Académique Documents

Professionnel Documents

Culture Documents

Rajadhani Business School: Programme: MBA Trimester:3 (Noble) Paper Code: MBA 32 Academic Year: 2016-2017

Transféré par

Manoj Anand0 évaluation0% ont trouvé ce document utile (0 vote)

40 vues3 pagesThis document contains a lesson plan for a Principles and Practices of Management Concepts course. It outlines 18 lectures covering topics like financial management, risk and return, sources of finance, cost of capital, types of investment decisions, and capital budgeting techniques. The plan lists the lecture topics, methodology, required textbook and page numbers, scheduled date, and actual delivery date for each class. It also provides textbook and reference book details. The course runs from June 17, 2016 to January 2017.

Description originale:

Lesson Plan

Titre original

Lesson Plan Format

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document contains a lesson plan for a Principles and Practices of Management Concepts course. It outlines 18 lectures covering topics like financial management, risk and return, sources of finance, cost of capital, types of investment decisions, and capital budgeting techniques. The plan lists the lecture topics, methodology, required textbook and page numbers, scheduled date, and actual delivery date for each class. It also provides textbook and reference book details. The course runs from June 17, 2016 to January 2017.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

40 vues3 pagesRajadhani Business School: Programme: MBA Trimester:3 (Noble) Paper Code: MBA 32 Academic Year: 2016-2017

Transféré par

Manoj AnandThis document contains a lesson plan for a Principles and Practices of Management Concepts course. It outlines 18 lectures covering topics like financial management, risk and return, sources of finance, cost of capital, types of investment decisions, and capital budgeting techniques. The plan lists the lecture topics, methodology, required textbook and page numbers, scheduled date, and actual delivery date for each class. It also provides textbook and reference book details. The course runs from June 17, 2016 to January 2017.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

RAJADHANI BUSINESS SCHOOL

Lesson Plan for Principles and Practices of Management Concepts (PPMC)

