Académique Documents

Professionnel Documents

Culture Documents

F 51124304

Transféré par

hanamay_07Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

F 51124304

Transféré par

hanamay_07Droits d'auteur :

Formats disponibles

1BDC CPA REVIEW INSTITUTE myadong, cpa;

O SQUARE ACCOUNTING SERVICES lacordova, cpa

3/F Fuentes Bldg., Marasbaras, Tacloban City

Mobile No.: 0927-981-6331; 0919-340-7505

E-mail: dargelaluser@gmail.com

THEORY OF ACCOUNTS TA-1004Q1: CASH AND CASH EQUIVALENTS

1. One of the following is least likely classified as cash for financial reporting purposes.

a. Bank drafts and money orders

b. Stale checks issued to creditors

c. Postdated checks from customers

d. Undelivered checks to trade suppliers

2. Under PAS 7, cash equivalents are short-term and highly liquid investments that are

a. classified as available-for sale securities

b. Readily convertible into cash and acquired one year before maturity

c. Readily convertible into cash and acquired six months before maturity

d. Readily convertible into cash and acquired three months before maturity

3. Balance sheet date is December 31, 2008. Which of the following is not a cash equivalent?

a. 12-month BSP treasury note due February 15, 2009 (date of purchase: November 31, 2008)

b. 6-month BSP treasury note due January 15, 2009 (date of purchase: October 1, 2008)

c. 3-month BSP treasury bill due March 15, 2009 ( date of purchase: December 15, 2008)

d. 1-month money market placement

4. Cash deposited in a bank experiencing financial difficulty is written down to

a. Present value c. Estimated realizable value

b. Maturity value d. Value in use

5. Cash denominated in foreign currency shall be translated to Philippine peso using

a. Closing rate c. Historical rate

b. Average rate d. Passing rate

6. Significant deposits in a foreign bank subject to foreign exchange restriction should be classified

a. as cash and cash equivalents with appropriate disclosure

b. as non-trade receivables with appropriate disclosure

c. as held-to-maturity securities with appropriate disclosure

d. as part of non-current assets with appropriate disclosure

7. A material credit balance in the cash in bank account (BANK OVERDRAFT)

a. Is treated as an error

b. Is treated as a current liability

c. Is netted against cash and net cash amount is reported

d. May be offset against a demand deposit account maintained in another bank

8. Checks drawn before the balance sheet date but held later delivery ( UNDELIVERED CHECKS)

a. Should be treated as trade receivable

b. Should be regarded as cash equivalents

c. Should be restored back to cash balance

d. Should be treated as outstanding checks for bank reconciliation purposes

9. Deposits held as compensating balances

a. Usually do not earn interest

b. If legally restricted and held against short-term credit may be included as cash

c. If legally restricted and held against long-term credit may be included among current assets

d. If unrestricted as to withdrawal may be included as cash

THEORY OF ACCOUNTS Page 1 of 3

O SQUARE ACCTG SERVICES

10. The payment of accounts payable made after the close of the accounting period are recorded as if it were made at the

end of the current period.

a. Window dressing c. Kiting

b. Lapping d. Fishing

11. All of the following are necessary components of internal control over cash, except:

a. Daily deposit of all receipts in the companys bank account

b. Bank reconciliation

c. Petty cash system

d. Cash reserve

12. Which of the following is an incorrect application of the Imprest system of cash control?

a. Cash receipt must be deposited on a regular basis

b. Cash disbursements must be made in the form of checks, regardless of the amount

c. Material cash disbursements must be made in the form of checks

d. Insignificant cash disbursements must be made out of the petty cash fund.

