Académique Documents

Professionnel Documents

Culture Documents

How to become a CPA member under the CPA-CPA Australia MRA

Transféré par

Mubbasher HassanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

How to become a CPA member under the CPA-CPA Australia MRA

Transféré par

Mubbasher HassanDroits d'auteur :

Formats disponibles

How to become

a CPA, CGA member

Under the Mutual Recognition Agreement

Eligibility

A CPA Australia member who wishes to become a member of the Canadian CPA profession must:

a) Be the holder of an accounting degree approved by CPA Australia and have successfully completed:

i. the CPA Program; and

ii. the Mentor Program; or

b) Be the holder of a non-accounting degree, and have successfully completed:

i. an appropriate accounting conversion course approved by CPA Australia;

ii. the CPA Program; and

iii. the Mentor Program, or

c) Be a Member of CPA Australia that does not fall under either paragraphs(a) or (b) but who has at least

fifteen (15) years work experience, at least five (5)years of which has been at a senior level, and has not:

joined CPA Australia through an MRA with another accounting body.

been the subject of a current investigation or referral to a hearing into your professional conduct; or

have been subject to any disciplinary sanctions within the five (5)years prior to your application.

Requirements

1. Complete the CPD course, Overview of Canadian Tax and Law. Transfer credit may be granted to

applicants who have completed an equivalent course from a Canadian post-secondary institution

approved by the CPA provincial/regional body or school. For information about a transfer credit,

contact the appropriate CPA provincial body.

2. Meet any other admission requirements as imposed by the provincial body or under law.

Application Process

Step 1: Download and complete the initial application form.

a) Offshore applicants and those residing in British Columbia, please download this form.

b) Residents of Canada please download this form.

Step 2: Contact CPA Australia and request a Letter of Good Standing.

Step 3: If you are applying for membership under the 15 years of experience provision, and have not been

awarded the FCPA designation, provide a copy of your resume clearly showing your work experience.

For CPA Australia members

Step 4: Submit the Initial Application Form, Letter of Good Standing and your resume (if required) directly

to the appropriate CPA provincial body.

CPA Australia members who live in Canada must apply through their respective CPA provincial body. To

learn more, click here.

CPA Australia members who live outside of Canadamust apply through CPA British Columbia at CGA-

BCInternationalInquiries@bccpa.ca

Step 5: Complete the CPD course, Overview of Canadian Tax and Law, and submit the certificate of completion.

Step 6: Once the above information has been submitted and approved by the provincial CPA body, you will

need to complete and submit an Application for Membership. Your application must include payment of the

Application for Membership fee and annual dues. When your application is approved, you will be notified of

your admission to membership and will have the right to use the CPA, CGA designation.

A dynamic federation

The CPA bodies are a dynamic federation of national, provincial and territorial organizations. CPA Canada

represents the interests of members nationally and internationally and, in agreement with the provincial

and territorial associations, sets national standards for education and professional conduct. The provincial/

territorial associations represent members provincially, grant the designation, and administer the national

member standards and student education program in their respective jurisdictions. Your provincial CPA body

grants the designation and administers member standards and student education outside of Canada.

Originating designation

Members admitted under the terms of this mutual recognition agreement (MRA) are required to maintain

their originating designation. This includes payment of annual dues and annual reporting of CPD. If, for any

reason, a member ceases to hold his or her originating designation, the member shall automatically cease to

be a member of the other body under this MRA.

Public practice requirements

Admission as a member under this MRA does not automatically provide a member with the right to work

in public practice. Members will be required to meet the provincial entry to public practice requirements in

their respective jurisdiction.

