Académique Documents

Professionnel Documents

Culture Documents

IncomeTax Declaration Form - 2016-2017

Transféré par

आनंद चव्हाणTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IncomeTax Declaration Form - 2016-2017

Transféré par

आनंद चव्हाणDroits d'auteur :

Formats disponibles

Employee Name :

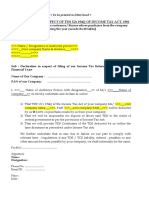

Sub:- Proposed Tax Planning for the F.Y 2016-2017 A.Y.2017-2018

This is to your kind information that the Company has to deduct TDS from your salary on monthly basis and to deposit the same in

Government Treasurery on monthly basis only. We therefore request all the employees to fill up the the following declaration form in duplicate

and submit the same to HR Departmnent at HO so as to avail the credit gainst your tax proposed saving invetments latest.

Please note that the benefit of tax credit will be given only on submission of information in writing to the HR Dept. at HO.

Company has no remedy other than to deduct TDS from your salary payments and to deposit in a Government Treasurery in the absence of

submission of correct information from the employees.

We hope that you will do the needful & oblige.

Thanking You,

Yours faithfully,

Head of HR Department

From

Employee Name :

To,

HR DEPT

RO

Sub:- Proposed Tax Planning for the F.Y 2016-17 A.Y2017 - 2018..

NATURE OF INVESTMENT AMOUNT (RS.) * DATE

ROOM RENT PAID

HOUSING LOAN INTEREST

DED U/S 80 C

PF & VPF

LIFE INSURANCE PREMIUM

PPF A/C CONTRIBUTION

NSC (INVT + ACCURED INT FIRST FIVE YR)

HOUSING LOAN PRINCIPAL REPAYMENT

TUITION FEES FOR 2 CHILDREN

E.L.S.S MUTUAL FUND

MUTUAL FUND-TAX SAVER (5 YRS & ABOVE)

STAMP DUTY & REGISTRATION FEES

80 CCC PENSION PLAN

ANY OTHER (SPECIFY)-

ANY OTHER (SPECIFY)-

ANY OTHER (SPECIFY)-

DED U/C VI A (Maxmimumb Rs.100000)

80 CCF INFRASTRUCTURE BOND

INT PAID ON CHILD EDUCATION LOAN

ANY OTHER (SPECIFY)-

ANY OTHER (SPECIFY)- DRESS/CLOTHS

ANY OTHER (SPECIFY)- MEDICAL

Total Rs..

The above information is true and correct to the best of my knowledge and information and I promise to invest the amounts as above in the

proposed investments till the end of .. I promise to produce the copy of the actual invetments before . along with the

original receipts of the same for verification to the Company.

I further declare that, in case the the information provided above is proved incorrect or wrong, I shall be held responsible for the same

and the Company is free to deduct and deposit TDS along with the interest on delayed payments as per the provisions of the Income Tax Act.

Regards

Signature of the Employee DATE :

Vous aimerez peut-être aussi

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoPas encore d'évaluation

- Role of DDO in Govt. OfficesDocument27 pagesRole of DDO in Govt. OfficesPratik ViholPas encore d'évaluation

- Declaration-FormatsDocument4 pagesDeclaration-FormatsG N Harish Kumar YadavPas encore d'évaluation

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SPas encore d'évaluation

- Smartivity Labs Employee Tax Form GuideDocument2 pagesSmartivity Labs Employee Tax Form GuideSanjeev Kumar50% (2)

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18Pas encore d'évaluation

- Narmada Offshore Construction Tax Declaration FormDocument4 pagesNarmada Offshore Construction Tax Declaration FormRanjan KumarPas encore d'évaluation

- BIO Undertaking CompanyDocument2 pagesBIO Undertaking Companygurpreet06Pas encore d'évaluation

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajPas encore d'évaluation

- SonuDocument3 pagesSonuTanu AnandPas encore d'évaluation

- Declaration Form (22-23)Document4 pagesDeclaration Form (22-23)vasavi kPas encore d'évaluation

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaPas encore d'évaluation

- US TaxRefunds Short NewJerseyDocument11 pagesUS TaxRefunds Short NewJerseyKeziah Cyra PapasPas encore d'évaluation

