Académique Documents

Professionnel Documents

Culture Documents

Assignment - Karla Company Provided The Following Information For 2016

Transféré par

April Boreres33%(3)33% ont trouvé ce document utile (3 votes)

1K vues1 pageThe document provides financial information for Karla Company in 2016, including revenues from purchases, rental income and sales totaling $7.85 million, along with expenses such as purchases, selling expenses, administrative expenses, and taxes totaling $7.25 million, resulting in a net income of $600,000.

Description originale:

Assignment for Financial Accouting Theory and Practice

Titre original

Assignment_Karla Company Provided the Following Information for 2016

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document provides financial information for Karla Company in 2016, including revenues from purchases, rental income and sales totaling $7.85 million, along with expenses such as purchases, selling expenses, administrative expenses, and taxes totaling $7.25 million, resulting in a net income of $600,000.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

33%(3)33% ont trouvé ce document utile (3 votes)

1K vues1 pageAssignment - Karla Company Provided The Following Information For 2016

Transféré par

April BoreresThe document provides financial information for Karla Company in 2016, including revenues from purchases, rental income and sales totaling $7.85 million, along with expenses such as purchases, selling expenses, administrative expenses, and taxes totaling $7.25 million, resulting in a net income of $600,000.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

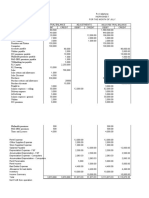

Karla Company provided the following information for 2016 Karla Company provided the following information for

ation for 2016

Purchases 5,250,000.00 Purchases 5,250,000.00

Purchases Returns and Allowances 150,000.00 Purchases Returns and Allowances 150,000.00

Rental income 250,000.00 Rental income 250,000.00

Selling Expenses: Selling Expenses:

Freight Out 175,000.00 Freight Out 175,000.00

Salesmen's commission 650,000.00 Salesmen's commission 650,000.00

Depreciation-store equipment 125,000.00 Depreciation-store equipment 125,000.00

Merchandise Inventory, January 1 1,000,000.00 Merchandise Inventory, January 1 1,000,000.00

Merchandise Inventory, December 31 1,500,000.00 Merchandise Inventory, December 31 1,500,000.00

Sales 7,850,000.00 Sales 7,850,000.00

Sales Returns and Allowances 140,000.00 Sales Returns and Allowances 140,000.00

Sales Discount 10,000.00 Sales Discount 10,000.00

Administrative Expenses: Administrative Expenses:

Officers' Salaries 500,000.00 Officers' Salaries 500,000.00

Depreciation-office equipment 300,000.00 Depreciation-office equipment 300,000.00

Freight In 250,000.00 Freight In 250,000.00

Income Tax 500,000.00 Income Tax 500,000.00

Loss on Sale of Equipment 50,000.00 Loss on Sale of Equipment 50,000.00

Purchase Discounts 100,000.00 Purchase Discounts 100,000.00

Dividend Revenue 150,000.00 Dividend Revenue 150,000.00

Loss on Sale of Investments 50,000.00 Loss on Sale of Investments 50,000.00

Instruction: Instruction:

Prepare an income statement Prepare an income statement

Vous aimerez peut-être aussi

- Accounting For Raw Materials - ExercisesDocument3 pagesAccounting For Raw Materials - ExercisesAmy Spencer100% (1)

- Accounting For Factory OverheadDocument27 pagesAccounting For Factory Overheadspectrum_480% (1)

- TFA 1 Chapter 33 - Financial Assets at Fair ValueDocument1 pageTFA 1 Chapter 33 - Financial Assets at Fair ValueIanna ManieboPas encore d'évaluation

- Cash Flow Statement BreakdownDocument2 pagesCash Flow Statement BreakdownPrecious ViterboPas encore d'évaluation

- Kas and KasDocument30 pagesKas and KasMiko ArniñoPas encore d'évaluation

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaePas encore d'évaluation

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJoyce Anne DugayPas encore d'évaluation

- Module 1 ExamDocument4 pagesModule 1 ExamTabatha Cyphers100% (2)

