Académique Documents

Professionnel Documents

Culture Documents

For Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)

Transféré par

Anonymous 2evaoXKKdTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

For Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)

Transféré par

Anonymous 2evaoXKKdDroits d'auteur :

Formats disponibles

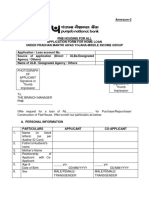

FORM NO.

2C

[See rule 12(1)(d) of Income-tax Rules, 1962]

RETURN OF INCOME

For Persons

n not liable to furnish a return of income u/s 139(1) and

n residing in such areas as are specified in the enclosed instruction, and

n who at any time during the previous year fulfil any one of the conditions specified in first proviso of

section 139(1) as mentioned in B below :

A. GENERAL INFORMATION

ITS-2C

1. PERMANENT ACCOUNT NUMBER ACKNOWLEDGEMENT

(If not applied for or not allotted, enclose Form 49A) For Office use only

2. NAME (LAST NAME/SURNAME, FIRST NAME, MIDDLE NAME IN THAT ORDER)

Receipt No. Date

Seal and Signature of Receiving

Official

3. ADDRESS FOR COMMUNICATION

(A. RESIDENCE or B. OFFICE )

(Flat No./Door/House No., Premises, Road, Locality/Village, Town/District, State/Union Territory in

that Order)

PIN TELEPHONE

FAX, IF ANY

4. SEX (M/F)

5. DATE OF BIRTH (DD -MM-YYYY) - - 6. Status*

7. IS THERE ANY CHANGE IN ADDRESS ? Yes No

If yes, whether A. Residence or B. Office

8. WARD/CIRCLE/SPL. RANGE

9. PREVIOUS YEAR 10. ASSESSMENT YEAR

- -

11. RESIDENTIAL STATUS *

12. IS THIS YOUR FIRST RETURN ? Yes No

If no, furnish Receipt Number

Date of filing of last Return - -

and Ward/Circle/Special Range where filed

* Fill in code as mentioned in instructions (See Action Points )

B. CONDITIONS APPLICABLE AS SPECIFIED IN FIRST

PROVISO TO SECTION 139(1)

Have you at any time during the previous year :

(i) been in occupation of an immovable property exceeding the Yes No

specified floor area, whether by way of ownership, tenancy or

otherwise ?

[I

Printed from www.incometaxindia.gov.in Page 1 of 4

(ii) been the owner or the lessee of a motor vehicle other than a two - Yes No

wheeled motor vehicle ?

(iii) been a subscriber to a cellular telephone not being a wireless in Yes No

local loop telephone ?

(iv) incurred expenditure for yourself or for any other person on travel Yes No

to any foreign country ?

(v) been a holder of a credit card, not being an add -on card, issued Yes No

by any bank or institution ?

(vi) been a member of a club where entrance fee charged is twenty-five Yes No

thousand rupees or more ?

C. INFORMATION IN RESPECT OF CONDITIONS SPECIFIED IN

FIRST PROVISO TO SECTION 139(1)

1. Immovable Property : (furnish this information if you satisfy condition B( i) above)

Address of property Nature of Occupancy Floor area (in If owner If tenant/lessee

(i.e., owner/tenant/ sq. m.) annual rent payable

other)

Year of Cost of

acquisition acquisition

2. Motor vehicle : (furnish this information if you satisfy condition B(ii) above)

Make of vehicle Whether owner/ Registration No. Year of Purchase price, Annual lease

Lessee acquisition if owned rent, if on lease

3. Cellular telephone (furnish this if you satisfy condition B(iii) above):

Cellular telephone

number(s) (not being a

wireless in local loop

telephone)

4. Expenditure on foreign travel : (furnish this information if you satisfy condition B(iv) above)

Name(s) of person travelled ( i.e., Passport No. Countries visited Period of travel Fare paid

Self and other(s))

Printed from www.incometaxindia.gov.in Page 2 of 4

5. Credit Card : (furnish this information if you satisfy` condition B( v) above)

Name of credit card held Issued by

6. Club membership : (furnish this information if you satisfy condition B( v i) above)

Name of club Nature of Membership Entrance fee paid

D. STATEMENT OF TOTAL INCOME AND TAXES

STATEMENT OF TOTAL INCOME (in Rs.)

