Académique Documents

Professionnel Documents

Culture Documents

Markel Corp (MKL) Analysis by Find - Me - Value

Transféré par

Wall Street ConversationsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Markel Corp (MKL) Analysis by Find - Me - Value

Transféré par

Wall Street ConversationsDroits d'auteur :

Formats disponibles

Markel Corp.

(MKL)

June 2017

@find_me_value

Twitter: @find_me_value Email: findmevalue@gmail.com

Disclosure:

This presentation is for discussion and general informational purposes only. It does not have regard to the specific investment objective, financial

situation, suitability, or the particular need of any specific person who may receive this presentation, and should not be taken as advice on the merits of

any investment decision. This presentation is not an offer to sell or the solicitation of an offer to buy interests in a fund or investment vehicle managed by

@Find_Me_Value (Twitter handle) and is being provided to you for informational purposes only.

The views expressed herein represent the opinions of @Find_Me_Value, and are based on publicly available information with respect to Markel Corp.

(MKL). Certain financial information and data used herein have been derived or obtained from public filings, including filings made by the issuer with the

securities and exchange commission (sec), and other sources.

@Find_Me_Value has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained

or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such

third party for the views expressed herein.

No warranty is made that data or information, whether derived or obtained from filings made with the SEC or from any third party, are accurate. No

agreement, arrangement, commitment or understanding exists or shall be deemed to exist between or among @Find_Me_Value and any third party or

parties by virtue of furnishing this presentation.

Except for the historical information contained herein, the matters addressed in this presentation are forward-looking statements that involve certain risks

and uncertainties. You should be aware that actual results may differ materially from those contained in the forward-looking statements. @Find_Me_Value

shall not be responsible or have any liability for any misinformation contained in any SEC filing, any third party report or this presentation. There is no

assurance or guarantee with respect to the prices at which any securities of the issuer will trade, and such securities may not trade at prices that may be

implied herein.

The estimates, projections and pro forma information set forth herein are based on assumptions which @Find_Me_Value believes to be reasonable, but

there can be no assurance or guarantee that actual results or performance of the issuer will not differ, and such differences may be material. This

presentation does not recommend the purchase or sale of any security. @Find_Me_Value reserves the right to change any of its opinions expressed

herein at any time as it deems appropriate. @Find_Me_Value disclaims any obligation to update the information contained herein. Under no

circumstances is this presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security.

Do your own research. Trust but verify.

Twitter: @find_me_value Email: findmevalue@gmail.com

Brief Overview of Markel Corp.

Twitter: @find_me_value Email: findmevalue@gmail.com

Summary:

Insurance company specialty insurance, niche markets

Focus on differentiation through expertise of clients, services

Formed in 1930 in Virginia, December 1986 IPO on NASDAQ at $8.33/share

Currently about $975 per share (BVPS is $615, trading at ~1.6x BVPS)

Compounded stock price about 17% CAGR since IPO in 1986

Models the business to be like Berkshire Hathaway

Consistently have underwriting profits

Invest the insurance portfolio in a double-barreled approach of public and private equities

Diversify the overall business through non-insurance company ownership

Grow earnings power at above-market rate

Measuring progress on longer term basis

Not splitting the stock price as it creates no economic value

No dividend, reinvests all cash flow

Twitter: @find_me_value Email: findmevalue@gmail.com

Important Events for Markel

Twitter: @find_me_value Email: findmevalue@gmail.com

Major Event: Terra Nova Acquisition (1999)

Markel wanted to expand more internationally

Acquired Terra Nova for $879 million, split about 50% in stock and 50% in cash

Subsequently had terrible underwriting performance as Terra Nova did not underwrite

policies appropriately

2000: 114% combined ratio

2001: 124% combined ratio

2002: 103.4% combined ratio

Example: 2000 Annual Report (7 months after acquisition was made)

The underwriting results of our International operation were disappointing, as we had a combined ratio of

116% from continuing operations. This is approximately 6% worse than our original expectation. These

poor results were due to business that was on the books prior to our acquisition. Throughout the year we

repriced and re-underwrote the ongoing business, and eliminated many underperforming programs. As a

result, we expect to report improved results in 2001, and we continue to believe that we will be able to

achieve underwriting profitability in the not too distant future.

The issues with the Terra Nova acquisition, in my opinion, is what caused tremendous

shareholder uncertainty with the late 2012 announcement of the Alterra Capital

acquisition, which would expand Markel into reinsurance

Twitter: @find_me_value Email: findmevalue@gmail.com

Major Event: Alterra Capital Acquisition (2013)

Announced December 2012

The $3.13 billion deal would be 73% in stock and 27% in cash

Stock price fell from $486 to $436 on the day of the announcement, a ~10% decline

Shareholders likely remembered the Terra Nova acquisition, the desire to enter into new

markets through M&A, and the subsequent terrible underwriting discoveries that led to a

few years of underwriting losses

Did Markel have underwriting losses post-Alterra, similar to Terra Nova?

