Académique Documents

Professionnel Documents

Culture Documents

SABIC Intrinsic Value

Transféré par

Anonymous rOv67R0 évaluation0% ont trouvé ce document utile (0 vote)

111 vues3 pagesIV

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentIV

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

111 vues3 pagesSABIC Intrinsic Value

Transféré par

Anonymous rOv67RIV

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

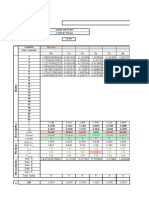

Intrinsic valuation for SABIC's stock

Calculating growth rate

annual g ( Q g (AVG) 3rd Q 20122nd 2012 1st 2012 4th 2011

EPS 2.1 1.77 2.42 1.75

g, EPS (A) 0.186923 0.046730666 0.186441 -0.2686 0.382857 -0.35897

Sales

g, sales (B)

ROE=(.1782+.2119+.1677)/3=18

RR= (8.39-4.5)/8.39=0.46

g = ROE x RR = .0828 (C) 0.0828

Average of two,(A+C)/2

GROWTH (rounded) 0.14

Cost of equity:

Average ROE for the past 3 years 0.18

Cost of Capital Calculations: weight

Debt (book value) 97263 0.2224598368

Minoroty interest (book value) 48953 0.1119652529

Equity (market value) 291000 0.6655749103

Total 437216

*Costs of debt and minority interest were obtained by dividing interests on total debt (minoroty interests)outstanding.

Wacc (rounded) 0.13

FCFF: 2012

NI 24780

plus Dep 13413

minus Cap exp. -10860

minus change in NWC -11393

minus other assets -1440

FCFF 14500

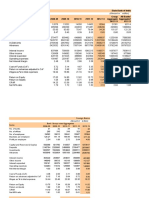

Growth of 14 percent will go for 10 years and then it will level off to 10 percent for another 10 years and then will go to 6 perce

Year growth FCff WACC Present value

0 14500

1 1.14 16530 1.13 14628.318584

2 1.14 18844.2 1.13 14757.772731

3 1.14 21482.39 1.13 14888.37249

4 1.14 24489.92 1.13 15020.127998

5 1.14 27918.51 1.13 15153.049485

6 1.14 31827.1 1.13 15287.147268

7 1.14 36282.9 1.13 15422.431757

8 1.14 41362.5 1.13 15558.913454

9 1.14 47153.25 1.13 15696.602954

10 1.14 53754.71 1.13 15835.510944

11 1.1 59130.18 1.13 15415.099149

12 1.1 65043.2 1.13 15005.84873

13 1.1 71547.52 1.13 14607.463365

14 1.1 78702.27 1.13 14219.654603

15 1.1 86572.5 1.13 13842.141649

16 1.1 95229.75 1.13 13474.651163

17 1.1 104752.7 1.13 13116.917061

18 1.1 115228 1.13 12768.680325

19 1.1 126750.8 1.13 12429.688812

20 1.1 139425.9 1.13 12099.697074

20 1.06 2111306 1.13 183223.98426

Present value to the firm 472452.07385

Deb and minority interest -146216

Present value to the equity 326236.07385

equity Fair Value per share 108.7454

equity market price per share 97

3rd 20111 2nd 2011 1st 2011 4th 2010

2.73 2.7 2.56 1.94

0.011111 0.054688 0.319588

Weight interest % Cost

0.22246 592 0.006087 0.001354

0.111965 3078 0.062877 0.00704

0.665575 0.18 0.119803

0.128198 WACC

rests)outstanding.

and then will go to 6 percent forever.

Vous aimerez peut-être aussi

- United States Census Figures Back to 1630D'EverandUnited States Census Figures Back to 1630Pas encore d'évaluation

- The Data - 1Document26 pagesThe Data - 1gekasPas encore d'évaluation

- Axis Bank Valuation PDFDocument13 pagesAxis Bank Valuation PDFDaemon7Pas encore d'évaluation

- Profit For The Year: Income Statement 2019 - DG CementDocument10 pagesProfit For The Year: Income Statement 2019 - DG CementHAMMAD AliPas encore d'évaluation

- Percent To Sales MethodDocument8 pagesPercent To Sales Methodmother25janPas encore d'évaluation

- Data Rasio Keuangan Pertanian1Document24 pagesData Rasio Keuangan Pertanian1satrio wijoyoPas encore d'évaluation

- Atlas Honda AnalysisDocument4 pagesAtlas Honda AnalysisInam KhanPas encore d'évaluation

