Académique Documents

Professionnel Documents

Culture Documents

Income-tax rules form for tax payment request

Transféré par

Anonymous 2evaoXKKdTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Income-tax rules form for tax payment request

Transféré par

Anonymous 2evaoXKKdDroits d'auteur :

Formats disponibles

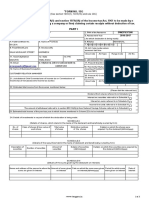

INCOME-TAX RULES, 1962

FORM No.68

Form of application under section 270AA(2) of the Income-tax Act, 1961

First Name Middle Name Last Name or Name of Entity PAN

Flat/ Door/ Block No. Name of Premises/ Building/ Road/ Street/ Post Office

Personal Information

Village

Area/ Locality Town/City/District State

Country Pin Code Phone No. with Email Address

STD code/ Mobile

No.

1 Assessment Year

2 Section under which assessment/reassessment* order is passed

Details of orders and payments

3 Date of the assessment/reassessment* order

4 Date of service of the assessment/reassessment* order

5 Amount of income assessed as per the assessment/reassessment* order

6 Tax and interest payable as per notice of demand (in Rs.)

7 Due date for payment as per notice of demand

8 Details of amounts paid

Sl. BSR Code Date of Deposit Serial Number of Amount (Rs.)

No. (DD/MM/YYYY) Challan

(i)

(ii)

(iii)

Form of verification

I, ____________________________son/daughter* of_____________________ do hereby declare that what is stated

above is true to the best of my information and belief. I further declare that no appeal has been filed in respect of the

order mentioned in column 2 above. I also undertake that no appeal shall be filed in respect of the said order before the

expiry of the period specified in section 270AA(4) of the Income-tax Act, 1961. I declare that I am making this

application in my capacity as ____________________ and I am also competent to file this application and verify it.

Place Signature

Date Seal

(wherever applicable)

*Strike off whichever is not applicable

Vous aimerez peut-être aussi

- Form 68 PDFDocument1 pageForm 68 PDFNihanth KandimallaPas encore d'évaluation

- Itr 62 Form 68Document1 pageItr 62 Form 68Suresh KumarPas encore d'évaluation

- IRF FormDocument2 pagesIRF Formnavin_netPas encore d'évaluation

- Form No. 27ADocument1 pageForm No. 27Akaturi3689Pas encore d'évaluation

- POST OFFICE ACCOUNT APPLICATIONDocument2 pagesPOST OFFICE ACCOUNT APPLICATIONDog OetPas encore d'évaluation

- Account Update Form PDFDocument2 pagesAccount Update Form PDFjohn lerry loberioPas encore d'évaluation

- Form No. 27B: (In Case Return Has Been Filed Earleer)Document1 pageForm No. 27B: (In Case Return Has Been Filed Earleer)anon-418665100% (1)

- ABC Company PAN and Interest DetailsDocument15 pagesABC Company PAN and Interest DetailsAnonymous 6z7noS4fPas encore d'évaluation

- Form 15G PDFDocument6 pagesForm 15G PDFSmitha GowdaPas encore d'évaluation

- Form No.60Document2 pagesForm No.60starlittle4259Pas encore d'évaluation

- AKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDocument4 pagesAKAPS4654E 4-O1-110 Jagannath (Or Which 2022-23 - : 712223 WhetherDebarshi SenguptaPas encore d'évaluation

- Form 15H DeclarationDocument2 pagesForm 15H Declarationyraju88Pas encore d'évaluation

- Individual Sole ProprietorDocument9 pagesIndividual Sole ProprietorAiyyamperumalPas encore d'évaluation

- Form No. 27Q (Document7 pagesForm No. 27Q (11co249lovemylifePas encore d'évaluation

- Form 27 C FormatDocument4 pagesForm 27 C FormatYash KediaPas encore d'évaluation

- Form 15G Declaration for Receiving Income Without Tax DeductionDocument4 pagesForm 15G Declaration for Receiving Income Without Tax DeductionMKPas encore d'évaluation

- Annexure 3 CIF FormDocument1 pageAnnexure 3 CIF FormVibhu Sharma JoshiPas encore d'évaluation

- Member Loan Application: This Form Is Not For SaleDocument3 pagesMember Loan Application: This Form Is Not For Salebernie romeroPas encore d'évaluation

