Académique Documents

Professionnel Documents

Culture Documents

Supreme Court rules SMI not included in retirement benefits

Transféré par

Sam FajardoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Supreme Court rules SMI not included in retirement benefits

Transféré par

Sam FajardoDroits d'auteur :

Formats disponibles

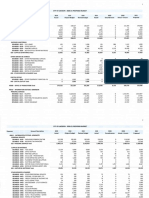

G.R. NO. 176985 - Ricardo E. Vergara, Jr. v. Coca-Cola Bottlers Philippines, Inc.

Facts:

Ricardo Vergara Jr. retired from Coca Bottlers Philippines Inc. in 2002, after 34 years of service, as district sales supervisor

(DSS).

At that time, the companys retirement plan stated that the annual performance incentive pay of sales supervisors shall be

considered in the computation of retirement benefits using the following formula:

Basic monthly salary + monthly average performance incentive (which is the total performance incentives earned

during the year immediately preceding + 12 months) x number of years in service.

Unsatisfied with the retirement pay he got, Vergara filed a complaint against the company with the National Labor Relations

Commission for payment of the sum of P474,600 representing unpaid sales management incentives (SMI), and the recovery

of the P496,016.67 that the company deducted from his pay to cover for the unpaid accounts of two dealers within his sales

territory.

After going through the NLRC, the parties entered into a compromise agreement with the company reimbursing Vergara the

P496,016.67 it deducted for the earlier mentioned unpaid accounts.

His plea for the payment of the SMI was, unfortunately, denied by the NLRC and, later, by the Court of Appeals. From these

turndowns, Vergara sought relief from the Supreme Court.

Issue: whether the SMI should be included in the computation of his retirement benefits on the ground of consistent company

practice.

Ruling: NO.

Generally, employees have a vested right over existing benefits voluntarily granted to them by their employer. Thus, any benefit and

supplement being enjoyed by the employees cannot be reduced, diminished, discontinued or eliminated by the employer. The

principle of non-diminution of benefits is actually founded on the Constitutional mandate to protect the rights of workers, to

promote their welfare, and to afford them full protection. In turn, said mandate is the basis of Article 4 of the Labor Code which

states that "all doubts in the implementation and interpretation of this Code, including its implementing rules and regulations, shall

be rendered in favor of labor.

Benefits are considered diminished if the following requisites are present: a) the grant or benefit is founded on a policy or has

ripened into a practice over a long period of time; b) the practice is consistent and deliberate; c) the practice is not due to error in the

construction or application of a doubtful or difficult question of law; and d) the diminution or discontinuance is done unilaterally by

the employer.

For a practice to be characterized as regular, it is essential that the employee is able to prove by substantial evidence that the giving

of the benefit is done over a long period of time, and that it has been made consistently and deliberately.

In this case, the Court found no substantial evidence to prove that the grant of SMI to all retired DSSs regardless of whether or not

they qualify to the same had ripened into company practice. Despite more than sufficient opportunity given him while his case was

pending before the NLRC, the CA, and even to the Court, petitioner utterly failed to adduce proof to establish his allegation that SMI

has been consistently, deliberately and voluntarily granted to all retired DSSs without any qualification or conditions whatsoever.

(To support his claim, Vergara submitted the sworn statements of two retired sales supervisors who said the SMI was included in their retirement

package even if they did not meet the sales and collection qualifiers. Against these testimonies, the company presented the counter-affidavits of

witnesses who stated that the inclusion of the SMI in one of the retirees pay was made to achieve industrial peace in the plant when it was going

through some labor problems, and that the other retiree has, in reality, met his sales and collection quota as to qualify him for the SMI.)

Vous aimerez peut-être aussi

- 5.1 International School Alliance of Educators V Quisumbing DigestDocument2 pages5.1 International School Alliance of Educators V Quisumbing Digestluigimanzanares100% (3)

- Marites Bernardo Et Al Vs NLRCDocument2 pagesMarites Bernardo Et Al Vs NLRCEdu RiparipPas encore d'évaluation

- Corporal vs. NLRC 341 Scra 658 (2008) DigestDocument2 pagesCorporal vs. NLRC 341 Scra 658 (2008) DigestArlando G. Arlando100% (4)

- A Soriano Aviation Vs Employees AssociationDocument3 pagesA Soriano Aviation Vs Employees AssociationRon AceroPas encore d'évaluation

- Bankard Union Vs NLRC DigestDocument2 pagesBankard Union Vs NLRC DigestEbbe Dy100% (3)

