Académique Documents

Professionnel Documents

Culture Documents

NDTV Tax Letter June 16 2017

Transféré par

PGurusDescription originale:

Copyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

NDTV Tax Letter June 16 2017

Transféré par

PGurusDroits d'auteur :

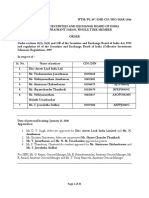

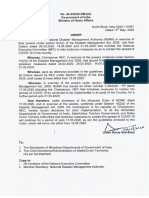

F.No. DCIT/Circle-18(1)/2017-18/150 Dated : 16.06.

2017

To

The Principal Officer,

M/s. New Delhi Television Limited,

207, Okhla Industrial Estate,

Phase-III, New Delhi - 110 020.

Madam/Sir,

Sub: Corporate announcement by M/s. New Delhi Television Limited regarding

intended disposal of equity stake by its subsidiaries Regarding-

Please refer to the above subject.

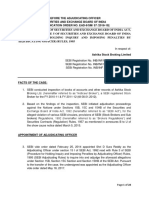

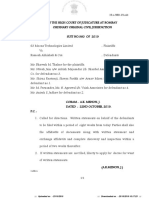

2. Order u/s 281 B of the Income Tax Act, 1961 directing provisional attachment of

assets was passed in the case of M/s. New Delhi Television Limited ("NDTV") on

14.09.2015, which was contested by NDTV in WP(C) 9120/2015 filed before the Hon'ble

Delhi High Court. During the proceedings, the Hon'ble High Court vide order dated

23.09.2015 was pleased to direct as under:-

"In the meanwhile, there shall be stay of operation of the impugned order dated

14.09.2015 subject to the petitioner's Li:1dertaking that the petitioner will not

alienate any asset or create any third party rights without the leave of the court

except in the ordinary course of business.''

3. NDTV has made corporate announcement at the National Stock Exchange and

Bombay Stock Exchange on 05.05.2017 intimating that the Board of Directors of NDTV

have approved, subject to approval of shareholders of NDTV, the following two intended

transactions of sale of equity :-

(i) Sale of entire 99.92% equity held by NDTV Lifestyle Holdings Ltd, NDTV

Convergence Ltd and NDTV Worldwide Ltd in the company NDTV Ethnic

Retail Ltd to the company Nameh Hotels & Resorts P Ltd@ Rs. 3.6518 per

equity share

(ii) Sale of 2% equity held by NDTV Networks Ltd in the company NDTV

Lifestyle Holdings Ltd to the company Narneh Hotels & Resorts P Ltd

@ Rs. 17.7247 per equity share

4. NDTV further disclosed on 12.05.2017 that the subsidiaries intended to be alienated

(i.e. NDTV Ethnic Retail Ltd and its WOS (100%) lndianroots Retail P Ltd) contribute

5352.01 million (i.e. Rs. 535.20 crore) towards the revenue and net worth of NDTV group.

On 19.05.2017. NDTV disclosed that it had issued postal ballot notice to its shareholders. It

also disclosed that for the purpose of fixing the value. NDTV has used the fair valuation

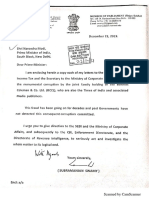

8. Apart from the above, more demand is likely to be raised for A Y 2008-09 amounting

to approx. Rs. 280 crore. Thus, it can be observed that there are / also likely to be, huge

demands in the case of NDTV. Reference is again invited to the directions of Hon'ble Delhi

High Court vide order dated 23.09.2015 passed in WP(C) 9120/2015 as reproduced in para 2

above. Copy of the said order is enclosed for ready reference. The said order continues to be

in operation till date.

9. [n view of the above, you are advised to ensure that the provisions of law and the

order passed by the Hon'ble Delhi High Court as stated above arc complied with in letter and

spirit and further, you are also advised not to create any charge / effect any transfer of any

asset of the company without previous permission of the Assessing Officer in accordance

with CBDT's Instruction No. 4 of 20l l dated 19.07.201 l.

