Académique Documents

Professionnel Documents

Culture Documents

GGATTL16

Transféré par

Tyler DrummondTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

GGATTL16

Transféré par

Tyler DrummondDroits d'auteur :

Formats disponibles

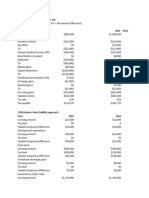

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C30 - Galveston City Number of Properties: 35122

Land Totals

Land - Homesite (+) $788,095,976

Land - Non Homesite (+) $852,713,940

Land - Ag Market (+) $39,609,127

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $1,680,419,043 (+) $1,680,419,043

Improvement Totals

Improvements - Homesite (+) $3,356,618,781

Improvements - Non Homesite (+) $2,946,041,433

Total Improvements (=) $6,302,660,214 (+) $6,302,660,214

Other Totals

Personal Property (2450) $518,626,013 (+) $518,626,013

Minerals (14) $1,586,322 (+) $1,586,322

Autos (0) $0 (+) $0

Total Market Value (=) $8,503,291,592 $8,503,291,592

Total Homestead Cap Adjustment (7040) (-) $267,509,406

Total Exempt Property (1420) (-) $1,917,485,780

Productivity Totals

Total Productivity Market (Non Exempt) (+) $39,609,127

Ag Use (289) (-) $188,758

Timber Use (0) (-) $0

Total Productivity Loss (=) $39,420,369 (-) $39,420,369

Total Assessed (=) $6,278,876,037

Exemptions (HS Assd 1,634,920,922 )

(HS) Homestead Local (9331) (+) $324,798,615

(HS) Homestead State (9331) (+) $0

(O65) Over 65 Local (4209) (+) $62,312,626

(O65) Over 65 State (4209) (+) $0

(DP) Disabled Persons Local (460) (+) $4,333,400

(DP) Disabled Persons State (460) (+) $0

(DV) Disabled Vet (174) (+) $1,853,090

(DVX/MAS) Disabled Vet 100% (79) (+) $11,740,270

(PRO) Prorated Exempt Property (46) (+) $837,398

(PC) Pollution Control (3) (+) $434,942

(HT) Historical (5) (+) $310,136

(FP) Freeport (6) (+) $12,668,390

(HB366) House Bill 366 (53) (+) $17,066

(FTZ) Foreign Trade Zone (1) (+) $9,231,829

Total Exemptions (=) $428,537,762 (-) $428,537,762

Net Taxable (Before Freeze) (=) $5,850,338,275

Printed on 03/20/2017 at 10:13 AM Page 1 of 65

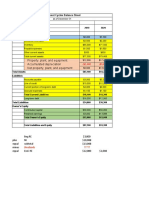

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $668,162,427

Freeze Taxable $474,669,829

Freeze Ceiling (3622) $1,939,041.64

**** O65 Transfer Totals

Transfer Assessed $3,265,355

Transfer Taxable $2,330,284

Post-Percent Taxable $2,038,854

Transfer Adjustment (18) $291,430

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $5,375,377,016

*** DP Freeze Totals

Freeze Assessed $44,435,341

Freeze Taxable $30,726,451

Freeze Ceiling (377) $120,263.53

*** DP Transfer Totals

Transfer Assessed $156,986

Transfer Taxable $115,589

Post-Percent Taxable $89,924

Transfer Adjustment (1) $25,665

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $5,344,624,899

Printed on 03/20/2017 at 10:13 AM Page 2 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C31 - Texas City Number of Properties: 23122

Land Totals

Land - Homesite (+) $187,260,590

Land - Non Homesite (+) $374,845,957

Land - Ag Market (+) $104,868,221

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $3,722,560

Total Land Market Value (=) $670,697,328 (+) $670,697,328

Improvement Totals

Improvements - Homesite (+) $1,077,311,565

Improvements - Non Homesite (+) $3,154,886,576

Total Improvements (=) $4,232,198,141 (+) $4,232,198,141

Other Totals

Personal Property (2123) $1,128,709,649 (+) $1,128,709,649

Minerals (202) $9,639,362 (+) $9,639,362

Autos (0) $0 (+) $0

Total Market Value (=) $6,041,244,480 $6,041,244,480

Total Homestead Cap Adjustment (3872) (-) $54,539,847

Total Exempt Property (1121) (-) $373,679,348

Productivity Totals

Total Productivity Market (Non Exempt) (+) $104,868,221

Ag Use (453) (-) $621,392

Timber Use (0) (-) $0

Total Productivity Loss (=) $104,246,829 (-) $104,246,829

Total Assessed (=) $5,508,778,456

Exemptions (HS Assd 909,597,046 )

(HS) Homestead Local (9161) (+) $179,628,097

(HS) Homestead State (9161) (+) $0

(O65) Over 65 Local (3503) (+) $68,296,630

(O65) Over 65 State (3503) (+) $0

(DP) Disabled Persons Local (667) (+) $6,411,536

(DP) Disabled Persons State (667) (+) $0

(DV) Disabled Vet (231) (+) $2,342,903

(DVX/MAS) Disabled Vet 100% (102) (+) $11,146,924

(PRO) Prorated Exempt Property (66) (+) $840,789

(PC) Pollution Control (20) (+) $318,504,511

(CHDO) CHDO (1) (+) $3,750,000

(HB366) House Bill 366 (29) (+) $6,354

(AB) Abatement (3) (+) $30,379,882

(FTZ) Foreign Trade Zone (2) (+) $118,907,212

Total Exemptions (=) $740,214,838 (-) $740,214,838

Net Taxable (Before Freeze) (=) $4,768,563,618

Printed on 03/20/2017 at 10:13 AM Page 3 of 65

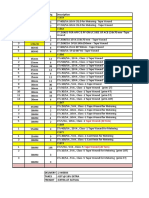

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $282,419,528

Freeze Taxable $161,002,009

Freeze Ceiling (3048) $653,778.75

**** O65 Transfer Totals

Transfer Assessed $1,217,370

Transfer Taxable $693,896

Post-Percent Taxable $295,977

Transfer Adjustment (14) $397,919

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $4,607,163,690

*** DP Freeze Totals

Freeze Assessed $44,207,162

Freeze Taxable $27,975,902

Freeze Ceiling (528) $119,548.50

*** DP Transfer Totals

Transfer Assessed $74,890

Transfer Taxable $49,912

Post-Percent Taxable $49,912

Transfer Adjustment (1) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $4,579,187,788

Printed on 03/20/2017 at 10:13 AM Page 4 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C32 - La Marque City Number of Properties: 9946

Land Totals

Land - Homesite (+) $79,657,441

Land - Non Homesite (+) $101,755,403

Land - Ag Market (+) $4,154,150

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $185,566,994 (+) $185,566,994

Improvement Totals

Improvements - Homesite (+) $486,151,117

Improvements - Non Homesite (+) $158,860,981

Total Improvements (=) $645,012,098 (+) $645,012,098

Other Totals

Personal Property (780) $103,335,965 (+) $103,335,965

Minerals (48) $1,074,328 (+) $1,074,328

Autos (0) $0 (+) $0

Total Market Value (=) $934,989,385 $934,989,385

Total Homestead Cap Adjustment (1580) (-) $21,445,153

Total Exempt Property (566) (-) $92,463,210

Productivity Totals

Total Productivity Market (Non Exempt) (+) $4,154,150

Ag Use (21) (-) $14,460

Timber Use (0) (-) $0

Total Productivity Loss (=) $4,139,690 (-) $4,139,690

Total Assessed (=) $816,941,332

Exemptions (HS Assd 395,313,371 )

(HS) Homestead Local (3869) (+) $0

(HS) Homestead State (3869) (+) $0

(O65) Over 65 Local (1355) (+) $26,123,035

(O65) Over 65 State (1355) (+) $0

(DP) Disabled Persons Local (274) (+) $2,604,340

(DP) Disabled Persons State (274) (+) $0

(DV) Disabled Vet (98) (+) $932,150

(DVX/MAS) Disabled Vet 100% (59) (+) $6,723,971

(PRO) Prorated Exempt Property (13) (+) $197,161

(PC) Pollution Control (1) (+) $3,840,000

(FP) Freeport (3) (+) $279,297

(HB366) House Bill 366 (60) (+) $12,262

Total Exemptions (=) $40,712,216 (-) $40,712,216

Net Taxable (Before Freeze) (=) $776,229,116

Printed on 03/20/2017 at 10:13 AM Page 5 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $97,458,535

Freeze Taxable $72,638,486

Freeze Ceiling (1103) $340,683.26

**** O65 Transfer Totals

Transfer Assessed $595,410

Transfer Taxable $535,410

Post-Percent Taxable $447,492

Transfer Adjustment (3) $87,918

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $703,502,712

*** DP Freeze Totals

Freeze Assessed $18,226,728

Freeze Taxable $15,017,083

Freeze Ceiling (220) $73,743.81

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $688,485,629

Printed on 03/20/2017 at 10:13 AM Page 6 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C33 - Hitchcock City Number of Properties: 6530

