Académique Documents

Professionnel Documents

Culture Documents

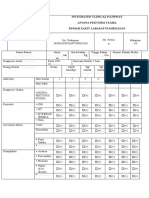

Tax Assessment Appeals and Remedies Process

Transféré par

elizafaith0 évaluation0% ont trouvé ce document utile (0 vote)

42 vues1 pageThe document outlines the tax assessment process and a taxpayer's remedies under the National Internal Revenue Code. It details the steps from an initial audit or investigation by a revenue officer, to the potential issuance of a Preliminary Assessment Notice (PAN) or Formal Letter of Demand (FLD), the taxpayer's right to submit a protest or reply, and options for appeal if the assessment is upheld. These include filing an appeal first with the Court of Tax Appeals (CTA) and potentially further appeal to the Supreme Court, ending the controversy.

Description originale:

Taxation

Titre original

Assessment Process

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document outlines the tax assessment process and a taxpayer's remedies under the National Internal Revenue Code. It details the steps from an initial audit or investigation by a revenue officer, to the potential issuance of a Preliminary Assessment Notice (PAN) or Formal Letter of Demand (FLD), the taxpayer's right to submit a protest or reply, and options for appeal if the assessment is upheld. These include filing an appeal first with the Court of Tax Appeals (CTA) and potentially further appeal to the Supreme Court, ending the controversy.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

42 vues1 pageTax Assessment Appeals and Remedies Process

Transféré par

elizafaithThe document outlines the tax assessment process and a taxpayer's remedies under the National Internal Revenue Code. It details the steps from an initial audit or investigation by a revenue officer, to the potential issuance of a Preliminary Assessment Notice (PAN) or Formal Letter of Demand (FLD), the taxpayer's right to submit a protest or reply, and options for appeal if the assessment is upheld. These include filing an appeal first with the Court of Tax Appeals (CTA) and potentially further appeal to the Supreme Court, ending the controversy.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

ASSESSMENT PROCESS AND TAXPAYERS

REMEDIES FROM TAX ASSESSMENT-NIRC

Issuance( of( A u d i t( o r( t a x( If( the( revenue( ocer( nds( sucient( T a x p a y e r ( m a y(

inves6ga6on( by( basis( to( assess( deciency( tax,( a( PAN( submit( ( a( Reply( to(

L e , e r ( o f( shall( be( issued,( except( as( those(

t h e( R e v e n u e( t h e( P A N( w i t h i n(

Authority( Ocer( provided(under(Sec(228(of(the(NIRC(

Ieen((15)(days(

Protest( of( the( FAN( must( be( If(the(taxpayer(was(not(able(to(refute(

made( within( thirty(30)( days( If( the( taxpayers( response(

the( ndings( in( PAN( or( if( he( is( in( i s( m e r i t o r i o u s ,( t h e(

f r o m ( t h e ( r e c e i p t ( o f(

assessment.( Submission( of(

default,(FLD/FAN(shall(be(issued( a s s e s s m e n t( s h a l l( b e(

dismissed(

suppor6ng( documents( within(

sixty( (60)( days( from( ling( of(

protest(( If( the( decision( is( adverse( to( the( taxpayer( or( in( case( of(

inac6on,(he(may(appeal(to(the(CTA(within(thirty((30)(days( The( taxpayer( may( opt( to( le( a(

from( receipt( of( decision( or( lapse( of( the( 180Vday( period.( mo6on(for(reconsidera6on(of(an(

If(the(decision(made(within(one( unfavorable( judgment( and(

hundred(eighty((180)(days(from(ling( Should(the(taxpayer(opt(to(await(for(the(nal(decision(on(

the(disputed(assessment(beyond(the(180(day(period,(the( appeal( the( decision( to( the( CTA(

of(protest(or(submission(of( later( on,( subject( to( the( 30Vday(

documents(is(in(favor(of(the( taxpayer(may(appeal(such(nal(decision(to(the(CTA((within(

thirty((30)(days(from(receipt(of(decision.((( period(to(appeal(

taxpayer,(the(assessment(is(

dismissed(

CTA(Division(decides(

Appeal(to(the(CTA(en(banc(subject( the(appeal(

to(compliance(with(prior(

requirements( Appeal(to(the(Supreme(

Court( End(of(controversy(

Vous aimerez peut-être aussi

- Legal EthicsDocument222 pagesLegal EthicsJessyyyyy123100% (14)