Vous aimerez peut-être aussi

- IC FAQ For ACCA Members FactsheetDocument3 pagesIC FAQ For ACCA Members FactsheetOmariPas encore d'évaluation

- Faqs For Acca Members: 1. What Is The Mra About? Does It Apply To Me?Document3 pagesFaqs For Acca Members: 1. What Is The Mra About? Does It Apply To Me?Dilawar HayatPas encore d'évaluation

- Faqs For Cpa and Acca Members: Mutual Recognition AgreementsDocument2 pagesFaqs For Cpa and Acca Members: Mutual Recognition AgreementsGavasker RamasamyPas encore d'évaluation

- Faqs For Cpa and Acca Members: Mutual Recognition AgreementsDocument2 pagesFaqs For Cpa and Acca Members: Mutual Recognition AgreementsKobby KatalistPas encore d'évaluation

- Faqs For Cpa and Acca Members: Mutual Recognition AgreementsDocument2 pagesFaqs For Cpa and Acca Members: Mutual Recognition AgreementsGangeshPas encore d'évaluation

- Cga Faq v6Document4 pagesCga Faq v6Jennifer BrennanPas encore d'évaluation

- IC - ACCA Member Application Process - ENDocument2 pagesIC - ACCA Member Application Process - ENGavasker RamasamyPas encore d'évaluation

- Certified General Accountants: Career Map For Internationally TrainedDocument16 pagesCertified General Accountants: Career Map For Internationally TrainedNaresh KumarPas encore d'évaluation

- RE-REGISTER ACCA/FIA QUALIFICATIONDocument4 pagesRE-REGISTER ACCA/FIA QUALIFICATIONYasir AliPas encore d'évaluation

- Registration of CASA With Other Professional BodiesDocument24 pagesRegistration of CASA With Other Professional BodiesTawanda NgowePas encore d'évaluation

- The Acca/Fia Qualification Re-Registration ApplicationDocument4 pagesThe Acca/Fia Qualification Re-Registration ApplicationMohammad Adil ChPas encore d'évaluation

- Reciprocity Policy Document MRADocument10 pagesReciprocity Policy Document MRAbwann77Pas encore d'évaluation

- International Skilled Worker - Occupation In-DemandDocument5 pagesInternational Skilled Worker - Occupation In-DemandFatima NacarPas encore d'évaluation

- IC FAQs For International Trained AccountantsDocument4 pagesIC FAQs For International Trained AccountantsPATRICIA GARCIAPas encore d'évaluation

- 2018 CAP Certification HandbookDocument28 pages2018 CAP Certification HandbookDELBOEL - Jennie100% (1)

- Membership Brochure: Zambia Institute of Chartered AccountantsDocument8 pagesMembership Brochure: Zambia Institute of Chartered AccountantsJeremiahPas encore d'évaluation

- Studying CA in Bangladesh - A Complete Guide (2020Document4 pagesStudying CA in Bangladesh - A Complete Guide (2020Shahrun NaharPas encore d'évaluation

- Registering As A CASA If You Are A Member of The BodiesDocument28 pagesRegistering As A CASA If You Are A Member of The BodiesNoel SteamerPas encore d'évaluation

- ACA CTA Joint Programme Brochure 2014Document4 pagesACA CTA Joint Programme Brochure 2014karlr9Pas encore d'évaluation

- International Skilled Worker - Saskatchewan Express EntryDocument5 pagesInternational Skilled Worker - Saskatchewan Express EntryFatima NacarPas encore d'évaluation

- ICAEW Training StepsDocument4 pagesICAEW Training StepsZaid AhmadPas encore d'évaluation

- Of Certified Management Accountant: Ractising The ProfessionDocument8 pagesOf Certified Management Accountant: Ractising The ProfessionTiago PereiraPas encore d'évaluation

- F5242 ICAS Student Handbook PDFDocument16 pagesF5242 ICAS Student Handbook PDFJohnyMacaroniPas encore d'évaluation

- ICAB Members Can Gain Global Recognition Through ICAEW, CIPFA, CPA Australia & CA ANZDocument3 pagesICAB Members Can Gain Global Recognition Through ICAEW, CIPFA, CPA Australia & CA ANZRumki SarkarPas encore d'évaluation

