Académique Documents

Professionnel Documents

Culture Documents

Chapter Trading

Transféré par

Nahidul Islam IUCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter Trading

Transféré par

Nahidul Islam IUDroits d'auteur :

Formats disponibles

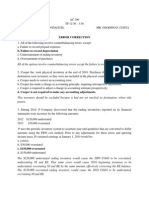

Course Name: Investment and Merchant Banking

Chapter note

Prepared by SM Nahidul Islam

Dept. of Finance & Banking

Islamic University, Kushtia.

Chapter Trading

Questions at a glance:

1. Describe the basic approach of trading.

2. Describe Market Making and Day Trading

3. What do you mean by Arbitrage? Describe the different types of Arbitrage.

SM Nahidul Islam

Dept. of Finance & Banking (2nd batch)

1. Describe the basic approach of trading.

Or

Define efficient market & state the types of efficient market

Or

Define technical analysis. State the assumptions of technical analysis.

Answer: There are following three basic approaches to trading.

1. Fundamental analysis: Fundamental analysis is really a logical and systematic approach to

estimating the future dividends and share price. It is based on the basic premise that share

price is determined by a number of fundamental factors relating to the economy, industry and

company.

The purpose of fundamental analysis is to evaluate the present and future earning capacity of

a share based on the economy, industry and company fundamentals and thereby assess the

intrinsic value of the share .The investor can compare the intrinsic value of the share with the

prevailing market price to arrive at an investment decision.

2. Market efficiency hypothesis: A market for securities in which every security's price equals

its investment value at all times, implying that a specified set of information is fully and

immediately reflected in market prices. Different forms of efficient market are given below:

a. Weak-form market efficiency: It states that any information contained in the past is

already included in the current price and that its future price cannot be predicted by

analyzing past prices. This is because many market participants have access to past price

information, and hence any free lunches would have been consumed.

b. Semi strong-Form Market Efficiency: A level of market efficiency in which all relevant

publicly available information is fully and immediately reflected in security prices.

Information available to the public includes past prices, trading volumes, economic

reports, brokerage recommendations, advisory newsletters, and other news articles.

c. Strong-form market efficiency: It implies that all relevant information, public or private,

is immediately and fully reflected in security prices. Thus this information cannot be used

to earn abnormal profits.

3. Technical analysis: Technical analysis attempts to use information on past price and volume

to predict future price movement. It also attempts to time the markets. For its purposes,

technical analysis is based on several key assumptions, including:

a. Demand and supply determine market price.

b. Securities prices tend to move in trends that persist for long periods.

c. Reversals of trends are caused by shifts in demand and supply, which can be detected in

charts.

d. Many chart patterns tend to repeat themselves.

Technicians have developed numerous techniques, which attempt to predict changes in demand

(bulls) and supply (bears).

Islamic University, Kushtia 2

SM Nahidul Islam

Dept. of Finance & Banking (2nd batch)

2. Describe Market Making and Day Trading

Answer: Market making is an integral part of a dealers operation and is necessary for the

underwriting business. In addition, the information on market flow the dealer obtains through

market making is valuable. Dealers stand ready to buy at bid and sell at offer (asked). The bid-

asked spread is largely determined by the dealers perception of risks such as price uncertainty

and carry in making the market. During volatile periods market makers widen the spread to

protect themselves. If the trader is making a market but feels that the market is going against

him, he will hedge with other highly correlated securities.

In day trading, traders make money by buying securities or currencies and then selling them

again in a short period, hoping to gain a small fraction of a point on the sale. Day trading is not

investing, however. Day trading is a tough profession that is not for the faint of heart. It is a risk-

versus-reward scenario that may allow the astute and disciplined trader who studies the art and

science of day trading to make profits greater than what he or she would make at most other

professions.

3. What do you mean by Arbitrage? Describe the different types of Arbitrage.

Answer: Arbitrage is the simultaneous buying and selling of securities, currency, or

commodities in different markets or in derivative forms in order to take advantage of differing

prices for the same asset. Several types of arbitrage are given below

1. Index Arbitrage: An index arbitrage trades in the cash and futures markets when the

differences between the theoretical futures price and actual futures price are sufficiently

large to generate arbitrage profits. A trader can generate arbitrage profits by selling the

futures index if it is expensive and buying the underlying stocks, or by buying the futures

contract when it is cheap and selling short the underlying stocks.

2. Convertible Arbitrage: A convertible arbitrage involves the purchase of convertible

bonds or preferred stocks and then hedging that position by selling short the underlying

equity. The resulting position generates income from the accrued interest or preferred

dividends and interest earned on the short-sale proceeds.

3. Mergers and Acquisitions Risk Arbitrage: Risk arbitrage is an integral part of

proprietary trading. Arbitrageurs take a position in firms in a merger or a takeover. They

are interested in the deal, not in becoming shareholders. In order to commit funds, they

must have reasonable belief that the deal will go through. The standard strategy is to go

long on the target and short on the acquiring firm.

