tim

e Evaluation is not used then IT0007 & IT0008 will govern the calculations.\

Functions ZTIL is an important function, where Time Mgt and Payroll processe

s come together. This schema has

Key rules such as X010 & X012 for valuation of wage types

Function ZLIT brings the hours from time management (either time evaluation

or normal working

hours) together with the dollar rates from payroll. For example, i

f an employee needs to get paid

overtime at 1.5 times the normal rate, the schema needs to know th

e number of hours and the

employee s hourly rate. ZLIT function brings the two together: hours

and rate.

Table ZL contains time w.t s. Time w.t s in this table contains hours but not am

ounts. ZLIT function uses hours from ZL table and Rates from IT to arrive at amo

unts

Function PARTT performs partial month calculations (as if EE joins in mid-mo

nth) and PARX table is generated

Function P2003 processes Substitutions infotype (IT2003)

Function P2010 processes EE Remuneration Infotype (IT2010), IT2010 is used t

o either to load time data from external time systems or to manually enter time

data in the absence of any time-clocking systems

Function DAYPR checks time processing with or with-out clock times

PCR X013 performs the valuation. For example, if a EE is salaried, u may nee

d to calculate EE s derived hourly

rate for partial month calculations. /001 & /002 are valuation w.t s that are

generated in this sub-schema

PCR X020 collects w.t s using ADDCU operation.

Table C1 is generated when EE works across different cost centers in one PY

period.

UMCO: Non-Authorized check

This sub-schema addresses Off-Cycle payroll.

Function P0221 reads IT0221 which is Year-end adjustments and manual checks.

PCR UNAM processes wage types of IT0221

PCR X023, X024 & X025 are related to Gross calculations. PRCL 20, 41 & 04 ar

e used in w.t s of these rules

PCR s with PRCL66 are related to w.t s that are related to Goals / Deductions

PCR UD11 & PCR UD21 are related to Retro Calculations

UTXO: Tax Processing

Function UPAR1 with parameter BSI controls BSI version.

BSI tax factory is that is integrated with US PY and takes care of Federal,

State & Local tax calculations

BSI handles tax policies, tax rates and any annual tax changes

BSI sends Tax Update Bulletins (TUBS) to their customers on a regular basis

Function USTAX passes control to BSI and brings back tax w.t s from BSI. Tax w

.t s (/401, /402, /403 etc.,) are

generated in BSI and are sent to PY schema when processing this function

PCR UPTX separates tax amounts for each of tax authorities. IT207 & IT208 ha

ve multiple tax authorities and

levels (Federal, State & Local)

UAP0: Process Additional Payments / Deductions

This sub-schema has another sub-schema UBE1 nested with it, which processes

U.S benefits for health & Insurance plans.

Function P0014 & P0015 processes IT0014 & IT0015 using PCR U011 & PCRU015 re

spectively.

Function P0267 handles Off-cycle / Bonus payment with PCR U012

Function COPY UBE1 copies sub-schema UBE1 for Benefits processing.

Function P0167 & P0168 processes IT0167 (Health Plans) & IT0168 (Insurance P

lans) respectively.

PCR ZRU1 is a custom rule created for this schema

Related Tables: IT & V0 split tables

UALO: Proration & Cumulation

This schema processes w.t cumulations as controlled by PRCL20

Function GEN/8 & PCR XPPF are used to generate /801 & /802 respectively. If

a w.t needs to be prorated then this function and rule should be used.

