Académique Documents

Professionnel Documents

Culture Documents

Leases: Other Lease Accounting Issues Executory Costs

Transféré par

SteeeeeeeephTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Leases: Other Lease Accounting Issues Executory Costs

Transféré par

SteeeeeeeephDroits d'auteur :

Formats disponibles

Leases

Other Lease Accounting Issues

Executory Costs

These are the normal costs of ownership and include such things as maintenance, insurance,

taxes, etc. Executory costs are normally paid by the lessee. In some lease agreements the lessor

pays certain executory costs and is subsequently reimbursed by the lessee. In this situation, the

lessee expenses such costs as paid and the lessor treats this as a pass through cost, not part of the

lessors expenses.

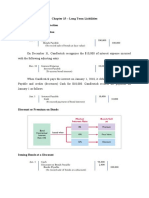

Discount Rate

The lessee is required to use the lower of the interest rate implicit in the lease or the lessees

incremental borrowing rate.

Lessors Initial Direct Costs

Initial direct costs are those costs such as legal fees, commissions, etc. that are incurred by the

lessor in order to originate the lease. These costs are handled differently depending on how the

lessor classifies the lease.

1) Operating Leases: initial direct costs are capitalized (as an asset) and amortized over the

life of the lease.

2) Direct Financing Leases: initial direct costs are deferred by reducing the lessors

unearned interest revenue. The amortization of unearned interest revenue includes both

the recognition of interest earned and the expensing of the initial direct costs.

3) Sales-Type Leases: initial direct costs are expensed at the recognition of the transaction

as selling costs.

F:\course\ACCT3322\200720\module2\c15\tnotes\c15c.doc 12/11/2006 1

Vous aimerez peut-être aussi

- C12 Intangible Assets PDFDocument32 pagesC12 Intangible Assets PDFSteeeeeeeephPas encore d'évaluation

- Chapter 13 LeaseDocument4 pagesChapter 13 Leasemaria isabella100% (2)

- 400 - 515 Lease Review44BDocument6 pages400 - 515 Lease Review44BZenni T XinPas encore d'évaluation

- Lease financing types and rationaleDocument13 pagesLease financing types and rationaleJay KishanPas encore d'évaluation

- LeasingDocument14 pagesLeasingFelix SwarnaPas encore d'évaluation

- Fundamentals of LeasingDocument27 pagesFundamentals of LeasingMehedi HasanPas encore d'évaluation

- Accounting for Leases GuideDocument13 pagesAccounting for Leases GuideShane KimPas encore d'évaluation

- C19A Share-Based Compensation & EPSDocument5 pagesC19A Share-Based Compensation & EPSSteeeeeeeephPas encore d'évaluation

- Audit of LeaseDocument17 pagesAudit of LeaseTrisha Mae RodillasPas encore d'évaluation

- Theoretical and Regulatory Framework of Leasing: Management of Financial Services - MY KhanDocument28 pagesTheoretical and Regulatory Framework of Leasing: Management of Financial Services - MY KhanSuraj Rajpurohit50% (2)

- CCIM Module 3 Study GuideDocument8 pagesCCIM Module 3 Study GuideTony Simpson100% (1)

- Chapter 4 LeaseDocument63 pagesChapter 4 Leasesamuel hailu100% (1)

- RMK Akm 2-CH 21Document14 pagesRMK Akm 2-CH 21Rio Capitano0% (1)

- Leases Accounting GuideDocument12 pagesLeases Accounting GuideIrvin OngyacoPas encore d'évaluation

- Chapter 13 LeasesDocument4 pagesChapter 13 LeasesAngelica Joy ManaoisPas encore d'évaluation

- Financial Services 2Document21 pagesFinancial Services 2Uma NPas encore d'évaluation

- LESSORDocument6 pagesLESSORLoreine Cyrille LirioPas encore d'évaluation

- Chapter 20 Accounting For Leases: Advantages of Leasing From The Lessee's ViewpointDocument4 pagesChapter 20 Accounting For Leases: Advantages of Leasing From The Lessee's ViewpointTruyenLePas encore d'évaluation

- Accounting For Leases Lecture Outline: Teaching TipDocument7 pagesAccounting For Leases Lecture Outline: Teaching TipKaya NedaPas encore d'évaluation

- Long Term Liabilities ChapterDocument11 pagesLong Term Liabilities Chapterowais khanPas encore d'évaluation