- Ultratech Cement LTD.: Total IncomeDocument36 pagesUltratech Cement LTD.: Total IncomeRezwan KhanPas encore d'évaluation

- Blue Star LTDDocument21 pagesBlue Star LTDRishab BansalPas encore d'évaluation

- Act WorkDocument10 pagesAct WorkAsad Uz JamanPas encore d'évaluation

- Final Balance Sheet AnnualDocument887 pagesFinal Balance Sheet AnnualEKAPas encore d'évaluation

- Amar EcoDocument8 pagesAmar EcoviragamamarPas encore d'évaluation

- ONGCDocument10 pagesONGCswaroop shettyPas encore d'évaluation

- Data - All in OneDocument69 pagesData - All in OnegekasPas encore d'évaluation

- The DataDocument27 pagesThe DatagekasPas encore d'évaluation

- Software-Analisis NPV, BC &IRR-Ralat OkDocument3 pagesSoftware-Analisis NPV, BC &IRR-Ralat Ok01PPBNIKEN AULIA FRANSISKA SMK PP N BENGKULUPas encore d'évaluation

- Christ University Christ UniversityDocument9 pagesChrist University Christ UniversityBharathPas encore d'évaluation

- Absa and KCB RatiosDocument8 pagesAbsa and KCB RatiosAmos MutendePas encore d'évaluation

- Group 9 - ONGC - MA ProjectDocument11 pagesGroup 9 - ONGC - MA ProjectShubham JainPas encore d'évaluation

- D - Past Earthquake Data of World & IndiaDocument5 pagesD - Past Earthquake Data of World & IndiaG V krishnaPas encore d'évaluation

- Aftab Auto: Year 2012 2013 2014 2015 2016Document11 pagesAftab Auto: Year 2012 2013 2014 2015 2016Yazdan Ibon KamalPas encore d'évaluation

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- Idea Model TemplateDocument22 pagesIdea Model TemplateNaman MalhotraPas encore d'évaluation

- Tabla Calculo LD-LCDocument12 pagesTabla Calculo LD-LCJorge AriasPas encore d'évaluation

- Fin 301 Final Assignment Group Name G 1Document26 pagesFin 301 Final Assignment Group Name G 1Avishake SahaPas encore d'évaluation

- Sana 33Document8 pagesSana 33Samsam RaufPas encore d'évaluation

- Financial Statements Analysis Analysis and Interpretation of Companies Dawood Equities Limited Ratio Analysis Year Rati OsDocument8 pagesFinancial Statements Analysis Analysis and Interpretation of Companies Dawood Equities Limited Ratio Analysis Year Rati OsSamsam RaufPas encore d'évaluation

- Income Tax Collection Data-2017-18-20181023105926 PDFDocument11 pagesIncome Tax Collection Data-2017-18-20181023105926 PDFsachingadadePas encore d'évaluation

- Machine A Cash FlowsDocument1 pageMachine A Cash FlowsRadhakrishna IndalkarPas encore d'évaluation

- BBTN, BRPT, TowrDocument18 pagesBBTN, BRPT, TowrGooglee AkunPas encore d'évaluation

- Stimulation Stock PriceDocument7 pagesStimulation Stock PriceNatchanon ChaipongpatiPas encore d'évaluation

- HanssonDocument11 pagesHanssonJust Some EditsPas encore d'évaluation

- SG4 - Krakatau Steel ADocument25 pagesSG4 - Krakatau Steel AFadhila HanifPas encore d'évaluation

- GDP Per Capita Growth Rate (Annual %) From Year 1971 To 2020Document6 pagesGDP Per Capita Growth Rate (Annual %) From Year 1971 To 2020Hà ViPas encore d'évaluation

- (1+i) (1+i) (1+i) (1+i) (1+i) (1+i)Document22 pages(1+i) (1+i) (1+i) (1+i) (1+i) (1+i)Flavia Rojas GuillenPas encore d'évaluation

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6Pas encore d'évaluation

- Interpretation of Comparative Balance Sheet and Income StatementDocument4 pagesInterpretation of Comparative Balance Sheet and Income Statementshruti jainPas encore d'évaluation

- Quarterly Financial Highlights of Commercial Banks-FY 2006 2007-2nd-QuarterDocument1 pageQuarterly Financial Highlights of Commercial Banks-FY 2006 2007-2nd-QuarterRagnar LothbrokPas encore d'évaluation

- MacroEco Assignment-2Document8 pagesMacroEco Assignment-2shashank sonalPas encore d'évaluation

