Académique Documents

Professionnel Documents

Culture Documents

Tax - MCIT

Transféré par

Ttlrpq0 évaluation0% ont trouvé ce document utile (0 vote)

156 vues3 pagesThe MCIT imposes a minimum 2% tax on the gross income of domestic corporations beginning in their 4th year of operations, if greater than the tax computed under Section 27(A). Any excess MCIT can be carried forward for 3 years. The Secretary of Finance may suspend the MCIT for corporations suffering losses due to labor disputes, force majeure, or legitimate business reverses. Gross income is defined as gross sales less returns, discounts, and cost of goods sold/services, which includes direct expenses to produce/provide goods/services.

Description originale:

MCIT

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe MCIT imposes a minimum 2% tax on the gross income of domestic corporations beginning in their 4th year of operations, if greater than the tax computed under Section 27(A). Any excess MCIT can be carried forward for 3 years. The Secretary of Finance may suspend the MCIT for corporations suffering losses due to labor disputes, force majeure, or legitimate business reverses. Gross income is defined as gross sales less returns, discounts, and cost of goods sold/services, which includes direct expenses to produce/provide goods/services.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

156 vues3 pagesTax - MCIT

Transféré par

TtlrpqThe MCIT imposes a minimum 2% tax on the gross income of domestic corporations beginning in their 4th year of operations, if greater than the tax computed under Section 27(A). Any excess MCIT can be carried forward for 3 years. The Secretary of Finance may suspend the MCIT for corporations suffering losses due to labor disputes, force majeure, or legitimate business reverses. Gross income is defined as gross sales less returns, discounts, and cost of goods sold/services, which includes direct expenses to produce/provide goods/services.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

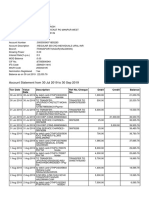

Minimum Corporate Income Tax or MCIT

(E) Minimum Corporate Income Tax on Domestic Corporations.

(1) Imposition of Tax. A minimum corporate income tax of two percent (2%)

of the gross income as of the end of the taxable year, as defned herein, is

hereby imposed on a corporation taxable under this Title, beginning on the

fourth taxable year immediately following the year in which such corporation

commenced its business operations, when the minimum income tax is

greater than the tax computed under Subsection (A) of this Section for the

taxable year.

(2) Carry Forward of Excess Minimum Tax . Any excess of the minimum

corporate income tax over the normal income tax as computed under

Subsection (A) of this Section shall be carried forward and credited against

the normal income tax for the three (3) immediately succeeding taxable

years.

(3) Relief from the Minimum Corporate Income Tax Under Certain Conditions .

The Secretary of Finance is hereby authorized to suspend the imposition of

the minimum corporate income tax on any corporation which suffers losses

on account of prolonged labor dispute, or because of force majeure, or

because of legitimate business reverses.

The Secretary of Finance is hereby authorized to promulgate, upon

recommendation of the Commissioner, the necessary rules and regulations

that shall defne the terms and conditions under which he may suspend the

imposition of the minimum corporate income tax in a meritorious case.

(4) Gross Income Defned . For purposes of applying the minimum

corporate income tax provided under Subsection (E) hereof, the term 'gross

income' shall mean gross sales less sales returns, discounts and allowances

and cost of goods sold. 'Cost of goods sold' shall include all business

expenses directly incurred to produce the merchandise to bring them to their

present location and use.

For a trading or merchandising concern, 'cost of goods sold' shall include the

invoice cost of the goods sold, plus import duties, freight in transporting the

goods to the place where the goods are actually sold including insurance

while the goods are in transit.

For a manufacturing concern, 'cost of goods manufactured and sold' shall

include all costs of production of fnished goods, such as raw materials used,

direct labor and manufacturing overhead, freight cost, insurance premiums

and other costs incurred to bring the raw materials to the factory or

warehouse.

In the case of taxpayers engaged in the sale of service, 'gross income' means

gross receipts less sales returns, allowances, discounts and cost of services.

'Cost of services' shall mean all direct costs and expenses necessarily

incurred to provide the services required by the customers and clients

including (A) salaries and employee benefts of personnel, consultants and

specialists directly rendering the service and

(B) cost of facilities directly utilized in providing the service such as

depreciation or rental of equipment used and cost of supplies: Provided,

however, That in the case of banks, 'cost of services' shall include interest

expense.