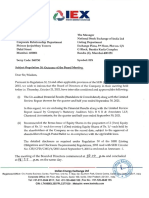

Yours faithfully,

Encls : As above. Dy. Commissioner of [ncome

Tax Circle-l8( l), New Delhi

Copy to (for information and with the request to take notice that the revenue's interest

is not adversely affected) :-

l. The Vice President, Listing and Compliance, National Stock Exchange Of [ndia Ltd.,

Exchange Plaza, C-l, Block G, Sandra Kurla Complex, Sandra East, Mumbai - 400

05 l.

2. The Assistant Vice President, Compliance and Listing, National Stock Exchange Of

India Ltd., Exchange Plaza, C-1, Block G, Sandra Kurla Complex, Sandra East.

Mumbai - 400 051.

3. The Chief General Manager, Corporate Finance Department Division of Corporate

Restructuring, Securities Exchange Board of India (SEBI), Plot No.C4-A,'G' Block,

Sandra Kurla Complex, Sandra (East), Mumbai 40005 l.

4. The Deputy General Manager, Integrated Surveillance Department, (ISO), Securities

Exchange Board of India (SEBI), Plot No.C4-A,'G' Block, Bandra Kurla Complex,

Sandra (East), Mumbai 40005 l .

5. The General Manager_ Compliance and Listing. BSE Ltd., Phiroze Jecjeebhoy

Towers, Dalal Street, Mumbai - 400001.

6. The Deputy General Manager, Compliance and Listing, BSE Ltd.. Phiroze Jeejeebhoy

Towers. Dalal Street. Mumbai - 40000 I.

7. Mis. Nameh Hotels & Resorts Private Limited. Plot No. 09, Ground Floor, Copia

Corporate Suites. Jasola. New Delhi - 110044.

Vous aimerez peut-être aussi

- Indiabulls PILDocument64 pagesIndiabulls PILPGurus100% (1)

- 16-5 Villanueva vs. CaDocument2 pages16-5 Villanueva vs. CaGC EleccionPas encore d'évaluation

- Tender High MastDocument53 pagesTender High MastsaranyavishnukanthPas encore d'évaluation

- Fast-Track Tax Reform: Lessons from the MaldivesD'EverandFast-Track Tax Reform: Lessons from the MaldivesPas encore d'évaluation

- CFD factFindingCommittee ReportDocument49 pagesCFD factFindingCommittee ReportPGurus100% (1)

- International Code of Signals SlidesDocument54 pagesInternational Code of Signals Slidesjoshuaraj_27100% (2)

- F App FinderDocument89 pagesF App Finderkolboldbard50% (2)

- Mumbai TendernoticeDocument6 pagesMumbai TendernoticeRahul HanumantePas encore d'évaluation

- The Rei Vindicatio and Estoppel PDFDocument10 pagesThe Rei Vindicatio and Estoppel PDFfoxations100% (1)

- People of The Philippines,: ComplainantDocument2 pagesPeople of The Philippines,: ComplainantGabriel Ray Luzano100% (2)

- Legal Notice - Osho PackagingDocument4 pagesLegal Notice - Osho PackagingUtkarsh KhandelwalPas encore d'évaluation

- Eye Movement Desensitization & Reprocessing (EMDR) Therapy: Michael K, MS3Document7 pagesEye Movement Desensitization & Reprocessing (EMDR) Therapy: Michael K, MS3michael karp100% (1)

- G.R. No. 188471Document2 pagesG.R. No. 188471Noel Christopher G. BellezaPas encore d'évaluation

- Home Credit: Refno. Hcin/Lc/2019-20/52Document20 pagesHome Credit: Refno. Hcin/Lc/2019-20/52kakdebhara8698615696Pas encore d'évaluation

- Debenture Holders Communication PDFDocument42 pagesDebenture Holders Communication PDFV RadhakrishnanPas encore d'évaluation

