Académique Documents

Professionnel Documents

Culture Documents

Daily DAX Journal 050810

Transféré par

Jay SchneiderCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Daily DAX Journal 050810

Transféré par

Jay SchneiderDroits d'auteur :

Formats disponibles

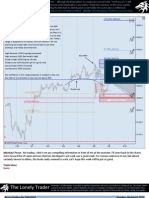

Daily DAX The long trade on a bounce from 6320 achieved its target of 6360, with only ten

only ten points of heat. Not bad considering

. the potential for chop today. The range was a half point shy of the aggressive estimate. The 3 day profile suggests

Journal hesitance at higher prices going into the ECB rate announcement today and US employment data on Friday.

04 Aug 2010 Range studies: Aggressive 112.5; conservative 85; H 6445/50 L 6255/60 Calendar: GE factory orders, ECB rate, US init claims

DAX 30min Wednesday, 04 August 2010

Wednesday's volume was back within normal the normal

summer range. The wave pattern has completed here, so there

is a significant chance of a pullback ahead of US employment

data on Friday. The ECB announces policy meeting minutes and

Aggressive range H

the rate decision. The status quo is expected -- and priced in.

High Extreme: 6455 (123 fib extension)

High primary: 6420 (range estimate) Conservative range H

Low primary: 6260 (below 3d POC, above key fib retracement)

Low Extreme: 6220/30 (7d POC, key fib retracement) Yesterday's target achieved.

My confidence in this range projection is not high. Rate

decision days are usually quiet, unless there are surprises. The

expectation is no change to rates or posture. I will need to see

decisive price action after the data releases. Until then, one

trade idea. Otherwise, only scalps. HVN

3POC

Conservative range L

Aggressive range L

7POC

HVN

Trade a bounce above 6220, or 6260

on strong responsive buying. Target

6310, trail thereafter if order flow

agrees. Reassess after GE factory

orders, ECB announcement.

Thursday's theme: The odds favor a narrow range day, but of course anything can happen. Scalp the ranges according to price

action of the market leader after the US open (probably euro, but confirm with ES and ESX). Watch earnings, which could end up

moving the markets quite a bit if they are anything like HSBC and BNP reports were on Monday.

Trade ideas: Buy DAX at support and take profit at value.

Long -- Trade a bounce above 6220, targeting 6310, trail thereafter. If strong responsive buying is seen at 6260, buy and target

6310. Trail stop if order flow agrees.

The Lonely Trader

Disclaimer: All information is provided as market commentary and not as investment or trading advice. The Lonely Trader

expressly disclaims liability, without limitation, for losses or damages resulting from reliance on such information. Past

results are no guarantee of future performance. Please consult a registered financial advisor before risking your capital.

Range Studies for DAX 0910 Wednesday, August 04, 2010

Previous day range 109.0 Comments:

Previous day pattern WS GMT 0506: I've strayed a bit from the statistical range projections, in favor of what I

Number of occurrences 94 consider high probability price points, using a combination of high volume nodes,

retracements, and established support and resistance at previous swing highs and lows.

(last 200 days)

Although the trend is up, the odds of a correction are good.

Avg range after WS 75.5%

> 82.5 <

Prob of expansion → 17.0% Prob of contraction → 67.0% Probability of duplication → 16.0%

Projected expansion 146.5 Projected contraction 66.0 Projected duplication 109.0

( 134.5% ) ( 60.5% ) ( 100.2% )