Land Totals

Land - Homesite (+) $63,670,590

Land - Non Homesite (+) $35,597,855

Land - Ag Market (+) $23,438,787

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $122,707,232 (+) $122,707,232

Improvement Totals

Improvements - Homesite (+) $223,135,075

Improvements - Non Homesite (+) $70,421,621

Total Improvements (=) $293,556,696 (+) $293,556,696

Other Totals

Personal Property (353) $40,442,843 (+) $40,442,843

Minerals (173) $1,971,785 (+) $1,971,785

Autos (0) $0 (+) $0

Total Market Value (=) $458,678,556 $458,678,556

Total Homestead Cap Adjustment (506) (-) $8,871,217

Total Exempt Property (302) (-) $38,450,747

Productivity Totals

Total Productivity Market (Non Exempt) (+) $23,438,787

Ag Use (415) (-) $1,749,600

Timber Use (0) (-) $0

Total Productivity Loss (=) $21,689,187 (-) $21,689,187

Total Assessed (=) $389,667,405

Exemptions (HS Assd 176,924,980 )

(HS) Homestead Local (1570) (+) $0

(HS) Homestead State (1570) (+) $0

(O65) Over 65 Local (565) (+) $19,764,936

(O65) Over 65 State (565) (+) $0

(DP) Disabled Persons Local (134) (+) $0

(DP) Disabled Persons State (134) (+) $0

(DV) Disabled Vet (43) (+) $424,960

(DVX/MAS) Disabled Vet 100% (15) (+) $1,377,132

(PRO) Prorated Exempt Property (4) (+) $113,978

(HB366) House Bill 366 (27) (+) $7,169

Total Exemptions (=) $21,688,175 (-) $21,688,175

Net Taxable (Before Freeze) (=) $367,979,230

Printed on 03/20/2017 at 10:13 AM Page 7 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $49,841,215

Freeze Taxable $31,431,219

Freeze Ceiling (499) $109,961.24

**** O65 Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $336,548,011

*** DP Freeze Totals

Freeze Assessed $9,089,578

Freeze Taxable $8,704,819

Freeze Ceiling (113) $35,085.99

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $327,843,192

Printed on 03/20/2017 at 10:13 AM Page 8 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C34 - Jamaica Beach City Number of Properties: 1642

Land Totals

Land - Homesite (+) $86,824,810

Land - Non Homesite (+) $50,964,890

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $137,789,700 (+) $137,789,700

Improvement Totals

Improvements - Homesite (+) $198,420,967

Improvements - Non Homesite (+) $54,686,523

Total Improvements (=) $253,107,490 (+) $253,107,490

Other Totals

Personal Property (61) $3,169,229 (+) $3,169,229

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $394,066,419 $394,066,419

Total Homestead Cap Adjustment (290) (-) $15,609,031

Total Exempt Property (59) (-) $3,266,770

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $375,190,618

Exemptions (HS Assd 86,178,753 )

(HS) Homestead Local (341) (+) $0

(HS) Homestead State (341) (+) $0

(O65) Over 65 Local (151) (+) $0

(O65) Over 65 State (151) (+) $0

(DP) Disabled Persons Local (14) (+) $0

(DP) Disabled Persons State (14) (+) $0

(DV) Disabled Vet (13) (+) $107,500

(DVX/MAS) Disabled Vet 100% (2) (+) $597,254

(HB366) House Bill 366 (5) (+) $721

Total Exemptions (=) $705,475 (-) $705,475

Net Taxable (Before Freeze) (=) $374,485,143

Printed on 03/20/2017 at 10:13 AM Page 9 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $34,780,222

Freeze Taxable $34,566,239

Freeze Ceiling (122) $66,120.83

**** O65 Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $339,918,904

*** DP Freeze Totals

Freeze Assessed $2,156,269

Freeze Taxable $1,743,998

Freeze Ceiling (10) $4,109.23

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $338,174,906

Printed on 03/20/2017 at 10:13 AM Page 10 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C36 - Dickinson City Number of Properties: 9036

Land Totals

Land - Homesite (+) $133,524,638

Land - Non Homesite (+) $65,219,765

Land - Ag Market (+) $6,254,140

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $204,998,543 (+) $204,998,543

Improvement Totals

Improvements - Homesite (+) $629,338,582

Improvements - Non Homesite (+) $147,048,344

Total Improvements (=) $776,386,926 (+) $776,386,926

Other Totals

Personal Property (603) $81,534,866 (+) $81,534,866

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $1,062,920,335 $1,062,920,335

Total Homestead Cap Adjustment (1251) (-) $20,780,331

Total Exempt Property (458) (-) $68,027,566

Productivity Totals

Total Productivity Market (Non Exempt) (+) $6,254,140

Ag Use (42) (-) $35,530

Timber Use (0) (-) $0

Total Productivity Loss (=) $6,218,610 (-) $6,218,610

Total Assessed (=) $967,893,828

Exemptions (HS Assd 598,203,137 )

(HS) Homestead Local (4348) (+) $0

(HS) Homestead State (4348) (+) $0

(O65) Over 65 Local (1423) (+) $13,860,839

(O65) Over 65 State (1423) (+) $0

(DP) Disabled Persons Local (206) (+) $1,931,740

(DP) Disabled Persons State (206) (+) $0

(DV) Disabled Vet (111) (+) $1,106,780

(DVX/MAS) Disabled Vet 100% (48) (+) $7,473,820

(PRO) Prorated Exempt Property (8) (+) $59,854

(PC) Pollution Control (1) (+) $600,514

(HB366) House Bill 366 (22) (+) $5,797

Total Exemptions (=) $25,039,344 (-) $25,039,344

Net Taxable (Before Freeze) (=) $942,854,484

Printed on 03/20/2017 at 10:13 AM Page 11 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $162,691,471

Freeze Taxable $147,711,302

Freeze Ceiling (1233) $518,429.42

**** O65 Transfer Totals

Transfer Assessed $895,250

Transfer Taxable $843,250

Post-Percent Taxable $747,106

Transfer Adjustment (4) $96,144

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $795,047,038

*** DP Freeze Totals

Freeze Assessed $18,749,373

Freeze Taxable $15,793,329

Freeze Ceiling (174) $57,975.52

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $779,253,709

Printed on 03/20/2017 at 10:13 AM Page 12 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C37 - Friendswood City Number of Properties: 12323

Land Totals

Land - Homesite (+) $519,932,711

Land - Non Homesite (+) $181,508,147

Land - Ag Market (+) $11,997,700

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $713,438,558 (+) $713,438,558

Improvement Totals

Improvements - Homesite (+) $2,396,463,512

Improvements - Non Homesite (+) $186,833,454

Total Improvements (=) $2,583,296,966 (+) $2,583,296,966

Other Totals

Personal Property (962) $81,635,913 (+) $81,635,913

Minerals (88) $1,968,272 (+) $1,968,272

Autos (0) $0 (+) $0

Total Market Value (=) $3,380,339,709 $3,380,339,709

Total Homestead Cap Adjustment (4371) (-) $113,413,528

Total Exempt Property (568) (-) $123,546,460

Productivity Totals

Total Productivity Market (Non Exempt) (+) $11,997,700

Ag Use (39) (-) $62,790

Timber Use (0) (-) $0

Total Productivity Loss (=) $11,934,910 (-) $11,934,910

Total Assessed (=) $3,131,444,811

Exemptions (HS Assd 2,509,125,624 )

(HS) Homestead Local (8104) (+) $499,571,531

(HS) Homestead State (8104) (+) $0

(O65) Over 65 Local (2200) (+) $54,268,331

(O65) Over 65 State (2200) (+) $0

(DP) Disabled Persons Local (116) (+) $2,646,950

(DP) Disabled Persons State (116) (+) $0

(DV) Disabled Vet (143) (+) $1,396,500

(DVX/MAS) Disabled Vet 100% (48) (+) $11,861,556

(PRO) Prorated Exempt Property (3) (+) $6,261,144

(HB366) House Bill 366 (55) (+) $14,390

Total Exemptions (=) $576,020,402 (-) $576,020,402

Net Taxable (Before Freeze) (=) $2,555,424,409

Printed on 03/20/2017 at 10:13 AM Page 13 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $486,563,406

Freeze Taxable $338,913,718

Freeze Ceiling (1873) $1,642,205.96

**** O65 Transfer Totals

Transfer Assessed $1,159,690

Transfer Taxable $827,752

Post-Percent Taxable $728,336

Transfer Adjustment (4) $99,416

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,216,411,275

*** DP Freeze Totals

Freeze Assessed $23,147,476

Freeze Taxable $15,635,357

Freeze Ceiling (101) $82,139.19

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $2,200,775,918

Printed on 03/20/2017 at 10:13 AM Page 14 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C38 - City Of Kemah Number of Properties: 1723

Land Totals

Land - Homesite (+) $40,128,430

Land - Non Homesite (+) $62,958,415

Land - Ag Market (+) $524,590

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $103,611,435 (+) $103,611,435

