Académique Documents

Professionnel Documents

Culture Documents

Equity Report 21 Aug To 25 Aug

Transféré par

zoidresearchTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Equity Report 21 Aug To 25 Aug

Transféré par

zoidresearchDroits d'auteur :

Formats disponibles

EQUITY TECHNICAL REPORT

WEEKLY

[21 AUG to 25 AUG 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

21 AUG to 25 AUG 2017

NIFTY 50 9837.40 (126.60) (1.30%)

Indian Benchmark Index started a week

on a bullish note. After 5 days of

consecutive selling, the nifty showed

strength. The nifty closed at 9794 after

making a high of 9818. On Tuesday, was

Market holiday due to Indian

Independence Day.. On Wednesday,

Market ended the trading session on a

bullish note. The Nifty future ended higher

by 91 points at 9907. It has opened at

9829 made a high of 9910 and low of 9778

overall, 132 points movement was there in

Intraday trade On Thursday, Indices pared

gains to end flat. The nifty opened in 9946

and a hit a high of 9,940.However, it failed

to sustain at this level and dropped to an

Intraday low of 9884. The index was up by

7 points and close at 9904. On Friday, the

market was remained highly volatile, The

weakness in the market was witnessed

due to surprise resignation of Infosys CEO

Mr. Vishal Sikka. The share price of

Infosys fell by 9.56%, the biggest one day

fall in last one year. The benchmark Index

Nifty50 (spot) opened the week at 9755.75

made a high of 9947.80 low of 9752.10

and closed the week at 9837.40. Thus the

Nifty closed the week with a gaining of

126.6 points or 1.30%. Future Outlook:

The Nifty daily chart is bearish

Formations

trend; we advised to if Nifty future

The 20 days EMA are placed at sell below 9770 than target will be

9897.90 9680 Nifty upside weekly

The 5 days EMA are placed at Resistance is 10000-9910 level. On

9861.03 the downside strong support at

9750-9680.

