Académique Documents

Professionnel Documents

Culture Documents

Salaried Class - The Soft Target For Income Tax Collections: CMA Arif Farooqui

Transféré par

महेन्द्र ऋषिTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Salaried Class - The Soft Target For Income Tax Collections: CMA Arif Farooqui

Transféré par

महेन्द्र ऋषिDroits d'auteur :

Formats disponibles

Salaried Class The Soft target for Income Tax Collections

CMA Arif Farooqui

As earlier years, this year too salaried class had so much expectation from budget and as earlier

years this year too they are disappointed after budget. No new deductions or no enhanced

deductions, no rebate, no parity with self-employed/professionals (who are taxed on net income

basis).

IT rates halved to 5% on income below Rs 5 Lakhs but benefit from rate cut is reduced by

decreasing tax rebate to Rs 2500 from Rs 5000 for taxpayer with income up to Rs 3.50Lakhs which

was earlier Rs 5 Lakhs. 10% surcharge is introduced for person having income more than Rs 50

Lakhs. Most affected person by surcharge will be salaried class as few taxpayers other than him will

declare income which attract surcharge.

Corporate taxes have been assumed to grow by 8.4%in 2016-17 (vs 12.6% last year), personal

income tax collections are expected to grow by 17% in 2016-17 (vs 14% last year). When corporate

profitability is low and people are getting low hikes then on what ground government can think to

increase personal income tax collections? Answer is just squeeze your cash cow Salaried class

It felt being salaried class is a PAAP after seeing a businessman who is earning even less than us,

live lavish life by paying lesser tax and that too without violating any rules. Survival in todays

corporates world is not easy. Employees have to complete unrealistic targets, scold by bosses, lives

with fear of losing job etc. Even as loyalist taxpayer, what benefits he is getting? Should not he get

priority over the queue at railway station, hospitals etc.? Government must have some sympathies

towards them.

Salaried persons, the most honest person in matter of payment of income tax. Pay up to 35% of their

GROSS earning as income tax but instead of getting some relief as loyalist taxpayers they are

ignored year after year by government. Every year before finalizing budget, finance minister takes

inputs from corporates, bankers etc. Why he not bothers to take inputs from his loyalist taxpayer and

try to understand their problems?

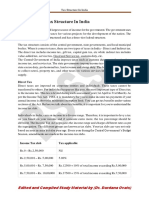

The following will demonstrate that there is discrimination against the salaried class.

Treatment for salaried

Expenses Treatment for self-employed / professionals

class

Taxable Income Gross Salary (almost) Net income after deducting all expenses

Payment of Tax Monthly basis Quarterly basis

Deduction available is Actual amount incurred is allowed as

Transport Allowance

Rs 1600 per month. deduction.

Can claim entire amount as business

Lunch / Dinner No deduction

development expense from his income.

Can claim entire interest expense as

deduction. Further he can also claim

Buying a Car No deduction

depreciation on car and drivers salary as

expenses

Can claim entire interest amount as well as

Interest on self- Exempt up to Rs 1.5

depreciation on house as expenses provide

occupied house lakh per annum.

that use that property for official use too

Training No deduction Full amount is deductible

This is not the only lacunae. Some of deductions allowed to salaried class have been unchanged for

decades.

1. Education and Hostel Allowances Exemption limit of education allowance and hostel

allowance are Rs 100 and Rs 300 per month respectively. At present these allowances seems as

a joke, even in villages there is no school / hostel which has such low fees.

2. Medical Reimbursements Exemption limit for reimbursement of medical expenses is Rs

15000 annually for entire family and it was set in 1998. Since then medical costs have risen

radically.

3. Interest on self-occupied house/property Deduction amount of Rs 1,50,000 was set in 1999.

Property rates have zoomed up significantly since then.

1. Deduction under Section 80C Rs 1,50,000 is not matching present days inflation. Almost all

savings and investments are covered under this section.

5. Leave Salary Leave salary is exempted at retirement to maximum of Rs 3,00,000 and it too

was fixed in 1998.

6. Free Food Value of free food or meal vouchers provided by the employer is exempt from

income tax to the extent of Rs. 50 per meal.

