Académique Documents

Professionnel Documents

Culture Documents

JUL 30 NBC Financial Group Eco News

Transféré par

Miir ViirCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

JUL 30 NBC Financial Group Eco News

Transféré par

Miir ViirDroits d'auteur :

Formats disponibles

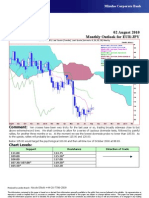

July 30, 2010

Canadian GDP advanced 0.1% in May Canadian economy slowing in Q2

Real GDP (chained dollars)

1.0 % m/m

Latest: 0.1% (actual) +0.2% (expected)

0.8

Previous: 0.0% (no revision)

0.6

0.4

FACTS: Real GDP increased 0.1% in May after remaining

0.2

essentially unchanged one-month earlier. Activity was up in

the goods producing sector (+0.6%), marking a ninth 0.0

consecutive monthly increase. The mining and oil & gas -0.2

extraction (+3.4%) and agriculture (+1.3%) industries were -0.4

Shading = Canadian recession

the top performers among goods-producing industries while

-0.6

construction (-1.6%) and utilities (-0.5%) lagged. Industrial

production was up 1.2%. Production in non-durable -0.8

manufactured goods increased 0.8% while durable -1.0

2004 2005 2006 2007 2008 2009 2010

manufacturing industries retreated (-0.4%). Energy An economy well positioned to benefit from economic

production jumped 2.4% in May. The service sector activity growth in emerging markets

was down 0.1%, registering a second consecutive monthly GDP at basic prices

8 Mining and O&G

drop, with wholesale trade (-1.8%) posting the largest 3 month change %

extraction

7

decline. Transportation & warehousing (+0.5%) and Arts, 6

entertainment and recreation (+0.5%) showed the strongest 5

increase. 4

3

2

1

OPINION: For a second month in a row, the Canadian 0

-1

economy is growing at a rate below its historical average. The -2

service sector posted a second consecutive monthly -3

Construction

decrease a first since 2003 when excluding the latest -4 Shading = Canadian recession

-5

recessionary period. On that front, we have to keep in mind

-6

that the service sector is in an expansion phase which began -7

in September 2009 and is growing at a respectable 3% -8

2006 2007 2008 2009 2010

annualized growth rate since then. Mining and Oil and gas

extraction is clearly the “sector of the month”, and the recent

trend is representative of how strong global growth coming Total hours worked allow us to be optimistic

from emerging markets is benefiting the Canadian economy Real GDP at basic prices and total hours worked (q/q, annualized)

Total hours

(middle chart). On a negative note, construction and real 8 % q/q, ann.

worked

estate are showing their first signs of weakness, which are in 6

part due to a front loading of activity. With two months of data 4

in the quarter, the GDP growth is already running at a rate of

2.2%. We expect the economy to show decent growth in 2

June. Recall that 225K jobs were created in the second 0

quarter with total hours worked up a solid 4.7% (and wage bill -2

advancing 6.2%). Canadian growth should be in the

-4

neighbourhood of 3% in Q2 in line with what the Bank of GDP so far

Canada released in its latest monetary policy report. As a -6 in the

quarter

result, this morning’s report on Canadian GDP does not alter -8

our view on Canadian interest rates.

-10

-12

Matthieu Arseneau 1998 2000 2002 2004 2006 2008 2010

ECONOMIC AND STRATEGY GROUP – 514.879.2529

Stéfane Marion, Chief Economist and Strategist

General: National Bank Financial (NBF) is an indirect wholly owned subsidiary of National Bank of Canada. National Bank of Canada is a public company listed on Canadian stock exchanges. ♦ The particulars contained herein were obtained

from sources which we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer

to buy or sell the securities mentioned herein. ♦Canadian Residents: In respect of the distribution of this report in Canada, NBF accepts responsibility for its contents. To make further inquiry related to this report or effect any transaction,

Canadian residents should contact their NBF Investment advisor. ♦ U.S. Residents: NBF Securities (USA) Corp., an affiliate of NBF, accepts responsibility for the contents of this report, subject to any terms set out above. Any U.S. person

wishing to effect transactions in any security discussed herein should do so only through NBF Securities (USA) Corp. UK Residents: In respect of the distribution of this report to UK residents, NBF has approved this financial promotion for the

purposes of Section 21(1) of the Financial Services and Markets Act 2000. NBF and/or its parent and/or any companies within or affiliates of the National Bank of Canada group and/or any of their directors, officers and employees may have or

may have had interests or long or short positions in, and may at any time make purchases and/or sales as principal or agent, or may act or may have acted as market maker in the relevant securities or related financial instruments discussed in

this report, or may act or have acted as investment and/or commercial banker with respect thereto. The value of investments can go down as well as up. Past performance will not necessarily be repeated in the future. The investments contained

in this report are not available to private customers. This report does not constitute or form part of any offer for sale or subscription of or solicitation of any offer to buy or subscribe for the securities described herein nor shall it or any part of it

form the basis of or be relied on in connection with any contract or commitment whatsoever. This information is only for distribution to non-private customers in the United Kingdom within the meaning of the rules of the Regulated by the Financial

Services Authority. ♦ Copyright: This report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to

without in each case the prior express written consent of National Bank Financial.

