Académique Documents

Professionnel Documents

Culture Documents

East West Bancorp SWOT Analysis 1

Transféré par

Dioner RayDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

East West Bancorp SWOT Analysis 1

Transféré par

Dioner RayDroits d'auteur :

Formats disponibles

East West Bancorp SWOT Analysis, USP &

Competitors

Posted in Banking & Financial Services, Total Reads: 1611

Advertisements

SWOT Analysis of East West Bancorp with USP, Competition, STP (Segmentation, Targeting, Positioning) -

Marketing Analysis

East West Bancorp

Parent Company East West Bancorp

Category Regional Banks

Sector Banking and Financial Services

Tagline/ Slogan -

USP Its speciality is that it is a Chinese American Bank

STP

Segment Retail and consumer banking

Target Group Individuals and business enterprises

Positioning Providing hassle free customer service to all its customers

SWOT Analysis

1. The bank offers a variety of banking and financial services through a

network of around 110+ bank branches operating in the US, China and Hong

Kong

2. It is expanding its product portfolio by acquiring its competitors in various

locations

3. The company has focus on industries with cross-border growth potential

drives its bridge banking strategy. The dedicated banking experts, with

Strengths specialized knowledge in key growth sectors, keep East West Bank at the

forefront of opportunity in the U.S. and Greater China.

4. Good brand visibility in the domestic banking circuit in US

1. The asset base of the bank has been growing at a snails pace and this may

be a cause for concern in the long term

2. Cash dues from other banks have increased and it signifies the weak credit

terms of the bank which may have a debilitating effect on the performance

3. Total equity of the bank has increased and this signifies a dilution in the

Weaknesses ownership

1. The US banking industry which suffered in the wake of the financial crisis

seems to have recovered and this provides better opportunities to the banks

2. The global asset management and custody banks sector is growing at a

rapid pace. It can explore into this untapped potential to generate more

profits

3. It can as well expand in the other developing countries as they also offer a

Opportunities growth potential for the bank

1. The US government framed the Dodd-Frank Act, significantly

restructuring financial regulation in the US. These severe changes in

regulations by US Federal government may affect operations and increase

costs

2. Since the start of the global financial crisis, banking industry in the US has

been undergoing a series of consolidations which could impact the margins

3. Increasing number of online attacks may indirectly affect the revenue for

Threats the bank

Competition

1. Associated Banc-Corp

2. Cathay General Bancorp

Competitors 3. City National Corp

Vous aimerez peut-être aussi

- Bdo - Industryanalysis PaperDocument12 pagesBdo - Industryanalysis PaperJohn Michael Dela CruzPas encore d'évaluation

- GaisanoDocument6 pagesGaisanoMordani Abbas0% (1)

- Assignment 1 - Levels of StrategyDocument1 pageAssignment 1 - Levels of StrategySherilyn BunagPas encore d'évaluation

- Case Study - StrukturaDocument6 pagesCase Study - StrukturaNiyel Janda50% (2)

- The Nature of Functional UnitsDocument20 pagesThe Nature of Functional UnitsMark Salva67% (3)

- LEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Document1 pageLEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Miles SantosPas encore d'évaluation

- Cash Management: Why Organisations Hold CashDocument15 pagesCash Management: Why Organisations Hold CashAjay Kumar TakiarPas encore d'évaluation

- Chapter 10 Testbank Used For Online QuizzesDocument57 pagesChapter 10 Testbank Used For Online QuizzesTrinh Lê100% (1)

- Assessment of Street Food in Catbalogan City, Philippines: Janice D. ElliDocument10 pagesAssessment of Street Food in Catbalogan City, Philippines: Janice D. ElliAnonymous iTIO6awtBPas encore d'évaluation

- EmperadorDocument15 pagesEmperadorDonnan OreaPas encore d'évaluation

- Executive SummaryDocument2 pagesExecutive SummaryJPIA MSU-IIT67% (3)

