Académique Documents

Professionnel Documents

Culture Documents

Form Dbs Visa Debit

Transféré par

imthinking1984Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form Dbs Visa Debit

Transféré par

imthinking1984Droits d'auteur :

Formats disponibles

TAKEONE - BACK

Terms & Conditions

“An all-in-one convenient way to pay”

Hi, I’m the new DBS Visa Debit Card. With me, you’ll enjoy the

Apply for the SECTION D – MY CONTACT INFORMATION

Address: We will mail your DBS Visa Debit Card & PIN to your Primary Account address as per the Bank’s record. Please issue and continue to issue me with the Card until I/you terminate the Card.

convenience of accessing your bank account by signing for

purchases in Singapore and overseas. You can even shop online

DBS Visa Debit Card I confirm that all information stated in this application is correct and complete.

or order via phone or mail. And thanks to me, you will still be I’m absolutely free.

e. I authorise you to conduct any checks on me and/or to verify any information and/or to disclose

able to perform NETS transactions and withdraw money at over or release any information relating to me and/or any of my account(s) from or to any other party

900 DBS/POSB ATMs island-wide. “Please take the time to read this section. It’s really important.” or source as you may from time to time deem fit at your own discretion for the purpose of this

1. DBS Visa Debit Card can be used to make retail purchases with either Point-

application and without liability or notice to me.

of-Sale (PIN or Signature) or Card-Not-Present (Online, Mail or Telephone Order)

“Get 0.3%* cashback on your purchases” payment. The amount will be deducted directly from the bank account that is I understand that it is my responsibility to take necessary precautions to safeguard my Card and PIN.

Every three months, 0.3% of your spending is credited back to your linked to your DBS Visa Debit Card.

account whenever you sign for your purchases in Singapore 2. As the DBS Visa Debit Card may be used for Point-of-Sale Signature and Card- I am aware that my Card may be used for Point-of-Sale (PIN or Signature) or Card-Not-Present

and overseas, as well as for online, mail and phone transactions. Not-Present payments, you will have to take necessary precautions to safeguard SECTION E – DBS INTERNET BANKING (Online, Mail or Telephone Order) transactions and I understand that the safekeeping of my Card

Signing for your purchases has never been more rewarding. your Card against any unauthorised transaction. If in doubt, please approach our

staff for advice. If you are not an existing DBS Internet Banking customer, you request for DBS is critical to prevent unauthorised transactions.

When you spend When you get your cashback 3. Eligibility iBanking and authorise us to send your Personal Internet Banking User ID, PIN I am aware that the Card and PIN will be sent to my Primary Account mailing address as per the

• You must be at least 16 years old and have a DBS Savings Plus Account, POSB and iB Secure Device (if applicable) to the mailing address of your account linked

January to March By 30 April Passbook Savings Account, DBS Autosave Account or DBS Current Account. Bank’s record at my sole risk.

to your DBS Visa Debit Card (i.e. the Primary Account stipulated in Section C above,

• You will need to submit a photocopy of your Passport or NRIC with the the “Primary Account”). I understand that it is my duty to notify you if my Card is lost or stolen and I will not be liable for

April to June By 30 July completed application form.

any transaction made after I have reported the loss.

• Your signature will be verified against any of your signature records with the Bank.

July to September By 30 October Please ensure that the signature on the application form matches the Bank’s record. You understand that this Primary Account linked to your DBS Visa Debit Card (the

Notwithstanding that my Primary Account may be operated by way of thumbprint and/or

“Card”) is the DBS iBanking Primary Account, the mailing address on record of the

October to December By 30 January 4. Please allow two weeks for application processing. signature, by signing on this application, I authorise you to debit directly from my Primary

Primary Account will be used for DBS iBanking correspondences and from which

SECTION A – MY PERSONAL DETAILS Account linked to the Card any payment or withdrawal made via the Card.

*0.3% cashback is calculated based on spend amount on posting date. Cashback earned for the current

fee charges (where applicable) will be debited.

quarter’s transactions (e.g. January to March) will be credited in the following month (e.g. April) to the

primary account linked to your DBS Visa Debit Card and reflected in your monthly Debit Card/bank I agree to be bound by the DBS Debit Card Agreement (as may be amended by the Bank

account statement (e.g. May). Cashback is not valid for NETS purchases and bill payments. You request and authorise us to extend DBS iBanking access to you for all your

from time to time), a copy of which will be sent with the Card and can also be accessed at

DBS/POSB accounts including joint accounts.

http://www.dbs.com/sg/cards. I agree that I am responsible for all transactions made with

