Académique Documents

Professionnel Documents

Culture Documents

Solution - Audit of Investment

Transféré par

MJ YaconDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Solution - Audit of Investment

Transféré par

MJ YaconDroits d'auteur :

Formats disponibles

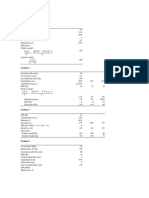

Sample Working Paper

Sec. A Sec. B Accrued Gain or Loss

Int. Income

No. of Shares Amount No. of Shares Amount Interest on sale

1,000 1,000,000 2,000 1,500,000

INVESTMENT

Types EQUITY SECURITY DEBT SECURITY

Category/ at FMVTPL at FMVTOCI Invest. In Asso. at FMVTPL at FMVTOCI

Classification

Initial at FMV only at FMV plus Transaction Cost at FMV only at FMV + Transaction Cost

Measurement

Gain or loss FMVTPL and FMVTOCI FMVTOCI/at Amortized Cost:

on Sale G/L = NDP - CV of Investment* G/L = NDP - Unamortized Cost

* fmv based on the latest FS

Investment in Associates:

G/L = NDP - Carrying Value of the Invest. In Asso.*

*Update as of the date of sale the bal. of Invest. in Asso.

Subsequent FMV FMV CV of Invest. In Asso. FMV FMV

Measurement

Val. Allow. Yes Yes No Yes Yes

UH G/L

Impairment Loss of Securities:

For Equity Security under FMV model, there will be NO IMPAIRMENT TO RECOGNIZE regardless whether the change

is judged to be temporary or permanent.

For Amortized Cost, recognize the IMPAIRMENT LOSS.

Recoverable Cost xxx

Less: Carrying Value xxx

Impairment Loss xxx

Problem 1

2010 Trading Security 500,000

Unrealized holding gain - PL 500,000

Unrealized holding loss - OCI 700,000

Investment at FMVTOCI 700,000

2011 Trading Security 200,000

Unrealized holding gain - PL 200,000

OIC - FMV this year compare it to Cost

PL - FMV this year compare it to FMV last year

2012 Unrealized holding loss - PL 600,000

Trading Security 600,000

FMV this year 4,200,000

Cost 4,000,000

Unrealized holding gain - OCI 200,000

Investment at FMVTOCI 900,000

Unrealized holding loss - OCI 700,000

Unrealized holding gain - OCI 200,000

Problem 2

At FMVTPL at FMVTOCI

1/1/10 - Trading Security 3,649,600 Invest. At FMVTOCI 3,649,600

Cash 3,649,600 Cash

12/31/10 - Trading Sec. 390,400 Int. Recei. Int. Inc. Amort

UHG - PL 390,400

320,000 364,960 44,960

320,000 369,456 49,456

FMV this year 4,040,000

Amortized cost this year 3,694,560

UHG - OCI 345,440

Invest. At FMVTOCI 345,440

UHG - OCI

Invest. At FMVTOCI 44,960

Interest Income

BT SECURITY

at Amortized Cost

FMV + Transaction Cost

ortized Cost:

mortized Cost

Amortized Cost

No

whether the change

at Amortized Cost

Invest. at Amortized Cost 3,649,600

3,649,600 Cash 3,649,600

CV

3,649,600 1/1/2010

3,694,560 12/31/2010

3,744,016 12/31/2011

345,440

Invest. At Amortized Cost 44,960

44,960 Interest Income 44,960

Vous aimerez peut-être aussi

- ICAEW Past Questions Answers March 2008 To March 2015 Summary of Financial Accounting-Application Level PDFDocument274 pagesICAEW Past Questions Answers March 2008 To March 2015 Summary of Financial Accounting-Application Level PDFmizan81953% (15)

- Internship Reflection PaperDocument1 pageInternship Reflection PaperMJ Yacon67% (3)

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamPas encore d'évaluation

- MAS Risk and Rates of Returns Practice Problems AnswerDocument29 pagesMAS Risk and Rates of Returns Practice Problems AnswerMJ YaconPas encore d'évaluation

- All Subj - Mock Board Exam BBDocument9 pagesAll Subj - Mock Board Exam BBMJ YaconPas encore d'évaluation

- All Subjects-Prtc AaDocument16 pagesAll Subjects-Prtc AaMJ Yacon100% (2)

- CIMA F2 Course Notes PDFDocument293 pagesCIMA F2 Course Notes PDFganPas encore d'évaluation