- Canadian ImmigrationDocument132 pagesCanadian ImmigrationCarol Evangeline EvangelistaPas encore d'évaluation

- Saskatchewan Experience Application Guide For Students Sub-CategoryDocument16 pagesSaskatchewan Experience Application Guide For Students Sub-CategoryAmoy Pixel NicholsonPas encore d'évaluation

- RM Reinstatement 2023 Extended2Document9 pagesRM Reinstatement 2023 Extended2naufalraffie1Pas encore d'évaluation

- ACCA Brochure (19 April 2010)Document2 pagesACCA Brochure (19 April 2010)mahabub376Pas encore d'évaluation

- Frequently Asked QuestionsDocument3 pagesFrequently Asked QuestionsmuhammadanasmustafaPas encore d'évaluation

- Guide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassDocument62 pagesGuide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassIgor GoesPas encore d'évaluation

- App Guide Intl Skilled Workers (OCT) PDFDocument26 pagesApp Guide Intl Skilled Workers (OCT) PDFAie B SerranoPas encore d'évaluation

- Apply permanent residence: Federal skilled worker programDocument62 pagesApply permanent residence: Federal skilled worker programsilantknife_1841Pas encore d'évaluation

- Membership PDFDocument11 pagesMembership PDFdeolah06Pas encore d'évaluation

- Guide to Saskatchewan's International Skilled Workers Immigration ProgramDocument26 pagesGuide to Saskatchewan's International Skilled Workers Immigration ProgramSwachhaPas encore d'évaluation

- RICS Fellowship Application GuideDocument7 pagesRICS Fellowship Application Guidedaveco1Pas encore d'évaluation

- Faqs For Cgas: Membership Application Form From This PageDocument2 pagesFaqs For Cgas: Membership Application Form From This PageShagufta KashifPas encore d'évaluation

- Uniform CPA Examination HandbookDocument30 pagesUniform CPA Examination HandbookHermione PotterPas encore d'évaluation

- SEE Guide (11-Sep-15)Document26 pagesSEE Guide (11-Sep-15)MitkoSrbakoskiPas encore d'évaluation

- Canada Visa Consultants in ChandigarhDocument10 pagesCanada Visa Consultants in Chandigarhakkam immigrationPas encore d'évaluation

- Foundations in Accountancy Re-Registration Application: Student PortalDocument4 pagesFoundations in Accountancy Re-Registration Application: Student PortalDavis KasitomuPas encore d'évaluation

- Application Guide For International Skilled Workers CategoryDocument28 pagesApplication Guide For International Skilled Workers CategoryRojan Alexei GranadoPas encore d'évaluation

- Guide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassDocument67 pagesGuide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassAvijit DasPas encore d'évaluation

- Appliction GuideDocument26 pagesAppliction GuideMANDEEPPas encore d'évaluation

- Appguide Skilled WorkersDocument18 pagesAppguide Skilled WorkersmahmadwasiPas encore d'évaluation

- Reduced Subscription 2016 v2Document1 pageReduced Subscription 2016 v2sunain_the_bestPas encore d'évaluation

- CPA Ontario Fellows Nomination FY22 SAMPLEDocument18 pagesCPA Ontario Fellows Nomination FY22 SAMPLEdrsaniwambaiPas encore d'évaluation

- Maintenance Bulletin Cpim Cfpim CSCP CLTDDocument7 pagesMaintenance Bulletin Cpim Cfpim CSCP CLTDdrmohamed120Pas encore d'évaluation

- Immigrate To CanadaDocument192 pagesImmigrate To Canadaletsgomets2100% (1)

- NSNP Community Stream GuideDocument19 pagesNSNP Community Stream Guidedeja980Pas encore d'évaluation

- The Professional Practice of Accounting: An Overview of the Profession, Regulations, and RequirementsDocument22 pagesThe Professional Practice of Accounting: An Overview of the Profession, Regulations, and RequirementsMiyangPas encore d'évaluation