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

21 AUG to 25 AUG 2017

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 10042 9940 9846 9744 9650

AUTOMOBILE

BAJAJ-AUTO 2903.92 2857.63 2821.82 2775.53 2739.72

BOSCHLTD 23549.20 22791.60 22196.30 21438.70 20843.40

EICHERMOT 32792.15 32151.80 30958.50 30318.15 29124.85

HEROMOTOCO 4154.57 4070.63 3960.07 3876.13 3765.57

M&M 1397.60 1383.80 1365.70 1351.90 1333.80

MARUTI 7816.40 7707.60 7611.30 7502.50 7406.20

TATAMTRDVR 239.68 233.32 228.53 222.17 217.38

TATAMOTORS 401.67 391.03 381.82 371.18 361.97

CEMENT & CEMENT PRODUCTS

ACC 1863.97 1829.13 1790.07 1755.23 1716.17

AMBUJACEM 285.48 280.22 271.48 266.22 257.48

GRASIM 1150.25 1124.15 1097.15 1071.05 1044.05

ULTRACEMCO 4129.52 4071.93 3981.02 3923.43 3832.52

CONSTRUCTION

LT 1173.53 1152.07 1135.53 1114.07 1097.53

CONSUMER GOODS

ASIANPAINT 1182.93 1161.47 1142.23 1120.77 1101.53

HINDUNILVR 1244.33 1223.27 1185.23 1164.17 1126.13

ITC 292.28 287.07 278.78 273.57 265.28

ENERGY

BPCL 539.70 521.50 493.40 475.20 447.10

GAIL 393.48 387.37 378.58 372.47 363.68

NTPC 183.53 178.47 173.58 168.52 163.63

ONGC 163.70 162.30 160.90 159.50 158.10

POWERGRID 228.05 225.50 222.10 219.55 216.15

RELIANCE 1621.87 1598.63 1574.42 1551.18 1526.97

TATAPOWER 86.97 83.63 80.12 76.78 73.27

FINANCIAL SERVICES

AXISBANK 509.40 499.90 493.95 484.45 478.50

BANKBARODA 160.30 153.75 145.70 139.15 131.10

HDFCBANK 1808.45 1780.30 1761.65 1733.50 1714.85

HDFC 1805.48 1770.27 1730.78 1695.57 1656.08

ICICIBANK 303.32 298.23 292.77 287.68 282.22

INDUSINDBK 1682.82 1651.93 1623.12 1592.23 1563.42

KOTAKBANK 1022.82 1003.18 985.37 965.73 947.92

SBIN 289.70 284.20 279.20 273.70 268.70

YESBANK 1820.05 1770.40 1739.35 1689.70 1658.65

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

21 AUG to 25 AUG 2017

INDUSTRIAL MANUFACTURING

BHEL 135.57 132.73 128.92 126.08 122.27

IT

HCLTECH 904.35 890.30 870.65 856.60 836.95

INFY 1090.62 1006.93 945.57 861.88 800.52

TCS 2596.40 2555.10 2508.60 2467.30 2420.80

TECHM 458.15 443.50 421.75 407.10 385.35

WIPRO 292.53 290.32 288.78 286.57 285.03

MEDIA & ENTERTAINMENT

ZEEL 543.60 527.60 513.90 497.90 484.20

METALS

COALINDIA 257.25 250.30 242.40 235.45 227.55

HINDALCO 247.28 238.67 230.88 222.27 214.48

TATASTEEL 654.55 640.10 622.55 608.10 590.55

SERVICES

ADANIPORTS 414.27 400.23 391.77 377.73 369.27

PHARMA

AUROPHARMA 743.18 723.97 705.78 686.57 668.38

CIPLA 612.37 588.83 570.47 546.93 528.57

DRREDDY 2067.17 2024.58 1997.32 1954.73 1927.47

LUPIN 988.58 963.47 948.93 923.82 909.28

SUNPHARMA 522.12 496.13 464.42 438.43 406.72

TELECOM

BHARTIARTL 434.37 427.68 415.72 409.03 397.07

INFRATEL 408.83 402.07 389.98 383.22 371.13

IDEA 96.37 93.33 89.07 86.03 81.77

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

VEDL 279.10 298.40 6.92% 19.30

TECHM 402.80 428.85 6.47% 26.05

EICHERMOT 29627.35 31511.45 6.36% 1884.10

TATAPOWER 76.55 80.30 4.90% 3.75

TATASTEEL 596.75 625.65 4.84% 28.90

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

INFY 987.70 923.25 -6.53% -64.45

BOCHLTD 22623.20 22034.00 -2.60% -589.20

DRREDDY 2011.15 1982.00 -1.45% -29.15

YESBANK 1739.40 1720.75 -1.07% -18.65

KOTAKBANK 992.20 983.55 -0.87% -8.65

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

21 AUG to 25 AUG 2017

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

18/AUG/2017 4784.99 6967.11 -2182.12

17/AUG/2017 3453.31 4434.36 -981.05

16/AUG/2017 5399.89 6489.99 -1090.10

14/AUG/2017 3230.73 4869.56 -1638.83

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

18/AUG/2017 3699.36 3114.77 584.59

17/AUG/2017 2764.95 1936.36 828.59

16/AUG/2017 3569.72 2232.81 1336.91

14/AUG/2017 3652.65 2033.48 1619.17

MOST ACTIVE NIFTY CALLS & PUTS:

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

31/AUG/2017 CE 9900 272772 4106475

31/AUG/2017 CE 10000 240314 5903925

31/AUG/2017 CE 9800 146101 3150375

31/AUG/2017 PE 9800 300906 5892825

31/AUG/2017 PE 9700 214993 4538400

31/AUG/2017 PE 9900 166238 2969025

MOST ACTIVE BANK NIFTY CALLS & PUTS:

