Académique Documents

Professionnel Documents

Culture Documents

FI Co Interview Questionnaire

Transféré par

Jit GhoshDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FI Co Interview Questionnaire

Transféré par

Jit GhoshDroits d'auteur :

Formats disponibles

FI Co Interview Questionnaire:

1. New GL vs Classic GL

New GL in ECC 6.0 provides an extension to the functionality of classic GL used in ECC 5.0. Following

features which stands as a comparison between two of them :

(1) Extended Data Structure provides flexibility

SAP has consolidated the multiple totals table (GLT0, GLPCT, etc) in classic GL into a single FAGLFLEXT

Totals table with New GL. One Summary Table provides flexibility and faster response time for reporting.

FAGLFLEXT can also be enhanced by adding customer defined fields.

(2) Segment Reporting to ensure Statutory Requirements

IAS accounting standards define the statutory requirements for segment reporting. New GL has

document splitting functionality that enables segment reporting. Standard Segment Reporting

functionality is not available in Classic GL.

(3) Real Time Integration between FI and CO

Classic GL has the period-close reconciliation ledger functionality to synchronize FI and CO for cost

transfers across functional area, business area and company code originating in CO. New GL has a real-

time integration between FI and CO that happens with each transaction originating in CO instead of a

summary posting done by reconciliation ledger during period-close.

(4) Parallel Accounting

New GL provides Non-leading ledgers for parallel accounting like IFRS and GAAP. Parallel accounting can

also be implemented using Account based approach which is also available in classic GL.

(5) Reduce Time by Faster Period Close Activities

Faster Period Close is possible with New GL as,

(a) Reconciliation Ledger is not required

(b) Balance sheet Adjustments are not required

(c) Profit and Loss Adjustment are not required

(d) Activities related to Special Purpose Ledger are not required

(e) Depreciation posting is online instead of a batch session

(6) Flexible Drill-down Reporting in New GL

New GL has advanced drill-down capabilities by segment and other characteristics.

SAP GST for India :

1. Ensure a condition based tax procedure is used. SAP's proposed roadmap is for TAXINN

2. The Govt has said that the Outgoing invoice will be validated by GST Network, so the same would

probably be an interface to GST Network, something like a Golden tax in China

3. The GST in india will be a dual structure tax regime, so you will need to set up the requisite condition

types in your tax procedure and in your sales schema

4. If you are not on TAXINN, you will need to migrate to TAXINN given as per roadmap by SAP

5. Every GST No will be at state level, so configuration change will be required for the same to be set up

as Business Place in SAP

6. You will have to be on the required SP Level as per the details which will be provided by SAP.

7. There will be some amount of overlap for VAT and GST Regime expected, so you would need to plan

for a transition time for the tax applicability and how to migrate the open documents from VAT to GST.

Of course, this will also depend on legal guidance on GST from the Govt and it is still under works.

SAP GST for Malaysia :

GST03 is the prescribed form from RMCD for periodic GST Return submissions by all GST registered

organizations in Malaysia w.e.f April 1st 2015. As per the detailed already published at SAP Note

1932169, GST03 (GST return form) is now a standard delivery from SAP :

New GST is simple and straight forward. (except for few nuances like deemed supply / supply from

special economic zones) -- 0% GST, 6% GST,Tax exempted goods.

Tax Determination :

Sales Output Tax determination :

Material Tax Classification based on Material itself :

Code Material Tax Classification

0 Zero Rated 0%

1 Standard Rated 6%

E Exempted

Customer Tax Classification based on type of customer

Code Customer Tax Classification

0 Zero Rated 0%

1 Standard Rated 6%

D Designated Area 0%

G Government 0%

Marginal Scheme Tax for Malaysia GST :

GST is normally due on the full value of goods when they are sold, but the motor trade margin scheme

enables it to be charged only on the difference (or margin) between the buying and selling prices of

second-hand cars, rather than on the full selling prices.

It applies only to motor vehicles and is intended mainly for motor traders, but it can be used by any GST-

registered person who sells a vehicle in the course of business.

Complying the rules under Margin Scheme nature of Down Payment Tax calculation will cover the

following scenario:

Scenario 1 : Second Hand Car Sales: Down Payment received from customer is more than the margin

earned by NAZA.

Scenario 2: Second Hand Car Sales: Down Payment received from customer is less than the margin

earned by NAZA.

