Académique Documents

Professionnel Documents

Culture Documents

MCB Lite Faqs

Transféré par

Arfin KazmiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MCB Lite Faqs

Transféré par

Arfin KazmiDroits d'auteur :

Formats disponibles

MCB Lite

FAQs

What is MCB Lite?

MCB Lite is a socially connected payments solution that saves you time and money by

enabling you to make unlimited free payments through a Visa Card and a Mobile Wallet.

How do I apply for MCB Lite?

You can apply for MCB Lite through any of the following ways:

1. Call us at 24/7 Help Line 111-000-622

2. Visit any of the Lite enabled Branches.

Can I apply for MCB Lite without a valid CNIC?

No, according to statutory requirements any account holder needs to be a minimum of

18 years or above and have a valid CNIC.

How and when will I receive my MCB Lite Card?

It will be delivered to you within 7 working days* if you order online or through our call

center.

* Subject to courier delays.

Do I need any specific mobile connection to use the Mobile Wallet?

No, this service is telecom agnostic which means that it will work with any prepaid or

postpaid connection of any mobile network.

Do I need any special mobile handset to use the Mobile Wallet Service?

No you don't. This service will work on any internet enabled mobile phone or device.

If I dont have internet on my mobile phone can I still access my Mobile Wallet?

Yes, you can use it on any internet enabled device including a laptop, PC or a tablet.

How is MCB Lite different from my existing MCB Bank Account?

Your MCB Lite Mobile Wallet is just like your real world wallet in which you store money

based on how much you need and it just functions as your bank account. Through this

you can send money to MCB Bank and other bank accounts, buy top-ups, pay utility

bills and so much more all through your mobile phone. Click here for an updated list of

IBFT Banks.

What is the difference between a Visa Debit Card and a MCB Lite Card?

While your MCB Visa Debit Card is linked to your conventional bank account, your MCB

Lite Card is a Visa enabled card, which is linked to your MCB Lite Mobile Wallet. It

provides you with the same flexibility of a Visa Debit Card. It can be used at ATMs or at

any POS, locally and internationally. It can also be used for online shopping. The only

difference is in the transaction limits that are levied on your MCB Lite Mobile Wallet

depending upon your choice of package.

Do I need to activate my MCB Lite Mobile Wallet and Card after purchase?

Yes, you do.

Customers simply need to call our Call Center on 111-000-622 to set their

transaction/ATM PIN. New to Bank (NTB) Customers need to visit any MCB Bank

Branch with the filled out Application Form in their MCB Lite packs for activation. Please

note that account activation for NTB Customers cannot be done over the phone.

However, Card activation will be done over the phone by calling the MCB Bank Call

Center on 111-000-622 once you have activated your Mobile Wallet.

How can I deposit funds in my MCB Lite Mobile Wallet?

You can deposit funds in to your MCB Lite Mobile Wallet by visiting your nearest MCB

Bank Branch. You will be required to fill out a Deposit Slip, a copy of which you will keep

as proof of deposit.

Additionally, MCB Bank Customers can request to link their MCB Bank Account to their

MCB Lite Mobile Wallet in order to easily move funds between the two, absolutely free

of cost. Simply call our Call Center on 111-000-622 to get this service activated.

How can I withdraw funds from my MCB Lite Mobile Wallet?

You can withdraw money from your MCB Lite Mobile Wallet through the following ways:

Any 1-Link/M-Net/VISA powered ATM

MCB Bank Branches

What are my transaction limits, maximum balance limits and top-ups limits?

You can enjoy the following limits with your MCB Lite Mobile Wallet:

MCB Lite 0 MCB Lite 1 MCB Lite 2

Funds-in/out (Daily) PKR. 15,000 PKR. 25,000 PKR. 100,000

Funds-in/out (Monthly) PKR. 25,000 PKR. 60,000 PKR. 500,000

Funds-in/out (Yearly) PKR. 120,000 PKR. 500,000 PKR. 5,000,000

A/C Balance Limit PKR. 100,000 Unlimited Unlimited

Top-Ups (Daily) PKR. 5,000 PKR. 5,000 PKR. 10,000

Can I transfer funds to any MCB Bank customer?

Yes you can transfer money to any MCB Bank customer through your Mobile Wallet. All

you need is your beneficiaries account number or mobile number.

Can I hold a Joint Account for MCB Lite?

No, you cannot hold a joint account for MCB Lite.

Can I have a saving account in MCB Lite?

All MCB Lite Mobile Wallets are current accounts.

Do I get a Cheque book for my MCB Lite Account?

No, you do not receive a Cheque book for your MCB Lite Mobile Wallet.

Am I charged on ATM transactions?