Lastly I want to draw attention on this point,

Maximum exemption limit must be increased In budget speech, FM said, people earning up to

Rs 4.50 Lakhs should invest Rs 1.50 under section 80C, they can avoid paying tax for an income up

to Rs 4.50 Lakhs. Looking at cost of living, running a family in such a small amount is very difficult

and how to save so much. It would be great help if present limit is increase. Most affected person

here too is salaried class as other taxpayer got deduction for all expenses and their net income

comes lower than Rs 2.50 Lakhs even if they earning more than 10 Lakhs.

Conclusion:

Salaried class needs to be taxed in a similar manner in which self-employed / professionals are

taxed, that is all expenses should be allowed as deduction, only net income should be taxed and all

exemptions should be done away with or substantially hike the caps for all allowances just by taking

into account the inflation aspect or standard deduction must be back.

Efforts of government should be to increase the tax net and not milk the cow in their hands. Only

1.5% (1.90Crore) Indians pay income tax and more than half of this, pay less Rs 1,000. Over the

years, number of income tax payers has fallen even though tax revenue has risen. Any shortfall in

income tax collection should be made up by taxing people who are paying zero taxes and leading

lavish lifestyles including rich farmers and politicians. is it justifiable that a rich farmer and politicians

who has bungalows, SUVs servants etc. does not pay income tax but a salaried person who earns

just Rs 25,000 pm and reach his office going through all the torture of public transport, pay income

tax?

Vous aimerez peut-être aussi

- Save Tax with Deductions for Home Loans, Insurance & MoreDocument14 pagesSave Tax with Deductions for Home Loans, Insurance & MoreSrinivas Pavan KumarPas encore d'évaluation

- Heads of Income TaxDocument6 pagesHeads of Income Taxkanchan100% (1)

- A Haven on Earth: Singapore Economy Without Duties and TaxesD'EverandA Haven on Earth: Singapore Economy Without Duties and TaxesPas encore d'évaluation

- Tax GuideDocument27 pagesTax GuideanjaliPas encore d'évaluation

- Budget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaDocument79 pagesBudget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaLukkana VaraprasadPas encore d'évaluation

- Discuss salary components and tax saving schemesDocument11 pagesDiscuss salary components and tax saving schemesmohithPas encore d'évaluation

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210Pas encore d'évaluation

- Indian Tax Structure ExplainedDocument7 pagesIndian Tax Structure ExplainedHarshita MarmatPas encore d'évaluation

- Compensation Analysis of Manufacturing IndustriesDocument14 pagesCompensation Analysis of Manufacturing IndustriesSankar Rajan100% (13)

- Salary StructureDocument6 pagesSalary StructureValluru SrinivasPas encore d'évaluation

- SalariesDocument6 pagesSalariesrichaPas encore d'évaluation

- Pvt Ltd SavingsDocument5 pagesPvt Ltd Savingstaxqoof1Pas encore d'évaluation

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiPas encore d'évaluation

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravPas encore d'évaluation

- Tax Planning IndiaDocument20 pagesTax Planning IndiaRohanTheGreatPas encore d'évaluation

- Tax 3Document1 pageTax 3Rakesh KumarPas encore d'évaluation

- Institute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurDocument24 pagesInstitute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurRambres SainiPas encore d'évaluation

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsPas encore d'évaluation

- BudgetDocument21 pagesBudgetshweta_narkhede01Pas encore d'évaluation

- Section 80C: List of Eligible Investments Are As FollowsDocument7 pagesSection 80C: List of Eligible Investments Are As FollowsKachua SinghPas encore d'évaluation

- Income Tax CalculatorDocument8 pagesIncome Tax CalculatorbabulalseshmaPas encore d'évaluation

- Notes On SalariesDocument18 pagesNotes On SalariesParul KansariaPas encore d'évaluation

- Taxation-Direct-and-Indirect - AssignmentDocument8 pagesTaxation-Direct-and-Indirect - AssignmentAkshatPas encore d'évaluation

- Lesson 4 Taxation of Employment IncomeDocument32 pagesLesson 4 Taxation of Employment IncomeakpanyapPas encore d'évaluation