Programme: MBA Trimester:3(Noble) Paper Code: MBA 32 Academic Year: 2016-2017

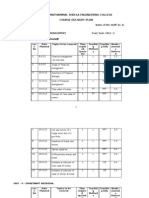

Lecture Details of the Topics/Sub-topics Methodology Book Date of Actual Date

No. to be covered (Page No.) Class as Per of Delivery

Schedule

Unit1:Introduction about Financial Lecture TB1.1-1.4 24-10-16 24-10-16

L1 Management, meaning, Objective,

Importance

Financial Goal- Profit maximizations, Lecture TB 1.5-1.11 26-10-16 27-10-16

L2 Wealth Maximizations-Financial

management Decisions area

Unit2:Risk and Return-Meaning- of Lecture TB 2.1-2.6 31-10-16 31-10-16

L3 risk-Risk associated areas-Money

value future value-Future cash flows

Simple interest- compound interest Lecture TB 2.7-2.12 3-11-16 3-11-16

L4 Problem

Risk- Meaning- types of Risk- Lecture TB 4.1-4.6 6-11-16 7-11-16

L5 Calculation of Risk and return Problem RB 101-110

Unit-3 Sources of Finance-When Lecture TB 4.8 10-11-16 10-11-16

L6 company needs finance- different

methods for raising funds- cost

associated for raising funds

Long term and Medium term funds- Lecture TB 20.1-20.15 12-11-16 14-11-16

L7 Equity shares- preference shares-

retained Earnings-Loans- Public

deposit-Debentures- Bond

Short term fundsPrimary market Lecture TB 20.16-20.27 24-11-16 24-11-16

L8 secondary market- different TB 20.34-20.35

methods for raising funds in

primary market and secondary

market

Unit-4 Cost of capital: Meaning of Lecture TB 16.1-16.10 2-12-16 1-12-16

L9 cost of Capital-Cost- Importance Problem

Application

Cost of Equity- application- Lecture TB 16.11-16.34 5-12-16 5-12-16

L10 computation of cost of capital Problem

Cost of debentures- tax application Lecture TB 16.01-16.10 8-12-16 14-12-16

L11 before and after tax Problem

Waited average cost of Capital- Lecture TB 16.17-16.19 13-12-16 16-12-16

L12 marginal cost of capital Problem

Unit-5 Types of investment Decision- Lecture TB 32.1-32.5 14-12-16 17-12-16

L13 Capital expenditure decisions-Capital Problem

budgeting process

Investment evaluation techniques- Lecture TB 32.44-32.49 17-12-16 19-12-16

L14 traditional Method and Modern Problem

methods

Payback period- Average rate of Lecture TB 32.44-32.49 19-12-16 19-12-16

L15 return method- profitability Index Problem

method-Discounted pay back period

Method

Net Present value method- Lecture TB 32.14-32.27 21-12-16 21-12-16

L16 Importance- Advantage and Problem RB 101-110

Disadvantage-IRR Method

L17 Capital rationing- Project selection Lecture TB 32.52- 32.53 21-1-17 22-1-17

under rationing Problem TB 32.44- 32.46

Capital Budgeting decision under risk Lecture TB 32.44-32.53 3-1-17 5-1-17

L18 Problem RB 111-136

DaL19te of Commencement of Classes: 17-06-2016

Text Book (TB):

1. Shashi k Gupta and Rk Sharma(2009) Financial Management Theory and practices, Kalyani Publishers,

Ludhina

Reference Books:

1. Rajni Sofat and preeti Hiro (2011), Strategic Financial Management, PHL Learning Private Limited, New

Delhi.

Faculty Member Academic Coordinator Head of the Department

Director

Vous aimerez peut-être aussi

- Management Accounting and Control - ACT 5002Document6 pagesManagement Accounting and Control - ACT 5002Apoorva SharmaPas encore d'évaluation

- ACT 5002 - REVISED Course OutlineDocument6 pagesACT 5002 - REVISED Course OutlinerizzzPas encore d'évaluation

- Creating Strategic Value through Financial TechnologyD'EverandCreating Strategic Value through Financial TechnologyPas encore d'évaluation

- Tyba Economics Syllabus Course OutcomesDocument20 pagesTyba Economics Syllabus Course OutcomesNikita NimbalkarPas encore d'évaluation

- Fiannce Accounting Efpm 2020 Outline PDFDocument6 pagesFiannce Accounting Efpm 2020 Outline PDFHarsh MaheshwariPas encore d'évaluation

- Course File - Financial ManagementDocument7 pagesCourse File - Financial ManagementMello JonesPas encore d'évaluation

- Mba ZC411 (HHSM) Course HandoutDocument8 pagesMba ZC411 (HHSM) Course HandoutKarthikPas encore d'évaluation

- CHO - Economics MBADocument5 pagesCHO - Economics MBASakshiPas encore d'évaluation

- HandoutDocument3 pagesHandoutHET DAVE DAVEPas encore d'évaluation

- Fin F212 1143Document2 pagesFin F212 1143bijesh9784Pas encore d'évaluation

- Sapm - Course HandoutsDocument5 pagesSapm - Course Handoutskaranjotsinghgrover89Pas encore d'évaluation

- Econ F211 1023Document3 pagesEcon F211 1023rohit BindPas encore d'évaluation

- Batch 22-24 - ACT 5001 - Financial Accounting - CODocument5 pagesBatch 22-24 - ACT 5001 - Financial Accounting - COadharsh veeraPas encore d'évaluation

- FINE3015 2122 - CourseOutline Sem1Document2 pagesFINE3015 2122 - CourseOutline Sem1Wang Hon YuenPas encore d'évaluation

- Mba ZC416 Course HandoutDocument12 pagesMba ZC416 Course HandoutSajid RehmanPas encore d'évaluation

- ACC501 AccountsDocument15 pagesACC501 AccountsSandip KumarPas encore d'évaluation

- FIN 201 - Introduction To Finance - Spring 2020 - JesminDocument5 pagesFIN 201 - Introduction To Finance - Spring 2020 - JesminRatul AhamedPas encore d'évaluation