2013: adjusted combined ratio of 101.8% for the reinsurance segment

2014: 95.7% combined ratio for reinsurance

2015: 89.7% combined ratio for reinsurance

2016: 87.2% combined ratio for reinsurance

Looks like Markel management avoided making the same mistake twice

Twitter: @find_me_value Email: findmevalue@gmail.com

Why did Markel Acquire Alterra?

Increased scale and size, almost doubling their gross premiums written to $4.4 billion

from $2.5 billion

Some insurance duration diversification about 50% would be short-tail, 50% long-tail

Alterra was 56% short-tail, 44% long tail

Markel believed Alterras management did an adequate job reserving their policies written

Expands the investment balance sheet, giving Gayner (Markels CIO) a total of $16 billion

to work with

Adjust the Alterra portfolio to become more Markel-oriented

End of 2012, 94.9% of the portfolio was in cash and fixed maturities, 5.1% in hedge funds

Twitter: @find_me_value Email: findmevalue@gmail.com

Overview of Insurance

Twitter: @find_me_value Email: findmevalue@gmail.com

Markels Insurance Business:

Largely a specialty insurance provider

Different than standard market rates more regulated, products and coverage is mostly

uniform

Standard market is highly competitive on price

Specialty market (where Markel writes insurance) is less price-sensitive, more focus is on

hard-to-place risks that are outside of expertise of standard insurance carriers

Some niche markets Markel focuses on:

Wind and earthquake exposed commercial properties

Professional liability

Workers compensation for small businesses

Classic cars

Summer camps

Twitter: @find_me_value Email: findmevalue@gmail.com

What Kind of Insurance Company is Markel?

$3.9 billion in earned premiums in 2016 (similar in 2014, 2015)

Earned Premiums = 78% is non-reinsurance

Reserves = 74% are non-reinsurance

About 60% of business is casualty / 40% is property

80% of premiums written are in North America (77% United States), with 7% from UK

Twitter: @find_me_value Email: findmevalue@gmail.com

Insurance Overview: Underwriting is a Strength

Have shown a good job of adequately

reserving losses, compared to actual claims

paid (see chart)

Focus on underwriting profits is a true

differentiator in the insurance industry; other

companies will say this, but it is lip service

However, this also means that MKL will not

grow premiums much, if at all, at times during

price-competitive times

This focus on underwriting profits limits their

ability to extract leverage out of the fixed

income portfolio; however, it allows them to

invest a higher percentage of SH Equity in

investments than the typical insurance

company

Twitter: @find_me_value Email: findmevalue@gmail.com

Underwriting: Compared to P&C Industry

If combined ratio > 100%, they lose money

on underwriting insurance for the year

Twitter: @find_me_value Email: findmevalue@gmail.com

Markel Consistently Outperforms P&C Industry on Underwriting

Twitter: @find_me_value Email: findmevalue@gmail.com

How Insurance Has Impacted Markels Economics

The market has been soft for the last ~12

years or so; in other words, excess capital and

too much competition on price leads to often

underpricing risks and later losing money

Markels float slowed down in mid-2000s,

which is when the soft market began

Organic growth in the insurance business (i.e.

writing policies) slowed, as since Markel tries

to match the reserves (duration and in size)

with a fixed income portfolio, the fixed income-

to-S/H Equity leverage declined

Due to this, Markel shifted focus to earning

money in other ways in addition to U/W profits

Twitter: @find_me_value Email: findmevalue@gmail.com

Writing Insurance & the Fixed Income Portfolio

The fixed income portfolio, all things being considered,

grows with growth in the reserves/ underwriting more

insurance

Shorter-tail: more investments likely will be shorter

duration, more liquid, as premiums in and claims paid

have short lives. This is more common in property-type

insurance.

Longer tail: possible to expand the fixed income portfolio

a little more than claims take longer to pay out. This is

more common in casualty-type insurance.

