Académique Documents

Professionnel Documents

Culture Documents

HALU

Transféré par

Clarisse300 évaluation0% ont trouvé ce document utile (0 vote)

14 vues1 pageHALU

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentHALU

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues1 pageHALU

Transféré par

Clarisse30HALU

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Page 1 of 1

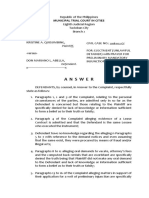

BIR Form No.

Republika ng Pilipinas Monthly Percentage

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Tax Return 2551M

September 2005 (ENCS)

3 For the month (MM /YYYY) 4 Amended Return? No. of Sheets

1 For the i Calendar

j

k

l

m

n j Fiscal

k

l

m

n 5 Attached

2

Year Ended

12 - December 2016 11 - November 2016

(MM/YYYY) j Yes

k

l

m

n 0

i No

j

k

l

m

n

Part I Background Information

6 TIN 446 273 816 000 7 RDO 028 Line of Business / Occupation

Code 8

7020-REAL ESTATE ACTIVITIES

9 Taxpayer's Name (For Individual) Last Name, First Name, Middle Name/ (For Non-individual) Registered Name 10 Telephone Number

CARLOS, MARY GRACE, GOYAL 9375780

11 Registered Address 12 Zip Code

608 CARLOS EXTN., SAN BARTOLOME, NOVALICHES, QUEZON CITY 1116

13 Are you availing of tax relief under Special Law / International Tax Treaty? j Yes

k

l

m

n i No

j

k

l

m

n If yes, specify

Part II Computation of Tax ATC

Taxable Transaction / Industry Classification ATC Taxable Amount Tax Rate Tax Due

PERSON EXEMPT FROM VAT UNDER SEC. 109V (SEC. 16) PT010 0.00 3.0 0.00

19 Total Tax Due 19 0.00

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1) 20A 0.00

20B Tax Paid in Return Previously Filed, if this is an amended return 20B 0.00

21 Total Tax Credit/Payments (Sum of Items 20A & 20B) 21 0.00

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22 0.00

23 Add Penalties Surcharge Interest Compromise

23A 0.00 23B 0.00 23C 0.00 23D 0.00

24 Total Amount Payable (Overpayment) (Sum of Items 22 and 23D) 24 0.00

If Overpayment, mark one box only j

k

l

m

n j To be issued a Tax Credit Certificate

k

l

m

n

To be Refunded

Schedule 1 Tax Withheld Claimed as Tax Credit

Period Covered Name of Withholding Agent Income Payments Tax Withheld Applied

Total Amount(to item 20A)................. 0.00

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25___________________________________________________________________________________ 26_____________________________

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

___________________________________________ ___________________________________________ ______________________________

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

___________________________________________ _______________ _______________ ______________________________

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance Date of Expiry TIN of Signatory

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

file://C:\Users\clarisse\AppData\Local\Temp\{C66626E0-8E02-40EC-8AEB-918FB3C7E91C}\forms\BIR... 12/17/2016

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Tax General Principles - TAXREVDocument37 pagesTax General Principles - TAXREVAnselmo Rodiel IVPas encore d'évaluation

- Fixed Asset Register SampleDocument55 pagesFixed Asset Register SampleClarisse30Pas encore d'évaluation

- Sample Tax Question (Solution and Answer)Document18 pagesSample Tax Question (Solution and Answer)FRITZ JANN CERAPas encore d'évaluation

- February Payslip 2023.pdf - 1-2Document1 pageFebruary Payslip 2023.pdf - 1-2Arbaz KhanPas encore d'évaluation

- Correct!: C. Both Are CorrectDocument27 pagesCorrect!: C. Both Are CorrectNica Jane MacapinigPas encore d'évaluation

- Annex A (Lease Contract)Document3 pagesAnnex A (Lease Contract)Clarisse30Pas encore d'évaluation

- Cagandahan Vs RepublicDocument1 pageCagandahan Vs RepublicClarisse30Pas encore d'évaluation

- Judicial Affidavit Mrs. RelevoDocument9 pagesJudicial Affidavit Mrs. RelevoClarisse30100% (1)

- CIR vs. PHILEXDocument2 pagesCIR vs. PHILEXBarem Salio-anPas encore d'évaluation

- Unlawful Detainer - Judicial Affidavit of ComplainantDocument9 pagesUnlawful Detainer - Judicial Affidavit of ComplainantClarisse30Pas encore d'évaluation

- Sample Information Frustrated HomicideDocument3 pagesSample Information Frustrated HomicideClarisse30100% (1)

- Schedule of Accounts Receivables - TobesDocument1 pageSchedule of Accounts Receivables - TobesClarisse30100% (1)

- Answer Unlawful DetainerDocument5 pagesAnswer Unlawful DetainerClarisse30Pas encore d'évaluation

- Summary of Works/Scope of WorksDocument4 pagesSummary of Works/Scope of WorksClarisse30Pas encore d'évaluation

- Philippine Amusement and Gaming Corporation (PAGCOR) vs. Commissioner of Internal Revenue, 846 SCRA 340, November 22, 2017Document27 pagesPhilippine Amusement and Gaming Corporation (PAGCOR) vs. Commissioner of Internal Revenue, 846 SCRA 340, November 22, 2017Christopher IgnacioPas encore d'évaluation