- Criminal Procedure 2018 BarDocument54 pagesCriminal Procedure 2018 BarelizafaithPas encore d'évaluation

- Complete Exam Tax Law Notes PDFDocument84 pagesComplete Exam Tax Law Notes PDFannpurna pathakPas encore d'évaluation

- Sales Tax ExemptionsDocument6 pagesSales Tax ExemptionsAlyssa RobertsPas encore d'évaluation

- DMPW9BBLJ2D1 (Amazon)Document1 pageDMPW9BBLJ2D1 (Amazon)mansoura789Pas encore d'évaluation

- SPL Case DigestDocument174 pagesSPL Case DigestelizafaithPas encore d'évaluation

- BIR Form 1800 - Donor's Tax ReturnDocument2 pagesBIR Form 1800 - Donor's Tax ReturnangelgirlfabPas encore d'évaluation

- Video Response WorksheetDocument2 pagesVideo Response WorksheetStephen MceleaveyPas encore d'évaluation

- COURSE OUTLINE ON CONFLICTS OF LAWDocument75 pagesCOURSE OUTLINE ON CONFLICTS OF LAWelizafaith100% (1)

- Conflicts of LawDocument75 pagesConflicts of Lawelizafaith100% (1)

- Outline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancDocument1 pageOutline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancRaymond RogacionPas encore d'évaluation

- 172 Fernandez Hermanos, Inc. v. CIR (Uy)Document4 pages172 Fernandez Hermanos, Inc. v. CIR (Uy)Avie UyPas encore d'évaluation

- Clinical pathways for tuberculosis meningitisDocument6 pagesClinical pathways for tuberculosis meningitisklinik bgpPas encore d'évaluation

- Intellectual Property LawDocument34 pagesIntellectual Property LawDennis Aran Tupaz AbrilPas encore d'évaluation

- Philippine Legal CitationDocument72 pagesPhilippine Legal CitationArwella GregorioPas encore d'évaluation

- People Vs EstacioDocument2 pagesPeople Vs EstacioJoshua L. De JesusPas encore d'évaluation

- People Vs EstacioDocument2 pagesPeople Vs EstacioJoshua L. De JesusPas encore d'évaluation

- Statement 20141230Document15 pagesStatement 20141230adam sandsPas encore d'évaluation

- PHILIPPINE BUSINESS BANK V CHUA PDFDocument4 pagesPHILIPPINE BUSINESS BANK V CHUA PDFColee StiflerPas encore d'évaluation

- Labor Law Review Notes for Midterms 2015-2016Document21 pagesLabor Law Review Notes for Midterms 2015-2016MichaelPas encore d'évaluation

- 00170form 10Document3 pages00170form 10Jome MathewPas encore d'évaluation

- The Civil Procedure Code (Approved Forms) Gn. 388.PDF#PdfjsDocument84 pagesThe Civil Procedure Code (Approved Forms) Gn. 388.PDF#PdfjsYUSTO HABIYEPas encore d'évaluation

- GAR44 EditedDocument1 pageGAR44 EditedKapil SoodPas encore d'évaluation

- Tumor Sinonasal Tumor Ganas Hidung (C300) Tumor Ganas Sinus Maksila (C310) 2019Document2 pagesTumor Sinonasal Tumor Ganas Hidung (C300) Tumor Ganas Sinus Maksila (C310) 2019edohermendy_32666011Pas encore d'évaluation

- CP Tumor Sinonasal BaruDocument2 pagesCP Tumor Sinonasal Baruedohermendy_32666011Pas encore d'évaluation

- CP Tosilitis KronisDocument1 pageCP Tosilitis Kronisedohermendy_32666011Pas encore d'évaluation

- Krispy Kreme Case Analysis StrategiesDocument30 pagesKrispy Kreme Case Analysis StrategiesWisnu Sentosa WijayaPas encore d'évaluation

- LACIV220Document2 pagesLACIV220johnathan fissellaPas encore d'évaluation

- CP StrokDocument3 pagesCP StrokInstalasi Farmasi Rumah Sakit LarasatiPas encore d'évaluation

- Tax Refund Claim ProcessDocument1 pageTax Refund Claim ProcessMonaliePas encore d'évaluation

- Angina Pektoris Clinical PathwayDocument3 pagesAngina Pektoris Clinical PathwayInstalasi Farmasi Rumah Sakit LarasatiPas encore d'évaluation

