Académique Documents

Professionnel Documents

Culture Documents

East Silver Lane

Transféré par

Nikko Franchello Santos0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues1 pageDigest

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDigest

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

12 vues1 pageEast Silver Lane

Transféré par

Nikko Franchello SantosDigest

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

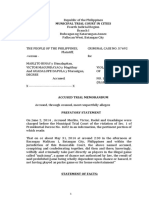

REPUBLIC OF THE PHILIPPINES, - versus - EAST HELD:

SILVERLANE REALTY DEVELOPMENT CORPORATION,

NO. In Heirs of Malabanan, this Court ruled that possession and

G.R. No. 186961 February 20, 2012 occupation of an alienable and disposable public land for the

periods provided under the Civil Code do not automatically

FACTS: convert said property into private property or release it from the

public domain. There must be an express declaration that the

The Respondent (East Silverlane) filed with the RTC an property is no longer intended for public service or development

application for land registration, It was claimed that the of national wealth. Without such express declaration, the

respondents predecessors-in-interest had been in open, property, even if classified as alienable or disposable, remains

notorious, continuous and exclusive possession of the subject property of the State, and thus, may not be acquired by

property since June 12, 1945. After hearing the same on the prescription.

merits, the RTC granting the respondents petition for registration

of the land in question. On appeal by the petitioner, the CA A reading of the CAs Decision shows that it affirmed the

affirmed the RTCs Decision. The CA found no merit in the grant of the respondents application given its supposed

petitioners appeal, holding that; compliance with Section 14 (2) of P.D. No. 1529. The CA ruled,

the respondent acquired title to the subject property by

It is a settled rule that an application for land registration must prescription as its predecessors-in-interest had possessed the

conform to three requisites: (1) the land is alienable public land; subject property for more than thirty (30) years.

(2) the applicants open, continuous, exclusive and notorious Citing Buenaventura v. Republic of the Philippines, the CA held

possession and occupation thereof must be since June 12, 1945, that even if possession commenced after June 12, 1945,

or earlier; and (3) it is a bona fide claim of ownership. registration is still possible under Section 14 (2) and possession

in the concept of an owner effectively converts an alienable and

In the case at bench, petitioner-appellee has met all the

disposable public land into private property.

requirements. Anent the first requirement, both the report and

certification issued by the Department of Environment and This Court, however, disagrees on the conclusion

Natural Resources (DENR) shows that the subject land was arrived at by the CA. On the premise that the application for

within the alienable and disposable zone and was released and registration, is based on Section 14 (2), it was not proven that

certified as such on December 31, 1925. the respondent and its predecessors-in-interest had been in

possession of the subject property in the manner prescribed by

In the case at bench, ESRDC tacked its possession and occupation

law and for the period necessary before acquisitive prescription

over the subject land to that of its predecessors-in-interest.

may apply.

Copies of the tax declarations and real property historical

ownership pertaining thereto were presented in court. It is a While the subject land was supposedly declared

settled rule that albeit tax declarations and realty tax payment of alienable and disposable on December 31, 1925 per the Report

property are not conclusive evidence of ownership, of the Community Environment and Natural Resources Office

nevertheless, they are good indicia of the possession in the (CENRO), the Department of Agrarian Reform (DAR) converted

concept of owner for no one in his right mind would be paying the same from agricultural to industrial only on October 16,

taxes for a property that is not in his actual or at least 1990. Therefore, it was only in 1990 that the subject property

constructive possession. They constitute at least proof that the had been declared patrimonial and it is only then that the

holder has a claim of title over the property. The voluntary prescriptive period began to run. The respondent cannot benefit

declaration of a piece of property for taxation purposes from the alleged possession of its predecessors-in-interest

manifests not only ones sincere and honest desire to obtain title because prior to the withdrawal of the subject property from the

to the property and announces his adverse claim against the public domain, it may not be acquired by prescription.

