Académique Documents

Professionnel Documents

Culture Documents

Local Governments Proposing Property Tax Increases in 2017

Transféré par

The Salt Lake Tribune0 évaluation0% ont trouvé ce document utile (0 vote)

4K vues2 pagesProperty valuation notices now arriving at mailboxes across Utah are delivering expensive news: 64 local governments are proposing property tax hikes this year.

Titre original

Local governments proposing property tax increases in 2017

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentProperty valuation notices now arriving at mailboxes across Utah are delivering expensive news: 64 local governments are proposing property tax hikes this year.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

4K vues2 pagesLocal Governments Proposing Property Tax Increases in 2017

Transféré par

The Salt Lake TribuneProperty valuation notices now arriving at mailboxes across Utah are delivering expensive news: 64 local governments are proposing property tax hikes this year.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

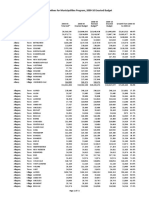

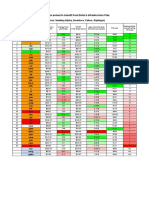

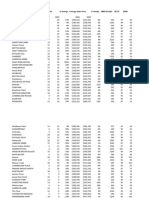

Local

governments proposing property tax increases, 2017

Tax on

Tax on $250,000

$250,000 home with

home if no proposed Percentage

Entity Name increase increase Difference difference

INTERLAKEN TOWN $0.00 $239.53 $239.53 New tax

SANPETE COUNTY $297.41 $470.53 $173.11 58.2%

TINTIC SCHOOL DISTRICT $979.14 $1,115.40 $136.26 13.9%

WELLINGTON $265.38 $384.04 $118.66 44.7%

JUAB COUNTY SCHOOL DISTRICT $1,025.61 $1,124.61 $99.00 9.7%

GARLAND $424.88 $523.05 $98.18 23.1%

OGDEN CITY SCHOOL DISTRICT $1,107.56 $1,203.68 $96.11 8.7%

GRANITE SCHOOL DISTRICT $841.78 $932.11 $90.34 10.7%

BOX ELDER SCHOOL DISTRICT $1,025.89 $1,111.28 $85.39 8.3%

MILLARD COUNTY SCHOOL DISTRICT $850.58 $933.49 $82.91 9.7%

WASATCH COUNTY SCHOOL DISTRICT $1,017.64 $1,097.25 $79.61 7.8%

BLUFFDALE $163.76 $240.76 $77.00 47.0%

HURRICANE VALLEY FIRE DISTRICT $117.43 $193.60 $76.18 64.9%

WEBER COUNTY $390.50 $462.00 $71.50 18.3%

SOUTH OGDEN CITY $329.18 $398.75 $69.58 21.1%

MORGAN COUNTY SCHOOL DISTRICT $975.01 $1,044.45 $69.44 7.1%

LOGAN CITY SCHOOL DISTRICT $1,254.96 $1,315.46 $60.50 4.8%

NEBO SCHOOL DISTRICT $1,221.69 $1,278.48 $56.79 4.6%

MENDON $206.53 $262.35 $55.83 27.0%

BOX ELDER MUNICIPAL SERVICE FUND $0.00 $53.49 $53.49 N/A

CENTERVILLE $132.96 $186.18 $53.21 40.0%

JUAB COUNTY $307.04 $357.64 $50.60 16.5%

SOUTH DAVIS METRO FIRE SERVICE AREA $1.24 $50.60 $49.36 3988.9%

SCOFIELD $113.16 $161.43 $48.26 42.6%

DAVIS COUNTY $216.43 $264.55 $48.13 22.2%

GARFIELD COUNTY SCHOOL DISTRICT $759.00 $806.58 $47.57 6.3%

SALT LAKE CITY SCHOOL DISTRICT $743.88 $790.35 $46.47 6.2%

CACHE COUNTY SCHOOL DISTRICT $1,073.05 $1,118.98 $45.93 4.3%

IRON COUNTY SCHOOL DISTRICT $825.00 $866.94 $41.94 5.1%

RICH COUNTY SCHOOL DISTRICT $640.48 $680.63 $40.15 6.3%

CARBON COUNTY $423.23 $461.31 $38.09 9.0%

WEST VALLEY CITY $534.19 $570.76 $36.58 6.8%

HUNTSVILLE $161.98 $197.31 $35.34 21.8%

SEVIER COUNTY SCHOOL DISTRICT $1,060.13 $1,094.09 $33.96 3.2%

WASHINGTON TERRACE $365.61 $396.14 $30.53 8.3%

GENOLA $114.81 $143.69 $28.88 25.1%

OGDEN $398.06 $426.66 $28.60 7.2%

WEST BOUNTIFUL $186.86 $215.33 $28.46 15.2%

FAIRVIEW $161.70 $188.93 $27.23 16.8%

SALT LAKE CITY LIBRARY $89.79 $114.68 $24.89 27.7%

SALT LAKE VALLEY LAW ENFORCEMENT $255.61 $279.54 $23.93 9.4%