Vous aimerez peut-être aussi

- Using Economic Indicators to Improve Investment AnalysisD'EverandUsing Economic Indicators to Improve Investment AnalysisÉvaluation : 3.5 sur 5 étoiles3.5/5 (1)

- Current State of Indian Economy: July 2009Document23 pagesCurrent State of Indian Economy: July 2009nandhu28Pas encore d'évaluation

- Governing the Market: Economic Theory and the Role of Government in East Asian IndustrializationD'EverandGoverning the Market: Economic Theory and the Role of Government in East Asian IndustrializationÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Consumer Price Index (Cpi) Bulletin October 2022Document2 pagesConsumer Price Index (Cpi) Bulletin October 2022K_a_TT_yPas encore d'évaluation

- Consumer Price Index - Mar 21Document4 pagesConsumer Price Index - Mar 21BernewsAdminPas encore d'évaluation

- Republic of Austria Investor Information PDFDocument48 pagesRepublic of Austria Investor Information PDFMi JpPas encore d'évaluation

- JUL 23 NBC Financial Group Eco NewsDocument1 pageJUL 23 NBC Financial Group Eco NewsMiir ViirPas encore d'évaluation

- Alberta Economy: Indicators at A GlanceDocument4 pagesAlberta Economy: Indicators at A Glanceabdulloh aqilPas encore d'évaluation

- Global Energy Trends 2020 EditionDocument49 pagesGlobal Energy Trends 2020 EditionkanusudPas encore d'évaluation

- Pakistan Major Business Sectors: Consulate General of SwitzerlandDocument6 pagesPakistan Major Business Sectors: Consulate General of SwitzerlandSuleman Iqbal BhattiPas encore d'évaluation

- GDP 2020 Q1Document34 pagesGDP 2020 Q1Primedia BroadcastingPas encore d'évaluation

- Economic Highlights: Industrial Production Bounced Back in May, GDPGrowth To Remain Resilient in The 2Q - 08/07/2010Document3 pagesEconomic Highlights: Industrial Production Bounced Back in May, GDPGrowth To Remain Resilient in The 2Q - 08/07/2010Rhb InvestPas encore d'évaluation

- Tanzania Monthly Economic Review (MER) - May 2018Document28 pagesTanzania Monthly Economic Review (MER) - May 2018Tioman LadaPas encore d'évaluation

- Nys Econ Rpt2-2012Document4 pagesNys Econ Rpt2-2012Elizabeth BenjaminPas encore d'évaluation

- Consumer Price Index - Nov 20Document4 pagesConsumer Price Index - Nov 20BernewsAdminPas encore d'évaluation

- Econ of ActsDocument1 pageEcon of ActsChris GobbiPas encore d'évaluation

- Paper Produ AnálisisDocument13 pagesPaper Produ Análisisashlye CarrascoPas encore d'évaluation

- Kantar Worldpanel Division FMCG Monitor Nov 2020 ENDocument10 pagesKantar Worldpanel Division FMCG Monitor Nov 2020 ENcosmosmediavnPas encore d'évaluation

- Current State of Indian Economy: November 2008Document22 pagesCurrent State of Indian Economy: November 2008mayankmangalammPas encore d'évaluation

- Consumer Price Index - May 20Document5 pagesConsumer Price Index - May 20BernewsAdminPas encore d'évaluation

- Current Trends Update - Canada: Overview and HighlightsDocument3 pagesCurrent Trends Update - Canada: Overview and Highlightsderailedcapitalism.comPas encore d'évaluation

- Consumer Price Index - Dec 21Document4 pagesConsumer Price Index - Dec 21Anonymous UpWci5Pas encore d'évaluation

- Detail Note 2020q1 EnglishDocument16 pagesDetail Note 2020q1 Englishdilmisedara61Pas encore d'évaluation

- Consumer Price Index - Jan 21Document4 pagesConsumer Price Index - Jan 21BernewsAdminPas encore d'évaluation

