Académique Documents

Professionnel Documents

Culture Documents

2010 February Equity Brokerage

Transféré par

rgt18Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2010 February Equity Brokerage

Transféré par

rgt18Droits d'auteur :

Formats disponibles

ICRA INDUSTRY UPDATE

EQUITY BROKERAGE INDUSTRY UPDATE

Profitability declines in Q3FY10 on sequential basis;

nevertheless better than Q3FY09

Analyst Contact: Industry Outlook: Neutral

Karthik Srinivasan ICRA continues to maintain a neutral outlook on domestic

karthiks@icraindia.com brokerage houses on account of inherent volatility in the

+91-22-3047 0028 capital markets and also on account of uncertainty on the

February 2010

outcome of various impending structural changes in the

Vikas Garg industry which could have mixed implications for brokerage

vikasg@icraindia.com houses.

+91-22-3047-0024 ICRA has noted the profitability indicators during Q3F10 for

most players in the segment, which has shown some

Ravi Mittal moderation over the previous sequential quarter.

ravim@icraindia.com Nevertheless, the profitability indicators remained comfortable

+91-22-3047-0036 compared to the Q3FY09.

Industry Update: Q3FY09-10

Operating environment remains comfortable in third quarter of

FY10; though profitability declines on a sequential basis.

Equity broking turnover at National Stock Exchange (NSE) and

Bombay Stock Exchange (BSE), combined, remained flat on

sequential quarter on quarter basis but reported a 79% rise on

year on year basis.

Market proportion further shifts more in favour of Option

trading; cash market trading proportion continues to decline.

Overall average equity brokerage yields may have declined

with larger proportion of option trading volumes; yields likely to

remain intact for respective segments namely cash, futures

and options.

Capital market remained conducive for initial public offerings

(IPO) though not many IPOs during the period.

No major opportunity for IPO funding during the quarter under

review. Lending against securities also remained subdued.

Website:

www.icra.in

ICRA Rating Feature Equity Brokerage Industry Q3FY10 Update

Equity brokerage turnover remained flat during the quarter; proportion changes more in favor

of option trading…

Source: NSE, BSE Website

During Q3FY10, equity broking turnover remained flat on sequential quarter basis, while it reported a

79% rise on year on year basis albeit on low base in Q3FY09. Nevertheless, average daily turnover

increased to Rs 983 billion in Q3FY10 from Rs 934 billion in Q2FY10 with lesser number of trading

days (61) during the quarter. While the trading volume in cash segment declined by 16% during the

quarter on q-o-q basis, trading volume in option segment grew by 14% during the quarter on q-o-q

basis. On the other hand, trading volume in the future segment reported a marginal decline during the

quarter. In-fact, trading volumes in the Options segment has been on an increasing trend since FY09

and the option trading volumes accounted for 40% of the total trading volumes on the Exchange

houses in Q3FY10 compared to less than 10% proportion during FY08. The proportion of trading in

future segment remained steady at 39% during Q3FY10 while the proportion of trading in the cash

segment declined considerably to 22% from 26% in Q2FY10.

While the equity broking volumes have remained stable during the Q3FY09-10, a similar growth is not

reflected in the equity broking revenues of the brokerage houses on account of lower average

brokerage yields on option trades. On an average, yield on trading in options is 1 – 2 basis points

while it is 3 – 4 basis points in the future segment and as high as 10 – 12 basis points in the cash

segment. Accordingly, ICRA believes the overall average brokerage yield to have declined in

Q3FY09-10, however, average yields in the respective segment may not have declined significantly

during the quarter.

1

Lending portfolio remained almost flat...