Daily range studies Volume studies Time, price and event

3 days 99.8 Value area high 6365.0 Aggressive range est. 112.5

10 days 112.6 Point of control 6335.5 Conservative range est. 85.0

20 days 112.5 Value area low 6297.5 Aggressive range H 6455.0

50 days 125.2 Opening range 9.0 Conservative range H 6427.5

10 day max range 200.0 Initial balance 18.5 Today's H range est. 6420.0

10 day min range 47.5 R2 high vol node 6300.0 0.70 Today's L range est. 6220.0

3/10 0.89 R1 high vol node 6280.0 0.80 Conservative range L 6257.5

10 day true high 6376.5 Pvt high vol node 6220.0 1.00 Aggressive range L 6230.0

5 day true high 6376.5 S1 high vol node 6178.0 1.20 3 day range pivot 6280.0

Yesterday's high 6376.5 S2 high vol node 6140.0 0.85 02 Sep 08 high 6566.0

Yesterday's low 6267.5 3D VAH 6319.0 02 August high 6376.5

5 day true low 6063.0 3D VPOC 6279.5 15 July swing high 6264.5

10 day true low 5954.5 3D VAL 6249.0 20 July swing low 5911.5

Yesterday's settlement 6342.5 3 day vol avg 128.9 GE factory orders M/L

Previous settlement 6304.0 10 day vol avg 130.6 ECB rate and policy High

10 day range position 0.92 20 day vol avg 130.6 US initial claims Med

Calendar GMT Area Event Mkt Risk Exp Prev Remarks

Thursday 0130 AU Monetary policy statement Ccy High Inflationary language

1000 GE Factory orders Jun YoY, MoM Equ M/L 24.8 DAX intraday, likely priced in

1100 UK BoE rate decision statement (TBD) Ccy High 0.50 0.50 GBP pairs, likely priced in

Asset purchase target Ccy High 200B 200B See above

1145 EU ECB monetary policy/rate statement C/E High 1.00 1.00 Likely priced in, but intraday volatility

1230 CA Building permits Jun MoM Ccy Med -10.8 CAD pairs, ES correlated

US Continuing/initial claims Jul 24/31 Equ M/L 455K 457K ES, DAX intraday (cont. 4515K, 4565K)

Comments -- and insults as long as they are clever -- are welcome.

See contact info below.

Interested in contributing to this study? Jay Schneider -- FX and futures, range studies

Want to exchange ideas? Have a suggestion? San Diego Area, USA

Email

Please contact --> Blog

The Lonely Trader

Disclaimer: All information is provided as market commentary and not as investment or trading advice. The Lonely Trader

expressly disclaims liability, without limitation, for losses or damages resulting from reliance on such information. Past

results are no guarantee of future performance. Please consult a registered financial advisor before risking your capital.

Vous aimerez peut-être aussi

- Daily DAX Journal 110810Document2 pagesDaily DAX Journal 110810Jay SchneiderPas encore d'évaluation

- Daily Studies 040810Document2 pagesDaily Studies 040810Jay SchneiderPas encore d'évaluation

- Daily CallsDocument18 pagesDaily CallsArun DubeyPas encore d'évaluation

- Daily Studies 010810Document2 pagesDaily Studies 010810Jay SchneiderPas encore d'évaluation

- DRM - Handouts (1) 2Document54 pagesDRM - Handouts (1) 2tanshlinkedinPas encore d'évaluation

- Index Review:: Current Technical SetupDocument7 pagesIndex Review:: Current Technical SetupavnsivaPas encore d'évaluation

- Daily CallsDocument18 pagesDaily Callsreesty68_unfearyPas encore d'évaluation

- Market Radar: Traders' CornerDocument5 pagesMarket Radar: Traders' CornerKeerthi Vasan SPas encore d'évaluation

- WeeklyTechnicals PDFDocument21 pagesWeeklyTechnicals PDFsaran21Pas encore d'évaluation

- Technical and DerivativesDocument5 pagesTechnical and DerivativesSarvesh BhagatPas encore d'évaluation

- Futures Margin CalculationDocument79 pagesFutures Margin CalculationMUSKAAN BAHLPas encore d'évaluation

- Futures' Bhavcopy Analyser - Setup 1Document6 pagesFutures' Bhavcopy Analyser - Setup 1Sreenivas GuduruPas encore d'évaluation

- Trend Determination 10topcryptobrokersDocument12 pagesTrend Determination 10topcryptobrokersomer khanPas encore d'évaluation

- Change in Polarity by Saif ThobaniDocument19 pagesChange in Polarity by Saif Thobanilala lajpat raiPas encore d'évaluation

- R24 Yield Curve StrategiesDocument41 pagesR24 Yield Curve StrategiesRayBrianCasazolaPas encore d'évaluation

- DEALING RANGE STRATEGY - The Prop TraderDocument10 pagesDEALING RANGE STRATEGY - The Prop Traderyoussner327Pas encore d'évaluation

- Dan Sheridan: RulesDocument54 pagesDan Sheridan: RulesOptionPoncho100% (2)

- Tech SpotlightDocument18 pagesTech SpotlightJPas encore d'évaluation

- RR 0607201500536Document5 pagesRR 0607201500536Om PrakashPas encore d'évaluation