Taxation Calculation process during down payment received from customer covering the above scenario

is covered in the FS document under Frice ID: FI011 AR 201 Down payment Calculation under Margin

Scheme.

Tax Calculation based on Sales and Purchase difference by SD

Validate tax calculate Down Payment based on maximum of tax on margin -- Condition 1:

Received Initial Customer Down Payment amount more than the Margin amount earned by

Naza . Condition 2: Received Customer Down Payment amount less than the Margin Amount

earned by Naza

Report to track the Selling and Purchase of used vehicle.

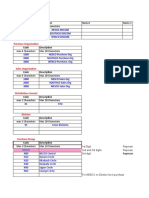

Validation user exit check for PO and User-Exit Biswajit Yes Program:

Invoice against vendor master on the YFI00290

GST registration number. T-code GGB0

-Upon entry of certain tax code in PO, FI Complete

user exit will check vendor master to Document

ensure that field Tax Number 1 is Validation (Step

populated. 2)

-Upon entry of tax code in MIRO and

FB60/FB65, user exit will check vendor

master to ensure that field Tax Number

1 is populated

Month & Year End Activities :

Month End Steps Tcode Module Used

1 Update month end Exchange rate S_BCE_68000174 FI

2 Ensure the open item is bill for the month VF04 SD

3 Ensure the billing documents have been released VF05N SD

4 Run Depreciation AFAB FI

Month End Steps Tcode Module Used

5 Clear Vendor Line Items F.13/ F-44 FI

6 Clear Customer Line Items F.13/ F-32 FI

Create Posting Documents from Recurring Documents & Posting

7 Documents F.14 & SM35 FI

8 Run accrual reversal entries F.81 FI

9 Post with Clearing for Bank Reconciliation F-04 FI

10 Manual GL Account clearing F-03 FI

11 Automatic Clearing (i.e. GRIR clearing account) F.13 MM

12 Generate Customer Statement of Account F.27 FI

13 Ensure all current month GL park documents have been posted FBV0 FI

14 Execute Foregin Currency Revaluation FAGL_FC_VAL FI

15 Tax clearing / Tax adjustment process FB41, FB50 FI

Get confirmation from Kamarudin that there are no unprocessed

16 error for interfaces email AMS/POS/DMS

Run GL/AR/AP account line item display report FAGLL03 /FBL5N/

17 Note: For interface verify this match with AMS/DMS/POS FBL1N FI

18 Run GL Account Balance display report FAGLB03 FI

19 Detail profit and loss report YFI09 FI

20 Customized profit and loss / balance sheet report YFI10 / YFI11 FI

21 Detailed profit and loss by branch and department YCO01 / YCO02 FI

22 List of balances (TB) S_ALR_87012277 FI

23 Financial Statement S_ALR_87012284 FI

24 Line item journal (journal listing) S_ALR_87012287 FI

S_ALR_87013001 /

S_ALR_87013002 /

25 Run Internal order report S_ALR_87013003 FI

26 Enhancement internal order report (Motor and Bikes group only) YFI30 FI

27 Verify whether deemed supply >RM500 for manual tax entry MB51 / FAGLL03 MM /FI

28 GST Report FIMY_GST03 FI

29 Open new MM period MMPV MM

30 Open/Close new FI period S_ALR_87003642 FI

31 Close CO Period OKP1 FI

Year End Closing Steps Tcode

1 Perform Asset fiscal year change AJRW FI

2 Perform Asset Year End closing AJAB FI

3 Carry Forward AP and AR F.07 FI

4 GL Balance Carryforward FAGLGVTR FI

CO Month End Activities & Settlement along with their dependency:

Activities T Code Dependency

Module

CO-PC Marking allowance and release for next posting CK40N/CK24 Period open

period

Dependency : Next month(Period open) for MM/FI

CO-CC Correction of Cost Center entries KB61N FI Entries Completion

CO Actual SKF Maintenance - KB31N

CO-IO Periodic Reposting of Internal Orders - KSW5 Completion of all

inventory transaction

including

consumptions

CO-CC Cost Distribution Cycle run in Cost Centre Accounting KSV5 Cost reposting

CO-CC Cost Assessment Cycle run in Cost Centre Accounting KSU5 Cost reposting

CO-PS Settlement of Investment Orders to Fixed Assets KO8G FA Transaction

CO-CC Cost Splitting among Activity Types in Cost Centre KSS2 Cost reporting , Cost

Accounting Center Distribution

CO-PC Calculate Overhead rate Manual

CO-CC Calculate Actual Price Calculation KSII Cost reposting

CO-PC Apply % Overhead rates S_ALR_87008275

PC Overhead Run on Production Orders CO43 Actual Overhead %

Calculation,

Revaluation of

Activities with Actual

Prices

CO-PC WIP Calculation on Production Order KKAO Closure of all

Production Order

confirmations and

goods movements.