As Markels insurance business mix has shifted, they

are now more matched in terms of insurance reserves

with their fixed income portfolio

Due to the fact that the duration of the liabilities are 4-6

years, they underwrite consistently at a profit, and earn

about $300m post-tax in net investment income, they

can invested a sizable portion of SH Equity in higher

return investments (public equities)

Twitter: @find_me_value Email: findmevalue@gmail.com

Soft Market in Insurance since 2005

Fixed income leverage tied directly to growth

in insurance business

As the market became soft, Markels reserve

(and float) became stagnant, actually

declining some

Other components of the balance sheet were

growing still namely the equity portfolio

Goals is to match insurance liabilities with the

fixed income portfolio and use the

shareholders equity for higher return

investments, such as Markel Ventures and

Equities

Markel strives to be around 65% of SH Equity

in Equity Investments (see chart)

Twitter: @find_me_value Email: findmevalue@gmail.com

Soft Market = Stagnant Premium Growth:

See chart right

The soft market made writing insurance less

profitable, Markel slowed down writing insurance,

the fixed income portfolio became stagnant while

SH Equity continued to grow. Thus, the Fixed

income-to-SH Equity leverage decreased

In 2002, fixed income was 2.8x the size of SH

Equity. A 3% yield on the fixed income portfolio

essentially grew BV by 8.4%, prior to any other

income sources.

Its not difficult to see why Markel grew BVPS

around 20% CAGR in the early 2000s

Now, fixed income-SH Equity leverage is 1.17x.

The same 3% yield adds about 3.6% growth in BV.

Twitter: @find_me_value Email: findmevalue@gmail.com

BVPS Growth

Twitter: @find_me_value Email: findmevalue@gmail.com

BVPS Metric

Does BVPS growth the only metric that matters?

In my opinion, for the most part, yes

Similar to Berkshire Hathaway. Despite the tremendous non-insurance segments at BRK,

what propels stock returns is adequate growth in BVPS at this point.

Of the total assets, $25 billion are in insurance operations and $1.5 billion in Markel

Ventures. Given that Ventures earns minimal net income and only comprises of 5-6% of

assets, Markel is still very much an insurance company and is valued based on B/S

returns.

It is my belief that BVPS growth is the primary metric for the stock.

Investors may, at times, recognize the value of MKL Ventures, but the backstop for

valuation will continue to be BVPS growth over time, until Ventures becomes far more

sizable and contributes more to net income/FCFE

Twitter: @find_me_value Email: findmevalue@gmail.com

Markel: BVPS & Growth

BVPS Growth has been impressive over time, growing at a ~14% CAGR from 1999-2016

Markels stated goal is to double BVPS every 5 years

In the following slides, I will discuss exactly how Markels BVPS growth has been so strong

Using history as a guide, I will then try to estimate how Markels BVPS growth should be going forward

Twitter: @find_me_value Email: findmevalue@gmail.com

What Is the Narrative for Why BVPS Grows?

Many think of Markel as growing BVPS at above-industry rates for these reasons:

Culture for writing insurance; i.e. actually trying to have underwriting profits

Investing in equities at an above-industry rate (50-65% of SH Equity is in equities)

Above average investment skill by Gayner, the CIO

Double-barrel approach of investing capital: public market equities or private market (Markel Ventures)

I briefly discussed Markels skill as underwriters of insurance

This does provide them the luxury of investing in equities at a higher percentage of SH Equity than other

P&C companies

Provides them the luxury to invest in private companies Markel Ventures due to the relative consistency

in underwriting, among other things

Is Tom Gayner, Markels CIO, the secret sauce for their investing capabilities?

Does Markel Ventures propel book-value-per-share growth in addition to their other

methods?

Twitter: @find_me_value Email: findmevalue@gmail.com

Historical BV Growth:

Based on my analysis, since

E2002, S/H Equity has grown

by $7.3 billion:

$2.3 billion from Alterra

acquisition in 2013

$3.7 billion from net income

$1.4 billion from OCI flowing

through to the balance sheet, net

of taxes

Some reduction/increase from

share repurchases, RSUs, stock

issuance

Excluding Alterra, 100% of the

BV growth has come from net

income and OCI

73% from net income

27% from OCI gains

Twitter: @find_me_value Email: findmevalue@gmail.com

Is Tom Gayner Markels Lou Simpson (GEICO)?

Gayner does not do any of the underwriting business, therefore any underwriting profit is

not his doing

Gayners primary responsibilities are:

Invest the public equity portfolio

Invest the fixed income portfolio

Invest in Markel Ventures (private companies)

It is undeniable that the investment portfolio has been the main reason for historically

strong BVPS growth. Is it due to:

Actual investment performance being above average

Investment leverage

Large portion of SH Equity invested in equities, in order to drive higher BVPS growth

Answer: All of the above.