MCIT is as opposed to 27(A)

(A) In General. Except as otherwise provided in this Code, an income tax of thirty-

fve percent (35%) is hereby imposed upon the taxable income derived during each

taxable year from all sources within and without the Philippines by every

corporation, as defned in Section 22(B) of this Code and taxable under this Title as

a corporation, organized in, or existing under the laws of the Philippines: Provided,

That effective January 1, 1998, the rate of income tax shall be thirty-four percent

(34%); effective January 1, 1999, the rate shall be thirty-three percent (33%); and

effective January 1, 2000 and thereafter, the rate shall be thirty-two percent (32%).

In the case of corporations adopting the fscal-year accounting period, the taxable

income shall be computed without regard to the specifc date when specifc sales,

purchases and other transactions occur. Their income and expenses for the fscal

year shall be deemed to have been earned and spent equally for each month of the

period.

The reduced corporate income tax rates shall be applied on the amount computed

by multiplying the number of months covered by the new rates within the fscal

year by the taxable income of the corporation for the period, divided by twelve.

Provided, further, That the President, upon the recommendation of the Secretary of

Finance, may, effective January 1, 2000, allow corporations the option to be taxed at

ffteen percent (15%) of gross income as defned herein, after the following

conditions have been satisfed:

(1) A tax effort ratio of twenty percent (20%) of Gross National Product (GNP);

(2) A ratio of forty percent (40%) of income tax collection to total tax

revenues;

(3) A VAT tax effort of four percent (4%) of GNP; and

(4) A 0.9 percent (0.9%) ratio of the Consolidated Public Sector Financial

Position (CPSFP) to GNP.

The option to be taxed based on gross income shall be available only to frms whose

ratio of cost of sales to gross sales or receipts from all sources does not exceed ffty-

fve percent (55%).

The election of the gross income tax option by the corporation shall be irrevocable

for three (3) consecutive taxable years during which the corporation is qualifed

under the scheme.

For purposes of this Section, the term 'gross income' derived from business shall be

equivalent to gross sales less sales returns, discounts and allowances and cost of

goods sold. 'Cost of goods sold' shall include all business expenses directly incurred

to produce the merchandise to bring them to their present location and use.

For a trading or merchandising concern, 'cost of goods sold' shall include the invoice

cost of the goods sold, plus import duties, freight in transporting the goods to the

place where the goods are actually sold, including insurance while the goods are in

transit.

For a manufacturing concern, 'cost of goods manufactured and sold' shall include all

costs of production of fnished goods, such as raw materials used, direct labor and

manufacturing overhead, freight cost, insurance premiums and other costs incurred

to bring the raw materials to the factory or warehouse.

In the case of taxpayers engaged in the sale of service, 'gross income' means gross

receipts less sales returns, allowances and discounts.

Corporation, defned under Sec 22(B)

(B) The term 'corporation' shall include partnerships, no matter how created or

organized, joint-stock companies, joint accounts (cuentas en participacion),

associations, or insurance companies, but does not include general professional

partnerships and a joint venture or consortium formed for the purpose of

undertaking construction projects or engaging in petroleum, coal, geothermal and

other energy operations pursuant to an operating or consortium agreement under a

service contract with the Government. 'General professional partnerships' are

partnerships formed by persons for the sole purpose of exercising their common

profession, no part of the income of which is derived from engaging in any trade or

business.

Vous aimerez peut-être aussi

- Chase Sep V 2.9Document11 pagesChase Sep V 2.9faxev83733100% (1)

- New Balance $10,195.04 Minimum Payment Due $102.00 Payment Due Date 10/23/22Document11 pagesNew Balance $10,195.04 Minimum Payment Due $102.00 Payment Due Date 10/23/22Rahul SharmaPas encore d'évaluation

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- Power BinsDocument1 pagePower Binsrickymarts100% (2)

- RR 9-98Document5 pagesRR 9-98matinikkiPas encore d'évaluation

- Exclusive Commercial Leasing AuthorityDocument6 pagesExclusive Commercial Leasing AuthorityKatharina Sumantri0% (1)

- CREBA Vs Romulo DigestDocument20 pagesCREBA Vs Romulo DigestMigen SandicoPas encore d'évaluation

- Revenue Regulations 9-98Document5 pagesRevenue Regulations 9-98Kayzer SabaPas encore d'évaluation

- Check-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresDocument10 pagesCheck-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresAryan BishtPas encore d'évaluation

- Minimum Corporate Income TaxDocument76 pagesMinimum Corporate Income TaxFC Estoesta100% (1)