CO-PC Variance Calculation on Production Orders KKS1 WIP Calculation

CO-PC Settlement of Production Orders CO88 Variance Calculation

CO-FI Closing FI Period OB52 PO Settlement

CO-PA PA Assessment ( Cost Center Assessment) KEU5 Cost Centre

Assessment

Vous aimerez peut-être aussi

- Sap Interfaces I DocsDocument36 pagesSap Interfaces I Docssujatha pathiPas encore d'évaluation

- Foreign Currency Valuation ConfigurationDocument9 pagesForeign Currency Valuation ConfigurationKRISHNAPas encore d'évaluation

- Business PartnerDocument12 pagesBusiness PartnernaysarPas encore d'évaluation

- 2.KEL Blue PrintDocument80 pages2.KEL Blue Printanand chawanPas encore d'évaluation

- SAP End User FICO Transaction CodeDocument4 pagesSAP End User FICO Transaction CodeParesh VaghasiyaPas encore d'évaluation

- SAP FI SD Integration Process Flow (With Images)Document7 pagesSAP FI SD Integration Process Flow (With Images)sjobsvn100% (1)

- F110 IssuesDocument3 pagesF110 Issuesrajesh1978.nair2381Pas encore d'évaluation

- Basics of SAP Standard Cost Estimate - Understanding Costing Variant-Part 2 - SAP BlogsDocument27 pagesBasics of SAP Standard Cost Estimate - Understanding Costing Variant-Part 2 - SAP BlogsAnilPas encore d'évaluation

- F-13 Vendor Automatic Account ClearingDocument6 pagesF-13 Vendor Automatic Account ClearingDipak kumar PradhanPas encore d'évaluation

- THD - Document Splitting ConfigurationDocument16 pagesTHD - Document Splitting ConfigurationNaresh Kumar100% (1)

- Financial Accounting Global Settings - Rohini GadkariDocument26 pagesFinancial Accounting Global Settings - Rohini GadkariSahitee BasaniPas encore d'évaluation

- SAP S4HANA 2021 Financial Closing & CockpitDocument39 pagesSAP S4HANA 2021 Financial Closing & CockpitYinka FaluaPas encore d'évaluation

- What Is Special GL TransactionDocument4 pagesWhat Is Special GL TransactionRaj ShettyPas encore d'évaluation

- SAP Threeway Match Functionality & Configuration - SAP BlogsDocument6 pagesSAP Threeway Match Functionality & Configuration - SAP Blogsshiv0308Pas encore d'évaluation

- Accounting Entries: Search E.G. SAP ABAPDocument18 pagesAccounting Entries: Search E.G. SAP ABAPHemant HomkarPas encore d'évaluation

- Controlling TheoryDocument19 pagesControlling TheorysrinivasPas encore d'évaluation

- Sap Fico & MM ContentDocument185 pagesSap Fico & MM Contentdusa.mohanPas encore d'évaluation

- Sample Question SAP Certificate FIDocument54 pagesSample Question SAP Certificate FILaurens VerelstPas encore d'évaluation

- FI Document Parking WorkflowDocument49 pagesFI Document Parking WorkflowTeja BabuPas encore d'évaluation

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- Sap Fico Interview QuestionsDocument357 pagesSap Fico Interview QuestionsMohamed Azouggarh100% (1)

- Base Method-FI AADocument4 pagesBase Method-FI AAGanesh RameshPas encore d'évaluation

- Introduction To Document Splitting in New GLDocument8 pagesIntroduction To Document Splitting in New GLvenkat6299Pas encore d'évaluation

- SAP Fiscal Year Variant ConfigurationDocument3 pagesSAP Fiscal Year Variant Configurationramakrishna099Pas encore d'évaluation

- Recurring EntriesDocument10 pagesRecurring EntriesAB100% (1)

- AssetAccounting, Excise, Cash JournalDocument4 pagesAssetAccounting, Excise, Cash JournalsrinivasPas encore d'évaluation