While the H1FY10 had seen a significant pick up

in the lending activities buoyed by increasing

trend in the equity prices and improving

operating environment, Q3FY10 saw almost no

growth in the lending portfolio of margin funding

& loan against shares. During Q3FY10, stock

prices remained relatively range bound leading

to lesser demand of margin funding / loan

against shares. While the credit book remained

almost flat during the quarter under review,

average book in Q3FY10 was higher than that in

H1FY10 on account of lower book size as on

Mar-09. Going forward, in ICRA’s view, loan

against securities activity may pick up at a

quicker pace on account of lower incremental

concerns on economy. Source: Company, ICRA database

1

Data compiled for Aditya Birla Finance Ltd, ECL Finance Ltd, Emkay Global Finance Ltd, IDFC, IL&FS Financial Services

Ltd, India Infoline Investment Services Ltd, Investsmart Financial Services Ltd, Kotak Mahindra Investments Ltd , Kotak

Mahindra Prime Ltd, Motilal Oswal Financial Services Ltd, Rathi Global Finance Ltd and Religare Finvest Ltd.

ICRA Rating Services Page 2

ICRA Rating Feature Equity Brokerage Industry Q3FY10 Update

No major IPO funding during the quarter…

During FY10, many large ticket IPOs hit the capital market. Domestic capital market has already seen

20 IPOs in the current financial year (till December 2009) with an overall mobilization of ~Rs 204

billion as compared with Rs 20 billion

mobilized by 18 IPOs in the entire FY09.

While the addition of new stocks adds to

brokerage volumes, new IPOs also help

the brokerage houses in earning

distribution income and advisory fees. In

addition, they also provide a quick

revenue source for the NBFCs in terms of

the IPO funding. However unlike H1FY10,

IPO funding remained subdued during

Q3FY10 against the backdrop of lower

than expected IPO listing gains on few big

IPOs in H1FY10. During Q3FY10, big

IPOs like JSW Energy Ltd (~Rs 38.2

billion) and Indiabulls Power Ltd (~Rs 15.3

billion) saw lackluster response in the HNI

segment. Although few of the smaller

IPOs like DB Crop Ltd (~Rs 3.8 billion) Source: NSE Website

and Cox & Kings India Ltd (Rs 6.1 billion)

got high subscription level in the HNI segment, in ICRA estimates, IPO funding during Q3FY10 would

have been much lower at Rs 23 billion as against Rs 335 billion in H1FY10.

For IPO funding, NBFCs raise 15 – 20 days money from the mutual funds through the issuance of

short term Non Convertible Debentures (NCD). However, with RBI proposing to ban NCD of less than

2

90 days maturity , going forward, NBFCs may have to tap alternate sources of funds thereby

impacting their spread. In ICRA’s view, while the new proposal of RBI, if implemented, could increase

the cost of funds for the brokerage houses, they would still continue with their IPO funding programme

on account of favorable risk-adjusted returns. ICRA expects that GoI’s plans of diluting its stakes in

various un-listed public sector companies could also add to the IPO funding business.

3

Broking network continues to grow at a rapid pace; led by the franchisee route…

Brokerage houses have rapidly scaled up their branch network in 9MFY10, as compared with the

FY09, buoyed by the improvement in

market sentiments in the FY10. During

Q3FY10, ICRA’s sampled brokerage

houses added 679 branches / franchisee

(1,664 YTD & 1,274 in FY08-09) large part

of which was in the form of franchisee as

the brokerage houses continue to remain

cautious on adding company owned

branches in order to keep costs low. Over

past few years most of the brokerage

houses have been expanding their branch

network through franchisee route in order

to gain market share while keeping a

flexible cost structure. Going forward also,

brokerage houses have chalked out

aggressive expansion plans and ICRA

expects higher proportion of the franchisee

network. Earlier in H2FY09, most of the

brokerage houses had put their expansion

plans on hold with few of them also Source: Company, ICRA database

consolidating the branch network.

2

Made in the Credit Policy of October 2009

3

Data compiled for seven brokerage houses namely Anand Rathi Financial Services Ltd, Edelweiss Capital Ltd, Emkay Global

Financial Services Ltd, India Infoline Ltd, Kotak Securities Ltd, Motilal Oswal Financial Services Ltd, Religare Enterprise Ltd,

and Sharekhan Ltd.