1. Salaries 101

2. Income from house property 102

3. Profits and gains of business or profession 103

4. Capital gains

a. Short-term 104

b. Long-term 105

5. Income from other sources 107

6. Gross total income (total of 1 to 5) 110

7. Deductions under Ch -VIA 111

8. Total Income (6 7) in words 123

9. Net agricultural income for rate purposes 124

10. Income claimed exempt 125

E. NO. OF DOCUMENTS/STATEMENTS ATTACHED

Description In Figures In words

Verification *

I (Name in fulland in block letters),

son/daughter/wife of Shri solemnly declare that to the best of my

knowledge and belief, the information given in this return is cor rect, complete and truly stated and is in

accordance with the provisions of Income -tax Act, 1961 in respect of the income on which I am chargeable to

income-tax for the previous year ended relevant to assessment year I further

declare that I am making this return in my capacity as and I am also competent to

make this return and verify it.

[I

Printed from www.incometaxindia.gov.in Page 3 of 4

Date :

Place : Signature

*Any person making a false statement in the return or accompanying schedules or statements shall be liable to

be prosecuted under section 277 of the Income-tax Act, 1961 and on conviction be punishable under that section

with rigorous imprisonment and with fine.

[I

Printed from www.incometaxindia.gov.in Page 4 of 4

Vous aimerez peut-être aussi

- Form7 2007 08Document12 pagesForm7 2007 08api-3850174Pas encore d'évaluation

- Form7 2008 09Document13 pagesForm7 2008 09api-3850174Pas encore d'évaluation

- Acknowledgement: For Individuals/hindu Undivided Families/companiesDocument4 pagesAcknowledgement: For Individuals/hindu Undivided Families/companiesJaspreet WaliaPas encore d'évaluation

- Landlord's Instruction FormDocument2 pagesLandlord's Instruction FormKatharina SumantriPas encore d'évaluation

- Wealthtax Return FormDocument7 pagesWealthtax Return FormsugasenthilPas encore d'évaluation

- Admin Forms House Building Advance ApplicationDocument3 pagesAdmin Forms House Building Advance Applicationramu83Pas encore d'évaluation

- ICICI Pru MF NominationDocument2 pagesICICI Pru MF NominationMailPas encore d'évaluation

- Ontario Standard Lease 2021(2)Document15 pagesOntario Standard Lease 2021(2)exohguilianaPas encore d'évaluation

- Ontario Standard Lease 2021(3Document15 pagesOntario Standard Lease 2021(3exohguilianaPas encore d'évaluation

- Lease - 112 - 1 Chef LaneDocument17 pagesLease - 112 - 1 Chef LaneDon HillPas encore d'évaluation

- Form 12 CDocument1 pageForm 12 Cmkharb941Pas encore d'évaluation

- Tuohidul & Yasir Lease AgreementDocument21 pagesTuohidul & Yasir Lease AgreementTuohidul AlamPas encore d'évaluation

- Form I Transaction of Immovable Property Standard Forms 20200804171038Document3 pagesForm I Transaction of Immovable Property Standard Forms 20200804171038Manmeet SinghPas encore d'évaluation

- Fidelity Bond Application Form G57 1Document2 pagesFidelity Bond Application Form G57 1Allezon Diomangay DeliquiñaPas encore d'évaluation

- Application For Gift PermissionDocument5 pagesApplication For Gift PermissionRamisha JainPas encore d'évaluation

- Goa Homestay Registration FormDocument3 pagesGoa Homestay Registration FormAashish GuptaPas encore d'évaluation

- New Tenant ApplicationDocument1 pageNew Tenant ApplicationLiam ThomsonPas encore d'évaluation

- Business ON - App-New Guideline-EnglishDocument3 pagesBusiness ON - App-New Guideline-EnglishMuhammad UsmanPas encore d'évaluation

- First Home Finance Application FormDocument6 pagesFirst Home Finance Application Formmkhize.christian.21Pas encore d'évaluation