- OneSource BrochureDocument6 pagesOneSource BrochureJames WallPas encore d'évaluation

- CO Interview QuestionsDocument3 pagesCO Interview QuestionsAtul BhatnagarPas encore d'évaluation

- Accounting Entries During Settlement - Variance Calculation - SAP Q&ADocument2 pagesAccounting Entries During Settlement - Variance Calculation - SAP Q&Akkka TtPas encore d'évaluation

- Fi MM SD ScenariosDocument4 pagesFi MM SD ScenariosAnwar Bin Saleem MirzaPas encore d'évaluation

- ABST2 Preparation For Year-End Closing - Account ReconcilatiDocument13 pagesABST2 Preparation For Year-End Closing - Account ReconcilatiOkikiri Omeiza RabiuPas encore d'évaluation

- Sap Fico Interview Questions PreviewDocument26 pagesSap Fico Interview Questions PreviewPriyanka SharmaPas encore d'évaluation

- What Is SAP Reconciliation Account - ERProofDocument10 pagesWhat Is SAP Reconciliation Account - ERProofShailesh SuranaPas encore d'évaluation

- New Asset AccountingDocument19 pagesNew Asset AccountingShruti ChapraPas encore d'évaluation

- Fixed Asset Process GuideDocument15 pagesFixed Asset Process Guidekumar4868Pas encore d'évaluation

- SAP FICO-Revised PDFDocument6 pagesSAP FICO-Revised PDFakhilesh chauhanPas encore d'évaluation

- Define Functional Area in SAP - Create Functional AreaDocument5 pagesDefine Functional Area in SAP - Create Functional AreaSandeepPas encore d'évaluation

- Profit Center AccountingDocument4 pagesProfit Center AccountingSpandana SatyaPas encore d'évaluation

- Accounts Payable - Outgoing Payments (F110)Document28 pagesAccounts Payable - Outgoing Payments (F110)Sharad Tiwari100% (1)

- Rar CoceptsDocument18 pagesRar CoceptsMoorthy EsakkyPas encore d'évaluation

- SAP Asset Accounting Changes-02jul21Document30 pagesSAP Asset Accounting Changes-02jul21Sekhar KattaPas encore d'évaluation

- Useful Reports Tcode in SAP Financial AccountingDocument2 pagesUseful Reports Tcode in SAP Financial AccountingHuseyn Ismayilov50% (2)

- GR&IR Clearing AccountDocument8 pagesGR&IR Clearing AccountWupankPas encore d'évaluation

- Head Office and Branch Concept Demostrated For Both Vendors CustomersDocument13 pagesHead Office and Branch Concept Demostrated For Both Vendors CustomersAvinash Malladhi0% (1)

- AUC Down Payment and AUC Settlement PDFDocument29 pagesAUC Down Payment and AUC Settlement PDFram200519_216760914Pas encore d'évaluation

- SAP - GL Account PostingDocument8 pagesSAP - GL Account PostingRT1234Pas encore d'évaluation

- Sap Fico Basic SettingsDocument63 pagesSap Fico Basic Settingsthella deva prasadPas encore d'évaluation

- 20 FICO Tips - Series 3 - SAP BlogsDocument17 pages20 FICO Tips - Series 3 - SAP BlogsManish BalwaniPas encore d'évaluation

- SAP FICO Consultants - SAP FICO Real Time Q - S Submitted by Ravi DeepuDocument3 pagesSAP FICO Consultants - SAP FICO Real Time Q - S Submitted by Ravi DeepuNethaji GurramPas encore d'évaluation

- SAP FICO Related DocumentsDocument10 pagesSAP FICO Related DocumentsD. Sai Laxmi100% (1)

- Maintain Depreciation Key - Asset SAPDocument3 pagesMaintain Depreciation Key - Asset SAPAni Nalitayui LifityaPas encore d'évaluation

- Basic Cash Management ConfigurationDocument2 pagesBasic Cash Management ConfigurationManuel RobalinhoPas encore d'évaluation

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesD'EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesPas encore d'évaluation

- SAP S/4HANA Embedded Analytics: Experiences in the FieldD'EverandSAP S/4HANA Embedded Analytics: Experiences in the FieldPas encore d'évaluation

- Voyager - S4HANA Conversion ProjectDocument4 pagesVoyager - S4HANA Conversion ProjectJit GhoshPas encore d'évaluation