PCR X023 uses PRCL20 and w.t s in Result Tables of PY

IT (Input tables) are most relevant for UAL0

UDD0: Process Deductions & Benefits

UDD0 sub-schema plays an important role in Retroactive accounting

This sub-schema also handles intermediate w.t s during retro calculations as P

Y schema runs multiple times depending on retro periods

For Example, If during PY period 17, retro demands adjustment of PY Period 1

5, schema runs for periods 17, 16 & 15. In this situation sub-schema UDD0 handle

s intermediate flow of w.t s. It has 2 nested sub-schemas UBE2 (for Benefits) & UD

P0 (Deduction goals and totals)

UBE2 handles Savings, Flexible spending and Miscellaneous plan related deduc

tions

Function P0170 processes flexible spending account plans

Function P0169 processes Savings plans (401(k))

Function P0477 processes Miscellaneous plan deductions

Function COPY UDP0 manages a sub-schema to process IT0014 & IT0015 with Goal

amount w.t s

Function LIMIT checks if the amount in certain w.t s exceed a limit

Function PRDNT works with DDNTK table. Like arrears processing DDNTK table h

as deeper impact in retro calc s

PCR UD11 & PCR UD21 are related to retro calculations.

PCR X024 & PCR X025 manages Cumulation w.t s using PRCL40 & PRCL04 respective

ly

Related tables: IT, ARRRS (arrears), DDNTK

UGRN: Garnishment Calculation

Tables generated in this schema are different from those tables generated in oth

er schemas

Function IF with parameter GREX checks for active Garnishments.

Active Garnishments have their status setup via IT0194

Inactive & Released status Garnishments are not processed in Schema

Function UGARN performs calculations of Garnishments

PCR UGRT with PRCL59 processes all earnings that have garnishability. Functi

on PRT reads PCR UGRT (just as PIT)

PCR UGDN calculates disposable net income

Several tables relevant for UGRN are:

GRDOC contains Garnishment documents

GRREC contains Garnishment records

GRORD contains Garnishment Orders

IT tables are generated like with all other sub-schemas

UNA0: Calculate Net Pay

If you need to write rules before final result tables are written, this is t

he subschema to use.

You will mostly be concerned with the IT and RT tables in this subschema, wh

ich by now have completed the logic and calculation portions of the schema.

UNN0: Net Processing Bank Transfer

This schema used infotypes to create Bank transfers or check payment tables

Function P011 is used if IT0011 (External Bank transfer) is used

Function P0009 processes IT0009

Function P9ZNC is used for EE s who has to receive cheques with Zero amount

Related Tables: BT & RT

UEND: Final Processing

Schema UEND serves a single, very important purpose:

presenting you with the payroll results table that will be available in the

payroll clusters.

These tables will be used for all subsequent processing, such as finance pos

ting, accounts payable posting, checks processing, tax processing, and payroll r

eporting in general.

These tables contain an individual employee s payroll results for each pay per

iod.

When running the schema using the log option, this is where you drill down t

o check the results with the

following tables:

RT

CRT which contains MTD and YTD (month-to-date and year-to-date) accumulation

s

========================================

Vous aimerez peut-être aussi

- SAP Payroll Canada: Payroll InfotypesDocument4 pagesSAP Payroll Canada: Payroll Infotypeshellosri2001Pas encore d'évaluation

- BIR Ruling 023-09Document5 pagesBIR Ruling 023-09Juno Geronimo100% (1)

- Asad Bank StatementDocument6 pagesAsad Bank Statementapi-344873207100% (2)

- SAP HCM Payroll Concepts and ProcessesDocument17 pagesSAP HCM Payroll Concepts and ProcessesRitu Gupta100% (2)

- Subsequent Activities in SAP HR PayrollDocument7 pagesSubsequent Activities in SAP HR PayrollclaokerPas encore d'évaluation

- Income Tax Calculation (SAP Library - Payroll India (PY-IN) )Document6 pagesIncome Tax Calculation (SAP Library - Payroll India (PY-IN) )Pradeep KumarPas encore d'évaluation

- Understanding Functions in Payroll Schemas (Specific Eg, WPBP) - SAP BlogsDocument22 pagesUnderstanding Functions in Payroll Schemas (Specific Eg, WPBP) - SAP Blogsnoidsonly100% (1)

- SAP HR QueriesDocument26 pagesSAP HR QueriesEswar PrasadPas encore d'évaluation

- SAP Payroll Basics - Part 1 - Insight Consulting PartnersDocument2 pagesSAP Payroll Basics - Part 1 - Insight Consulting PartnersDionisis Panagopoulos100% (1)