However, I believe the investment leverage and the decision to have a sizable portion of

SH Equity in public equities are the dominant force behind the growth

Twitter: @find_me_value Email: findmevalue@gmail.com

Investment Performance: Public Equities

In comparing the equity portfolio performance with the S&P 500, a substantial portion of alpha was generated prior to the global

financial crisis of 2008/2009

Gayner purposefully decided against investing in many technology stocks in the late 2000s, and he did superior to the S&P 500

due to this in the following year of the early 2000s

From 2009 to 2016, the average outperformance by Gayner in the public equity portfolio has been 1.7% per year

1.7% may seem immaterial, but I consider it a nice accomplishment, especially considering the increased competitiveness of

public market investing and as Markels balance sheet has expanded, thus limiting the potential public investments that can be

made

By my calculations, Gayner has added around $300m (pre-tax) in added returns from 2009-2016, compared to if he just

invested passively in the S&P 500

Twitter: @find_me_value Email: findmevalue@gmail.com

Investment Performance: Fixed Income

Comparing the fixed income portfolio to the Barclays Aggregate Bond Index, despite the volatility in comparing the two on a year

to year basis, there really hasnt been any net outperformance on a pre-tax basis

However, Markel invests a sizable portion in municipal bonds, some are tax free and some are not

On a net basis, about 1/3 of the post-tax net investment income, which is the single largest driver of BVPS growth, comes from

tax-free municipal bond income

Municipal bond tax-free interest = ~$90 million per year

Being active in choosing which bonds to own is more apparent in looking at the estimated post-tax bond returns

Twitter: @find_me_value Email: findmevalue@gmail.com

Markel Ventures

The creation of this segment inside Markel likely has more stock price value than actual economic value, at

this point

If we prefer to value MKL on a BVPS growth basis, Ventures barely contributes:

$1.2 billion in revenues in 2016

$165 million in EBITDA (which would have been 2.1% of beginning of the year MKL S/H Equity)

With depreciation and amortization expenses of $60 million + $35 million in interest expense, not much net income from Markel Ventures yet

$56 million of net income

The amortization expenses are due to the acquisitions, in due time should decrease and the FCFE should mirror net income more closely

The economics of Markel Venture are decent, and net income understates the actual cash flow the business is

generating

Net income of $56 million in 2016

FCFE of $75m - $80m in 2016

I would anticipate Markel Ventures will become a meaningful contributor at some point; but currently:

Markel Ventures is likely worth around the invested capital in the business

The actual cash flow exceeds net income, but is not meaningful enough yet to move the stock

As there is limited net income, it does not propel BVPS growth yet, which I still believe is the primary metric for the stock price

However, if there is continued reinvestment in Ventures, it will undoubtedly give investors more to think about beyond just BVPS growth as the

economics of Ventures is understated in its contribution to BV

Twitter: @find_me_value Email: findmevalue@gmail.com

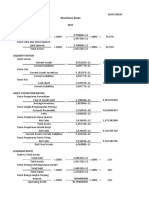

Overview of Markel Ventures Economics:

Twitter: @find_me_value Email: findmevalue@gmail.com

Circling Back Around to BVPS Growth

Why else is BVPS growth the primary current metric for valuing Markel Corp?

Their entire philosophy is: Our overriding perspective is a long-term one, and

correspondingly, we believe growth in book value per share over a multi-year

period is the best measure for assessing how we are doing at running the Company

and creating shareholder value.

Compensation is also tied to BVPS growth: For 2016, all of our executive officers

received incentive compensation relative to their base salaries on an equivalent

basis, and incentive compensation should comprise the vast majority of their target

compensation. Consistent with our long-term perspective, we believe incentive

compensation should be paid primarily on the basis of growth in book value

over a multi-year period.

The principal performance metrics for any compensation is book value growth over

the past 5 years

It would make sense that if BVPS growth is the primary metric for management

compensation, as well as it being their core management philosophy, at current state

BVPS growth should also be the primary metric for valuation

Despite Markel Ventures revenues and robust EBITDA, management is not incentive

based on MKL Ventures at the moment, as minimal net income from Ventures flows

through to BVPS growth

Twitter: @find_me_value Email: findmevalue@gmail.com

What Has Been Historical Drivers of BVPS Growth?