- Prubankers Association vs. Prudential Bank & Trust CompanyDocument2 pagesPrubankers Association vs. Prudential Bank & Trust CompanyMaden Agustin100% (2)

- Yolanda Mercado Vs AMA, DigestDocument1 pageYolanda Mercado Vs AMA, DigestAlan Gultia100% (1)

- Racelis Vs United Philippine LinesDocument1 pageRacelis Vs United Philippine LinesEarvin Joseph BaracePas encore d'évaluation

- Fuji Television Network v. Arlene Espiritu DigestDocument2 pagesFuji Television Network v. Arlene Espiritu DigestBarzillai BanogonPas encore d'évaluation

- Intertrod Maritime V NLRC G.R. 81087Document2 pagesIntertrod Maritime V NLRC G.R. 81087Dino Bernard LapitanPas encore d'évaluation

- Union of Filipro Employees Vs VivarDocument2 pagesUnion of Filipro Employees Vs VivarIan AuroPas encore d'évaluation

- A. Nate Casket Maker vs. Arango - DigestDocument2 pagesA. Nate Casket Maker vs. Arango - DigestBigs BeguiaPas encore d'évaluation

- 191 Durabuilt Recapping Plant v. NLRCDocument1 page191 Durabuilt Recapping Plant v. NLRCNN DDL0% (1)

- Songco Vs NLRCDocument3 pagesSongco Vs NLRCDi Koy50% (2)

- Philippine Spring Water v CA Ruling on Regular Employment StatusDocument3 pagesPhilippine Spring Water v CA Ruling on Regular Employment StatusEdeline CosicolPas encore d'évaluation

- P.I. Manufacturing, Inc. vs. P.I. Manufacturing Supervisors and Foreman AssociationDocument2 pagesP.I. Manufacturing, Inc. vs. P.I. Manufacturing Supervisors and Foreman Associationbrendamanganaan100% (1)

- Robina Farms V VillaDocument2 pagesRobina Farms V VillaDales BatoctoyPas encore d'évaluation

- Villamaria Jr. v Callejo Sr. Boundary-Hulog SchemeDocument1 pageVillamaria Jr. v Callejo Sr. Boundary-Hulog SchemeIda ChuaPas encore d'évaluation

- 326 Barcenas V NLRCDocument3 pages326 Barcenas V NLRCfullgrinPas encore d'évaluation

- Philippine Long Distance Telephone Company vs. Henry EstraneroDocument2 pagesPhilippine Long Distance Telephone Company vs. Henry EstraneroLara DellePas encore d'évaluation

- Manila Trading V Manila Trading Labor Association - Case DigestDocument2 pagesManila Trading V Manila Trading Labor Association - Case DigestClarice Joy SjPas encore d'évaluation

- Family driver's rights governed by Civil CodeDocument3 pagesFamily driver's rights governed by Civil CodeJanex TolineroPas encore d'évaluation

- Villamaria v. Court of AppealsDocument2 pagesVillamaria v. Court of Appealsapbuera100% (1)

- Metro Bank vs. NLRC DigestDocument2 pagesMetro Bank vs. NLRC DigestChantal Evanne CastañedaPas encore d'évaluation

- Mercury Drug Workers Awarded Back PayDocument2 pagesMercury Drug Workers Awarded Back Paytalla aldoverPas encore d'évaluation

- Alilin vs. Petron (Digest)Document2 pagesAlilin vs. Petron (Digest)Jerwin Cases Tiamson100% (1)

- Atienza Vs SalutaDocument4 pagesAtienza Vs SalutaEmmanuel Enrico de Vera100% (2)

- Grand Shipping Vs GalvezDocument3 pagesGrand Shipping Vs GalvezLara DellePas encore d'évaluation

- Fuji Television Network, Inc. vs. Arlene S. EspirituDocument5 pagesFuji Television Network, Inc. vs. Arlene S. Espiritukimgoopio100% (3)

- Phil. Aeolus Automotive United Corp. Vs NLRC - Labor LawDocument2 pagesPhil. Aeolus Automotive United Corp. Vs NLRC - Labor LawAdremesin-severino Honee100% (1)

- People v. OchoaDocument3 pagesPeople v. OchoaPhattsBee100% (1)

- La Consolacion Vs PascuaDocument1 pageLa Consolacion Vs Pascuafay garneth buscato100% (1)

- 10 Benitez Vs Sta FeDocument4 pages10 Benitez Vs Sta FeLucille AriannePas encore d'évaluation

- Congson V NLRCDocument2 pagesCongson V NLRCNeapolle FleurPas encore d'évaluation