- Economic Highlights - Leading Index Eased Further in July, Indicating Economic Slowdown in 2H 2010 Will Likely Extend Into 1H 2011 - 22/09/2010Document2 pagesEconomic Highlights - Leading Index Eased Further in July, Indicating Economic Slowdown in 2H 2010 Will Likely Extend Into 1H 2011 - 22/09/2010Rhb InvestPas encore d'évaluation

- Consumer Price Index March 2011Document14 pagesConsumer Price Index March 2011Politics.iePas encore d'évaluation

- Consumer Price Index - Jan 22 (06042022)Document4 pagesConsumer Price Index - Jan 22 (06042022)Anonymous UpWci5Pas encore d'évaluation

- July Retail Sales: Real Growth Continues: Consumer DiscretionaryDocument4 pagesJuly Retail Sales: Real Growth Continues: Consumer DiscretionaryMuhammad ImranPas encore d'évaluation

- Consumer Price Index (Cpi) Bulletin September 2022Document2 pagesConsumer Price Index (Cpi) Bulletin September 2022K_a_TT_yPas encore d'évaluation

- National Accounts Estimates 2023 q1Document1 pageNational Accounts Estimates 2023 q1henryvijayfPas encore d'évaluation

- National Accounts Estimates 2023 q2Document1 pageNational Accounts Estimates 2023 q2Sachini ChathurikaPas encore d'évaluation

- NESG Manufacturing Policy Brief May 2021Document11 pagesNESG Manufacturing Policy Brief May 2021uchenna joel iconPas encore d'évaluation

- GDP 2019 Annual PublicationDocument17 pagesGDP 2019 Annual PublicationAnonymous UpWci5Pas encore d'évaluation

- Singapore Consumer Price Index by Household Income Group: July - December and Full Year 2020Document5 pagesSingapore Consumer Price Index by Household Income Group: July - December and Full Year 2020Thu Hương BạchPas encore d'évaluation

- Dgp2023 Ceat LimitedDocument34 pagesDgp2023 Ceat Limited24812Pas encore d'évaluation

- Consumer Price Index - Dec 20Document4 pagesConsumer Price Index - Dec 20BernewsAdminPas encore d'évaluation

- Economic Highlights - Industrial Production Rebounded in March, Real GDP Grew Strongly in The 1Q - 12/5/2010Document4 pagesEconomic Highlights - Industrial Production Rebounded in March, Real GDP Grew Strongly in The 1Q - 12/5/2010Rhb InvestPas encore d'évaluation

- Ornua Customer Report - January 2022Document20 pagesOrnua Customer Report - January 2022Dixit NagpalPas encore d'évaluation

- Consumer Price Index - June 20Document5 pagesConsumer Price Index - June 20BernewsAdminPas encore d'évaluation

- National Output Income ExpenDocument40 pagesNational Output Income ExpenImanthi AnuradhaPas encore d'évaluation

- Kantar Worldpanel Division FMCG Monitor Full Year 2020 EN FinalDocument10 pagesKantar Worldpanel Division FMCG Monitor Full Year 2020 EN FinalvinhtamledangPas encore d'évaluation

- JUL 30 NBC Financial Group Weekly Economic LetterDocument11 pagesJUL 30 NBC Financial Group Weekly Economic LetterMiir ViirPas encore d'évaluation

- Prod 2Document20 pagesProd 2Valter SilveiraPas encore d'évaluation

- South Asia Monitor (June 2021)Document4 pagesSouth Asia Monitor (June 2021)Cornhill StrategyPas encore d'évaluation

- Fact SheetDocument4 pagesFact SheetSadanand MahatoPas encore d'évaluation

- Tracing - The - Business - Cycle - of - India - Since - The - PandemicDocument15 pagesTracing - The - Business - Cycle - of - India - Since - The - Pandemicsappyyadav1297Pas encore d'évaluation

- Singapore EconomyDocument11 pagesSingapore EconomyK60 Nguyễn Thúy HoàPas encore d'évaluation

- Mer September 2017Document30 pagesMer September 2017Anonymous iFZbkNwPas encore d'évaluation

- Current State of Indian Economy August 2010 Current State of Indian EconomyDocument16 pagesCurrent State of Indian Economy August 2010 Current State of Indian EconomyNishant VyasPas encore d'évaluation

- FinalDocument19 pagesFinalShashwat GodayalPas encore d'évaluation

- Canada OECD Economic Outlook May 2021Document4 pagesCanada OECD Economic Outlook May 2021Qian XinzhouPas encore d'évaluation