Improvement Totals

Improvements - Homesite (+) $108,995,630

Improvements - Non Homesite (+) $78,485,014

Total Improvements (=) $187,480,644 (+) $187,480,644

Other Totals

Personal Property (435) $38,609,599 (+) $38,609,599

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $329,701,678 $329,701,678

Total Homestead Cap Adjustment (125) (-) $5,188,379

Total Exempt Property (70) (-) $12,121,784

Productivity Totals

Total Productivity Market (Non Exempt) (+) $524,590

Ag Use (1) (-) $360

Timber Use (0) (-) $0

Total Productivity Loss (=) $524,230 (-) $524,230

Total Assessed (=) $311,867,285

Exemptions (HS Assd 93,224,086 )

(HS) Homestead Local (451) (+) $16,499,184

(HS) Homestead State (451) (+) $0

(O65) Over 65 Local (138) (+) $18,287,431

(O65) Over 65 State (138) (+) $0

(DP) Disabled Persons Local (13) (+) $1,490,141

(DP) Disabled Persons State (13) (+) $0

(DV) Disabled Vet (7) (+) $77,000

(DVX/MAS) Disabled Vet 100% (3) (+) $300,790

(PRO) Prorated Exempt Property (3) (+) $719,375

(FP) Freeport (2) (+) $294,587

(HB366) House Bill 366 (27) (+) $6,399

Total Exemptions (=) $37,674,907 (-) $37,674,907

Net Taxable (Before Freeze) (=) $274,192,378

Printed on 03/20/2017 at 10:13 AM Page 15 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C40 - League City Number of Properties: 40656

Land Totals

Land - Homesite (+) $1,230,354,199

Land - Non Homesite (+) $665,812,896

Land - Ag Market (+) $60,999,190

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $1,957,166,285 (+) $1,957,166,285

Improvement Totals

Improvements - Homesite (+) $5,446,302,483

Improvements - Non Homesite (+) $1,209,182,538

Total Improvements (=) $6,655,485,021 (+) $6,655,485,021

Other Totals

Personal Property (2807) $519,685,206 (+) $519,685,206

Minerals (1) $10,386 (+) $10,386

Autos (0) $0 (+) $0

Total Market Value (=) $9,132,346,898 $9,132,346,898

Total Homestead Cap Adjustment (5984) (-) $82,895,570

Total Exempt Property (1255) (-) $559,634,138

Productivity Totals

Total Productivity Market (Non Exempt) (+) $60,999,190

Ag Use (168) (-) $820,799

Timber Use (0) (-) $0

Total Productivity Loss (=) $60,178,391 (-) $60,178,391

Total Assessed (=) $8,429,638,799

Exemptions (HS Assd 5,588,320,556 )

(HS) Homestead Local (24784) (+) $1,108,051,278

(HS) Homestead State (24784) (+) $0

(O65) Over 65 Local (5073) (+) $221,786,085

(O65) Over 65 State (5073) (+) $0

(DP) Disabled Persons Local (537) (+) $22,166,813

(DP) Disabled Persons State (537) (+) $0

(DV) Disabled Vet (580) (+) $5,636,000

(DVX/MAS) Disabled Vet 100% (252) (+) $50,241,524

(PRO) Prorated Exempt Property (24) (+) $1,766,470

(PC) Pollution Control (1) (+) $14,561

(FP) Freeport (6) (+) $32,877,037

(HB366) House Bill 366 (48) (+) $13,858

Total Exemptions (=) $1,442,553,626 (-) $1,442,553,626

Net Taxable (Before Freeze) (=) $6,987,085,173

Printed on 03/20/2017 at 10:13 AM Page 16 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $798,595,893

Freeze Taxable $460,024,626

Freeze Ceiling (3774) $2,760,681.10

**** O65 Transfer Totals

Transfer Assessed $3,222,590

Transfer Taxable $1,822,132

Post-Percent Taxable $1,773,294

Transfer Adjustment (13) $48,838

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $6,527,011,709

*** DP Freeze Totals

Freeze Assessed $77,077,127

Freeze Taxable $40,372,256

Freeze Ceiling (408) $255,803.73

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $6,486,639,453

Printed on 03/20/2017 at 10:13 AM Page 17 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C46 - Clear Lake Shores Number of Properties: 1668

Land Totals

Land - Homesite (+) $28,758,295

Land - Non Homesite (+) $26,414,018

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $55,172,313 (+) $55,172,313

Improvement Totals

Improvements - Homesite (+) $113,199,186

Improvements - Non Homesite (+) $27,121,226

Total Improvements (=) $140,320,412 (+) $140,320,412

Other Totals

Personal Property (171) $15,008,044 (+) $15,008,044

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $210,500,769 $210,500,769

Total Homestead Cap Adjustment (66) (-) $1,925,765

Total Exempt Property (210) (-) $5,133,710

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $203,441,294

Exemptions (HS Assd 111,793,443 )

(HS) Homestead Local (377) (+) $22,105,044

(HS) Homestead State (377) (+) $0

(O65) Over 65 Local (134) (+) $13,044,829

(O65) Over 65 State (134) (+) $0

(DP) Disabled Persons Local (12) (+) $1,049,890

(DP) Disabled Persons State (12) (+) $0

(DV) Disabled Vet (4) (+) $41,500

(DVX/MAS) Disabled Vet 100% (1) (+) $222,858

(HB366) House Bill 366 (14) (+) $2,818

Total Exemptions (=) $36,466,939 (-) $36,466,939

Net Taxable (Before Freeze) (=) $166,974,355

Printed on 03/20/2017 at 10:13 AM Page 18 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $20,771,108

Freeze Taxable $9,932,187

Freeze Ceiling (68) $11,195.01

**** O65 Transfer Totals

Transfer Assessed $360,000

Transfer Taxable $188,000

Post-Percent Taxable $0

Transfer Adjustment (1) $188,000

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $156,854,168

*** DP Freeze Totals

Freeze Assessed $1,119,760

Freeze Taxable $595,808

Freeze Ceiling (4) $309.66

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $156,258,360

Printed on 03/20/2017 at 10:13 AM Page 19 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C54 - City Of Santa Fe Number of Properties: 7372

Land Totals

Land - Homesite (+) $125,776,909

Land - Non Homesite (+) $47,015,410

Land - Ag Market (+) $18,394,860

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $191,187,179 (+) $191,187,179

Improvement Totals

Improvements - Homesite (+) $580,990,938

Improvements - Non Homesite (+) $114,112,216

Total Improvements (=) $695,103,154 (+) $695,103,154

Other Totals

Personal Property (513) $36,438,408 (+) $36,438,408

Minerals (183) $352,954 (+) $352,954

Autos (0) $0 (+) $0

Total Market Value (=) $923,081,695 $923,081,695

Total Homestead Cap Adjustment (2450) (-) $58,454,521

Total Exempt Property (417) (-) $81,993,596

Productivity Totals

Total Productivity Market (Non Exempt) (+) $18,394,860

Ag Use (240) (-) $161,590

Timber Use (0) (-) $0

Total Productivity Loss (=) $18,233,270 (-) $18,233,270

Total Assessed (=) $764,400,308

Exemptions (HS Assd 540,557,705 )

(HS) Homestead Local (3479) (+) $0

(HS) Homestead State (3479) (+) $0

(O65) Over 65 Local (1193) (+) $17,184,332

(O65) Over 65 State (1193) (+) $0

(DP) Disabled Persons Local (218) (+) $3,033,450

(DP) Disabled Persons State (218) (+) $0

(DV) Disabled Vet (81) (+) $831,220

(DVX/MAS) Disabled Vet 100% (48) (+) $7,007,879

(PRO) Prorated Exempt Property (2) (+) $8,575

(FP) Freeport (1) (+) $8,333

(HB366) House Bill 366 (77) (+) $18,047

Total Exemptions (=) $28,091,836 (-) $28,091,836

Net Taxable (Before Freeze) (=) $736,308,472

Printed on 03/20/2017 at 10:13 AM Page 20 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $135,138,107

Freeze Taxable $117,430,492

Freeze Ceiling (953) $265,080.62

**** O65 Transfer Totals

Transfer Assessed $244,030

Transfer Taxable $214,030

Post-Percent Taxable $191,503

Transfer Adjustment (2) $22,527

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $618,855,453

*** DP Freeze Totals

Freeze Assessed $21,262,815

Freeze Taxable $17,756,969

Freeze Ceiling (157) $39,513.82

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $601,098,484

Printed on 03/20/2017 at 10:13 AM Page 21 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C56 - Village Of Tiki Number of Properties: 1327

Land Totals

Land - Homesite (+) $117,393,166

Land - Non Homesite (+) $18,015,118

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $135,408,284 (+) $135,408,284

Improvement Totals

Improvements - Homesite (+) $313,206,811

Improvements - Non Homesite (+) $3,446,680

Total Improvements (=) $316,653,491 (+) $316,653,491

Other Totals

Personal Property (46) $1,965,446 (+) $1,965,446

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $454,027,221 $454,027,221

Total Homestead Cap Adjustment (169) (-) $5,918,865

Total Exempt Property (17) (-) $764,720

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $447,343,636

Exemptions (HS Assd 208,234,944 )