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

24/AUG/2017 CE 24500 130395 617480

24/AUG/2017 CE 24300 110789 329760

24/AUG/2017 CE 24200 97972 254400

24/AUG/2017 PE 23800 93406 244520

24/AUG/2017 PE 24000 89974 342320

24/AUG/2017 PE 23500 71995 254320

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

21 AUG to 25 AUG 2017

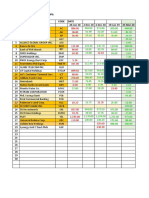

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

19 AUG 17 ASHOKLEY SELL BELOW 103.5 99-95

12 AUG 17 ENGINERSIN SELL AROUND 150-149.5 144-137 OPEN

ALL TGT

5 AUG 17 TATAMTRDVR SELL AROUND 255 245-232

ACHIEVED

ALL TGT

22 JUL 17 KTKBANK SELL BELOW 157 151-144

ACHIEVED

ALL TGT

15 JUL 17 GODREJIND SELL BELOW 660 633-605

ACHIEVED

1ST TGT

8 JUL 17 DELTACORP BUY AROUND 167 175-185

ACHIEVED

1ST TARGET

1 JUL 17 TCS BUY AROUND 2360 2455-2555

ACHIEVED

1ST TARGET

23 JUN 17 SUNPHARMA BUY AROUND 540-545 562-605

ACHIEVED

1ST TARGET

17 JUN 17 TVSMOTORS BUY AROUND 550 572-600

ACHIEVED

ALL TARGET

3 JUN 17 AUROPHARMA BUY AROUND 590 614-640

ACHIEVED

BOOK AT

20 MAY 17 BHARTIARTL BUY AROUND 372 388-402

386.35

BOOK AT

13 MAY 17 AXISBANK SELL BELOW 500 480-450

484.45

1ST TARGET

6 MAY 17 VOLTAS BUY ON DEEP 422 439-456

ACHIEVED

1ST TARGET

29 APR 17 IDFC BUY ON DEEP 62 65-68

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

202, Mangal City Mall,

PU-4 Plot No.A-1,Sch No. 54 Vijay Nagar Circle,

AB Road, Indore

Pin : 452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

Vous aimerez peut-être aussi

- Hybrid Vehicle ToyotaDocument30 pagesHybrid Vehicle ToyotaAdf TrendPas encore d'évaluation

- IRS Document 6209 Manual (2003 Ed.)Document0 pageIRS Document 6209 Manual (2003 Ed.)iamnumber8Pas encore d'évaluation

- 5% Compound PlanDocument32 pages5% Compound PlanArvind SinghPas encore d'évaluation

- HR PoliciesDocument129 pagesHR PoliciesAjeet ThounaojamPas encore d'évaluation

- Red Bull FinalDocument28 pagesRed Bull FinalYousaf Haroon Yousafzai0% (1)

- 300zx 1991 FSM SearchableDocument1 248 pages300zx 1991 FSM SearchableMilka Tesla100% (2)

- Askari Aviation Services Marketing ReportDocument66 pagesAskari Aviation Services Marketing Reportsyed usman wazir100% (1)

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchPas encore d'évaluation

- Equity Technical Weekly ReportDocument6 pagesEquity Technical Weekly ReportzoidresearchPas encore d'évaluation

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchPas encore d'évaluation

- Equity Weekly Report 8 May To 12 MayDocument6 pagesEquity Weekly Report 8 May To 12 MayzoidresearchPas encore d'évaluation

- Equity Report 22 May To 26 MayDocument6 pagesEquity Report 22 May To 26 MayzoidresearchPas encore d'évaluation

- Equity Weekly ReportDocument6 pagesEquity Weekly ReportzoidresearchPas encore d'évaluation

- Equity Report 16 - 20 OctDocument6 pagesEquity Report 16 - 20 OctzoidresearchPas encore d'évaluation

- Equity Report 19 June To 23 JuneDocument6 pagesEquity Report 19 June To 23 JunezoidresearchPas encore d'évaluation