- The Only Way To Know Rizal Is To Read Rizal by Ambeth Ocampo Reaction PaperDocument1 pageThe Only Way To Know Rizal Is To Read Rizal by Ambeth Ocampo Reaction PapergenesisPas encore d'évaluation

- Review Questions and ProblemsDocument4 pagesReview Questions and ProblemsIsha LarionPas encore d'évaluation

- 2GO Group, Inc.Document5 pages2GO Group, Inc.john lloyd Jose100% (1)

- Cfas Quiz Pas 19Document5 pagesCfas Quiz Pas 19Michaella NudoPas encore d'évaluation

- Herstatt Risk and Collapse of Herstatt BankDocument21 pagesHerstatt Risk and Collapse of Herstatt BankChirdeep PareekPas encore d'évaluation

- Material Culture, International MarketingDocument1 pageMaterial Culture, International MarketingBalaji Ram100% (2)

- Final Exam: Question 1: Choose The Best Answer: (20 Marks)Document8 pagesFinal Exam: Question 1: Choose The Best Answer: (20 Marks)Faker PlaymakerPas encore d'évaluation

- Banco de Oro or BDO Unibank, Inc. Is The Largest Bank Based in Makati CityDocument7 pagesBanco de Oro or BDO Unibank, Inc. Is The Largest Bank Based in Makati CityErfan TanhaeiPas encore d'évaluation

- Case-Security Bank CorpDocument6 pagesCase-Security Bank CorpFernando VergaraPas encore d'évaluation

- Case 11 (Bupol)Document7 pagesCase 11 (Bupol)Viancx PallarcoPas encore d'évaluation

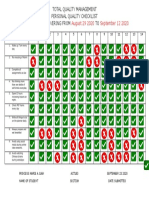

- 02 - Personal Quality Checklist TemplateDocument1 page02 - Personal Quality Checklist TemplatePrincess Marie JuanPas encore d'évaluation

- Globe Telecommunications Report: in Partial Fulfillment of The Requirement For The Subject Advanced Accounting IDocument41 pagesGlobe Telecommunications Report: in Partial Fulfillment of The Requirement For The Subject Advanced Accounting IPatricia Deanne Markines PacanaPas encore d'évaluation

- Bsma 2103 - Acc 204 - Midterm Examination (Part 1 - Theories)Document18 pagesBsma 2103 - Acc 204 - Midterm Examination (Part 1 - Theories)Chryshelle LontokPas encore d'évaluation

- Quiz. For Ten (10) Points Each, Answer The Following Questions BrieflyDocument2 pagesQuiz. For Ten (10) Points Each, Answer The Following Questions BrieflyJohn Phil PecadizoPas encore d'évaluation

- PESTEL ANALYSIS OF SAN MIGUEL CORPORATION MAria Aila Ataiza Anabel BindoDocument7 pagesPESTEL ANALYSIS OF SAN MIGUEL CORPORATION MAria Aila Ataiza Anabel BindoEmmanuel EsmerPas encore d'évaluation

- San Miguel & Universal Robina Financial-AnalysisDocument18 pagesSan Miguel & Universal Robina Financial-AnalysisJeng AndradePas encore d'évaluation

- Why Nations Trade With Each OtherDocument2 pagesWhy Nations Trade With Each OtherPlatero RolandPas encore d'évaluation

- Name: Cabahug, Rizalyn O. Year/Section: 3 Assignment-Lesson 4: Global Finance & Electronic Banking W/ International SeminarDocument2 pagesName: Cabahug, Rizalyn O. Year/Section: 3 Assignment-Lesson 4: Global Finance & Electronic Banking W/ International SeminarRizalyn Cabahug0% (1)