- Practical Guide Ias 17 LeasesDocument15 pagesPractical Guide Ias 17 Leasesgeorge antwiPas encore d'évaluation

- 21 Accounting For LeasesDocument28 pages21 Accounting For LeasesWisnuadi Sony PradanaPas encore d'évaluation

- Unit FourDocument28 pagesUnit FourTesfaye Megiso BegajoPas encore d'évaluation

- Lease PDFDocument13 pagesLease PDFAsma HatamPas encore d'évaluation

- Corporate Reporting - SPRING 2021 ACC-344 Assignment # 03 Submitted ToDocument5 pagesCorporate Reporting - SPRING 2021 ACC-344 Assignment # 03 Submitted ToAliyya TaimurPas encore d'évaluation

- Term Paper # 1. Definition and Meaning of Lease FinancingDocument16 pagesTerm Paper # 1. Definition and Meaning of Lease FinancingAniket PuriPas encore d'évaluation

- ACCT201 Handout (Topic 6) - LiabilitiesDocument36 pagesACCT201 Handout (Topic 6) - LiabilitiesElvin TanPas encore d'évaluation

- LeaseDocument1 pageLeasevanvunPas encore d'évaluation

- ILOs on Lease AccountingDocument12 pagesILOs on Lease AccountingMon RamPas encore d'évaluation

- Accounting for Leases from Lessor's Point of ViewDocument12 pagesAccounting for Leases from Lessor's Point of ViewJoh AguilarPas encore d'évaluation

- CH 21Document11 pagesCH 21Hanif MusyaffaPas encore d'évaluation

- Financial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverDocument41 pagesFinancial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverSouliman MuhammadPas encore d'évaluation

- Guidelines On The Tax Implications of Leasing 2010 01Document12 pagesGuidelines On The Tax Implications of Leasing 2010 01Ravi ChandraPas encore d'évaluation

- Lesson 2 LeaseDocument26 pagesLesson 2 Leaselil telPas encore d'évaluation

- Chapter14 - Leases Lessors2008 - Gripping IFRS 2008 by ICAPDocument27 pagesChapter14 - Leases Lessors2008 - Gripping IFRS 2008 by ICAPFalah Ud Din SheryarPas encore d'évaluation

- Auditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPADocument29 pagesAuditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPAArcelli Dela CruzPas encore d'évaluation

- LeasingDocument2 pagesLeasingSurya SimbolonPas encore d'évaluation

- LESSEE ACCOUNTING Basic PrinciplesDocument12 pagesLESSEE ACCOUNTING Basic PrinciplesDave AlerePas encore d'évaluation

- Chapter 13 LeasesDocument13 pagesChapter 13 Leaseslou-924Pas encore d'évaluation

- Accounting For Leases Fra 2012Document8 pagesAccounting For Leases Fra 2012Srishti ShawPas encore d'évaluation

- FinanceDocument7 pagesFinanceAyesha GuptaPas encore d'évaluation

- 1 Year MBADocument28 pages1 Year MBABijoy BijoyPas encore d'évaluation

- Assignment IA 2 - Week 15 PDFDocument39 pagesAssignment IA 2 - Week 15 PDFViola JovitaPas encore d'évaluation

- IAS 17 Leases GuideDocument13 pagesIAS 17 Leases GuideashfakkadriPas encore d'évaluation

- Relative Resource Manager 2Document61 pagesRelative Resource Manager 2hannah8985Pas encore d'évaluation

- IFRS 16: Lessor & Lessee Accounting Treatment in The Finance LeaseDocument2 pagesIFRS 16: Lessor & Lessee Accounting Treatment in The Finance LeaseboygarfanPas encore d'évaluation

- Leasing As A Financing AlternativeDocument35 pagesLeasing As A Financing AlternativeHamza Najmi100% (1)

- Understanding Long-Term Debt FinancingDocument22 pagesUnderstanding Long-Term Debt FinancingBlack boxPas encore d'évaluation

- 202004021945300501vasudha Kumar Finance Management 1Document7 pages202004021945300501vasudha Kumar Finance Management 1StarboyPas encore d'évaluation

- Lecture 5 - Notes On LeasingDocument1 pageLecture 5 - Notes On LeasingCalvin MaPas encore d'évaluation

- Keompok 5 - Accounting For LeasesDocument49 pagesKeompok 5 - Accounting For LeasesSirly NovianiPas encore d'évaluation