MAPLETON CITY $351.86 $375.24 $23.38 6.6%

NIBLEY CITY $208.73 $229.21 $20.49 9.8%

SALT LAKE CITY $569.53 $589.33 $19.80 3.5%

PLEASANT VIEW $151.94 $170.91 $18.98 12.5%

SYRACUSE $198.96 $216.29 $17.33 8.7%

TORREY $21.73 $37.95 $16.23 74.7%

PANGUITCH LAKE FIRE PROTECTION $83.33 $98.18 $14.85 17.8%

WEST POINT $124.03 $135.30 $11.28 9.1%

NORTH DAVIS FIRE DISTRICT $152.76 $162.53 $9.76 6.4%

PAYSON $166.24 $176.00 $9.76 5.9%

WAYNE COUNTY $220.55 $229.35 $8.80 4.0%

DAVIS COUNTY LIBRARY $43.18 $51.70 $8.53 19.7%

PROVIDENCE $178.34 $185.76 $7.42 4.2%

JORDAN VALLEY WATER CONSERVANCY $47.99 $55.00 $7.01 14.6%

CACHE COUNTY $251.35 $256.44 $5.09 2.0%

CENTRAL UTAH WATER CONSERVANCY $51.98 $55.00 $3.03 5.8%

LEWISTON CITY $311.85 $314.60 $2.75 0.9%

SALT LAKE COUNTY $305.11 $307.73 $2.61 0.9%

CARBON MUNICIPAL SERVICES FUND $38.50 $39.74 $1.24 3.2%

SALT LAKE COUNTY LIBRARY $83.19 $84.15 $0.96 1.2%

MAGNA MOSQUITO ABATEMENT DISTRICT $6.33 $6.88 $0.55 8.7%

UNIFIED FIRE SERVICE AREA $0.00 $0.41 $0.41 N/A

SALT LAKE CO. ASSESSING & COLLECTING $33.28 $33.55 $0.27 0.8%

Source: Salt Lake Tribune analysis of Utah Tax Commission data.

Vous aimerez peut-être aussi

- Richter Et Al 2024 CRB Water BudgetDocument12 pagesRichter Et Al 2024 CRB Water BudgetThe Salt Lake Tribune100% (4)

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Document103 pages2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- Modern Money and Banking BookDocument870 pagesModern Money and Banking BookRao Abdur Rehman100% (6)

- Financial Astrology by Mahendra SharmaDocument9 pagesFinancial Astrology by Mahendra SharmaMahendra Prophecy33% (3)

- 2020 Property Collection For Cook CountyDocument5 pages2020 Property Collection For Cook CountyWGN Web DeskPas encore d'évaluation

- Cupp-Patterson School Funding Formula Estimated AidDocument17 pagesCupp-Patterson School Funding Formula Estimated AidAndy ChowPas encore d'évaluation

- NetChoice V Reyes Official ComplaintDocument58 pagesNetChoice V Reyes Official ComplaintThe Salt Lake TribunePas encore d'évaluation

- SEC Cease-And-Desist OrderDocument9 pagesSEC Cease-And-Desist OrderThe Salt Lake Tribune100% (1)

- The Relevance of Sales Promotion To Business OrganizationsDocument40 pagesThe Relevance of Sales Promotion To Business OrganizationsJeremiah LukiyusPas encore d'évaluation

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDocument15 pagesCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- The System of Government Budgeting Bangladesh: Motahar HussainDocument9 pagesThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadPas encore d'évaluation

- 2008 Domestic Water SurveyDocument1 page2008 Domestic Water SurveyCaroline Nordahl BrosioPas encore d'évaluation

- 2019 Property Tax Increases in UtahDocument3 pages2019 Property Tax Increases in UtahThe Salt Lake TribunePas encore d'évaluation

- Oct 21 StatsDocument1 pageOct 21 StatsMatt PollockPas encore d'évaluation

- 2020 Property Collection For Cook CountyDocument5 pages2020 Property Collection For Cook CountyWGN Web DeskPas encore d'évaluation

- City ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioDocument2 pagesCity ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioBrett WidnessPas encore d'évaluation

- City ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioDocument2 pagesCity ZIP Code Average Listing Average Selling Average Sold Top 10 Price Price To List RatioBrett WidnessPas encore d'évaluation