- Claim For Homestead Property Tax Standard / Supplemental DeductionDocument2 pagesClaim For Homestead Property Tax Standard / Supplemental DeductionBock DharmaPas encore d'évaluation

- New Fidelity Bond Application FormDocument4 pagesNew Fidelity Bond Application FormJunaz EmboyPas encore d'évaluation

- Mortgage Loan Application FormDocument4 pagesMortgage Loan Application Formkishor patelPas encore d'évaluation

- Ucc1 1Document12 pagesUcc1 1Kregener100% (10)

- Form 15H DeclarationDocument2 pagesForm 15H Declarationyraju88Pas encore d'évaluation

- Form 27 C FormatDocument4 pagesForm 27 C FormatYash KediaPas encore d'évaluation

- Application Form For PMAY MIG Loan PDFDocument8 pagesApplication Form For PMAY MIG Loan PDFakibPas encore d'évaluation

- Risk Number: Kagawaran NG Pananalapi Kawanihan NG Ingatang-YamanDocument8 pagesRisk Number: Kagawaran NG Pananalapi Kawanihan NG Ingatang-Yamancompostelabarangay7Pas encore d'évaluation

- Form 27CDocument2 pagesForm 27Ctulsi22187Pas encore d'évaluation

- Contractor's Accreditation ChecklistDocument12 pagesContractor's Accreditation Checklistalvin castroPas encore d'évaluation

- Disclosure of Lobbying Activities: Complete This Form To Disclose Lobbying Activities Pursuant To 31 U.S.C.1352Document1 pageDisclosure of Lobbying Activities: Complete This Form To Disclose Lobbying Activities Pursuant To 31 U.S.C.1352SUPER INDUSTRIAL ONLINEPas encore d'évaluation

- Burglary and HousebreakingDocument2 pagesBurglary and HousebreakingyatzirigPas encore d'évaluation

- KMC Property Tax FormDocument13 pagesKMC Property Tax FormbitunmouPas encore d'évaluation

- Form 15H DeclarationDocument2 pagesForm 15H DeclarationIndrasish BasuPas encore d'évaluation

- WND PIU4 BP Xi 235 N Z390Document2 pagesWND PIU4 BP Xi 235 N Z390Nishant VincentPas encore d'évaluation

- Appendix-I of G.O.Ms - No.59Document2 pagesAppendix-I of G.O.Ms - No.59maheshPas encore d'évaluation

- ICICI Bank Letter of OfferDocument5 pagesICICI Bank Letter of OfferHighline Hotel100% (2)

- 22.form of Application For Grant of Arms Licence For Individual Under New Arms Rules 2016. Form A 1 S 1 S 2 S 3 1Document8 pages22.form of Application For Grant of Arms Licence For Individual Under New Arms Rules 2016. Form A 1 S 1 S 2 S 3 1deeksha bhardwajPas encore d'évaluation

- Ontario Residential Tenancy AgreementDocument14 pagesOntario Residential Tenancy Agreementshortstak337Pas encore d'évaluation

- CA AOF For Other Than Sole ProprietorshipDocument16 pagesCA AOF For Other Than Sole ProprietorshipnewattelectricPas encore d'évaluation

- CircularDocument3 pagesCircularZahir AbbasPas encore d'évaluation

- Annexure 01 PMAY Application FormDocument3 pagesAnnexure 01 PMAY Application FormDebargha 2027Pas encore d'évaluation

- ITR-5 Indian Income Tax ReturnDocument34 pagesITR-5 Indian Income Tax ReturnGurpreetPas encore d'évaluation

- Realty Transfer Tax Statement of Value REV 183Document2 pagesRealty Transfer Tax Statement of Value REV 183maria-bellaPas encore d'évaluation

- Form15H PDFDocument2 pagesForm15H PDFSrinivasulu NatukulaPas encore d'évaluation

- Experion Elements - Application FormDocument17 pagesExperion Elements - Application Formsunneytyagi3895Pas encore d'évaluation

- 8 A 70B03C19Q00000074Document75 pages8 A 70B03C19Q00000074Justin Rohrlich100% (1)

