Académique Documents

Professionnel Documents

Culture Documents

Morning Call July 27 2010

Transféré par

chibondkingCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Morning Call July 27 2010

Transféré par

chibondkingDroits d'auteur :

Formats disponibles

Stone Street Advisors

Morning Call – 7/27/10

ChiBondKing – laszlochi@gmail.com

Morning Focus

Busy day, 2Y bond auction combined with a ton of macro related news from Asia/Europe. In the US we are anticipating consumer

confidence at 10AM EST (June). Asia was a mixed bag overnight, Australia at 4497 +0.25pct, Nikkei 225 9496 -0.07pct, Hang Seng

20973 +0.64pct, Shanghai 2575 -0.51pct. Europe is currently up at time of publication, CAC40 +1.23pct, DAX +0.77pct, FTSE

+0.90pct.

Ed. Note: I am trying to make this publication more useful. Your feedback (good/bad) helps keep the motivation strong. What do

you want to see more of, what do you want to see less of in this publication. What time do you think we should be releasing this?

Any feedback, suggestions are welcome. If you think we're missing out on something, email me at the address In the header.

Thanks!

Notable Overnight Headlines

Asia

• Japan offers 2.6T Yen in 2Y JGB's with 0.20pct coupon (Reuters)

• EM ASIA DEBT-Spreads at 2-month low; more issuers seen (Reuters)

• China State Construction +6.1%; Strong Order Flow (DJ)

• PetroVietnam To Sell Bonds On International Mkt Later This Yr (DJ) – Refer to BP news for PV

• EM ASIA FX-Won hits 5-week peak; c.banks weigh on peso, baht (Reuters)

• The New Growth Engine, Borat: Kazakhstan's GDP grows 8.0 pct (Reuters)

• Kuwait April CPI +2.8 pct y/y (Reuters)

• Key 10-year JGB yield closes at 7-year low

• Taiwan June Leading Index Edges Down To 114.8 From 114.9 In May

• Singapore visitor arrivals up 26.7 pct in June (Reuters)

• Philippines May Manufacturing Value Up 18.7% On Year Vs. 24.5% Increase In April, May Imports Up 4.9% On Month Vs.

0.2% Fall In April

• China c.bank 1-year bill yield 2.0929 pct at sale (Reuters)

Europe

• ECB Allots EUR189.986B In Main Refinancing Tender At Fixed 1% (DJ)

• German June Import Prices Up 0.9% On Month, Consensus 0.6%

• UBS Q2 operating income of CHF9.19 billion, says it may see more subdued client activity, expects lower portfolio

management fee income (MW)

• Deutsche Bank Q2 pre-tax profit of 1.5 billion EUR (MW)

• Overnight deposits at ECB continue steady rise (Reuters)

• French 3-month To June Housing Starts Up 2.5%

• Turkey Ctrl Bk: 2010 Inflation Target Revised to 7.5% From 8.4% (DJ)

• Sweden June PPI Up 1.3% On Month, Consensus 0.2%, Sweden June M3 Money Supply Up 2% On Year Vs. 0.3% Increase In

May

• Dutch July business confidence down to -2.4 points

• Euro-zone June M3 sees 0.3% rise, private loans up (MW)

• Hungary ups 3-month T-bill offer, yield edges lower (Reuters)

• Moody's reviews Hungarian covered bonds for possible downgrade (Reuters)

• S. Africa Q2 Jobless Rate At 25.3% Vs. 25.2% In Q1

• U.K. July retail sales volumes jump: CBI (MW)

• Turkish 10-year bond yields 8.98 pct, above forecast (Reuters)

US Pre Open

Equities

• BP: PetroVietnam Mulls Buying Part Of BP Stake In Vietnam Gas Block (DJ), Tony Hayward calls it quits, gets sent to

Siberia - BP to sell up to $30 billion of assets (MW)

• YHOO/GOOG/MSFT -Yahoo Japan may adopt Google's search engine (Reuters)

Interesting Morning Reading

• Recovery Apartheid – Josh Brown “The Reformed Broker”:

http://www.thereformedbroker.com/2010/07/27/recovery-apartheid/

• Mid-Summer Predictions – Eli Radke: http://mytradingnet.com/blog/?p=520

Notable Bond Market/Economic Events

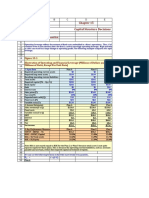

• Bond Auctions (1PM ET)

o 2Y Note

• Upcoming Bond Auctions (This Week)

o 7/28 – 5Y Note

o 7/29 – 7Y Note

• Economic Releases For Today

o 10AM – Consumer Confidence (June) – Consensus 51.3, SSA Estimate 49.9

o 10AM – Richmond Manufacturing Index – Cons. 14

o 9:30PM ET – Australian CPI – Cons. 1.0pct

o 11PM ET – Natl Bank Of NZ Business Confidence

Disclosure/Legal

The material contained in this document is informational only, and is not intended as an offer or a solicitation to buy or

sell any securities. The author is not acting as an advisor or fiduciary in any respect in connection with providing this

information and no information or material contained within this document is to be relied upon for the purpose of

making or communicating investment or other decisions nor construed as either projections or predictions. Investors

must make their own independent decisions regarding any securities, financial instruments or strategies mentioned

herein. Please contact your financial advisor to determine the suitability of the material contained herein to your

investment goals, objectives and risk criteria. The material contained in this document is intended for qualified investors

only. The person or persons involved in the preparation or issuance of the information contained in the material within

this document may deal as principal in any of the securities mentioned, and may have a long or short position in

