Académique Documents

Professionnel Documents

Culture Documents

Chapter 3 - Part 3 - Inclass Exercises - SOLUTIONS

Transféré par

Summer0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues3 pagesTitre original

Chapter 3 - part 3 - inclass exercises - SOLUTIONS.docx

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

18 vues3 pagesChapter 3 - Part 3 - Inclass Exercises - SOLUTIONS

Transféré par

SummerDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

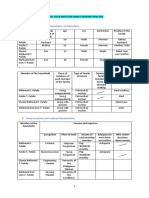

Exercise 3-6 (20 minutes)

1. Cost of Goods Manufactured

Direct materials:

Raw materials inventory, beginning . $12,000

Add: Purchases of raw materials. 30,000

Total raw materials available . 42,000

Deduct: Raw materials inventory, ending 18,000

Raw materials used in production 24,000

Less indirect materials included in manufac-

turing overhead .. 5,000

Direct labor .

Manufacturing overhead appli

process inventory...

Total manufacturing costs

Add: Beginning work in process inventory

Deduct: Ending work in process inventory

Cost of goods manufactured...

2. Cost of Goods Sold

Finished goods inventory, beginning. $ 35,000

Add: Cost of goods manufactured . 155,000

Goods available for sale 190,000

Deduct: Finished goods 42,000

Unadjusted cost of goods sold 148,000

Add: Underapplied overhead 4,000

Adjusted cost of goods sold

$ 19,000

58,000

87,000

164,000

56,000

220,000

65,000

$155,000

Exercise 3-16 (15 minutes)

1. Item (a): Actual manufacturing overhead costs incurred for the

year.

Item (b): Overhead cost applied to work in process for the year.

Item (c): Cost of goods manufactured for the year.

Item (d): Cost of goods sold for the year.

2. Cost of Goods Sold.....

Manufacturing Overhead

70,000

70,000

3. The underapplied overhead will be allocated to the other accounts on

the basis of the amount of overhead applied during the year in the end-

ing balance of each account:

Work in Proces: $19,500 5%

Finished Goods. 58,500 15

Cost of Goods Sold .. 312,000 _80

Total cost. $390,000 100 %

Using these percentages, the journal entry would be as follows:

Work in Process (5% x $70,000) 3,500

Finished Goods (15% x $70,000) 10,500

Cost of Goods Sold (80% x $70,000) . 56,000

Manufacturing Overhead. 70,000

Exercise 3-18 (30 minutes)

1. The predetermined overhead rate is computed as follows:

Y = $128,000 + $0.80 per MH x 80,000 MHs

Estimated fixed manufacturing overhead ... $128,000

Estimated variable manufacturing overhead

$0.80 per MH x 80,000 MHs 64,000

Estimated total manufacturing overhead co: $192,000

The predetermined overhead rate is computed as follows:

Estimated total manufacturing ovethead....... $192,000

+ Estimated total machine-hours ... 80,000 MHs

= Predetermined overhead rate . . $2.40. per MH

x

The amount of overhead cost applied to Work in Process for the year

would be: 75,000 machine-hours x $2.40 per machine-hour =

$180,000. This amount is shown in entry (a) below:

Manufacturing Overhead

Maintenance 21,000 (@ 180,000

Indirect materials 8,000

Indirect labor 60,000

Utilities 32,000

Insurance 7,000

Depreciation 56,000

Balance 4,000

Work in Process

Direct materials 710,000

Direct labor 90,000

Overhead (a) 180,000

3. Overhead is undetapplied by $4,000 for the year, as shown in the Manu-

facturing Overhead account above. The entry to close out this balance

to Cost of Goods Sold would be:

Cost of Goods Sold ...

Manufacturing Overhead.