State and all other interested parties, but also the intention to

contribute needed revenues to the Government. Such an act On this basis, respondent would have been eligible for

strengthens ones bona fide claim of acquisition of ownership. application for registration because his claim of ownership and

possession over the subject property even exceeds thirty (30)

The petitioner assails the foregoing, according to the petitioner; years. However, it is jurisprudentially clear that the thirty (30)-

the respondent did not present a credible and competent year period of prescription for purposes of acquiring ownership

witness to testify on the specific acts of ownership performed by and registration of public land under Section 14 (2) of P.D. No.

its predecessors-in-interest on the subject property. Hence, this 1529 only begins from the moment the State expressly declares

present petition. that the public dominion property is no longer intended

for public service or the development of the national wealth or

ISSUE:

that the property has been converted into patrimonial.

Whether or Not the respondent has proven itself

entitled to the benefits of the PLA (Public Land Act) and P.D. No.

1529 on confirmation of imperfect or incomplete titles.

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Self-Assessment Guide: Can I? YES NODocument8 pagesSelf-Assessment Guide: Can I? YES NONikko Franchello SantosPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Writen-exam-TM1CoC2 With AnswersDocument2 pagesWriten-exam-TM1CoC2 With AnswersNikko Franchello SantosPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Self-Assessment Guide: Can I? YES NODocument9 pagesSelf-Assessment Guide: Can I? YES NONikko Franchello SantosPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Reaction PaperDocument3 pagesReaction PaperNikko Franchello Santos100% (6)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Administrative Law Chapter 1-2-3Document6 pagesAdministrative Law Chapter 1-2-3Nikko Franchello Santos100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- EducationDocument1 pageEducationNikko Franchello SantosPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Accused Trial MemorandumDocument11 pagesAccused Trial MemorandumNikko Franchello SantosPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Commercial Law Review-ReviewerDocument32 pagesCommercial Law Review-ReviewerNikko Franchello SantosPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- 5656Document11 pages5656Nikko Franchello SantosPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- When Is The Proper Time To File Demurrer To Evidence?Document74 pagesWhen Is The Proper Time To File Demurrer To Evidence?Nikko Franchello SantosPas encore d'évaluation

- And Its Improvements As The Private Property of The Herein Accused, Through False and FraudulentDocument2 pagesAnd Its Improvements As The Private Property of The Herein Accused, Through False and FraudulentNikko Franchello SantosPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Is More Particularly Described As Follows:: Supreme CourtDocument5 pagesIs More Particularly Described As Follows:: Supreme CourtNikko Franchello SantosPas encore d'évaluation

- Pre Trial Brief For Torrico 2Document7 pagesPre Trial Brief For Torrico 2Nikko Franchello SantosPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- PIL Immunity From JursidictionDocument2 pagesPIL Immunity From JursidictionNikko Franchello SantosPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Cross Border Insolvency ProceedingsDocument15 pagesCross Border Insolvency ProceedingsNikko Franchello SantosPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Home Insurance v. American Steamship-A Bill of LadingDocument2 pagesHome Insurance v. American Steamship-A Bill of LadingNikko Franchello SantosPas encore d'évaluation

- Case Digests No. 10Document3 pagesCase Digests No. 10Nikko Franchello SantosPas encore d'évaluation

- First, Proof Must Be Shown That Such Facilities Are CustomarilyDocument9 pagesFirst, Proof Must Be Shown That Such Facilities Are CustomarilyNikko Franchello SantosPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Tariff and Customs Code ReviewerDocument6 pagesTariff and Customs Code ReviewerNikko Franchello Santos75% (4)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- 373 Scra 665 & 410 Scra 652Document3 pages373 Scra 665 & 410 Scra 652Nikko Franchello SantosPas encore d'évaluation

- LTD CasesDocument32 pagesLTD CasesNikko Franchello SantosPas encore d'évaluation

- Law: Contracts General ProvisionsDocument8 pagesLaw: Contracts General ProvisionsFatima TawasilPas encore d'évaluation

- Property Detail Report: 150 Broadhollow RD, Melville, NY 11747Document2 pagesProperty Detail Report: 150 Broadhollow RD, Melville, NY 11747Szabo AndreeaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Vocabulary Set 3 - CopyrightsDocument3 pagesVocabulary Set 3 - CopyrightsLinh ThuyPas encore d'évaluation