- LBC ExpressDocument3 pagesLBC ExpressArmae AguduloPas encore d'évaluation

- Sample Exam Ch2Document12 pagesSample Exam Ch2wikidoggPas encore d'évaluation

- Problem 1-1 Multiple Choice (ACP)Document11 pagesProblem 1-1 Multiple Choice (ACP)Irahq Yarte Torrejos0% (1)

- Case AnalysisDocument2 pagesCase AnalysisMary Jane PabroaPas encore d'évaluation

- FINAL Narrative Report Philippine National BankDocument38 pagesFINAL Narrative Report Philippine National BankTanyelle LouvPas encore d'évaluation

- Module 1.a The Accountancy ProfessionDocument6 pagesModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- Chapter 1 - IntroductionDocument4 pagesChapter 1 - IntroductionFrancisco CardenasPas encore d'évaluation

- STRAMADocument22 pagesSTRAMAMilaine ZilabboPas encore d'évaluation

- Related Literature (Joan)Document6 pagesRelated Literature (Joan)Santa Dela Cruz NaluzPas encore d'évaluation

- San Miguel Corporation Case Study AnalysisDocument5 pagesSan Miguel Corporation Case Study Analysislowi shooPas encore d'évaluation

- Budgeting Multiple ChoiceDocument2 pagesBudgeting Multiple ChoiceRachel Mae FajardoPas encore d'évaluation

- Topic 4. Delivery and Transfer of OwnershipDocument36 pagesTopic 4. Delivery and Transfer of OwnershipHPas encore d'évaluation

- Literature ReviewDocument3 pagesLiterature ReviewKenneth Aldrin JosePas encore d'évaluation

- Bdo Unibank IncDocument20 pagesBdo Unibank IncDonnan OreaPas encore d'évaluation

- Pawnshop Research1Document13 pagesPawnshop Research1Jazmin Gail Bautista NanaliPas encore d'évaluation

- International Financial Management PPT Chap 1Document25 pagesInternational Financial Management PPT Chap 1serge folegwePas encore d'évaluation

- PESTELDocument14 pagesPESTELAmy LlunarPas encore d'évaluation

- David Sm13e CN 13Document22 pagesDavid Sm13e CN 13Koki Mostafa100% (2)

- Innovation and Strategy Formulation-ReviewerDocument2 pagesInnovation and Strategy Formulation-ReviewerErika Mae LegaspiPas encore d'évaluation

- Marketing Plan Mangrae Fruitshake and Milktea ShopDocument12 pagesMarketing Plan Mangrae Fruitshake and Milktea ShopShaly Mae Dimog Castro100% (1)

- Handout One Accounting For Financial StatementsDocument12 pagesHandout One Accounting For Financial StatementsKaith Mendoza100% (1)

- Top Competitors of BDODocument2 pagesTop Competitors of BDORozen Anne PolonioPas encore d'évaluation

- Gen Econ Case StudiesDocument4 pagesGen Econ Case StudiesJohanah TenorioPas encore d'évaluation

- SwotDocument1 pageSwotMichael ArevaloPas encore d'évaluation

- Human ResourceDocument6 pagesHuman ResourceKarl Tabanao50% (2)

- Bank of The Philippine Islands Balanced Scorecard Group 2Document5 pagesBank of The Philippine Islands Balanced Scorecard Group 2Jasper TabernillaPas encore d'évaluation

- Paciones - Narrative Report On Chapter 9 Strategy FramewokDocument11 pagesPaciones - Narrative Report On Chapter 9 Strategy FramewokMeach CallejoPas encore d'évaluation

- Swot AnalysisDocument3 pagesSwot AnalysisKent TacsagonPas encore d'évaluation

- 5 - Flow Systems, Activity Relationship, and Space RequirementsDocument21 pages5 - Flow Systems, Activity Relationship, and Space RequirementsHello WorldPas encore d'évaluation

- Bank of America SwotDocument3 pagesBank of America SwotIftikhar JatoiPas encore d'évaluation