13. Petty cash fund is

a. Restricted cash

b. Set aside for the payment of payroll

c. Separately classified as current asset

d. Money kept on hand for making minor disbursements of coins and currency

14. What is the major purpose of an Imprest petty cash fund?

a. To ease the payment of cash to vendors

b. To effectively control cash disbursements

c. To effectively plan cash inflows and outflows

d. to determine the honesty of the petty cashier

15. Under the Imprest fund system, the petty cash fund account is debited

a. Only when the fund is created

b. When the fund is created and every time it is replenished

c. When the fund is created and when the size of the fund is increased

d. When the fund is abolished and when the size of fund is decreased

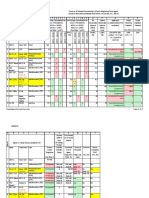

PETTY CASH ACCOUNTING

For purposes of replenishing the petty cash fund, assume the following amounts;

Petty cash fund: P10,000 (representing the size of the fund)

Petty cash vouchers: P5,000 (representing various minor expenses for the period)\

CASE Coins and Currencies Amount of Replenishment Petty Cash Replenishment Journal

Check entry

1 Expenses 5,000

P5,000 P5,000 Cash in Bank 5,000

2 18.)

P4,000 17.) 19.)

20.)

3 22.)

P7,000 21.) 23.)

24.)

25. The entry to replenish the petty cash fund of P1,000 of various minor expenditures would include a :

a. Debit to cash c. debit to petty cash fund

b. credit to cash d, credit to petty cash fund

26. IOUs found in the petty cash drawer at the time of replenishment should be reported as part of

a. Cash and cash equivalents c. Trading securities

b. Receivables d. Prepare the petty cash voucher

THEORY OF ACCOUNTS Page 2 of 3

O SQUARE ACCTG SERVICES

27. An employee asks for an authorized reimbursement of transportation charges out of the Imprest petty cash fund. To

document this transaction, the petty cashier should

a. Debit transportation expense c. credit cash

b. debit receivable from employee d. Prepare the petty cash voucher

28. The cash Short or Over account

a. is a real account

b. Is a contra-cash account

c. Is debited upon reimbursement when the petty cash fund proves out over

d. Is debited upon reimbursement when the petty cash fund proves short

29. A debit balance (i.e., shortage) in the Cash Short or over account at the end of the period that can be attributed to the

fault of the petty cashier is treated as a

a. Receivable from employee c. Miscellaneous expense

b. Payable to employee d. Miscellaneous income

30. A bank reconciliation is

a. A merger of two previously competing banks currently in the process of reconciliation

b. A statement sent by bank to depositor on a monthly basis

c. A formal financial statement that lists all of a firms bank account balances and previously closed bank accounts

d. A schedule that accounts for the differences between a firms bank statement balance (balance per bank) and the balance

shown in its general ledger ( balance per books)

31. This is normally added to the cash balance per ledger in order to determine the correct cash balance.

a. Note receivable collected by bank in favor of the depositor and credited to depositors account

b. Service charge

c. NSF customer check

d. Erroneous bank debit

32. This is normally deducted from the bank statement in preparing bank reconciliation

a. Certified check

b. Deposit in transit

c. Outstanding check

d. Reduction of loan charged to the account of the depositor

33. Balance per bank is LESS the correct balance. No error was committed. There must be

a. Deposits credited by the bank but not yet recorded by the company

b. Outstanding check

c. Deposits in transit

d. Bank charges not yet recorded by the company

34. Balance per book is MORE than correct balance. No error was committed. There must be

a. Deposits credited by the bank but not yet recorded by the company

b. Outstanding checks

c. Deposits in transit

d. Bank charges not yet recorded by the company

35. Which will not require an adjusting entry in the depositor?

a. Bank service charge

b. NSF check from customer

c. Deposit of another company is credited to the account of the depositor

d. Check in payment of account payable for P2,000 is recorded by the depositor as P20

THEORY OF ACCOUNTS Page 3 of 3

O SQUARE ACCTG SERVICES

Vous aimerez peut-être aussi

- Cash & Cash Equivalents Accounting GuideDocument5 pagesCash & Cash Equivalents Accounting Guidejane dillanPas encore d'évaluation

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristinePas encore d'évaluation

- Ta-1004q1 Cash and Cash EquivalentsDocument3 pagesTa-1004q1 Cash and Cash Equivalentsleonardo alis100% (1)

- Problem Solving (With Answers)Document12 pagesProblem Solving (With Answers)sunflower100% (1)

- Quiz On Cash Ga TheoriesDocument5 pagesQuiz On Cash Ga TheoriesgarciarhodjeannemarthaPas encore d'évaluation