- Republic Act No 9337Document31 pagesRepublic Act No 9337Mie TotPas encore d'évaluation

- This Study Resource Was: Revenue Regulations No. 9-98Document6 pagesThis Study Resource Was: Revenue Regulations No. 9-98Cyruss Xavier Maronilla NepomucenoPas encore d'évaluation

- Statement of Account: NO 116 Kampung Gita Laut Jalan Pinang Jawa 3 93050 Kuching, SarawakDocument2 pagesStatement of Account: NO 116 Kampung Gita Laut Jalan Pinang Jawa 3 93050 Kuching, Sarawaksu shafinaPas encore d'évaluation

- Goods Sold' Shall Include The Invoice Cost of TheDocument9 pagesGoods Sold' Shall Include The Invoice Cost of TheChaze CerdenaPas encore d'évaluation

- Ra 9337Document34 pagesRa 9337Inayab AtienzaPas encore d'évaluation

- Tax On CorporationsDocument4 pagesTax On Corporationsdenise airaPas encore d'évaluation

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument35 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledKevin MatibagPas encore d'évaluation

- General Tax Liabilities of Domestic CorpsDocument5 pagesGeneral Tax Liabilities of Domestic CorpsCora EleazarPas encore d'évaluation

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument45 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledJo BatsPas encore d'évaluation

- Evat CaseDocument45 pagesEvat CaseJo BatsPas encore d'évaluation

- Tax DiscussionDocument10 pagesTax DiscussionMaisie ZabalaPas encore d'évaluation

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholPas encore d'évaluation

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholPas encore d'évaluation

- Today Is Friday, September 26, 2014Document13 pagesToday Is Friday, September 26, 2014annabanana07Pas encore d'évaluation

- Tax On ServiceDocument21 pagesTax On ServiceHazel-mae LabradaPas encore d'évaluation

- Ra 9337Document39 pagesRa 9337KcompacionPas encore d'évaluation

- CREBA v. Executive SecretaryDocument35 pagesCREBA v. Executive Secretarydes_4562Pas encore d'évaluation

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument26 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDeeterosePas encore d'évaluation

- Section 1. Section 27 of The National Internal Revenue Code of 1997, AsDocument55 pagesSection 1. Section 27 of The National Internal Revenue Code of 1997, AsVladimir Reyes100% (1)

- 22.-CREBA, Inc. v. Romulo, G.R No. 160756Document24 pages22.-CREBA, Inc. v. Romulo, G.R No. 160756Christine Rose Bonilla LikiganPas encore d'évaluation

- RR 9 98 PDFDocument7 pagesRR 9 98 PDFJoey Villas MaputiPas encore d'évaluation

- 164706-2010-Chamber of Real Estate and Builders20210505-11-1blgqsoDocument20 pages164706-2010-Chamber of Real Estate and Builders20210505-11-1blgqsoGina RothPas encore d'évaluation

- B Chamber of Real Estate Vs RomuloDocument23 pagesB Chamber of Real Estate Vs RomuloAr Yan SebPas encore d'évaluation

- 18 Chamber of Real Estate and Builders Association vs. Alberto RomuloDocument23 pages18 Chamber of Real Estate and Builders Association vs. Alberto RomuloAriel Conrad MalimasPas encore d'évaluation

- Chamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlDocument20 pagesChamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlMark Gabriel B. MarangaPas encore d'évaluation

- Ra 9337Document41 pagesRa 9337Arianne MarzanPas encore d'évaluation

- 09 Ra 9337 PDFDocument41 pages09 Ra 9337 PDFHonorio John P. ZingapanPas encore d'évaluation

- Petitioner Vs Vs Respondents: en BancDocument21 pagesPetitioner Vs Vs Respondents: en BancDaryl YuPas encore d'évaluation

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document28 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Abbey Agno PerezPas encore d'évaluation

- Tax On CorporationsDocument6 pagesTax On CorporationsJumen Gamaru TamayoPas encore d'évaluation

- 65 - (G.R. No. 160756. March 09, 2010)Document26 pages65 - (G.R. No. 160756. March 09, 2010)alda hobisPas encore d'évaluation

- Chamber vs. Romulo 614 SCRA 605 2010Document17 pagesChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroPas encore d'évaluation

- Tax Assigned CasesDocument21 pagesTax Assigned CasesPawi ProductionsPas encore d'évaluation