- SWOT Analysis of Bank of AmericaDocument2 pagesSWOT Analysis of Bank of AmericaNouman KhanPas encore d'évaluation

- Probability and Statistics NotesDocument27 pagesProbability and Statistics NotesDioner Ray100% (2)

- Sociology of Crime-1Document44 pagesSociology of Crime-1Dioner RayPas encore d'évaluation

- Integral Calculus NotesDocument29 pagesIntegral Calculus NotesDioner Ray100% (3)

- Differential Equations NotesDocument68 pagesDifferential Equations NotesDioner Ray100% (1)

- Sociology of Crime-1Document44 pagesSociology of Crime-1Dioner RayPas encore d'évaluation

- DRUGS EDUC. QuestionnaireDocument7 pagesDRUGS EDUC. QuestionnaireDioner Ray100% (5)

- BALLISTICS QuestDocument11 pagesBALLISTICS QuestDioner Ray100% (2)

- Folder Tabbings by Lantaw TVDocument1 pageFolder Tabbings by Lantaw TVDioner RayPas encore d'évaluation

- (Cdi 1) Fundamentals of Criminal InvestigationDocument12 pages(Cdi 1) Fundamentals of Criminal InvestigationAlbert Bermudez87% (31)

- FIRE TECH. QuestionnaireDocument7 pagesFIRE TECH. QuestionnaireDioner Ray100% (3)

- Forensic FingerprintingDocument11 pagesForensic FingerprintingDioner Ray80% (5)

- Forensic PhotographyDocument13 pagesForensic PhotographyDioner RayPas encore d'évaluation

- Forensic MedicineDocument12 pagesForensic MedicineDioner RayPas encore d'évaluation

- OCI QuestionnaireDocument8 pagesOCI QuestionnaireDioner RayPas encore d'évaluation

- FUNDAMENTALS OF CDI QuestionnaireDocument6 pagesFUNDAMENTALS OF CDI QuestionnaireDioner Ray100% (9)

- TRAFFIC MGT. AND ACCIDENT INVEST - QuestionsDocument7 pagesTRAFFIC MGT. AND ACCIDENT INVEST - QuestionsDioner Ray100% (7)

- SPECIAL CRIME INVEST - QuestionsDocument7 pagesSPECIAL CRIME INVEST - QuestionsDioner Ray100% (2)

- Crim. 3 Ethics and ValuesDocument13 pagesCrim. 3 Ethics and ValuesDioner Ray50% (8)

- Criminalistics 2 Police PhotograpyDocument12 pagesCriminalistics 2 Police PhotograpyDioner Ray0% (2)

- Compiled Sociology of Crimes Review QuestionsDocument10 pagesCompiled Sociology of Crimes Review QuestionsDioner RayPas encore d'évaluation

- Cdi 2 Traffic Management and Accident InvestigationDocument21 pagesCdi 2 Traffic Management and Accident InvestigationDioner Ray79% (19)

- WebSite and Web BrowserDocument15 pagesWebSite and Web BrowserDioner RayPas encore d'évaluation

- Fingerprint Classification FormulaDocument13 pagesFingerprint Classification FormulaDioner Ray50% (2)

- Crim. 4 Juvenile Delinquency and Crime PreventionDocument20 pagesCrim. 4 Juvenile Delinquency and Crime PreventionDioner Ray50% (2)

- Police PhotographyDocument89 pagesPolice PhotographyDioner RayPas encore d'évaluation

- 2015 Cdi Final CoachingDocument24 pages2015 Cdi Final CoachingDioner Ray95% (21)

- CDIDocument59 pagesCDIDioner RayPas encore d'évaluation

- CA Final CoachingDocument318 pagesCA Final CoachingDioner Ray100% (2)

- Cdi 3 Special Crime InvestigationDocument14 pagesCdi 3 Special Crime InvestigationDioner Ray100% (9)