4,000

4,000

Vous aimerez peut-être aussi

- Chapter 9 - Flexible Budgets and Performance AnalysisDocument3 pagesChapter 9 - Flexible Budgets and Performance AnalysisSummerPas encore d'évaluation

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerPas encore d'évaluation

- ACCT 311 - Chapter 5 Notes - Part 2Document2 pagesACCT 311 - Chapter 5 Notes - Part 2SummerPas encore d'évaluation

- ACCT 311 - Chapter 4 NotesDocument6 pagesACCT 311 - Chapter 4 NotesSummerPas encore d'évaluation

- ACCT 311 - Chapter 6 NotesDocument4 pagesACCT 311 - Chapter 6 NotesSummerPas encore d'évaluation

- Chapter 11 Solutions - Inclass ExercisesDocument4 pagesChapter 11 Solutions - Inclass ExercisesSummerPas encore d'évaluation

- ACCT 311 - Chapter 7 NotesDocument5 pagesACCT 311 - Chapter 7 NotesSummerPas encore d'évaluation

- ACCT 311 - Chapter 7 NotesDocument5 pagesACCT 311 - Chapter 7 NotesSummerPas encore d'évaluation

- ACCT 311 - Chapter 10 NotesDocument4 pagesACCT 311 - Chapter 10 NotesSummerPas encore d'évaluation

- ACCT 311 - Chapter 13 NotesDocument4 pagesACCT 311 - Chapter 13 NotesSummerPas encore d'évaluation

- ACCT 311 - Chapter 12 NotesDocument8 pagesACCT 311 - Chapter 12 NotesSummerPas encore d'évaluation

- ACCT 311 - Chapter 13 NotesDocument4 pagesACCT 311 - Chapter 13 NotesSummerPas encore d'évaluation

- ACCT 311 Exam ReviewDocument6 pagesACCT 311 Exam ReviewSummerPas encore d'évaluation

- ACCT 311 - Chapter 12 Solutions - Inclass PracticeDocument6 pagesACCT 311 - Chapter 12 Solutions - Inclass PracticeSummerPas encore d'évaluation

- ACCT 311 - Exam 2 Review and SolutionsDocument6 pagesACCT 311 - Exam 2 Review and SolutionsSummerPas encore d'évaluation

- ACC 311 Exam 3 Review KeyDocument7 pagesACC 311 Exam 3 Review KeySummerPas encore d'évaluation

- ACC 311 Exam 3 Review KeyDocument7 pagesACC 311 Exam 3 Review KeySummerPas encore d'évaluation

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 4 - Inclass ExercisesDocument8 pagesChapter 4 - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 6 - Inclass ExercisesDocument4 pagesChapter 6 - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 5 - Inclass Exercises - Part 2Document4 pagesChapter 5 - Inclass Exercises - Part 2SummerPas encore d'évaluation

- Chapter 5 - Inclass Exercises - Part 1Document3 pagesChapter 5 - Inclass Exercises - Part 1SummerPas encore d'évaluation

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 7 - Inclass ExercisesDocument4 pagesChapter 7 - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 9 - Inclass Ex 9-4Document3 pagesChapter 9 - Inclass Ex 9-4SummerPas encore d'évaluation

- Chapter 8 - Inclass ExercisesDocument8 pagesChapter 8 - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 9 - Inclass ExercisesDocument5 pagesChapter 9 - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 9 Solutions - Inclass ExercisesDocument5 pagesChapter 9 Solutions - Inclass ExercisesSummerPas encore d'évaluation

- Chapter 10 - Inclass ExercisesDocument4 pagesChapter 10 - Inclass ExercisesSummerPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Ojo 30% Homework - First Term - English 3Document4 pagesOjo 30% Homework - First Term - English 3Eillen GómezPas encore d'évaluation

- Exercise For Frail Elders - Elizabeth Best-MartiniDocument20 pagesExercise For Frail Elders - Elizabeth Best-Martinihop2e08etqknumzfxzsPas encore d'évaluation

- HIlife Brochure-1Document24 pagesHIlife Brochure-1Rakesh KumarPas encore d'évaluation

- Bodyweight Cardio ExercisesDocument8 pagesBodyweight Cardio ExercisesSameer's HomePas encore d'évaluation