(HS) Homestead Local (464) (+) $41,396,579

(HS) Homestead State (464) (+) $0

(O65) Over 65 Local (212) (+) $2,080,000

(O65) Over 65 State (212) (+) $0

(DP) Disabled Persons Local (10) (+) $100,000

(DP) Disabled Persons State (10) (+) $0

(DV) Disabled Vet (5) (+) $46,000

(DVX/MAS) Disabled Vet 100% (4) (+) $1,252,034

(HB366) House Bill 366 (7) (+) $1,376

Total Exemptions (=) $44,875,989 (-) $44,875,989

Net Taxable (Before Freeze) (=) $402,467,647

Printed on 03/20/2017 at 10:13 AM Page 22 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $76,168,862

Freeze Taxable $58,222,465

Freeze Ceiling (171) $102,322.86

**** O65 Transfer Totals

Transfer Assessed $801,900

Transfer Taxable $621,520

Post-Percent Taxable $310,674

Transfer Adjustment (2) $310,846

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $343,934,336

*** DP Freeze Totals

Freeze Assessed $3,623,840

Freeze Taxable $2,809,072

Freeze Ceiling (9) $5,249.25

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $341,125,264

Printed on 03/20/2017 at 10:13 AM Page 23 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

C58 - City Of Bayou Vista Number of Properties: 1317

Land Totals

Land - Homesite (+) $69,428,070

Land - Non Homesite (+) $5,332,840

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $74,760,910 (+) $74,760,910

Improvement Totals

Improvements - Homesite (+) $144,507,870

Improvements - Non Homesite (+) $3,000,120

Total Improvements (=) $147,507,990 (+) $147,507,990

Other Totals

Personal Property (50) $2,277,742 (+) $2,277,742

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $224,546,642 $224,546,642

Total Homestead Cap Adjustment (156) (-) $2,507,664

Total Exempt Property (24) (-) $2,552,580

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $219,486,398

Exemptions (HS Assd 139,910,591 )

(HS) Homestead Local (682) (+) $27,720,516

(HS) Homestead State (682) (+) $0

(O65) Over 65 Local (286) (+) $2,820,000

(O65) Over 65 State (286) (+) $0

(DP) Disabled Persons Local (28) (+) $270,000

(DP) Disabled Persons State (28) (+) $0

(DV) Disabled Vet (15) (+) $152,540

(DVX/MAS) Disabled Vet 100% (7) (+) $1,329,718

(HB366) House Bill 366 (12) (+) $2,925

Total Exemptions (=) $32,295,699 (-) $32,295,699

Net Taxable (Before Freeze) (=) $187,190,699

Printed on 03/20/2017 at 10:13 AM Page 24 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $47,319,748

Freeze Taxable $35,149,877

Freeze Ceiling (234) $98,366.33

**** O65 Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $152,040,822

*** DP Freeze Totals

Freeze Assessed $5,515,790

Freeze Taxable $4,162,632

Freeze Ceiling (25) $11,163.21

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $147,878,190

Printed on 03/20/2017 at 10:13 AM Page 25 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

D01 - Drainage #1 Number of Properties: 16379

Land Totals

Land - Homesite (+) $276,176,820

Land - Non Homesite (+) $166,542,860

Land - Ag Market (+) $110,920,253

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $553,639,933 (+) $553,639,933

Improvement Totals

Improvements - Homesite (+) $1,246,683,858

Improvements - Non Homesite (+) $308,663,801

Total Improvements (=) $1,555,347,659 (+) $1,555,347,659

Other Totals

Personal Property (1029) $102,406,689 (+) $102,406,689

Minerals (319) $7,316,349 (+) $7,316,349

Autos (0) $0 (+) $0

Total Market Value (=) $2,218,710,630 $2,218,710,630

Total Homestead Cap Adjustment (4546) (-) $99,524,694

Total Exempt Property (832) (-) $168,354,846

Productivity Totals

Total Productivity Market (Non Exempt) (+) $110,920,253

Ag Use (1011) (-) $1,428,532

Timber Use (0) (-) $0

Total Productivity Loss (=) $109,491,721 (-) $109,491,721

Total Assessed (=) $1,841,339,369

Exemptions (HS Assd 1,183,872,309 )

(HS) Homestead Local (7577) (+) $0

(HS) Homestead State (7577) (+) $0

(O65) Over 65 Local (2382) (+) $45,475,337

(O65) Over 65 State (2382) (+) $0

(DP) Disabled Persons Local (456) (+) $8,335,680

(DP) Disabled Persons State (456) (+) $0

(DV) Disabled Vet (169) (+) $1,713,580

(DVX/MAS) Disabled Vet 100% (93) (+) $14,267,400

(PRO) Prorated Exempt Property (4) (+) $11,102

(PC) Pollution Control (1) (+) $71,390

(FP) Freeport (1) (+) $8,333

(HB366) House Bill 366 (30) (+) $7,377

Total Exemptions (=) $69,890,199 (-) $69,890,199

Net Taxable (Before Freeze) (=) $1,771,449,170

Printed on 03/20/2017 at 10:13 AM Page 26 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

D02 - Drainage #2 Number of Properties: 16593

Land Totals

Land - Homesite (+) $125,815,697

Land - Non Homesite (+) $169,764,430

Land - Ag Market (+) $44,711,473

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $340,291,600 (+) $340,291,600

Improvement Totals

Improvements - Homesite (+) $770,077,799

Improvements - Non Homesite (+) $540,908,227

Total Improvements (=) $1,310,986,026 (+) $1,310,986,026

Other Totals

Personal Property (1261) $198,725,179 (+) $198,725,179

Minerals (143) $2,384,398 (+) $2,384,398

Autos (0) $0 (+) $0

Total Market Value (=) $1,852,387,203 $1,852,387,203

Total Homestead Cap Adjustment (2579) (-) $37,092,090

Total Exempt Property (854) (-) $162,248,589

Productivity Totals

Total Productivity Market (Non Exempt) (+) $44,711,473

Ag Use (288) (-) $261,860

Timber Use (0) (-) $0

Total Productivity Loss (=) $44,449,613 (-) $44,449,613

Total Assessed (=) $1,608,596,911

Exemptions (HS Assd 628,980,114 )

(HS) Homestead Local (6659) (+) $0

(HS) Homestead State (6659) (+) $0

(O65) Over 65 Local (2579) (+) $62,263,814

(O65) Over 65 State (2579) (+) $0

(DP) Disabled Persons Local (518) (+) $4,944,340

(DP) Disabled Persons State (518) (+) $0

(DV) Disabled Vet (170) (+) $1,646,400

(DVX/MAS) Disabled Vet 100% (90) (+) $9,962,989

(PRO) Prorated Exempt Property (28) (+) $607,043

(PC) Pollution Control (2) (+) $2,360,643

(FP) Freeport (4) (+) $3,662,922

(CHDO) CHDO (1) (+) $3,750,000

(HB366) House Bill 366 (39) (+) $8,017

Total Exemptions (=) $89,206,168 (-) $89,206,168

Net Taxable (Before Freeze) (=) $1,519,390,743

Printed on 03/20/2017 at 10:13 AM Page 27 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

F01 - Galv County Emergency Service #01 Number of Properties: 13456

Land Totals

Land - Homesite (+) $234,308,669

Land - Non Homesite (+) $71,505,726

Land - Ag Market (+) $61,960,013

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $367,774,408 (+) $367,774,408

Improvement Totals

Improvements - Homesite (+) $1,040,947,483

Improvements - Non Homesite (+) $127,050,981

Total Improvements (=) $1,167,998,464 (+) $1,167,998,464

Other Totals

Personal Property (744) $68,599,086 (+) $68,599,086

Minerals (268) $1,047,321 (+) $1,047,321

Autos (0) $0 (+) $0

Total Market Value (=) $1,605,419,279 $1,605,419,279

Total Homestead Cap Adjustment (4023) (-) $92,535,564

Total Exempt Property (657) (-) $83,309,915

Productivity Totals

Total Productivity Market (Non Exempt) (+) $61,960,013

Ag Use (893) (-) $1,016,922

Timber Use (0) (-) $0

Total Productivity Loss (=) $60,943,091 (-) $60,943,091

Total Assessed (=) $1,368,630,709

Exemptions (HS Assd 988,009,127 )

(HS) Homestead Local (6317) (+) $0

(HS) Homestead State (6317) (+) $0

(O65) Over 65 Local (2017) (+) $19,484,363

(O65) Over 65 State (2017) (+) $0

(DP) Disabled Persons Local (415) (+) $3,824,600

(DP) Disabled Persons State (415) (+) $0

(DV) Disabled Vet (137) (+) $1,391,080

(DVX/MAS) Disabled Vet 100% (76) (+) $11,964,097

(PRO) Prorated Exempt Property (2) (+) $8,575

(FP) Freeport (1) (+) $8,333

(HB366) House Bill 366 (61) (+) $17,495

Total Exemptions (=) $36,698,543 (-) $36,698,543

Net Taxable (Before Freeze) (=) $1,331,932,166

Printed on 03/20/2017 at 10:13 AM Page 28 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