- Costacc Module 5 QuizDocument11 pagesCostacc Module 5 QuizGemPas encore d'évaluation

- Problem 1Document14 pagesProblem 1Jerry DiazPas encore d'évaluation

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzPas encore d'évaluation

- Macb A1Document24 pagesMacb A1Luu Nhat HaPas encore d'évaluation

- Quiz in ELEC 01 (Inventory Estimation)Document3 pagesQuiz in ELEC 01 (Inventory Estimation)djanine cardinalesPas encore d'évaluation

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDocument6 pagesMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetYaj CruzadaPas encore d'évaluation

- Topic 3Document12 pagesTopic 3Carry KelvinsPas encore d'évaluation

- Cost Concepts & Behavior Lesson 2 SeatworkDocument5 pagesCost Concepts & Behavior Lesson 2 SeatworkElla Marie WicoPas encore d'évaluation

- Answer Key: Change in Accounting Policy Problem 1Document9 pagesAnswer Key: Change in Accounting Policy Problem 1finn mertensPas encore d'évaluation

- Port Folio Number - 2007-MASDocument8 pagesPort Folio Number - 2007-MASAndreaPas encore d'évaluation

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaPas encore d'évaluation

- Chapter 7 Acctng For Materials Activity PDFDocument3 pagesChapter 7 Acctng For Materials Activity PDFGwyneth Hannah Sator RupacPas encore d'évaluation

- Mon Exam.21221sDocument2 pagesMon Exam.21221sNicole Anne Santiago SibuloPas encore d'évaluation

- Conceptual Framework and Accounting StandardsDocument11 pagesConceptual Framework and Accounting StandardsAngela TalastasPas encore d'évaluation

- Leslie Company Manufacturing Department Cost of Production Report For January Materials Conversion CostDocument8 pagesLeslie Company Manufacturing Department Cost of Production Report For January Materials Conversion Costmaica G.Pas encore d'évaluation

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Quiz 1 Cost AccountingDocument3 pagesQuiz 1 Cost AccountingKryss Clyde TabliganPas encore d'évaluation

- Chapter 11Document11 pagesChapter 11Joan LeonorPas encore d'évaluation

- Basic Concepts and Job Order Cost CycleDocument15 pagesBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- Inventories - TheoriesDocument9 pagesInventories - TheoriesIrisPas encore d'évaluation

- Chapter 5Document5 pagesChapter 5chocolatebears67% (3)

- 7166materials Problems-Standard CostingDocument14 pages7166materials Problems-Standard CostingLumina JuliePas encore d'évaluation

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoPas encore d'évaluation

- QUIZ3Document6 pagesQUIZ3Jillian Mae Sobrino BelegorioPas encore d'évaluation

- This Study Resource Was: Award: 1.00 PointDocument2 pagesThis Study Resource Was: Award: 1.00 PointAaron Jan FelicildaPas encore d'évaluation

- Managerial Accounting Exercises Chapter 12Document6 pagesManagerial Accounting Exercises Chapter 12Angelica Lorenz100% (1)

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasPas encore d'évaluation

- Cost Accounting Solution Manual by de Leon: Read/DownloadDocument2 pagesCost Accounting Solution Manual by de Leon: Read/DownloadLovely AbegaelPas encore d'évaluation

- Absorption Costing Vs Variable CostingDocument20 pagesAbsorption Costing Vs Variable CostingMa. Alene MagdaraogPas encore d'évaluation

- Cost Accounting CycleDocument8 pagesCost Accounting CycleRosiel Mae CadungogPas encore d'évaluation

- Finals Quiz CostDocument42 pagesFinals Quiz CostIsabelle Candelaria0% (1)

- Gapas, Daniel John L. Financial Management Exercise 1: True or FalseDocument18 pagesGapas, Daniel John L. Financial Management Exercise 1: True or FalseDaniel John GapasPas encore d'évaluation

