Académique Documents

Professionnel Documents

Culture Documents

TD BANK-JUL-30-TD Economic-US Real GDP Commentary

Transféré par

Miir ViirCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TD BANK-JUL-30-TD Economic-US Real GDP Commentary

Transféré par

Miir ViirDroits d'auteur :

Formats disponibles

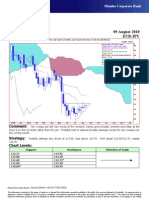

TD Economics

July 30, 2010

Data Release: Q2 data confirms a half-hearted consumer

• Real GDP for Q2 came in at 2.4% (annualized), which was near expectations of 2.6%. However, the real story

was in the annual revisions. Although Q1-2010 was revised up a full percentage point to 3.7%, this was because

the level of GDP had dropped for the prior quarters on downward revisions that resulted in a slightly deeper

recession, with a peak-to-trough of -4.1% (instead of -3.8%)

• Let’s start with the Q2 data. Much of the strength came from the investment category, as equipment and software

rose by 22%. Residential investment also posted a robust gain of 28%. Personal consumption rose on the

quarter, but at a rather tepid 1.6% pace. Meanwhile, there was a large accumulation in inventories that added

one percentage point to the headline GDP growth figure. Although exports rose by a robust 10.3%, the gain was

trumped by a massive 28.8% gain in imports, with the net effect shaving 2.8 percentage points from GDP.

• On the back revisions to the annual data, real personal consumption bore the brunt of the downward adjustment,

with a peak-trough now of -2.4% compared to -1.9% prior.

Key Implications

• There are two elements to today’s GDP report. The first is the figures specifically for the second quarter, which

supports the notion that a mid-cycle slowdown is well entrenched. The US will not have a traditional period of

pent-up consumer demand-driven growth. Real consumer spending has held below 2% growth in each of the

past three quarters, when traditionally we would expect to see it in the 3-5% range. We expect consumer

spending to lumber along in a 1-2.5% range over the quarters to come.

• Although domestic demand was strong at 5.1% in the second quarter, much of that stemmed from business

investment. The large accumulation in inventories alongside tepid consumer spending also makes us suspect

that some of the inventory swing was unintended, and thus there will be pay-back to production and investment in

the coming quarter.

• The second element to today’s report came in the form of the revisions to the historical data which showed that a

slightly deeper recession, which was more heavily embedded in consumer spending. These revisions help

explain a few head scratchers that have irritated economists in recent months, but still don’t fully resolve them.

First, the deeper recession will temper some of the unusually strong productivity gains that were reported over the

recession. Second, that deeper recession also provides a little more rationale for the large degree of job losses

that materialized over the period. Third, the resulting larger amount of economic slack provides a little more

support for the persistently low rate of core inflation (with pressures still on the downside), as the recovery gets

increasingly long in the tooth.

Beata Caranci, Associate Vice President and Deputy Chief Economist

416-982-8067

DISCLAIMER

This report is provided by TD Economics for customers of TD Bank Financial Group. It is for information purposes only and may not be appropriate for other

purposes. The report does not provide material information about the business and affairs of TD Bank Financial Group and the members of TD Economics are not

spokespersons for TD Bank Financial Group with respect to its business and affairs. The information contained in this report has been drawn from sources

believed to be reliable, but is not guaranteed to be accurate or complete. The report contains economic analysis and views, including about future economic and fi

nancial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome

may be materially different. The Toronto-Dominion Bank and its affi liates and related entities that comprise TD Bank Financial Group are not liable for any errors

or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Vous aimerez peut-être aussi

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirPas encore d'évaluation

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirPas encore d'évaluation

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirPas encore d'évaluation

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirPas encore d'évaluation

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirPas encore d'évaluation

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirPas encore d'évaluation

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirPas encore d'évaluation

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirPas encore d'évaluation

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirPas encore d'évaluation

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirPas encore d'évaluation

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirPas encore d'évaluation

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirPas encore d'évaluation

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirPas encore d'évaluation

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Interest Bond CalculatorDocument6 pagesInterest Bond CalculatorfdfsfsdfjhgjghPas encore d'évaluation