4. Structural Arbitrage: The objective is to identify opportunities through the recombination

and restructuring of securities. Historically, structural arbitrage has generated handsome

profits for pioneering investment banks. Many forms of structural arbitrage have been

implemented across the capital markets, but this activity is most prevalent in the global

fixed-income markets.

5. Convergence trading: It is a trading strategy consisting of two positions: buying one

asset forwardi.e., for delivery in future (going long the asset)and selling a similar asset

Islamic University, Kushtia 3

SM Nahidul Islam

Dept. of Finance & Banking (2nd batch)

forward (going short the asset) for a higher price, in the expectation that by the time the

assets must be delivered, the prices will have become closer to equal (will have converged),

and thus one profits by the amount of convergence.

6. Yield Curve Arbitrage: A yield curve arbitrage involves trading bonds of different

maturities on the yield curve. A trader would long the cheap part of the curve and short the

rich. If the arbitrageur is successful, he will be able to unwind his positions at a profit

because the abnormal yield spread will have returned to the expected norm in one of

several ways:

The security shorted will have fallen in price and risen in yield.

The security purchased will have risen in price or fallen in yield.

A combination of the above two will have occurred.

7. Covered Interest Arbitrage: Covered interest arbitrage involves the short-term

investment in a foreign currency that is covered by a forward contract to sell that currency

when the investment matures.

Islamic University, Kushtia 4

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Presentation On Capital BudgetingDocument15 pagesPresentation On Capital BudgetingNahidul Islam IUPas encore d'évaluation

- Answer To The Case StudyDocument11 pagesAnswer To The Case StudyNahidul Islam IU100% (3)

- Kevlar ButterflyDocument20 pagesKevlar Butterflyadoniscal100% (1)

- Berkshire PartnersDocument2 pagesBerkshire PartnersAlex TovPas encore d'évaluation

- Capital Structure and Financial OfferingDocument2 pagesCapital Structure and Financial OfferingVictoria Mabini72% (25)

- Solutions To End-Of-Chapter Problems 11Document6 pagesSolutions To End-Of-Chapter Problems 11weeeeeshPas encore d'évaluation

- Wharton Venture CapitalDocument9 pagesWharton Venture CapitalMarthy RavelloPas encore d'évaluation

- New York Stock ExchangeDocument9 pagesNew York Stock ExchangeMahendra SharmaPas encore d'évaluation

- Business ResearchDocument35 pagesBusiness ResearchNahidul Islam IUPas encore d'évaluation

- Andrew Lockwood: Trading Cheat SheetDocument20 pagesAndrew Lockwood: Trading Cheat SheetSeptiandi hendra SaputraPas encore d'évaluation

- Error CorrectionDocument8 pagesError CorrectionCharlie Magne G. SantiaguelPas encore d'évaluation

- MathDocument3 pagesMathNahidul Islam IU100% (4)

- Finance Means Money ManagementDocument1 pageFinance Means Money ManagementNahidul Islam IUPas encore d'évaluation

- Exercise of LeverageDocument1 pageExercise of LeverageNahidul Islam IUPas encore d'évaluation

- Buy A Land For TK 10Document1 pageBuy A Land For TK 10Nahidul Islam IUPas encore d'évaluation

- Components of Capital StructureDocument3 pagesComponents of Capital StructureNahidul Islam IUPas encore d'évaluation

- C. DFL Or, 1.25 Or, 50% D. DFL Or, 1.25 Or, 8% E. DTL Dol X DFL XDocument1 pageC. DFL Or, 1.25 Or, 50% D. DFL Or, 1.25 Or, 8% E. DTL Dol X DFL XNahidul Islam IUPas encore d'évaluation

- Finance Major MBA LeverageDocument4 pagesFinance Major MBA LeverageNahidul Islam IUPas encore d'évaluation

- Final Exam - Spring-2020 RevisedDocument1 pageFinal Exam - Spring-2020 RevisedNahidul Islam IUPas encore d'évaluation

- Total Customer of A BankDocument1 pageTotal Customer of A BankNahidul Islam IUPas encore d'évaluation

- Median 3. Mode 4. Standard Deviation 5. Variance 6. Coefficient of VariationDocument3 pagesMedian 3. Mode 4. Standard Deviation 5. Variance 6. Coefficient of VariationNahidul Islam IUPas encore d'évaluation

- Finance Major MBA LeverageDocument4 pagesFinance Major MBA LeverageNahidul Islam IUPas encore d'évaluation

- Time Value of Money Means TodayDocument3 pagesTime Value of Money Means TodayNahidul Islam IUPas encore d'évaluation

- Time Value of Money Means TodayDocument3 pagesTime Value of Money Means TodayNahidul Islam IUPas encore d'évaluation