- Declaration for TDS u/s 194QDocument2 pagesDeclaration for TDS u/s 194QCma Saurabh AroraPas encore d'évaluation

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekalePas encore d'évaluation

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghPas encore d'évaluation

- Exit_process_and_FAQ'sDocument8 pagesExit_process_and_FAQ'snaimishamaniPas encore d'évaluation

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000Pas encore d'évaluation

- Employee Exit ChecklistDocument9 pagesEmployee Exit ChecklistRudraneel DasPas encore d'évaluation

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050Pas encore d'évaluation

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaPas encore d'évaluation

- Standing Instruction Form Through IndusInd Bank Account-2Document1 pageStanding Instruction Form Through IndusInd Bank Account-2SonuPas encore d'évaluation

- Additional Documents Real EstateDocument10 pagesAdditional Documents Real EstateSamaira SheikhPas encore d'évaluation

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurPas encore d'évaluation

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloPas encore d'évaluation

- Declaration: Details of Investment (FINANCIAL YEAR 2017-2018)Document1 pageDeclaration: Details of Investment (FINANCIAL YEAR 2017-2018)Dinesh SanodiyaPas encore d'évaluation

- Digitally Signed Tender Document Non Working Relative Undertaking ESIC EPFO RegistrationDocument288 pagesDigitally Signed Tender Document Non Working Relative Undertaking ESIC EPFO RegistrationOkram RishiPas encore d'évaluation

- Consent Form-Corporate NPSDocument1 pageConsent Form-Corporate NPSAnto RejoyPas encore d'évaluation

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantPas encore d'évaluation

- CBZDocument6 pagesCBZPatrick MukoyiPas encore d'évaluation

- Delvo Accounting Proposal for Outsourced ServicesDocument3 pagesDelvo Accounting Proposal for Outsourced Servicesmary joy ariate100% (2)

- Directly transfer your RSP/RIF/TFSA to Tangerine in 2 easy stepsDocument3 pagesDirectly transfer your RSP/RIF/TFSA to Tangerine in 2 easy stepsThomasGunnPas encore d'évaluation

- Rental Application FormDocument3 pagesRental Application FormNyasha SvondoPas encore d'évaluation

- Retirement Settelement BenefitsDocument15 pagesRetirement Settelement BenefitssantoshkumarPas encore d'évaluation

- Terminal Benefit - Nilam ShahDocument24 pagesTerminal Benefit - Nilam ShahRaghava NarayanaPas encore d'évaluation

- Income Tax Declaration Form 2012-13Document1 pageIncome Tax Declaration Form 2012-13Srikanth VsrPas encore d'évaluation

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagPas encore d'évaluation

- Di FormatDocument3 pagesDi FormatStudents AffairsPas encore d'évaluation

- Request LetterDocument4 pagesRequest LetterMayur JoshiPas encore d'évaluation

- 2016 - April - EPF Joint Declaration For Correction in DoBDocument1 page2016 - April - EPF Joint Declaration For Correction in DoBemufarmingPas encore d'évaluation

- TAX STATEMENT 2015-16Document2 pagesTAX STATEMENT 2015-16JeganPas encore d'évaluation

- IncomeDocument5 pagesIncomevishalPas encore d'évaluation

- Overview of TDS: Who Shall Deduct Tax at Source?Document37 pagesOverview of TDS: Who Shall Deduct Tax at Source?pradeep_ravi_7Pas encore d'évaluation

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18Pas encore d'évaluation

- Composite Declaration Form for EPF MembershipDocument2 pagesComposite Declaration Form for EPF MembershipKeshav SarafPas encore d'évaluation

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiPas encore d'évaluation

- ANNEXURE 6 Kaibalya@smelterpurDocument11 pagesANNEXURE 6 Kaibalya@smelterpurDhanraj ParmarPas encore d'évaluation

- Payroll Management Made Easy: My Payroll Self GuideDocument29 pagesPayroll Management Made Easy: My Payroll Self GuidePrashant TambePas encore d'évaluation

- INVESTMENT DECLARATIONDocument1 pageINVESTMENT DECLARATIONShishir RoyPas encore d'évaluation

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamPas encore d'évaluation

- Form 16 For AY 2015-16 CAknowledge - inDocument16 pagesForm 16 For AY 2015-16 CAknowledge - inKiranPas encore d'évaluation