- FABM2 Q2W5 TaxationDocument8 pagesFABM2 Q2W5 TaxationDanielle SocoralPas encore d'évaluation

- APS's ProposalDocument373 pagesAPS's ProposalJonathan AllredPas encore d'évaluation

- Foundation of Economics NotesDocument16 pagesFoundation of Economics Notesrosa100% (1)

- TEST BANK Reviewer - INT Assets TEST BANK Reviewer - INT AssetsDocument24 pagesTEST BANK Reviewer - INT Assets TEST BANK Reviewer - INT AssetsClarisse PelayoPas encore d'évaluation

- MBA Class of 2019: Full-Time Employment StatisticsDocument4 pagesMBA Class of 2019: Full-Time Employment StatisticsakshatmalhotraPas encore d'évaluation

- Adverbial ClauseDocument3 pagesAdverbial ClausefaizzzzzPas encore d'évaluation

- Class 10th - The Great DepressionDocument12 pagesClass 10th - The Great DepressionT A N Y A T I W A R IPas encore d'évaluation

- Life Insurance Corporation of India: (To Be Mentioned After Issuance of Policy)Document2 pagesLife Insurance Corporation of India: (To Be Mentioned After Issuance of Policy)Ravikiran Reddy AdmalaPas encore d'évaluation

- Corporate Finance (Chapter 4) (7th Ed)Document27 pagesCorporate Finance (Chapter 4) (7th Ed)Israt Mustafa100% (1)

- Enterprise Risk Management Maturity-Level Assessment ToolDocument25 pagesEnterprise Risk Management Maturity-Level Assessment ToolAndi SaputraPas encore d'évaluation

- Play Fair at The Olympics: Respect Workers' Rights in The Sportswear IndustryDocument12 pagesPlay Fair at The Olympics: Respect Workers' Rights in The Sportswear IndustryOxfamPas encore d'évaluation

- Chapter 4Document2 pagesChapter 4Dai Huu0% (1)

- Pitchbook Private Equity Breakdown 4Q 2009Document6 pagesPitchbook Private Equity Breakdown 4Q 2009Zerohedge100% (1)

- Becg m-4Document25 pagesBecg m-4CH ANIL VARMAPas encore d'évaluation

- Private Equity AsiaDocument12 pagesPrivate Equity AsiaGiovanni Graziano100% (1)

- Vinamilk Corporate GovernanceDocument4 pagesVinamilk Corporate GovernanceLeeNPas encore d'évaluation

- Bata Pak (Final)Document32 pagesBata Pak (Final)Samar MalikPas encore d'évaluation

- Tiyasha Guha CG Law343 17.09Document2 pagesTiyasha Guha CG Law343 17.09raj vardhan agarwalPas encore d'évaluation

- CBE UG YearbookDocument605 pagesCBE UG Yearbookchad DanielsPas encore d'évaluation

- Group Assignment Secret RecipeDocument33 pagesGroup Assignment Secret RecipeFarah GhazaliPas encore d'évaluation

- Eo - 359-1989 PS-DBMDocument3 pagesEo - 359-1989 PS-DBMKing Gerazol GentuyaPas encore d'évaluation

- Sales Executive Business Development in Boston MA Resume Martin LairdDocument2 pagesSales Executive Business Development in Boston MA Resume Martin LairdMartinLairdPas encore d'évaluation

- Letter HeadDocument1 pageLetter Headmelvin bautistaPas encore d'évaluation

- Case Study 1Document2 pagesCase Study 1April Lyn SantosPas encore d'évaluation

- Client Project Nine - Commonwealth Youth ProgrammeDocument2 pagesClient Project Nine - Commonwealth Youth ProgrammeberthiadPas encore d'évaluation

- sportstuff.comDocument3 pagessportstuff.comRanjitha KumaranPas encore d'évaluation

- Maneco ReviewerDocument6 pagesManeco ReviewerKristine PunzalanPas encore d'évaluation

- Project On Ibrahim Fibers LTDDocument53 pagesProject On Ibrahim Fibers LTDumarfaro100% (1)

- Spring Specialisations List Updated 10062021Document19 pagesSpring Specialisations List Updated 10062021ashokPas encore d'évaluation