- Attach - 2024 Year Over Year Breakdowns and GraphsDocument15 pagesAttach - 2024 Year Over Year Breakdowns and GraphsTom SummerPas encore d'évaluation

- AIM 09 - 10 Remaining PaymentsDocument72 pagesAIM 09 - 10 Remaining PaymentsrkarlinPas encore d'évaluation

- Manitoba School Funding 2024-25Document2 pagesManitoba School Funding 2024-25ChrisDcaPas encore d'évaluation

- K 12 EducationDocument15 pagesK 12 EducationWTOL DIGITAL100% (1)

- U.S. R&D Spending by State, 2006-11 (In USD Millions)Document2 pagesU.S. R&D Spending by State, 2006-11 (In USD Millions)Sunil KumarPas encore d'évaluation

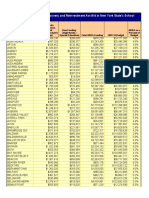

- Comparison of Incomes and Rents, Rent-Stabilized vs. Market-Rate RentalsDocument3 pagesComparison of Incomes and Rents, Rent-Stabilized vs. Market-Rate RentalsBrad LanderPas encore d'évaluation

- NWMLS September ReportDocument3 pagesNWMLS September ReportNeal McNamaraPas encore d'évaluation

- 01560-Designated Statestable7-7-06-JT 4Document5 pages01560-Designated Statestable7-7-06-JT 4losangelesPas encore d'évaluation

- Ventas Diarias Reporte de Ocupacion 09 DE ABRIL2023Document2 pagesVentas Diarias Reporte de Ocupacion 09 DE ABRIL2023Carlos GuzmanPas encore d'évaluation

- News Release: Home Sales Activity Strong Through Olympic PeriodDocument7 pagesNews Release: Home Sales Activity Strong Through Olympic PeriodBenAmzalegPas encore d'évaluation

- Administracion 1Document4 pagesAdministracion 1AGUSTIN VALDEZ AMAYAPas encore d'évaluation

- Chart Top Towns 2019Document11 pagesChart Top Towns 2019Tony PetrosinoPas encore d'évaluation

- REBGV Stats Package October 2009Document7 pagesREBGV Stats Package October 2009eyalpevznerPas encore d'évaluation

- WDW2008 IncreaseDocument1 pageWDW2008 Increaseahecht100% (1)

- TareaDocument2 pagesTareaCortez Nava Alison MonserratPas encore d'évaluation

- Arra Percent Budget by Dist 2009 10Document14 pagesArra Percent Budget by Dist 2009 10jspectorPas encore d'évaluation

- Single Family ResidenceDocument2 pagesSingle Family Residenceapi-15743601Pas encore d'évaluation

- OC StatsDocument6 pagesOC Statskelvin.internetPas encore d'évaluation

- REBGV Stats September 2009Document7 pagesREBGV Stats September 2009BenAmzalegPas encore d'évaluation

- Route 1 Reports - PC - MILER Web Palwinder Jul-SepDocument3 pagesRoute 1 Reports - PC - MILER Web Palwinder Jul-SepLemon GundersonPas encore d'évaluation

- REBGV Stats Package March 2010Document6 pagesREBGV Stats Package March 2010BenAmzalegPas encore d'évaluation

- Tabela TraderDocument18 pagesTabela TraderVENHAN PARA O MUNDO PES.Pas encore d'évaluation

- P'ractica 4Document1 pageP'ractica 4Maribel Águila alejoPas encore d'évaluation

- Utah Proposed Property Tax Increases For 2014Document1 pageUtah Proposed Property Tax Increases For 2014The Salt Lake TribunePas encore d'évaluation

- CERA County List 8.31Document2 pagesCERA County List 8.31WXYZ-TV Channel 7 DetroitPas encore d'évaluation

- ECOT Transfers by District 12-13 To 17-18 Jan2018Document8 pagesECOT Transfers by District 12-13 To 17-18 Jan2018msdyer923Pas encore d'évaluation

- April 2011 OREODocument1 pageApril 2011 OREOJoe SegalPas encore d'évaluation

- Property Taxes On Owner-Occupied Housing, by State 2008Document10 pagesProperty Taxes On Owner-Occupied Housing, by State 20082391136Pas encore d'évaluation

- Market Report - September 2010Document1 pageMarket Report - September 2010STAORPas encore d'évaluation

- Vancouver Real Estate Stats Package - August2010Document7 pagesVancouver Real Estate Stats Package - August2010BenAmzalegPas encore d'évaluation