- Econf421 SapmDocument3 pagesEconf421 SapmYash BhardwajPas encore d'évaluation

- PGDM SFM 2020 21 FinalDocument4 pagesPGDM SFM 2020 21 FinalLiya Mary VarghesePas encore d'évaluation

- RP Tip Print NewDocument15 pagesRP Tip Print NewshinjasidhuPas encore d'évaluation

- Bba Ist Sem DSCDocument5 pagesBba Ist Sem DSCAbhishek YadavPas encore d'évaluation

- T3 Financial Institutions and MarketsDocument5 pagesT3 Financial Institutions and MarketsHarshit AgarwalPas encore d'évaluation

- Mba ZC416 Course HandoutDocument12 pagesMba ZC416 Course HandoutareanPas encore d'évaluation

- Financial AccountingDocument4 pagesFinancial AccountingprachiPas encore d'évaluation

- Chapter 1Document25 pagesChapter 1ebrahimnejad64Pas encore d'évaluation

- Managerial Corporate Finance MM ZG627 4 R Sridhar: Digital Learning HandoutDocument7 pagesManagerial Corporate Finance MM ZG627 4 R Sridhar: Digital Learning HandoutBhuvana Sundar BagavathiPas encore d'évaluation

- New Course Outline-Macroeconomics 2022-2023Document8 pagesNew Course Outline-Macroeconomics 2022-2023isaacPas encore d'évaluation

- Accounting For ManagersDocument11 pagesAccounting For ManagersAfnan AhmedPas encore d'évaluation

- Accounting and Managerial DecisionsDocument2 pagesAccounting and Managerial DecisionsloganathanPas encore d'évaluation

- IntroductionDocument12 pagesIntroductionf20212615Pas encore d'évaluation

- Financial Accounting PrinciplesDocument11 pagesFinancial Accounting PrinciplesMohammad Faseeh ShakirPas encore d'évaluation

- Text-Book P1 Version 3Document399 pagesText-Book P1 Version 3Nat SuphattrachaiphisitPas encore d'évaluation

- ECON F212 FOFA - Course Handout - 2015-16-2Document2 pagesECON F212 FOFA - Course Handout - 2015-16-2Chanakya CherukumalliPas encore d'évaluation

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDocument2 pagesBirla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionAstitva AgnihotriPas encore d'évaluation

- MFMC0001: Business Environment and Management Practices: ObjectivesDocument16 pagesMFMC0001: Business Environment and Management Practices: ObjectivesIshan SharmaPas encore d'évaluation

- Managerial Economics Course Plan BBA LLB SEM1Document15 pagesManagerial Economics Course Plan BBA LLB SEM1Himani GuptaPas encore d'évaluation

- Financial Markets and Institutions Course Outline - SINDHUDocument4 pagesFinancial Markets and Institutions Course Outline - SINDHUNajia SiddiquiPas encore d'évaluation

- TCNH - B02041 - International Finance 150217Document17 pagesTCNH - B02041 - International Finance 150217Minh ChePas encore d'évaluation

- Course OutlineDocument4 pagesCourse Outlinetacamp daPas encore d'évaluation

- Course Outline Principle of Accounting BESE10 2K21 Final VersionDocument14 pagesCourse Outline Principle of Accounting BESE10 2K21 Final VersionHasan AhmedPas encore d'évaluation

- Syllabus For S.Y.Bcom Course: Semester: Iii: Jai Hind College AutonomousDocument17 pagesSyllabus For S.Y.Bcom Course: Semester: Iii: Jai Hind College AutonomousmukeshntPas encore d'évaluation

- Syllabus - ECO 152Document3 pagesSyllabus - ECO 152subhankar daPas encore d'évaluation

- Course Name: (Perakaunan Kewangan Pertengahan II)Document11 pagesCourse Name: (Perakaunan Kewangan Pertengahan II)Jeya VilvamalarPas encore d'évaluation

- MMB 704 Financial ManagementDocument3 pagesMMB 704 Financial ManagementTarun kumarPas encore d'évaluation

- Micro Economics Analysis - Ba LLB Sem 1 Course PlanDocument15 pagesMicro Economics Analysis - Ba LLB Sem 1 Course PlanHimani GuptaPas encore d'évaluation

