Académique Documents

Professionnel Documents

Culture Documents

07 Park ISM ch07 PDF

Transféré par

Benn DoucetTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

07 Park ISM ch07 PDF

Transféré par

Benn DoucetDroits d'auteur :

Formats disponibles

7-1

Part 3

Analysis of Project Cash

Flows

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

7-2

Chapter 7 Cost Concepts Relevant to Decision Making

Classifying Cost

7.1

Storage and material handling costs for raw materials: product cost (indirect

costs)

Gains or loss on disposal of factory equipment: period income (costs)

Lubricants for machinery and equipment used in production: product cost

(manufacturing overhead)

Depreciation of a factory building: product cost (manufacturing overhead)

Depreciation of manufacturing equipment: product cost (manufacturing

overhead)

Depreciation of the company presidents automobile: period cost

Leasehold costs for land on which factory buildings stand: period cost

Inspection costs of finished goods: product cost

Direct labour cost: product cost

Raw materials cost: product cost

Advertising expenses: period cost

Cost Behaviour

7.2 *

Wages paid to temporary workers: variable cost

Property taxes on factory building: fixed cost

Property taxes on administrative building: fixed cost

Sales commission: variable cost

Electricity for machinery and equipment in the plant: variable cost

Heat and air-conditioning for the plant: fixed cost

Salaries paid to design engineers: fixed cost

Regular maintenance on machinery and equipment: fixed cost

*

An asterisk next to a problem number indicates that the solution is available to students

on the Companion Website.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

7-3

Basic raw materials used in production: variable cost

Factory fire insurance: fixed cost

7.3

(a) 6

(b) 11

(c) 5, (Note: It is tempting to select 1, but the graphs are drawn in cumulative

basis)

(d) 4

(e) 2

(f) 10

(g) 3

(h) 7

(i) 9

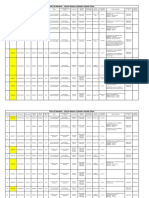

7.4

Output Level

Question

1,000 Units 2,000 Units

(a) Total manufacturing cost $98,000 $130,000

(b) Manufacturing cost per unit $98 $65

(c) Total variable costs $67,000 $104,000

(d) Total variable costs per unit $67 $52

(e) Total costs to be recovered $125,000 $162,000

Cost-Volume-Profit Relationships

7.5 *

(a) Total unit manufacturing costs if 30,000 units are produced: $21

Total mfg. costs $150, 000 $300, 000 $180, 000 $630, 000

Unit cost =$630, 000 / 30, 000 $21

(b) Total unit manufacturing costs if 40,000 units are produced: $20.33

Total mfg. costs $200, 000 $400, 000 $133,333 $80, 000 $813,333

Unit cost =$813,333 / 40, 000 $20.33

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

7-4

(c) Break-even price with 30,000 units produced: $29.33

Total cost Mfg. cost + Selling & Admin

=$630,000+$250,000 $880, 000

Unit cost =$880, 000 / 30, 000 $29.33

7.6 *

(a) Break-even sales volume: $200,000

(b) Marginal contribution rate (MCR) = $20,000/$100,000 = 20%, which is

equivalent to the slope of the profit-loss function.

(c) Let R = break-even sales dollars; F = total fixed cost; V = variable cost per

unit; Q = sales price per unit

F F V V

R ; 1 0.2; 0.8;

1V MCR Q Q

Q

V V 1 0.8

1 1 1 0.1579;

0.95Q Q 0.95 0.95

$40, 000

R $253,333

0.1579

(d)

F 1.1F $44, 000

$44, 000

R $220, 000

0.2

(e)

V V

1 0.2; 0.8;

Q Q

1.06V

1 1 1.06(0.8) 0.1520;

Q

$40, 000

R $263,158

0.1520

(f)

$40, 000 $20, 000

$100, 000

0.2

7.7

(a) Total fixed cost to be recovered

(b) Sales volume & Profit/Loss

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

7-5

(c) Profit = 0

(d) Profit per sales volume

(e) Break-even volume

7.8

(a)