- Sappress Practical Sap Us Payroll 2.Document72 pagesSappress Practical Sap Us Payroll 2.kajay050167% (3)

- Practical Sap Us PayrollDocument37 pagesPractical Sap Us PayrollBharathk Kld100% (2)

- Time Schema SAPDocument3 pagesTime Schema SAPanupthkPas encore d'évaluation

- SAP Payroll Schemas, Rules and Functions ExplainedDocument21 pagesSAP Payroll Schemas, Rules and Functions ExplainedUday KiranPas encore d'évaluation

- Payroll Schemas and PCR ConfigurationDocument23 pagesPayroll Schemas and PCR Configurationananth-jPas encore d'évaluation

- Accessing Cluster Tables in SAPDocument19 pagesAccessing Cluster Tables in SAProys4396510Pas encore d'évaluation

- Preferential TaxationDocument7 pagesPreferential TaxationJane100% (1)

- Budget & EconomyDocument13 pagesBudget & Economysonu_dpsPas encore d'évaluation

- SAP HCM Study Material - PayrollDocument8 pagesSAP HCM Study Material - PayrollAditya_Vickram_540Pas encore d'évaluation

- How To Audit Payroll in SAP & Matchcode WDocument5 pagesHow To Audit Payroll in SAP & Matchcode WManepali TejPas encore d'évaluation

- Practical Sap Us Payroll Sample 72701Document72 pagesPractical Sap Us Payroll Sample 72701prdeshpandePas encore d'évaluation

- SAP Income TaxDocument5 pagesSAP Income TaxBullet BairagiPas encore d'évaluation

- SETUPS FOR ALLDocument22 pagesSETUPS FOR ALLpadmanabha14Pas encore d'évaluation

- SAP HR Training Course OverviewDocument2 pagesSAP HR Training Course OverviewVishal ShorgharPas encore d'évaluation

- Configure and run off-cycle payroll in SAPDocument5 pagesConfigure and run off-cycle payroll in SAPHemant ShettyPas encore d'évaluation

- SAP HR and Payroll Wage TypesDocument3 pagesSAP HR and Payroll Wage TypesBharathk Kld0% (1)

- Concept of SchemaDocument7 pagesConcept of SchemaBiru BhaiPas encore d'évaluation

- Expert Mode Organizational Units/Objects Transaction CodesDocument51 pagesExpert Mode Organizational Units/Objects Transaction CodesPradeep KumarPas encore d'évaluation

- SAP HCM - Absence Quota GenerationDocument39 pagesSAP HCM - Absence Quota Generationsainath89100% (6)

- s5 PDFDocument5 pagess5 PDFKeshav KumarPas encore d'évaluation

- Payroll - Configuration - V0 01Document38 pagesPayroll - Configuration - V0 01Abdul WahabPas encore d'évaluation

- Indian Specific Processing ClassesDocument9 pagesIndian Specific Processing ClassesRakesh RakeePas encore d'évaluation

- Integrating Personnel and Organizational Management in SAPDocument89 pagesIntegrating Personnel and Organizational Management in SAPnaren_3456Pas encore d'évaluation

- Guide For Overtime PCRDocument28 pagesGuide For Overtime PCRVishwanath RaoPas encore d'évaluation

- SAP Wage TypesDocument4 pagesSAP Wage TypesSanjay MuralidharanPas encore d'évaluation

- Commonly Used SAP HR ReportsDocument4 pagesCommonly Used SAP HR ReportsBrian GriffithPas encore d'évaluation

- SAP HR Payroll Schemas and Personnel Calculation RulesDocument17 pagesSAP HR Payroll Schemas and Personnel Calculation RulesRoberto Martínez83% (6)

- Payroll Schemas and Personnel Calculation Rules (PCR)Document14 pagesPayroll Schemas and Personnel Calculation Rules (PCR)ruchityaPas encore d'évaluation

- 4.1 Payroll PDFDocument19 pages4.1 Payroll PDFjfmorales100% (1)