- Financial ManagementDocument2 pagesFinancial ManagementSingh HarshPas encore d'évaluation

- Bba 1st Sem SyllabusDocument16 pagesBba 1st Sem SyllabusNavin Gehani100% (4)

- Course Outline-Autumn, FIN 201Document5 pagesCourse Outline-Autumn, FIN 201Shahinul KabirPas encore d'évaluation

- Course Delivery Plan - FMDocument7 pagesCourse Delivery Plan - FMAbdul KadharPas encore d'évaluation

- Postgraduate Department of Commerce SyllabusDocument34 pagesPostgraduate Department of Commerce SyllabusAKPas encore d'évaluation

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDocument4 pagesPost Graduate Diploma in Management: Narsee Monjee Institute of Management Studiesharendra choudharyPas encore d'évaluation

- Cost and Finance Management SyllabusDocument6 pagesCost and Finance Management SyllabusDondu HarishPas encore d'évaluation

- BBA Syllabus FinalDocument13 pagesBBA Syllabus FinalHimanshuPas encore d'évaluation

- EMBA-FA Course Outline - 2023 - Sec C DDocument3 pagesEMBA-FA Course Outline - 2023 - Sec C DgeorgeavadakkelPas encore d'évaluation

- Principles of Economics 5th Edition Mankiw Test BankDocument8 pagesPrinciples of Economics 5th Edition Mankiw Test BankNicholasEatonnjgf100% (45)

- ECO 5002 - Course OutlineDocument7 pagesECO 5002 - Course OutlinerizzzPas encore d'évaluation

- TCNH-B02030-Syllabus Business Finance 271216Document12 pagesTCNH-B02030-Syllabus Business Finance 271216Duy MinhPas encore d'évaluation

- Lesson Plan-EEFM - NEW FinalDocument5 pagesLesson Plan-EEFM - NEW FinaltanmayeePas encore d'évaluation

- Crompton Case1Document5 pagesCrompton Case1Manoj AnandPas encore d'évaluation

- Unit 1: Gains From International Capital FlowDocument16 pagesUnit 1: Gains From International Capital FlowManoj AnandPas encore d'évaluation

- Operations ManagementDocument1 pageOperations ManagementManoj AnandPas encore d'évaluation

- 1st Unit KTU OMgmtDocument67 pages1st Unit KTU OMgmtManoj AnandPas encore d'évaluation

- Indian Middle-Class OpportunitiesDocument12 pagesIndian Middle-Class OpportunitiesManoj AnandPas encore d'évaluation

- Crompton Case1Document5 pagesCrompton Case1Manoj AnandPas encore d'évaluation

- IEC StandardsDocument2 pagesIEC StandardsHammad Ali Zaman100% (1)

- What Is OdontoglypicsDocument1 pageWhat Is OdontoglypicsManoj AnandPas encore d'évaluation

- 46 KSDC Scientific Reg FormDocument2 pages46 KSDC Scientific Reg FormManoj AnandPas encore d'évaluation

- .Choice & Installation of Cables For Low Voltage Power SystemsDocument70 pages.Choice & Installation of Cables For Low Voltage Power SystemsManoj AnandPas encore d'évaluation

- Gland Plate Design InformationDocument1 pageGland Plate Design InformationManoj AnandPas encore d'évaluation

- Fertilizer Schedule For Fruit CropsDocument7 pagesFertilizer Schedule For Fruit CropsManoj AnandPas encore d'évaluation

- Ambica CatalogueDocument7 pagesAmbica CatalogueManoj AnandPas encore d'évaluation

- SP6 2Document191 pagesSP6 2RameshPas encore d'évaluation

- Photo Dynamic TherapyDocument1 pagePhoto Dynamic TherapyManoj AnandPas encore d'évaluation

- SP6-Steel Hand BookDocument209 pagesSP6-Steel Hand BookAmit87% (15)

- Financial Management in The Public SectorDocument216 pagesFinancial Management in The Public SectorRubens KöthPas encore d'évaluation

- Basic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingDocument107 pagesBasic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingKang JoonPas encore d'évaluation