- Cpa Review School of The Philippines Manila Financial Accounting and Reforting Theory Valix Siy Valix Escala Revised Conceptual FrameworkDocument43 pagesCpa Review School of The Philippines Manila Financial Accounting and Reforting Theory Valix Siy Valix Escala Revised Conceptual FrameworkRichard BorjaPas encore d'évaluation

- HW On Book Value Per ShareDocument4 pagesHW On Book Value Per ShareCharles TuazonPas encore d'évaluation

- Nutty Company Problem 23 - 5Document2 pagesNutty Company Problem 23 - 5Ya NaPas encore d'évaluation

- 3RD Accrued Liabilities and Deferred RevenueDocument5 pages3RD Accrued Liabilities and Deferred RevenueAnthony DyPas encore d'évaluation

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewMarylorieanne CorpuzPas encore d'évaluation

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquitePas encore d'évaluation

- Absorption and Variable CostingDocument2 pagesAbsorption and Variable CostingJenni LoricoPas encore d'évaluation

- Costing Methods ComparisonDocument24 pagesCosting Methods ComparisonJohn BernabePas encore d'évaluation

- Module 4 Absorption and Variable Costing NotesDocument3 pagesModule 4 Absorption and Variable Costing NotesMadielyn Santarin Miranda100% (3)

- Quiz ReceivablesDocument9 pagesQuiz ReceivablesJanella PatriziaPas encore d'évaluation

- 1st Mastery Abm2Document6 pages1st Mastery Abm2Annabel EchavezPas encore d'évaluation

- DocxDocument151 pagesDocxJillianne JillPas encore d'évaluation

- Chapter 2 Cost AcctngDocument10 pagesChapter 2 Cost AcctngJustine Reine CornicoPas encore d'évaluation

- Cost Accounting Systems and ClassificationsDocument45 pagesCost Accounting Systems and ClassificationsracabrerosPas encore d'évaluation

- Assignmentkarla Company Provided The Following Information For 2016 PDF FreeDocument1 pageAssignmentkarla Company Provided The Following Information For 2016 PDF FreePatrisha Carpio BeleyPas encore d'évaluation

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyPas encore d'évaluation

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarPas encore d'évaluation

- Japc Worksheet AGUST 31, 2017Document6 pagesJapc Worksheet AGUST 31, 2017Dy Ju Arug ALPas encore d'évaluation

- M Enterprises: Financial Statements/ReportsDocument30 pagesM Enterprises: Financial Statements/ReportsAishah Mae M. AtomarPas encore d'évaluation

- Release of Claim and Subrogation Reciept: Paseguruhan NG Mga Naglilingkod Sa PamahalaanDocument2 pagesRelease of Claim and Subrogation Reciept: Paseguruhan NG Mga Naglilingkod Sa PamahalaanApril BoreresPas encore d'évaluation

- Release of Claim and Subrogation Reciept: Paseguruhan NG Mga Naglilingkod Sa PamahalaanDocument2 pagesRelease of Claim and Subrogation Reciept: Paseguruhan NG Mga Naglilingkod Sa PamahalaanApril BoreresPas encore d'évaluation

- Tanada Vs AngaraDocument2 pagesTanada Vs AngaraJanskie Mejes Bendero LeabrisPas encore d'évaluation

- MACARIOLA VS ASUNCION JUDGMENTDocument2 pagesMACARIOLA VS ASUNCION JUDGMENTApril BoreresPas encore d'évaluation

- Boreres - Assignment 01 - Political Law ReviewDocument17 pagesBoreres - Assignment 01 - Political Law ReviewApril BoreresPas encore d'évaluation

- Bersamin Civ BlueredDocument29 pagesBersamin Civ BlueredbpdmacapendegPas encore d'évaluation

- BENGSON III VS. HRET: Natural-Born Citizenship QualificationDocument3 pagesBENGSON III VS. HRET: Natural-Born Citizenship QualificationApril BoreresPas encore d'évaluation

- Sonic V ChuaDocument14 pagesSonic V ChuaIna VillaricaPas encore d'évaluation

- Oposa Vs FactoranDocument1 pageOposa Vs FactoranApril BoreresPas encore d'évaluation