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- ACCTG102 MidtermQ1 CashDocument13 pagesACCTG102 MidtermQ1 CashRose Marie93% (15)

- Theory of Accounts Cash and Cash EquivalentsDocument9 pagesTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- 1st Long Exam (Summer 2022) WITHOUT ANSWERDocument10 pages1st Long Exam (Summer 2022) WITHOUT ANSWERDaphnie Kitch CatotalPas encore d'évaluation

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonPas encore d'évaluation

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- Financial Accounting 1Document35 pagesFinancial Accounting 1Bunbun 221Pas encore d'évaluation

- 03 - Cash & Cash Equivalents - TheoryDocument2 pages03 - Cash & Cash Equivalents - TheoryROMAR A. PIGAPas encore d'évaluation

- FARAP-4501 (Cash and Cash Equivalents)Document10 pagesFARAP-4501 (Cash and Cash Equivalents)Marya NvlzPas encore d'évaluation

- Cash and Cash Equivalents ControlsDocument48 pagesCash and Cash Equivalents ControlsLorraine Mae Robrido100% (1)

- Q1 SMEsDocument6 pagesQ1 SMEsJennifer RasonabePas encore d'évaluation

- Cash and Cash Equivalents QUIZDocument4 pagesCash and Cash Equivalents QUIZGIRLPas encore d'évaluation

- Cash and Cash Equi Theories and ProblemsDocument29 pagesCash and Cash Equi Theories and ProblemsIris Mnemosyne100% (5)

- Acctg 100C 01Document6 pagesAcctg 100C 01Jose Magallanes100% (1)

- Actg6146 ReviewerDocument21 pagesActg6146 ReviewerRegine Vega100% (1)

- Cash and Cash Equivalents ExamDocument7 pagesCash and Cash Equivalents ExamRudydanvinz BernardoPas encore d'évaluation

- Quiz On Audit of CashDocument11 pagesQuiz On Audit of CashY JPas encore d'évaluation

- 2 - Cash and Cash EquivalentsDocument5 pages2 - Cash and Cash EquivalentsandreamriePas encore d'évaluation

- Financial Accounting Exam ReviewDocument15 pagesFinancial Accounting Exam ReviewChjxksjsgskPas encore d'évaluation

- Cash and Cash Equivalents, Bank Reconciliation, and Proof of CashDocument8 pagesCash and Cash Equivalents, Bank Reconciliation, and Proof of CashMichaelPas encore d'évaluation

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezPas encore d'évaluation

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaPas encore d'évaluation

- ACCTG102 MidtermQ1.5 Cash Make Up ExamDocument6 pagesACCTG102 MidtermQ1.5 Cash Make Up ExamBarrylou Manayan100% (1)

- Theories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesTheories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionRyan PatitoPas encore d'évaluation

- ProbsDocument27 pagesProbsDante Jr. Dela Cruz50% (2)

- Quiz 1Document11 pagesQuiz 1Sam VeraPas encore d'évaluation

- Cash and Cash EqDocument18 pagesCash and Cash EqElaine YapPas encore d'évaluation

- Cce Quiz AnswersDocument7 pagesCce Quiz AnswersNiña Yna Franchesca PantallaPas encore d'évaluation

- 1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashDocument7 pages1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashSheidee ValientePas encore d'évaluation

- 03 Quiz On Topic 03 Theories and FAR Problems With Answer KeyDocument4 pages03 Quiz On Topic 03 Theories and FAR Problems With Answer KeyNye NyePas encore d'évaluation

- FAR-Cash & Cash Equivalents Theory-MCDocument5 pagesFAR-Cash & Cash Equivalents Theory-MCOlive Grace CaniedoPas encore d'évaluation

- Assessment Test 2nd Cash&RecDocument6 pagesAssessment Test 2nd Cash&RecMellowPas encore d'évaluation

- A. TheoryDocument10 pagesA. TheoryROMULO CUBID100% (1)

- 01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Document4 pages01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Bea GarciaPas encore d'évaluation

- Test Bank Far 3 Cpar PDFDocument24 pagesTest Bank Far 3 Cpar PDFRommel Monfiel100% (1)