F02 - Galv County Emergency Service #02 Number of Properties: 15874

Land Totals

Land - Homesite (+) $233,165,485

Land - Non Homesite (+) $154,842,209

Land - Ag Market (+) $8,807,067

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $396,814,761 (+) $396,814,761

Improvement Totals

Improvements - Homesite (+) $628,512,122

Improvements - Non Homesite (+) $61,364,566

Total Improvements (=) $689,876,688 (+) $689,876,688

Other Totals

Personal Property (328) $75,081,256 (+) $75,081,256

Minerals (272) $5,228,878 (+) $5,228,878

Autos (0) $0 (+) $0

Total Market Value (=) $1,167,001,583 $1,167,001,583

Total Homestead Cap Adjustment (490) (-) $18,732,041

Total Exempt Property (1145) (-) $28,961,320

Productivity Totals

Total Productivity Market (Non Exempt) (+) $8,807,067

Ag Use (180) (-) $318,894

Timber Use (0) (-) $0

Total Productivity Loss (=) $8,488,173 (-) $8,488,173

Total Assessed (=) $1,110,820,049

Exemptions (HS Assd 164,223,988 )

(HS) Homestead Local (902) (+) $32,614,982

(HS) Homestead State (902) (+) $0

(O65) Over 65 Local (462) (+) $4,556,327

(O65) Over 65 State (462) (+) $0

(DP) Disabled Persons Local (55) (+) $550,000

(DP) Disabled Persons State (55) (+) $0

(DV) Disabled Vet (35) (+) $347,630

(DVX/MAS) Disabled Vet 100% (9) (+) $1,447,738

(PRO) Prorated Exempt Property (15) (+) $68,170

(HB366) House Bill 366 (15) (+) $3,881

Total Exemptions (=) $39,588,728 (-) $39,588,728

Net Taxable (Before Freeze) (=) $1,071,231,321

Printed on 03/20/2017 at 10:13 AM Page 29 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

GGA - Galveston County Number of Properties: 188755

Land Totals

Land - Homesite (+) $3,996,949,373

Land - Non Homesite (+) $2,761,090,276

Land - Ag Market (+) $335,512,073

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $3,722,560

Total Land Market Value (=) $7,097,274,282 (+) $7,097,274,282

Improvement Totals

Improvements - Homesite (+) $16,731,022,858

Improvements - Non Homesite (+) $8,441,463,435

Total Improvements (=) $25,172,486,293 (+) $25,172,486,293

Other Totals

Personal Property (12889) $2,779,753,073 (+) $2,779,753,073

Minerals (944) $39,177,338 (+) $39,177,338

Autos (0) $0 (+) $0

Total Market Value (=) $35,088,690,986 $35,088,690,986

Total Homestead Cap Adjustment (30619) (-) $733,983,044

Total Exempt Property (8236) (-) $3,356,767,396

Productivity Totals

Total Productivity Market (Non Exempt) (+) $335,512,073

Ag Use (2593) (-) $4,936,804

Timber Use (0) (-) $0

Total Productivity Loss (=) $330,575,269 (-) $330,575,269

Total Assessed (=) $30,667,365,277

Exemptions (HS Assd 14,076,686,031 )

(HS) Homestead Local (74827) (+) $2,750,695,411

(HS) Homestead State (74827) (+) $0

(O65) Over 65 Local (23078) (+) $1,293,643,485

(O65) Over 65 State (23078) (+) $0

(DP) Disabled Persons Local (3260) (+) $168,267,047

(DP) Disabled Persons State (3260) (+) $0

(DV) Disabled Vet (1701) (+) $16,902,233

(DVX/MAS) Disabled Vet 100% (765) (+) $124,211,346

(PRO) Prorated Exempt Property (198) (+) $11,412,722

(PC) Pollution Control (26) (+) $323,394,528

(CHDO) CHDO (1) (+) $3,750,000

(HB366) House Bill 366 (151) (+) $46,077

(AB) Abatement (1) (+) $14,442,190

(FTZ) Foreign Trade Zone (3) (+) $128,139,041

Total Exemptions (=) $4,834,904,080 (-) $4,834,904,080

Net Taxable (Before Freeze) (=) $25,832,461,197

Printed on 03/20/2017 at 10:13 AM Page 30 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $3,270,317,301

Freeze Taxable $1,507,903,246

Freeze Ceiling (19491) $6,586,822.71

**** O65 Transfer Totals

Transfer Assessed $23,855,775

Transfer Taxable $11,947,414

Post-Percent Taxable $8,903,082

Transfer Adjustment (116) $3,044,332

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $24,321,513,619

*** DP Freeze Totals

Freeze Assessed $325,859,885

Freeze Taxable $116,136,833

Freeze Ceiling (2663) $486,326.24

*** DP Transfer Totals

Transfer Assessed $1,621,066

Transfer Taxable $700,653

Post-Percent Taxable $365,795

Transfer Adjustment (10) $334,858

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $24,205,041,928

Printed on 03/20/2017 at 10:13 AM Page 31 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

J01 - Galv College Number of Properties: 48273

Land Totals

Land - Homesite (+) $1,092,242,607

Land - Non Homesite (+) $1,035,039,825

Land - Ag Market (+) $47,098,784

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $2,174,381,216 (+) $2,174,381,216

Improvement Totals

Improvements - Homesite (+) $4,140,029,568

Improvements - Non Homesite (+) $3,051,033,986

Total Improvements (=) $7,191,063,554 (+) $7,191,063,554

Other Totals

Personal Property (2774) $556,549,863 (+) $556,549,863

Minerals (23) $18,213,729 (+) $18,213,729

Autos (0) $0 (+) $0

Total Market Value (=) $9,940,208,362 $9,940,208,362

Total Homestead Cap Adjustment (7787) (-) $301,630,988

Total Exempt Property (1918) (-) $1,943,454,005

Productivity Totals

Total Productivity Market (Non Exempt) (+) $47,098,784

Ag Use (402) (-) $382,633

Timber Use (0) (-) $0

Total Productivity Loss (=) $46,716,151 (-) $46,716,151

Total Assessed (=) $7,648,407,218

Exemptions (HS Assd 1,872,422,932 )

(HS) Homestead Local (10435) (+) $372,033,884

(HS) Homestead State (10435) (+) $0

(O65) Over 65 Local (4752) (+) $46,940,637

(O65) Over 65 State (4752) (+) $0

(DP) Disabled Persons Local (520) (+) $4,813,400

(DP) Disabled Persons State (520) (+) $0

(DV) Disabled Vet (212) (+) $2,236,090

(DVX/MAS) Disabled Vet 100% (88) (+) $13,422,812

(PRO) Prorated Exempt Property (54) (+) $889,550

(PC) Pollution Control (3) (+) $434,942

(HB366) House Bill 366 (60) (+) $18,605

(FTZ) Foreign Trade Zone (1) (+) $9,231,829

Total Exemptions (=) $450,021,749 (-) $450,021,749

Net Taxable (Before Freeze) (=) $7,198,385,469

Printed on 03/20/2017 at 10:13 AM Page 32 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

J05 - Mainland College Number of Properties: 85224

Land Totals

Land - Homesite (+) $1,193,239,507

Land - Non Homesite (+) $903,448,093

Land - Ag Market (+) $248,434,220

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $3,722,560

Total Land Market Value (=) $2,348,844,380 (+) $2,348,844,380

Improvement Totals

Improvements - Homesite (+) $5,037,195,848

Improvements - Non Homesite (+) $4,030,251,154

Total Improvements (=) $9,067,447,002 (+) $9,067,447,002

Other Totals

Personal Property (6101) $1,710,904,538 (+) $1,710,904,538

Minerals (542) $13,684,576 (+) $13,684,576

Autos (0) $0 (+) $0

Total Market Value (=) $13,140,880,496 $13,140,880,496

Total Homestead Cap Adjustment (13214) (-) $234,061,501

Total Exempt Property (3737) (-) $757,064,929

Productivity Totals

Total Productivity Market (Non Exempt) (+) $248,434,220

Ag Use (2009) (-) $4,123,712

Timber Use (0) (-) $0

Total Productivity Loss (=) $244,310,508 (-) $244,310,508

Total Assessed (=) $11,905,443,558

Exemptions (HS Assd 4,434,805,698 )

(HS) Homestead Local (33684) (+) $875,395,821

(HS) Homestead State (33684) (+) $0

(O65) Over 65 Local (11282) (+) $260,349,609

(O65) Over 65 State (11282) (+) $0

(DP) Disabled Persons Local (2115) (+) $46,987,286

(DP) Disabled Persons State (2115) (+) $0

(DV) Disabled Vet (851) (+) $8,484,513

(DVX/MAS) Disabled Vet 100% (424) (+) $56,250,071

(PRO) Prorated Exempt Property (107) (+) $1,768,433

(PC) Pollution Control (23) (+) $322,959,586

(CHDO) CHDO (1) (+) $3,750,000

(HB366) House Bill 366 (55) (+) $15,872

(FTZ) Foreign Trade Zone (2) (+) $118,907,212

Total Exemptions (=) $1,694,868,403 (-) $1,694,868,403

Net Taxable (Before Freeze) (=) $10,210,575,155

Printed on 03/20/2017 at 10:13 AM Page 33 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $1,144,608,365