- NEW Form 1583 ExampleDocument2 pagesNEW Form 1583 ExampleruslanPas encore d'évaluation

- E.G Lands, House, Shops, Other Buildings EtcDocument5 pagesE.G Lands, House, Shops, Other Buildings EtcKannan M ChamyPas encore d'évaluation

- Certificate of Residence (For Tax Treaty Relief)Document3 pagesCertificate of Residence (For Tax Treaty Relief)Nancy VelascoPas encore d'évaluation

- Request For Quotation: (This Is Not An Order)Document1 pageRequest For Quotation: (This Is Not An Order)Julio CruzPas encore d'évaluation

- Iob419201760530pm Annexure To Sme ApplicationsDocument13 pagesIob419201760530pm Annexure To Sme ApplicationsB.sewada DrPas encore d'évaluation

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilPas encore d'évaluation

- FLISP Application FormDocument6 pagesFLISP Application FormLungisani Dauglas Mtshali100% (1)

- Education Loan: State Bank of IndiaDocument4 pagesEducation Loan: State Bank of IndiaDeepakPas encore d'évaluation

- PMAY Application FormDocument4 pagesPMAY Application Formkundan_bokPas encore d'évaluation

- COMMON TRANSACTION REQUESTDocument2 pagesCOMMON TRANSACTION REQUESTChintan JainPas encore d'évaluation

- Form No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Document1 pageForm No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- "Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Document3 pages"Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Anonymous 2evaoXKKdPas encore d'évaluation

- Sem 3 Malacca Itinerary - W Tutorial HoursDocument1 pageSem 3 Malacca Itinerary - W Tutorial HoursAnonymous 2evaoXKKdPas encore d'évaluation

- May05 121 Musick Air AsiaDocument6 pagesMay05 121 Musick Air AsiaAnonymous 2evaoXKKdPas encore d'évaluation

- Income-tax rules form for tax payment requestDocument1 pageIncome-tax rules form for tax payment requestAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64c PDFDocument1 pageItr62form 64c PDFAnonymous 2evaoXKKdPas encore d'évaluation

- The Big Brown Fox Jumps Over The Lazy DogDocument1 pageThe Big Brown Fox Jumps Over The Lazy DogAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Document1 pageForm No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Income tax form for individuals without PANDocument5 pagesIncome tax form for individuals without PANHarit KumarPas encore d'évaluation

- Itr62form 64cDocument1 pageItr62form 64cAnonymous 2evaoXKKdPas encore d'évaluation

- 2016 APAC Fit-Out Cost Guide - Occupier ProjectsDocument26 pages2016 APAC Fit-Out Cost Guide - Occupier ProjectsSkywardFire100% (1)

- Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 2gupta_gk4uPas encore d'évaluation

- Volume 2 - Supply Chain Management PDFDocument18 pagesVolume 2 - Supply Chain Management PDFAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64dDocument2 pagesItr62form 64dAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64cDocument1 pageItr62form 64cAnonymous 2evaoXKKdPas encore d'évaluation

- Itr 62 Form 64 BDocument2 pagesItr 62 Form 64 BAnonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Income-Tax Rules APA ApplicationDocument8 pagesIncome-Tax Rules APA ApplicationAnonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961Document2 pagesForm No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961rajdeeppawarPas encore d'évaluation

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Anonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABAAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ac: Audit Report Under Section 33ABDocument3 pagesForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdPas encore d'évaluation

- Section 32 Deduction Claim FormDocument2 pagesSection 32 Deduction Claim FormAnonymous 2evaoXKKdPas encore d'évaluation

- Document 3456789 summaryDocument3 pagesDocument 3456789 summaryJoão Israel FerreiraPas encore d'évaluation

- (See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDocument14 pages(See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDaniel C MohanPas encore d'évaluation

- AgentScope: A Flexible Yet Robust Multi-Agent PlatformDocument24 pagesAgentScope: A Flexible Yet Robust Multi-Agent PlatformRijalPas encore d'évaluation

- Water Jet CuttingDocument15 pagesWater Jet CuttingDevendar YadavPas encore d'évaluation