- Equity Outlook 13 Feb To 17 FebDocument6 pagesEquity Outlook 13 Feb To 17 FebzoidresearchPas encore d'évaluation

- Equity Report 15 May To 19 MayDocument6 pagesEquity Report 15 May To 19 MayzoidresearchPas encore d'évaluation

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchPas encore d'évaluation

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaPas encore d'évaluation

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744Pas encore d'évaluation

- Term PaperDocument9 pagesTerm Paperkavya surapureddy100% (1)

- Index Movement:: National Stock Exchange of India LimitedDocument37 pagesIndex Movement:: National Stock Exchange of India LimitedJayant SharmaPas encore d'évaluation

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliPas encore d'évaluation

- Orb Plus Excel Call Generator1Document8 pagesOrb Plus Excel Call Generator1dewanibipin0% (2)

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDocument13 pagesNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingPas encore d'évaluation

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeDocument4 pagesSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayPas encore d'évaluation

- Index Movement:: National Stock Exchange of India LimitedDocument27 pagesIndex Movement:: National Stock Exchange of India LimitedjanuianPas encore d'évaluation

- Open High Low LTP CHNG TradeDocument33 pagesOpen High Low LTP CHNG TradeAnand ChineyPas encore d'évaluation

- Equity StockDocument4 pagesEquity StockChaitanya EnterprisesPas encore d'évaluation

- New Microsoft Excel WorksheetDocument9 pagesNew Microsoft Excel WorksheetSneha JadhavPas encore d'évaluation

- Technical Morning - Call - 120922 PDFDocument5 pagesTechnical Morning - Call - 120922 PDFSomeone 4780Pas encore d'évaluation

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Document2 pagesNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Daily-Equity 17 Sep 2010Document3 pagesDaily-Equity 17 Sep 2010Vikram JunejaPas encore d'évaluation

- Intraday Trading System 1Document4 pagesIntraday Trading System 1Rajesh Chowdary ParaPas encore d'évaluation

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeDocument8 pagesBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayPas encore d'évaluation

- Les Indices BoursierDocument6 pagesLes Indices BoursierkhalifatoPas encore d'évaluation

- Historic Data Nifty50 9THJULYDocument3 pagesHistoric Data Nifty50 9THJULYsriniaithaPas encore d'évaluation

- 802 PB 20 Pages 2 3 and 4Document4 pages802 PB 20 Pages 2 3 and 4stephanie1665Pas encore d'évaluation

- Category Date Buy Value Sell Value Net ValueDocument7 pagesCategory Date Buy Value Sell Value Net ValueMohd FarazPas encore d'évaluation

- Bhaocopy JulyDocument35 pagesBhaocopy JulysubodhPas encore d'évaluation

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Document3 pagesStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaPas encore d'évaluation

- MW NIFTY MIDCAP 150 03 Apr 2023Document8 pagesMW NIFTY MIDCAP 150 03 Apr 2023SumitPas encore d'évaluation

- Client Portfolio Statement: %mkvalDocument2 pagesClient Portfolio Statement: %mkvalMonjur MorshedPas encore d'évaluation

- BSE PSU Energy StocksDocument3 pagesBSE PSU Energy StocksYatrikPas encore d'évaluation

- Portfolio-1 With February 2022 CE Writting OpportunityDocument5 pagesPortfolio-1 With February 2022 CE Writting OpportunityPravin SinghPas encore d'évaluation

- Nifty 500 COMPANY WITH ANALYSISDocument3 pagesNifty 500 COMPANY WITH ANALYSISVILAS KORKEPas encore d'évaluation

- Weekly 12082017Document5 pagesWeekly 12082017Thiyaga RajanPas encore d'évaluation

- Kategori Lapangan Usaha 2000 2001 2002: Tabel 1. Produk Domestik Bruto Atas Dasar Harga Berlaku (Miliar Rupiah)Document6 pagesKategori Lapangan Usaha 2000 2001 2002: Tabel 1. Produk Domestik Bruto Atas Dasar Harga Berlaku (Miliar Rupiah)Fauzan AhmadPas encore d'évaluation