- IA1 - 1st Mock Quiz (With Suggested Answers)Document6 pagesIA1 - 1st Mock Quiz (With Suggested Answers)Rogienel ReyesPas encore d'évaluation

- 1201 Cash QuestionsDocument12 pages1201 Cash QuestionsAngel Mae YapPas encore d'évaluation

- AP-04 Order To Cash and Purchase To Pay Processes - Audit of CashDocument7 pagesAP-04 Order To Cash and Purchase To Pay Processes - Audit of CashKate NuevaPas encore d'évaluation

- FINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSDocument9 pagesFINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSPau Santos76% (29)

- (Cash and Cash Equivalents Drills) Acc.106Document18 pages(Cash and Cash Equivalents Drills) Acc.106Boys ShipperPas encore d'évaluation

- 11 ACCT 1AB CashDocument17 pages11 ACCT 1AB CashJustLike JeloPas encore d'évaluation

- Simulates Midterm Exam. IntAcc1 PDFDocument11 pagesSimulates Midterm Exam. IntAcc1 PDFA NuelaPas encore d'évaluation

- Inter Acctg Midterms 1Document4 pagesInter Acctg Midterms 1Jorie MeroyPas encore d'évaluation

- Handout - CashDocument17 pagesHandout - CashPenelope PalconPas encore d'évaluation

- Audit 2-Prelim-Quiz 1 (1663899998)Document3 pagesAudit 2-Prelim-Quiz 1 (1663899998)Ella Mae Clavano NuicaPas encore d'évaluation

- AP Audit of Cash BalanceDocument5 pagesAP Audit of Cash BalanceMa. BeatricePas encore d'évaluation

- E-Handout On Audit of Cash and Cash EquivalentsDocument12 pagesE-Handout On Audit of Cash and Cash EquivalentsAsnifah AlinorPas encore d'évaluation

- Holy Cross College: B. Cause and EffectDocument12 pagesHoly Cross College: B. Cause and EffectSam VeraPas encore d'évaluation

- AEFAR 3 PRELIMS PrintDocument7 pagesAEFAR 3 PRELIMS Print버니 모지코Pas encore d'évaluation

- Cash Equivalents Concepts ExplainedDocument4 pagesCash Equivalents Concepts ExplainedDessa GarongPas encore d'évaluation

- Acc05 Take Home Quiz Cash and ReceivablesDocument12 pagesAcc05 Take Home Quiz Cash and ReceivablesJullia BelgicaPas encore d'évaluation

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)D'EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Pas encore d'évaluation

- Mastering Credit - The Ultimate DIY Credit Repair GuideD'EverandMastering Credit - The Ultimate DIY Credit Repair GuideÉvaluation : 1 sur 5 étoiles1/5 (1)

- Islamic Banking And Finance for Beginners!D'EverandIslamic Banking And Finance for Beginners!Évaluation : 2 sur 5 étoiles2/5 (1)

- CHED Teaching Guide on Disaster ReadinessDocument58 pagesCHED Teaching Guide on Disaster Readinessjerielseguido-1Pas encore d'évaluation

- Module5 PPST2 6 2Document36 pagesModule5 PPST2 6 2Jhonabie Suligan Cadeliña100% (1)

- Asexual Vs Sexual Reproduction PowerPointDocument22 pagesAsexual Vs Sexual Reproduction PowerPointKathleenAyalaHapatinga100% (3)

- Accounting Cash QuestionsDocument1 pageAccounting Cash Questionshanamay_07Pas encore d'évaluation

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShanePas encore d'évaluation

- PSA 520 Psa 500 Audit Evidence PSA 501: Is The Difference Significant?Document3 pagesPSA 520 Psa 500 Audit Evidence PSA 501: Is The Difference Significant?hanamay_07Pas encore d'évaluation

- TT CD BDocument5 pagesTT CD Bhanamay_07Pas encore d'évaluation

- Fa1 2014Document339 pagesFa1 2014hanamay_07100% (1)

- All Associates Warning Against ChangesDocument67 pagesAll Associates Warning Against Changesramesh0% (1)

- VEGA MX CMP12HP Data SheetDocument2 pagesVEGA MX CMP12HP Data SheetLuis Diaz ArroyoPas encore d'évaluation