No, your MCB Lite ATM transactions are free of cost on MCB ATMs. There are switch

charges on ATMs of other banks. Similarly, charges would also apply on international

ATM transactions.

How do I get my ATM PIN Code?

You will set your ATM PIN through IVR when you call our Call Center to activate your

MCB Lite Card.

How do I get my Mobile Wallet Login PIN?

You will receive the Login PIN SMS as soon as your mobile wallet is created. This SMS

will contain a link to set your Mobile Wallet Login PIN. You will receive this SMS prior to

card pack delivery.

Why do I have 2 MCB Lite PIN codes?

Your Login Pin is used to log in to your Mobile Wallet via www.mcblite.com while your

MCB Lite Transactional/ATM PIN is used for confirming any transaction made through

the Mobile Wallet or at the ATM. This dual PIN mechanism enhances the security of

your Mobile Wallet.

What should I do if I forget my ATM PIN or if it is compromised?

You should contact us immediately on our 24-hour Call Centre at 111-000-622 or +92-

21-111-000-622 from overseas to change your MCB Lite ATM PIN.

What if I forget my Mobile Wallet PIN?

Simply call 111-000-622 to reset your Mobile Wallet PIN.

What should I do if my MCB Lite Card is lost or stolen?

You must report your lost or stolen card immediately by calling our 24-hour Call Centre

at 111-000-622.

Can I access my Mobile Wallet if Im travelling outside Pakistan?

Yes, you can access the service using your own phone if you are on international

roaming and enjoy the full experience of your Mobile Wallet and its

features. Alternatively you can access your Mobile Wallet using any other

Internet/GPRS enabled device from the country you are visiting; however, you will not

receive SMS alerts associated with the service since they will be sent to your registered

mobile number.

Can I use MCB Lite Card if Im travelling outside Pakistan?

Yes you can you use your MCB Lite Card at any ATM or POS machine around the

world that is powered by VISA.

How do I upgrade to MCB Lite 1 or MCB Lite 2?

Once we receive your application form along with your CNIC copy, you are upgraded to

MCB Lite 1. To upgrade to MCB Lite 2 you need to fill out an upgrade form, and send it

to the address provided on the upgrade form along with any of the additional documents

mentioned on the form. Your request will be processed within two to three working days

after your application is received.

What documents do I need to upgrade to Lite 2?

You need to show your proof of income along with a copy of your CNIC to upgrade to

Lite 2.

Are there any charges of upgrading to MCB Lite 1 or 2?

There are no charges of upgrading to either MCB Lite 1 or 2.

What is the annual fee of using the MCB Lite service?

For a detailed overview of the fee and charges, please view the Charges and

Limit's section.

How can I get my MCB Lite Mobile Wallet statement?

You can view your MCB Lite mini-statement through your Mobile Wallet. Simply log onto

www.mcblite.com and select mini statement or request for an e-statement by calling

the MCB Bank Call Center on 111-000-622.

How do I add someone to my Quick Pay list?

You can add mobile operators, utility bill companies, a friend or anyone else you

transact frequently with to your quick pay list. For example, if you want to add a friend,

simply add your friends name in the "Add to Quick Pay" field while sending money to

him/her.

Once successfully added, you will receive a confirmation SMS on your registered

mobile number.

What is the minimum balance I can have in my Mobile Wallet?

There is no minimum limit requirement for your MCB Lite Mobile Wallet. However, zero

balance wallets are disabled after 6 months of inactivity.

Can anybody else deposit funds into my Mobile Wallet? If yes, then what

information s/he may need?

Yes, anyone can deposit money into your Mobile Wallet. All s/he needs to do is go to an

agent or MCB Bank Branch, fill out a deposit slip and provide your mobile number.

What should I do if I notice transactions on my Mobile Wallet that aren't mine?

If you think there have been fraudulent transactions on your Mobile Wallet, you should

contact us immediately on 111-000-622 or +92-21-111-000-622 from overseas.

Are my transactions secure over the mobile?

Yes, the Mobile Wallet is a safe and secure way to make payments, because:

Information is not stored on your mobile phone which means that your PIN is never

exposed even if your mobile handset is lost or stolen.

All transactions are secured with Advanced Encryption Methodologies.

In addition, to conduct any transaction on your Mobile Wallet you need to first enter your

Login PIN followed by your Transaction/ATM PIN.

How long is my card valid for?

The validity period of your card is 5 years from the date of issue.

Can I get 2 or more MCB Lite Mobile Wallets on my name?

No, at this point in time one Mobile Wallet can be issued on one valid CNIC only.

Where can I get more information about the service?

Call Center: 111-000-622.

What is One Time Password (OTP)?

OTP is a 6 figure numeric code sent to customers on their registered mobile number.