- Private LTD CompaniesDocument16 pagesPrivate LTD CompaniesanjankatamPas encore d'évaluation

- Financial Statements of Tata Steel - 2018Document69 pagesFinancial Statements of Tata Steel - 2018Samaksh VermaPas encore d'évaluation

- Utility 2016Document20 pagesUtility 2016menaga muruganPas encore d'évaluation

- February 16-17, 2011 - UpdateDocument2 pagesFebruary 16-17, 2011 - UpdateJC CalaycayPas encore d'évaluation

- Shares HIGH LOW SignalDocument10 pagesShares HIGH LOW SignalYASH DOSHIPas encore d'évaluation

- Shareable Sheet-Protected-UnlockedDocument2 pagesShareable Sheet-Protected-UnlockedTrading TrainingPas encore d'évaluation

- B2Document14 pagesB2marathi techPas encore d'évaluation

- Next 50Document631 pagesNext 50Kasthuri CoimbatorePas encore d'évaluation

- Da Chart New From Nov-1Document2 pagesDa Chart New From Nov-1nellaimathivel4489Pas encore d'évaluation

- Gain 24 MayDocument5 pagesGain 24 MayPallavi M SPas encore d'évaluation

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Document11 pagesNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiPas encore d'évaluation

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975Pas encore d'évaluation

- Mangal Keshav Securities LimitedDocument10 pagesMangal Keshav Securities Limitedsubh2501Pas encore d'évaluation

- Ipo Allotment Shares Returns (As On 05/01/2022)Document3 pagesIpo Allotment Shares Returns (As On 05/01/2022)Arpit jainPas encore d'évaluation

- 01042010Document9 pages01042010Kishore KunduPas encore d'évaluation

- ZerodhaDocument89 pagesZerodhaAarti ParmarPas encore d'évaluation

- United States Census Figures Back to 1630D'EverandUnited States Census Figures Back to 1630Pas encore d'évaluation

- Equity Report 16 - 20 OctDocument6 pagesEquity Report 16 - 20 OctzoidresearchPas encore d'évaluation

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchPas encore d'évaluation

- Equity Weekly Report 19-23 NovDocument10 pagesEquity Weekly Report 19-23 NovzoidresearchPas encore d'évaluation

- Equity Report 19 June To 23 JuneDocument6 pagesEquity Report 19 June To 23 JunezoidresearchPas encore d'évaluation

- Equity Report 15 May To 19 MayDocument6 pagesEquity Report 15 May To 19 MayzoidresearchPas encore d'évaluation

- Equity Weekly ReportDocument6 pagesEquity Weekly ReportzoidresearchPas encore d'évaluation

- Equity Outlook 13 Feb To 17 FebDocument6 pagesEquity Outlook 13 Feb To 17 FebzoidresearchPas encore d'évaluation

- Equity Report 16 Aug To 19 AugDocument6 pagesEquity Report 16 Aug To 19 AugzoidresearchPas encore d'évaluation

- Equity Report 12 Dec To 16 DecDocument6 pagesEquity Report 12 Dec To 16 DeczoidresearchPas encore d'évaluation

- Equity Report 14 Nov To 18 NovDocument6 pagesEquity Report 14 Nov To 18 NovzoidresearchPas encore d'évaluation

- Equity Report 31 Oct To 4 NovDocument6 pagesEquity Report 31 Oct To 4 NovzoidresearchPas encore d'évaluation

- Equity Technical Report 10 - 14 OctDocument6 pagesEquity Technical Report 10 - 14 OctzoidresearchPas encore d'évaluation

- Equity Technical Report 25 To 29 July - ZoidresearchDocument6 pagesEquity Technical Report 25 To 29 July - ZoidresearchzoidresearchPas encore d'évaluation