- Environmental Assessment of Sewer ConstructionDocument32 pagesEnvironmental Assessment of Sewer ConstructionKaleab TadessePas encore d'évaluation

- Modern Indian HistoryDocument146 pagesModern Indian HistoryJohn BoscoPas encore d'évaluation

- Mythi From AndromedaDocument383 pagesMythi From AndromedaRico MinnerPas encore d'évaluation

- Calibration Motion Control System-Part2 PDFDocument6 pagesCalibration Motion Control System-Part2 PDFnurhazwaniPas encore d'évaluation

- Piping MaterialDocument45 pagesPiping MaterialLcm TnlPas encore d'évaluation

- Ana White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Document20 pagesAna White - PLANS - A Murphy Bed YOU Can Build, and Afford To Build - 2011-03-03Ahmad KamilPas encore d'évaluation

- Test Bank For Core Concepts of Accounting Information Systems 14th by SimkinDocument36 pagesTest Bank For Core Concepts of Accounting Information Systems 14th by Simkinpufffalcated25x9ld100% (46)

- Clean Agent ComparisonDocument9 pagesClean Agent ComparisonJohn APas encore d'évaluation

- Course: Citizenship Education and Community Engagement: (8604) Assignment # 1Document16 pagesCourse: Citizenship Education and Community Engagement: (8604) Assignment # 1Amyna Rafy AwanPas encore d'évaluation

- Individual Assignment ScribdDocument4 pagesIndividual Assignment ScribdDharna KachrooPas encore d'évaluation

- PREMIUM BINS, CARDS & STUFFDocument4 pagesPREMIUM BINS, CARDS & STUFFSubodh Ghule100% (1)

- Um 0ah0a 006 EngDocument1 pageUm 0ah0a 006 EngGaudencio LingamenPas encore d'évaluation

- Weir Stability Analysis Report PDFDocument47 pagesWeir Stability Analysis Report PDFSubodh PoudelPas encore d'évaluation

- Ca. Rajani Mathur: 09718286332, EmailDocument2 pagesCa. Rajani Mathur: 09718286332, EmailSanket KohliPas encore d'évaluation

- Lesson 2 Mathematics Curriculum in The Intermediate GradesDocument15 pagesLesson 2 Mathematics Curriculum in The Intermediate GradesRose Angel Manaog100% (1)

- Modified Release Drug ProductsDocument58 pagesModified Release Drug Productsmailtorubal2573100% (2)

- Gi 007 Gerund InfinitiveDocument2 pagesGi 007 Gerund Infinitiveprince husainPas encore d'évaluation

- LON-Company-ENG 07 11 16Document28 pagesLON-Company-ENG 07 11 16Zarko DramicaninPas encore d'évaluation

- Job Description Support Worker Level 1Document4 pagesJob Description Support Worker Level 1Damilola IsahPas encore d'évaluation

- Emerson Park Master Plan 2015 DraftDocument93 pagesEmerson Park Master Plan 2015 DraftRyan DeffenbaughPas encore d'évaluation

- Microsoft Word 2000 IntroductionDocument72 pagesMicrosoft Word 2000 IntroductionYsmech SalazarPas encore d'évaluation

- School Quality Improvement System PowerpointDocument95 pagesSchool Quality Improvement System PowerpointLong Beach PostPas encore d'évaluation

- Lecture 1 Family PlanningDocument84 pagesLecture 1 Family PlanningAlfie Adam Ramillano100% (4)

- Reservoir Rock TypingDocument56 pagesReservoir Rock TypingAffan HasanPas encore d'évaluation

- Put The Items From Exercise 1 in The Correct ColumnDocument8 pagesPut The Items From Exercise 1 in The Correct ColumnDylan Alejandro Guzman Gomez100% (1)

- Spsi RDocument2 pagesSpsi RBrandy APas encore d'évaluation

- The Botanical AtlasDocument74 pagesThe Botanical Atlasjamey_mork1100% (3)

- Investigatory Project Pesticide From RadishDocument4 pagesInvestigatory Project Pesticide From Radishmax314100% (1)