No. Description No. Description

1. Profit (Loss) 6. Break even

2. Sales volume 7. Loss

3. Total manufacturing cost 8. Profit

4. Variable costs 9. Total revenue

5. Fixed costs 10. Marginal contribution

(b)

Unit Variable Contribution Fixed Net Income

Case Sales Margin per Unit

Sold Expenses Expenses (Loss)

A 9,000 $270,000 $162,000 $12 $90,000 $18,000

B 14,000 $350,000 $140,000 $15 $170,000 $40,000

C 20,000 $400,000 $280,000 $6 $85,000 $35,000

D 5,000 $100,000 $30,000 $14 $82,000 ($12,000)

Cost Concepts Relevant to Decision Making

7.9 Additional units ordered = 100

Labour cost = ($12)(5)(100) = $6,000

Material cost = ($14)(100) = $1,400

Overhead cost = (50%) ($6,000) = $3,000

Total cost = $6,000 + $1,400 + $3,000 = $10,400

Profit = (30%) ($10,400) = $3,120

Unit price to quote = $10,400 + $3,120 = $13,520

7.10

(a) Product mix that must satisfy: A:B = 4:3, or 4B = 3A (or B = 0.75A)

Break-even formula: Total revenue = Total cost: 10A + 12(0.75)A = 5A +

10(0.75)A + 2,600; 6.5A = 2,600; A = 400 units and B = 300 units

(b) 10A + 12A = 5A + 10A + 2,600; A = 371.43 units

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

7-6

(c) Compute the marginal contribution rate (MCR) for each product: Product A =

$5, Product B= $2; with the assumption (A > 0 and B > 0), more preference

should be given to Product A

(d) Product A: MCR = $5 per unit; Production time = 0.5 hour per unit; profit per

hour = $10

Product B: MCR = $2 per unit; Production time = 0.25 hour per unit; profit

per hour = $8

Conclusion: Product A is more profitable, so it should be pushed first.

7.11

(a) Incremental cost

In-house O utscoring

Description O ption O ption

Soldering operation $4.80

Direct m aterials $7.50 $6.00

Direct labor $5.00 $4.25

M fg. O v erhead $4.00 $3.40

Fixed cost $0.20 $0.20

Unit cost $16.70 $18.65

The outsourcing option would cost $1.95 more for each unit. Note that the

fixed cost of $20,000 (or $0.20 per unit based on 100,000 production

volume) remains unchanged under either option.

(b) Break-even price = $4.80 - $1.95 = $2.85 per unit

Short Case Studies

ST 7.1

(a) Break-even volume:

six-day operation: capacity 270 tonnes/day, 6 days, Q = $270/tonne

F = ($4,200)(6 days) = $25,200, V = [$7.56+($0.16)(1.2)(1000)] =

$199.56/tonne

F NV NQ

F $25, 200

Nb 357.75 tonnes

Q V $270 $199.56

seven-day operation: capacity 270 tonnes/day, 7 days, Q = $270/tonne

F = ($4,200)(6 days) + $420 = $29,820,

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

7-7

V = [$7.56(6/7) + $15.12(1/7) + ($0.16)(1.2)(1000)] = $200.64/tonne

F NV NQ

F $29,820

Nb 429.93 tonnes

Q V $270 $200.64

(b)

six-day operation:

V 199.56

MCR 1 1 0.2609

Q 270

seven-day operation:

V 200.64

MCR 1 1 0.2569

Q 270

(c)

$25, 200

Average total cost per tonne = $199.56 $215.12 / tonne

(270)(6)

Net profit margin before taxes = Sales Costs = $270 $215.12 =

$54.88/tonne

(d)

$420

Sunday profit margin = $270 [ $192 $15.12] $61.32 0

270

Yes, it could be economical for the mill to operate on Sunday. The incremental

profit margin for the seven-day operation is less than the six-day operation.