- Tax Calculation for Salary IncomeDocument8 pagesTax Calculation for Salary IncomeAli Raza RahmaniPas encore d'évaluation

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaPas encore d'évaluation

- Allowances and Minmum Wage ActDocument22 pagesAllowances and Minmum Wage ActjinujithPas encore d'évaluation

- Direct Tax CodeDocument8 pagesDirect Tax CodeImran HassanPas encore d'évaluation

- Tax by Shivin VargheseDocument5 pagesTax by Shivin VargheseManu VarghesePas encore d'évaluation

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaPas encore d'évaluation

- Income From Salary: Explain Fully On What Basis Income Is Taxed Under The Head SalaryDocument4 pagesIncome From Salary: Explain Fully On What Basis Income Is Taxed Under The Head SalaryDeepika BhopalePas encore d'évaluation

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXPas encore d'évaluation

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalPas encore d'évaluation

- Rohit SinghDocument9 pagesRohit SinghRohit SinghPas encore d'évaluation

- Income From Salary' & Its Computation: TaxationDocument35 pagesIncome From Salary' & Its Computation: TaxationChintan ShahPas encore d'évaluation

- 5 Tax InstrumentsDocument3 pages5 Tax InstrumentsktsnlPas encore d'évaluation

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYPas encore d'évaluation

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument10 pagesIncome Tax in India - Wikipedia, The Free EncyclopediakandurimaruthiPas encore d'évaluation

- 6 Employment Income Taxation 2021Document91 pages6 Employment Income Taxation 2021siyad ahmedPas encore d'évaluation

- Components of SalaryDocument17 pagesComponents of SalaryMona ShresthaPas encore d'évaluation

- 8 ways to lower your tax billDocument6 pages8 ways to lower your tax billansplanetPas encore d'évaluation

- Tax Touch Up: Which Is That Amt DepositedDocument5 pagesTax Touch Up: Which Is That Amt DepositedVelayudham ThiyagarajanPas encore d'évaluation

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelPas encore d'évaluation

- Tax Midterm PrepDocument28 pagesTax Midterm PrepDhruv MehtaPas encore d'évaluation

- Vaishnavi ProjectDocument72 pagesVaishnavi ProjectAkshada DhaparePas encore d'évaluation

- Income Tax KnowledgeDocument5 pagesIncome Tax KnowledgeAbhishekPas encore d'évaluation

- Direct Tax Management in 40 CharactersDocument72 pagesDirect Tax Management in 40 CharactersvivekPas encore d'évaluation

- Heads of IncomeDocument6 pagesHeads of Incomevijay kumarPas encore d'évaluation

- Income From Salary (Section 12) : RsDocument8 pagesIncome From Salary (Section 12) : RsKashifPas encore d'évaluation

- Upload 2Document27 pagesUpload 2NAGESH PORWALPas encore d'évaluation

- Compensation LetterDocument5 pagesCompensation LetterJonathan Adams100% (1)

- Income Tax 1Document26 pagesIncome Tax 1Vismaya CholakkalPas encore d'évaluation

- Salary Includes: U/s 17Document14 pagesSalary Includes: U/s 17Ansh NayyarPas encore d'évaluation

- Value Added Tax Black Book 2 2332Document47 pagesValue Added Tax Black Book 2 2332sanket yelawePas encore d'évaluation

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarPas encore d'évaluation

- Taxation ProjectDocument23 pagesTaxation ProjectAkshata MasurkarPas encore d'évaluation

- Direct Tax Code: Capital Gains Tax On Sale of Residential PropertyDocument5 pagesDirect Tax Code: Capital Gains Tax On Sale of Residential Propertykarthikeyan.mohandossPas encore d'évaluation

- Tax Slab and Deductions for FY 2009-10Document44 pagesTax Slab and Deductions for FY 2009-10pradeep mathurPas encore d'évaluation

- Product DescriptionDocument5 pagesProduct Descriptionमहेन्द्र ऋषिPas encore d'évaluation

- CD Copyright Page MathzingDocument1 pageCD Copyright Page Mathzingमहेन्द्र ऋषिPas encore d'évaluation