(including possibly a position that was accumulated on the basis of the material prior to it being disseminated and/or a

position inconsistent with the information within this document), Accordingly, information included in or excluded from

this document is not independent from the proprietary interests of the author, which may conflict with your interests.

Certain transactions, including those involving futures, options, derivatives and high yield securities, give rise to

substantial risk and are not suitable for all investors. Foreign currency denominated securities are subject to fluctuations

in exchange rates that could have an adverse effect on the value or price of or income derived from any investments

discussed herein. Unless otherwise specifically stated, all statements contained within this document (including any

views, opinions or forecasts) are solely those of the individual(s) making the statement, as of the date indicated only,

and are subject to change without notice. Changes to assumptions made in the preparation of such materials may have

a material impact on returns. The author or authors does not undertake a duty to update these materials or to notify

you when or whether the analysis has changed. While the information contained within this document is believed to be

reliable, no representation or warranty, whether express or implied, is made and no liability or responsibility is accepted

by the author or affiliated parties as to the accuracy or completeness thereof.

Vous aimerez peut-être aussi

- FI Chartbook - 12/8/2010 (Data Up To 12/7)Document26 pagesFI Chartbook - 12/8/2010 (Data Up To 12/7)chibondkingPas encore d'évaluation

- US Bond Auction StatisticsDocument23 pagesUS Bond Auction StatisticschibondkingPas encore d'évaluation

- US Bond Auction Statistics - 11/29/2010Document21 pagesUS Bond Auction Statistics - 11/29/2010chibondkingPas encore d'évaluation

- US Bond Auction Statistics - December 2010Document27 pagesUS Bond Auction Statistics - December 2010chibondkingPas encore d'évaluation

- Fixed Income Chartbook: List of FiguresDocument9 pagesFixed Income Chartbook: List of FigureschibondkingPas encore d'évaluation

- US Bond Auction Statistics (As of 11/16/2010)Document21 pagesUS Bond Auction Statistics (As of 11/16/2010)chibondkingPas encore d'évaluation

- Breakfast With Dave 082310Document13 pagesBreakfast With Dave 082310chibondkingPas encore d'évaluation

- (Bank of America) Introduction To Cross Currency SwapsDocument6 pages(Bank of America) Introduction To Cross Currency Swapszerohedges100% (2)

- Swaps and Swaps Yield CurveDocument4 pagesSwaps and Swaps Yield Curvevineet_bmPas encore d'évaluation

- SSA End of Day - July 28 2010Document3 pagesSSA End of Day - July 28 2010chibondkingPas encore d'évaluation

- BAML NA Growth AnalysisDocument7 pagesBAML NA Growth AnalysischibondkingPas encore d'évaluation

- US Bond Auction Statistics - October 2010Document19 pagesUS Bond Auction Statistics - October 2010chibondkingPas encore d'évaluation

- SSA - STIRS Update - July 2010Document4 pagesSSA - STIRS Update - July 2010chibondkingPas encore d'évaluation

- Morning Call June 28 2010Document4 pagesMorning Call June 28 2010chibondkingPas encore d'évaluation

- Morning Call July 26 2010Document3 pagesMorning Call July 26 2010chibondkingPas encore d'évaluation

- Morning Call June 14 2010Document4 pagesMorning Call June 14 2010chibondking100% (1)

- Morning Call June 16 2010Document4 pagesMorning Call June 16 2010chibondkingPas encore d'évaluation

- Morning Call July 7 2010Document4 pagesMorning Call July 7 2010chibondkingPas encore d'évaluation

- Morning Call June 21 2010Document5 pagesMorning Call June 21 2010chibondkingPas encore d'évaluation

- Bear Stearns RMBS Residuals PrimerDocument48 pagesBear Stearns RMBS Residuals PrimerBrad Samples100% (1)

- Us Index Option Strategies - BNP ParibasDocument14 pagesUs Index Option Strategies - BNP Paribaschibondking100% (1)

- Morning Call June 17 2010Document5 pagesMorning Call June 17 2010chibondkingPas encore d'évaluation

- Morning Call - June 1 2010Document2 pagesMorning Call - June 1 2010chibondkingPas encore d'évaluation

- Morning Call - June 7 2010Document7 pagesMorning Call - June 7 2010chibondkingPas encore d'évaluation