“No bills. No interest. No charges.” You have read, understood and agreed to be bound by DBS’ prevailing terms and the Card, and am responsible for all liabilities which may be incurred in respect of the Card. I

Whenever I’m used for payments, you pay directly from your conditions governing electronic services. (For a copy, kindly visit http://www.dbs. understand that if I retain or use the Card, I shall be deemed to have accepted the DBS Debit

bank account and it will be reflected in your monthly Debit Card/ com/sg/personal/ibanking/additionalinfo/terms) Card Agreement.

bank account statement. So you won’t have to worry about Name to appear on the Card (19 characters):

paying the monthly bills, increasing interest or racking up late If you are an existing DBS Internet Banking customer, your DBS Visa Debit Card You may decline my application without providing any reason.

charges. Plus, it’s easy to keep up with all your transactions Account will be automatically linked to your existing User ID. I confirm that at the time of this application, I am not an undischarged bankrupt and no statutory

online with DBS iBanking.

demand has been served on me nor any legal proceedings commenced against me.

SECTION B – REPLACEMENT OF MY EXISTING DBS ATM CARD

SECTION F – STATEMENT OF APPLICANT

“Lost your Card? Just give us a call” Existing DBS ATM Card number to be replaced: (IMPORTANT: PLEASE READ BEFORE SIGNING)

If I’m misplaced, please report your lost or stolen Card by calling

1800 111 1111 immediately. You won’t be liable for any Please note:

transactions made after you have reported the loss to the Bank, 1. You must complete this section if you have an existing DBS ATM Card.

i. The Card and its PIN as well as the Personal Internet Banking User ID, PIN for

DBS iBanking and iB Secure Device (if applicable) will be sent to the mailing Signature of Card Applicant

so it’s important to call as soon as you can. 2. Your above DBS ATM Card will be replaced by the new DBS Visa Debit Card that you are applying for.

(Note: Signatures will be verified against any of your

The account(s), ATM Card limit and NETS limit of your new DBS Visa Debit Card will follow your existing

DBS ATM Card indicated above.

address of the Primary Account as per the Bank’s record at your sole risk. signature records with the Bank.)

Please ensure that you have updated the Primary Account mailing address.

SECTION C – DESIGNATION OF MY ACCOUNTS

(FOR NEW APPLICANT ONLY)

ii. Point-of-Sale PIN spending limit for NETS is pre-set at SGD2,000 daily,

To take me home, subject to availability of funds in your account.

visit any DBS Branch or mail iii. Point-of-Sale Signature spending limit is pre-set at SGD5,000 daily, subject to

ay.

the completed form to us today. availability of funds in your account.

iv. Each secured Card-Not-Present (online, mail or phone) transaction limit is

pre-set at SGD3,000, subject to the availability of funds in your account.

*Primary Account is used for Point-of-Sale, ATM and Card-Not-Present transactions without account selection

e.g. Point-of-Sale payments (PIN or Signature), ATM Fast Cash, correspondence & debiting of fees.

For DBS Visa Debit Card, the Primary Account must be operated by signature.

v. ATM withdrawal limit is pre-set at SGD2,000 daily. You can choose to increase

it up to a maximum of SGD3,000 daily by visiting any DBS/POSB Branch.

Please note that we do not accept POSB Passcard Account or POSB Current Account.

#

Delete where applicable.

DBS Bank Ltd Co. Reg. No: 196800306E Dec 09

Logo Description Address/Tel Legals & TM Promo Details Image Caption

DBS-CC09110_100x210.indd 2 Procolor Separation Pte Ltd will make every effort to carry out instructions

JOB NO: 1514/09 12/4/09 5:00:31 PM

Date:

Time:

Job No:

01/10/2009

Client:

DBS-CC09110

Colour:

Studio:

DBS Take One Debit Card

Trim: -

Kelsey

Servicing:

AD:

-

ACD:

Copy:

-

ECD:

Booking No:

FA Due Date:

394x210mm to customer’s satisfaction. However, we accept no responsibility or

liability for any error which is not noted on the proof. Customers are

urged to check the proof thoroughly before authorising print runs. DATE : 18.11.2009

SCREEN:175K

MAC: SUE TEL: 6295 1311

C M Y K 9 TF

12.35pm - - Victor

4C

XX/08/2009 DATE : 04.12.2009 MAC: SUE

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PreviewDocument3 pagesPreviewAdetunji Babatunde TaiwoPas encore d'évaluation

- Stcpay WU 176760433Document1 pageStcpay WU 176760433Alb AklbPas encore d'évaluation