ICRA Rating Services Page 3

ICRA Rating Feature Equity Brokerage Industry Q3FY10 Update

4

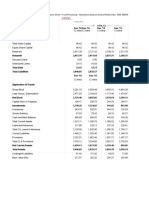

Profitability declines in Q3FY10 on sequential quarter basis; robust growth on y-o-y basis…

4

Financial profitability of the eight listed brokerage houses declined marginally during Q3FY10 from

the previous quarter. Brokerage houses’ total income declined by 4% during Q3FY10 on sequential

quarter basis on account of lesser contribution from the equity broking business, though non-broking

operations & fund based operations provided some support. In ICRA’s view, equity brokerage income

of the listed brokerage houses got impacted in Q3FY10 despite flat industry brokerage volumes on

account of high proportion of trading turnover in low yielding option segment. Nonetheless, their total

income grew by 21% on year on year basis albeit on a low base. Brokerage houses’ operating

expenses grew marginally by 5% on sequential quarter basis (9% on year on year basis) as they

again become active on branch expansion and recruitment. Accordingly, Brokerage houses’ profit

before tax and exceptional items declined by 21% on sequential quarter basis while it grew by 96% on

year on year basis.

Source: BSE website. ICRA database4

Brokerage houses operating efficiency indicators also moderated, though marginally, during the

Q3FY10. Operating cost to Operating income ratio increased to 74% in Q3FY10 from 68% in Q2FY10

(84% in Q3FY09) largely led by the rise in employee expense which stood at 28% of the total income

in Q3FY10 as against 25% in Q2FY10 (30% in Q3FY09). While the brokerage houses have again

started scaling up their branch network, focus is more on maintaining high proportion of franchisee so

as to keep the operating expenses flexible. While brokerage houses do not disclose the credit

provisioning on quarterly basis, in ICRA’s view, Q3FY10 would have seen lower incremental credit

provisioning.

Conclusion

ICRA continues to maintain a neutral outlook on domestic brokerage houses. While ICRA has noted a

marginal decline in the profitability indicators during Q3F10 for most players in the segment and

inherent volatility in the capital markets, it expects brokerage houses’ short term profitability to remain

comfortable assuming no further negative surprises in the global & domestic market, easing of

liquidity & credit concerns and improving of market sentiments. In the short term, the actual budget

announcement would be a key driver for setting a trend in equity trading volumes. Over the medium

term, the outcome of various impending structural changes in the industry could have crucial bearing

on brokerage houses’ profitability.

February 2010

4

Data compiled for eight listed brokerage houses namely Edelweiss Capital Ltd, Emkay Global Financial Services Ltd, Geojit

BNP Paribas Financial Services Ltd , HSBC Investdirect (India) Ltd, India Infoline Ltd, Indiabulls Securities Services Ltd, Motilal

Oswal Financial Services Ltd, and Religare Enterprise Ltd.

ICRA Rating Services Page 4

ICRA Rating Feature Equity Brokerage Industry Q3FY10 Update

Annexure 1: ICRA rated entities engaged in capital market related business operations

Sr. No Company Rating as on February 23, 2010

1 Anand Rathi Commodities Limited A2+ (SO)

2 Anand Rathi Financial Securities Limited LA-/ A2+

3 Anand Rathi Stock & Shares Brokers Limited LA-/ A2+

4 Aditya Birla Finance Limited (Erstwhile Birla Global A1+

Finance Company Limited)