- INVAL-40ECSDocument6 pagesINVAL-40ECSTejaswi ReddyPas encore d'évaluation

- Filling Penalties and Remedies CparDocument7 pagesFilling Penalties and Remedies CparGelyn CruzPas encore d'évaluation

- Factoring Sap PayrollDocument10 pagesFactoring Sap Payrollvickywesucceed67% (3)

- Understand SAP HR Payroll Clusters and TablesDocument7 pagesUnderstand SAP HR Payroll Clusters and TablesarunPas encore d'évaluation

- SAP HR Reports for Mail MergeDocument5 pagesSAP HR Reports for Mail Mergesrinivas4745Pas encore d'évaluation

- 3 Methods Calculate Firm Goodwill Under 40 CharactersDocument4 pages3 Methods Calculate Firm Goodwill Under 40 CharactersJosé Edson Jr.Pas encore d'évaluation

- Understanding Functions in Payroll SchemasDocument11 pagesUnderstanding Functions in Payroll Schemasnuta24Pas encore d'évaluation

- Invoice: Hollyhill Industrial Estate Hollyhill, Cork Ireland VAT No: GB 117223643Document1 pageInvoice: Hollyhill Industrial Estate Hollyhill, Cork Ireland VAT No: GB 117223643Marian BlnPas encore d'évaluation

- SAP Payroll Basics - Part 2: Central Functions in The Payroll Schema - Insight Consulting PartnersDocument2 pagesSAP Payroll Basics - Part 2: Central Functions in The Payroll Schema - Insight Consulting PartnersDionisis Panagopoulos100% (2)

- Infotype DetailDocument13 pagesInfotype DetailSingh 10Pas encore d'évaluation

- CLUSTER TABLES GUIDE PAYROLL INTEGRATIONDocument5 pagesCLUSTER TABLES GUIDE PAYROLL INTEGRATIONSuresh P100% (1)

- SAP HR Common Error MessagesDocument20 pagesSAP HR Common Error Messagesbelrosa2150% (2)

- Sap PayrollDocument20 pagesSap PayrollhariveerPas encore d'évaluation

- Time Evaluation Additional Slides - HR310 FinalDocument56 pagesTime Evaluation Additional Slides - HR310 Finaledu450Pas encore d'évaluation

- Workshop Relgas yDocument28 pagesWorkshop Relgas yEduardo Rocha100% (1)

- Madhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRDocument7 pagesMadhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRMurali MohanPas encore d'évaluation

- Tax Reporter Configuration OSS Note 0000544849Document11 pagesTax Reporter Configuration OSS Note 0000544849Pavan DonepudiPas encore d'évaluation

- IN00 SchemaDocument9 pagesIN00 SchematnfrPas encore d'évaluation

- Retroactive Accounting PDFDocument16 pagesRetroactive Accounting PDFMohamed ShanabPas encore d'évaluation

- Payroll Troubleshooting Reference GuideDocument75 pagesPayroll Troubleshooting Reference Guidesenthilmask80Pas encore d'évaluation

- Configuring SAP HR Payroll Settings For Retroactive AccountingDocument1 pageConfiguring SAP HR Payroll Settings For Retroactive Accountingravibabu1620Pas encore d'évaluation

- SAP HR Time Management User Manual WWW Sapdocs PDFDocument52 pagesSAP HR Time Management User Manual WWW Sapdocs PDFpuspaoktavianiPas encore d'évaluation

- 1809 Take HCM To The Cloud With Employee Central PDFDocument34 pages1809 Take HCM To The Cloud With Employee Central PDFrameshjakkula100% (1)

- Sap HRDocument3 pagesSap HRManidip GangulyPas encore d'évaluation

- An SAP Consultant - SAP HR Benefits BADIs and Enhancement SpotsDocument1 pageAn SAP Consultant - SAP HR Benefits BADIs and Enhancement SpotsarunPas encore d'évaluation

- Configure decimal places for unit of measure quantitiesDocument4 pagesConfigure decimal places for unit of measure quantitiessainath89Pas encore d'évaluation

