Académique Documents

Professionnel Documents

Culture Documents

CRR Reduction Circular Jan 2016

Transféré par

ejogheneta0 évaluation0% ont trouvé ce document utile (0 vote)

23 vues1 pagerree

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentrree

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

23 vues1 pageCRR Reduction Circular Jan 2016

Transféré par

ejoghenetarree

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

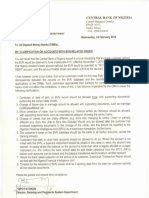

CENTRAL BANK OF NIGERIA

Financial Policy & Regulation Department

Central Business District

PMB. 0187

Garki, Abuja.

09-46237 40]

E-mail: fprd@cbn.gov.ng

FPR/DIR/GEN/CIR/01/002

January 8, 2016

Circular to all banks

REDUCTION IN CASH RESERVE REQUIREMENT (CRR) TO ENHANCE BANKS’ LIQUIDITY FOR

REAL SECTOR FINANCING

The Monetary Policy Committee (MPC), at its 104 meeting held on November 234

and 24h, 2015, reduced the CRR by 500 basis points, from 25 per cent to 20 per cent

with a view to channeling the liquidity arising therefrom to the real sector. The

reduction is part of the Bank's initiatives towards stimulating output growth, expanding

the industrial base, diversitying the economy and increasing the accretion to foreign

reserves.

To give effect to the above policy thrust, the CBN is introducing measures to ensure

that funds realized from the reduction in CRR are applied strictly to qualifying projects.

Consequently, deposit money banks are henceforth required to appraise their

customers’ loan requests relating to the agricultural value chain, manufacturing,

mining and solid minerals, infrastructure and other real sectorrelated projects and

forward same to the CBN for final approval and disbursement. It should be noted that

trading activities and refinancing of projects are not encouraged under this

programme.

For further information, please contact the Director, Development Finance

Department, Central Bank of Nigeria, Abuja.

KEVIN N. AMUGO

DIRECTOR, FINANCIAL POLICY & REGULATION DEPARTMENT

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Chartered Insurance Institute of Nigeria - Exemption GuidelinesDocument2 pagesChartered Insurance Institute of Nigeria - Exemption Guidelinesejogheneta100% (1)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Disbursement February 2016Document12 pagesDisbursement February 2016ejoghenetaPas encore d'évaluation

- Module A Stage1Document11 pagesModule A Stage1ejoghenetaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Module B Stage1Document14 pagesModule B Stage1ejoghenetaPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- CIS Diploma SyllabusDocument21 pagesCIS Diploma Syllabusejogheneta0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Module B Stage2Document17 pagesModule B Stage2ejoghenetaPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- CBN Press Release Fraud1Document1 pageCBN Press Release Fraud1ejoghenetaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Guide To Charges For Banks - 2Document68 pagesGuide To Charges For Banks - 2ejoghenetaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Revised BDC Circular and Guidelines-Corrected-Final 2015Document16 pagesRevised BDC Circular and Guidelines-Corrected-Final 2015ejoghenetaPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Central Bank of Nigeria Communique No. 105 of The Monetary Policy Committee Meeting of Monday and Tuesday, January 25 and 26, 2016Document8 pagesCentral Bank of Nigeria Communique No. 105 of The Monetary Policy Committee Meeting of Monday and Tuesday, January 25 and 26, 2016ejoghenetaPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Central Bank of Nigeria: Press ReleaseDocument1 pageCentral Bank of Nigeria: Press ReleaseejoghenetaPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Note Book Laptops: 1. HP 15 - Intel CeleronDocument3 pagesNote Book Laptops: 1. HP 15 - Intel CeleronejoghenetaPas encore d'évaluation

- Introduction of Negotiable Current Account Maintenance Fee Not Exceeding n1 Per MilleDocument1 pageIntroduction of Negotiable Current Account Maintenance Fee Not Exceeding n1 Per MilleejoghenetaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- CBN Press Statement On BVNDocument1 pageCBN Press Statement On BVNejoghenetaPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Flowchart NotaryDocument3 pagesFlowchart NotaryejoghenetaPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- BDC-Annual Renewal Fee Dec 31, 2015Document1 pageBDC-Annual Renewal Fee Dec 31, 2015ejoghenetaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- BVN Issues CircularDocument1 pageBVN Issues CircularejoghenetaPas encore d'évaluation

- DefinitionDocument34 pagesDefinition23userPas encore d'évaluation

- Faith and Reason - Stevenson, Shandi PDFDocument7 pagesFaith and Reason - Stevenson, Shandi PDFejogheneta100% (1)

- How To Issue An FXdraft PDFDocument1 pageHow To Issue An FXdraft PDFejoghenetaPas encore d'évaluation

- Tenney TopicsJohnPt2 BSDocument16 pagesTenney TopicsJohnPt2 BSejoghenetaPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- HY-Terms of Business enDocument3 pagesHY-Terms of Business enejoghenetaPas encore d'évaluation

- 2014 CommuniqueDocument3 pages2014 CommuniqueejoghenetaPas encore d'évaluation

- Name - Date - Topic: Double Times Double Digit Multiplication Worksheet 1Document5 pagesName - Date - Topic: Double Times Double Digit Multiplication Worksheet 1ejoghenetaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Webservices - Freedomgate SchoolsDocument2 pagesWebservices - Freedomgate SchoolsejoghenetaPas encore d'évaluation

- Pricelist PDFDocument3 pagesPricelist PDFejoghenetaPas encore d'évaluation

- HY-customer Agreement enDocument18 pagesHY-customer Agreement enejoghenetaPas encore d'évaluation

- Module 1 - Oil & Gas Value Chain Plus Global Energy Scene (CompDocument33 pagesModule 1 - Oil & Gas Value Chain Plus Global Energy Scene (Compejogheneta100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- HY-customer Agreement enDocument18 pagesHY-customer Agreement enejoghenetaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)