- This Study Resource Was: ZumwaldDocument2 pagesThis Study Resource Was: ZumwaldVevo PPas encore d'évaluation

- Trader's Weekly Tool Kit: Section - 1Document12 pagesTrader's Weekly Tool Kit: Section - 1Milan VaishnavPas encore d'évaluation

- LPX - RBC Deep DiveDocument36 pagesLPX - RBC Deep DiveBryan DavisPas encore d'évaluation

- Tutorial 3 - Liquidity: State and Discuss The Common Approach To Liquidity ManagementDocument7 pagesTutorial 3 - Liquidity: State and Discuss The Common Approach To Liquidity ManagementTACN-4TC-19ACN Nguyen Thu HienPas encore d'évaluation

- Dof Assignment1 M.P.K SrihariDocument10 pagesDof Assignment1 M.P.K Sriharimpk srihariPas encore d'évaluation

- The Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCDocument25 pagesThe Great Resistance. Bitcoin Price Report 1st Issue. EmperorBTCHulu LuluPas encore d'évaluation

- Bhagyodya Stampings Note utxD0RUNkpDocument3 pagesBhagyodya Stampings Note utxD0RUNkpAshutosh BiswalPas encore d'évaluation

- Long StraddleDocument2 pagesLong StraddlepkkothariPas encore d'évaluation

- Investment AppraisalDocument3 pagesInvestment AppraisalDawar Hussain (WT)Pas encore d'évaluation

- Basic Harmonic PatternsDocument7 pagesBasic Harmonic PatternsEduard Septianus100% (1)

- Basic Harmonic PatternsDocument6 pagesBasic Harmonic PatternsCharles Onyechere100% (2)

- APC Incentive StructureDocument17 pagesAPC Incentive StructureMohd NaimPas encore d'évaluation

- Regresi BergandaDocument7 pagesRegresi BergandaPeridaBertuPas encore d'évaluation

- Commodities & Currencies - Weakness On The US Dollar Continues 09/08/2010Document3 pagesCommodities & Currencies - Weakness On The US Dollar Continues 09/08/2010Rhb InvestPas encore d'évaluation

- Presentación Riesgos de LiquidezDocument21 pagesPresentación Riesgos de LiquidezPiero Martin LeónPas encore d'évaluation

- MS&E448: Statistical Arbitrage: Group 5: Carolyn Soo, Zhengyi Lian, Jiayu Lou, Hang YangDocument31 pagesMS&E448: Statistical Arbitrage: Group 5: Carolyn Soo, Zhengyi Lian, Jiayu Lou, Hang Yangakion xcPas encore d'évaluation

- MS&E448: Statistical Arbitrage: Group 5: Carolyn Soo, Zhengyi Lian, Jiayu Lou, Hang YangDocument31 pagesMS&E448: Statistical Arbitrage: Group 5: Carolyn Soo, Zhengyi Lian, Jiayu Lou, Hang Yang123Pas encore d'évaluation

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsPas encore d'évaluation

- Derivatives 081110Document5 pagesDerivatives 081110Stock ReportsPas encore d'évaluation

- Group 40Document7 pagesGroup 40Rachel LiPas encore d'évaluation

- NCB Capital Daily Technical Report: Market AnalysisDocument3 pagesNCB Capital Daily Technical Report: Market Analysisrizwan maqboolPas encore d'évaluation

- Weekly Sector Watch-April 01,'24Document14 pagesWeekly Sector Watch-April 01,'24advik porwalPas encore d'évaluation

- 1-Debt To IncomeDocument39 pages1-Debt To IncomezungetsuPas encore d'évaluation

- Case Study Report Format: Cover Page IntroductionDocument9 pagesCase Study Report Format: Cover Page IntroductionJego ElevadoPas encore d'évaluation

- Precision TradingDocument37 pagesPrecision TradinggeorgePas encore d'évaluation

- 2014-05 GSB Historic Multiplier Analysis - FEADocument16 pages2014-05 GSB Historic Multiplier Analysis - FEAqx6v4r5n4nPas encore d'évaluation

- Emerging Topics Finance - Quant StrategiesDocument24 pagesEmerging Topics Finance - Quant Strategiesromualdo gengibrePas encore d'évaluation