- Safari - 7 Feb 2019 at 4:45 PMDocument1 pageSafari - 7 Feb 2019 at 4:45 PMClarisse30Pas encore d'évaluation

- B.O.Q. For Samar Isolation FacilityDocument2 pagesB.O.Q. For Samar Isolation FacilityClarisse30Pas encore d'évaluation

- 2012 - 2014 Security Services For Nfa Region ViiDocument2 pages2012 - 2014 Security Services For Nfa Region ViiClarisse30Pas encore d'évaluation

- Deped Standard Color Scheme For School BuildingDocument1 pageDeped Standard Color Scheme For School BuildingClarisse30100% (2)

- DBP PDFDocument2 pagesDBP PDFClarisse30Pas encore d'évaluation

- Statement of Management'S Responsibility For Financial StatementsDocument1 pageStatement of Management'S Responsibility For Financial StatementsClarisse30Pas encore d'évaluation

- Maker Payment Instruction Receipt (291800026233920)Document1 pageMaker Payment Instruction Receipt (291800026233920)Clarisse30Pas encore d'évaluation

- Reach More People Nearby With An Ongoing PromotionDocument4 pagesReach More People Nearby With An Ongoing PromotionClarisse30Pas encore d'évaluation

- Calendar of BiddingsDocument3 pagesCalendar of BiddingsClarisse30Pas encore d'évaluation

- Steampunk Construction: PayrollDocument2 pagesSteampunk Construction: PayrollClarisse30Pas encore d'évaluation

- BIR Form 1902 PDFDocument1 pageBIR Form 1902 PDFClarisse30Pas encore d'évaluation

- 1701Q Jan 2018 Final Rev2Document2 pages1701Q Jan 2018 Final Rev2Balot EspinaPas encore d'évaluation

- Monthly Expenses: Rent Food Tuition Books Entertainment Car Payment Gas MiscellaneousDocument3 pagesMonthly Expenses: Rent Food Tuition Books Entertainment Car Payment Gas MiscellaneousMuqiew HanisPas encore d'évaluation

- Vsa Taxation Incometaxation Part4.1 MCQ 1Document18 pagesVsa Taxation Incometaxation Part4.1 MCQ 1lopa.palis.uiPas encore d'évaluation

- Form12BB ZensarDocument2 pagesForm12BB ZensarRam GuggulPas encore d'évaluation

- MWP & KeymanDocument11 pagesMWP & KeymanEnnsignn Advisory Services P LtdPas encore d'évaluation

- Cin Training 1: Larsen Toubro Infotech LimitedDocument44 pagesCin Training 1: Larsen Toubro Infotech Limitednamea2zPas encore d'évaluation

- Hoạch định thuếDocument24 pagesHoạch định thuếAn Trần Thị HảiPas encore d'évaluation

- Group 2 Fiscal Policy Assignment 2Document16 pagesGroup 2 Fiscal Policy Assignment 2NGHIÊM NGUYỄN MINH100% (1)

- Tax Deductibility InformationDocument5 pagesTax Deductibility InformationAnonymous lMvZ6MuI2Pas encore d'évaluation

- Cocktails and Hors D'oeuvres by The BayDocument2 pagesCocktails and Hors D'oeuvres by The BaySunlight FoundationPas encore d'évaluation

- Implementation Steps and GuidlinesDocument97 pagesImplementation Steps and Guidlinesanon_581911123Pas encore d'évaluation

- City University of PasayDocument19 pagesCity University of PasayFroilan G. AgatepPas encore d'évaluation

- PAY SLIP ExcelDocument26 pagesPAY SLIP Excelhitesh nandawaniPas encore d'évaluation

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroPas encore d'évaluation

- Internet Invoice Template 2Document1 pageInternet Invoice Template 2Alex BikashviliPas encore d'évaluation

- AcknowledgementDocument1 pageAcknowledgementBaldhariPas encore d'évaluation

- Indian Oil Corporation Limited: Ppadma@indianoil - In/dmahapatra@indianoil - inDocument3 pagesIndian Oil Corporation Limited: Ppadma@indianoil - In/dmahapatra@indianoil - inSaileshPas encore d'évaluation

- Income Taxation Chapter 1Document3 pagesIncome Taxation Chapter 1Armalyn CangquePas encore d'évaluation

- Modal Hand GlovesDocument1 pageModal Hand GlovesSteven TalakuaPas encore d'évaluation

- Tax Invoice/Retail Invoice: OptivalDocument1 pageTax Invoice/Retail Invoice: Optivalrangasamy.tnstcPas encore d'évaluation

- Chapter C2 Formation of The Corporation Discussion QuestionsDocument16 pagesChapter C2 Formation of The Corporation Discussion QuestionsPennyW0% (1)

- Cost of Capital Solved Problems - Cost of Capital - Capital StructureDocument1 pageCost of Capital Solved Problems - Cost of Capital - Capital StructureAnonymous qOdzTznKE100% (1)

- Public Finance ReviewerDocument3 pagesPublic Finance ReviewerLayca SupnadPas encore d'évaluation

- PKF WWTG 2020 2021 OnlineDocument1 207 pagesPKF WWTG 2020 2021 OnlineHussain MunshiPas encore d'évaluation