- DR - Urmil Dave PDFDocument30 pagesDR - Urmil Dave PDFAditya TiwariPas encore d'évaluation

- Notice and Notice of Defective Chain of Title SlsDocument3 pagesNotice and Notice of Defective Chain of Title SlsCindy BrownPas encore d'évaluation

- Landti Bar QsDocument5 pagesLandti Bar QsMikkaEllaAnclaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Jurisprudence - CuyopanDocument5 pagesJurisprudence - CuyopanDaniel Patrick HuligangaPas encore d'évaluation

- Brand Book 1porthwestDocument35 pagesBrand Book 1porthwestnaama k bat mitzvahPas encore d'évaluation

- Maine Municipal Issues Paper 2018Document24 pagesMaine Municipal Issues Paper 2018Lauren PorterPas encore d'évaluation

- Bonnevie v. CA (G.R. No. L-49101, October 24, 1983)Document3 pagesBonnevie v. CA (G.R. No. L-49101, October 24, 1983)Lorie Jean UdarbePas encore d'évaluation

- Law Notes (LL.B Notes) - Family LawDocument31 pagesLaw Notes (LL.B Notes) - Family LawkimmiahujaPas encore d'évaluation

- Agcaoili LTD PDFDocument32 pagesAgcaoili LTD PDFruss8dikoPas encore d'évaluation

- Rent Reciept Wipro PDFDocument1 pageRent Reciept Wipro PDFRajPas encore d'évaluation

- CORPORATION REVIEWER VillanuevaDocument142 pagesCORPORATION REVIEWER Villanuevabobbys88Pas encore d'évaluation

- Contract of Lease (Hacienda)Document4 pagesContract of Lease (Hacienda)Jemmie Rose100% (2)

- JPC Corporate ProfileDocument3 pagesJPC Corporate ProfileJoburg Property Company50% (2)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Property de Leon Notes PDFDocument3 pagesProperty de Leon Notes PDFTrick San Antonio100% (2)

- Order Imperial Vs Cayetano (DBB)Document5 pagesOrder Imperial Vs Cayetano (DBB)DianneBalizaBisoñaPas encore d'évaluation

- UPP4722 PP Tuto PresentationDocument35 pagesUPP4722 PP Tuto PresentationPoh ZI RungPas encore d'évaluation

- Torrens System General Principles: Land Titles and DeedsDocument3 pagesTorrens System General Principles: Land Titles and DeedsMinnie chanPas encore d'évaluation

- Laurel vs. Garcia 187 SCRA 797Document20 pagesLaurel vs. Garcia 187 SCRA 797Jacinth DelosSantos DelaCernaPas encore d'évaluation

- Report Property 2 2Document27 pagesReport Property 2 2SORITA LAWPas encore d'évaluation

- 49 Valuation of Assets Under Wealth Tax ActDocument7 pages49 Valuation of Assets Under Wealth Tax ActVikash SharmaPas encore d'évaluation

- Abatement of NuisanceDocument3 pagesAbatement of NuisanceArman Arizala Brioso Perez100% (1)

- 7 September 2020 Mr. Gil Abad Atty. Evelyn S. EnriquezDocument2 pages7 September 2020 Mr. Gil Abad Atty. Evelyn S. EnriquezClara SuarezPas encore d'évaluation

- Income From House Property Notes For CA CSCMA StudentsDocument28 pagesIncome From House Property Notes For CA CSCMA StudentsSantosh Chavan100% (1)

- For TarpDocument40 pagesFor TarpRumylo AgustinPas encore d'évaluation

- UDA Act of Sri LankaDocument25 pagesUDA Act of Sri LankaManInTheBush100% (1)

- Tax 86-12Document5 pagesTax 86-12Marinel FelipePas encore d'évaluation

- Legal Forms Judicial AffidavitDocument9 pagesLegal Forms Judicial AffidavitHazel NatanauanPas encore d'évaluation