My analysis is that 73% of BV growth has come from net income, 27% from OCI

Of the net income, here are the dominant contributors:

Net Investment Income (3x as much of a contributor compared to U/W profits)

Underwriting Profits

Markel Ventures (< 1% run rate in 2017 as a contributor to BVPS growth)

Offset by interest expense amortization charges

Of the OCI, the dominant contributor is unrealized gains in the investment portfolio, largely the

equities, net of estimated taxes

Flow through of the realized selling in the investment portfolio, which increases net income on the P&L, but decreases the

unrealized gains in OCI if there is a net realized gain

Twitter: @find_me_value Email: findmevalue@gmail.com

Net Income: Largest Driver of BVPS Growth

73% of the BV growth due to net income

Despite being known for their underwriting skill, the

vast majority of the BVPS growth was due to the

interest income and dividends received from the

investment portfolio

This chart may be very telling in terms of

understanding why BV growth has slowed over the

last 15 years

Investment portfolio leverage to SH Equity has declined

And thus, NII contribution to BV growth for that year has

decline

From 2002-2007, Net Investment Income (interest

income + dividends from equities) contributed 10-

13% per year. In other words, if they didnt earn any

return on anything else, they wouldve increased BV

by 10-13% CAGR during that time period.

Now, it adds incremental BV contribution of less

than 4%, which is about 1/3 of what it was 15 years

ago.

Twitter: @find_me_value Email: findmevalue@gmail.com

What Drives Net Income?

The largest contributor to BVPS growth is net investment income

About $400m pre-tax, per year, around $300m post-tax (estimated)

Historical BVPS growth was much higher due specifically to the fixed income leverage-to- SH Equity, not as much the Equity

portfolio

As investment leverage has declined, BVPS growth has come down

Net Investment Income, a function of:

Fixed income yields and reinvestment yields

Equity yields and amount in equities

Taxation - how much is in tax-free municipal versus the 35% corporate tax on dividends, interest

Current issues are:

Fixed income yields have been coming down, as bonds mature and current rates are low

Premiums are not growing organically, and thus the fixed income leverage to SH Equity has been coming down from previous years

More and more of the growth in BVPS is coming from OCI, which is tied directly to the performance of the equity portfolio (stock

market)

What happens if the stock market takes a tumble, how does this impact BVPS growth?

Current valuations in the public and private markets are elevated, and thus there is less activity in MKL Ventures (except for a few

deals here and there) and the public equity portfolio is under-invested, at 0.55x (+/-) compared to the goal of 0.65x

In order to grow BVPS at double digit clips in this environment, would need to use the excess cash on the balance sheet + current

MKL stock to make another acquisition (I think this is an actual possibility, based on their desire to grow BVPS and lack of

investment opportunities)

Twitter: @find_me_value Email: findmevalue@gmail.com

Thinking About Future BVPS Growth:

To think about future BV growth, may be helpful to think of different scenarios and how net income

will be influenced

If interest rates higher, MKL has about $4 billion in ST investments and cash (unrestricted) earning about $10 million a year

on (0.25% ROR), and they would be more inclined to put the capital to work. Currently, with rates low, they are purposely

being more patient and feel the opportunity cost is minimal

If they write more casualty insurance: fixed income to SH Equity leverage could increase, as casualty is more long-tailed

If they write more property insurance: fixed income to SH equity leverage could decrease, as it is more short-tailed. Also -

could decrease the duration of the fixed income portfolio (meaning lower yields on portfolio). This would make the balance

sheet more volatile.

At current scenario, they are earning about $275m - $300m post-tax from interest and dividends. Considering the lack of

reinvestment options in fixed income markets, the lack of insurance organic growth, the higher valuation in both public and

private equity markets, the cash flow likely to accumulate in ST investments and cash for the time being. This is good (they

are being patient, are disciplined) and bad (temporarily under-earning, market could stay this way for some time, in which

they are under-earnings and continuing to accumulate cash. Maybe this leads them to become impatient?)

Twitter: @find_me_value Email: findmevalue@gmail.com

Estimating Current BVPS Growth:

Assumptions:

No large M&A deal

Current soft insurance market

Minimal core premium growth

Increased focus on underwriting profits due to other circumstances requiring the need of more contribution of U/W profits

Some growth in MKL Ventures

Fixed income leverage-to-SH stays around 1.2x, but declines some over time due to anemic premium growth

Minimal realized gains on investment portfolio as equity dividend yield (at cost) is about 3.2%, but ~25% of the stocks they own

do not pay dividends. The remaining 75% of stock portfolio averages 4% dividend yield. This implies theyve been held for a

period of years, as only 5 of their top 50 holdings has a dividend yield > 3.0%

Net Investment income = easiest to forecast

Underwriting profits = forecastable, in a range, barring any large CAT event

The largest problem I foresee is that there are limited reinvestment opportunities, currently

Limited reinvestment back in to equities

Limited desire to add much to the fixed income portfolio, as rates are low and premium growth is low

Valuations in the private business market is higher, as theyve been outbid as others are willing to pay higher valuations

Twitter: @find_me_value Email: findmevalue@gmail.com

BVPS in Current Market State: Assumptions

Twitter: @find_me_value Email: findmevalue@gmail.com

BVPS Growth Estimates:

Twitter: @find_me_value Email: findmevalue@gmail.com

Notes on BVPS Growth:

Equity portfolio is under-leveraged. If go from 58% of SH Equity to 65%, would increase the equity portfolio by $585 million. If

average dividend is 1.5% and returns are 6%, it would add an extra $2.00 - $2.50 per share in BV (extra 3% +/- on current BV)

If insurance market became hard, returns could increase substantially, despite the likelihood that there would be an initial BV

impact from whatever event ( large CAT, for example)

Interest rates rising would likely be a net benefit, as bond income could be reinvested, and at better yields, and there is an extra

$3 - $4 billion in dry powder just waiting. If $3 billion were reinvested at 3% pre-tax yields, it could add about $5 per share in BV

due to increases in net investment income without assuming any unrealized gains

If the market stays as it is, I would guess that Markel grows BVPS at around 5-8% over the next 3-5 years

Could be higher if underwriting is slightly better. For every 1% improvement in total combined ratio, would increase BVPS by $1.75 +/-

Markel Ventures could improve at a faster organic clip than 5%

Investments could perform better than 6% for equities and 0% for fixed income

If there is minimal unrealized growth in the portfolio, based on the current state of the market and industry, I would estimate

about 4% BVPS growth

My guess: if the market stays AS IT IS Markel will do a decent size acquisition in the next 2-3 years. Could be in the

insurance space, or a larger acquisition to bolster Markel Ventures. This would (obviously) increase BVPS growth and

provide other reinvestment opportunities.

Twitter: @find_me_value Email: findmevalue@gmail.com

Feedback/Comments are Appreciated.

Twitter:

@find_me_value

Twitter: @find_me_value Email: findmevalue@gmail.com

Vous aimerez peut-être aussi

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketD'EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketPas encore d'évaluation

- Capital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValueD'EverandCapital Allocation: Principles, Strategies, and Processes for Creating Long-Term Shareholder ValuePas encore d'évaluation

- John Deere Investment AnalysisDocument6 pagesJohn Deere Investment Analysisgl101Pas encore d'évaluation

- Hiding in Plain Site: Diving Deeply Into SEC FilingsDocument8 pagesHiding in Plain Site: Diving Deeply Into SEC FilingsfootnotedPas encore d'évaluation

- Eric Khrom of Khrom Capital 2013 Q1 LetterDocument4 pagesEric Khrom of Khrom Capital 2013 Q1 LetterallaboutvaluePas encore d'évaluation

- Pershing Square Target Presentation 2008Document80 pagesPershing Square Target Presentation 2008goldan203454Pas encore d'évaluation

- Interviews Value InvestingDocument87 pagesInterviews Value Investinghkm_gmat4849100% (1)

- Eminence CapitalMen's WarehouseDocument0 pageEminence CapitalMen's WarehouseCanadianValuePas encore d'évaluation

- Sequoia Transcript 2012Document20 pagesSequoia Transcript 2012EnterprisingInvestorPas encore d'évaluation

- Idea VelocityDocument2 pagesIdea Velocitynirav87404Pas encore d'évaluation

- 2010 Q4 Letter Khrom CapitalDocument5 pages2010 Q4 Letter Khrom CapitalallaboutvaluePas encore d'évaluation

- RV Capital June 2015 LetterDocument8 pagesRV Capital June 2015 LetterCanadianValuePas encore d'évaluation

- Third Point Q3 2019 LetterDocument13 pagesThird Point Q3 2019 LetterZerohedge100% (2)

- Scion 2006 4q Rmbs Cds Primer and FaqDocument8 pagesScion 2006 4q Rmbs Cds Primer and FaqsabishiiPas encore d'évaluation

- Arlington Value 2014 Annual Letter PDFDocument8 pagesArlington Value 2014 Annual Letter PDFChrisPas encore d'évaluation

- VALUEx Vail 2014 - Visa PresentationDocument19 pagesVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- Einhorn Q4 2015Document7 pagesEinhorn Q4 2015CanadianValuePas encore d'évaluation

- 2012 q3 Letter DdicDocument5 pages2012 q3 Letter DdicDistressedDebtInvestPas encore d'évaluation

- How To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007Document145 pagesHow To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007tomhigbiePas encore d'évaluation

- Arlington Value 2006 Annual Shareholder LetterDocument5 pagesArlington Value 2006 Annual Shareholder LetterSmitty WPas encore d'évaluation

- Seth Klarman Letter 1999 PDFDocument32 pagesSeth Klarman Letter 1999 PDFBean LiiPas encore d'évaluation