Freeze Taxable $679,008,563

Freeze Ceiling (9306) $1,221,104.60

**** O65 Transfer Totals

Transfer Assessed $7,409,720

Transfer Taxable $4,697,376

Post-Percent Taxable $3,375,845

Transfer Adjustment (43) $1,321,531

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $9,530,245,061

*** DP Freeze Totals

Freeze Assessed $160,491,575

Freeze Taxable $85,928,904

Freeze Ceiling (1624) $155,707.40

*** DP Transfer Totals

Transfer Assessed $694,290

Transfer Taxable $435,432

Post-Percent Taxable $376,275

Transfer Adjustment (5) $59,157

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $9,444,257,000

Printed on 03/20/2017 at 10:13 AM Page 34 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M04 - Bacliff Number of Properties: 4314

Land Totals

Land - Homesite (+) $61,765,161

Land - Non Homesite (+) $24,029,579

Land - Ag Market (+) $85,210

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $85,879,950 (+) $85,879,950

Improvement Totals

Improvements - Homesite (+) $147,378,208

Improvements - Non Homesite (+) $31,575,870

Total Improvements (=) $178,954,078 (+) $178,954,078

Other Totals

Personal Property (260) $29,771,569 (+) $29,771,569

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $294,605,597 $294,605,597

Total Homestead Cap Adjustment (60) (-) $1,419,613

Total Exempt Property (53) (-) $10,655,830

Productivity Totals

Total Productivity Market (Non Exempt) (+) $85,210

Ag Use (2) (-) $1,030

Timber Use (0) (-) $0

Total Productivity Loss (=) $84,180 (-) $84,180

Total Assessed (=) $282,445,974

Exemptions (HS Assd 123,760,213 )

(HS) Homestead Local (1363) (+) $0

(HS) Homestead State (1363) (+) $0

(O65) Over 65 Local (384) (+) $3,625,460

(O65) Over 65 State (384) (+) $0

(DP) Disabled Persons Local (111) (+) $0

(DP) Disabled Persons State (111) (+) $0

(DV) Disabled Vet (34) (+) $338,480

(DVX/MAS) Disabled Vet 100% (25) (+) $2,015,417

(PRO) Prorated Exempt Property (2) (+) $39,402

(HB366) House Bill 366 (26) (+) $4,520

Total Exemptions (=) $6,023,279 (-) $6,023,279

Net Taxable (Before Freeze) (=) $276,422,695

Printed on 03/20/2017 at 10:13 AM Page 35 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M05 - Bayview Number of Properties: 854

Land Totals

Land - Homesite (+) $13,722,510

Land - Non Homesite (+) $12,184,720

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $25,907,230 (+) $25,907,230

Improvement Totals

Improvements - Homesite (+) $41,679,100

Improvements - Non Homesite (+) $14,273,210

Total Improvements (=) $55,952,310 (+) $55,952,310

Other Totals

Personal Property (82) $5,687,881 (+) $5,687,881

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $87,547,421 $87,547,421

Total Homestead Cap Adjustment (6) (-) $174,317

Total Exempt Property (11) (-) $1,019,650

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $86,353,454

Exemptions (HS Assd 32,964,468 )

(HS) Homestead Local (257) (+) $0

(HS) Homestead State (257) (+) $0

(O65) Over 65 Local (87) (+) $3,971,450

(O65) Over 65 State (87) (+) $0

(DP) Disabled Persons Local (15) (+) $577,640

(DP) Disabled Persons State (15) (+) $0

(DV) Disabled Vet (4) (+) $34,500

(PRO) Prorated Exempt Property (1) (+) $418,695

(FP) Freeport (1) (+) $289,332

(HB366) House Bill 366 (13) (+) $2,445

Total Exemptions (=) $5,294,062 (-) $5,294,062

Net Taxable (Before Freeze) (=) $81,059,392

Printed on 03/20/2017 at 10:13 AM Page 36 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M07 - San Leon Number of Properties: 5553

Land Totals

Land - Homesite (+) $56,916,482

Land - Non Homesite (+) $26,825,202

Land - Ag Market (+) $835,210

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $84,576,894 (+) $84,576,894

Improvement Totals

Improvements - Homesite (+) $195,438,415

Improvements - Non Homesite (+) $29,669,832

Total Improvements (=) $225,108,247 (+) $225,108,247

Other Totals

Personal Property (213) $9,008,914 (+) $9,008,914

Minerals (2) $8,004 (+) $8,004

Autos (0) $0 (+) $0

Total Market Value (=) $318,702,059 $318,702,059

Total Homestead Cap Adjustment (214) (-) $12,162,885

Total Exempt Property (101) (-) $12,959,140

Productivity Totals

Total Productivity Market (Non Exempt) (+) $835,210

Ag Use (17) (-) $7,980

Timber Use (0) (-) $0

Total Productivity Loss (=) $827,230 (-) $827,230

Total Assessed (=) $292,752,804

Exemptions (HS Assd 146,734,750 )

(HS) Homestead Local (1252) (+) $14,878,167

(HS) Homestead State (1252) (+) $0

(O65) Over 65 Local (464) (+) $4,349,610

(O65) Over 65 State (464) (+) $0

(DP) Disabled Persons Local (100) (+) $937,515

(DP) Disabled Persons State (100) (+) $0

(DV) Disabled Vet (45) (+) $453,850

(DVX/MAS) Disabled Vet 100% (23) (+) $3,107,845

(PRO) Prorated Exempt Property (8) (+) $309,986

(HB366) House Bill 366 (11) (+) $3,314

Total Exemptions (=) $24,040,287 (-) $24,040,287

Net Taxable (Before Freeze) (=) $268,712,517

Printed on 03/20/2017 at 10:13 AM Page 37 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M09 - Galv Co Fresh Water Supply Dist #6 Number of Properties: 1337

Land Totals

Land - Homesite (+) $117,393,166

Land - Non Homesite (+) $18,198,598

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $135,591,764 (+) $135,591,764

Improvement Totals

Improvements - Homesite (+) $313,206,811

Improvements - Non Homesite (+) $3,634,830

Total Improvements (=) $316,841,641 (+) $316,841,641

Other Totals

Personal Property (47) $1,957,482 (+) $1,957,482

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $454,390,887 $454,390,887

Total Homestead Cap Adjustment (169) (-) $5,918,865

Total Exempt Property (17) (-) $764,720

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $447,707,302

Exemptions (HS Assd 208,234,944 )

(HS) Homestead Local (464) (+) $41,396,579

(HS) Homestead State (464) (+) $0

(O65) Over 65 Local (212) (+) $2,080,000

(O65) Over 65 State (212) (+) $0

(DP) Disabled Persons Local (10) (+) $100,000

(DP) Disabled Persons State (10) (+) $0

(DV) Disabled Vet (5) (+) $46,000

(DVX/MAS) Disabled Vet 100% (4) (+) $1,252,034

(HB366) House Bill 366 (7) (+) $1,376

Total Exemptions (=) $44,875,989 (-) $44,875,989

Net Taxable (Before Freeze) (=) $402,831,313

Printed on 03/20/2017 at 10:13 AM Page 38 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M12 - Mud District #12 Number of Properties: 1748

Land Totals

Land - Homesite (+) $87,364,770

Land - Non Homesite (+) $7,038,230

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $94,403,000 (+) $94,403,000

Improvement Totals

Improvements - Homesite (+) $200,320,020

Improvements - Non Homesite (+) $3,362,430

Total Improvements (=) $203,682,450 (+) $203,682,450

Other Totals

Personal Property (64) $2,047,824 (+) $2,047,824

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $300,133,274 $300,133,274

Total Homestead Cap Adjustment (245) (-) $4,356,086

Total Exempt Property (27) (-) $2,556,870

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $293,220,318

Exemptions (HS Assd 192,440,639 )

(HS) Homestead Local (919) (+) $38,040,412

(HS) Homestead State (919) (+) $0

(O65) Over 65 Local (380) (+) $3,730,000

(O65) Over 65 State (380) (+) $0

(DP) Disabled Persons Local (44) (+) $410,000

(DP) Disabled Persons State (44) (+) $0

(DV) Disabled Vet (20) (+) $199,040

(DVX/MAS) Disabled Vet 100% (13) (+) $2,470,242

(HB366) House Bill 366 (14) (+) $3,410

Total Exemptions (=) $44,853,104 (-) $44,853,104

Net Taxable (Before Freeze) (=) $248,367,214

Printed on 03/20/2017 at 10:13 AM Page 39 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M18 - Tara Glen Mud Number of Properties: 446