- Week 1 Pe 12 Activity SheetDocument8 pagesWeek 1 Pe 12 Activity SheetDenise Michelle AntivoPas encore d'évaluation

- 45 Minute Full Body Dumbbell Workout For Beginners - Shrinkinguy FitnessDocument6 pages45 Minute Full Body Dumbbell Workout For Beginners - Shrinkinguy FitnessHex MARTINEZPas encore d'évaluation

- Pre-Test: Hope Module 1Document6 pagesPre-Test: Hope Module 1angel annPas encore d'évaluation

- The Circulatory System P2Document17 pagesThe Circulatory System P2Kristal CampbellPas encore d'évaluation

- Physical Therapy Leg Exercises For Stroke Patients - Flint RehabDocument16 pagesPhysical Therapy Leg Exercises For Stroke Patients - Flint RehabSabita SinghPas encore d'évaluation

- Sanford Coaching Manual - Rev1Document19 pagesSanford Coaching Manual - Rev1Mostafa Gamal100% (1)

- Okido Yoga Workshop A4 May 14Document1 pageOkido Yoga Workshop A4 May 14jmfurugoriPas encore d'évaluation

- Key Functional Exercises You Should Know PowerpointDocument36 pagesKey Functional Exercises You Should Know PowerpointJames YanPas encore d'évaluation

- Adi Mudra Brahmi MudraDocument1 pageAdi Mudra Brahmi MudraConstantin-Mihail PopescuPas encore d'évaluation

- Family Nursing Practice BaselineDocument3 pagesFamily Nursing Practice BaselineNathaniel PulidoPas encore d'évaluation

- bped-theory (2)Document27 pagesbped-theory (2)Prajjawal VermaPas encore d'évaluation

- Participation in Sports in Relation To Adolescent Growth and DevelopmentDocument10 pagesParticipation in Sports in Relation To Adolescent Growth and DevelopmentFlorentina LucanPas encore d'évaluation

- Success Secrets For Youth (New) - (Reality Book )Document278 pagesSuccess Secrets For Youth (New) - (Reality Book )Gagan MPas encore d'évaluation

- Pointers To Review in P.E 11 1Document5 pagesPointers To Review in P.E 11 1Serenity Nicole MateoPas encore d'évaluation

- Mr. Fat Loss: in This IssueDocument45 pagesMr. Fat Loss: in This IssueXie Zhen WuPas encore d'évaluation

- Edfd472 5Document9 pagesEdfd472 5api-497842163Pas encore d'évaluation

- PEDH or Physical Ed. HealthDocument6 pagesPEDH or Physical Ed. HealthCijesPas encore d'évaluation

- Hybrid Performance Method W1Document2 pagesHybrid Performance Method W1Louis Trần100% (1)

- Mapeh 8 1 Summative Test: Name: Jheaw Xhyra Kent R.Ycong Grade 8-LcbDocument2 pagesMapeh 8 1 Summative Test: Name: Jheaw Xhyra Kent R.Ycong Grade 8-LcbRisnaDPejo100% (1)

- My Personal Fitness ProgramDocument8 pagesMy Personal Fitness ProgramTrinidad, Gwen StefaniPas encore d'évaluation

- Discharge PlanDocument2 pagesDischarge PlanJohn MaglintePas encore d'évaluation

- The Truth About Strength and Conditioning For Young Soccer PlayersDocument2 pagesThe Truth About Strength and Conditioning For Young Soccer PlayersxyzPas encore d'évaluation

- PE Journal Entry on Importance of Physical EducationDocument2 pagesPE Journal Entry on Importance of Physical EducationRaizah Salva CambarihanPas encore d'évaluation

- Pathfit Midterm 2Document6 pagesPathfit Midterm 2Xhejian EwanPas encore d'évaluation

- Bow-Mapeh 7Document1 pageBow-Mapeh 7cristine gutierrezPas encore d'évaluation

- Rashid Fundamental Positions of The Arms and FeetDocument9 pagesRashid Fundamental Positions of The Arms and FeetMARIA LALAINE ACAINPas encore d'évaluation