- November '08 Metro Vancouver Real Estate StatisticsDocument6 pagesNovember '08 Metro Vancouver Real Estate StatisticsHudsonHomeTeam100% (1)

- Budgeted Change in Per - Pupil Spending by Region 2010 - 11 School YearDocument15 pagesBudgeted Change in Per - Pupil Spending by Region 2010 - 11 School YearNick ReismanPas encore d'évaluation

- Companies Poised To Benefit From Biden's Infrastructure Plan (Sources: Seeking Alpha, Investors, Yahoo, Kiplinger)Document1 pageCompanies Poised To Benefit From Biden's Infrastructure Plan (Sources: Seeking Alpha, Investors, Yahoo, Kiplinger)fcsamscribdPas encore d'évaluation

- News Water Rwsarates2010Document1 pageNews Water Rwsarates2010readthehookPas encore d'évaluation

- Reporte de Ventas Ok Market Noviembre 2022Document9 pagesReporte de Ventas Ok Market Noviembre 2022XxKevin 1519Pas encore d'évaluation

- Compound Growth ChartDocument13 pagesCompound Growth Chartpepe_rozyPas encore d'évaluation

- Single Family ResidenceDocument2 pagesSingle Family Residenceapi-15743601Pas encore d'évaluation

- Vuksinick Excel1Document4 pagesVuksinick Excel1api-418450750Pas encore d'évaluation

- Fishers Subdivision DataDocument3 pagesFishers Subdivision Datamtaylor609Pas encore d'évaluation

- Last Name First Name Age Birthdate Address GenderDocument21 pagesLast Name First Name Age Birthdate Address GenderRochel CopinoPas encore d'évaluation

- Community Crossings 2020-1 AwardsDocument5 pagesCommunity Crossings 2020-1 AwardsIndiana Public Media NewsPas encore d'évaluation

- Greater Vancouver Dec 2010Document7 pagesGreater Vancouver Dec 2010urbaniak_bcPas encore d'évaluation

- Route 3 Reports - PC - MILER WebDocument2 pagesRoute 3 Reports - PC - MILER WebLemon GundersonPas encore d'évaluation

- Control Negociaciones FectivDocument7 pagesControl Negociaciones Fectivdisenio1.gpsietePas encore d'évaluation

- Shannon Grants 2019Document1 pageShannon Grants 2019Patrick JohnsonPas encore d'évaluation

- Dividend KingsDocument6 pagesDividend KingsVelmurugan JeyavelPas encore d'évaluation

- Real Estate StatsDocument131 pagesReal Estate StatsDerek BanasPas encore d'évaluation

- Upper Basin Alternative, March 2024Document5 pagesUpper Basin Alternative, March 2024The Salt Lake TribunePas encore d'évaluation

- Park City ComplaintDocument18 pagesPark City ComplaintThe Salt Lake TribunePas encore d'évaluation

- Salt Lake City Council Text MessagesDocument25 pagesSalt Lake City Council Text MessagesThe Salt Lake TribunePas encore d'évaluation

- Settlement Agreement Deseret Power Water RightsDocument9 pagesSettlement Agreement Deseret Power Water RightsThe Salt Lake TribunePas encore d'évaluation

- The Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseDocument66 pagesThe Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseThe Salt Lake TribunePas encore d'évaluation

- Wasatch IT-Jazz ContractDocument11 pagesWasatch IT-Jazz ContractThe Salt Lake TribunePas encore d'évaluation

- U.S. Army Corps of Engineers LetterDocument3 pagesU.S. Army Corps of Engineers LetterThe Salt Lake TribunePas encore d'évaluation

- Spectrum Academy Reform AgreementDocument10 pagesSpectrum Academy Reform AgreementThe Salt Lake TribunePas encore d'évaluation

- Unlawful Detainer ComplaintDocument81 pagesUnlawful Detainer ComplaintThe Salt Lake Tribune100% (1)

- Gov. Cox Declares Day of Prayer and ThanksgivingDocument1 pageGov. Cox Declares Day of Prayer and ThanksgivingThe Salt Lake TribunePas encore d'évaluation

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocument41 pagesOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

- Employment Contract - Liz Grant July 2023 To June 2025 SignedDocument7 pagesEmployment Contract - Liz Grant July 2023 To June 2025 SignedThe Salt Lake TribunePas encore d'évaluation

- Superintendent ContractsDocument21 pagesSuperintendent ContractsThe Salt Lake TribunePas encore d'évaluation

- Goodly-Jazz ContractDocument7 pagesGoodly-Jazz ContractThe Salt Lake TribunePas encore d'évaluation

- Teena Horlacher LienDocument3 pagesTeena Horlacher LienThe Salt Lake TribunePas encore d'évaluation