- Wey Ifrs 2e CCCDocument19 pagesWey Ifrs 2e CCCAnonymous 1SUDEbgFPas encore d'évaluation

- Sell Side M&ADocument17 pagesSell Side M&AAbhishek SinghPas encore d'évaluation

- Supply Chain Finance at Procter & Gamble - 6713-XLS-ENGDocument37 pagesSupply Chain Finance at Procter & Gamble - 6713-XLS-ENGKunal Mehta100% (2)

- Review ComputationsDocument7 pagesReview ComputationsMae MaupoPas encore d'évaluation

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzPas encore d'évaluation

- Chapter 4 - RoblesDocument18 pagesChapter 4 - RoblesYesha SibayanPas encore d'évaluation

- ACCT 4250 - Assignment 3Document14 pagesACCT 4250 - Assignment 3Thao TranPas encore d'évaluation

- CH 2 in ClassDocument2 pagesCH 2 in ClassMAINY RYANPas encore d'évaluation

- ACC 124 Discussion - Dec. 11, 2023Document6 pagesACC 124 Discussion - Dec. 11, 2023racquelcamatchoPas encore d'évaluation

- Non-Resident Foreign CorporationDocument4 pagesNon-Resident Foreign CorporationRosemarie CruzPas encore d'évaluation

- 4-02 - 03 - Andika Fivaldi - Latihan Soal Pertemuan 7Document9 pages4-02 - 03 - Andika Fivaldi - Latihan Soal Pertemuan 7Andika FivaldiPas encore d'évaluation

- 8b Tut Questions SolutionsDocument3 pages8b Tut Questions SolutionsMk SAPas encore d'évaluation

- Investment ActivityDocument4 pagesInvestment ActivityShekinah GellaPas encore d'évaluation

- Activity I Problem 15-6: W/ ChangesDocument106 pagesActivity I Problem 15-6: W/ Changesmore100% (1)

- Module 5 AssignmentDocument5 pagesModule 5 AssignmentMayPas encore d'évaluation

- IFRS 9 Non-Strategic Equity Investments ExampleDocument10 pagesIFRS 9 Non-Strategic Equity Investments Examplenicklewandowski87Pas encore d'évaluation

- HW4Document8 pagesHW4jfcPas encore d'évaluation

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghPas encore d'évaluation

- Solution of Past PaperDocument17 pagesSolution of Past Papermishal zikriaPas encore d'évaluation

- Ifrs 9 Equity Investments IllustrationDocument7 pagesIfrs 9 Equity Investments IllustrationVatchdemonPas encore d'évaluation

- A3 Example NotesDocument8 pagesA3 Example NotesMuyano, Mira Joy M.Pas encore d'évaluation

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghPas encore d'évaluation

- Afa A1Document11 pagesAfa A1Segarambal MasilamoneyPas encore d'évaluation

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaPas encore d'évaluation

- Chapter 9 - Alwi Syahnur Nasution - 120104160048Document6 pagesChapter 9 - Alwi Syahnur Nasution - 120104160048Nugrah LesmanaPas encore d'évaluation

- Comprehensive Income ModuleDocument5 pagesComprehensive Income ModuleMich Jerald MendiolaPas encore d'évaluation

- Presentation of Financial Statement Income StatementDocument5 pagesPresentation of Financial Statement Income Statementgerald almencionPas encore d'évaluation

- AFA1-3C - Assignment 1Document12 pagesAFA1-3C - Assignment 1Segarambal MasilamoneyPas encore d'évaluation

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdPas encore d'évaluation

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêPas encore d'évaluation

- 1joint Arrangement - SolutionDocument11 pages1joint Arrangement - SolutionLisel SalibioPas encore d'évaluation

- Financial Accounting Module 2Document85 pagesFinancial Accounting Module 2paul ndhlovuPas encore d'évaluation

- Equity: Distance Education Course Guide Using Obtl Design V1Document12 pagesEquity: Distance Education Course Guide Using Obtl Design V1Albert Sean LocsinPas encore d'évaluation

- Required: Prepare Entries For Year 1 and 2 in The Books of Victoria CorporationDocument9 pagesRequired: Prepare Entries For Year 1 and 2 in The Books of Victoria CorporationJennica CruzadoPas encore d'évaluation