- 50200034161705Document2 pages50200034161705only2ankurPas encore d'évaluation

- Application Form-East Kidwai NagarDocument19 pagesApplication Form-East Kidwai NagarAmit ChoudharyPas encore d'évaluation

- Or Eprocure - Gov.in/epublish/app Cs@stclimited - Co.inDocument9 pagesOr Eprocure - Gov.in/epublish/app Cs@stclimited - Co.inPrabhat kumarPas encore d'évaluation

- National Aluminium Company Limited: NALCO Bhawan, Plot No.P/1, Nayapalli, Bhubaneswar-751013, IndiaDocument10 pagesNational Aluminium Company Limited: NALCO Bhawan, Plot No.P/1, Nayapalli, Bhubaneswar-751013, IndiaCma Subhash AtipamulaPas encore d'évaluation

- Interim Order in The Matter of Garima Homes and Farmhouses LimitedDocument11 pagesInterim Order in The Matter of Garima Homes and Farmhouses LimitedShyam Sunder100% (1)

- A Maharatna Company: Skmehta - Cil@coalindia - in Skmehta - Cil@coalindia - in WWW - Coalindia.inDocument16 pagesA Maharatna Company: Skmehta - Cil@coalindia - in Skmehta - Cil@coalindia - in WWW - Coalindia.inCHERANJIT DASPas encore d'évaluation

- Ts 122 Itat 2019 (Del) TP Technip Italy 1Document29 pagesTs 122 Itat 2019 (Del) TP Technip Italy 1bharath289Pas encore d'évaluation

- Tax Department Notice To NDTVDocument32 pagesTax Department Notice To NDTVThe WirePas encore d'évaluation

- Legal Notice Dinesh GoyalDocument7 pagesLegal Notice Dinesh GoyalThangarajPas encore d'évaluation

- Order in The Matter of Disc Assets Lead India LTDDocument25 pagesOrder in The Matter of Disc Assets Lead India LTDShyam SunderPas encore d'évaluation

- Annexures A1, A2, A3Document28 pagesAnnexures A1, A2, A3AGM Planning UdaipurPas encore d'évaluation

- MC01 Master Circular The Housing Finance Companies NHB Directions 2010Document92 pagesMC01 Master Circular The Housing Finance Companies NHB Directions 2010AkhyaPas encore d'évaluation

- Amendment RFP 3 22-23 30-09-2022Document14 pagesAmendment RFP 3 22-23 30-09-2022Karan PanchalPas encore d'évaluation

- Iffco - Tokio General Insurance Co. LTD: Signature Not VerifiedDocument13 pagesIffco - Tokio General Insurance Co. LTD: Signature Not VerifiedPankaj SinghPas encore d'évaluation

- MTNL Annual Report 2009-10Document157 pagesMTNL Annual Report 2009-10Mohammad ShoaibPas encore d'évaluation

- LOBPENGGPT01201112 File3of3Document461 pagesLOBPENGGPT01201112 File3of3Vikas TanejaPas encore d'évaluation

- Adjudication Order Against Ms - Manju Gupta in The Matter of Asian Oilfield Services LTDDocument7 pagesAdjudication Order Against Ms - Manju Gupta in The Matter of Asian Oilfield Services LTDShyam SunderPas encore d'évaluation

- Finvasia Equity DP IndividualDocument20 pagesFinvasia Equity DP IndividualVictor NairPas encore d'évaluation

- Im - Infra Series IVDocument89 pagesIm - Infra Series IVdroy21Pas encore d'évaluation

- 1776 Loc TendersDocument76 pages1776 Loc TendersVINOTH KUMAR RAVINDRANPas encore d'évaluation

- Set of Account Opening DocumentDocument20 pagesSet of Account Opening DocumentVenu MadhavPas encore d'évaluation

- 4 3007201707-Tender DocumentsDocument67 pages4 3007201707-Tender DocumentsRafikul RahemanPas encore d'évaluation