- ReturnDocument1 pageReturnNahidul Islam IUPas encore d'évaluation

- CPMDocument2 pagesCPMNahidul Islam IUPas encore d'évaluation

- The Effect of Macroeconomic Variables On The Financial Performance of Non-Life Insurance Companies in BangladeshDocument22 pagesThe Effect of Macroeconomic Variables On The Financial Performance of Non-Life Insurance Companies in BangladeshNahidul Islam IUPas encore d'évaluation

- ReportDocument2 pagesReportNahidul Islam IUPas encore d'évaluation

- Strongly AgreeDocument1 pageStrongly AgreeNahidul Islam IUPas encore d'évaluation

- AuditDocument1 pageAuditNahidul Islam IUPas encore d'évaluation

- Internee 1Document4 pagesInternee 1Nahidul Islam IUPas encore d'évaluation

- Determinants of Deposit Mobilization of Private Commercial PDFDocument8 pagesDeterminants of Deposit Mobilization of Private Commercial PDFNahidul Islam IUPas encore d'évaluation

- Final ReportDocument68 pagesFinal ReportNahidul Islam IUPas encore d'évaluation

- Selected Questions For MBA and BBADocument1 pageSelected Questions For MBA and BBANahidul Islam IUPas encore d'évaluation

- Fin 514 Fixed Income SecuritiesDocument3 pagesFin 514 Fixed Income SecuritiesNahidul Islam IUPas encore d'évaluation

- Selected Questions For MBA and BBADocument1 pageSelected Questions For MBA and BBANahidul Islam IUPas encore d'évaluation

- The History of SukukDocument4 pagesThe History of SukukNahidul Islam IUPas encore d'évaluation

- Government FinanceDocument2 pagesGovernment FinanceNahidul Islam IUPas encore d'évaluation

- MB0041Document26 pagesMB0041Saurav KumarPas encore d'évaluation

- Re Teh D.o.o.: Academic VersionDocument13 pagesRe Teh D.o.o.: Academic VersionVito MartiniPas encore d'évaluation

- FS Analysis TIPDocument7 pagesFS Analysis TIPprincess mae batallonesPas encore d'évaluation

- Krispy Kreme Matrices-ReportsDocument14 pagesKrispy Kreme Matrices-ReportsAbid Stanadar100% (1)

- Employee Stock Options: Practice QuestionsDocument3 pagesEmployee Stock Options: Practice Questionsrcraw87Pas encore d'évaluation

- THFJ 50 Women in Hedge Funds 2011Document12 pagesTHFJ 50 Women in Hedge Funds 2011marianneowyPas encore d'évaluation

- Merchant BankingDocument41 pagesMerchant BankingPooja balwaniPas encore d'évaluation

- Objective of AccountingDocument15 pagesObjective of AccountingVenus TanPas encore d'évaluation

- Ch03 Hull 9theditionDocument21 pagesCh03 Hull 9theditionPranjal MandloiPas encore d'évaluation

- Divya Final FinalDocument54 pagesDivya Final FinalujwaljaiswalPas encore d'évaluation

- Opalesque 2010 Hong Kong RoundtableDocument22 pagesOpalesque 2010 Hong Kong RoundtableOpalesque PublicationsPas encore d'évaluation

- UGBA 131 Syllabus Spring 2016Document6 pagesUGBA 131 Syllabus Spring 2016Rushil SurapaneniPas encore d'évaluation

- Banking & Financials - Writing On The WallDocument42 pagesBanking & Financials - Writing On The WallUnplugged12Pas encore d'évaluation

- Financial Analysis of The Coca Cola CompanyDocument6 pagesFinancial Analysis of The Coca Cola Companyماہین کامرانPas encore d'évaluation

- Prednaska Opce 1Document67 pagesPrednaska Opce 1Oberoi MalhOtra MeenakshiPas encore d'évaluation

- Ind-AS 103Document69 pagesInd-AS 103amarPas encore d'évaluation

- Barron 39 S 08 17 2020Document68 pagesBarron 39 S 08 17 2020dhana sekaranPas encore d'évaluation

- IPO (Penna Cements) : By, Vishnu Murali FM-1708 MBA 16-ADocument8 pagesIPO (Penna Cements) : By, Vishnu Murali FM-1708 MBA 16-AVishnu MuraliPas encore d'évaluation

- Credit Finals ReviewerDocument38 pagesCredit Finals ReviewerShua AbadPas encore d'évaluation

- c38fn2 - Revision Handout (2018)Document6 pagesc38fn2 - Revision Handout (2018)Syaimma Syed AliPas encore d'évaluation

- Fdi Notes: Chain Stage in A Host Country Through FDIDocument5 pagesFdi Notes: Chain Stage in A Host Country Through FDIansarPas encore d'évaluation