- Morning Call - June 11 2010Document4 pagesMorning Call - June 11 2010chibondkingPas encore d'évaluation

- Morning Call - June 3 2010Document7 pagesMorning Call - June 3 2010chibondkingPas encore d'évaluation

- Statistical Summary - May 18 2010Document8 pagesStatistical Summary - May 18 2010chibondkingPas encore d'évaluation

- Morning Call - June 2 2010Document10 pagesMorning Call - June 2 2010chibondkingPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 04 Chapter 1Document26 pages04 Chapter 1Motiram paudelPas encore d'évaluation

- Pentalpha Brochure - The Trust Oversight Manager For Many Chase Securities Trusts.Document7 pagesPentalpha Brochure - The Trust Oversight Manager For Many Chase Securities Trusts.83jjmackPas encore d'évaluation

- Project Report On Working-CapitalDocument74 pagesProject Report On Working-Capitalravikant2105100% (1)

- Question On SFMDocument4 pagesQuestion On SFMjazzy123Pas encore d'évaluation

- Applying Value Drivers To Hotel ValuationDocument20 pagesApplying Value Drivers To Hotel ValuationErsan YildirimPas encore d'évaluation

- Chapter 15Document25 pagesChapter 15Mohamed MedPas encore d'évaluation

- China Strategy 2011Document178 pagesChina Strategy 2011Anees AisyahPas encore d'évaluation

- Syllabus CFA Level 2Document2 pagesSyllabus CFA Level 2Phi AnhPas encore d'évaluation

- Day Trading StrategiesDocument4 pagesDay Trading Strategiesthushantha50% (2)

- Ch15 Tool KitDocument20 pagesCh15 Tool KitNino Natradze100% (1)

- Stock BrokerDocument10 pagesStock BrokershubhdeepPas encore d'évaluation

- Top 52 Financial Analyst Interview Questions and AnswersDocument24 pagesTop 52 Financial Analyst Interview Questions and AnswersJerry TurtlePas encore d'évaluation

- Certified Valuation Analyst - CVA in Egypt by Developers For Training and ConsultancyDocument2 pagesCertified Valuation Analyst - CVA in Egypt by Developers For Training and ConsultancydevelopersegyptPas encore d'évaluation

- Paramount 93Document12 pagesParamount 93kevinfuryPas encore d'évaluation

- Assignment On SebiDocument17 pagesAssignment On SebiSUFIYAN SIDDIQUIPas encore d'évaluation

- Dwnload Full Corporate Financial Management 5th Edition Glen Arnold Test Bank PDFDocument35 pagesDwnload Full Corporate Financial Management 5th Edition Glen Arnold Test Bank PDFhofstadgypsyus100% (12)

- Energy InsuranceDocument8 pagesEnergy Insurancezoltan zavoczkyPas encore d'évaluation

- Business PlanDocument7 pagesBusiness Planapi-535920590Pas encore d'évaluation

- Financial Risk Manager - FRM in Egypt by Developers For Training and ConsultancyDocument3 pagesFinancial Risk Manager - FRM in Egypt by Developers For Training and ConsultancydevelopersegyptPas encore d'évaluation

- The Promise and Peril of Real OptionsDocument17 pagesThe Promise and Peril of Real OptionsAmit Kumar JainPas encore d'évaluation

- Exercises On Bond ValuationDocument3 pagesExercises On Bond Valuationkean leigh felicanoPas encore d'évaluation

- Mark Sellers - So You Want To Be The Next Warren Buffett MBA Talk (2007)Document6 pagesMark Sellers - So You Want To Be The Next Warren Buffett MBA Talk (2007)Denis100% (5)

- Effect of Age On Financial Decisions: Shruti MaheshwariDocument10 pagesEffect of Age On Financial Decisions: Shruti MaheshwariCristinaCrissPas encore d'évaluation

- Ibd Chartpatterns PDFDocument1 pageIbd Chartpatterns PDFmathaiyan,arun100% (1)

- Deutsche Bank Assets Management - Clinton Equity StrategiesDocument6 pagesDeutsche Bank Assets Management - Clinton Equity StrategiesBeverly TranPas encore d'évaluation

- CLS Gathers Momentum, Rao, CCILDocument6 pagesCLS Gathers Momentum, Rao, CCILShrishailamalikarjunPas encore d'évaluation

- Liberty - July 30 2019Document1 pageLiberty - July 30 2019Lisle Daverin BlythPas encore d'évaluation

- Introduction To Bangladesh Stock MarketDocument9 pagesIntroduction To Bangladesh Stock MarketSadman Shabab RatulPas encore d'évaluation

- Auditing Cash and Cash EquivalentsDocument11 pagesAuditing Cash and Cash EquivalentsJustine FloresPas encore d'évaluation

- Tutoring - BP SampleDocument29 pagesTutoring - BP SamplePro Business Plans100% (2)