- List of T-Codes - REM ModuleDocument7 pagesList of T-Codes - REM Moduleमहेन्द्र ऋषि67% (3)

- CD Copyright PageDocument1 pageCD Copyright Pageमहेन्द्र ऋषिPas encore d'évaluation

- Laghu Parashari - With Hindi CommentaryDocument397 pagesLaghu Parashari - With Hindi Commentaryastrology is divine89% (19)

- Ajirnamrit ManjariDocument123 pagesAjirnamrit ManjariMaharshi ShrimaliPas encore d'évaluation

- Astro LearnDocument23 pagesAstro Learnमहेन्द्र ऋषि100% (1)

- Product DescriptionDocument5 pagesProduct Descriptionमहेन्द्र ऋषिPas encore d'évaluation

- CRP SettingDocument2 pagesCRP Settingमहेन्द्र ऋषिPas encore d'évaluation

- Parasar 70 - PLDocument240 pagesParasar 70 - PLमहेन्द्र ऋषिPas encore d'évaluation

- Hindi Quatations2Document107 pagesHindi Quatations2महेन्द्र ऋषिPas encore d'évaluation

- Hindi Quotations 1Document106 pagesHindi Quotations 1api-3792728100% (2)

- Ajirnamrit ManjariDocument123 pagesAjirnamrit ManjariMaharshi ShrimaliPas encore d'évaluation

- Ajirnamrit ManjariDocument123 pagesAjirnamrit ManjariMaharshi ShrimaliPas encore d'évaluation

- TA Bill Check ListDocument1 pageTA Bill Check Listमहेन्द्र ऋषिPas encore d'évaluation

- PL - 70 Parashar LightDocument239 pagesPL - 70 Parashar Lightमहेन्द्र ऋषि0% (1)

- Unicode Xpos2Document2 pagesUnicode Xpos2महेन्द्र ऋषिPas encore d'évaluation

- Quote of The MomentDocument1 pageQuote of The Momentमहेन्द्र ऋषिPas encore d'évaluation

- BSNL Vision & MissionDocument15 pagesBSNL Vision & MissionAgeesh A NairPas encore d'évaluation

- Directory BSNL RAJDocument78 pagesDirectory BSNL RAJमहेन्द्र ऋषि60% (5)

- Rl"inr@ RR I I I, Foit@: at .Opj C"JDocument1 pageRl"inr@ RR I I I, Foit@: at .Opj C"Jमहेन्द्र ऋषिPas encore d'évaluation

- Chapter I: Introduction of Study: Goods and Service Tax (GST)Document73 pagesChapter I: Introduction of Study: Goods and Service Tax (GST)Prajakta KamblePas encore d'évaluation

- Tax invoice generator for electrical goodsDocument2 pagesTax invoice generator for electrical goodsbenson9Pas encore d'évaluation

- Blake Weber 2022 Tax InvoiceDocument65 pagesBlake Weber 2022 Tax InvoiceBlake Weber100% (1)

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaPas encore d'évaluation

- Adeverinta de Venit Anaf 1Document2 pagesAdeverinta de Venit Anaf 1Elena ParaschivPas encore d'évaluation

- Shiawassee County Ballot Proposals Nov. 2020Document3 pagesShiawassee County Ballot Proposals Nov. 2020WILX Krystle HollemanPas encore d'évaluation

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalPas encore d'évaluation

- Paper 11 PDFDocument6 pagesPaper 11 PDFKaysline Oscar CollinesPas encore d'évaluation

- Banate Financial Management AssessmentDocument10 pagesBanate Financial Management Assessmentmervin escribaPas encore d'évaluation

- Documentary Stamp Tax, Capital Gains Tax, and Donor's TaxDocument3 pagesDocumentary Stamp Tax, Capital Gains Tax, and Donor's TaxJoyPas encore d'évaluation

- Circular 23 2017Document2 pagesCircular 23 2017Singh SranPas encore d'évaluation

- Budget and Budgetary SystemDocument6 pagesBudget and Budgetary SystemunicornPas encore d'évaluation

- Form No.12baDocument2 pagesForm No.12baAmit BhatiPas encore d'évaluation

- Invoice - BN25 - JULY 21 (GI-1)Document1 pageInvoice - BN25 - JULY 21 (GI-1)poltu barPas encore d'évaluation