- 2012-13 Budget Page 998Document1 page2012-13 Budget Page 998Jim CoxPas encore d'évaluation

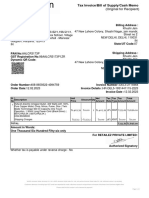

- Tax Invoice: Coraplast IndustriesDocument1 pageTax Invoice: Coraplast IndustriesParesh GanganiPas encore d'évaluation

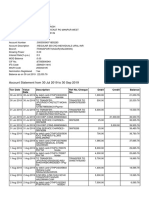

- Tax Invoice: SI No. Descriptions of Goods Qty MRP Rate Taxable Value (INR) Igst (INR) Amount (INR)Document1 pageTax Invoice: SI No. Descriptions of Goods Qty MRP Rate Taxable Value (INR) Igst (INR) Amount (INR)Saurabh MehraPas encore d'évaluation

- Internet Bill - Feb 2022Document4 pagesInternet Bill - Feb 2022Mano MadhiPas encore d'évaluation

- 5th South Pacific ORL Forum Proposal UPDATEDocument10 pages5th South Pacific ORL Forum Proposal UPDATELexico InternationalPas encore d'évaluation

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2020Hajeera BicsPas encore d'évaluation

- TD New AWC at Ambedkar NagarDocument134 pagesTD New AWC at Ambedkar NagarAbu MariamPas encore d'évaluation

- GG Cempaka: 279 Villas KalimantanDocument4 pagesGG Cempaka: 279 Villas KalimantanmarkPas encore d'évaluation

- FNF Settlement Guidelines and Ways To Reach Finance: Computation As Per Input F&F Calculation ParametersDocument1 pageFNF Settlement Guidelines and Ways To Reach Finance: Computation As Per Input F&F Calculation ParametersVivekMedaramitlaPas encore d'évaluation

- INR One Thousand One Hundred and Ninety Nine Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR One Thousand One Hundred and Ninety Nine Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EKamlesh PatelPas encore d'évaluation

- Tax Laws and Practice IntroductionDocument27 pagesTax Laws and Practice Introductionfatma jaffarPas encore d'évaluation

- MLDC Is Subject To Improperly Accumulated Earnings Tax (IAET)Document2 pagesMLDC Is Subject To Improperly Accumulated Earnings Tax (IAET)Franco David BaratetaPas encore d'évaluation

- ChopperDocument1 pageChopperKhushi JainPas encore d'évaluation

- IT Module No. 6 Capital Gains Taxation Module Specific Learning OutcomesDocument18 pagesIT Module No. 6 Capital Gains Taxation Module Specific Learning Outcomesdesiree bautistaPas encore d'évaluation

- Non-Resident Foreign CorporationDocument4 pagesNon-Resident Foreign CorporationRosemarie CruzPas encore d'évaluation

- Musafiri GabrielleDocument1 pageMusafiri GabriellemwakaPas encore d'évaluation

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeSz. RolandPas encore d'évaluation

- TAXATION ATsDocument13 pagesTAXATION ATsgazer beamPas encore d'évaluation

- Vikram Singh Negi SBI Bank StatementDocument4 pagesVikram Singh Negi SBI Bank StatementArushi SinghPas encore d'évaluation

- Exploring Local Bank Compliance On Emv ChipsDocument17 pagesExploring Local Bank Compliance On Emv ChipsRomskyPas encore d'évaluation

- LBR JWB Sesi 2 - MEDIKA ADIJAYA - 2021Document13 pagesLBR JWB Sesi 2 - MEDIKA ADIJAYA - 2021Sandi RiswandiPas encore d'évaluation

- Government of SindhDocument1 pageGovernment of SindhMohammadUzairPas encore d'évaluation

- Invoice 300323-504-33 TDocument1 pageInvoice 300323-504-33 TТатьяна ДевятоваPas encore d'évaluation

- White Paper The Business Model of Apple Pay and Apple CardDocument15 pagesWhite Paper The Business Model of Apple Pay and Apple CardTBeaver BuilderPas encore d'évaluation

- Manasporn KRUEAWONG FNSACC502 NAM PDFDocument21 pagesManasporn KRUEAWONG FNSACC502 NAM PDFStephanie NGPas encore d'évaluation

- Withholding Tax Under Section 153, 155 & 165: Description AmountDocument2 pagesWithholding Tax Under Section 153, 155 & 165: Description AmountMuhammad AhmedPas encore d'évaluation

- Accounting Voucher 60Document1 pageAccounting Voucher 60Pavan BhandarePas encore d'évaluation