- Covid-19 Advent and Impact Assessment: Annex-IIIDocument8 pagesCovid-19 Advent and Impact Assessment: Annex-IIIAsaad AreebPas encore d'évaluation

- Contribution of Agriculture, Industries and Service Sectorto GDP in BangladeshDocument6 pagesContribution of Agriculture, Industries and Service Sectorto GDP in BangladeshlimonextremePas encore d'évaluation

- Industrial Production: Low Growth, But Better Than Hoped ForDocument9 pagesIndustrial Production: Low Growth, But Better Than Hoped FornnsriniPas encore d'évaluation

- March 2022 CPI ReportDocument4 pagesMarch 2022 CPI ReportBernewsAdminPas encore d'évaluation

- India International Trade Investment Website June 2022Document18 pagesIndia International Trade Investment Website June 2022vinay jodPas encore d'évaluation

- Consumer Price Index - June 21Document4 pagesConsumer Price Index - June 21BernewsAdminPas encore d'évaluation

- 2020 4 GDP SwitzerlandDocument4 pages2020 4 GDP SwitzerlandService NadraPas encore d'évaluation

- 2013 Merrill Lynch Japan Conference 2013 Merrill Lynch Japan ConferenceDocument50 pages2013 Merrill Lynch Japan Conference 2013 Merrill Lynch Japan Conferencenattu123456Pas encore d'évaluation

- Annual Average of The Real Estate Price Index 2020ENDocument2 pagesAnnual Average of The Real Estate Price Index 2020ENCmc lebPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirPas encore d'évaluation

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirPas encore d'évaluation

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirPas encore d'évaluation

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirPas encore d'évaluation

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirPas encore d'évaluation

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirPas encore d'évaluation

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirPas encore d'évaluation

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirPas encore d'évaluation

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirPas encore d'évaluation

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirPas encore d'évaluation

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirPas encore d'évaluation

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirPas encore d'évaluation

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirPas encore d'évaluation

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirPas encore d'évaluation

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirPas encore d'évaluation

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirPas encore d'évaluation

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirPas encore d'évaluation

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirPas encore d'évaluation

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirPas encore d'évaluation

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirPas encore d'évaluation

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirPas encore d'évaluation

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirPas encore d'évaluation

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirPas encore d'évaluation

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirPas encore d'évaluation

- Hindi ShivpuranDocument40 pagesHindi ShivpuranAbrar MojeebPas encore d'évaluation

- Feds Subpoena W-B Area Info: He Imes EaderDocument42 pagesFeds Subpoena W-B Area Info: He Imes EaderThe Times LeaderPas encore d'évaluation

- Final Prmy Gr4 Math Ph1 HWSHDocument55 pagesFinal Prmy Gr4 Math Ph1 HWSHKarthik KumarPas encore d'évaluation

- HAYAT - CLINIC BrandbookDocument32 pagesHAYAT - CLINIC BrandbookBlankPointPas encore d'évaluation

- Paramount Healthcare Management Private Limited: First Reminder Letter Without PrejudiceDocument1 pageParamount Healthcare Management Private Limited: First Reminder Letter Without PrejudiceSwapnil TiwariPas encore d'évaluation

- Pt. Trijaya Agro FoodsDocument18 pagesPt. Trijaya Agro FoodsJie MaPas encore d'évaluation

- III.A.1. University of Hawaii at Manoa Cancer Center Report and Business PlanDocument35 pagesIII.A.1. University of Hawaii at Manoa Cancer Center Report and Business Planurindo mars29Pas encore d'évaluation

- UnixDocument251 pagesUnixAnkush AgarwalPas encore d'évaluation

- Asus Test ReportDocument4 pagesAsus Test ReportFerry RiantoPas encore d'évaluation

- Villamaria JR Vs CADocument2 pagesVillamaria JR Vs CAClarissa SawaliPas encore d'évaluation

- Internet Bill FormatDocument1 pageInternet Bill FormatGopal Singh100% (1)

- Bag Technique and Benedict ToolDocument2 pagesBag Technique and Benedict ToolAriel Delos Reyes100% (1)

- BECIL Registration Portal: How To ApplyDocument2 pagesBECIL Registration Portal: How To ApplySoul BeatsPas encore d'évaluation

- Industrial Machine and ControlsDocument31 pagesIndustrial Machine and ControlsCarol Soi100% (4)

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREDocument170 pages21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89Pas encore d'évaluation

- Manual: Functional SafetyDocument24 pagesManual: Functional SafetymhaioocPas encore d'évaluation

- LM2TB8 2018 (Online)Document252 pagesLM2TB8 2018 (Online)SandhirPas encore d'évaluation