- Full Text Due Process ClauseDocument79 pagesFull Text Due Process ClauseAnonymous 2UPF2xPas encore d'évaluation

- Chamber of Real Estate and Builders' Association v. RomuloDocument19 pagesChamber of Real Estate and Builders' Association v. RomuloNxxxPas encore d'évaluation

- Misc Sections For Exams March 2022Document11 pagesMisc Sections For Exams March 2022Daniyal AhmedPas encore d'évaluation

- Title Ii Chapter IvDocument8 pagesTitle Ii Chapter IvMae CarpilaPas encore d'évaluation

- Tax Assigned CasesDocument21 pagesTax Assigned CasesDominic EmbodoPas encore d'évaluation

- Minimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Document48 pagesMinimum Corporate Income Tax (Mcit), Improperly Accumulated Earnings Tax (Iaet) and Gross Income Tax (Git)Andrea Renice S. FerriolPas encore d'évaluation

- 2.4 Tax On Income - Tax On CorporationsDocument15 pages2.4 Tax On Income - Tax On CorporationsfelixacctPas encore d'évaluation

- Notes in Tax On CorporationDocument7 pagesNotes in Tax On CorporationNinaPas encore d'évaluation

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoPas encore d'évaluation

- CREBA V RomuloDocument58 pagesCREBA V RomuloBuladasPukikiPas encore d'évaluation

- CREBA Vs RomuloDocument19 pagesCREBA Vs RomuloVincent OngPas encore d'évaluation

- Taxation CasesDocument296 pagesTaxation CasesshelPas encore d'évaluation

- 5 CREBA Vs RomuloDocument50 pages5 CREBA Vs RomuloYour Public ProfilePas encore d'évaluation

- Chamber of Real Estate and Builders' Association v. Romulo, SupraDocument18 pagesChamber of Real Estate and Builders' Association v. Romulo, SupraJMae MagatPas encore d'évaluation

- Lawphil: Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument31 pagesLawphil: Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledMarie Nickie BolosPas encore d'évaluation

- Tax On CorporationsDocument14 pagesTax On CorporationsPo EllaPas encore d'évaluation

- Chamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlDocument6 pagesChamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlMathew Beniga GacoPas encore d'évaluation

- Creba V Exec Sec RomuloDocument18 pagesCreba V Exec Sec RomuloAnonymous qVilmbaMPas encore d'évaluation

- F6 Tax RulesDocument2 pagesF6 Tax RulesLavneesh ShibduthPas encore d'évaluation

- GR 179115Document19 pagesGR 179115MelgenPas encore d'évaluation

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocument10 pagesCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaPas encore d'évaluation

- Court Law 2Document5 pagesCourt Law 2TtlrpqPas encore d'évaluation

- Creating. What The Hell Is This Blah BlahDocument4 pagesCreating. What The Hell Is This Blah BlahTtlrpqPas encore d'évaluation

- CreatedDocument4 pagesCreatedTtlrpqPas encore d'évaluation

- IcicleDocument5 pagesIcicleTtlrpqPas encore d'évaluation

- PubCorp - MicroDigests 08302017Document4 pagesPubCorp - MicroDigests 08302017TtlrpqPas encore d'évaluation

- Legal Forms - Agency ReviewerDocument4 pagesLegal Forms - Agency ReviewerTtlrpqPas encore d'évaluation

- Legal Forms - Week 4Document4 pagesLegal Forms - Week 4TtlrpqPas encore d'évaluation

- Labor Law I - Expanded Syllabus (Atty Quan)Document5 pagesLabor Law I - Expanded Syllabus (Atty Quan)TtlrpqPas encore d'évaluation

- MMDA v. Bel-AirDocument3 pagesMMDA v. Bel-AirTtlrpqPas encore d'évaluation

- Smart Comm v. AstorgaDocument2 pagesSmart Comm v. AstorgaTtlrpqPas encore d'évaluation

- Duplicate Upon Entry of New CertificateDocument5 pagesDuplicate Upon Entry of New CertificateTtlrpqPas encore d'évaluation

- MMDA v. Viron Transportation CoDocument3 pagesMMDA v. Viron Transportation CoTtlrpqPas encore d'évaluation

- Stock Incur, Create or Increase Bonded Indebtedness.Document29 pagesStock Incur, Create or Increase Bonded Indebtedness.TtlrpqPas encore d'évaluation

- Republic of The Philippines Congress of The Philippines Metro Manila Sixteenth Congress Third Regular SessionDocument21 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Sixteenth Congress Third Regular SessionTtlrpqPas encore d'évaluation