- Data City SeedsDocument50 pagesData City SeedsPierre BerthelierPas encore d'évaluation

- Pendidikan Karakter Khas PesantrensampleDocument35 pagesPendidikan Karakter Khas PesantrensampleFini RosyidatunPas encore d'évaluation

- Form 405 TDS ReturnDocument5 pagesForm 405 TDS ReturnPravin ShirolePas encore d'évaluation

- TNB Bank Guarantee TitleDocument3 pagesTNB Bank Guarantee TitleTRIO BUILDERSPas encore d'évaluation

- Appendix2 Expenditure Question Paper 2023 ECoRDocument13 pagesAppendix2 Expenditure Question Paper 2023 ECoRLearn UrselfPas encore d'évaluation

- Appointment Processing Checklist: Qualification StandardsDocument2 pagesAppointment Processing Checklist: Qualification StandardsRhodie SalazarPas encore d'évaluation

- Disclosure Summary Page: F9Rinstrn0QnsDocument6 pagesDisclosure Summary Page: F9Rinstrn0QnsZach EdwardsPas encore d'évaluation

- Disclosure Summary Page: Late Filed Nports Era Subject To Possible Civil and Criminal Penalties. Following Sentence: Ga4'Document3 pagesDisclosure Summary Page: Late Filed Nports Era Subject To Possible Civil and Criminal Penalties. Following Sentence: Ga4'Zach EdwardsPas encore d'évaluation

- Bond For Good behaviour-Drafting-Criminal Template-635Document1 pageBond For Good behaviour-Drafting-Criminal Template-635Aastha PrakashPas encore d'évaluation

- Remedies LKGDocument41 pagesRemedies LKGHNicdaoPas encore d'évaluation

- Manual Tr-6 ChallanDocument1 pageManual Tr-6 ChallanmeisPas encore d'évaluation

- Clinical Pathway TBDocument2 pagesClinical Pathway TBAyu WulandariPas encore d'évaluation

- VAT Refund Claim Process: 5 Key StepsDocument1 pageVAT Refund Claim Process: 5 Key StepsMonaliePas encore d'évaluation

- Medical Sicness For Gazeteed OfficerDocument2 pagesMedical Sicness For Gazeteed OfficerVISHRUTH SHEKHAWATPas encore d'évaluation

- CP Abses Leher DalamDocument2 pagesCP Abses Leher DalamASMA199307Pas encore d'évaluation

- Lumbera Tax Easy NotesDocument19 pagesLumbera Tax Easy NotesMark Gregory SalayaPas encore d'évaluation

- ACT Application For Deposit of A Community PlanDocument6 pagesACT Application For Deposit of A Community PlanConveyancers DirectoryPas encore d'évaluation

- DFFG DFFG DFFGDocument1 pageDFFG DFFG DFFGNalustosPas encore d'évaluation

- F Deed of CovenantDocument2 pagesF Deed of Covenantdave mohammedPas encore d'évaluation

- FORM 11 (Revhhdhdhh Ised)Document2 pagesFORM 11 (Revhhdhdhh Ised)kishore112wwPas encore d'évaluation

- PDF Document PDFDocument3 pagesPDF Document PDFMiacristel EstolePas encore d'évaluation

- Tabla 1Document2 pagesTabla 1Mercedes Mitzumi Sosa RaymundoPas encore d'évaluation

- Tax Ordinance-Books 1-30 FCTBDocument51 pagesTax Ordinance-Books 1-30 FCTBRaiha MoriyomPas encore d'évaluation

- Notice to Surety on Breach of a BondDocument1 pageNotice to Surety on Breach of a BondAdvocate Shishir SaxenaPas encore d'évaluation

- Motor Service v Yellow Taxi Summary Judgment RulingDocument2 pagesMotor Service v Yellow Taxi Summary Judgment RulingColee StiflerPas encore d'évaluation

- FORMAT BG (Pindahmilik) PDFDocument3 pagesFORMAT BG (Pindahmilik) PDFPubg rafiqPas encore d'évaluation

- 2005-04-07 DR2 SummaryDocument2 pages2005-04-07 DR2 SummaryZach EdwardsPas encore d'évaluation

- Clinical Pathway DMDocument2 pagesClinical Pathway DMAyu WulandariPas encore d'évaluation