- Introduction To Financial Accounting: Page 1 of 7 Dure Nayab19-May-10-4:27:26 PMDocument7 pagesIntroduction To Financial Accounting: Page 1 of 7 Dure Nayab19-May-10-4:27:26 PMSalman AliPas encore d'évaluation

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatPas encore d'évaluation

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubPas encore d'évaluation

- Chapter 4 - Audit of InvestmentsDocument45 pagesChapter 4 - Audit of InvestmentsClene DocontePas encore d'évaluation

- Felix Fernando - C13-Q3Document3 pagesFelix Fernando - C13-Q3Steve IdnPas encore d'évaluation

- Co Operative HSG Soc. 2Document48 pagesCo Operative HSG Soc. 2ishan.patel.310Pas encore d'évaluation

- Week11 Example QuestionDocument2 pagesWeek11 Example Questiongohhs_aaron100% (1)

- LECTUREDocument12 pagesLECTURETryonPas encore d'évaluation

- Afar. Diagnostic: Response: Correct Answer: Score: 1 Out of 1 YesDocument31 pagesAfar. Diagnostic: Response: Correct Answer: Score: 1 Out of 1 YesMitch MinglanaPas encore d'évaluation

- Financial Instruments Testing WP Pro FormaDocument7 pagesFinancial Instruments Testing WP Pro FormaMaria Fatima AlambraPas encore d'évaluation

- ReconciliationDocument11 pagesReconciliationchukku2803Pas encore d'évaluation

- BTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsDocument21 pagesBTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsgatotkaPas encore d'évaluation

- H.10 Regular Way Purchase or Sale of Financial AssetsDocument8 pagesH.10 Regular Way Purchase or Sale of Financial Assetschen.abellar.swuPas encore d'évaluation

- FM2 - NCP1 Practice QuestionsDocument9 pagesFM2 - NCP1 Practice QuestionsKAIF KHANPas encore d'évaluation

- Question 1-Standard CostingDocument2 pagesQuestion 1-Standard CostingGrechen UdigengPas encore d'évaluation

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 6Document3 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 6YOHANNES WIBOWOPas encore d'évaluation

- Investment in Associate Summary - A Project of Barters PHDocument5 pagesInvestment in Associate Summary - A Project of Barters PHEvita Faith LeongPas encore d'évaluation

- WH1002 - Executive ReportDocument10 pagesWH1002 - Executive ReportM.K.PereraPas encore d'évaluation

- Business & Financial RiskDocument26 pagesBusiness & Financial RiskPrabhuvardhan ReddyPas encore d'évaluation

- Individual/Group Assignments (Optional) Assignment 1Document3 pagesIndividual/Group Assignments (Optional) Assignment 1Robin GhotiaPas encore d'évaluation

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Group Project 2 - Published Account DEC2019 FAR270 - SSDocument6 pagesGroup Project 2 - Published Account DEC2019 FAR270 - SSHaru BiruPas encore d'évaluation

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuPas encore d'évaluation

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- Wealth of Experience: Real Investors on What Works and What Doesn'tD'EverandWealth of Experience: Real Investors on What Works and What Doesn'tPas encore d'évaluation

- Anti Money Laundering ActDocument74 pagesAnti Money Laundering ActMJ YaconPas encore d'évaluation

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconPas encore d'évaluation

- Proficiency - TheoryDocument3 pagesProficiency - TheoryMJ YaconPas encore d'évaluation

- ToaDocument18 pagesToaMJ YaconPas encore d'évaluation

- The Causes of Hyperthyroidism Include: Graves' Disease - The Most CommonDocument1 pageThe Causes of Hyperthyroidism Include: Graves' Disease - The Most CommonMJ YaconPas encore d'évaluation

- BudgetingDocument20 pagesBudgetingMJ YaconPas encore d'évaluation

- All Subjects PicpaDocument16 pagesAll Subjects PicpaMJ YaconPas encore d'évaluation

- ALL SubjectsDocument11 pagesALL SubjectsMJ YaconPas encore d'évaluation

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconPas encore d'évaluation

- All Subj - Board Exam-Picpa EeDocument9 pagesAll Subj - Board Exam-Picpa EeMJ YaconPas encore d'évaluation

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconPas encore d'évaluation

- EO EncounterDocument12 pagesEO EncounterMJ YaconPas encore d'évaluation

- EO Encounter ElimsDocument8 pagesEO Encounter ElimsMJ YaconPas encore d'évaluation

- Cpa Review Questions - Batch 7Document44 pagesCpa Review Questions - Batch 7MJ YaconPas encore d'évaluation