- Bases de Datos para Ejercicios en ExcelDocument1 022 pagesBases de Datos para Ejercicios en ExcelBessy Jackeline Villanueva BeltranPas encore d'évaluation

- Industry AvaragesDocument81 pagesIndustry Avaragessandeep kumarPas encore d'évaluation

- Book 3Document4 pagesBook 3Abdullah Al Mamun NayEmPas encore d'évaluation

- Case Study 2Document21 pagesCase Study 2karimPas encore d'évaluation

- Model RegresieDocument14 pagesModel RegresieIon BataPas encore d'évaluation

- From Utility Function To Demand Function and Deman CurveDocument10 pagesFrom Utility Function To Demand Function and Deman CurveJulianPas encore d'évaluation

- Materi Penilaian BisnisDocument7 pagesMateri Penilaian BisnisyuliwidyantiPas encore d'évaluation

- Regression StatisticsDocument18 pagesRegression StatisticsMunteanu ArianaPas encore d'évaluation

- Future N Present Value - Lat Tabel - Bu LuckyDocument26 pagesFuture N Present Value - Lat Tabel - Bu LuckyMichelleAngelinePas encore d'évaluation

- Sr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Document6 pagesSr. No Name Roll No Programme: Case Analysis Section 2 Toffee Inc. Course: Operations Management (Tod 221)Harshvardhan Jadwani0% (1)

- SEZ DataDocument10 pagesSEZ DataraviPas encore d'évaluation

- Group 9 - ONGC - MA ProjectDocument13 pagesGroup 9 - ONGC - MA ProjectShubham JainPas encore d'évaluation

- Assets AnalysDocument6 pagesAssets AnalysБогдан БалакаPas encore d'évaluation

- 2006 2007 2008 Sales Net Sales Less CogsDocument17 pages2006 2007 2008 Sales Net Sales Less CogsMohammed ArifPas encore d'évaluation

- Maruti Suzuki Balance SheetDocument6 pagesMaruti Suzuki Balance SheetMasoud AfzaliPas encore d'évaluation

- Valuation GroupNo.12Document4 pagesValuation GroupNo.12John DummiPas encore d'évaluation

- PasfDocument14 pagesPasfAbhishek BhatnagarPas encore d'évaluation

- IntegralsDocument5 pagesIntegralsSonya MorozPas encore d'évaluation

- CF - 80012100326 - H075 - DIV A - Saurav BhandariDocument9 pagesCF - 80012100326 - H075 - DIV A - Saurav BhandariSauravPas encore d'évaluation

- Wilkins Excel SheetDocument9 pagesWilkins Excel SheetYuvraj Aayush Sisodia100% (1)

- APB30091213FDocument9 pagesAPB30091213FMoorthy EsakkyPas encore d'évaluation

- 20 Python Libraries You Arent Using But ShouldDocument74 pages20 Python Libraries You Arent Using But ShouldRaja SooriamurthiPas encore d'évaluation

- PA ArticleDocument41 pagesPA ArticlevidhyapathyPas encore d'évaluation

- Gail (India)Document17 pagesGail (India)Anonymous rOv67RPas encore d'évaluation

- (Crabel T.) Trading Close-To-close PatternsDocument1 page(Crabel T.) Trading Close-To-close PatternsAnonymous rOv67RPas encore d'évaluation

- Crabel T. Trading Close-To-close Patterns 1989Document4 pagesCrabel T. Trading Close-To-close Patterns 1989Om PrakashPas encore d'évaluation

- 20 Python Libraries You Arent Using But ShouldDocument2 pages20 Python Libraries You Arent Using But ShouldAnonymous rOv67RPas encore d'évaluation

- Deploying ASI On JD Edwards EnterpriseOneDocument7 pagesDeploying ASI On JD Edwards EnterpriseOneAviReddyPas encore d'évaluation

- Reversing Mac DDocument122 pagesReversing Mac DAnonymous rOv67RPas encore d'évaluation

- Creating Power Forms Using JD Edwards 9.0 ToolsetDocument13 pagesCreating Power Forms Using JD Edwards 9.0 ToolsetAnonymous rOv67RPas encore d'évaluation

- 9 1 Required Components For Installing JD Edwards EnterpriseOne Tools 9.2.0.1 Rev PDFDocument3 pages9 1 Required Components For Installing JD Edwards EnterpriseOne Tools 9.2.0.1 Rev PDFAnonymous rOv67RPas encore d'évaluation

- Day Trading S & P 500 Index: Futures ContractDocument85 pagesDay Trading S & P 500 Index: Futures ContractfendyPas encore d'évaluation