- Clinical Pathway TB Paru RSBDocument2 pagesClinical Pathway TB Paru RSBNatasha nindaPas encore d'évaluation

- 'Cic3Sz0 Fog Set-Jatc A (: Disclosure Summary PageDocument15 pages'Cic3Sz0 Fog Set-Jatc A (: Disclosure Summary PageZach EdwardsPas encore d'évaluation

- Reglementary PeriodsDocument12 pagesReglementary PeriodsGlenda Lyn Araño100% (1)

- T.N.T.C FORM 49 (See Subsidiary Rule 10 Under T.R.16) Periodical Increment CertificateDocument3 pagesT.N.T.C FORM 49 (See Subsidiary Rule 10 Under T.R.16) Periodical Increment CertificatesiumbooPas encore d'évaluation

- Application Form Application Form: Action by Personnel Action by PersonnelDocument9 pagesApplication Form Application Form: Action by Personnel Action by PersonnelJobert Lapiz Cayubit Jr.Pas encore d'évaluation

- SMF Ilmu Kesehatan THT - KL RSUD Dr. Soetomo Surabaya: Karsinoma Nasofaring ICD-10: C11Document1 pageSMF Ilmu Kesehatan THT - KL RSUD Dr. Soetomo Surabaya: Karsinoma Nasofaring ICD-10: C11edohermendy_32666011Pas encore d'évaluation

- Nasopharyngeal Carcinoma Clinical PathwayDocument1 pageNasopharyngeal Carcinoma Clinical Pathwayedohermendy_32666011Pas encore d'évaluation

- Clinical Pathway HivDocument2 pagesClinical Pathway HivAyu WulandariPas encore d'évaluation

- Contract Costing 07Document16 pagesContract Costing 07Kamal BhanushaliPas encore d'évaluation

- Work Items:: Billing Itemization For ContractDocument9 pagesWork Items:: Billing Itemization For ContractShyam SPas encore d'évaluation

- US v. Go Chico (1909Document77 pagesUS v. Go Chico (1909elizafaithPas encore d'évaluation

- Poli 2017Document12 pagesPoli 2017BrunxAlabastroPas encore d'évaluation

- Third Division: L/Epublic of TljeDocument13 pagesThird Division: L/Epublic of TljeelizafaithPas encore d'évaluation

- House of Representatives: 5a. PRES. APPROP./ 5a. PRES. APPROP.Document2 pagesHouse of Representatives: 5a. PRES. APPROP./ 5a. PRES. APPROP.elizafaithPas encore d'évaluation

- US v. Go Chico (1909Document77 pagesUS v. Go Chico (1909elizafaithPas encore d'évaluation

- Court upholds conviction of man for raping his 12-year old daughterDocument12 pagesCourt upholds conviction of man for raping his 12-year old daughterelizafaithPas encore d'évaluation

- Stat ConDocument102 pagesStat ConelizafaithPas encore d'évaluation

- Leave Benefits Under Existing LawsDocument2 pagesLeave Benefits Under Existing LawselizafaithPas encore d'évaluation

- Faith CommRevDocument9 pagesFaith CommRevelizafaithPas encore d'évaluation

- Civil Law SyllabusDocument8 pagesCivil Law SyllabusElmo DecedaPas encore d'évaluation

- 02 Labor Law Syllabus 2018 PDFDocument6 pages02 Labor Law Syllabus 2018 PDFRobert WeightPas encore d'évaluation

- Legal Forms ProjectDocument2 pagesLegal Forms ProjectelizafaithPas encore d'évaluation

- Stat ConDocument146 pagesStat ConelizafaithPas encore d'évaluation

- Stat Con WK 11-7Document36 pagesStat Con WK 11-7elizafaithPas encore d'évaluation

- UP 2010 Legal FormsDocument80 pagesUP 2010 Legal FormselizafaithPas encore d'évaluation

- Stat ConDocument102 pagesStat ConelizafaithPas encore d'évaluation

- Code of CommerceDocument4 pagesCode of CommerceelizafaithPas encore d'évaluation

- Special ProceedingsDocument40 pagesSpecial ProceedingselizafaithPas encore d'évaluation

- Code of CommerceDocument4 pagesCode of CommerceelizafaithPas encore d'évaluation

- Last Will and Testament.2Document3 pagesLast Will and Testament.2elizafaithPas encore d'évaluation