- Member Guide0813Document4 pagesMember Guide0813shayanPas encore d'évaluation

- 4921 - Reduced Sub Application 2022 (Members) EXTENDEDDocument2 pages4921 - Reduced Sub Application 2022 (Members) EXTENDEDMurtaza LanewalaPas encore d'évaluation

- P3 Professional-Practice-Of-AccountancyDocument38 pagesP3 Professional-Practice-Of-AccountancyMa. Elene MagdaraogPas encore d'évaluation

- Pmi PDC CCR HandbookDocument11 pagesPmi PDC CCR Handbookdleon72Pas encore d'évaluation

- Canada Skilled Worker Visa Application Pack 9111ehDocument27 pagesCanada Skilled Worker Visa Application Pack 9111ehJames Ojegbemi100% (2)

- GRC 2023 Las Vegas - Terms and ConditionsDocument3 pagesGRC 2023 Las Vegas - Terms and ConditionsNew ComersPas encore d'évaluation

- Audit Assurance MidtermDocument8 pagesAudit Assurance MidtermMohammad Farhan SafwanPas encore d'évaluation

- BCPNP: Becoming PR in British ColumbiaD'EverandBCPNP: Becoming PR in British ColumbiaPas encore d'évaluation

- Work Permit: Types of Work Permits & Work Permit ExemptionsD'EverandWork Permit: Types of Work Permits & Work Permit ExemptionsPas encore d'évaluation

- TM 1Document1 pageTM 1Shoaib HasanPas encore d'évaluation

- Apply Materials Cover SheetDocument2 pagesApply Materials Cover SheetMubbasher HassanPas encore d'évaluation

- Guidelines For Filing Trademark Application in PakistanDocument7 pagesGuidelines For Filing Trademark Application in PakistanRadzxPas encore d'évaluation

- Giki Engineering Sample Paper 02Document14 pagesGiki Engineering Sample Paper 02Mubbasher HassanPas encore d'évaluation

- Guide to Money, Banking, and Financial TermsDocument15 pagesGuide to Money, Banking, and Financial TermsMubbasher HassanPas encore d'évaluation

- List of Centers 2017Document2 pagesList of Centers 2017Mubbasher HassanPas encore d'évaluation

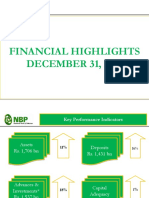

- Financial Highlights Dec 2015Document18 pagesFinancial Highlights Dec 2015Mubbasher HassanPas encore d'évaluation

- Auditing McqsDocument27 pagesAuditing McqsGhulam Abbas100% (5)

- 2014714137745127sales Act Government of Pakistan Updated Up To July 12014Document148 pages2014714137745127sales Act Government of Pakistan Updated Up To July 12014Junaid NaseemPas encore d'évaluation

- Guide For Practical Driving Test - Part-1 and Part-2Document18 pagesGuide For Practical Driving Test - Part-1 and Part-2computerjinPas encore d'évaluation

- AFS ModelDocument2 pagesAFS ModelMubbasher HassanPas encore d'évaluation

- EmiratesDocument8 pagesEmiratesMubbasher Hassan100% (1)

- Property Summary - Spring 2010Document95 pagesProperty Summary - Spring 2010Jayme AlterPas encore d'évaluation

- Demand Letter OutlineDocument2 pagesDemand Letter OutlinekhriskammPas encore d'évaluation

- City of Bacolod v. Phuture Visions Co., Inc.Document18 pagesCity of Bacolod v. Phuture Visions Co., Inc.Carlo FernandezPas encore d'évaluation

- Moritz V Universal Motion To Compel ArbitrationDocument20 pagesMoritz V Universal Motion To Compel ArbitrationTHROnline100% (1)

- Beneficial ConstructionDocument12 pagesBeneficial Constructionjisha shaji67% (3)