One Time Password (OTP) has been introduced as an additional security feature by

MCB Bank to protect customers account(s). OTP is confidential and should not be

shared with anyone, even if the person claims to be an MCB Bank official. Please

ensure that your mobile number is updated with us to be able to authenticate your login.

What is the advantage of having an authentication mechanism through OTP for

Login?

The advantage of having an OTP authentication mechanism is that even if the

credentials (details) of the customer (like username, password, ATM pin etc.) are

compromised/ stolen, OTP authentication mechanism will ensure that any fraudulent/

unauthorized logins are not done through your MCB Lite services.

Why does the customer need to enter OTP for Logging in?

This is an additional authentication required for logging in. With this added security

feature, the customer can have a greater peace of mind knowing that without inputting

the OTP, login activity will not be completed.

When will the customer need to enter OTP?

The customer will need to enter the OTP every single time he/she want to log in to MCB

Lite.

I am entering correct OTP but it still states incorrect?

If you have tried to log in multiple times, multiple OTPs will be generated. Every new

attempt will generate a new OTP. You will have to enter the latest OTP in order to log in

successfully.

What should I do if I do not receive OTP on my mobile number registered with

MCB Bank?

This may be due to the following reasons a) The mobile number registered for the use

of MCB Lite is not your current mobile number or b) In case your registered mobile

number with the Bank is ported out, Please SMS MCB to 9460 to ensure receiving SMS

alerts from the Bank.

Can I use the same OTP multiple times?

No. OTP is a dynamic password and is valid for one time login. For security reasons,

each OTP can only be used for 1 login authentication only.

From where will I receive my OTP?

You will receive OTP from 6222 ONLY (MCB Bank's official SMS code).

Are there any charges for using the OTP?

The Bank does not charge customers for receiving OTP. This service is completely free.

What if the customer receives the message Already logged in?

If the customer receives such a message, the customer must wait for 5 minutes and

login again

What if the customer receives the message Invalid OTP Reference?

This message is displayed when the customer has entered invalid OTP. The customer

must use one of the two links labeled Login or Logout on the user interface in order

to go back to the Login Page. And remember, do not press the Back button or

Refresh button of the browser, since it will generate Exception 500 Error.

What if the customer receives the message Exception 500 Error?

If the customer receives the Exception 500 Error, the customer must re-enter the URL

(www.mcblite.com) in the address bar of the browser and login again.

What is auto-pick-up facility?

It is an additional feature of the Mobile Banking App specifically designed for the OTP.

With this feature the Mobile Banking App is able to take the OTP details from your SMS

inbox to auto-pick-up/ auto-populate/ fill in the OTP field at the time of login. This

feature creates convenience for the customer, as the customer will not have to manually

enter the OTP details, currently it is available on all Android based mobile phones

ONLY.

Is auto-pick-up facility for OTP available on all mobile operating systems?

The OTP auto-pick-up facility is only available for Android based mobile phones. It is not

available on phones with operating systems like Windows by Microsoft and Apples iOS.

Vous aimerez peut-être aussi

- ELEN211Document79 pagesELEN211Kurt RobinsonPas encore d'évaluation

- HEC Academic Evaluation Formula (HEC-AEFDocument4 pagesHEC Academic Evaluation Formula (HEC-AEFzafarkhani100% (1)

- CSC Newsletter Month of December 2016Document17 pagesCSC Newsletter Month of December 2016Arfin KazmiPas encore d'évaluation

- Late Fee For Registration of Magazine by Net PageDocument3 pagesLate Fee For Registration of Magazine by Net PageArfin KazmiPas encore d'évaluation

- BRM Lecture2Document33 pagesBRM Lecture2Kashan FarrukhPas encore d'évaluation

- PCS FormDocument8 pagesPCS FormSher Zaman BhuttoPas encore d'évaluation

- ListDocument2 pagesListArfin KazmiPas encore d'évaluation

- Benedict's Test For Reducing SugarDocument2 pagesBenedict's Test For Reducing SugarMohammed Parfals100% (2)

- List of Candidates for Combined Competitive Exam 2013 Hyderabad CenterDocument441 pagesList of Candidates for Combined Competitive Exam 2013 Hyderabad CenterArfin KazmiPas encore d'évaluation

- BRM Lecture2Document33 pagesBRM Lecture2Kashan FarrukhPas encore d'évaluation

- New File PDFDocument28 pagesNew File PDFArfin KazmiPas encore d'évaluation

- Job EvaluationDocument2 pagesJob EvaluationArfin KazmiPas encore d'évaluation

- Subject: Letter of Leave ApplicationDocument2 pagesSubject: Letter of Leave ApplicationArfin KazmiPas encore d'évaluation

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentArfin KazmiPas encore d'évaluation