- Corpo Specified PowersDocument19 pagesCorpo Specified PowerselizafaithPas encore d'évaluation

- Statement of Axis Account No:920010055264310 For The Period (From: 11-06-2021 To: 10-12-2021)Document4 pagesStatement of Axis Account No:920010055264310 For The Period (From: 11-06-2021 To: 10-12-2021)Sanjay BaldwaPas encore d'évaluation

- INV5606545Document11 pagesINV5606545mrgrayinthedarkPas encore d'évaluation

- On WCTDocument28 pagesOn WCTumaambekar123Pas encore d'évaluation

- Taxation of Income in NepalDocument24 pagesTaxation of Income in NepalSophiya PrabinPas encore d'évaluation

- Annual Income Tax ReturnDocument2 pagesAnnual Income Tax ReturnRAS ConsultancyPas encore d'évaluation

- G.R. No. 176290 September 21, 2007 SYSTRA PHILIPPINES, INC., Petitioner, Commissioner of Internal Revenue, RespondentDocument6 pagesG.R. No. 176290 September 21, 2007 SYSTRA PHILIPPINES, INC., Petitioner, Commissioner of Internal Revenue, RespondentWayne ViernesPas encore d'évaluation

- ACCDocument16 pagesACCFarah AlyaPas encore d'évaluation

- StatementDocument4 pagesStatementlorielys0909Pas encore d'évaluation

- Ym Fo CSG 8 TF 4 WV4 enDocument14 pagesYm Fo CSG 8 TF 4 WV4 enAbhimanyuPas encore d'évaluation

- Electronic MoneyDocument2 pagesElectronic Moneyphongvu21Pas encore d'évaluation

- Medicard PhilippinesDocument2 pagesMedicard PhilippinesNFNLPas encore d'évaluation

- My Zone Card Statement: Payment SummaryDocument2 pagesMy Zone Card Statement: Payment SummaryKunal DasPas encore d'évaluation

- Aigo: Project Introduction: Blockchain and Crypto Payments To E-CommerceDocument7 pagesAigo: Project Introduction: Blockchain and Crypto Payments To E-CommerceBayu RhezaPas encore d'évaluation

- OpTransactionHistoryUX511 01 2024Document24 pagesOpTransactionHistoryUX511 01 2024Nishant ThakerPas encore d'évaluation

- Forms BrgyDocument13 pagesForms BrgyErlinda LagunaPas encore d'évaluation

- DT Volume 2 Dec 21 CS Executive CA Saumil Manglani UpdatedDocument180 pagesDT Volume 2 Dec 21 CS Executive CA Saumil Manglani UpdatedSouvik MukherjeePas encore d'évaluation

- Accrued Expenses ExplainedDocument14 pagesAccrued Expenses ExplainedDebbie Grace Latiban LinazaPas encore d'évaluation

- MSPP LeafletDocument4 pagesMSPP LeafletChayan MukherjeePas encore d'évaluation

- Citibank Rewards Redemption T&CsDocument9 pagesCitibank Rewards Redemption T&CsdesignsolutionsallPas encore d'évaluation

- WalmartDocument3 pagesWalmartJulie SalamonPas encore d'évaluation

- BirDocument15 pagesBirRudolf Christian Oliveras Ugma100% (1)

- Dhaka Power Distribution Company Ltd. (DPDC) : Payment Short Ledger (Post-Paid)Document6 pagesDhaka Power Distribution Company Ltd. (DPDC) : Payment Short Ledger (Post-Paid)sagor islamPas encore d'évaluation

- NTS 4.7 Selection TrialDocument3 pagesNTS 4.7 Selection TrialNicholasFCheongPas encore d'évaluation

- Official Registration and Assessment Form: of Antipolo, RizalDocument1 pageOfficial Registration and Assessment Form: of Antipolo, RizalKarylle CandontolPas encore d'évaluation

- Notice: Health Insurance Portability and Accountability Act of 1996 Implementation: Taxpayer Advocacy PanelsDocument1 pageNotice: Health Insurance Portability and Accountability Act of 1996 Implementation: Taxpayer Advocacy PanelsJustia.comPas encore d'évaluation

- Visa International Operating Regulations Main PDFDocument1 171 pagesVisa International Operating Regulations Main PDFДрагослав БјелицаPas encore d'évaluation

- Tax CDocument18 pagesTax Calmira garciaPas encore d'évaluation