- VanvanDocument1 pageVanvanDioner RayPas encore d'évaluation

- Quijano ST., San Juan, San Ildefonso, BulacanDocument2 pagesQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzPas encore d'évaluation

- De Mgginimis Benefit in The PhilippinesDocument3 pagesDe Mgginimis Benefit in The PhilippinesSlardarRadralsPas encore d'évaluation

- Bye, Bye Nyakatsi Concept PaperDocument6 pagesBye, Bye Nyakatsi Concept PaperRwandaEmbassyBerlinPas encore d'évaluation

- Dog and Cat Food Packaging in ColombiaDocument4 pagesDog and Cat Food Packaging in ColombiaCamilo CahuanaPas encore d'évaluation

- Bill CertificateDocument3 pagesBill CertificateRohith ReddyPas encore d'évaluation

- Organic Farming in The Philippines: and How It Affects Philippine AgricultureDocument6 pagesOrganic Farming in The Philippines: and How It Affects Philippine AgricultureSarahPas encore d'évaluation

- Irda CircularDocument1 pageIrda CircularKushal AgarwalPas encore d'évaluation

- DSE at A GlanceDocument27 pagesDSE at A GlanceMahbubul HaquePas encore d'évaluation

- PT Berau Coal: Head O CeDocument4 pagesPT Berau Coal: Head O CekresnakresnotPas encore d'évaluation

- VENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Document1 pageVENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Riandi HartartoPas encore d'évaluation

- Ram Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaDocument12 pagesRam Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaShamy Aminath100% (1)

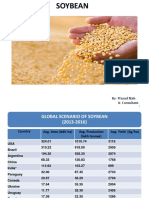

- Soybean Scenario - LaturDocument18 pagesSoybean Scenario - LaturPrasad NalePas encore d'évaluation

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Document1 pageBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahPas encore d'évaluation

- Working Capital Appraisal by Banks For SSI PDFDocument85 pagesWorking Capital Appraisal by Banks For SSI PDFBrijesh MaraviyaPas encore d'évaluation

- Buku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiaDocument17 pagesBuku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiadianPas encore d'évaluation

- JK Fenner (India) LimitedDocument55 pagesJK Fenner (India) LimitedvenothPas encore d'évaluation

- Bahasa Inggris IIDocument15 pagesBahasa Inggris IIMuhammad Hasby AsshiddiqyPas encore d'évaluation

- 11980-Article Text-37874-1-10-20200713Document14 pages11980-Article Text-37874-1-10-20200713hardiprasetiawanPas encore d'évaluation

- Production Planning & Control: The Management of OperationsDocument8 pagesProduction Planning & Control: The Management of OperationsMarco Antonio CuetoPas encore d'évaluation

- Fabozzi Ch13 BMAS 7thedDocument36 pagesFabozzi Ch13 BMAS 7thedAvinash KumarPas encore d'évaluation

- Revenue Procedure 2014-11Document10 pagesRevenue Procedure 2014-11Leonard E Sienko JrPas encore d'évaluation

- CBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportDocument2 pagesCBIM 2021 Form B-3 - Barangay Sub-Project Work Schedule and Physical Progress ReportMessy Rose Rafales-CamachoPas encore d'évaluation

- Use CaseDocument4 pagesUse CasemeriiPas encore d'évaluation

- Dak Tronic SDocument25 pagesDak Tronic SBreejum Portulum BrascusPas encore d'évaluation

- Alcor's Impending Npo FailureDocument11 pagesAlcor's Impending Npo FailureadvancedatheistPas encore d'évaluation

- July 07THDocument16 pagesJuly 07THYashwanth yashuPas encore d'évaluation

- Project ReportDocument110 pagesProject ReportAlaji Bah CirePas encore d'évaluation

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDocument12 pagesReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryPas encore d'évaluation

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDocument15 pagesThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoPas encore d'évaluation

- Company ProfileDocument13 pagesCompany ProfileDauda AdijatPas encore d'évaluation