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181Pas encore d'évaluation

- Covering Letter For Miscellaneous Remittances - LatestDocument2 pagesCovering Letter For Miscellaneous Remittances - LatestSALE EXECUTIVESPas encore d'évaluation

- NCDMB Vendor Registration FormDocument3 pagesNCDMB Vendor Registration FormkenonesisaikiPas encore d'évaluation

- India Statutory Form TemplateDocument11 pagesIndia Statutory Form TemplateMadhusudan MadhuPas encore d'évaluation

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BPas encore d'évaluation

- Mithun Pandya (RM)Document4 pagesMithun Pandya (RM)Naveen ChoudharyPas encore d'évaluation

- PEETAM SINGHDocument4 pagesPEETAM SINGHNaveen ChoudharyPas encore d'évaluation

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesD'EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesPas encore d'évaluation

- Raci Metrix QuestionsDocument1 pageRaci Metrix Questionsआनंद चव्हाणPas encore d'évaluation

- CTM 190 199 PDFDocument10 pagesCTM 190 199 PDFPauline HernandoPas encore d'évaluation

- SR No. Silicon Discription Qty Unit Exp. DTDocument4 pagesSR No. Silicon Discription Qty Unit Exp. DTआनंद चव्हाणPas encore d'évaluation

- CV for Mechanical Engineer with Aluminum Design ExperienceDocument2 pagesCV for Mechanical Engineer with Aluminum Design Experienceआनंद चव्हाणPas encore d'évaluation

- Objective Evidence FormDocument2 pagesObjective Evidence Formआनंद चव्हाणPas encore d'évaluation

- Navneet K RayDocument4 pagesNavneet K Rayआनंद चव्हाणPas encore d'évaluation

- Bend GlassDocument1 pageBend Glassआनंद चव्हाणPas encore d'évaluation

- CTM 190 199 PDFDocument10 pagesCTM 190 199 PDFPauline HernandoPas encore d'évaluation

- On Site Glazing ProcedureDocument2 pagesOn Site Glazing Procedureआनंद चव्हाणPas encore d'évaluation

- Moisture in GlassDocument1 pageMoisture in Glassआनंद चव्हाणPas encore d'évaluation

- Personal Details: Course Institution Examination Authority Year of Passing Percentage/ CgpaDocument2 pagesPersonal Details: Course Institution Examination Authority Year of Passing Percentage/ Cgpaआनंद चव्हाणPas encore d'évaluation

- MR - Ranjit Sambhaji Mohite: ObjectiveDocument2 pagesMR - Ranjit Sambhaji Mohite: Objectiveआनंद चव्हाणPas encore d'évaluation

- FORM V Check List For WorkersDocument2 pagesFORM V Check List For Workersआनंद चव्हाणPas encore d'évaluation

- From - 11 (New)Document1 pageFrom - 11 (New)आनंद चव्हाणPas encore d'évaluation

- Curriculum-Vitae: Career ObjectiveDocument2 pagesCurriculum-Vitae: Career Objectiveआनंद चव्हाणPas encore d'évaluation

- Resume: Sushant Tanaji HaraleDocument5 pagesResume: Sushant Tanaji Haraleआनंद चव्हाणPas encore d'évaluation

- ObjectiveDocument3 pagesObjectiveआनंद चव्हाणPas encore d'évaluation

- Curriculum Vitae: Previous OrganizationDocument2 pagesCurriculum Vitae: Previous Organizationआनंद चव्हाणPas encore d'évaluation

- Ansari Jaunel Firoz Alam: Professional GoalsDocument2 pagesAnsari Jaunel Firoz Alam: Professional Goalsआनंद चव्हाणPas encore d'évaluation

- Code Name of Groups Activity Remarks Group Admin Remarks If Any Respon SibilityDocument7 pagesCode Name of Groups Activity Remarks Group Admin Remarks If Any Respon Sibilityआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationआनंद चव्हाणPas encore d'évaluation

- MBA - SyllabusDocument56 pagesMBA - SyllabusPreethi GopalanPas encore d'évaluation

- LorealDocument36 pagesLorealShivya GuptaPas encore d'évaluation

- Need Expectation of Interested Parties According To I So 220002018Document2 pagesNeed Expectation of Interested Parties According To I So 220002018Shivyog SanatanPas encore d'évaluation