- Reliance Call NoticeDocument6 pagesReliance Call NoticeBharatPas encore d'évaluation

- 6989 F (Y)Document4 pages6989 F (Y)oisik kunduPas encore d'évaluation

- 2022 139 Taxmann Com 380 SAT Mumbai 25 03 2022Document6 pages2022 139 Taxmann Com 380 SAT Mumbai 25 03 2022shubhendra mishraPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument6 pagesSecurities and Exchange Board of IndiaShyam SunderPas encore d'évaluation

- Order in The Matter of M/s IHI Developers India LTDDocument14 pagesOrder in The Matter of M/s IHI Developers India LTDShyam SunderPas encore d'évaluation

- Q - Law NOV 2021Document10 pagesQ - Law NOV 2021bakchodikarnekliyePas encore d'évaluation

- DocsDocument20 pagesDocsgawakharepriyaPas encore d'évaluation

- Irb InfraDocument43 pagesIrb InfraslohariPas encore d'évaluation

- Issues Related To Taxation of NPOsDocument17 pagesIssues Related To Taxation of NPOsCA Poonam GuptaPas encore d'évaluation

- BSE FilingDocument1 pageBSE FilingLokesh BhatiPas encore d'évaluation

- Talegaon Amravat (Approved Length 58 KM) Vol. II & IIIDocument490 pagesTalegaon Amravat (Approved Length 58 KM) Vol. II & IIIUjjval JainPas encore d'évaluation

- Page 1 of 29Document29 pagesPage 1 of 29vv222vvPas encore d'évaluation

- Application FormDocument27 pagesApplication FormSaurabh GoyalPas encore d'évaluation

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåPas encore d'évaluation

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarPas encore d'évaluation

- Before The Adjudicating Officer Securities and Exchange Board of India (ADJUDICATION ORDER NO. EAD-9/SM/ 57 /2018-19)Document28 pagesBefore The Adjudicating Officer Securities and Exchange Board of India (ADJUDICATION ORDER NO. EAD-9/SM/ 57 /2018-19)DarshanPas encore d'évaluation

- P.M. On The Same Day.: Indian Energy ExchangeDocument16 pagesP.M. On The Same Day.: Indian Energy ExchangeSandyPas encore d'évaluation

- CORRIGENDUM2Document4 pagesCORRIGENDUM2Shalini BorkerPas encore d'évaluation

- Supply Of: Aqueous Film Forming Foam (AFFF)Document20 pagesSupply Of: Aqueous Film Forming Foam (AFFF)Navneet KumarPas encore d'évaluation

- Digest Case Laws December 2011Document48 pagesDigest Case Laws December 2011TalukaPatelSamajBhesanPas encore d'évaluation

- Kyc Form 2019Document28 pagesKyc Form 2019Pratick SarkarPas encore d'évaluation

- Outcome of AGMDocument3 pagesOutcome of AGMAmish GangarPas encore d'évaluation

- HRSG Tender8228 PDFDocument222 pagesHRSG Tender8228 PDFnefoussiPas encore d'évaluation

- Manju J Homes MinutesDocument14 pagesManju J Homes MinutesShruti Mohanty100% (1)

- ShowfileDocument4 pagesShowfileMkPas encore d'évaluation

- Tri Pre Engl LHeadNotice Danieli India 280221Document4 pagesTri Pre Engl LHeadNotice Danieli India 280221Sandeep Kumar GuptaPas encore d'évaluation

- L&T Tax Saver Fund Application FormDocument32 pagesL&T Tax Saver Fund Application FormPrajna CapitalPas encore d'évaluation

- Finance Bill 2012 - Major Issues and ChallengesDocument8 pagesFinance Bill 2012 - Major Issues and ChallengesNehaPas encore d'évaluation

- Application Form - Heartbeat IIDocument26 pagesApplication Form - Heartbeat IITilak Raj ChandanPas encore d'évaluation