- RAR ProcessDocument16 pagesRAR ProcessJit GhoshPas encore d'évaluation

- S5 - RA T CodesDocument5 pagesS5 - RA T CodesJit GhoshPas encore d'évaluation

- COPA Activate Account BasedDocument2 pagesCOPA Activate Account BasedJit GhoshPas encore d'évaluation

- Concur Discovery Questions: Topic Item Country/Business UnitsDocument12 pagesConcur Discovery Questions: Topic Item Country/Business UnitsJit GhoshPas encore d'évaluation

- Concur Customer Discovery QuestionnaireDocument17 pagesConcur Customer Discovery QuestionnaireJit GhoshPas encore d'évaluation

- XK99 Mass Vendor ChangeDocument4 pagesXK99 Mass Vendor ChangeJit GhoshPas encore d'évaluation

- S. No. Module Dev ID Development Type Frequency Explanation of Requirements Standard SAP Solution Input OutputDocument1 pageS. No. Module Dev ID Development Type Frequency Explanation of Requirements Standard SAP Solution Input OutputJit GhoshPas encore d'évaluation

- Sap PC NTSDocument2 pagesSap PC NTSJit GhoshPas encore d'évaluation

- CESU - RAPDRP - FICO - PC Master DataDocument2 pagesCESU - RAPDRP - FICO - PC Master DataJit GhoshPas encore d'évaluation

- CESU - RAPDRP - FICO - CC Master DataDocument2 pagesCESU - RAPDRP - FICO - CC Master DataJit GhoshPas encore d'évaluation

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshPas encore d'évaluation

- Concur Customer Discovery Questionnaire RevisedDocument13 pagesConcur Customer Discovery Questionnaire RevisedJit GhoshPas encore d'évaluation

- Dear Sir,: Larsen & Toubro Limited Electrical & Automation Control & AutomationDocument2 pagesDear Sir,: Larsen & Toubro Limited Electrical & Automation Control & AutomationJit GhoshPas encore d'évaluation

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshPas encore d'évaluation

- DISCOMs - FICO - GL 7TA - 210 ClientDocument49 pagesDISCOMs - FICO - GL 7TA - 210 ClientJit GhoshPas encore d'évaluation

- Busness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Document10 pagesBusness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Jit GhoshPas encore d'évaluation

- Asset Legacy Transfer Error - Accumulated Values For Activation Date Not Allowed in Transfer YearDocument2 pagesAsset Legacy Transfer Error - Accumulated Values For Activation Date Not Allowed in Transfer YearJit GhoshPas encore d'évaluation

- REFX - L2 TrainingDocument49 pagesREFX - L2 Traininggagan3y83% (6)

- Busness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Document10 pagesBusness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)Jit GhoshPas encore d'évaluation

- S4hana CopaDocument10 pagesS4hana CopaGhosh2Pas encore d'évaluation

- SGR - ID - Wtihholding TaxDocument13 pagesSGR - ID - Wtihholding TaxJit GhoshPas encore d'évaluation

- Incorrect WTH TAN Calculation For DP and Invoice ProcessingDocument2 pagesIncorrect WTH TAN Calculation For DP and Invoice ProcessingJit GhoshPas encore d'évaluation

- 1000 Nesco Discom 2000 Southco Discom 3000 Wesco Discom: Code DescriptionDocument58 pages1000 Nesco Discom 2000 Southco Discom 3000 Wesco Discom: Code DescriptionGhosh2Pas encore d'évaluation

- S.no Doc Type Company Code Doc. Date Posting Date Ref. No Doc Header TextDocument8 pagesS.no Doc Type Company Code Doc. Date Posting Date Ref. No Doc Header TextGhosh2Pas encore d'évaluation

- 6b. CESU - RAPDRP - FICO - RICEFW - Flow ChartDocument3 pages6b. CESU - RAPDRP - FICO - RICEFW - Flow ChartJit GhoshPas encore d'évaluation

- Miel Development List Abap Bi BoDocument5 pagesMiel Development List Abap Bi BoJit GhoshPas encore d'évaluation

- As Is - Study Cesu Business Processes & Legacy SystemsDocument19 pagesAs Is - Study Cesu Business Processes & Legacy SystemsJit GhoshPas encore d'évaluation

- Reply-Wesco - FICO AMDocument165 pagesReply-Wesco - FICO AMJit GhoshPas encore d'évaluation