Land Totals

Land - Homesite (+) $14,291,770

Land - Non Homesite (+) $189,310

Land - Ag Market (+) $0

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $14,481,080 (+) $14,481,080

Improvement Totals

Improvements - Homesite (+) $62,639,720

Improvements - Non Homesite (+) $289,340

Total Improvements (=) $62,929,060 (+) $62,929,060

Other Totals

Personal Property (9) $707,223 (+) $707,223

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $78,117,363 $78,117,363

Total Homestead Cap Adjustment (25) (-) $198,582

Total Exempt Property (6) (-) $117,110

Productivity Totals

Total Productivity Market (Non Exempt) (+) $0

Ag Use (0) (-) $0

Timber Use (0) (-) $0

Total Productivity Loss (=) $0 (-) $0

Total Assessed (=) $77,801,671

Exemptions (HS Assd 70,101,058 )

(HS) Homestead Local (373) (+) $0

(HS) Homestead State (373) (+) $0

(O65) Over 65 Local (65) (+) $1,920,000

(O65) Over 65 State (65) (+) $0

(DP) Disabled Persons Local (11) (+) $240,000

(DP) Disabled Persons State (11) (+) $0

(DV) Disabled Vet (8) (+) $92,000

(DVX/MAS) Disabled Vet 100% (4) (+) $795,010

Total Exemptions (=) $3,047,010 (-) $3,047,010

Net Taxable (Before Freeze) (=) $74,754,661

Printed on 03/20/2017 at 10:13 AM Page 40 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

M19 - Westwood Management District Number of Properties: 208

Land Totals

Land - Homesite (+) $2,797,360

Land - Non Homesite (+) $3,324,380

Land - Ag Market (+) $2,933,970

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $9,055,710 (+) $9,055,710

Improvement Totals

Improvements - Homesite (+) $11,115,940

Improvements - Non Homesite (+) $304,860

Total Improvements (=) $11,420,800 (+) $11,420,800

Other Totals

Personal Property (3) $119,106 (+) $119,106

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $20,595,616 $20,595,616

Total Homestead Cap Adjustment (0) (-) $0

Total Exempt Property (3) (-) $145,180

Productivity Totals

Total Productivity Market (Non Exempt) (+) $2,933,970

Ag Use (5) (-) $11,970

Timber Use (0) (-) $0

Total Productivity Loss (=) $2,922,000 (-) $2,922,000

Total Assessed (=) $17,528,436

Exemptions (HS Assd 6,234,540 )

(HS) Homestead Local (20) (+) $0

(HS) Homestead State (20) (+) $0

(O65) Over 65 Local (2) (+) $0

(O65) Over 65 State (2) (+) $0

(DV) Disabled Vet (1) (+) $5,000

(DVX/MAS) Disabled Vet 100% (2) (+) $696,970

Total Exemptions (=) $701,970 (-) $701,970

Net Taxable (Before Freeze) (=) $16,826,466

Printed on 03/20/2017 at 10:13 AM Page 41 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

N01 - Nav District #1 Number of Properties: 24402

Land Totals

Land - Homesite (+) $338,395,861

Land - Non Homesite (+) $583,179,752

Land - Ag Market (+) $11,343,427

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $932,919,040 (+) $932,919,040

Improvement Totals

Improvements - Homesite (+) $2,096,571,585

Improvements - Non Homesite (+) $2,612,503,391

Total Improvements (=) $4,709,074,976 (+) $4,709,074,976

Other Totals

Personal Property (2234) $488,905,145 (+) $488,905,145

Minerals (0) $0 (+) $0

Autos (0) $0 (+) $0

Total Market Value (=) $6,130,899,161 $6,130,899,161

Total Homestead Cap Adjustment (6232) (-) $231,527,140

Total Exempt Property (1084) (-) $1,885,854,512

Productivity Totals

Total Productivity Market (Non Exempt) (+) $11,343,427

Ag Use (85) (-) $5,378

Timber Use (0) (-) $0

Total Productivity Loss (=) $11,338,049 (-) $11,338,049

Total Assessed (=) $4,002,179,460

Exemptions (HS Assd 1,244,797,001 )

(HS) Homestead Local (8081) (+) $247,475,569

(HS) Homestead State (8081) (+) $0

(O65) Over 65 Local (3606) (+) $35,630,603

(O65) Over 65 State (3606) (+) $0

(DP) Disabled Persons Local (415) (+) $3,923,400

(DP) Disabled Persons State (415) (+) $0

(DV) Disabled Vet (144) (+) $1,553,090

(DVX/MAS) Disabled Vet 100% (63) (+) $8,099,183

(PRO) Prorated Exempt Property (32) (+) $428,908

(PC) Pollution Control (3) (+) $434,942

(FP) Freeport (6) (+) $12,668,390

(HB366) House Bill 366 (50) (+) $16,223

(FTZ) Foreign Trade Zone (1) (+) $9,231,829

Total Exemptions (=) $319,462,137 (-) $319,462,137

Net Taxable (Before Freeze) (=) $3,682,717,323

Printed on 03/20/2017 at 10:13 AM Page 42 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

RFL - Co Road & Flood Number of Properties: 188755

Land Totals

Land - Homesite (+) $3,996,949,373

Land - Non Homesite (+) $2,761,090,276

Land - Ag Market (+) $335,512,073

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $3,722,560

Total Land Market Value (=) $7,097,274,282 (+) $7,097,274,282

Improvement Totals

Improvements - Homesite (+) $16,731,022,858

Improvements - Non Homesite (+) $8,441,463,435

Total Improvements (=) $25,172,486,293 (+) $25,172,486,293

Other Totals

Personal Property (12889) $2,779,753,073 (+) $2,779,753,073

Minerals (944) $39,177,338 (+) $39,177,338

Autos (0) $0 (+) $0

Total Market Value (=) $35,088,690,986 $35,088,690,986

Total Homestead Cap Adjustment (30619) (-) $733,983,044

Total Exempt Property (8236) (-) $3,356,767,396

Productivity Totals

Total Productivity Market (Non Exempt) (+) $335,512,073

Ag Use (2593) (-) $4,936,804

Timber Use (0) (-) $0

Total Productivity Loss (=) $330,575,269 (-) $330,575,269

Total Assessed (=) $30,667,365,277

Exemptions (HS Assd 14,076,686,031 )

(HS) Homestead Local (74827) (+) $2,750,361,363

(HS) Homestead State (74827) (+) $145,359,660

(O65) Over 65 Local (23078) (+) $1,293,643,485

(O65) Over 65 State (23078) (+) $0

(DP) Disabled Persons Local (3260) (+) $168,267,047

(DP) Disabled Persons State (3260) (+) $0

(DV) Disabled Vet (1701) (+) $16,902,233

(DVX/MAS) Disabled Vet 100% (765) (+) $123,614,058

(PRO) Prorated Exempt Property (198) (+) $11,406,081

(PC) Pollution Control (26) (+) $323,394,528

(CHDO) CHDO (1) (+) $3,750,000

(HB366) House Bill 366 (151) (+) $46,077

(AB) Abatement (1) (+) $14,442,190

(FTZ) Foreign Trade Zone (3) (+) $128,139,041

Total Exemptions (=) $4,979,325,763 (-) $4,979,325,763

Net Taxable (Before Freeze) (=) $25,688,039,514

Printed on 03/20/2017 at 10:13 AM Page 43 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

S10 - Galveston Isd Number of Properties: 48277

Land Totals

Land - Homesite (+) $1,092,242,607

Land - Non Homesite (+) $1,035,045,875

Land - Ag Market (+) $47,098,784

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $2,174,387,266 (+) $2,174,387,266

Improvement Totals

Improvements - Homesite (+) $4,140,029,568

Improvements - Non Homesite (+) $3,050,947,996

Total Improvements (=) $7,190,977,564 (+) $7,190,977,564

Other Totals

Personal Property (2776) $557,078,661 (+) $557,078,661

Minerals (23) $18,213,729 (+) $18,213,729

Autos (0) $0 (+) $0

Total Market Value (=) $9,940,657,220 $9,940,657,220

Total Homestead Cap Adjustment (7787) (-) $301,630,988

Total Exempt Property (1918) (-) $1,943,454,005

Productivity Totals

Total Productivity Market (Non Exempt) (+) $47,098,784

Ag Use (402) (-) $382,633

Timber Use (0) (-) $0

Total Productivity Loss (=) $46,716,151 (-) $46,716,151

Total Assessed (=) $7,648,856,076

Exemptions (HS Assd 1,872,422,932 )

(HS) Homestead Local (10435) (+) $370,893,233

(HS) Homestead State (10435) (+) $259,578,812

(O65) Over 65 Local (4752) (+) $0

(O65) Over 65 State (4752) (+) $46,762,850

(DP) Disabled Persons Local (520) (+) $0

(DP) Disabled Persons State (520) (+) $4,970,328

(DV) Disabled Vet (211) (+) $2,205,432

(DVX/MAS) Disabled Vet 100% (88) (+) $10,855,864

(PRO) Prorated Exempt Property (54) (+) $889,550

(PC) Pollution Control (2) (+) $226,728

(HB366) House Bill 366 (60) (+) $18,605

(FTZ) Foreign Trade Zone (1) (+) $9,231,829

Total Exemptions (=) $705,633,231 (-) $705,633,231

Net Taxable (Before Freeze) (=) $6,943,222,845

Printed on 03/20/2017 at 10:13 AM Page 44 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $768,137,966