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254Pas encore d'évaluation

- E-Auction Sale NoticeDocument3 pagesE-Auction Sale Noticesunitjain191Pas encore d'évaluation

- Implementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportD'EverandImplementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportPas encore d'évaluation

- Dr. K Kathirvel vs. CBI (Status Report)Document20 pagesDr. K Kathirvel vs. CBI (Status Report)PGurus100% (1)

- Subramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020Document3 pagesSubramanian Swamy's Letter To Speaker On Sonia Faking Qualifications Sept 28, 2020PGurusPas encore d'évaluation

- Letter To Prime Minister On AIIMS Investigation of SSRDocument3 pagesLetter To Prime Minister On AIIMS Investigation of SSRPGurusPas encore d'évaluation

- Madurai HC Palani Temple JudgmentDocument22 pagesMadurai HC Palani Temple JudgmentPGurus100% (2)

- Letter To Prime MinisterDocument2 pagesLetter To Prime MinisterPGurus100% (1)

- APPWW Opposition To St. Paul ResolutionDocument3 pagesAPPWW Opposition To St. Paul ResolutionPGurusPas encore d'évaluation

- The Hindu Group Salary Cuts LetterDocument2 pagesThe Hindu Group Salary Cuts LetterPGurus100% (1)

- MHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresDocument9 pagesMHA Order Dt. 17.5.2020 On Extension of Lockdown Till 31.5.2020 With Guidelines On Lockdown MeasuresThe Indian Express75% (16)

- Swamy Legal Notice To Indian ExpressDocument12 pagesSwamy Legal Notice To Indian ExpressPGurusPas encore d'évaluation

- Delhi Govt SuggestionsDocument7 pagesDelhi Govt SuggestionsPGurusPas encore d'évaluation

- Press Note 2Document7 pagesPress Note 2PGurusPas encore d'évaluation

- Telegraph 1Document1 pageTelegraph 1PGurusPas encore d'évaluation

- Dr. Shiva Ayyadurai's Letter To President Donald TrumpDocument4 pagesDr. Shiva Ayyadurai's Letter To President Donald TrumpPGurus96% (24)

- DR Swamy S Letter To PM 2020 03 20Document6 pagesDR Swamy S Letter To PM 2020 03 20PGurus100% (3)

- Press Note 1Document6 pagesPress Note 1PGurusPas encore d'évaluation

- Indian Express CEO LetterDocument3 pagesIndian Express CEO LetterPGurusPas encore d'évaluation

- 2019 12 Pakistan Religious Freedom Under Attack Final Compressed Single PagesDocument48 pages2019 12 Pakistan Religious Freedom Under Attack Final Compressed Single PagesPGurusPas encore d'évaluation

- Journalist UnionsDocument6 pagesJournalist UnionsPGurusPas encore d'évaluation

- CM Letter PalgharDocument4 pagesCM Letter PalgharPGurusPas encore d'évaluation

- Tax Department Notice To NDTVDocument32 pagesTax Department Notice To NDTVThe WirePas encore d'évaluation

- 1573819906-7751-D-17 - Young IndianDocument175 pages1573819906-7751-D-17 - Young IndianPGurusPas encore d'évaluation

- Kashmir Ground Report by Group of Intellectuals and Academicians (GIA)Document31 pagesKashmir Ground Report by Group of Intellectuals and Academicians (GIA)PGurusPas encore d'évaluation

- Bombay High Court Order in The Case of 63 Moons Vs Chidambaram and Others Re NSELDocument1 pageBombay High Court Order in The Case of 63 Moons Vs Chidambaram and Others Re NSELPGurusPas encore d'évaluation

- Subramanian Swamy's Complaint To PM & Others On Frauds of Times of India Group Dec 23, 2019Document26 pagesSubramanian Swamy's Complaint To PM & Others On Frauds of Times of India Group Dec 23, 2019PGurus0% (1)