- Brand & TrademarkDocument9 pagesBrand & TrademarkIshita FarsaiyaPas encore d'évaluation

- Process of Trial Criminal ProcedureDocument3 pagesProcess of Trial Criminal ProcedureAniket PandeyPas encore d'évaluation

- Bomb Blast Case of 2005 - Victim Compensation - 001Document4 pagesBomb Blast Case of 2005 - Victim Compensation - 001New Delhi District Legal Services AuthorityPas encore d'évaluation

- TWW COVID 19 Business Closure OrderDocument2 pagesTWW COVID 19 Business Closure OrderGovernor Tom Wolf76% (42)

- The Ephialtic Reforms and Their Consequences.Document1 pageThe Ephialtic Reforms and Their Consequences.Lindsey FisherPas encore d'évaluation

- Code of Professional Responsibility and The Code of Judicial Conduct ReviewrerDocument29 pagesCode of Professional Responsibility and The Code of Judicial Conduct ReviewrerCholo MirandaPas encore d'évaluation

- Disney V SSI DCTDocument12 pagesDisney V SSI DCTpropertyintangiblePas encore d'évaluation

- Gumabon v. Larin: Motu Proprio Dismissal for Improper Venue Not AllowedDocument3 pagesGumabon v. Larin: Motu Proprio Dismissal for Improper Venue Not Allowedylessin100% (1)

- Bankruptcy Act of The Kingdom of Bhutan 1999 EnglishDocument28 pagesBankruptcy Act of The Kingdom of Bhutan 1999 EnglishTenzin LeewanPas encore d'évaluation

- Josselyn v. Powell, 1st Cir. (1993)Document13 pagesJosselyn v. Powell, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Wolf V Rickard Motion To DismissDocument45 pagesWolf V Rickard Motion To DismissTHROnline100% (1)

- Dubai Joint Special Power of AttorneyDocument1 pageDubai Joint Special Power of AttorneyJoseph TacderasPas encore d'évaluation

- Overview of Quezon City Jail CongestionDocument7 pagesOverview of Quezon City Jail Congestionjessieboy mikesellPas encore d'évaluation

- Codal Provisions Agency RevisedDocument6 pagesCodal Provisions Agency RevisedJeric P PaatanPas encore d'évaluation

- Business Law 3 Topic NotesDocument85 pagesBusiness Law 3 Topic Notesabel bernadPas encore d'évaluation

- 32 Esquillo V PeopleDocument2 pages32 Esquillo V PeopleKevin Juat Bulotano100% (1)

- De Borja v. Vda. de BorjaDocument1 pageDe Borja v. Vda. de Borjaviva_33100% (1)

- Non Disclosure Agreement Mutual Generic BlankDocument2 pagesNon Disclosure Agreement Mutual Generic BlankAmrita BajwaPas encore d'évaluation

- Contract Law Claimants WinDocument4 pagesContract Law Claimants WinMumtaz Begam Abdul KadirPas encore d'évaluation

- TruExpert Consultancy Inc Amends Articles of IncorporationDocument5 pagesTruExpert Consultancy Inc Amends Articles of Incorporationpargas100% (2)

- Philippines vs Rosemoor Mining License CancellationDocument2 pagesPhilippines vs Rosemoor Mining License CancellationloschudentPas encore d'évaluation

- ADR ReportDocument22 pagesADR Reportrenu tomarPas encore d'évaluation

- 30735-Article Text-90440-1-10-20200821Document30 pages30735-Article Text-90440-1-10-20200821kamran habibPas encore d'évaluation

- Berry v. The Great American Dream, Inc.Document11 pagesBerry v. The Great American Dream, Inc.eric_meyer8174Pas encore d'évaluation

- RA 9048 Form No. 1.2 Petition-correction-live-birth-EntryDocument3 pagesRA 9048 Form No. 1.2 Petition-correction-live-birth-EntryRasmia LaguindabPas encore d'évaluation