- ITX23003E - Statement and Payment of Tax Withheld For Other Payments-FnDocument2 pagesITX23003E - Statement and Payment of Tax Withheld For Other Payments-FnAmbrogio BonucciPas encore d'évaluation

- Application Number APPLICATION FORM For Floating Rate Savings Bonds, 2020 (Taxable)Document6 pagesApplication Number APPLICATION FORM For Floating Rate Savings Bonds, 2020 (Taxable)Vikas AbhyankarPas encore d'évaluation

- FORM 27Q TITLEDocument6 pagesFORM 27Q TITLESophia RosePas encore d'évaluation

- SBI Account Opening Form Without Cut Mark 02.08.2018Document20 pagesSBI Account Opening Form Without Cut Mark 02.08.2018Shishir Kant SinghPas encore d'évaluation

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONgrover.jatinPas encore d'évaluation

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssPas encore d'évaluation

- SSS Calamity Loan Application FormDocument3 pagesSSS Calamity Loan Application FormVeronica LagoPas encore d'évaluation

- Form No. 13: (See Rules 28 and 37G)Document7 pagesForm No. 13: (See Rules 28 and 37G)prasantadas13Pas encore d'évaluation

- Apply for Moratorium on Pag-IBIG STL PaymentsDocument2 pagesApply for Moratorium on Pag-IBIG STL PaymentsJhonson MedranoPas encore d'évaluation

- Account Update Form - 2019 PDFDocument7 pagesAccount Update Form - 2019 PDFjohn lerry loberioPas encore d'évaluation

- 2023721217646921CircularNo 1of2023-2024Document4 pages2023721217646921CircularNo 1of2023-2024krebs38Pas encore d'évaluation

- ARP Form NKKDocument4 pagesARP Form NKKAnthony NhanPas encore d'évaluation

- HLF047 ApplicationMoratoriumHLAmortizationPayments V03Document1 pageHLF047 ApplicationMoratoriumHLAmortizationPayments V03JamesPas encore d'évaluation

- Sav 1980Document2 pagesSav 1980Michael100% (1)

- Sav 1849Document2 pagesSav 1849Michael100% (1)

- Form 27CDocument2 pagesForm 27Ctulsi22187Pas encore d'évaluation

- For Re-KYC Nredocument NRI - 18.5Document4 pagesFor Re-KYC Nredocument NRI - 18.5rajucbit_2000Pas encore d'évaluation

- MOBILE REGISTRATION FORMDocument3 pagesMOBILE REGISTRATION FORMYusri JumatPas encore d'évaluation

- "Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Document3 pages"Form No. 15G: (See Section 197A (1), 197A (1A) and Rule 29C)Christopher Vinoth0% (2)

- Form No. 15GDocument2 pagesForm No. 15GGaneshPas encore d'évaluation

- FORM 15G DECLARATIONDocument3 pagesFORM 15G DECLARATIONulhas_nakashePas encore d'évaluation

- Form15H PDFDocument2 pagesForm15H PDFSrinivasulu NatukulaPas encore d'évaluation

- Page 8-9Document2 pagesPage 8-9incredible soulPas encore d'évaluation

- Adobe Scan Mar 25, 2022Document2 pagesAdobe Scan Mar 25, 2022GaneshPas encore d'évaluation

- Cis FormDocument1 pageCis Formzyd82pmg54Pas encore d'évaluation

- Update contact details online formDocument1 pageUpdate contact details online formGrace F. CuratchiaPas encore d'évaluation

- Re-KYC NRI FormDocument9 pagesRe-KYC NRI FormPaxton FettelPas encore d'évaluation

- GST Registration Form GuideDocument2 pagesGST Registration Form Guidesaurabh singhPas encore d'évaluation

- Bir 2307 FormDocument88 pagesBir 2307 FormTheresa Faye De GuzmanPas encore d'évaluation

- 26QDocument3 pages26QBaluvu JagadishPas encore d'évaluation

- Form 15 CA and 15 CBDocument6 pagesForm 15 CA and 15 CBscrana7480Pas encore d'évaluation

- Withholding Tax Alert: Key Points To NoteDocument3 pagesWithholding Tax Alert: Key Points To NotemusaPas encore d'évaluation