- 01-Sap HCM Paper1 (Q&A)Document16 pages01-Sap HCM Paper1 (Q&A)Anonymous Y1csGYPas encore d'évaluation

- Deductions Configuration and ProcessingDocument3 pagesDeductions Configuration and ProcessingSunil EnokkarenPas encore d'évaluation

- Enterprise Learning Content Caching OptionsDocument12 pagesEnterprise Learning Content Caching OptionsclaokerPas encore d'évaluation

- MSN TodayDocument6 pagesMSN TodayclaokerPas encore d'évaluation

- Hiring Employee in USA Without SSNDocument7 pagesHiring Employee in USA Without SSNclaokerPas encore d'évaluation

- Reprinting Form W-2 Employee Copies With Address ChangesDocument1 pageReprinting Form W-2 Employee Copies With Address ChangesclaokerPas encore d'évaluation

- Economic Analysis For Business Decisions Multiple Choice Questions Unit-1: Basic Concepts of EconomicsDocument15 pagesEconomic Analysis For Business Decisions Multiple Choice Questions Unit-1: Basic Concepts of EconomicsMuzaffar Mahmood KasanaPas encore d'évaluation

- H&R Block Income Tax School: CatalogDocument17 pagesH&R Block Income Tax School: CatalogclaokerPas encore d'évaluation

- Capital Budgeting, Problems and SolutionDocument3 pagesCapital Budgeting, Problems and SolutionclaokerPas encore d'évaluation

- SF 1808 Release Overview BizXDocument74 pagesSF 1808 Release Overview BizXclaokerPas encore d'évaluation

- Sales Area Transportation Planning Point Sales OrganizationDocument3 pagesSales Area Transportation Planning Point Sales OrganizationclaokerPas encore d'évaluation

- Accounting of MGR McqsDocument8 pagesAccounting of MGR McqsclaokerPas encore d'évaluation

- Management ResearchDocument5 pagesManagement ResearchclaokerPas encore d'évaluation

- Battery Stops Charging at 70 % - HP Support Community - 6584675Document7 pagesBattery Stops Charging at 70 % - HP Support Community - 6584675claokerPas encore d'évaluation

- Employment Standard Levy - ERP Human Capital Management - Community WikiDocument2 pagesEmployment Standard Levy - ERP Human Capital Management - Community WikiclaokerPas encore d'évaluation

- Management Models and Theories Associated With MotivationDocument16 pagesManagement Models and Theories Associated With MotivationReuben EscarlanPas encore d'évaluation

- Even Event Reason Replicate in EcpDocument15 pagesEven Event Reason Replicate in EcpclaokerPas encore d'évaluation

- Implementing Validation Rules in The New Payroll Control CenterDocument2 pagesImplementing Validation Rules in The New Payroll Control CenterclaokerPas encore d'évaluation

- Making RadioDocument4 pagesMaking RadioclaokerPas encore d'évaluation

- Cashflows 1Document34 pagesCashflows 1claokerPas encore d'évaluation

- Adoption AssistanceDocument4 pagesAdoption AssistanceclaokerPas encore d'évaluation

- Factors Affecting Organizational DesignDocument8 pagesFactors Affecting Organizational DesignclaokerPas encore d'évaluation

- Rockcollector2 - Quantitative Methods Final ExamDocument4 pagesRockcollector2 - Quantitative Methods Final ExamclaokerPas encore d'évaluation

- Statistics QDocument24 pagesStatistics Qclaoker100% (1)

- User Guide For Amity Proactored Online Exam 2016 PDFDocument10 pagesUser Guide For Amity Proactored Online Exam 2016 PDFAmit KumarPas encore d'évaluation

- Tee Performanceuserguide v75 1649374Document91 pagesTee Performanceuserguide v75 1649374claokerPas encore d'évaluation

- How To Find Personal Data and Assess Privacy RisksDocument4 pagesHow To Find Personal Data and Assess Privacy RisksclaokerPas encore d'évaluation