- Corporate Finance: Class Notes 14Document24 pagesCorporate Finance: Class Notes 14Sakshi VermaPas encore d'évaluation

- Es130617 1Document4 pagesEs130617 1satish sPas encore d'évaluation

- Value at RiskDocument28 pagesValue at RiskAndri GintingPas encore d'évaluation

- Title Meaning Short DescriptionDocument1 pageTitle Meaning Short DescriptionNassim Alami MessaoudiPas encore d'évaluation

- #L13 Txtbook Example Wessex Eng.Document30 pages#L13 Txtbook Example Wessex Eng.Ulugbek SayfiddinovPas encore d'évaluation

- Share Hold SellDocument4 pagesShare Hold SellIshwor sharmaPas encore d'évaluation

- Commodities & Currencies: More Likelihood of A Rebound On CPO This Week - 12/04/2010Document3 pagesCommodities & Currencies: More Likelihood of A Rebound On CPO This Week - 12/04/2010Rhb InvestPas encore d'évaluation

- Finance 101 Insead Lec 2Document18 pagesFinance 101 Insead Lec 2Dwijesh RajwadePas encore d'évaluation

- Case - ch11Document4 pagesCase - ch11riki3100% (14)

- TQU 5th AprilDocument12 pagesTQU 5th AprilnarnoliaPas encore d'évaluation

- Basics of Spreading: Ratio Spreads and BackspreadsDocument20 pagesBasics of Spreading: Ratio Spreads and BackspreadspkkothariPas encore d'évaluation

- Daily DAX Journal 070410Document2 pagesDaily DAX Journal 070410Jay SchneiderPas encore d'évaluation

- Daily DAX Journal 060410Document2 pagesDaily DAX Journal 060410Jay SchneiderPas encore d'évaluation

- Norton and Ariely - Building A Better AmericaDocument13 pagesNorton and Ariely - Building A Better AmericaradiorahimPas encore d'évaluation

- Afghanistan - Exit Vs Engagement - Asia Briefing No 115Document12 pagesAfghanistan - Exit Vs Engagement - Asia Briefing No 115Jay SchneiderPas encore d'évaluation

- The 2013 Energy ForecastDocument11 pagesThe 2013 Energy ForecastJay Schneider100% (1)

- Myth of DiversificationDocument6 pagesMyth of DiversificationJay SchneiderPas encore d'évaluation

- NBS Energy Data RevisionsDocument6 pagesNBS Energy Data RevisionsJay SchneiderPas encore d'évaluation

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDocument5 pagesThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderPas encore d'évaluation

- Daily DAX Journal 060810Document2 pagesDaily DAX Journal 060810Jay SchneiderPas encore d'évaluation

- Daily DAX Journal 100810Document2 pagesDaily DAX Journal 100810Jay SchneiderPas encore d'évaluation

- Daily DAX Journal 090810Document2 pagesDaily DAX Journal 090810Jay SchneiderPas encore d'évaluation

- Daily DAX Studies 020810Document2 pagesDaily DAX Studies 020810Jay SchneiderPas encore d'évaluation

- Weekly Outlook 180710Document6 pagesWeekly Outlook 180710Jay SchneiderPas encore d'évaluation

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDocument5 pagesThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderPas encore d'évaluation

- Daily Outlook 300710Document2 pagesDaily Outlook 300710Jay SchneiderPas encore d'évaluation

- Q3 2010 03jul 2010Document3 pagesQ3 2010 03jul 2010Jay SchneiderPas encore d'évaluation

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDocument5 pagesThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderPas encore d'évaluation

- The Lonely Trader: Date GMT Event Import Forecast Previous RemarksDocument5 pagesThe Lonely Trader: Date GMT Event Import Forecast Previous RemarksJay SchneiderPas encore d'évaluation

- Weekly Outlook 030710Document5 pagesWeekly Outlook 030710Jay Schneider100% (1)

- Calculus 2 - Chapter 3Document8 pagesCalculus 2 - Chapter 3Silverwolf CerberusPas encore d'évaluation

- CFPB Upstart No Action Letter RequestDocument14 pagesCFPB Upstart No Action Letter RequestCrowdfundInsiderPas encore d'évaluation

- Prudential Bank vs. Alviar 464 SCRA 353, July 28, 2005Document17 pagesPrudential Bank vs. Alviar 464 SCRA 353, July 28, 2005Samantha NicolePas encore d'évaluation