- MACARIOLA VS ASUNCION JUDGMENTDocument2 pagesMACARIOLA VS ASUNCION JUDGMENTApril BoreresPas encore d'évaluation

- President's authority over military affirmed in coup caseDocument4 pagesPresident's authority over military affirmed in coup caseApril BoreresPas encore d'évaluation

- Darines Vs QuiñonesDocument2 pagesDarines Vs QuiñonesApril BoreresPas encore d'évaluation

- BENGSON III VS. HRET: Natural-Born Citizenship StatusDocument5 pagesBENGSON III VS. HRET: Natural-Born Citizenship StatusApril BoreresPas encore d'évaluation

- 6.raytheon International v. Rouzie - General PrincipleDocument3 pages6.raytheon International v. Rouzie - General PrincipleApril BoreresPas encore d'évaluation

- Boreres Political Law Review Remaining Cases 01Document16 pagesBoreres Political Law Review Remaining Cases 01April BoreresPas encore d'évaluation

- Commercial Mixed Feed ManufacturerDocument22 pagesCommercial Mixed Feed ManufacturerAnonymous lXCcK4tPas encore d'évaluation

- 3aepublic of Tbe Ffflanila: QI:ourtDocument9 pages3aepublic of Tbe Ffflanila: QI:ourtApril BoreresPas encore d'évaluation

- VRP Nation Builders SummitDocument1 pageVRP Nation Builders SummitApril BoreresPas encore d'évaluation

- 5Ps Brochure 2018Document4 pages5Ps Brochure 2018April BoreresPas encore d'évaluation

- Mindanao Chapter: Association of The Law Students of The PhilippinesDocument2 pagesMindanao Chapter: Association of The Law Students of The PhilippinesApril BoreresPas encore d'évaluation

- GoodPRactice Documentation ScreenshotDocument3 pagesGoodPRactice Documentation ScreenshotApril BoreresPas encore d'évaluation

- Business Plan - Google DocsDocument22 pagesBusiness Plan - Google DocsApril BoreresPas encore d'évaluation

- 9Document22 pages9April BoreresPas encore d'évaluation

- Transimex Co. v. Mafre Asian InsuranceDocument10 pagesTransimex Co. v. Mafre Asian InsuranceJanskie Mejes Bendero LeabrisPas encore d'évaluation

- Knowledge Fair Gensan ProgramDocument1 pageKnowledge Fair Gensan ProgramApril BoreresPas encore d'évaluation

- Passive Income TAX RateDocument2 pagesPassive Income TAX RateApril BoreresPas encore d'évaluation

- 4Document2 pages4April BoreresPas encore d'évaluation

- 155 Arnault Vs Nazareno 87 Phil 29Document15 pages155 Arnault Vs Nazareno 87 Phil 29April BoreresPas encore d'évaluation

- IDCB Schedule of Activities For The Month of August 2018: DevelopmentDocument4 pagesIDCB Schedule of Activities For The Month of August 2018: DevelopmentApril BoreresPas encore d'évaluation

- Random Drug Test: CertificationDocument2 pagesRandom Drug Test: CertificationApril BoreresPas encore d'évaluation

- Dleg0170 Manual PDFDocument20 pagesDleg0170 Manual PDFEmmanuel Lucas TrobbianiPas encore d'évaluation

- Operation Check: Check Panel & Steering SwitchDocument20 pagesOperation Check: Check Panel & Steering SwitchJack CardiagPas encore d'évaluation

- Blackbook Project On IT in Insurance - 163417596Document75 pagesBlackbook Project On IT in Insurance - 163417596Dipak Chauhan57% (7)

- Financial Analysis P&GDocument10 pagesFinancial Analysis P&Gsayko88Pas encore d'évaluation

- Advanced Accounting 1: Accounting Lab Module Uph Business SchoolDocument36 pagesAdvanced Accounting 1: Accounting Lab Module Uph Business SchoolDenisse Aretha LeePas encore d'évaluation