- Davao Integrated Port Stevedoring Services Vs AbarquezDocument1 pageDavao Integrated Port Stevedoring Services Vs AbarquezHariette Kim Tiongson0% (1)

- International School Manila v. International School Alliance of Educators (ISAE)Document4 pagesInternational School Manila v. International School Alliance of Educators (ISAE)Ildefonso HernaezPas encore d'évaluation

- Santiago V CF Sharp Crew Management DigestDocument3 pagesSantiago V CF Sharp Crew Management DigestPatricia Anne GonzalesPas encore d'évaluation

- General Milling Corp Independent Labor Union V General Miling CorpDocument2 pagesGeneral Milling Corp Independent Labor Union V General Miling CorpNiajhan PalattaoPas encore d'évaluation

- Orlando Farm Growers Vs NLRCDocument2 pagesOrlando Farm Growers Vs NLRCIda Chua100% (1)

- 02 Intertrod Maritime Vs NLRCDocument3 pages02 Intertrod Maritime Vs NLRCDavid Antonio A. EscuetaPas encore d'évaluation

- Case DigestDocument3 pagesCase DigestTeacherEli100% (1)

- Dealco Farms Workers Regular StatusDocument2 pagesDealco Farms Workers Regular StatusjudyranePas encore d'évaluation

- Brotherhood Labor Unity Movement of The Phils. v. Zamora Case DigestDocument2 pagesBrotherhood Labor Unity Movement of The Phils. v. Zamora Case DigestTJ Paula Tapales JornacionPas encore d'évaluation

- Ecop vs. NWPC, RTWP-NCR & TucpDocument2 pagesEcop vs. NWPC, RTWP-NCR & TucpKei ShaPas encore d'évaluation

- Sonza V ABSCBN Case DigestDocument4 pagesSonza V ABSCBN Case DigestYsabel Padilla89% (9)

- 33 - G R - No - 190809-DigestDocument3 pages33 - G R - No - 190809-DigestNaomi InotPas encore d'évaluation

- Omanfil International Manpower Development Corporation, V. Rolando B.mesinaDocument1 pageOmanfil International Manpower Development Corporation, V. Rolando B.mesinaMark Anthony Reyes100% (1)

- Tan v. LagramaDocument3 pagesTan v. LagramaJustinePas encore d'évaluation

- 023 Tunay Na Pagkakaisa NG Manggagawa Sa Asia Brewery vs. Asia Brewery, Inc.Document2 pages023 Tunay Na Pagkakaisa NG Manggagawa Sa Asia Brewery vs. Asia Brewery, Inc.marvin_deleoncPas encore d'évaluation

- Rodolfo V People G.R. No. 146964, August 10, 2006 FactsDocument2 pagesRodolfo V People G.R. No. 146964, August 10, 2006 FactsGail Cariño0% (1)

- 1 King of Kings Transport V MamacDocument2 pages1 King of Kings Transport V MamacKia BiPas encore d'évaluation

- Labor Congress of The Phil vs. NLRCDocument1 pageLabor Congress of The Phil vs. NLRCEarl Tan100% (2)

- Century Properties, Inc. Vs Edwin J. Babiano and Emma B. Concepcion, 795 SCRA 671, G.R. No. 220978 (July 05, 2016)Document2 pagesCentury Properties, Inc. Vs Edwin J. Babiano and Emma B. Concepcion, 795 SCRA 671, G.R. No. 220978 (July 05, 2016)Lu CasPas encore d'évaluation

- Romeo Alba's employer-employee relationship affirmedDocument2 pagesRomeo Alba's employer-employee relationship affirmedLorraine Diano100% (1)

- SAN MIGUEL BREWERY, INC. vs. DEMOCRATIC LABOR ORGANIZATIONDocument1 pageSAN MIGUEL BREWERY, INC. vs. DEMOCRATIC LABOR ORGANIZATIONBeverlyn JamisonPas encore d'évaluation

- Colegio Del Santisimo Rosario V RojoDocument2 pagesColegio Del Santisimo Rosario V RojoSoc50% (2)

- UST Faculty Dismissal for Lack of Graduate DegreeDocument1 pageUST Faculty Dismissal for Lack of Graduate DegreeAb CastilPas encore d'évaluation

- 9.1 Vergara Vs Coca Cola BottlersDocument1 page9.1 Vergara Vs Coca Cola Bottlersluigimanzanares100% (1)

- Vergara V Coca ColaDocument1 pageVergara V Coca ColaJohnPas encore d'évaluation

- 35 - Vergara, Jr. v. Coca-Cola Bottlers Philippines, IncDocument2 pages35 - Vergara, Jr. v. Coca-Cola Bottlers Philippines, IncHello123Pas encore d'évaluation