- GuidelinesDocument6 pagesGuidelinesThe Indian ExpressPas encore d'évaluation

- Jammu and Kashmir Reorganisation Bill, 2019Document58 pagesJammu and Kashmir Reorganisation Bill, 2019PGurusPas encore d'évaluation

- Cease and Desist NoticeDocument5 pagesCease and Desist NoticePGurus100% (1)

- Letter From PadillaDocument1 pageLetter From PadillaEhlers AngelaPas encore d'évaluation

- Coalition Letter Opposing Inclusion of Section 702 in CR 2.28.24Document2 pagesCoalition Letter Opposing Inclusion of Section 702 in CR 2.28.24The Brennan Center for JusticePas encore d'évaluation

- Ulek Mayang ScriptDocument3 pagesUlek Mayang ScriptMartinLukePas encore d'évaluation

- AA Vaughan Tribunal Statement To Add Babcock As RespondentDocument26 pagesAA Vaughan Tribunal Statement To Add Babcock As RespondentAA Vaughan100% (1)

- Whistle-Blowing: Ethics and The Conduct of BusinessDocument31 pagesWhistle-Blowing: Ethics and The Conduct of BusinessSteven LohPas encore d'évaluation

- Gfiles October 2016Document60 pagesGfiles October 2016Gfiles Mangazine IndiaPas encore d'évaluation

- Issue OneDocument20 pagesIssue OneDimitris DavrisPas encore d'évaluation

- List of Books For Bachelor of Laws (Core and Professional Courses)Document58 pagesList of Books For Bachelor of Laws (Core and Professional Courses)gremilnazPas encore d'évaluation

- It Beats The ShakersDocument2 pagesIt Beats The Shakersjohnjohanson11Pas encore d'évaluation

- Conveying The Direction For Accumulation and Issues Involved in Partial AccumulationDocument5 pagesConveying The Direction For Accumulation and Issues Involved in Partial AccumulationnavvoPas encore d'évaluation

- Evolution of The Information Technology Act Genesis and NecessityDocument10 pagesEvolution of The Information Technology Act Genesis and NecessitychiragPas encore d'évaluation

- Campus Code of Conduct VJECDocument4 pagesCampus Code of Conduct VJECanoopkumar.mPas encore d'évaluation

- (History of Soviet Russia) Edward Hallett Carr-The Bolshevik Revolution, 1917-1923. 1-W. W. Norton (1985)Document444 pages(History of Soviet Russia) Edward Hallett Carr-The Bolshevik Revolution, 1917-1923. 1-W. W. Norton (1985)Caio BugiatoPas encore d'évaluation

- GT Chapter 2Document33 pagesGT Chapter 2Yared AbebePas encore d'évaluation

- Iqta PDFDocument9 pagesIqta PDFkeerthana yadavPas encore d'évaluation

- 10 Legal Aspects of BankingDocument7 pages10 Legal Aspects of BankingFalguni SarmalkarPas encore d'évaluation

- Manhood in Crisis Powerlessness HomophobDocument10 pagesManhood in Crisis Powerlessness HomophobHamid SyamiPas encore d'évaluation

- Thanalakshmi Electrical Stores: Tax InvoiceDocument1 pageThanalakshmi Electrical Stores: Tax InvoiceTech4 ManiaPas encore d'évaluation

- Requirements For Cargo Claims 04192017Document1 pageRequirements For Cargo Claims 04192017Ana ChanisPas encore d'évaluation

- Hearing Follow Up Questions All UnitsDocument20 pagesHearing Follow Up Questions All Unitsapi-260778000Pas encore d'évaluation

- FacebookDocument75 pagesFacebookPrabhash ChandPas encore d'évaluation

- Frantz Fanon. BioDocument25 pagesFrantz Fanon. BioBini SajilPas encore d'évaluation

- Antelope High School: Home of The TitansDocument2 pagesAntelope High School: Home of The Titansapi-358416845Pas encore d'évaluation