- Final Preboar1Document17 pagesFinal Preboar1MJ YaconPas encore d'évaluation

- Business Law and TaxationDocument15 pagesBusiness Law and TaxationKhim Dagangon100% (1)

- Naqdown FinalsDocument6 pagesNaqdown FinalsMJ YaconPas encore d'évaluation

- Naqdown Final Round 2013Document8 pagesNaqdown Final Round 2013MJ YaconPas encore d'évaluation

- Cpa Review QuestionsDocument81 pagesCpa Review QuestionsMJ YaconPas encore d'évaluation

- Financial Ratio Analysis of HealthsouthDocument11 pagesFinancial Ratio Analysis of Healthsouthfarha tabassumPas encore d'évaluation

- Ch09Part02.Home Office and Branch Accounting (Special Problems) PDFDocument2 pagesCh09Part02.Home Office and Branch Accounting (Special Problems) PDFStephanie Ann AsuncionPas encore d'évaluation

- Assignment FPADocument5 pagesAssignment FPAsuwilanji nachilombePas encore d'évaluation

- Corporate FailureDocument44 pagesCorporate FailureChamunorwa MunemoPas encore d'évaluation

- (123doc) - De-Thi-He-Thong-Thong-Tin-Kinh-DoanhDocument8 pages(123doc) - De-Thi-He-Thong-Thong-Tin-Kinh-DoanhTrần Minh HoàngPas encore d'évaluation

- Chapter 13 The Stock Market: Financial Markets and Institutions, 7e (Mishkin)Document11 pagesChapter 13 The Stock Market: Financial Markets and Institutions, 7e (Mishkin)Yousef ADPas encore d'évaluation

- Stock Index Futures GuideDocument13 pagesStock Index Futures GuideEric MarlowPas encore d'évaluation

- Liberty Medical Group Detailed Ratio Analysis - Group ComparisonDocument10 pagesLiberty Medical Group Detailed Ratio Analysis - Group ComparisonthrowawayyyPas encore d'évaluation

- ACT 202 Project Master Budgeting Naznin Islam Nipa 1512356030Document5 pagesACT 202 Project Master Budgeting Naznin Islam Nipa 1512356030Naznin NipaPas encore d'évaluation

- Intrinsic Value CalculatorDocument11 pagesIntrinsic Value CalculatorKrishnamoorthy SubramaniamPas encore d'évaluation

- ETF Vs Index FundsDocument2 pagesETF Vs Index FundsNishi Avasthi100% (1)

- Principles of Business For CSEC®: 2nd EditionDocument7 pagesPrinciples of Business For CSEC®: 2nd Editionyuvita prasadPas encore d'évaluation

- Background: Wachtell, Lipton, Rosen & KatzDocument5 pagesBackground: Wachtell, Lipton, Rosen & KatzFooyPas encore d'évaluation

- Warrants and Convertibles.Document15 pagesWarrants and Convertibles.C K SachcchitPas encore d'évaluation

- SPV1Document37 pagesSPV1ritu_gnimsPas encore d'évaluation

- R Stdev: X X N X Var X StddevDocument2 pagesR Stdev: X X N X Var X StddevnngggPas encore d'évaluation

- MSDocument23 pagesMSWaqas PirzadaPas encore d'évaluation

- ESOP Guide For Founders - Xto10xDocument28 pagesESOP Guide For Founders - Xto10xAdarsh ChamariaPas encore d'évaluation

- Supply Chain Managment - Chap 2,4,5Document150 pagesSupply Chain Managment - Chap 2,4,5Bùi Nam KhánhPas encore d'évaluation

- Advanced MACDDocument2 pagesAdvanced MACDshanmugam100% (1)

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoPas encore d'évaluation

- Chapter 17: Dividend Policy Problem 1: DPS K RBDocument4 pagesChapter 17: Dividend Policy Problem 1: DPS K RBMukul KadyanPas encore d'évaluation

- Chapter 4 Adjusting EntriesDocument81 pagesChapter 4 Adjusting EntrieskakaoPas encore d'évaluation

- IGCSE Business Analysis Past PaperDocument4 pagesIGCSE Business Analysis Past PaperPasta SempaPas encore d'évaluation

- Alive General MerchandiseDocument7 pagesAlive General MerchandiseDemsPas encore d'évaluation

- Module 1Document100 pagesModule 1aditi anandPas encore d'évaluation