- Frias vs. San Diego-SisonDocument6 pagesFrias vs. San Diego-SisonSam FajardoPas encore d'évaluation

- COMMON CARRIER DUTIES AND LIABILITYDocument25 pagesCOMMON CARRIER DUTIES AND LIABILITYSam Fajardo0% (1)

- 1st Set Cases - Sux ReviewDocument4 pages1st Set Cases - Sux ReviewSam FajardoPas encore d'évaluation

- Percentage Tax CaseDocument2 pagesPercentage Tax CaseSam FajardoPas encore d'évaluation

- Poli Law Velasco Cases by Dean Candelaria PDFDocument10 pagesPoli Law Velasco Cases by Dean Candelaria PDFdemosrea0% (1)

- Crisologo Vs SingsonDocument7 pagesCrisologo Vs SingsonSam FajardoPas encore d'évaluation

- Jose Modequillo V BrevaDocument1 pageJose Modequillo V BrevaSam FajardoPas encore d'évaluation

- Gutierrez Vs VillegasDocument3 pagesGutierrez Vs VillegasSam FajardoPas encore d'évaluation

- CREBA vs Romulo: Constitutionality of MCIT and CWTDocument2 pagesCREBA vs Romulo: Constitutionality of MCIT and CWTSam Fajardo100% (1)

- C.M. Hoskins and Co. Vs CirDocument1 pageC.M. Hoskins and Co. Vs CirSam FajardoPas encore d'évaluation

- ISIDRO TAN Vs Francisco ZanduetaDocument2 pagesISIDRO TAN Vs Francisco ZanduetaSam FajardoPas encore d'évaluation

- Insular Savings Bank Vs CA June 15, 2005Document2 pagesInsular Savings Bank Vs CA June 15, 2005Sam FajardoPas encore d'évaluation

- Tax DigestDocument3 pagesTax DigestSam FajardoPas encore d'évaluation

- Sample VAWC ComplaintDocument4 pagesSample VAWC ComplaintSam FajardoPas encore d'évaluation

- Petion For Recovery of Possession SampleDocument7 pagesPetion For Recovery of Possession SampleSam FajardoPas encore d'évaluation

- RTC Manila branch 33 lifts attachment for unliquidated damages claimDocument1 pageRTC Manila branch 33 lifts attachment for unliquidated damages claimSam FajardoPas encore d'évaluation

- Doctrines Criminal LawDocument3 pagesDoctrines Criminal LawSam FajardoPas encore d'évaluation

- RTC Manila branch 33 lifts attachment for unliquidated damages claimDocument1 pageRTC Manila branch 33 lifts attachment for unliquidated damages claimSam FajardoPas encore d'évaluation

- Provisional Remedies Case General Vs de VeneciaDocument1 pageProvisional Remedies Case General Vs de VeneciaSam FajardoPas encore d'évaluation

- DU Vs CADocument2 pagesDU Vs CASam FajardoPas encore d'évaluation

- Dy Keh Beng Vs ILMUPDocument1 pageDy Keh Beng Vs ILMUPSam FajardoPas encore d'évaluation

- LEONORA OBAÑA vs. COURT OF APPEALS and DU V. STRONGHOLD INSURANCEDocument4 pagesLEONORA OBAÑA vs. COURT OF APPEALS and DU V. STRONGHOLD INSURANCESam FajardoPas encore d'évaluation

- Nuisance CasesDocument6 pagesNuisance CasesSam FajardoPas encore d'évaluation

- PAL Vs LiganDocument8 pagesPAL Vs LiganSam FajardoPas encore d'évaluation

- Quiambao Vs OsorioDocument2 pagesQuiambao Vs OsorioSam FajardoPas encore d'évaluation

- Tenchavez vs. EscanoDocument4 pagesTenchavez vs. EscanoSam FajardoPas encore d'évaluation

- Menchaves Vs Teves G.R. No. 153201 January 26, 2005Document21 pagesMenchaves Vs Teves G.R. No. 153201 January 26, 2005Sam FajardoPas encore d'évaluation

- San Beda 2009 Civil Law (Torts and Damages) PDFDocument24 pagesSan Beda 2009 Civil Law (Torts and Damages) PDFKing Monteclaro MonterealPas encore d'évaluation

- Rules and Regulations Implementing The Government Service Insurance System Act of 1997Document69 pagesRules and Regulations Implementing The Government Service Insurance System Act of 1997ememPas encore d'évaluation