- Equity Technical Report (08 - 12 Aug)Document6 pagesEquity Technical Report (08 - 12 Aug)zoidresearchPas encore d'évaluation

- Equity (Nifty50) Technical Report (11 - 15 July)Document6 pagesEquity (Nifty50) Technical Report (11 - 15 July)zoidresearchPas encore d'évaluation

- Global Rum Industry Report 2015Document5 pagesGlobal Rum Industry Report 2015api-282708578Pas encore d'évaluation

- External Query LetterDocument2 pagesExternal Query LetterRohan RedkarPas encore d'évaluation

- Job Centre PlusDocument4 pagesJob Centre PlusKezia Dugdale MSPPas encore d'évaluation

- Rivalry in The Eastern Mediterranean: The Turkish DimensionDocument6 pagesRivalry in The Eastern Mediterranean: The Turkish DimensionGerman Marshall Fund of the United StatesPas encore d'évaluation

- Garuda Indonesia Vs Others, Winning The Price WarDocument16 pagesGaruda Indonesia Vs Others, Winning The Price Waryandhie570% (1)

- February-14 Rural Development SchemesDocument52 pagesFebruary-14 Rural Development SchemesAnonymous gVledD7eUGPas encore d'évaluation

- Outward Remittance Form PDFDocument2 pagesOutward Remittance Form PDFAbhishek GuptaPas encore d'évaluation

- Bitumen Price List 1-09-2010 & 16-09-2010Document2 pagesBitumen Price List 1-09-2010 & 16-09-2010Vizag RoadsPas encore d'évaluation

- CookBook 08 Determination of Conformance - 09-2018Document4 pagesCookBook 08 Determination of Conformance - 09-2018Carlos LópezPas encore d'évaluation

- Your Electricity Bill For: Sayan Ghosh MondalDocument2 pagesYour Electricity Bill For: Sayan Ghosh MondalJagadish ChandraPas encore d'évaluation

- Ministry-Wise Schemes and Developments Prelims 2019 PDFDocument214 pagesMinistry-Wise Schemes and Developments Prelims 2019 PDFAditya KumarPas encore d'évaluation

- UAS MS NathanaelCahya 115190307Document2 pagesUAS MS NathanaelCahya 115190307Nathanael CahyaPas encore d'évaluation

- Grant of IR17JulDocument2 pagesGrant of IR17JulAshwani BhallaPas encore d'évaluation

- Sustainable Space Exploration?Document11 pagesSustainable Space Exploration?Linda BillingsPas encore d'évaluation

- Final Magazine APRIL ISSUE 2016 Final Winth Cover PageDocument134 pagesFinal Magazine APRIL ISSUE 2016 Final Winth Cover PagePrasanna KumarPas encore d'évaluation

- Agutayan IslandDocument38 pagesAgutayan IslandJunar PlagaPas encore d'évaluation

- Please Quote This Reference Number in All Future CorrespondenceDocument2 pagesPlease Quote This Reference Number in All Future CorrespondenceSaipraveen PerumallaPas encore d'évaluation

- Dao29 2004Document17 pagesDao29 2004Quinnee VallejosPas encore d'évaluation

- JournalsDocument6 pagesJournalsharmen-bos-9036Pas encore d'évaluation

- Income CertificateDocument1 pageIncome CertificatedeepakbadimundaPas encore d'évaluation

- Dmu Bal Options Accounting&BusinessManagementDocument2 pagesDmu Bal Options Accounting&BusinessManagementMonalisa TayobPas encore d'évaluation

- Evening AdviseeDocument4 pagesEvening AdviseeHay JirenyaaPas encore d'évaluation

- DSA 2016 Malaysian ExhibitorsDocument6 pagesDSA 2016 Malaysian ExhibitorsShenie GutierrezPas encore d'évaluation

- Education and Social DevelopmentDocument30 pagesEducation and Social DevelopmentMichelleAlejandroPas encore d'évaluation