- Ngos' Due Diligence and Risk Mitigation: A Holistic ApproachDocument54 pagesNgos' Due Diligence and Risk Mitigation: A Holistic ApproachMichel KozahPas encore d'évaluation

- 26-200 kVA BrochureDocument16 pages26-200 kVA Brochureargo kuncahyoPas encore d'évaluation

- Catalogue: See Colour in A Whole New LightDocument17 pagesCatalogue: See Colour in A Whole New LightManuel AguilarPas encore d'évaluation

- Tune boilers regularlyDocument2 pagesTune boilers regularlyEliecer Romero MunozPas encore d'évaluation

- 2021.10.06 Boq Facade Civil Works at b10 - 20211129Document24 pages2021.10.06 Boq Facade Civil Works at b10 - 20211129Irul HimawanPas encore d'évaluation

- Drilling and Demolition: Hilti. Outperform. OutlastDocument48 pagesDrilling and Demolition: Hilti. Outperform. OutlastVinicius CoimbraPas encore d'évaluation

- Module Combustion Engineering-1-2Document13 pagesModule Combustion Engineering-1-2Julie Ann D. GaboPas encore d'évaluation

- The Structural Engineer - August 2022 UPDATEDDocument36 pagesThe Structural Engineer - August 2022 UPDATEDES100% (1)

- Fluid Mechanics of CH 4 & 5Document44 pagesFluid Mechanics of CH 4 & 5Adugna GosaPas encore d'évaluation

- BBEK4203 Principles of MacroeconomicsDocument20 pagesBBEK4203 Principles of MacroeconomicskiranaomomPas encore d'évaluation

- Effects of Job Evaluation On Workers' Productivity: A Study of Ohaukwu Local Government Area, Ebonyi State, NigeriaDocument6 pagesEffects of Job Evaluation On Workers' Productivity: A Study of Ohaukwu Local Government Area, Ebonyi State, Nigeriafrank kipkoechPas encore d'évaluation

- Win Server 2008 Manual Installation PDFDocument20 pagesWin Server 2008 Manual Installation PDFFery AlapolaPas encore d'évaluation

- Stellarisware Release Notes: Sw-Rln-6852Document160 pagesStellarisware Release Notes: Sw-Rln-6852Akio TakeuchiPas encore d'évaluation

- Icpo Naft 4Document7 pagesIcpo Naft 4Juan AgueroPas encore d'évaluation

- CJ718 Board Functional Test ProcedureDocument13 pagesCJ718 Board Functional Test ProcedureYudistira MarsyaPas encore d'évaluation

- Approved Local Government Taxes and Levies in Lagos StateDocument5 pagesApproved Local Government Taxes and Levies in Lagos StateAbū Bakr Aṣ-Ṣiddīq50% (2)

- الصراع التنظيمي وأثره...Document25 pagesالصراع التنظيمي وأثره...mohmod moohPas encore d'évaluation

- Politische StrategiesEnd 2012 de en FINALDocument405 pagesPolitische StrategiesEnd 2012 de en FINALFomePas encore d'évaluation

- 43 CSeT F Mock - 240818 PDFDocument26 pages43 CSeT F Mock - 240818 PDFben romdhane ahmedPas encore d'évaluation

- Flexi Wcdma BtsDocument25 pagesFlexi Wcdma BtsSyed Ashfaq HussainPas encore d'évaluation

- Google Inc 2014Document19 pagesGoogle Inc 2014Archit PateriaPas encore d'évaluation

- Moodlecloud 24284Document1 pageMoodlecloud 24284Giged BattungPas encore d'évaluation

- 1.1 Nature and Scope of International Financial ManagementDocument26 pages1.1 Nature and Scope of International Financial ManagementTuki DasPas encore d'évaluation

- QRHDocument12 pagesQRHNwe OoPas encore d'évaluation

- Doctrine of Repugnancy ExplainedDocument13 pagesDoctrine of Repugnancy ExplainedAmita SinwarPas encore d'évaluation