Although Sunday operation is not as profitable due to the increased labour and

fixed cost, the overall MCR is still positive.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

Vous aimerez peut-être aussi

- 03 Park ISM ch03 PDFDocument15 pages03 Park ISM ch03 PDFBenn DoucetPas encore d'évaluation

- 09 Park ISM Ch09Document15 pages09 Park ISM Ch09Benn DoucetPas encore d'évaluation

- 16 Park ISM ch16 PDFDocument18 pages16 Park ISM ch16 PDFBenn DoucetPas encore d'évaluation

- 10 Park ISM ch10 PDFDocument61 pages10 Park ISM ch10 PDFBenn DoucetPas encore d'évaluation

- Wind Riders of The Jagged Cliffs PDFDocument138 pagesWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- 08 Park ISM ch08 PDFDocument17 pages08 Park ISM ch08 PDFBenn DoucetPas encore d'évaluation

- 14 Park ISM ch14 PDFDocument36 pages14 Park ISM ch14 PDFBenn DoucetPas encore d'évaluation

- 04 Park ISM ch04 PDFDocument28 pages04 Park ISM ch04 PDFBenn DoucetPas encore d'évaluation

- 05 Park ISM ch05 PDFDocument39 pages05 Park ISM ch05 PDFBenn DoucetPas encore d'évaluation

- 12 Park ISM ch12 PDFDocument21 pages12 Park ISM ch12 PDFBenn DoucetPas encore d'évaluation

- 15 Park ISM ch15 PDFDocument36 pages15 Park ISM ch15 PDFBenn DoucetPas encore d'évaluation

- AD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFDocument130 pagesAD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFWannes Ikkuhyu100% (8)

- 11 Park ISM ch11 PDFDocument95 pages11 Park ISM ch11 PDFBenn DoucetPas encore d'évaluation

- 02 Park ISM ch02 PDFDocument3 pages02 Park ISM ch02 PDFBenn DoucetPas encore d'évaluation

- 13 Park ISM ch13 PDFDocument12 pages13 Park ISM ch13 PDFBenn DoucetPas encore d'évaluation

- 06 Park ISM ch06 PDFDocument44 pages06 Park ISM ch06 PDFBenn DoucetPas encore d'évaluation

- Dark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFDocument132 pagesDark Sun - 2419 - CGR2 - The Complete Gladiator's Handbook PDFPedro Lamas100% (2)

- Valley of Dust and Fire PDFDocument106 pagesValley of Dust and Fire PDFBenn Doucet100% (2)

- Slave Tribes PDFDocument98 pagesSlave Tribes PDFBenn Doucet100% (5)

- Black Spine PDFDocument314 pagesBlack Spine PDFBenn Doucet100% (6)

- The Ivory Triangle PDFDocument213 pagesThe Ivory Triangle PDFBenn Doucet100% (2)

- Veiled Alliance PDFDocument98 pagesVeiled Alliance PDFBenn Doucet100% (4)

- Asticlian GambitDocument121 pagesAsticlian GambitDylan Flippance100% (1)

- Wind Riders of The Jagged Cliffs PDFDocument138 pagesWind Riders of The Jagged Cliffs PDFBenn Doucet100% (1)

- Black FlamesDocument122 pagesBlack FlamesDylan Flippance100% (2)

- Arcane ShadowsDocument120 pagesArcane ShadowsKasper Holm100% (1)

- The Ivory TriangleDocument213 pagesThe Ivory TriangleDylan Flippance100% (1)

- Veiled Alliance PDFDocument98 pagesVeiled Alliance PDFBenn Doucet100% (4)

- Beyond The Prism PentadDocument34 pagesBeyond The Prism PentadDiego Fernando Lastorta67% (6)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Circular Flow of Process 4 Stages Powerpoint Slides TemplatesDocument9 pagesCircular Flow of Process 4 Stages Powerpoint Slides TemplatesAryan JainPas encore d'évaluation

- Annamalai International Journal of Business Studies and Research AijbsrDocument2 pagesAnnamalai International Journal of Business Studies and Research AijbsrNisha NishaPas encore d'évaluation