- Pentaho ReadmeDocument1 pagePentaho Readme梅止观Pas encore d'évaluation

- Wyckoff ThemesDocument8 pagesWyckoff ThemesAnonymous rOv67RPas encore d'évaluation

- TMI SectorOutlookDocument13 pagesTMI SectorOutlookAnonymous rOv67RPas encore d'évaluation

- Your Python Earning Potential CalculatorDocument2 pagesYour Python Earning Potential CalculatorAnonymous rOv67RPas encore d'évaluation

- Work Centre Rates Not Set Up: ReasonDocument2 pagesWork Centre Rates Not Set Up: ReasonAnonymous rOv67RPas encore d'évaluation

- Delivery ReportDocument5 pagesDelivery ReportAnonymous rOv67RPas encore d'évaluation

- MAMA Positional System v1.0Document2 pagesMAMA Positional System v1.0Vinoth KumarPas encore d'évaluation

- Turbo Charge Your Dividend Paying StocksDocument8 pagesTurbo Charge Your Dividend Paying StocksAnonymous rOv67RPas encore d'évaluation

- Relative Strength Index Your Step by Step Alton SwansonDocument83 pagesRelative Strength Index Your Step by Step Alton Swanson8bgbc60% (5)

- License TermDocument5 pagesLicense TermSin PanPas encore d'évaluation

- Relative Strength Index Your Step by Step Alton SwansonDocument3 pagesRelative Strength Index Your Step by Step Alton SwansonAnonymous rOv67RPas encore d'évaluation

- Heikin Ashi II PDFDocument6 pagesHeikin Ashi II PDFmagicxelPas encore d'évaluation

- Heiken Ashi ExplanationDocument7 pagesHeiken Ashi ExplanationAnonymous rOv67RPas encore d'évaluation

- 2017 09 06 Bse EqDocument50 pages2017 09 06 Bse EqAnonymous rOv67RPas encore d'évaluation

- 2017 09 01 Nse FoDocument12 pages2017 09 01 Nse FoAnonymous rOv67RPas encore d'évaluation

- TitlesDocument1 pageTitlesAnonymous rOv67RPas encore d'évaluation

- Advanced Option Strategies For Active InvestorsDocument70 pagesAdvanced Option Strategies For Active InvestorsAnonymous rOv67RPas encore d'évaluation

- The Volatility Course Workbook Step by Step Exercises To Help You Master The Volatility Course PDF EbookDocument28 pagesThe Volatility Course Workbook Step by Step Exercises To Help You Master The Volatility Course PDF EbookAnonymous rOv67RPas encore d'évaluation

- Derivative KitDocument110 pagesDerivative KitAnonymous rOv67RPas encore d'évaluation

- Tutorial Fm1Document2 pagesTutorial Fm1norsiahPas encore d'évaluation

- 10.roles, Responsibilities, Authority & AccountabilityDocument13 pages10.roles, Responsibilities, Authority & AccountabilitymuthuselvanPas encore d'évaluation

- INTERNSHIPDocument6 pagesINTERNSHIPsri vastavPas encore d'évaluation

- BE8-3 Date Account Titles and Explanation Debit CreditDocument4 pagesBE8-3 Date Account Titles and Explanation Debit CreditMai Phương NguyễnPas encore d'évaluation

- Typologies of E-TourismDocument18 pagesTypologies of E-Tourismsubbu2raj3372Pas encore d'évaluation

- Formulae For The Computation of The VariancesDocument5 pagesFormulae For The Computation of The VariancesGkæ E. GaleakelwePas encore d'évaluation

- Star Bucks Case AnalysisDocument19 pagesStar Bucks Case Analysisarchanasingh22Pas encore d'évaluation

- HHHDocument25 pagesHHHElena RahmatikaPas encore d'évaluation

- Questionnaires For SupermarketDocument6 pagesQuestionnaires For SupermarketOnkarPas encore d'évaluation

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANPas encore d'évaluation

- Influencer MarketingDocument5 pagesInfluencer MarketingRownokPas encore d'évaluation

- Hampshire ExpressDocument29 pagesHampshire Expressvivek0% (1)

- FIS and Audit Statement TemplateDocument4 pagesFIS and Audit Statement Templateissam jendoubiPas encore d'évaluation

- 2020 MayDocument15 pages2020 MaySenomi JayasinghePas encore d'évaluation

- Wal-Mart Activity System MapDocument1 pageWal-Mart Activity System MapWan Wan HushPas encore d'évaluation