- Labor FlowchartDocument1 pageLabor FlowchartClarissa de Vera50% (2)

- Department of Labor: FmlaenDocument1 pageDepartment of Labor: FmlaenUSA_DepartmentOfLaborPas encore d'évaluation

- ESTIMATING TOTAL PRODUCT COST OF A CHEMICAL PLANTDocument7 pagesESTIMATING TOTAL PRODUCT COST OF A CHEMICAL PLANTBINOD BINODPas encore d'évaluation

- Sunrise Credit Union: Name No. of Dependents Hourly Wage Hours WorkedDocument2 pagesSunrise Credit Union: Name No. of Dependents Hourly Wage Hours WorkedanzarPas encore d'évaluation

- 306 Bes HRMDocument131 pages306 Bes HRMAvinash RajpurohitPas encore d'évaluation

- COJ 2020-2021 Proposed Expenses PDFDocument182 pagesCOJ 2020-2021 Proposed Expenses PDFMelvin PriesterPas encore d'évaluation

- 00 - 2019 Labor Law NotesDocument16 pages00 - 2019 Labor Law NotesAnie Guiling-Hadji GaffarPas encore d'évaluation

- Selected Case Digests On Labor StandardsDocument5 pagesSelected Case Digests On Labor StandardsRegina Zagala100% (1)

- HRM Maruti SuzukiDocument18 pagesHRM Maruti Suzukikalyan kumarPas encore d'évaluation

- Business Mathematics - Module 14 - Overtime PayDocument6 pagesBusiness Mathematics - Module 14 - Overtime PayLovely Joy Hatamosa Verdon-DielPas encore d'évaluation

- ROCKY Mountain MutualDocument3 pagesROCKY Mountain MutualSiddharth GoenkaPas encore d'évaluation

- C.V of Mohammad Mizan ManagerDocument4 pagesC.V of Mohammad Mizan ManagerFaruque SathiPas encore d'évaluation

- NR526 2017-09Document158 pagesNR526 2017-09Simen EllingsenPas encore d'évaluation

- Revised Guidelines On The Implementation of The 13th Month Pay LawDocument4 pagesRevised Guidelines On The Implementation of The 13th Month Pay LawCheska Vergara100% (1)

- Lucban 09ACT2 HRMDocument3 pagesLucban 09ACT2 HRMGela SiaPas encore d'évaluation

- Royale Homes Marketing Corp v. Alcantara G.R. No, 195190Document7 pagesRoyale Homes Marketing Corp v. Alcantara G.R. No, 195190rachelPas encore d'évaluation

- Top Challenges of Compensation ManagementDocument5 pagesTop Challenges of Compensation ManagementAIMA zulfiqar0% (1)

- MALAYSIA'S EMPLOYMENT INSURANCE ACTDocument87 pagesMALAYSIA'S EMPLOYMENT INSURANCE ACTSyed Abbas AliPas encore d'évaluation

- LP ProjectDocument27 pagesLP ProjectOjasvi vyasPas encore d'évaluation

- The Payment of Gratuity Act, 1972Document33 pagesThe Payment of Gratuity Act, 1972madhuhaPas encore d'évaluation

- (G.) Lu vs. Enopia (Digest)Document2 pages(G.) Lu vs. Enopia (Digest)Dom Robinson BaggayanPas encore d'évaluation

- CSEA ComplaintDocument14 pagesCSEA ComplaintCasey SeilerPas encore d'évaluation

- Department of Labor: Workforce AccommodationsDocument3 pagesDepartment of Labor: Workforce AccommodationsUSA_DepartmentOfLaborPas encore d'évaluation

- Creed - Family Values and Domestic EconomiesDocument28 pagesCreed - Family Values and Domestic EconomiesGraziele DainesePas encore d'évaluation

- Advantages of Division of LabourDocument16 pagesAdvantages of Division of Labour'Emmanuel Orimogunje100% (1)

- Seafarer Entitled to Disability Benefits and Attorney's FeesDocument5 pagesSeafarer Entitled to Disability Benefits and Attorney's FeesMerabSalio-anPas encore d'évaluation

- Internal Wage StructureDocument34 pagesInternal Wage StructurePallavi ChhipaPas encore d'évaluation

- Evolution of Organisational Behaviour - Part 1Document10 pagesEvolution of Organisational Behaviour - Part 1arjun Singh100% (2)

- Tejana Radical - Emma TenayucaDocument29 pagesTejana Radical - Emma TenayucaJim WeillPas encore d'évaluation

- The Four Wheels of GrowthDocument2 pagesThe Four Wheels of Growthmattvincent loisaga100% (1)