- GST Form - Reg-16Document3 pagesGST Form - Reg-16VAR FINANCIAL SERVICESPas encore d'évaluation

- Form No. 15G: Part - IDocument3 pagesForm No. 15G: Part - ImohanPas encore d'évaluation

- WND PIU4 BP Xi 235 N Z390Document2 pagesWND PIU4 BP Xi 235 N Z390Nishant VincentPas encore d'évaluation

- Substituted by The Income-Tax (Twenty-Sixth Amendment) Rules, 2021, W.E.F. 2-9-2021Document2 pagesSubstituted by The Income-Tax (Twenty-Sixth Amendment) Rules, 2021, W.E.F. 2-9-2021Tushara VenkateshPas encore d'évaluation

- SB NreDocument7 pagesSB NreAsutosaPas encore d'évaluation

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corPas encore d'évaluation

- Bir Form 2307Document8 pagesBir Form 2307Alex CalannoPas encore d'évaluation

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- Sem 3 Malacca Itinerary - W Tutorial HoursDocument1 pageSem 3 Malacca Itinerary - W Tutorial HoursAnonymous 2evaoXKKdPas encore d'évaluation

- May05 121 Musick Air AsiaDocument6 pagesMay05 121 Musick Air AsiaAnonymous 2evaoXKKdPas encore d'évaluation

- 2016 APAC Fit-Out Cost Guide - Occupier ProjectsDocument26 pages2016 APAC Fit-Out Cost Guide - Occupier ProjectsSkywardFire100% (1)

- Itr62form 64cDocument1 pageItr62form 64cAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Document1 pageForm No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64cDocument1 pageItr62form 64cAnonymous 2evaoXKKdPas encore d'évaluation

- The Big Brown Fox Jumps Over The Lazy DogDocument1 pageThe Big Brown Fox Jumps Over The Lazy DogAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Document1 pageForm No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Income tax form for individuals without PANDocument5 pagesIncome tax form for individuals without PANHarit KumarPas encore d'évaluation

- Volume 2 - Supply Chain Management PDFDocument18 pagesVolume 2 - Supply Chain Management PDFAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64c PDFDocument1 pageItr62form 64c PDFAnonymous 2evaoXKKdPas encore d'évaluation

- Itr62form 64dDocument2 pagesItr62form 64dAnonymous 2evaoXKKdPas encore d'évaluation

- "Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Document3 pages"Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Anonymous 2evaoXKKdPas encore d'évaluation

- Itr 62 Form 64 BDocument2 pagesItr 62 Form 64 BAnonymous 2evaoXKKdPas encore d'évaluation

- Income-Tax Rules APA ApplicationDocument8 pagesIncome-Tax Rules APA ApplicationAnonymous 2evaoXKKdPas encore d'évaluation

- Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 2gupta_gk4uPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Anonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationDocument2 pagesPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ac: Audit Report Under Section 33ABDocument3 pagesForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961Document2 pagesForm No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961rajdeeppawarPas encore d'évaluation

- Section 32 Deduction Claim FormDocument2 pagesSection 32 Deduction Claim FormAnonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Document2 pagesForm No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961Anonymous 2evaoXKKdPas encore d'évaluation

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdPas encore d'évaluation

- Document 3456789 summaryDocument3 pagesDocument 3456789 summaryJoão Israel FerreiraPas encore d'évaluation

- Form 3ad: Audit Report Under Section 33ABADocument3 pagesForm 3ad: Audit Report Under Section 33ABAAnonymous 2evaoXKKdPas encore d'évaluation

- For Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)Document4 pagesFor Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)Anonymous 2evaoXKKdPas encore d'évaluation

- (See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDocument14 pages(See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDaniel C MohanPas encore d'évaluation

- Ownership and Governance of State Owned Enterprises A Compendium of National Practices 2021Document104 pagesOwnership and Governance of State Owned Enterprises A Compendium of National Practices 2021Ary Surya PurnamaPas encore d'évaluation

- Formulating and Expressing Internal Audit OpinionsDocument25 pagesFormulating and Expressing Internal Audit OpinionsMary Joy Dela Cruz - AgcaoiliPas encore d'évaluation