- LocGov - NewsDocument31 pagesLocGov - NewsTtlrpqPas encore d'évaluation

- Crimpro - May 20 2017Document2 pagesCrimpro - May 20 2017TtlrpqPas encore d'évaluation

- Crimrpo - May 20 - RevDocument9 pagesCrimrpo - May 20 - RevTtlrpqPas encore d'évaluation

- Llamado - Income Taxation - ExpandedDocument14 pagesLlamado - Income Taxation - ExpandedTtlrpq0% (1)

- Partnership - Chapter 3Document6 pagesPartnership - Chapter 3TtlrpqPas encore d'évaluation

- Qatar TINDocument6 pagesQatar TINphilip.lambert.za8793Pas encore d'évaluation

- East Penn Anticipated Budget Revenues 2023-2024Document14 pagesEast Penn Anticipated Budget Revenues 2023-2024Jay BradleyPas encore d'évaluation

- Chapter 8Document2 pagesChapter 8Kate AllaniguePas encore d'évaluation

- Rs. 113.7 Rs.38739.92 Rs.38821.43: Account Statement ForDocument3 pagesRs. 113.7 Rs.38739.92 Rs.38821.43: Account Statement Forirfan shamaPas encore d'évaluation

- Verifone User Guide: VX 820 and VX 680Document32 pagesVerifone User Guide: VX 820 and VX 680serradajaviPas encore d'évaluation

- Statement For Contract # 1034143520: Muhammad SaadDocument16 pagesStatement For Contract # 1034143520: Muhammad SaadSaad MalikPas encore d'évaluation

- Gentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipDocument1 pageGentjan Leshaj 59 Park Ridings London N8 0LB United Kingdom: Returns SlipnderimPas encore d'évaluation

- IND 13 CHP 14 8B Class Text HW Problems SolutionsDocument6 pagesIND 13 CHP 14 8B Class Text HW Problems SolutionsRespect InfinityPas encore d'évaluation

- Tax InvoiceDocument3 pagesTax Invoiceوصية الرحمنPas encore d'évaluation

- Agreement To Demolish/Remove and Reconstruct Improvement (Adri)Document4 pagesAgreement To Demolish/Remove and Reconstruct Improvement (Adri)PANGINOON LOVEPas encore d'évaluation

- MandateFormDocument2 pagesMandateFormNitin RautPas encore d'évaluation

- How Much Does It Really CostDocument2 pagesHow Much Does It Really Costapi-372302973Pas encore d'évaluation

- As485070 Dec2022 PayslipDocument2 pagesAs485070 Dec2022 PayslipAKM Enterprises Pvt LtdPas encore d'évaluation

- Vikram Singh Negi SBI Bank StatementDocument4 pagesVikram Singh Negi SBI Bank StatementArushi SinghPas encore d'évaluation

- Invoice - Sample - 13-03-2023Document1 pageInvoice - Sample - 13-03-2023Ahmad AliPas encore d'évaluation

- Month Taxes Withheld Adjustment Penalties: Name of Bank/Bank CodeDocument7 pagesMonth Taxes Withheld Adjustment Penalties: Name of Bank/Bank CodebayombongumcPas encore d'évaluation

- Answer Problem Chapter 6Document2 pagesAnswer Problem Chapter 6Phạm Minh TâmPas encore d'évaluation

- Ebook PDF Canadian Income Taxation 2018 2019 by William Buckwold PDFDocument41 pagesEbook PDF Canadian Income Taxation 2018 2019 by William Buckwold PDFdaniel.blakenship846100% (42)

- CBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Document16 pagesCBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Kuldeep JatPas encore d'évaluation

- Emo FormDocument2 pagesEmo FormKrishna Priya Rangubhotlu100% (2)

- Internet Bill - Feb 2022Document4 pagesInternet Bill - Feb 2022Mano MadhiPas encore d'évaluation

- E-Way Bill System-22110616-ERODE-DETAILEDDocument1 pageE-Way Bill System-22110616-ERODE-DETAILEDvragavhPas encore d'évaluation

- Credit Card Acquisition Offers Updated Latest Version - Aug - 2022 Updated V2Document6 pagesCredit Card Acquisition Offers Updated Latest Version - Aug - 2022 Updated V2knowmyitemsPas encore d'évaluation

- Ejemplo InvoiceDocument8 pagesEjemplo Invoiceagro88vdetPas encore d'évaluation