- WorldCom ScandalDocument2 pagesWorldCom ScandalchulipzPas encore d'évaluation

- Cost Volume Profit RelationshipDocument15 pagesCost Volume Profit RelationshipzaimfaizahPas encore d'évaluation

- Strategic Management in Global ContextDocument17 pagesStrategic Management in Global Contextsaifuddin ahammedfoysalPas encore d'évaluation

- Assessment Review Fmva Practice Exam PDFDocument22 pagesAssessment Review Fmva Practice Exam PDFsalaanPas encore d'évaluation

- Intermediate Accounting 1 Lecture NotesDocument16 pagesIntermediate Accounting 1 Lecture NotesAnalyn Lafradez100% (2)

- Partnership Formation and OperationDocument3 pagesPartnership Formation and OperationArden LlantoPas encore d'évaluation

- Tutorial 2 15DPM21F1033Document19 pagesTutorial 2 15DPM21F1033Frdus hmdnPas encore d'évaluation

- Brand Strategy Toolkit: Everything You Need To Define A Brand in One PlaceDocument26 pagesBrand Strategy Toolkit: Everything You Need To Define A Brand in One Placeoxade21Pas encore d'évaluation

- QuestionnaireDocument5 pagesQuestionnaireRiyaPas encore d'évaluation

- Inventory OptimizationDocument21 pagesInventory OptimizationAritra SenPas encore d'évaluation

- Investment Banking AnalystDocument2 pagesInvestment Banking AnalystJack JacintoPas encore d'évaluation

- Assessment Task 1 - BSBOPS505Document9 pagesAssessment Task 1 - BSBOPS505nahin pPas encore d'évaluation

- Brand AccountingDocument19 pagesBrand Accountingrushikes8050% (2)

- Long Question of Financial AcDocument20 pagesLong Question of Financial AcQasim AliPas encore d'évaluation

- Growing and Scaling An Ecommerce Business GuideDocument95 pagesGrowing and Scaling An Ecommerce Business GuidejeetPas encore d'évaluation

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobD'EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersD'EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersÉvaluation : 4.5 sur 5 étoiles4.5/5 (95)

- Summary of Noah Kagan's Million Dollar WeekendD'EverandSummary of Noah Kagan's Million Dollar WeekendÉvaluation : 5 sur 5 étoiles5/5 (2)

- The First Minute: How to start conversations that get resultsD'EverandThe First Minute: How to start conversations that get resultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (57)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverD'EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverÉvaluation : 4.5 sur 5 étoiles4.5/5 (186)

- The 7 Habits of Highly Effective PeopleD'EverandThe 7 Habits of Highly Effective PeopleÉvaluation : 4 sur 5 étoiles4/5 (2566)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0D'EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Évaluation : 5 sur 5 étoiles5/5 (2)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceD'EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceÉvaluation : 5 sur 5 étoiles5/5 (22)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisD'EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsD'EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsÉvaluation : 4.5 sur 5 étoiles4.5/5 (52)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tD'EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tÉvaluation : 4.5 sur 5 étoiles4.5/5 (63)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionD'EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionÉvaluation : 5 sur 5 étoiles5/5 (337)

- The Introverted Leader: Building on Your Quiet StrengthD'EverandThe Introverted Leader: Building on Your Quiet StrengthÉvaluation : 4.5 sur 5 étoiles4.5/5 (35)

- Spark: How to Lead Yourself and Others to Greater SuccessD'EverandSpark: How to Lead Yourself and Others to Greater SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsD'EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- Leadership Skills that Inspire Incredible ResultsD'EverandLeadership Skills that Inspire Incredible ResultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsD'EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsÉvaluation : 4.5 sur 5 étoiles4.5/5 (48)

- The Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeD'EverandThe Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeÉvaluation : 4.5 sur 5 étoiles4.5/5 (99)

- The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderD'EverandThe Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderPas encore d'évaluation

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthD'Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthÉvaluation : 5 sur 5 étoiles5/5 (52)

- Multipliers, Revised and Updated: How the Best Leaders Make Everyone SmarterD'EverandMultipliers, Revised and Updated: How the Best Leaders Make Everyone SmarterÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- The Little Big Things: 163 Ways to Pursue ExcellenceD'EverandThe Little Big Things: 163 Ways to Pursue ExcellencePas encore d'évaluation

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsD'EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsÉvaluation : 4.5 sur 5 étoiles4.5/5 (411)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andD'EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andÉvaluation : 4.5 sur 5 étoiles4.5/5 (709)