- J Pramod ResumeDocument3 pagesJ Pramod Resumechaitanya1186Pas encore d'évaluation

- 01Document2 pages01ishtee894Pas encore d'évaluation

- 2021-10-28 St. Mary's County TimesDocument32 pages2021-10-28 St. Mary's County TimesSouthern Maryland OnlinePas encore d'évaluation

- Basel II - RBI GuidelinesDocument70 pagesBasel II - RBI GuidelinesHarsh MehtaPas encore d'évaluation

- Budgeting QuestionsDocument8 pagesBudgeting QuestionsumarPas encore d'évaluation

- Ar 2008Document153 pagesAr 2008Faradilah Binti Ajma'inPas encore d'évaluation

- XXXXXXXXXXX0254 30 04 2023to29 05 2023Document2 pagesXXXXXXXXXXX0254 30 04 2023to29 05 2023RajeshPas encore d'évaluation

- Kingdom Bank AlliancesDocument17 pagesKingdom Bank AlliancesFarai Gillie GudoPas encore d'évaluation

- First National City Bank of New York Vs Tan - G.R. No. L-14234. February 28, 1962Document4 pagesFirst National City Bank of New York Vs Tan - G.R. No. L-14234. February 28, 1962RonStephaneMaylonPas encore d'évaluation

- Complaint-Affidavit: Office of The City ProsecutorDocument7 pagesComplaint-Affidavit: Office of The City ProsecutorMark LojeroPas encore d'évaluation

- RBI Placement Papers - RBI Interview Questions and Answers: Author: Administrator Saved FromDocument7 pagesRBI Placement Papers - RBI Interview Questions and Answers: Author: Administrator Saved FromAjay KumarPas encore d'évaluation

- Credit Transactions Compilation #6Document27 pagesCredit Transactions Compilation #6Vic RabayaPas encore d'évaluation

- VSA-IRS Business LawDocument32 pagesVSA-IRS Business LawjpbluejnPas encore d'évaluation

- PNB vs. Bank of New YorkDocument3 pagesPNB vs. Bank of New YorkPaula GasparPas encore d'évaluation

- BPI v. SuarezDocument2 pagesBPI v. SuarezMarrielDeTorresPas encore d'évaluation

- Application For Limited Registration For Supervised Practice As A Physiotherapist ALRP 66Document14 pagesApplication For Limited Registration For Supervised Practice As A Physiotherapist ALRP 66krushaa1Pas encore d'évaluation

- Notes of GFMDocument28 pagesNotes of GFMmohanraokp2279Pas encore d'évaluation

- 5.-Abstract-of-Canvass MEDALS FOR GRADUATIONDocument2 pages5.-Abstract-of-Canvass MEDALS FOR GRADUATIONAřčhäńgël KäśtïelPas encore d'évaluation

- Help To Buy Isa Key Features PDFDocument4 pagesHelp To Buy Isa Key Features PDFfsdesdsPas encore d'évaluation

- Analytical Study of Capital Structure of Icici BankDocument22 pagesAnalytical Study of Capital Structure of Icici BankKuldeep Ban100% (2)

- Impact of Corona Virus in Bangladesh: General InformationDocument6 pagesImpact of Corona Virus in Bangladesh: General InformationNasif HassanPas encore d'évaluation

- Pennies A Day QuizDocument1 pagePennies A Day QuizZane ZangwillPas encore d'évaluation

- 2016 1098-MORT MORTGAGE 4868 WellsFargoDocument2 pages2016 1098-MORT MORTGAGE 4868 WellsFargoJay EvansPas encore d'évaluation

- Valuation Objective QuestionsDocument13 pagesValuation Objective QuestionsRubina Hannure75% (8)

- Dao Heng Bank Inc. Etc vs. Spouse Laigo DigestDocument1 pageDao Heng Bank Inc. Etc vs. Spouse Laigo DigestLuz Celine CabadingPas encore d'évaluation

- Chapter 15 Business FinanceDocument55 pagesChapter 15 Business Financeapi-35899503767% (3)

- Information Needs of An Organization: "Need Is The Mother of Invention"Document15 pagesInformation Needs of An Organization: "Need Is The Mother of Invention"Suhas ParchurePas encore d'évaluation