- Corporate Governance MBA SyllabusDocument2 pagesCorporate Governance MBA SyllabusShahad UmmerPas encore d'évaluation

- The iBAS in BangladeshDocument23 pagesThe iBAS in BangladeshInternational Consortium on Governmental Financial Management100% (1)

- CPALEDocument24 pagesCPALEDonna FranciaPas encore d'évaluation

- Nestle Child LabourDocument13 pagesNestle Child Labourmayuramlani1986100% (5)

- Unit 03Document30 pagesUnit 03Shareen Prem DSouzaPas encore d'évaluation

- A General Introduction Into Purchasing Management (Boer & Telgen)Document35 pagesA General Introduction Into Purchasing Management (Boer & Telgen)Brigitte HuisintveldPas encore d'évaluation

- Accepting An Engagement AuditingDocument7 pagesAccepting An Engagement AuditingCarlo FrioPas encore d'évaluation

- Corporate Governance QuizDocument11 pagesCorporate Governance QuizMariefel OrdanezPas encore d'évaluation

- Imitations of Inancial Tatements 12: Balanced Scorecard Not Only Reports The Traditional Measures of Financial PerDocument2 pagesImitations of Inancial Tatements 12: Balanced Scorecard Not Only Reports The Traditional Measures of Financial PerNicolas AliasPas encore d'évaluation

- Imran ProfileDocument1 pageImran ProfileImran SaleemPas encore d'évaluation

- BSBFIN601 Project Portfolio 1Document21 pagesBSBFIN601 Project Portfolio 1Zumer FatimaPas encore d'évaluation

- Bachelor of Science in Accountancy-VDocument5 pagesBachelor of Science in Accountancy-Vmjay moredoPas encore d'évaluation

- 2014 C Cash and Cash EquivalentsDocument44 pages2014 C Cash and Cash Equivalentsridwanali96Pas encore d'évaluation

- PU 4 YEARS BBA V Semester SyllabusDocument12 pagesPU 4 YEARS BBA V Semester Syllabushimalayaban50% (2)

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions ManualDocument49 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manuala538448756100% (1)

- COSO and COSO ERMDocument6 pagesCOSO and COSO ERMAzkaPas encore d'évaluation

- Simple Problem On ABC: RequiredDocument3 pagesSimple Problem On ABC: RequiredShreshtha VermaPas encore d'évaluation

- 2020 21 RGICL Annual ReportDocument113 pages2020 21 RGICL Annual ReportShubrojyoti ChowdhuryPas encore d'évaluation

- of SatyamDocument11 pagesof SatyamNeha NPas encore d'évaluation

- Implementing Rules and Regulations of Republic Act No. 9904Document34 pagesImplementing Rules and Regulations of Republic Act No. 9904Roel Balingit86% (7)

- Check Disbursement Journal InstructionsDocument1 pageCheck Disbursement Journal Instructionsabbey89Pas encore d'évaluation

- ABE Level 6 Corporate Finance Examiner Report Dec 2016Document10 pagesABE Level 6 Corporate Finance Examiner Report Dec 2016Immanuel LashleyPas encore d'évaluation

- Paper - 6: Information Systems Control and Audit: AnswerDocument70 pagesPaper - 6: Information Systems Control and Audit: AnswerAshishSinghPas encore d'évaluation

- Roles and Functions of Nurse Manager in Financial ManagementDocument15 pagesRoles and Functions of Nurse Manager in Financial ManagementAbas AhmedPas encore d'évaluation

- Controller in Washington DC Metro Resume Eva BrzezinskiDocument2 pagesController in Washington DC Metro Resume Eva BrzezinskiEvaBrzezinskiPas encore d'évaluation

- Normal Duration: Subject Description FormDocument3 pagesNormal Duration: Subject Description Formcoming ohPas encore d'évaluation

- S I A (SIA) 10 I A E: Tandard On Nternal Udit Nternal Udit VidenceDocument5 pagesS I A (SIA) 10 I A E: Tandard On Nternal Udit Nternal Udit VidenceDivine Epie Ngol'esuehPas encore d'évaluation

- Audit Evidence and Audit Documentation Nature and Types Audit EvidenceDocument4 pagesAudit Evidence and Audit Documentation Nature and Types Audit EvidenceCattleyaPas encore d'évaluation