- How To Store Address Details For Personnel SubareasDocument3 pagesHow To Store Address Details For Personnel SubareasclaokerPas encore d'évaluation

- How To Find Personal Data and Assess Privacy RisksDocument4 pagesHow To Find Personal Data and Assess Privacy RisksclaokerPas encore d'évaluation

- SAP HCM Proposed Schedule PDFDocument7 pagesSAP HCM Proposed Schedule PDFclaokerPas encore d'évaluation

- Working WiththeEmployeeCentral Data ModelVers. 1.0Document9 pagesWorking WiththeEmployeeCentral Data ModelVers. 1.0claokerPas encore d'évaluation

- Powers of 10 - Scientific NotationDocument4 pagesPowers of 10 - Scientific NotationclaokerPas encore d'évaluation

- Airbnb Bengaluru Receipt RCZJ9Q3M9Document1 pageAirbnb Bengaluru Receipt RCZJ9Q3M9Tejasvi ParamkusamPas encore d'évaluation

- Navin Fluorine Advanced Sciences LTD - 346 - 22-11-2021Document1 pageNavin Fluorine Advanced Sciences LTD - 346 - 22-11-2021Pragnesh PrajapatiPas encore d'évaluation

- Disbursement Vouchers Version 2Document13 pagesDisbursement Vouchers Version 2Ryan Jay CagumbayPas encore d'évaluation

- Tata CorusDocument16 pagesTata CorusTarun Daga100% (2)

- A Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTDDocument1 pageA Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTD A Project of KIPS Preparations (PVT) LTDTalha AwanPas encore d'évaluation

- Your Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberDocument3 pagesYour Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan Novemberkhair kamilPas encore d'évaluation

- Taxation II Final Exam ReviewDocument2 pagesTaxation II Final Exam ReviewnoelremolacioPas encore d'évaluation

- Midterm Tasks1Document24 pagesMidterm Tasks1Kamran Memmedov100% (1)

- B-4 Account Computation PFC SuerteDocument3 pagesB-4 Account Computation PFC SuerteElmer AlasPas encore d'évaluation

- Cours Droit de TravailDocument1 pageCours Droit de Travailq65k7tsrf7Pas encore d'évaluation

- Donor's Tax Exam AnswersDocument6 pagesDonor's Tax Exam AnswersKyla BarbosaPas encore d'évaluation

- N3552005822 SKU71 - 2 - 3552005822: Service Number IvrsDocument1 pageN3552005822 SKU71 - 2 - 3552005822: Service Number IvrsShubham NamdevPas encore d'évaluation

- 1511256898711park Cubix Price Sheet 2 9 17 PDFDocument1 page1511256898711park Cubix Price Sheet 2 9 17 PDFManjunathPas encore d'évaluation

- Train Law Income TaxationDocument9 pagesTrain Law Income TaxationRuth CepePas encore d'évaluation

- Do Terra AugustDocument1 pageDo Terra AugustRoxana Costache MarinescuPas encore d'évaluation

- Invoice 299379 PDFDocument2 pagesInvoice 299379 PDFAmirul Amin IVPas encore d'évaluation

- CREATE Bill Impact on Philippine Company TaxesDocument8 pagesCREATE Bill Impact on Philippine Company TaxesHanee Ruth BluePas encore d'évaluation

- Apply NEFT funds transfer onlineDocument5 pagesApply NEFT funds transfer onlinePPCPL Chandrapur0% (1)

- Alnissiy Yemen - 04052018 Quo-33397 Batry + Spares YemenDocument2 pagesAlnissiy Yemen - 04052018 Quo-33397 Batry + Spares YemenSamir AjiPas encore d'évaluation

- State Bank of India - Personal BankingDocument2 pagesState Bank of India - Personal BankingeSupport GlobalIT Business Solutions LimitedPas encore d'évaluation

- Official Receipt: Global Indian International SchoolDocument1 pageOfficial Receipt: Global Indian International SchoolBadal BhattacharyaPas encore d'évaluation