- HSBCnet - MY MT940 File SpecificationDocument8 pagesHSBCnet - MY MT940 File SpecificationGhosh2Pas encore d'évaluation

- CVS v. US LawsuitDocument14 pagesCVS v. US LawsuitAndrew CassPas encore d'évaluation

- Test 1 SolutionDocument3 pagesTest 1 SolutionAmna Asif DarPas encore d'évaluation

- Certificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, LagunaDocument4 pagesCertificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, Lagunaandrea mancaoPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)rahul raj0% (1)

- Tax XXXXDocument15 pagesTax XXXXelvira bolaPas encore d'évaluation

- Ais ArticleDocument6 pagesAis ArticleMohamed A FarahPas encore d'évaluation

- Business Planning Taxation 2020 Study Manual-SAMPLEDocument50 pagesBusiness Planning Taxation 2020 Study Manual-SAMPLEIsavic Alsina0% (1)

- IBM Payslip April 2012Document1 pageIBM Payslip April 2012neale walters0% (1)

- Mithila Farjana - FinalDocument49 pagesMithila Farjana - FinalSelim KhanPas encore d'évaluation

- Quote For Microtek & Luminous 3.5KVA UPS-kongu EnergiesDocument2 pagesQuote For Microtek & Luminous 3.5KVA UPS-kongu EnergiessenmuruPas encore d'évaluation

- 8 Ways To Minimize Taxes When Selling A Business: Adam TkaczukDocument16 pages8 Ways To Minimize Taxes When Selling A Business: Adam TkaczukBerchadesPas encore d'évaluation

- KGN Pub. Bill No. 16, Majencio Brand SolutionDocument1 pageKGN Pub. Bill No. 16, Majencio Brand Solutioncsingh081Pas encore d'évaluation

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyPas encore d'évaluation

- Btax - Plq1-Answer KeyDocument6 pagesBtax - Plq1-Answer KeyJohn Victor Mancilla MonzonPas encore d'évaluation

- 1606-VAT Regs - Susana D LeeDocument2 pages1606-VAT Regs - Susana D LeeHanabishi RekkaPas encore d'évaluation

- Income Taxation Whole Book Cheat SheetDocument121 pagesIncome Taxation Whole Book Cheat SheetMaryane Angela100% (1)

- Employee Tax Calculation ReportDocument10 pagesEmployee Tax Calculation ReportFawazilHamdalahPas encore d'évaluation

- Taxation of MinersDocument76 pagesTaxation of MinersJeremiah NcubePas encore d'évaluation

- 23) Invoice No-729697096 DT 21.03.2020 IOCLDocument1 page23) Invoice No-729697096 DT 21.03.2020 IOCLkmuraliPas encore d'évaluation

- HP MCQDocument7 pagesHP MCQ887 shivam guptaPas encore d'évaluation

- Tax Information InterviewDocument2 pagesTax Information InterviewKIPA TV Pringsewu LampungPas encore d'évaluation

- Lesson Plan Planet - Paycheck - LP - 2 (1) .13.1Document15 pagesLesson Plan Planet - Paycheck - LP - 2 (1) .13.1Dayton Rogalski [Legacy HS]Pas encore d'évaluation

- Percentage MCQDocument2 pagesPercentage MCQMahabub hosenPas encore d'évaluation

- Additional Consolidation Reporting Issues: Mcgraw-Hill/IrwinDocument40 pagesAdditional Consolidation Reporting Issues: Mcgraw-Hill/IrwinRizki ApriyansyahPas encore d'évaluation

- UNIFEEDS TaxDocument64 pagesUNIFEEDS TaxRheneir MoraPas encore d'évaluation

- CREATE LAW - Short IntroDocument3 pagesCREATE LAW - Short IntroBenjie DavilaPas encore d'évaluation

- Cir v. Pal DigestDocument4 pagesCir v. Pal DigestkathrynmaydevezaPas encore d'évaluation

- Ey Thailand Tax Measures To Support Sez and Industry 4 0Document3 pagesEy Thailand Tax Measures To Support Sez and Industry 4 0harryPas encore d'évaluation

- Phil. 646), He May Be Imprisoned For Non-PaymentDocument5 pagesPhil. 646), He May Be Imprisoned For Non-PaymentAnna Marie DayanghirangPas encore d'évaluation

- Taxation Bar ReviewerDocument180 pagesTaxation Bar ReviewerRai MarasiganPas encore d'évaluation