- Photographing Shadow and Light by Joey L. - ExcerptDocument9 pagesPhotographing Shadow and Light by Joey L. - ExcerptCrown Publishing Group75% (4)

- Software Requirements Specification: Chaitanya Bharathi Institute of TechnologyDocument20 pagesSoftware Requirements Specification: Chaitanya Bharathi Institute of TechnologyHima Bindhu BusireddyPas encore d'évaluation

- Case Study Hotel The OrchidDocument5 pagesCase Study Hotel The Orchidkkarankapoor100% (4)

- 2010 - Impact of Open Spaces On Health & WellbeingDocument24 pages2010 - Impact of Open Spaces On Health & WellbeingmonsPas encore d'évaluation

- Top Malls in Chennai CityDocument8 pagesTop Malls in Chennai CityNavin ChandarPas encore d'évaluation

- Estimation of Working CapitalDocument12 pagesEstimation of Working CapitalsnehalgaikwadPas encore d'évaluation

- Krok2 - Medicine - 2010Document27 pagesKrok2 - Medicine - 2010Badriya YussufPas encore d'évaluation

- Orc & Goblins VII - 2000pts - New ABDocument1 pageOrc & Goblins VII - 2000pts - New ABDave KnattPas encore d'évaluation

- Udaan: Under The Guidance of Prof - Viswanathan Venkateswaran Submitted By, Benila PaulDocument22 pagesUdaan: Under The Guidance of Prof - Viswanathan Venkateswaran Submitted By, Benila PaulBenila Paul100% (2)

- Column Array Loudspeaker: Product HighlightsDocument2 pagesColumn Array Loudspeaker: Product HighlightsTricolor GameplayPas encore d'évaluation

- Intro To Gas DynamicsDocument8 pagesIntro To Gas DynamicsMSK65Pas encore d'évaluation

- Java development user guide eclipse tutorialDocument322 pagesJava development user guide eclipse tutorialVivek ParmarPas encore d'évaluation

- Axe Case Study - Call Me NowDocument6 pagesAxe Case Study - Call Me NowvirgoashishPas encore d'évaluation

- Innovation Through Passion: Waterjet Cutting SystemsDocument7 pagesInnovation Through Passion: Waterjet Cutting SystemsRomly MechPas encore d'évaluation

- DECA IMP GuidelinesDocument6 pagesDECA IMP GuidelinesVuNguyen313Pas encore d'évaluation

- FSRH Ukmec Summary September 2019Document11 pagesFSRH Ukmec Summary September 2019Kiran JayaprakashPas encore d'évaluation

- Evaluating Sources IB Style: Social 20ib Opvl NotesDocument7 pagesEvaluating Sources IB Style: Social 20ib Opvl NotesRobert ZhangPas encore d'évaluation

- Unit 1 - Gear Manufacturing ProcessDocument54 pagesUnit 1 - Gear Manufacturing ProcessAkash DivatePas encore d'évaluation

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriPas encore d'évaluation

- Artist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheDocument2 pagesArtist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheUy YuiPas encore d'évaluation

- ServiceDocument47 pagesServiceMarko KoširPas encore d'évaluation

- Disaster Management Plan 2018Document255 pagesDisaster Management Plan 2018sifoisbspPas encore d'évaluation

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaPas encore d'évaluation

- Experiences from OJT ImmersionDocument3 pagesExperiences from OJT ImmersionTrisha Camille OrtegaPas encore d'évaluation

- Books of AccountsDocument18 pagesBooks of AccountsFrances Marie TemporalPas encore d'évaluation

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniPas encore d'évaluation

- Coffee Table Book Design With Community ParticipationDocument12 pagesCoffee Table Book Design With Community ParticipationAJHSSR JournalPas encore d'évaluation

- The European Journal of Applied Economics - Vol. 16 #2Document180 pagesThe European Journal of Applied Economics - Vol. 16 #2Aleksandar MihajlovićPas encore d'évaluation