- HB 499 Utah County COG LetterDocument1 pageHB 499 Utah County COG LetterThe Salt Lake TribunePas encore d'évaluation

- PLPCO Letter Supporting US MagDocument3 pagesPLPCO Letter Supporting US MagThe Salt Lake TribunePas encore d'évaluation

- 2023.03.28 Emery County GOP Censure ProposalDocument1 page2023.03.28 Emery County GOP Censure ProposalThe Salt Lake TribunePas encore d'évaluation

- Final Signed Republican Governance Group Leadership LetterDocument3 pagesFinal Signed Republican Governance Group Leadership LetterThe Salt Lake TribunePas encore d'évaluation

- Proc 2022-01 FinalDocument2 pagesProc 2022-01 FinalThe Salt Lake TribunePas encore d'évaluation

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribunePas encore d'évaluation

- David Nielsen - Memo To US Senate Finance Committee, 01-31-23Document90 pagesDavid Nielsen - Memo To US Senate Finance Committee, 01-31-23The Salt Lake Tribune100% (1)

- Utah Senators Encourage Gov. DeSantis To Run For U.S. PresidentDocument3 pagesUtah Senators Encourage Gov. DeSantis To Run For U.S. PresidentThe Salt Lake TribunePas encore d'évaluation

- Ruling On Motion To Dismiss Utah Gerrymandering LawsuitDocument61 pagesRuling On Motion To Dismiss Utah Gerrymandering LawsuitThe Salt Lake TribunePas encore d'évaluation

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribunePas encore d'évaluation

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribunePas encore d'évaluation

- Redistricting LawsuitDocument2 pagesRedistricting LawsuitThe Salt Lake TribunePas encore d'évaluation

- Arithmetic of EquitiesDocument5 pagesArithmetic of Equitiesrwmortell3580Pas encore d'évaluation

- Feasibilities - Updated - BTS DropsDocument4 pagesFeasibilities - Updated - BTS DropsSunny SonkarPas encore d'évaluation

- BAIN REPORT Global Private Equity Report 2017Document76 pagesBAIN REPORT Global Private Equity Report 2017baashii4Pas encore d'évaluation

- Latihan Soal PT CahayaDocument20 pagesLatihan Soal PT CahayaAisyah Sakinah PutriPas encore d'évaluation

- BS Irronmongry 2Document32 pagesBS Irronmongry 2Peter MohabPas encore d'évaluation

- NaftaDocument18 pagesNaftaShabla MohamedPas encore d'évaluation

- Use CaseDocument4 pagesUse CasemeriiPas encore d'évaluation

- Delivering The Goods: Victorian Freight PlanDocument56 pagesDelivering The Goods: Victorian Freight PlanVictor BowmanPas encore d'évaluation

- 3D2N Bohol With Countryside & Island Hopping Tour Package PDFDocument10 pages3D2N Bohol With Countryside & Island Hopping Tour Package PDFAnonymous HgWGfjSlPas encore d'évaluation

- Bahasa Inggris IIDocument15 pagesBahasa Inggris IIMuhammad Hasby AsshiddiqyPas encore d'évaluation

- Manual Goldfinger EA MT4Document6 pagesManual Goldfinger EA MT4Mr. ZaiPas encore d'évaluation

- Flex Parts BookDocument16 pagesFlex Parts BookrodolfoPas encore d'évaluation

- L&T 2017-18 Annual Report AnalysisDocument3 pagesL&T 2017-18 Annual Report AnalysisAJAY GUPTAPas encore d'évaluation

- Presentation On " ": Human Resource Practices OF BRAC BANKDocument14 pagesPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziPas encore d'évaluation

- Manufactures Near byDocument28 pagesManufactures Near bykomal LPS0% (1)

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthDocument4 pagesPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezPas encore d'évaluation

- CBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportDocument2 pagesCBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportMessy Rose Rafales-CamachoPas encore d'évaluation

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocument148 pagesHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerPas encore d'évaluation

- Zubair Agriculture TaxDocument3 pagesZubair Agriculture Taxmunag786Pas encore d'évaluation

- JDocument2 pagesJDMDace Mae BantilanPas encore d'évaluation

- A Glossary of Macroeconomics TermsDocument5 pagesA Glossary of Macroeconomics TermsGanga BasinPas encore d'évaluation

- Community Development Fund in ThailandDocument41 pagesCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Revenue Procedure 2014-11Document10 pagesRevenue Procedure 2014-11Leonard E Sienko JrPas encore d'évaluation

- Agony of ReformDocument3 pagesAgony of ReformHarmon SolantePas encore d'évaluation