- Wisdom From Seth Klarman - Part 5Document3 pagesWisdom From Seth Klarman - Part 5suresh420Pas encore d'évaluation

- Artko Capital 2018 Q4 LetterDocument9 pagesArtko Capital 2018 Q4 LetterSmitty WPas encore d'évaluation

- 1 L I LL I: WWW EscDocument4 pages1 L I LL I: WWW EscforexmastertanPas encore d'évaluation

- The 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy HimDocument5 pagesThe 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy Himrakeshmoney99Pas encore d'évaluation

- Eric Khrom of Khrom Capital 2012 Q4 LetterDocument5 pagesEric Khrom of Khrom Capital 2012 Q4 LetterallaboutvaluePas encore d'évaluation

- Bill Ackman's Ira Sohn JCP PresentationDocument64 pagesBill Ackman's Ira Sohn JCP PresentationJohnCarney100% (1)

- Fitch - Mortgage REITs Rating GuidelineDocument18 pagesFitch - Mortgage REITs Rating GuidelinepacjkPas encore d'évaluation

- Bruce Berkowitz On WFC 90sDocument4 pagesBruce Berkowitz On WFC 90sVu Latticework PoetPas encore d'évaluation

- Notes From A Seth Klarman MBA LectureDocument5 pagesNotes From A Seth Klarman MBA LecturePIYUSH GOPALPas encore d'évaluation

- 2010 Value Investing Congress NotesDocument34 pages2010 Value Investing Congress NotesDistressedDebtInvestPas encore d'évaluation

- Klarman WorryingDocument2 pagesKlarman WorryingSudhanshuPas encore d'évaluation

- Chuck Akre Transcript VIC 2011Document13 pagesChuck Akre Transcript VIC 2011harishbihaniPas encore d'évaluation

- Greenlight Capital Letter (1-Oct-08)Document0 pageGreenlight Capital Letter (1-Oct-08)brunomarz12345Pas encore d'évaluation

- Tom Gayner Value Investor Conference TranscriptDocument9 pagesTom Gayner Value Investor Conference TranscriptCanadianValue100% (1)

- Li Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent LectureDocument14 pagesLi Lu's 2010 Lecture at Columbia My Previous Transcript View A More Recent Lecturepa_langstrom100% (1)

- Cadbury Trian LetterDocument14 pagesCadbury Trian Letterbillroberts981Pas encore d'évaluation

- 3 Crispin Odey PresentationDocument23 pages3 Crispin Odey PresentationWindsor1801Pas encore d'évaluation

- Elliott Management Letter To CDK 06.08.16Document5 pagesElliott Management Letter To CDK 06.08.16LuisA.GonzalezPas encore d'évaluation

- Aquamarine - 2013Document84 pagesAquamarine - 2013sb86Pas encore d'évaluation

- Baupost GroupDocument7 pagesBaupost GroupValueWalk0% (1)

- Graham & Doddsville Winter Issue 2018Document33 pagesGraham & Doddsville Winter Issue 2018marketfolly.comPas encore d'évaluation

- Peter LynchDocument2 pagesPeter LynchShiv PratapPas encore d'évaluation

- Focus InvestorDocument5 pagesFocus Investora65b66inc7288Pas encore d'évaluation

- Distressed Debt InvestingDocument5 pagesDistressed Debt Investingjt322Pas encore d'évaluation

- Warren BuffetDocument11 pagesWarren BuffetmabhikPas encore d'évaluation

- Einhorn - Q1 '12 Letter To PartnersDocument7 pagesEinhorn - Q1 '12 Letter To PartnersAAOI2Pas encore d'évaluation

- Summary of Louis C. Gerken & Wesley A. Whittaker's The Little Book of Venture Capital InvestingD'EverandSummary of Louis C. Gerken & Wesley A. Whittaker's The Little Book of Venture Capital InvestingPas encore d'évaluation

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachD'EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachPas encore d'évaluation

- Wisdom on Value Investing: How to Profit on Fallen AngelsD'EverandWisdom on Value Investing: How to Profit on Fallen AngelsÉvaluation : 4 sur 5 étoiles4/5 (6)

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsD'EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsPas encore d'évaluation

- Financial Fine Print: Uncovering a Company's True ValueD'EverandFinancial Fine Print: Uncovering a Company's True ValueÉvaluation : 3 sur 5 étoiles3/5 (3)

- Competitive Advantage in Investing: Building Winning Professional PortfoliosD'EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosPas encore d'évaluation

- Exceptional Stock Market Performers: Who Are They? What Sets Them Apart?D'EverandExceptional Stock Market Performers: Who Are They? What Sets Them Apart?Pas encore d'évaluation