- Ind - As 17Document22 pagesInd - As 17ambarishPas encore d'évaluation

- Unit 2 - Fund Based FSSDocument27 pagesUnit 2 - Fund Based FSSgowrirao496Pas encore d'évaluation

- NAS 17 LeasesDocument16 pagesNAS 17 LeasesbinuPas encore d'évaluation

- Lease, HP, Project FinanceDocument30 pagesLease, HP, Project FinanceSneha Ashok100% (1)

- Long Term Debt EditedDocument16 pagesLong Term Debt EditedAdugnaPas encore d'évaluation

- Real Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsD'EverandReal Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsPas encore d'évaluation

- C19C Share-Based Compensation & EPSDocument8 pagesC19C Share-Based Compensation & EPSSteeeeeeeephPas encore d'évaluation

- C21A Statement of Cash FlowsDocument7 pagesC21A Statement of Cash FlowsSteeeeeeeephPas encore d'évaluation

- Correction of ErrorDocument2 pagesCorrection of ErrorAKINYEMI ADISA KAMORUPas encore d'évaluation

- C 20 ADocument8 pagesC 20 Aanon_492374916Pas encore d'évaluation

- C17A Pension & Postretirement BenefitsDocument2 pagesC17A Pension & Postretirement BenefitsSteeeeeeeephPas encore d'évaluation

- C 19 BDocument3 pagesC 19 BPratiwi WidyaPas encore d'évaluation

- C18A Shareholder's EquityDocument2 pagesC18A Shareholder's EquitySteeeeeeeephPas encore d'évaluation

- C16B Income TaxesDocument6 pagesC16B Income TaxesSteeeeeeeephPas encore d'évaluation

- C17E Pension & Postretirement BenefitsDocument4 pagesC17E Pension & Postretirement BenefitsSteeeeeeeephPas encore d'évaluation

- Chapter 18 Shareholders' Equity: Paid-In Capital Fundamental Share RightsDocument9 pagesChapter 18 Shareholders' Equity: Paid-In Capital Fundamental Share RightsSteeeeeeeephPas encore d'évaluation

- C18C Shareholder's EquityDocument12 pagesC18C Shareholder's EquitySteeeeeeeeph100% (1)

- Calculating Projected Pension BenefitsDocument2 pagesCalculating Projected Pension BenefitsSteeeeeeeephPas encore d'évaluation

- Accounting For Income TaxDocument13 pagesAccounting For Income Taxs_hirenPas encore d'évaluation

- C17C Pension & Postretirement BenefitsDocument2 pagesC17C Pension & Postretirement BenefitsSteeeeeeeephPas encore d'évaluation

- Kontabiliteti I Obligacioneve (Anglisht)Document11 pagesKontabiliteti I Obligacioneve (Anglisht)Vilma HoxhaPas encore d'évaluation

- C12A Investment Securities PDFDocument9 pagesC12A Investment Securities PDFSteeeeeeeephPas encore d'évaluation

- C17D Pension & Postretirement BenefitsDocument4 pagesC17D Pension & Postretirement BenefitsSteeeeeeeephPas encore d'évaluation

- C14B Long Term NotesDocument7 pagesC14B Long Term NotesSteeeeeeeephPas encore d'évaluation

- C15A LeasesDocument14 pagesC15A LeasesSteeeeeeeephPas encore d'évaluation

- Bonds and Notes AccountingDocument4 pagesBonds and Notes AccountingSteeeeeeeephPas encore d'évaluation

- C7B Accounts ReceivablesDocument10 pagesC7B Accounts ReceivablesSteeeeeeeephPas encore d'évaluation

- C13B ContingenciesDocument5 pagesC13B ContingenciesSteeeeeeeephPas encore d'évaluation

- Leases: F:/course/ACCT3322/200720/module2/c15/tnotes/c15b.doc 12/11/2006 1Document1 pageLeases: F:/course/ACCT3322/200720/module2/c15/tnotes/c15b.doc 12/11/2006 1SteeeeeeeephPas encore d'évaluation

- C7A Cash & Cash EquivalentsDocument6 pagesC7A Cash & Cash EquivalentsSteeeeeeeephPas encore d'évaluation

- C12B Equity MethodDocument5 pagesC12B Equity MethodSteeeeeeeephPas encore d'évaluation

- C8A InventoriesDocument10 pagesC8A InventoriesSteeeeeeeephPas encore d'évaluation

- C7 Accounting For ReceivablesDocument36 pagesC7 Accounting For ReceivablesSteeeeeeeephPas encore d'évaluation