- Using The Monopoly Board GameDocument6 pagesUsing The Monopoly Board Gamefrieda20093835Pas encore d'évaluation

- Innovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschDocument28 pagesInnovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschacairalexPas encore d'évaluation

- Le Chatelier's Principle Virtual LabDocument8 pagesLe Chatelier's Principle Virtual Lab2018dgscmtPas encore d'évaluation

- Ae - Centuries Before 1400 Are Listed As Browsable DirectoriesDocument3 pagesAe - Centuries Before 1400 Are Listed As Browsable DirectoriesPolNeimanPas encore d'évaluation

- Centrifuge ThickeningDocument8 pagesCentrifuge ThickeningenviroashPas encore d'évaluation

- Research Paper On Air QualityDocument4 pagesResearch Paper On Air Qualityluwahudujos3100% (1)

- Stewart, Mary - The Little BroomstickDocument159 pagesStewart, Mary - The Little BroomstickYunon100% (1)

- Rockwell Collins RDRDocument24 pagesRockwell Collins RDRMatty Torchia100% (5)

- Particle BoardDocument1 pageParticle BoardNamrata RamahPas encore d'évaluation

- TrellisDocument1 pageTrellisCayenne LightenPas encore d'évaluation

- Lesson: The Averys Have Been Living in New York Since The Late NinetiesDocument1 pageLesson: The Averys Have Been Living in New York Since The Late NinetiesLinea SKDPas encore d'évaluation

- Pest of Field Crops and Management PracticalDocument44 pagesPest of Field Crops and Management PracticalNirmala RameshPas encore d'évaluation

- CDR Writing: Components of The CDRDocument5 pagesCDR Writing: Components of The CDRindikuma100% (3)

- All The Beauty in the World: The Metropolitan Museum of Art and MeD'EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeÉvaluation : 4.5 sur 5 étoiles4.5/5 (83)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeD'EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeÉvaluation : 4 sur 5 étoiles4/5 (88)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterD'EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterÉvaluation : 3.5 sur 5 étoiles3.5/5 (487)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedÉvaluation : 2.5 sur 5 étoiles2.5/5 (5)

- The United States of Beer: A Freewheeling History of the All-American DrinkD'EverandThe United States of Beer: A Freewheeling History of the All-American DrinkÉvaluation : 4 sur 5 étoiles4/5 (7)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyD'EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyPas encore d'évaluation

- Getting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsD'EverandGetting Started in Consulting: The Unbeatable Comprehensive Guidebook for First-Time ConsultantsÉvaluation : 4.5 sur 5 étoiles4.5/5 (10)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumD'EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumÉvaluation : 3 sur 5 étoiles3/5 (12)

- All You Need to Know About the Music Business: Eleventh EditionD'EverandAll You Need to Know About the Music Business: Eleventh EditionPas encore d'évaluation

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomD'EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomPas encore d'évaluation

- System Error: Where Big Tech Went Wrong and How We Can RebootD'EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootPas encore d'évaluation

- AI Superpowers: China, Silicon Valley, and the New World OrderD'EverandAI Superpowers: China, Silicon Valley, and the New World OrderÉvaluation : 4.5 sur 5 étoiles4.5/5 (398)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerD'EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerÉvaluation : 4 sur 5 étoiles4/5 (121)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesD'EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Pit Bull: Lessons from Wall Street's Champion TraderD'EverandPit Bull: Lessons from Wall Street's Champion TraderÉvaluation : 4 sur 5 étoiles4/5 (17)

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewD'EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewÉvaluation : 4.5 sur 5 étoiles4.5/5 (26)

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportD'EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportPas encore d'évaluation

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseD'EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseÉvaluation : 3.5 sur 5 étoiles3.5/5 (12)

- All You Need to Know About the Music Business: 11th EditionD'EverandAll You Need to Know About the Music Business: 11th EditionPas encore d'évaluation

- The World's Most Dangerous Geek: And More True Hacking StoriesD'EverandThe World's Most Dangerous Geek: And More True Hacking StoriesÉvaluation : 4 sur 5 étoiles4/5 (49)

- Glossy: Ambition, Beauty, and the Inside Story of Emily Weiss's GlossierD'EverandGlossy: Ambition, Beauty, and the Inside Story of Emily Weiss's GlossierÉvaluation : 4 sur 5 étoiles4/5 (45)

- Unveling The World Of One Piece: Decoding The Characters, Themes, And World Of The AnimeD'EverandUnveling The World Of One Piece: Decoding The Characters, Themes, And World Of The AnimeÉvaluation : 4 sur 5 étoiles4/5 (1)