- V H R F B: Isible and Idden ISK Actors For AnksDocument46 pagesV H R F B: Isible and Idden ISK Actors For AnksArfin KazmiPas encore d'évaluation

- AssignmentDocument14 pagesAssignmentArfin KazmiPas encore d'évaluation

- 1 SurahDocument3 pages1 SurahArfin KazmiPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Idbridge K50: Secure Token in Portable Usb FormatDocument2 pagesIdbridge K50: Secure Token in Portable Usb FormatstevicPas encore d'évaluation

- KOBIL-PSD2-Technical Aspects - 27.11.17 PDFDocument28 pagesKOBIL-PSD2-Technical Aspects - 27.11.17 PDFKhattabPas encore d'évaluation

- Account Statement From 15 Dec 2020 To 15 Jun 2021Document5 pagesAccount Statement From 15 Dec 2020 To 15 Jun 2021Vibhu TeotiaPas encore d'évaluation

- Assesement On Challenges of E-Payment Service Practice in Commercial Bank of EthiopiaDocument66 pagesAssesement On Challenges of E-Payment Service Practice in Commercial Bank of EthiopiaMebratu BirhanuPas encore d'évaluation

- Test Cases For ATM: Verifying The MessageDocument2 pagesTest Cases For ATM: Verifying The MessageAbdul WaheedPas encore d'évaluation

- ATMdesk Field Setup ManualDocument29 pagesATMdesk Field Setup Manualcarabinieri2Pas encore d'évaluation

- Atm ViewpointDocument14 pagesAtm ViewpointMuhammad Ahtisham Asif0% (1)

- Migrating From Requirements To DesignDocument34 pagesMigrating From Requirements To DesignParth KunderPas encore d'évaluation

- Jamuna BankDocument33 pagesJamuna BankAl AminPas encore d'évaluation

- H.R.DASGUPTA Account StatementDocument27 pagesH.R.DASGUPTA Account StatementBabuHalderPas encore d'évaluation

- DS-K1T342 Series MinMoe Release Note V3.16.1 - Build230802Document15 pagesDS-K1T342 Series MinMoe Release Note V3.16.1 - Build230802synstergate86Pas encore d'évaluation

- CRF-1 A (CPC)Document4 pagesCRF-1 A (CPC)SafwanPas encore d'évaluation

- CHASE Digital Services AgreementDocument46 pagesCHASE Digital Services AgreementPendi AgarwalPas encore d'évaluation

- Account Statement For Account Number4789000100003651: Branch DetailsDocument2 pagesAccount Statement For Account Number4789000100003651: Branch DetailsLok GyanPas encore d'évaluation

- Atm 123Document40 pagesAtm 123ahmedtaniPas encore d'évaluation

- Cryptera PTS Approval Letter 4 20273 04 2014Document5 pagesCryptera PTS Approval Letter 4 20273 04 2014dejavuePas encore d'évaluation

- E5170s-22 LTE CPE - Quick Start Guide - 01 - English - ErP - C - LDocument24 pagesE5170s-22 LTE CPE - Quick Start Guide - 01 - English - ErP - C - LNelsonPas encore d'évaluation

- Zte Blade v7 PDFDocument54 pagesZte Blade v7 PDFمستر بنPas encore d'évaluation

- NSS Full Registration ProcessDocument6 pagesNSS Full Registration ProcessMarian DeluxyPas encore d'évaluation

- Factors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryDocument17 pagesFactors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryalenePas encore d'évaluation

- Standardized Customer Request FormDocument7 pagesStandardized Customer Request FormSimar100% (1)

- Samsung 2Document3 pagesSamsung 2ดาริล หนึ่งPas encore d'évaluation

- ResolutionErrors - Nic - EinvoiceDocument2 pagesResolutionErrors - Nic - EinvoiceYash ChhabraPas encore d'évaluation

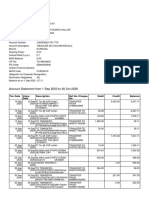

- Account Statement From 1 Sep 2020 To 30 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Sep 2020 To 30 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancebalajiPas encore d'évaluation

- BAEMSG Base24 ProsaDocument602 pagesBAEMSG Base24 ProsaJuan Castro100% (1)

- IDBI BANK Customer Request FormDocument2 pagesIDBI BANK Customer Request FormVivek Sinha67% (46)

- ATM MachineDocument19 pagesATM Machinevikas00707Pas encore d'évaluation

- RBSDocument90 pagesRBSMediha WaheedPas encore d'évaluation

- Accessing Megabank TrainingDocument52 pagesAccessing Megabank TrainingbholisinghPas encore d'évaluation

- PCode Resp CodeDocument2 pagesPCode Resp CodeSjb SthaPas encore d'évaluation