- FEU bonds and stocks valuationDocument7 pagesFEU bonds and stocks valuationAleah Jehan AbuatPas encore d'évaluation

- Block 3 ECO 08 Unit 1Document18 pagesBlock 3 ECO 08 Unit 1ThiruPas encore d'évaluation

- Nyse FFG 2005Document140 pagesNyse FFG 2005Bijoy AhmedPas encore d'évaluation

- Consumer Behaviour Study of IDBI Federal Life Insurance CustomersDocument9 pagesConsumer Behaviour Study of IDBI Federal Life Insurance CustomersAshu AgarwalPas encore d'évaluation

- PeruDocument15 pagesPeruVictor MalaspinaPas encore d'évaluation

- 13 - Findings and Suggestion PDFDocument9 pages13 - Findings and Suggestion PDFKhushboo GuptaPas encore d'évaluation

- AdSurf PonziDocument23 pagesAdSurf PonzibizopPas encore d'évaluation

- Captive Centre Setup in Vietnam PDFDocument113 pagesCaptive Centre Setup in Vietnam PDFsongaonkarsPas encore d'évaluation

- Sales TrainingDocument19 pagesSales TrainingAashish PardeshiPas encore d'évaluation

- CRITICAL ANALYSIS OF BANKING REGULATIONSDocument11 pagesCRITICAL ANALYSIS OF BANKING REGULATIONSBlanche AmbangPas encore d'évaluation

- ABT Chart Analysis GuideDocument10 pagesABT Chart Analysis GuideBoyka KirovPas encore d'évaluation

- OFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisDocument34 pagesOFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisThanhdat VoPas encore d'évaluation

- Brand Management As A Tool For Product Growth and DevelopmentDocument107 pagesBrand Management As A Tool For Product Growth and DevelopmentAshish SenPas encore d'évaluation

- Telecommunications in Nepal - Current State and NeedsDocument3 pagesTelecommunications in Nepal - Current State and NeedsSomanta BhattaraiPas encore d'évaluation

- Indore-Smart-City-Case-Study RemnameDocument63 pagesIndore-Smart-City-Case-Study RemnameGokul NathanPas encore d'évaluation

- Chapter 9 Managing The Office & ReportsDocument21 pagesChapter 9 Managing The Office & ReportsAlexander ZhangPas encore d'évaluation

- The Economic Times - Business News, Personal Finance, Financial News, India Stock Market Investing, Economy News, SENSEX, NIFTY, NSE, BSE Live, IPO News PDFDocument5 pagesThe Economic Times - Business News, Personal Finance, Financial News, India Stock Market Investing, Economy News, SENSEX, NIFTY, NSE, BSE Live, IPO News PDFKaushik BalachandarPas encore d'évaluation

- Solutions To Ch4 ExercisesDocument44 pagesSolutions To Ch4 ExercisesCharmaine Bernados Brucal38% (8)

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocument10 pagesFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelPas encore d'évaluation

- Project 1 - FCF Intel Example - DirectionsDocument27 pagesProject 1 - FCF Intel Example - Directionsअनुशा प्रसादम्Pas encore d'évaluation

- Bond Spreads - Leading Indicator For CurrenciesDocument6 pagesBond Spreads - Leading Indicator For CurrenciesanandPas encore d'évaluation

- Malaysian Airline SWOT Analysis Highlights Strengths, Weaknesses, Opportunities, ThreatsDocument5 pagesMalaysian Airline SWOT Analysis Highlights Strengths, Weaknesses, Opportunities, ThreatsutemianPas encore d'évaluation

- Income and Expenses Analysis Form ShortBondPaperDocument1 pageIncome and Expenses Analysis Form ShortBondPaperCirdec OveunirrabPas encore d'évaluation

- FinanceDocument53 pagesFinanceSheethal RamachandraPas encore d'évaluation

- LBO Excel ModelDocument6 pagesLBO Excel Modelrf_1238100% (2)

- Interview With John Duffy, CEO of JPMorganDocument4 pagesInterview With John Duffy, CEO of JPMorganWorldwide finance newsPas encore d'évaluation

- Competition Law and Policy in SingaporeDocument20 pagesCompetition Law and Policy in SingaporeERIA: Economic Research Institute for ASEAN and East AsiaPas encore d'évaluation