- Amalgamation Journal EntriesDocument5 pagesAmalgamation Journal EntriesBCS78% (9)

- Bond ValuationDocument35 pagesBond ValuationVijay SinghPas encore d'évaluation

- Case FubukiDocument1 pageCase FubukiSumayya ChughtaiPas encore d'évaluation

- Maldives Islamic Bank Appoints New CEO and Head of Office in Hulhumale AishathDocument1 pageMaldives Islamic Bank Appoints New CEO and Head of Office in Hulhumale AishathMH DataPas encore d'évaluation

- Mckinsey Quarterly - A Better Way To Understand TRSDocument6 pagesMckinsey Quarterly - A Better Way To Understand TRSqweenPas encore d'évaluation

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaPas encore d'évaluation

- Part 4 Capital BudgetingDocument5 pagesPart 4 Capital BudgetingToulouse18Pas encore d'évaluation

- Securities & Exchange Board of India (Sebi)Document25 pagesSecurities & Exchange Board of India (Sebi)lattymbaPas encore d'évaluation

- Skinning FundsDocument12 pagesSkinning FundsNehemia T MasiyaziPas encore d'évaluation

- Axiata Supplier Declaration Form: (Insert Your Organisation Name & Registration No.)Document3 pagesAxiata Supplier Declaration Form: (Insert Your Organisation Name & Registration No.)Mahamudul HasanPas encore d'évaluation

- Giao dịch bằng ngoại tệ, chuyển đổi báo cáo tài chính từ đồng tiền này sang đồng tiền khácDocument40 pagesGiao dịch bằng ngoại tệ, chuyển đổi báo cáo tài chính từ đồng tiền này sang đồng tiền khácHuỳnh Minh Gia HàoPas encore d'évaluation

- Ipsas 5 Borrowing CostsDocument12 pagesIpsas 5 Borrowing CostsArogundade kamaldeenPas encore d'évaluation

- BM - Simple and CompoundDocument50 pagesBM - Simple and CompoundMarites Domingo - Paquibulan100% (1)

- General Mathematics: Second Quarter Module 3: Simple and General AnnuitiesDocument15 pagesGeneral Mathematics: Second Quarter Module 3: Simple and General AnnuitiesJelrose SumalpongPas encore d'évaluation

- X-Ray of Economic Implications of Corruption in Nigerian EconomyDocument20 pagesX-Ray of Economic Implications of Corruption in Nigerian EconomyOdinakachi100% (1)

- Project Proposal SampleDocument2 pagesProject Proposal SampleliujinxinljxPas encore d'évaluation

- AIRTEL Tariff Guide Poster A1Document1 pageAIRTEL Tariff Guide Poster A1Øb RèxPas encore d'évaluation

- NK HPC YRQSu RHQW YDocument10 pagesNK HPC YRQSu RHQW YRam B HadimaniPas encore d'évaluation

- UCC-House Joint Resolution 192, Chapter 49 - 05.06.1933Document2 pagesUCC-House Joint Resolution 192, Chapter 49 - 05.06.1933Bálint FodorPas encore d'évaluation

- DisinvestmentDocument15 pagesDisinvestmentjeevithajeevuPas encore d'évaluation

- Chapter 4 Others Income 26092021Document24 pagesChapter 4 Others Income 26092021Nr ZhrhPas encore d'évaluation

- Rakesh Jhunjhunwala Latest Portfolio HoldingsDocument3 pagesRakesh Jhunjhunwala Latest Portfolio HoldingsAshish YadavPas encore d'évaluation

- Ch-5 MONEYDocument6 pagesCh-5 MONEYYoshita ShahPas encore d'évaluation

- Concepts Statement 5 - As AmendedDocument18 pagesConcepts Statement 5 - As AmendedDian AngelenePas encore d'évaluation

- Narasimham Committee ReportDocument4 pagesNarasimham Committee ReportSumit MehtaPas encore d'évaluation

- AF210 Syllabus-2024 Spring 2pm PDFDocument3 pagesAF210 Syllabus-2024 Spring 2pm PDFZinioPas encore d'évaluation

- Cashless Eco SystemDocument43 pagesCashless Eco SystemAnirudh PrabhuPas encore d'évaluation

- Repeat After Me 8 14 13Document15 pagesRepeat After Me 8 14 13api-221838643Pas encore d'évaluation

- A2 Level Essential Vocabulary: The Global Economy (Economics)Document10 pagesA2 Level Essential Vocabulary: The Global Economy (Economics)A Grade EssaysPas encore d'évaluation

- ch10 - Divisional Performance DevelopmentDocument15 pagesch10 - Divisional Performance DevelopmentF RPas encore d'évaluation