- Assignment Fiscal Policy in The PhilippinesDocument16 pagesAssignment Fiscal Policy in The PhilippinesOliver SantosPas encore d'évaluation

- Question Bank of Financial and Management Accounting - 2 MarkDocument28 pagesQuestion Bank of Financial and Management Accounting - 2 MarklakkuMS100% (1)

- M&E Systems and The BudgetDocument8 pagesM&E Systems and The BudgetreginaxyPas encore d'évaluation

- KKKKKKKDocument59 pagesKKKKKKKNidhi PandeyPas encore d'évaluation

- HCA16ge IM CH06Document14 pagesHCA16ge IM CH06Ann MaPas encore d'évaluation

- Steve Ballmer Email To Microsoft EmployeesDocument2 pagesSteve Ballmer Email To Microsoft EmployeesFOXBusiness.comPas encore d'évaluation

- RSC FY 2020 BudgetDocument196 pagesRSC FY 2020 BudgetFedSmith Inc.Pas encore d'évaluation

- Budget PreparationDocument2 pagesBudget PreparationAAAAAPas encore d'évaluation

- HAAVELMO, T. (1944), Multiplier Effects of A Balanced BudgetDocument9 pagesHAAVELMO, T. (1944), Multiplier Effects of A Balanced BudgetRafaela SardinhaPas encore d'évaluation

- Features of Job Order CostingDocument3 pagesFeatures of Job Order Costingsiddhi1234pedPas encore d'évaluation

- How To Save MoneyDocument1 pageHow To Save MoneyAndrey DinPas encore d'évaluation

- Chapter 10 - Standard CostingDocument10 pagesChapter 10 - Standard CostingindahmuliasariPas encore d'évaluation

- Cost AccountingDocument54 pagesCost AccountingAlankar SharmaPas encore d'évaluation

- The German HGV-toll Bernhard WielandDocument11 pagesThe German HGV-toll Bernhard WielandAyoub AchPas encore d'évaluation

- Folster:Henrekson - Growth Effects of Government Expenditure and Taxation in Rich CountriesDocument20 pagesFolster:Henrekson - Growth Effects of Government Expenditure and Taxation in Rich Countriesjess_clements_2Pas encore d'évaluation

- SBN-818: Disposition of Proceeds of Value-Added Tax For Healthcare ModernizationDocument2 pagesSBN-818: Disposition of Proceeds of Value-Added Tax For Healthcare ModernizationRalph RectoPas encore d'évaluation

- Micro 5Document5 pagesMicro 5trinhanhkhoiPas encore d'évaluation

- IVI-IPO Niketopoulos-2 On 12-14-2014Document10 pagesIVI-IPO Niketopoulos-2 On 12-14-2014aldertrackPas encore d'évaluation

- Cost Accounting Level 3: LCCI International QualificationsDocument14 pagesCost Accounting Level 3: LCCI International QualificationsHein Linn Kyaw80% (5)

- Mazhar Hanan CVDocument3 pagesMazhar Hanan CVMazhar HananPas encore d'évaluation

- Essential NGO Guide - Chapter 3 - Start-UpDocument35 pagesEssential NGO Guide - Chapter 3 - Start-UpWedaje AlemayehuPas encore d'évaluation

- Sample 1 JVADocument4 pagesSample 1 JVALourdes Mae Acosta JangPas encore d'évaluation

- Gov Acctg Solman MillanDocument69 pagesGov Acctg Solman MillanMichael Brian Torres100% (2)

- Financialmanagement 1Document3 pagesFinancialmanagement 1Sujatha J Jayabal100% (1)

- KPMG Audit of Memorial Gardens' ProjectDocument20 pagesKPMG Audit of Memorial Gardens' ProjectNorthbaynuggetPas encore d'évaluation

- Rks GuidelinesDocument65 pagesRks GuidelinesMrprambaPas encore d'évaluation

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunPas encore d'évaluation

- Business Expense Reimbursements Under Accountable PlansDocument5 pagesBusiness Expense Reimbursements Under Accountable PlansnotumblerPas encore d'évaluation