5 Bonanza Commodity Limited A2

6 Bonanza Portfolio Limited A2

7 CD Integrated Services Limited A3+

8 Crosseas Capital Services Private Limited A4+

9 Dalmia Securities Private Limited A1

10 Dimensional Securities Private Limited LBBB- / A3

11 ECL Finance Limited LAA-pp(SO) stable / A1+

12 Edelweiss Capital Limited LAA-pp / LAA-pn / LAA- stable

13 Emkay Global Financial Services Limited A2+

14 Enam Securities Private Limited A1+

15 Enam Finance Private Limited A1+(SO)

16 Gupta Equities Private Limited LBB+/ A4+

17 IDFC-SSKI Securities Private Limited A1+

18 IL&FS Financial Services Limited A1+

19 India Infoline Investment Services Limited LA+ stable / LAA-pp(SO) stable /

A1+

20 India Infoline Limited LAA-/ A1+

21 Infinity.com Financial Securities Limited A3

22 Intime Spectrum Securities Limited LBBB-/ A3

23 Inventure Growth & Securities Ltd A3+

24 Investsmart Financial Services Limited A1+

25 Joindre Capital Services Limited LBBB- / A3

26 KIFS Securities Private Limited A2+

27 Kotak Mahindra Investments Limited LAA -/ LAA-pp / A1+

28 Kotak Securities Limited LAA / LAA pp / A1+

29 Karvy Consultants Limited LA-

30 Karvy Stock Broking Limited LA-

31 Money Logix Securities Private Limited A4

32 Nirmal Bang Securities Private Limited LBBB/ A2

33 Pashupati Capital Services Private Limited LBBB- / A3

34 Pioneer Investcorp Limited LBBB- / A3

35 Prabhudas Lilladher Financial Services Private Limited A1

36 Progressive Share Brokers Private Limited LBB+ / A4+

37 Reliance Securities Limited A1+ (SO)

38 Religare Securities Limited A1+

39 Religare Finvest Limited LA+ / A1+

40 Sharekhan Limited A1+

41 Shilpa Stock Brokers Limited LBB+/ A4+

42 Standard Chartered - STCI Capital Markets Limited A1+

(formerly UTI Securities)

43 Sushil Financial Services Private Limited A4+

44 Sykes & Ray Equities (India) Limited A3

45 Systematix Shares & Stocks (India) Limited LBBB-/A3

46 TransGlobal Securities Limited LBBB-/ A3

ICRA Rating Services Page 5

ICRA Limited

An Associate of Moody's Investors Service

CORPORATE OFFICE

Building No. 8, 2nd Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002

Tel: +91 124 4545300; Fax: +91 124 4545350

Email: info@icraindia.com, Website: www.icra.in

REGISTERED OFFICE

1105, Kailash Building, 11th Floor; 26 Kasturba Gandhi Marg; New Delhi 110001

Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 30470000/24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai:

Tel + (91 44) 45964300, Fax + (91 44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283 1411/

2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 43326400 Fax + (91 80) 43326409 Ahmedabad:

Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251, Fax +

(91 40) 2373 5152 Pune: Tel + (91 20) 2556 1194/0195/0196, Fax + (91 20) 2556 1231

© Copyright, 2010 ICRA Limited. All Rights Reserved.

Contents may be used freely with due acknowledgement to ICRA.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable.

Although reasonable care has been taken to ensure that the information herein is true, such information is provided 'as

is' without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or implied,

as to the accuracy, timeliness or completeness of any such information. All information contained herein must be

construed solely as statements of opinion, and ICRA shall not be liable for any losses incurred by users from any use of

this publication or its contents.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Art Private BankingDocument6 pagesArt Private BankingShalini SethPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Maximum return minimum investmentDocument19 pagesMaximum return minimum investmentDavid BoișteanPas encore d'évaluation

- Cuban Cigar IndustryDocument4 pagesCuban Cigar Industrymeanest100% (2)

- 25 Cost AccountingDocument148 pages25 Cost AccountingTejo Jose100% (1)

- Comparative Study Between Private Sector Banks and Public Sector BanksDocument61 pagesComparative Study Between Private Sector Banks and Public Sector BanksJitendra Kumar68% (40)