- CH - 9 - Income and Spending - Keynesian Multipliers PDFDocument18 pagesCH - 9 - Income and Spending - Keynesian Multipliers PDFHarmandeep Singh50% (2)

- General Income TaxDocument3 pagesGeneral Income TaxFlorean SoniaPas encore d'évaluation

- Employee Benefits FlyerDocument3 pagesEmployee Benefits FlyerSaurabh RaghuvanshiPas encore d'évaluation

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- Jimma University College of Agriculture and Veterinary MedicineDocument2 pagesJimma University College of Agriculture and Veterinary MedicineÜm Yöñí Åvïd GödPas encore d'évaluation

- DTA GuideDocument19 pagesDTA Guiderav danoPas encore d'évaluation

- Monthly Income 15th 30th Source of Income Amounts (Estimated) TotalDocument3 pagesMonthly Income 15th 30th Source of Income Amounts (Estimated) TotalMyles Ninon LazoPas encore d'évaluation

- Individual Income TaxDocument4 pagesIndividual Income TaxCristopher Romero Danlog0% (1)

- Essilor India Payslip TitleDocument1 pageEssilor India Payslip TitlekrishnaPas encore d'évaluation

- Comprehensive guide to completing your individual tax returnDocument102 pagesComprehensive guide to completing your individual tax returnNick BesterPas encore d'évaluation

- Income Tax AccountingDocument24 pagesIncome Tax AccountingSYED WAFI100% (1)

- IT44 Extract of Income External FormDocument1 pageIT44 Extract of Income External FormBrandon BothaPas encore d'évaluation

- 2017 Bar Exams Questions in Taxation LawDocument7 pages2017 Bar Exams Questions in Taxation LawJade Marlu DelaTorre100% (1)

- De 6Document2 pagesDe 6ejao100% (8)

- Good CVDocument2 pagesGood CVChild TimePas encore d'évaluation

- CIR v. Mirant PagbilaoDocument4 pagesCIR v. Mirant Pagbilaoamareia yap100% (1)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemD'EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemPas encore d'évaluation

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsD'EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsPas encore d'évaluation

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassD'EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassPas encore d'évaluation

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProD'EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProÉvaluation : 4.5 sur 5 étoiles4.5/5 (43)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesD'EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesÉvaluation : 4 sur 5 étoiles4/5 (9)

- Sacred Success: A Course in Financial MiraclesD'EverandSacred Success: A Course in Financial MiraclesÉvaluation : 5 sur 5 étoiles5/5 (15)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesD'EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesÉvaluation : 3 sur 5 étoiles3/5 (3)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantD'EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantÉvaluation : 4 sur 5 étoiles4/5 (104)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesD'EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesÉvaluation : 4.5 sur 5 étoiles4.5/5 (30)

- How To Budget And Manage Your Money In 7 Simple StepsD'EverandHow To Budget And Manage Your Money In 7 Simple StepsÉvaluation : 5 sur 5 étoiles5/5 (4)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouD'EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouÉvaluation : 5 sur 5 étoiles5/5 (5)

- The Hidden Wealth Nations: The Scourge of Tax HavensD'EverandThe Hidden Wealth Nations: The Scourge of Tax HavensÉvaluation : 4.5 sur 5 étoiles4.5/5 (40)

- The Payroll Book: A Guide for Small Businesses and StartupsD'EverandThe Payroll Book: A Guide for Small Businesses and StartupsÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to get US Bank Account for Non US ResidentD'EverandHow to get US Bank Account for Non US ResidentÉvaluation : 5 sur 5 étoiles5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)D'EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Évaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessD'EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessÉvaluation : 5 sur 5 étoiles5/5 (5)

- How to Teach Economics to Your Dog: A Quirky IntroductionD'EverandHow to Teach Economics to Your Dog: A Quirky IntroductionPas encore d'évaluation

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistD'EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistÉvaluation : 5 sur 5 étoiles5/5 (6)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsD'EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingD'EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingÉvaluation : 5 sur 5 étoiles5/5 (3)