- Mission Ac Saad Test - 01 QP FinalDocument12 pagesMission Ac Saad Test - 01 QP FinalarunPas encore d'évaluation

- Gas Dehydration (ENGINEERING DESIGN GUIDELINE)Document23 pagesGas Dehydration (ENGINEERING DESIGN GUIDELINE)Tu Dang TrongPas encore d'évaluation

- Difference Between Text and Discourse: The Agent FactorDocument4 pagesDifference Between Text and Discourse: The Agent FactorBenjamin Paner100% (1)

- Wi FiDocument22 pagesWi FiDaljeet Singh MottonPas encore d'évaluation

- Lecture02 NoteDocument23 pagesLecture02 NoteJibril JundiPas encore d'évaluation

- Dole-Oshc Tower Crane Inspection ReportDocument6 pagesDole-Oshc Tower Crane Inspection ReportDaryl HernandezPas encore d'évaluation

- Mercedes BenzDocument56 pagesMercedes BenzRoland Joldis100% (1)

- SQL Guide AdvancedDocument26 pagesSQL Guide AdvancedRustik2020Pas encore d'évaluation

- John Titor TIME MACHINEDocument21 pagesJohn Titor TIME MACHINEKevin Carey100% (1)

- Pom Final On Rice MillDocument21 pagesPom Final On Rice MillKashif AliPas encore d'évaluation

- Marine Engineering 1921Document908 pagesMarine Engineering 1921Samuel Sneddon-Nelmes0% (1)

- Resume Template & Cover Letter Bu YoDocument4 pagesResume Template & Cover Letter Bu YoRifqi MuttaqinPas encore d'évaluation

- Evaluating MYP Rubrics in WORDDocument11 pagesEvaluating MYP Rubrics in WORDJoseph VEGAPas encore d'évaluation

- Bluetooth TutorialDocument349 pagesBluetooth Tutorialjohn bougsPas encore d'évaluation

- Thin Film Deposition TechniquesDocument20 pagesThin Film Deposition TechniquesShayan Ahmad Khattak, BS Physics Student, UoPPas encore d'évaluation

- Additional Help With OSCOLA Style GuidelinesDocument26 pagesAdditional Help With OSCOLA Style GuidelinesThabooPas encore d'évaluation

- Olympics Notes by Yousuf Jalal - PDF Version 1Document13 pagesOlympics Notes by Yousuf Jalal - PDF Version 1saad jahangirPas encore d'évaluation

- Cushman Wakefield - PDS India Capability Profile.Document37 pagesCushman Wakefield - PDS India Capability Profile.nafis haiderPas encore d'évaluation

- India Today 11-02-2019 PDFDocument85 pagesIndia Today 11-02-2019 PDFGPas encore d'évaluation

- TDS Sibelite M3000 M4000 M6000 PDFDocument2 pagesTDS Sibelite M3000 M4000 M6000 PDFLe PhongPas encore d'évaluation

- Lecture Ready 01 With Keys and TapescriptsDocument157 pagesLecture Ready 01 With Keys and TapescriptsBảo Châu VươngPas encore d'évaluation

- DMDW Mod3@AzDOCUMENTS - inDocument56 pagesDMDW Mod3@AzDOCUMENTS - inRakesh JainPas encore d'évaluation

- April 26, 2019 Strathmore TimesDocument16 pagesApril 26, 2019 Strathmore TimesStrathmore Times100% (1)

- Postgraduate Notes in OrthodonticsDocument257 pagesPostgraduate Notes in OrthodonticsSabrina Nitulescu100% (4)

- Bank NIFTY Components and WeightageDocument2 pagesBank NIFTY Components and WeightageUptrend0% (2)

- Polytechnic University Management Services ExamDocument16 pagesPolytechnic University Management Services ExamBeverlene BatiPas encore d'évaluation

- GATE ECE 2006 Actual PaperDocument33 pagesGATE ECE 2006 Actual Paperkibrom atsbhaPas encore d'évaluation

- S5-42 DatasheetDocument2 pagesS5-42 Datasheetchillin_in_bots100% (1)