Freeze Taxable $468,213,736

Freeze Ceiling (4084) $3,720,011.46

**** O65 Transfer Totals

Transfer Assessed $19,796,645

Transfer Taxable $13,409,210

Post-Percent Taxable $9,913,197

Transfer Adjustment (74) $3,496,013

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $6,471,513,096

*** DP Freeze Totals

Freeze Assessed $52,956,273

Freeze Taxable $26,754,304

Freeze Ceiling (423) $225,291.45

*** DP Transfer Totals

Transfer Assessed $861,026

Transfer Taxable $548,821

Post-Percent Taxable $300,117

Transfer Adjustment (4) $248,704

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $6,444,510,088

Printed on 03/20/2017 at 10:13 AM Page 45 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

S11 - Dickinson Isd Number of Properties: 31401

Land Totals

Land - Homesite (+) $448,357,863

Land - Non Homesite (+) $471,819,891

Land - Ag Market (+) $115,517,993

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $2,194,160

Total Land Market Value (=) $1,037,889,907 (+) $1,037,889,907

Improvement Totals

Improvements - Homesite (+) $1,821,414,087

Improvements - Non Homesite (+) $885,129,743

Total Improvements (=) $2,706,543,830 (+) $2,706,543,830

Other Totals

Personal Property (2516) $537,798,616 (+) $537,798,616

Minerals (203) $9,125,968 (+) $9,125,968

Autos (0) $0 (+) $0

Total Market Value (=) $4,291,358,321 $4,291,358,321

Total Homestead Cap Adjustment (3164) (-) $47,860,639

Total Exempt Property (1147) (-) $284,386,967

Productivity Totals

Total Productivity Market (Non Exempt) (+) $115,517,993

Ag Use (478) (-) $698,729

Timber Use (0) (-) $0

Total Productivity Loss (=) $114,819,264 (-) $114,819,264

Total Assessed (=) $3,844,291,451

Exemptions (HS Assd 1,691,604,176 )

(HS) Homestead Local (12232) (+) $0

(HS) Homestead State (12232) (+) $296,756,723

(O65) Over 65 Local (3401) (+) $0

(O65) Over 65 State (3401) (+) $31,693,696

(DP) Disabled Persons Local (612) (+) $0

(DP) Disabled Persons State (612) (+) $5,148,327

(DV) Disabled Vet (334) (+) $3,227,239

(DVX/MAS) Disabled Vet 100% (163) (+) $18,262,914

(PRO) Prorated Exempt Property (28) (+) $650,977

(PC) Pollution Control (5) (+) $8,862,300

(HB366) House Bill 366 (42) (+) $9,876

Total Exemptions (=) $364,612,052 (-) $364,612,052

Net Taxable (Before Freeze) (=) $3,479,679,399

Printed on 03/20/2017 at 10:13 AM Page 46 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $384,369,015

Freeze Taxable $280,335,189

Freeze Ceiling (2890) $3,366,844.29

**** O65 Transfer Totals

Transfer Assessed $10,494,770

Transfer Taxable $8,430,860

Post-Percent Taxable $5,853,006

Transfer Adjustment (51) $2,577,854

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $3,196,766,356

*** DP Freeze Totals

Freeze Assessed $51,196,076

Freeze Taxable $32,063,064

Freeze Ceiling (509) $440,237.68

*** DP Transfer Totals

Transfer Assessed $427,700

Transfer Taxable $357,700

Post-Percent Taxable $277,486

Transfer Adjustment (2) $80,214

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $3,164,623,078

Printed on 03/20/2017 at 10:13 AM Page 47 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

S13 - High Island Isd Number of Properties: 4382

Land Totals

Land - Homesite (+) $15,843,664

Land - Non Homesite (+) $23,487,144

Land - Ag Market (+) $1,317,410

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $40,648,218 (+) $40,648,218

Improvement Totals

Improvements - Homesite (+) $43,522,302

Improvements - Non Homesite (+) $11,111,434

Total Improvements (=) $54,633,736 (+) $54,633,736

Other Totals

Personal Property (66) $6,102,358 (+) $6,102,358

Minerals (279) $5,270,225 (+) $5,270,225

Autos (0) $0 (+) $0

Total Market Value (=) $106,654,537 $106,654,537

Total Homestead Cap Adjustment (33) (-) $219,490

Total Exempt Property (710) (-) $11,801,700

Productivity Totals

Total Productivity Market (Non Exempt) (+) $1,317,410

Ag Use (67) (-) $125,019

Timber Use (0) (-) $0

Total Productivity Loss (=) $1,192,391 (-) $1,192,391

Total Assessed (=) $93,440,956

Exemptions (HS Assd 12,900,731 )

(HS) Homestead Local (139) (+) $726,813

(HS) Homestead State (139) (+) $3,263,811

(O65) Over 65 Local (70) (+) $323,608

(O65) Over 65 State (70) (+) $604,837

(DP) Disabled Persons Local (9) (+) $0

(DP) Disabled Persons State (9) (+) $45,920

(DV) Disabled Vet (10) (+) $64,780

(DVX/MAS) Disabled Vet 100% (2) (+) $292,450

(PRO) Prorated Exempt Property (7) (+) $16,018

(HB366) House Bill 366 (6) (+) $1,588

Total Exemptions (=) $5,339,825 (-) $5,339,825

Net Taxable (Before Freeze) (=) $88,101,131

Printed on 03/20/2017 at 10:13 AM Page 48 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $5,780,052

Freeze Taxable $2,954,577

Freeze Ceiling (60) $31,068.58

**** O65 Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $85,146,554

*** DP Freeze Totals

Freeze Assessed $442,778

Freeze Taxable $227,081

Freeze Ceiling (7) $2,893.32

*** DP Transfer Totals

Transfer Assessed $0

Transfer Taxable $0

Post-Percent Taxable $0

Transfer Adjustment (0) $0

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $84,919,473

Printed on 03/20/2017 at 10:13 AM Page 49 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

S14 - Hitchcock Isd Number of Properties: 8566

Land Totals

Land - Homesite (+) $128,871,135

Land - Non Homesite (+) $81,629,423

Land - Ag Market (+) $19,744,373

Land - Timber Market (+) $0

Land - Exempt Ag/Timber Market (+) $0

Total Land Market Value (=) $230,244,931 (+) $230,244,931

Improvement Totals

Improvements - Homesite (+) $415,031,059

Improvements - Non Homesite (+) $93,660,490

Total Improvements (=) $508,691,549 (+) $508,691,549

Other Totals

Personal Property (487) $60,066,485 (+) $60,066,485

Minerals (107) $2,536,563 (+) $2,536,563

Autos (0) $0 (+) $0

Total Market Value (=) $801,539,528 $801,539,528

Total Homestead Cap Adjustment (801) (-) $16,654,717

Total Exempt Property (375) (-) $67,900,774

Productivity Totals

Total Productivity Market (Non Exempt) (+) $19,744,373

Ag Use (312) (-) $1,430,711

Timber Use (0) (-) $0

Total Productivity Loss (=) $18,313,662 (-) $18,313,662

Total Assessed (=) $698,670,375

Exemptions (HS Assd 309,111,748 )

(HS) Homestead Local (2245) (+) $0

(HS) Homestead State (2245) (+) $54,638,466

(O65) Over 65 Local (791) (+) $0

(O65) Over 65 State (791) (+) $7,269,364

(DP) Disabled Persons Local (183) (+) $0

(DP) Disabled Persons State (183) (+) $1,648,178

(DV) Disabled Vet (57) (+) $552,500

(DVX/MAS) Disabled Vet 100% (33) (+) $3,707,071

(PRO) Prorated Exempt Property (5) (+) $135,952

(HB366) House Bill 366 (35) (+) $6,344

Total Exemptions (=) $67,957,875 (-) $67,957,875

Net Taxable (Before Freeze) (=) $630,712,500

Printed on 03/20/2017 at 10:13 AM Page 50 of 65

GALVESTONCAD

Assessment Roll Grand Totals Report

Tax Year: 2016 As of: Supplement 8

**** O65 Freeze Totals

Freeze Assessed $95,807,817

Freeze Taxable $69,720,640

Freeze Ceiling (695) $749,163.05

**** O65 Transfer Totals

Transfer Assessed $1,656,540

Transfer Taxable $1,446,540

Post-Percent Taxable $1,116,344

Transfer Adjustment (6) $330,196

Freeze Adjusted Taxable (Net Taxable - Freeze Taxable - Transfer Adjustment) (=) $560,661,664

*** DP Freeze Totals

Freeze Assessed $14,028,978

Freeze Taxable $8,475,924

Freeze Ceiling (155) $111,199.60