- MGT401 Final Term 7 Solved Past PapersDocument71 pagesMGT401 Final Term 7 Solved Past Paperssweety67% (3)

- Becsr Assignment 3 - 19202065 - Sec ADocument3 pagesBecsr Assignment 3 - 19202065 - Sec AViresh Gupta100% (1)

- Sales Trading Resume TemplateDocument1 pageSales Trading Resume TemplateBlake ZhangPas encore d'évaluation

- Blaze ManufacturingDocument6 pagesBlaze ManufacturingmildredPas encore d'évaluation

- The Project Oriented Company 2Document6 pagesThe Project Oriented Company 2TH_2014Pas encore d'évaluation

- Sapm Interview QuestionsDocument2 pagesSapm Interview Questionsprobitsvizag100% (1)

- Capm ModelDocument12 pagesCapm ModelBittoo SinghPas encore d'évaluation

- Chapter 4 - RETURN and RiskDocument23 pagesChapter 4 - RETURN and RiskAlester Joseph ĻĕěPas encore d'évaluation

- Skills and Knowledge Inventories (SKI) Pension Area of PracticeDocument9 pagesSkills and Knowledge Inventories (SKI) Pension Area of PracticeKARTHIK NPas encore d'évaluation

- University of The CordillerasDocument6 pagesUniversity of The CordillerasBrix ChagsPas encore d'évaluation

- US Internal Revenue Service: p938 - 2002Document160 pagesUS Internal Revenue Service: p938 - 2002IRSPas encore d'évaluation

- Enumeration:List Down The Correct Answers: Fundamentals of Accounting 2Document1 pageEnumeration:List Down The Correct Answers: Fundamentals of Accounting 2Nicky Rivera100% (1)

- Manitok Corporate Presentation 2014-11-12 v005 FinalDocument27 pagesManitok Corporate Presentation 2014-11-12 v005 Finalticman123Pas encore d'évaluation

- Moore Medical Boosts Sales OnlineDocument6 pagesMoore Medical Boosts Sales OnlineMitesh Patel100% (1)

- The Process of Portfolio Management: Portfolio Construction, Management, & Protection, 5e, Robert A. StrongDocument33 pagesThe Process of Portfolio Management: Portfolio Construction, Management, & Protection, 5e, Robert A. StrongQamarulArifinPas encore d'évaluation

- Cgweek 2010Document13 pagesCgweek 2010jef7georgePas encore d'évaluation

- NestleDocument2 pagesNestleMd WasimPas encore d'évaluation

- Samman Mohammadi, Mohammad Monfared Maharlouie, Dan Omid Mansouri. 2012. The Effect of Cash Holdings On Income Smoothing PDFDocument10 pagesSamman Mohammadi, Mohammad Monfared Maharlouie, Dan Omid Mansouri. 2012. The Effect of Cash Holdings On Income Smoothing PDFhebert0595Pas encore d'évaluation

- Reverand Father Layog Case StudyDocument2 pagesReverand Father Layog Case StudyJomsPas encore d'évaluation

- 00 Current Affairs Latest UpdatedDocument165 pages00 Current Affairs Latest Updatedbanti1234Pas encore d'évaluation

- The Pre-Production Process EvaluationDocument8 pagesThe Pre-Production Process EvaluationMC_Onnell100% (1)

- Water Report - CostsDocument7 pagesWater Report - CostsEric ReynoldsPas encore d'évaluation

- GulfDocument17 pagesGulfmastermind_2848154Pas encore d'évaluation

- Vizag SteelDocument37 pagesVizag SteelPrashantGupta100% (1)

- Notice: Order Exempting Non-Convertible Preferred Securities From Rule 611 (A), Etc.Document2 pagesNotice: Order Exempting Non-Convertible Preferred Securities From Rule 611 (A), Etc.Justia.comPas encore d'évaluation